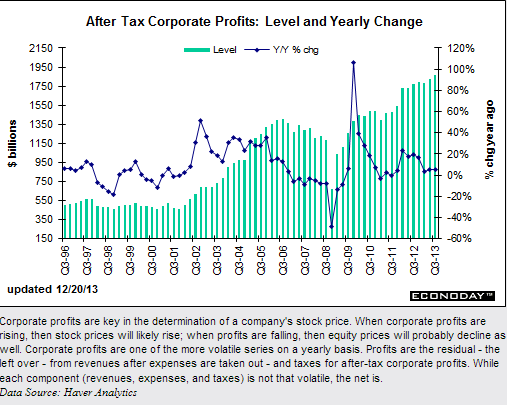

Profits are after tax but without inventory valuation and capital consumption adjustments. Corporate profits on a year-on-year basis increased 5.6 percent versus 5.3 percent in the second quarter.

They also show close correlation with the size of the Federal deficit.