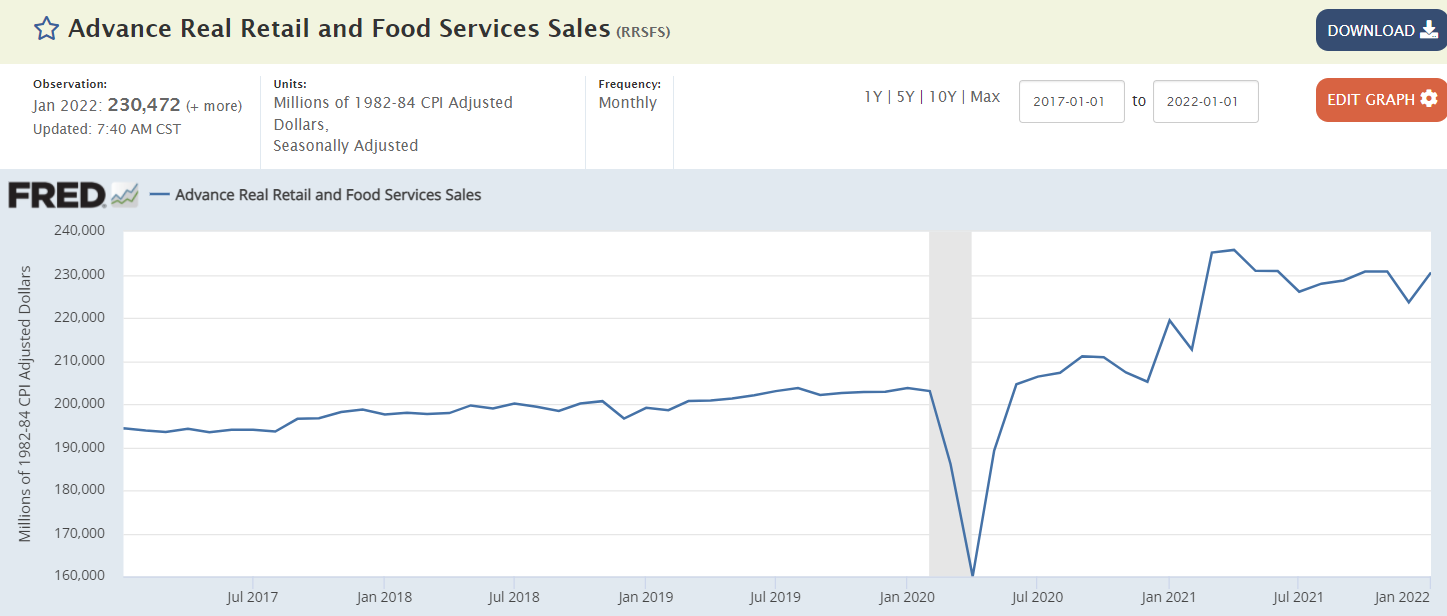

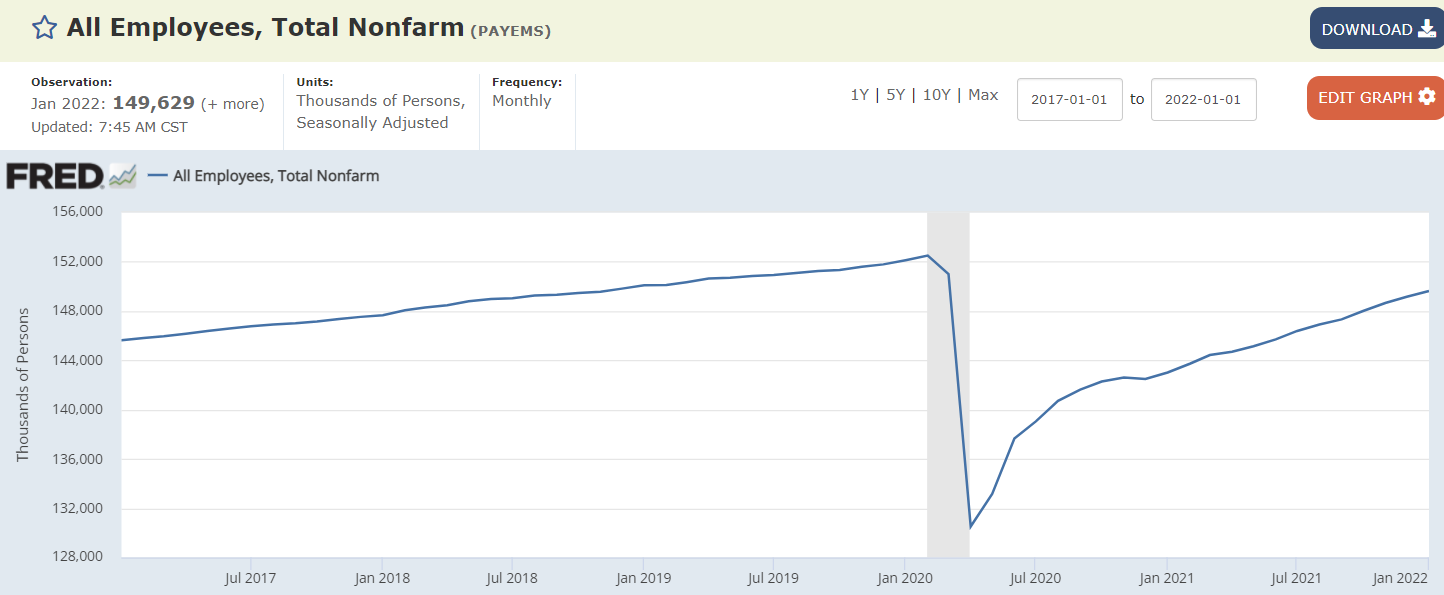

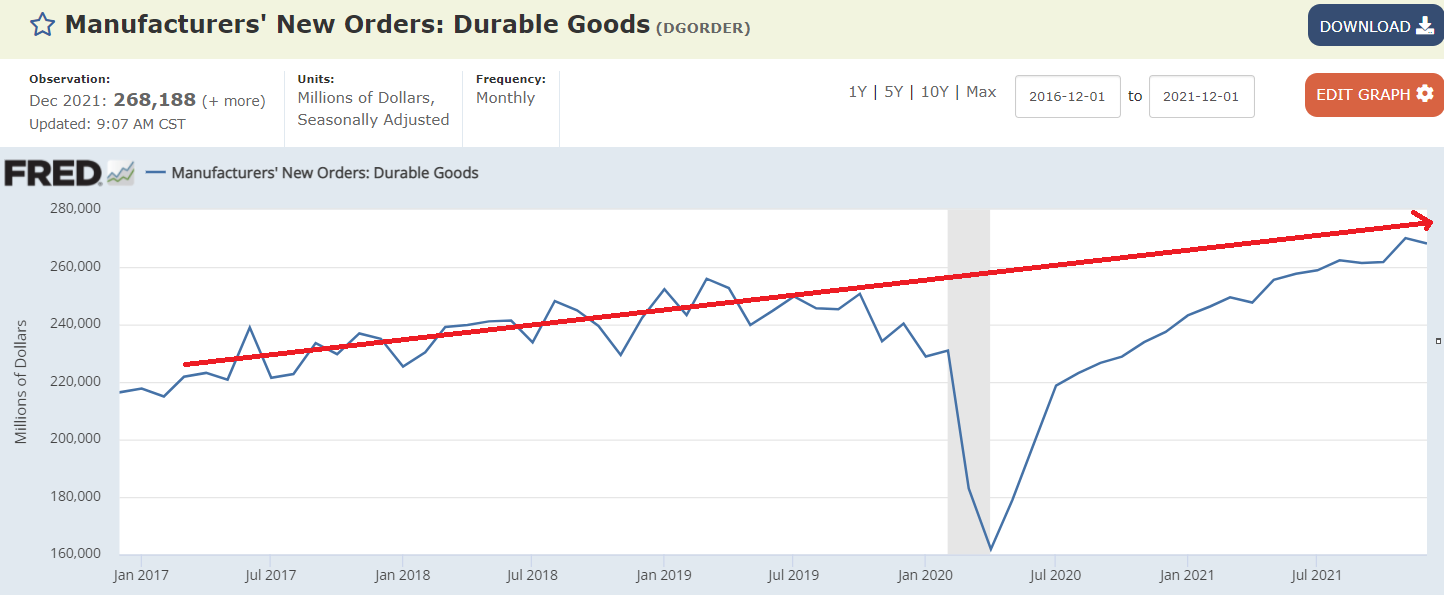

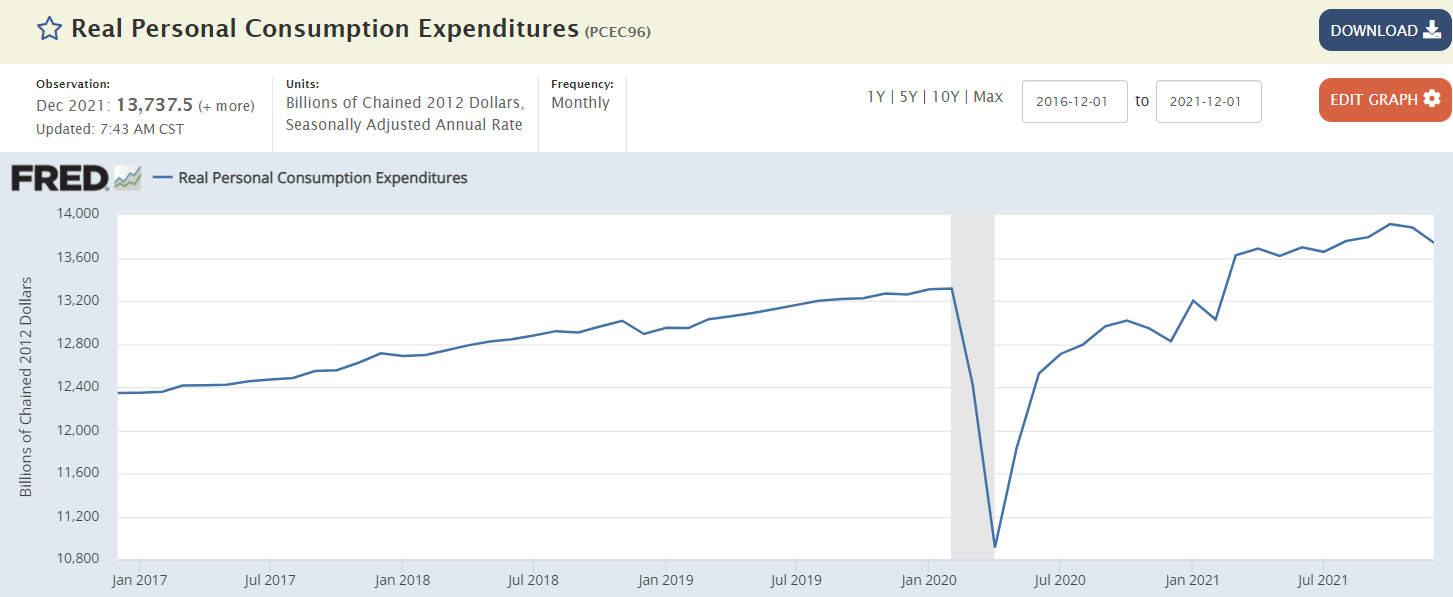

Slowly returning to the pre covid trend:

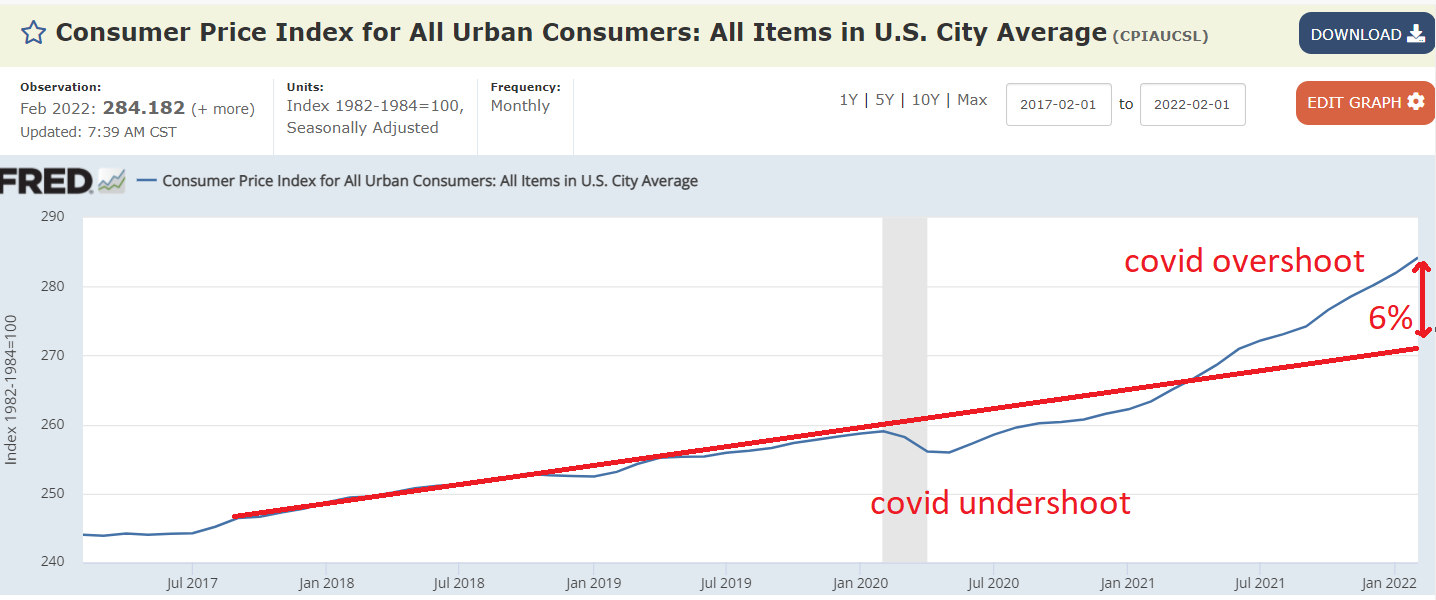

Still below the pre covid trend line:

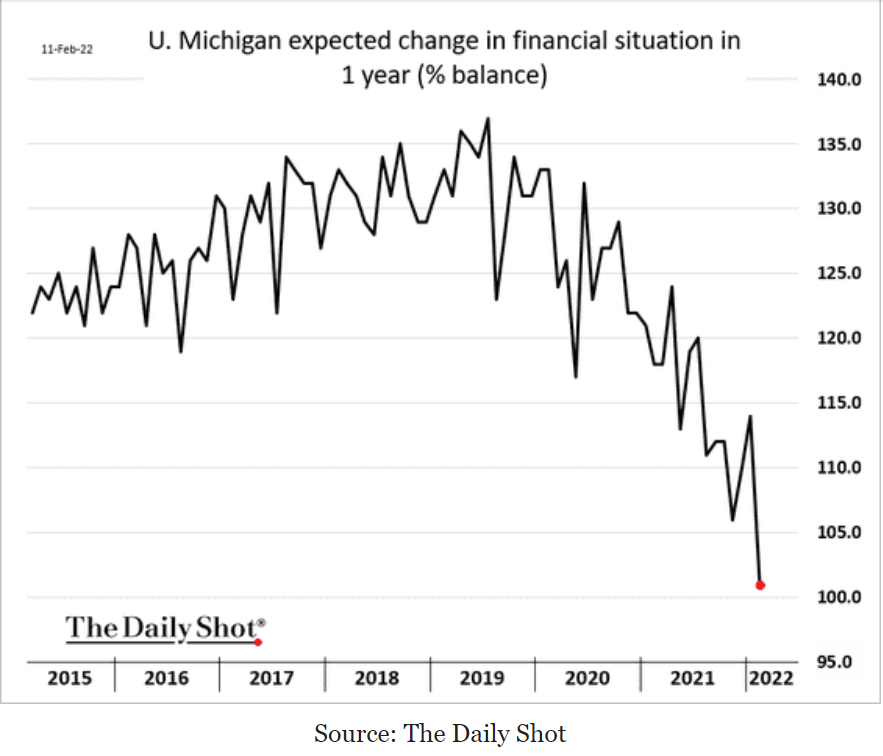

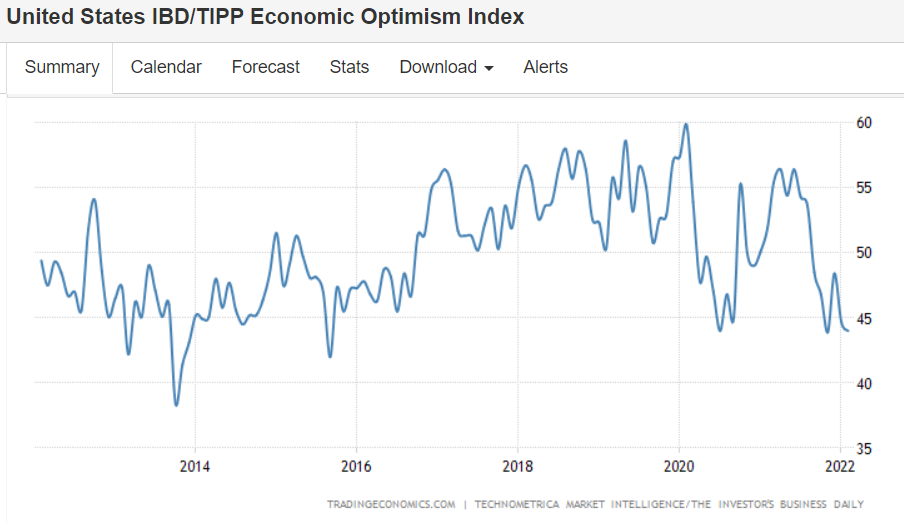

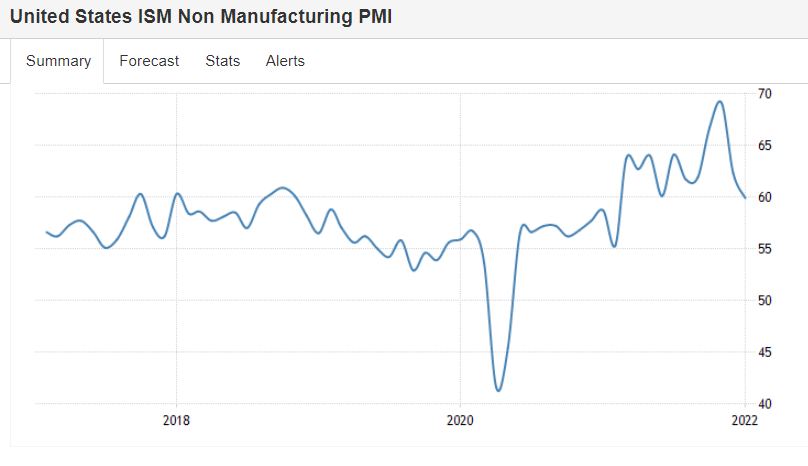

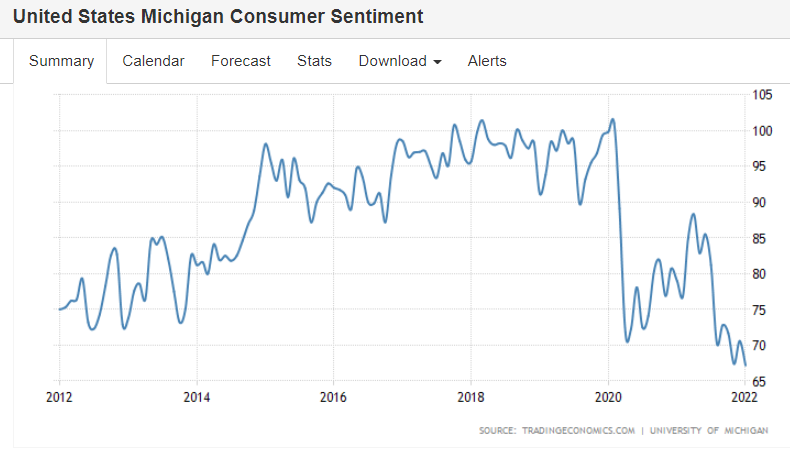

Post war slowdown continues:

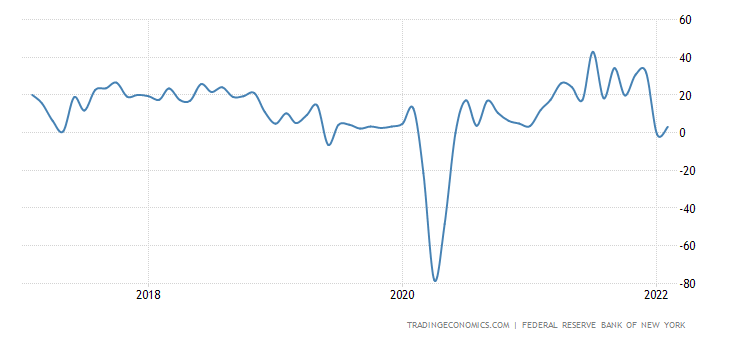

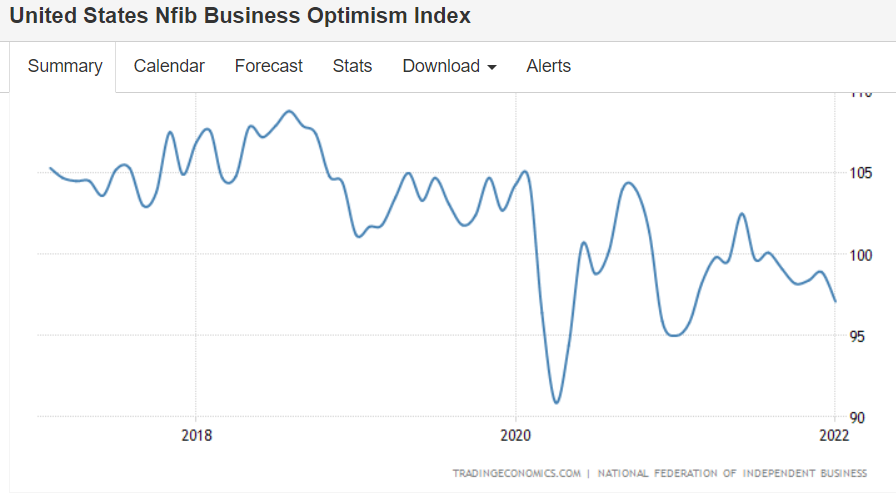

Below the 2018 highs, but still growing from the covid dip:

Adjusted for inflation, the slope is downward:

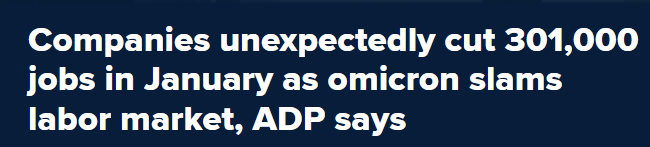

Post was slump continues:

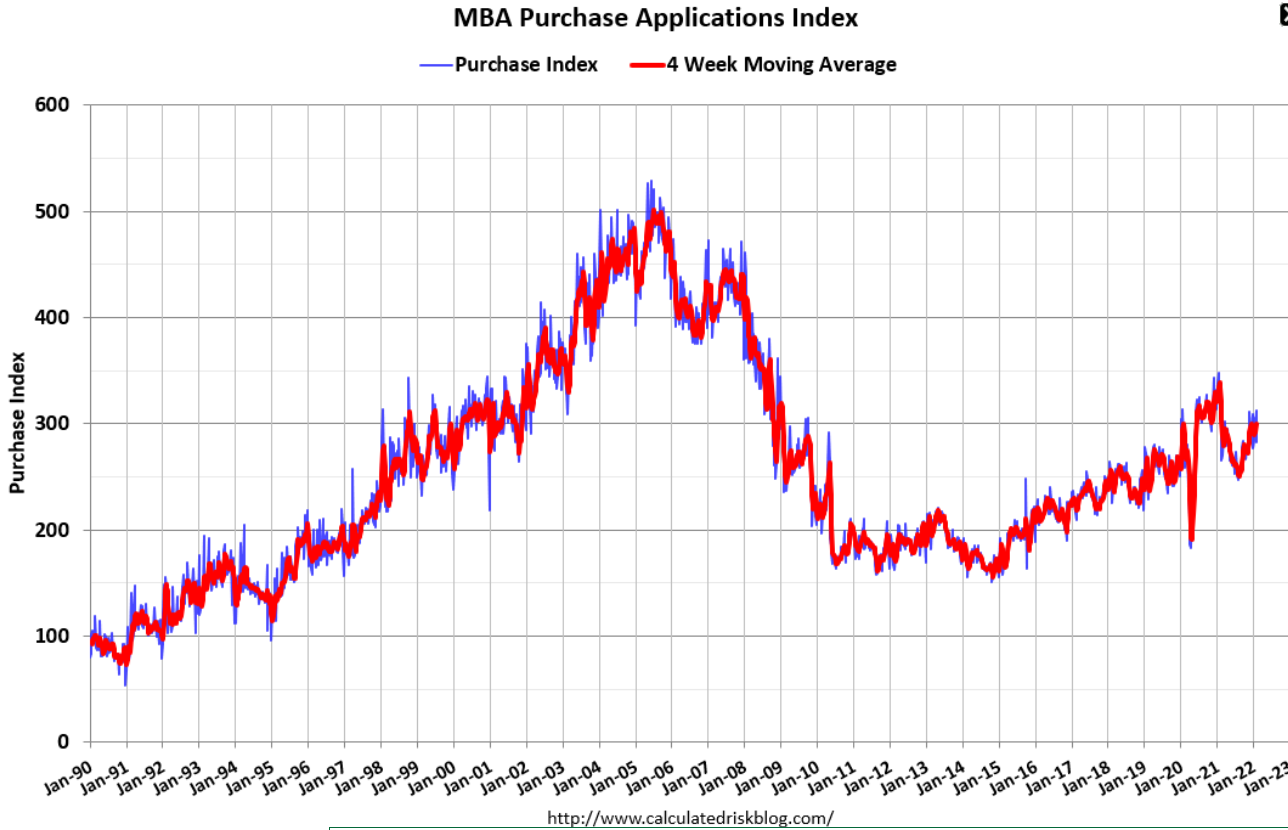

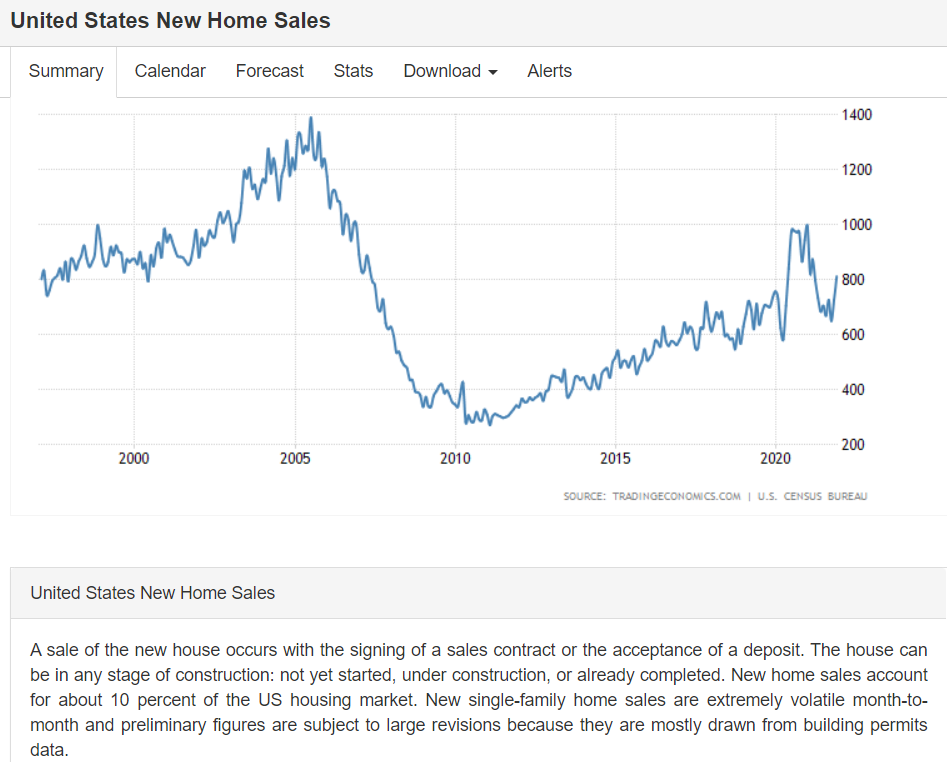

Mortgage applications and housing in general remains far weaker than it was when rates were far higher and the population was a lot lower as well:

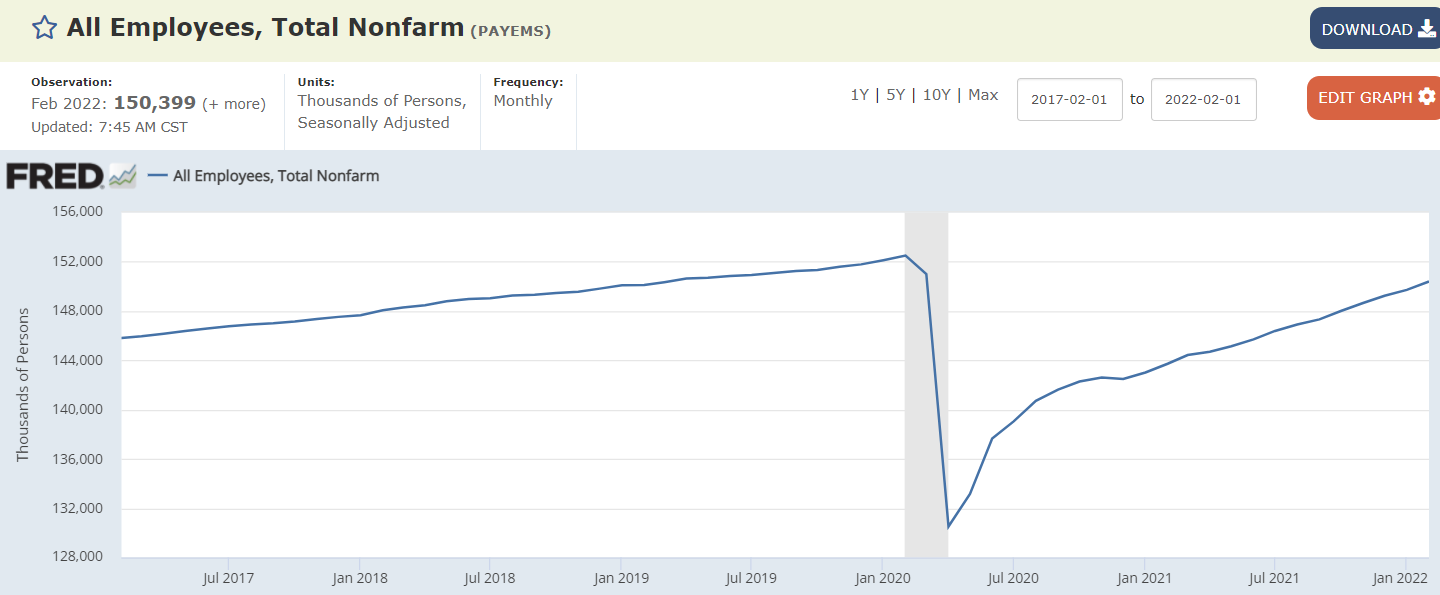

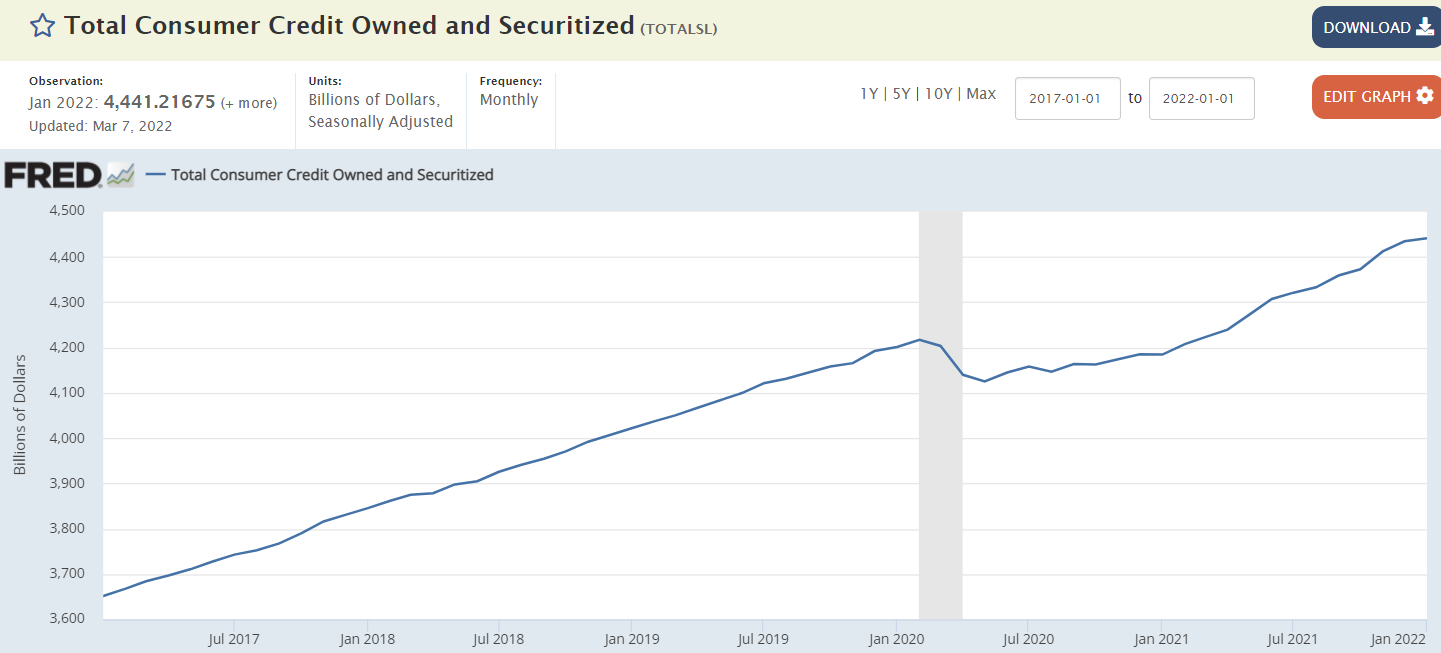

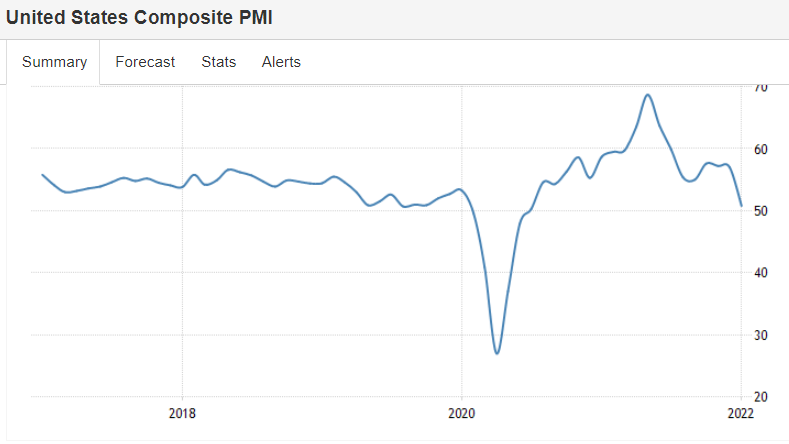

Still slowly working its way back to the pre covid trend:

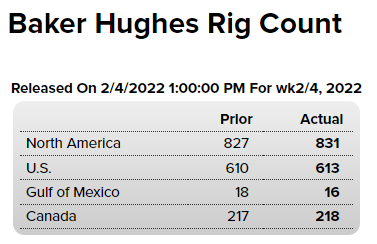

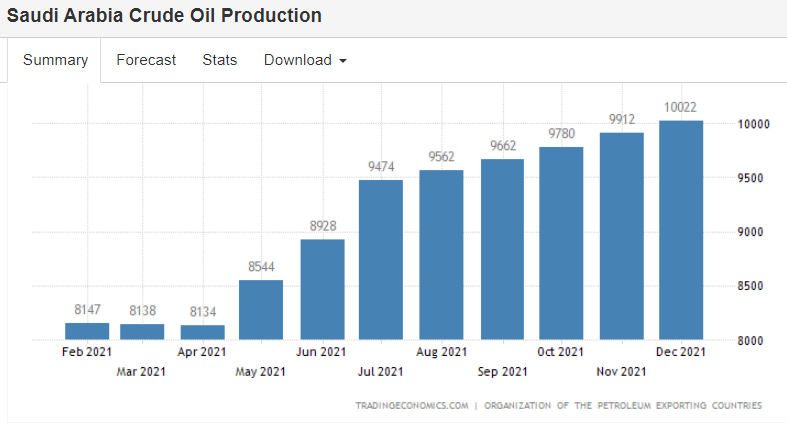

New rigs continue to come online, but it won’t interfere with Saudi/Russian price setting until sufficient production comes online to reduce Saudi sales. And right now sales are going up, indicating that demand for oil at the Saudi’s prices is increasing, as the Saudis set price and let their refiners buy all they want at their posted prices:

As previously discussed, Saudi OSP’s (official selling price spreads vs benchmarks) are now set above ‘fair value’ imparting a continuous upward pressure on prices. If this policy continues prices will continue to rise and seriously disrupt markets as happened in 2008:

Fading, and this series is not inflation adjusted:

Still high but falling fast:

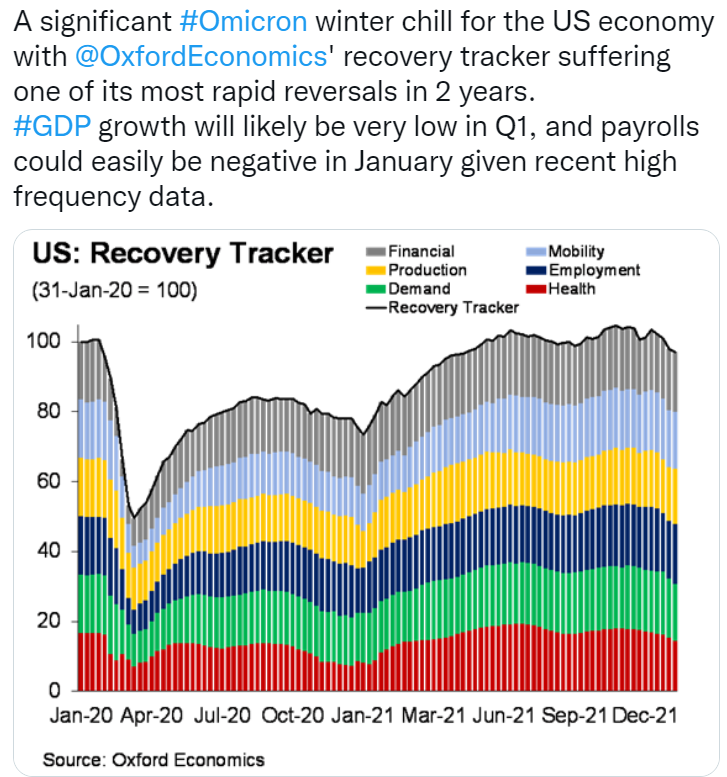

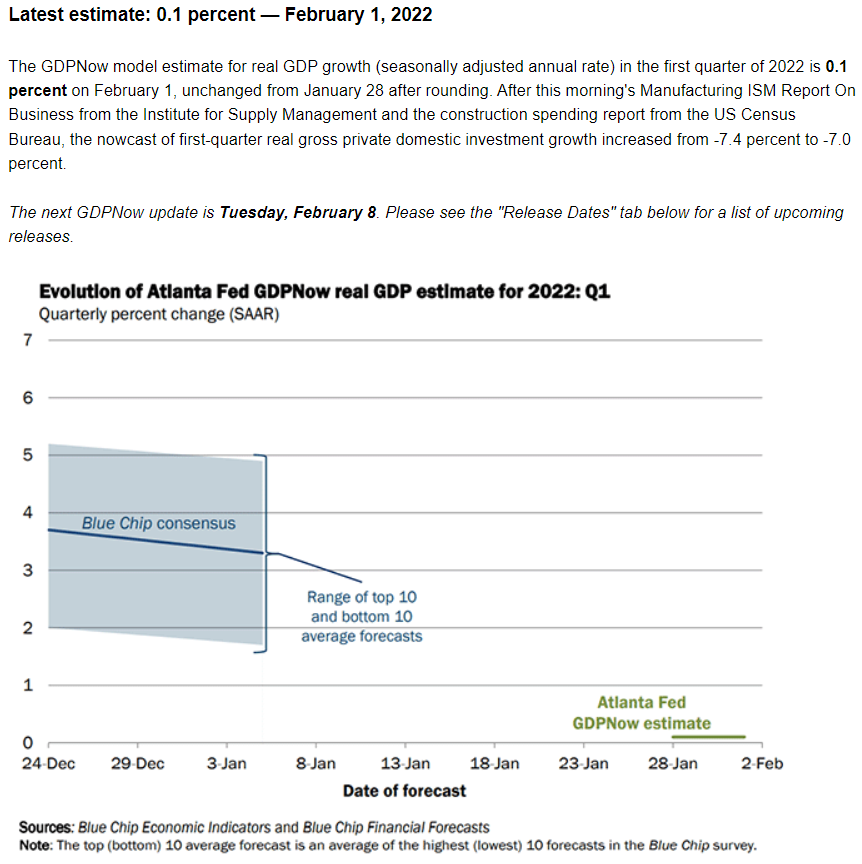

Still at only .1% GDP growth for Q1:

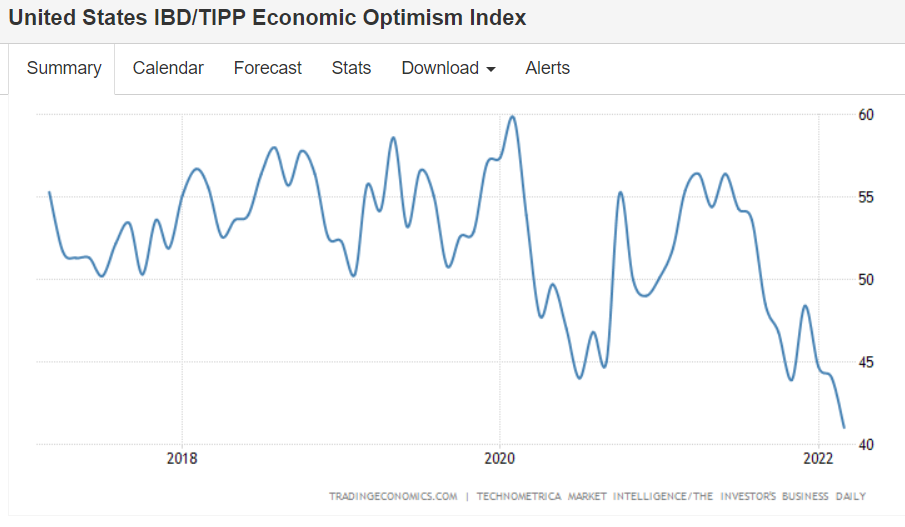

Still fading:

Still not looking like an excess demand problem:

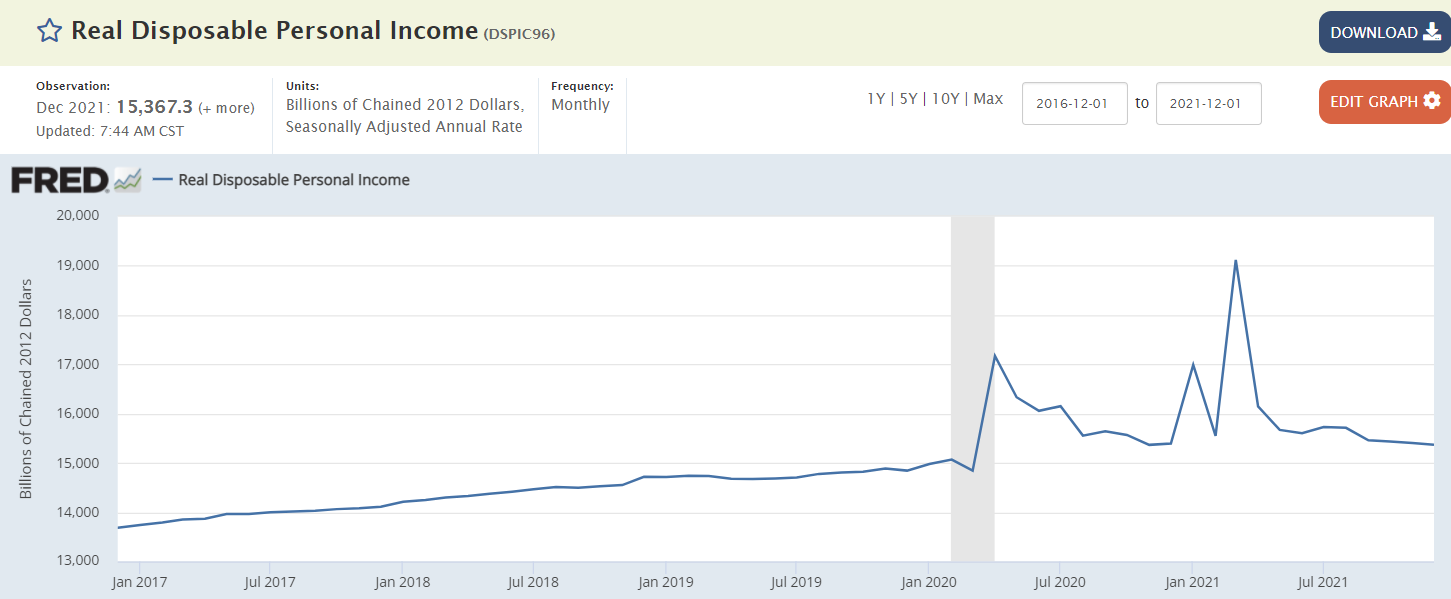

Might be the slowing income growth?

Covid dip, recovery, and now settling back at prior levels. After years of ultra low mortgage rates growth remains slower and absolute levels far below the prior cycle:

Post war slowdown narrative continues to unfold:

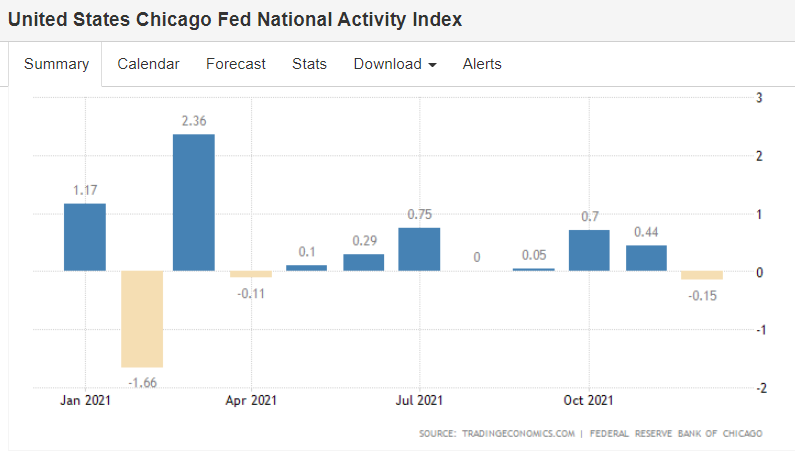

“The Chicago Fed National Activity Index in the US dropped to -0.15 in December 2021 from an upwardly revised +0.44 in the previous month, suggesting there was a contraction in economic activity following a two-month period of expansion.”