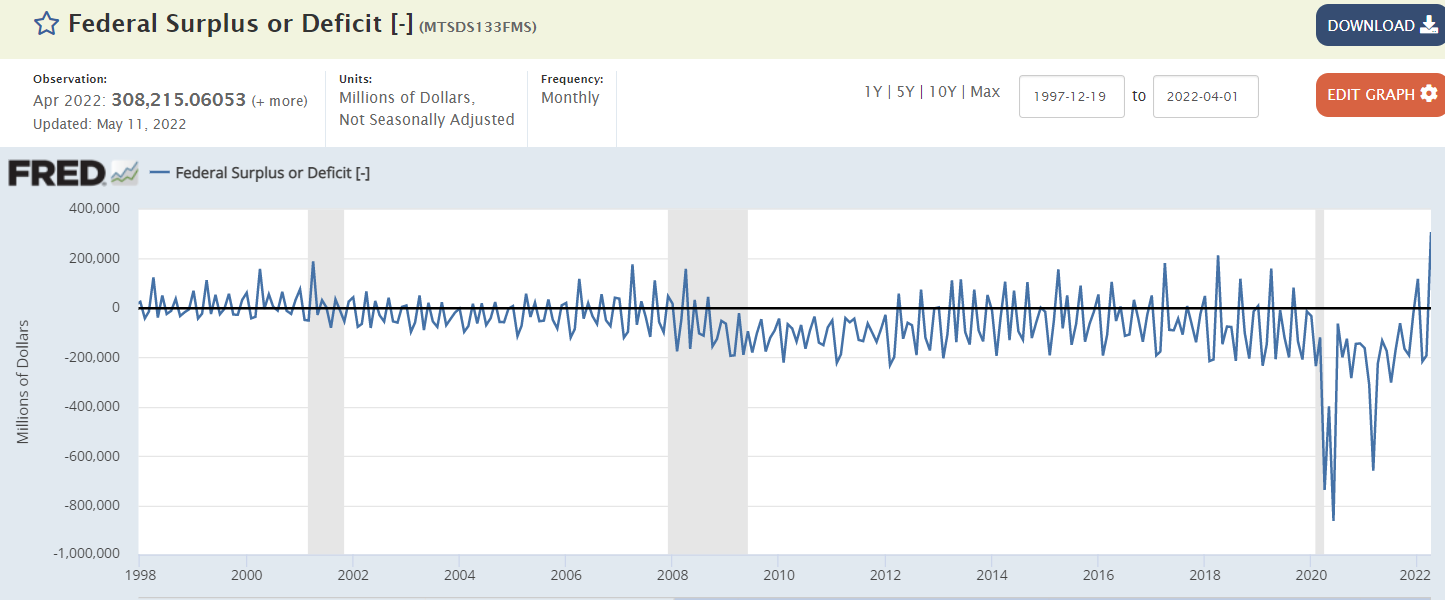

The US posted a budget surplus of USD 308 billion in April of 2022, the highest on record, switching from a USD 226 billion gap in the same period last year and above market expectations of a USD 226 billion surplus. April has traditionally been a budget surplus month due to the traditional April 15 tax filing deadline, except in 2009, 2010 and 2011 after a financial crisis, and in 2020 and 2021 due to the Covid-19 pandemic. Receipts jumped 97 percent to an all-time high of USD 864 billion, underpinned by tax receipts on the back of a strong economic recovery. At the same time, outlays slumped 16 percent to USD 555 billion, reflecting lower spending for COVID-19 relief. For the first seven months of the 2022 fiscal year, the US federal deficit was at USD 360 billion, a 81 percent decline from the same period of fiscal 2021. source: Financial Management Service, US Treasury Monthly Treasury Statement