PDF: New Credentials

Daily Archives: January 27, 2014 @ 4:34 pm (Monday)

ECB proposals to buy loans to households and companies

This is highly problematic.

If the ECB takes the risk, there is extreme moral hazard. If they don’t, lending won’t likely increase:

ECB poised for battle to ward off deflation

January 26 (FT) — Mario Draghi has signalled that he would be prepared for the ECB fight deflation in Europe by buying packages of bank loans to households and companies. Since the corporate bond market was small and working well, he said, there is no need to do something in that field. As the ECB does not issue debt and a decline in net lending remains a deep problem in peripheral eurozone countries, Mr Draghi said he favoured looking at a way to package bank loans to the private sector and for the ECB to buy them if economic conditions got worse. Mr Draghi said: What other assets would we buy? One thing is bank loans?.?.?.?the issue for further thinking in the future is to have an asset that would capture and package bank loans in the proper way. Right now securitisation is pretty dead, he said adding, that there was a possibility of buying asset backed securities if they were easy to understand, price and trade and rate.

State deficits turning to surplus

Just like any other agent, when they spend more than their income they are adding that much to growth, and as their deficits fall the are net adding that much less.

States Weigh New Plans for Revenue Windfalls

By Mark Peters

January 26 (WSJ) — Governors across the U.S. are proposing tax cuts, increases in school spending and college-tuition freezes. The strengthening in tax revenue started in late 2012 as higher-income residents in many states took increased capital gains among other steps to avoid rising federal tax rates on certain income. Those tax payments spilled over into 2013, and further fuel for collections came from a record stock market and improving economy. State tax revenue nationally climbed 6.7% in the fiscal year ended June 30, 2013, Moody’s Analytics says. Still, state spending last year remained below peak levels in 2008 when adjusted for inflation, while state reserves hit their highest level since the recession, reaching a total of $67 billion nationally, or 9.6% of state spending, according to a report last month from the National Association of State Budget Officers.

Interest rates and consumption

Who would have thought?

;)

Thanks Art.

The equation at the core of modern macro

By Noah Smith

“…the Euler Equation says that if interest rates are high, you put off consumption more. That makes sense, right? Money markets basically pay you not to consume today. The more they pay you, the more you should keep your money in the money market and wait to consume until tomorrow. But what Canzoneri et al. show is that this is not how people behave. The times when interest rates are high are times when people tend to be consuming more, not less.”

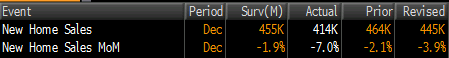

new home sales

Who would have thought that with purchase apps down 10% year over year sales would fall?

So seems like borrowers aren’t stepping up to the higher mortgage rates demanded by lenders fearful of future fed rate hiking?

That means the economy stalls and the Fed doesn’t hike?

Highlights

New home sales had been a bright spot in the housing sector — but not any more. Sales of new homes nose dived in December, to a 414,000 annual rate that’s below the low end estimate of Econoday’s consensus. More bad news comes from downward revisions that total 30,000 in the prior two months.

The drop in sales gave a lift to supply, at least supply relative to sales which is at 5.0 months vs 4.7 months in November. But the total number of new homes on the market actually fell, down 5,000 to an adjusted 171,000.

High prices are no doubt a factor behind the sales weakness but not a pronounced factor. The median price rose 0.6 percent to $270,200 with the year-on-year rate very modest at plus 4.6 percent which is right in line with the plus 4.6 percent year-on-year rate for sales.

Bad weather may have played a factor in December’s disappointment but heavy weather is common to all Decembers. Unattractive mortgage rates and the still soft jobs market appear to be holding down housing noticeably. On Thursday, watch for pending home sales data which track initial contract signings for sales of existing homes. The Dow is little changed following today’s results.

And note the downward slope of the last three prints: