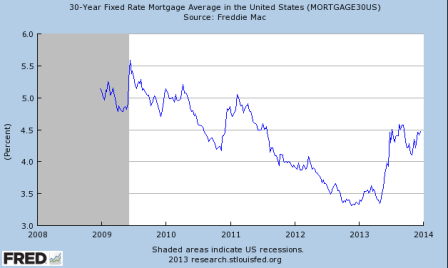

One of the main reasons for the Fed’s (near) 0 rate policy is to support the housing market. And after nearly 5 years of 0 rates, and mortgage rates dipping below 3.5%, though ‘off the bottom’ housing remains far below what would be considered ‘normal’.

And then, not long ago, and immediately after the Fed first hinted at reducing its QE purchases, mortgage rates spike by over 1%:

Full size image

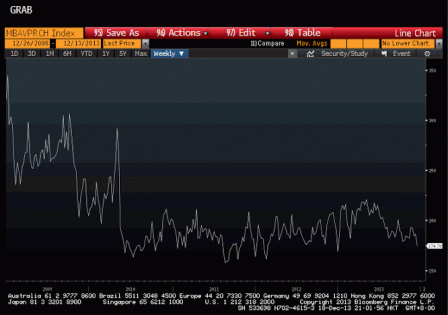

And, since then, mortgage refinance activity has all but vanished, and the number of mortgage applications for the purchase of homes swung from increasing nicely to decreasing alarmingly:

Full size image

The ‘Fed speak’ for this rise in rates ‘tightening financial conditions’. And one of the Fed’s concerns about tapering QE purchases was the concern that higher mortgage rates would slow the recovery. Therefore, in addition to announcing the reduction in purchases of Treasury securities and mortgage backed securities, they were careful to emphasize what’s called their ‘forward guidance’ with regard to the Fed funds rate. That is, they stated that they expected to be keeping short term rates low for the next couple of years or so, and maybe even longer than that, maybe even after unemployment goes below 6.5%, and presuming their inflation measure stops decelerating and moves back up towards their target.

Unfortunately for the Fed mortgage rates moved higher after the announcement, and not due to a burst of mortgage applications (see above charts), and not due to any immediate drop in Fed purchases, which continue in large size. Instead, what the Fed sees is a market that believes the Fed changed course because it believes the economy is recovering, and with recovery just around the corner rate hikes will come sooner rather than later. And with rate hikes on the way, investors would rather wait for the higher yields they believe are just down the road, than take the lower yields today.

Therefore, if you want to borrow today to buy a house, you have to pay investors a higher interest rate. And if you don’t want to pay the higher rate today, investors are willing to wait for those higher rates, and the house doesn’t get sold. And when the house doesn’t get sold the Fed leaves rates low for that much longer and their forecast again (they’ve been over estimating growth for 5 years now) turns out to be wrong.

So with ‘forward guidance’ not doing the trick, is there anything else can the Fed can do if it wants mortgage rates back down? Yes!

First, they can simply announce that they are buyers of 10 year treasury notes at, say, a yield of 2%, in unlimited quantities.

This would immediately bring the 10 year yield down from 2.92% to no more than 2%, and most likely the Fed would buy few if any at that price. That’s because when people know the Fed will buy at a price, they know they can then buy at a slightly lower interest rate, knowing that ‘worst case’ they can always sell to the Fed at a very small loss. That way they can earn the, say, 1.99% yield for as long as they hold the 10 year Treasury note. And there’s always a chance yields come down further as well, which means their securities increased in value as well.

And the lower 10 year rate would quickly translate into much lower mortgage rates as well. And, of course, the Fed could also do the same thing with the mortgage backed securities its already buying, which more directly targets mortgage rates.

So why isn’t the Fed doing this? Probably out of fear of offering to buy unlimited quantities might lead to them buying ‘too many’ Treasury securities. This fear, unfortunately, stems from their lack of understanding of their own monetary operations. Treasury securities are simply dollar balances in securities accounts at the Fed. When the Fed buys these securities they just debit the owner’s securities account and credit the reserve account of his bank. And when the Treasury issues and sells new securities, the Fed debits the buyer’s bank’s reserve account and credits his securities account. Whether the dollars are in reserve accounts or securities accounts is of no operational consequence and imposes no particular risk for the Fed, so those fears are groundless.

Second, the Fed (or Treasury or the Federal Financing Bank) could lend directly to the housing agencies at a fixed rate of say, 3% for the further purpose of funding their mortgage portfolio of newly originated agency mortgages. The agencies would then pass along this fixed rate, with some permitted ‘markup’ and fees to the borrowers. The Fed would then be repaid by the pass through of the monthly payments including prepayments made by the new mortgages. This would target mortgage rates directly and, as these mortgages would be held by the agencies and not sold in the market place, dramatically reduce what I call parasitic secondary market activity.

Has any of this been discussed? Not publicly or seriously that I know of.

Here’s a piece I wrote several years ago on these and other proposals:

Proposals for the Banking System, Treasury, Fed, and FDIC

And this which includes why it’s the Fed that sets rates, and not markets:

The Natural Rate of Interest Is Zero