Not the kind of thing that happens when policy is ‘hyperinflationary’ as feared by many:

Retail sales jumped up with the Federal transfer payments and have more recently

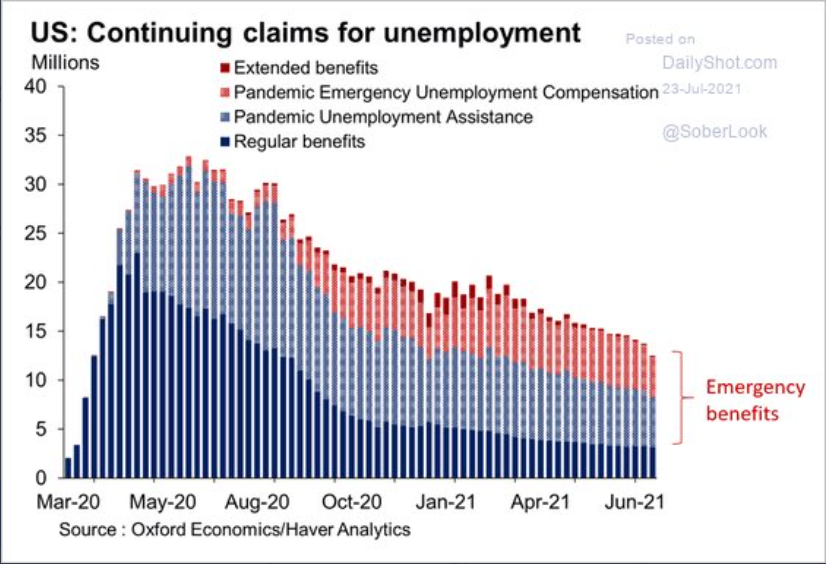

started to decline as transfer payments subsided. And the remaining Federal unemployment comp

of $300/week expires Labor day for approximately 7 million beneficiaries:

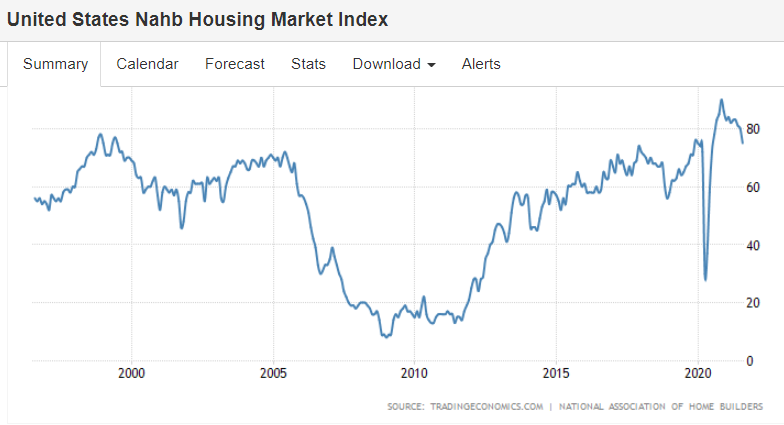

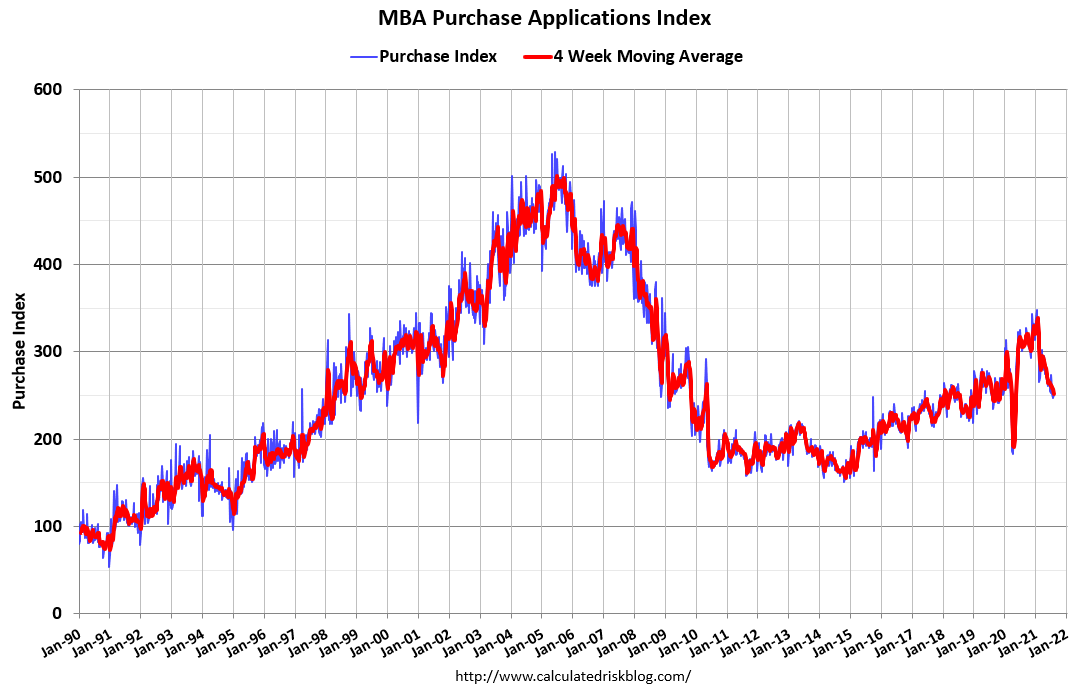

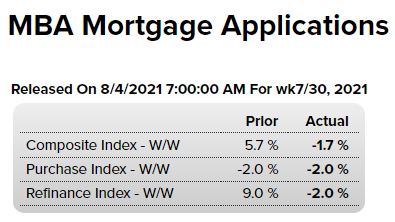

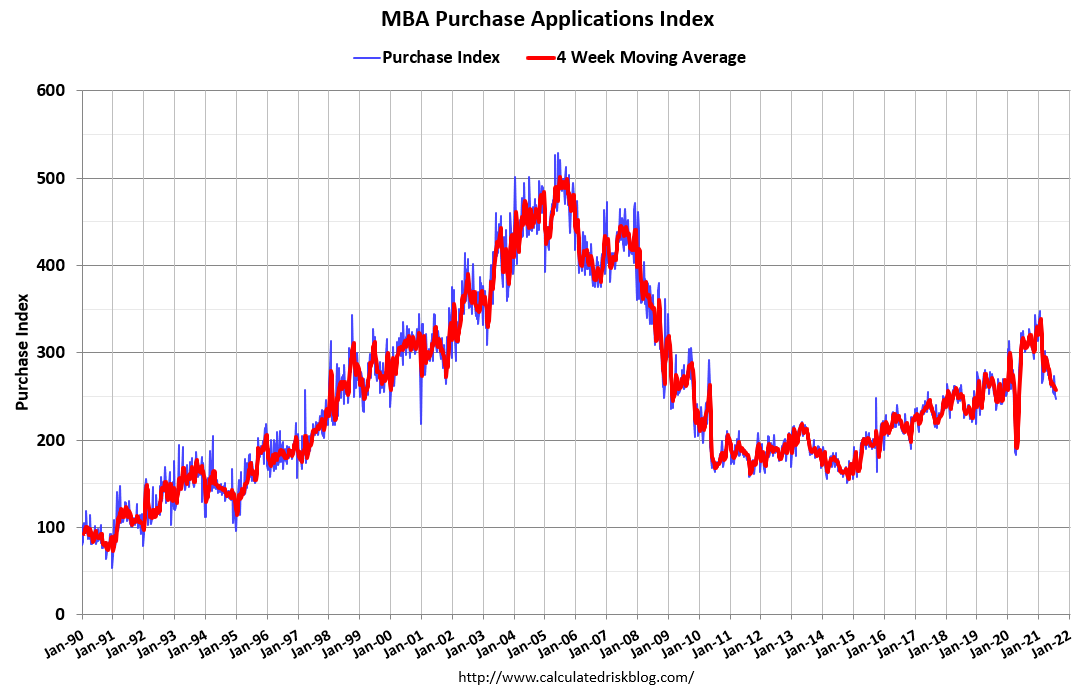

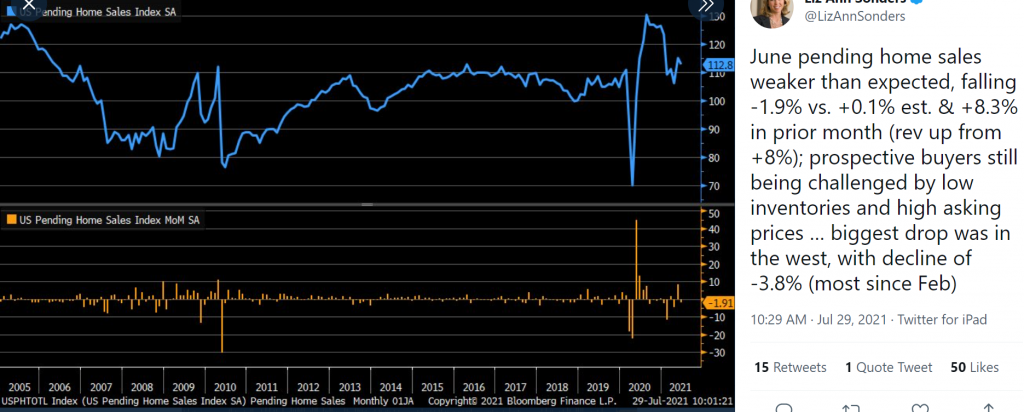

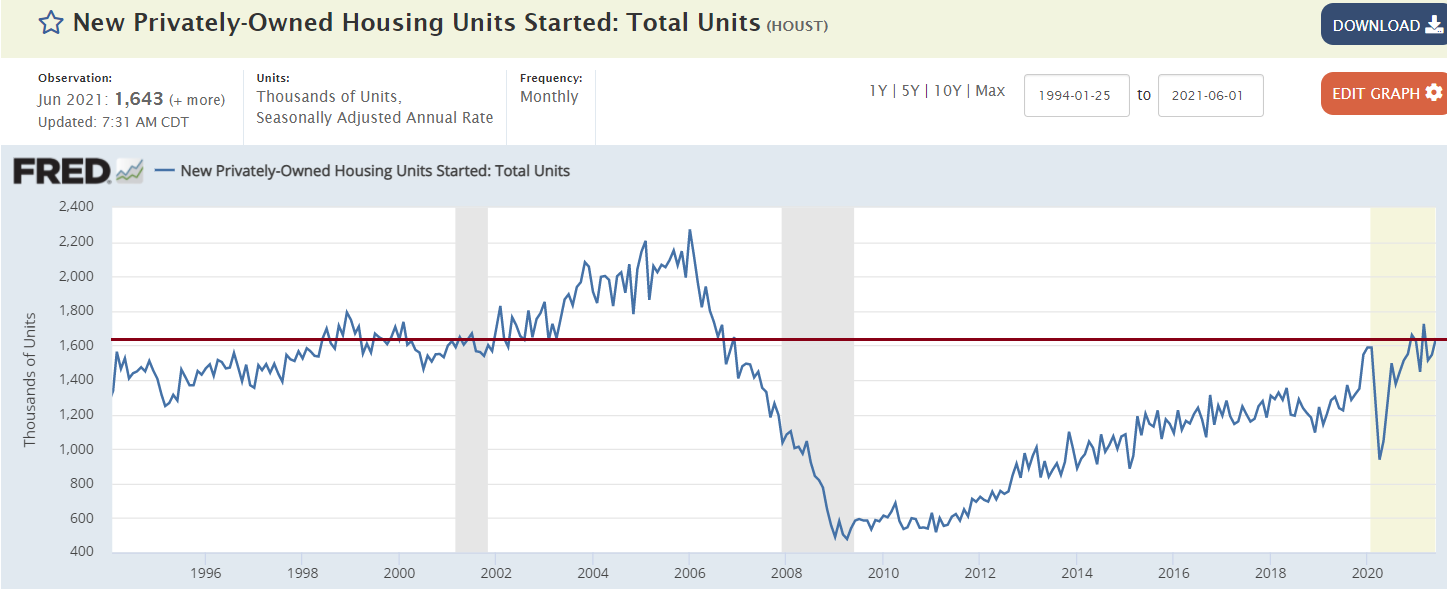

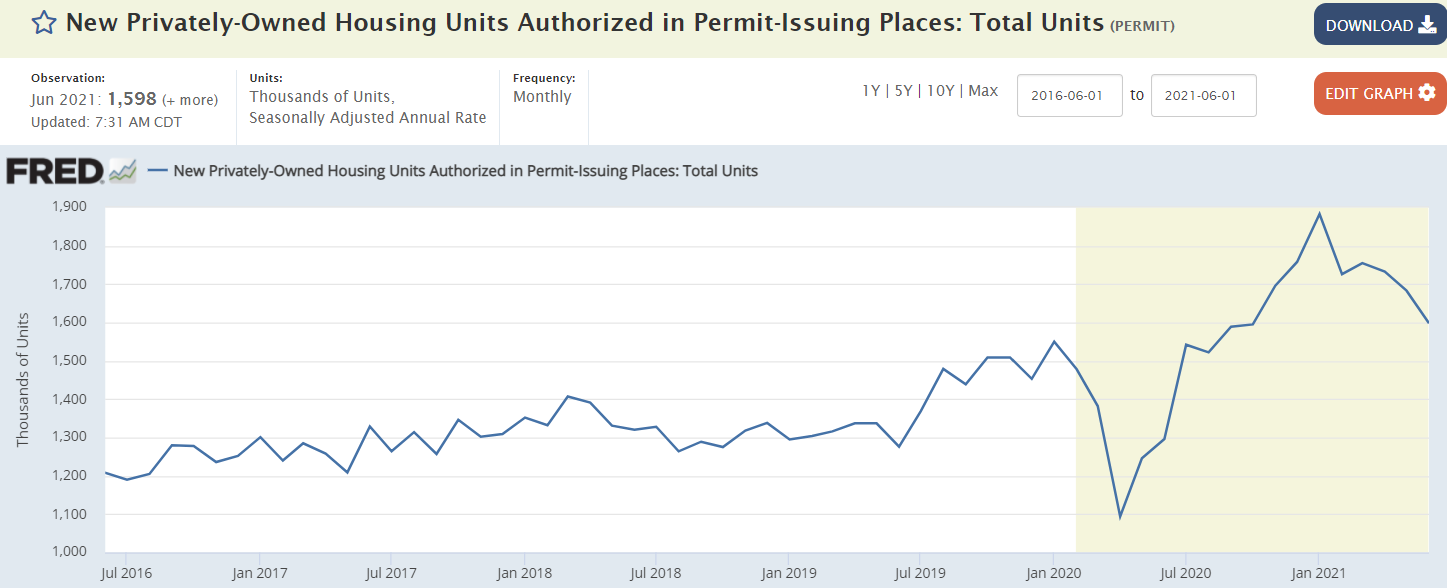

More evidence of a housing decline, even with the lowest rates ever:

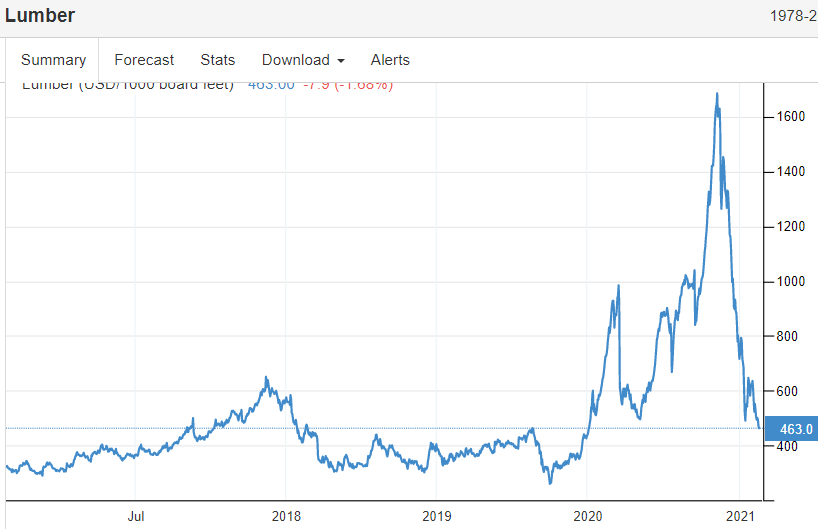

Lumber and housing often move together:

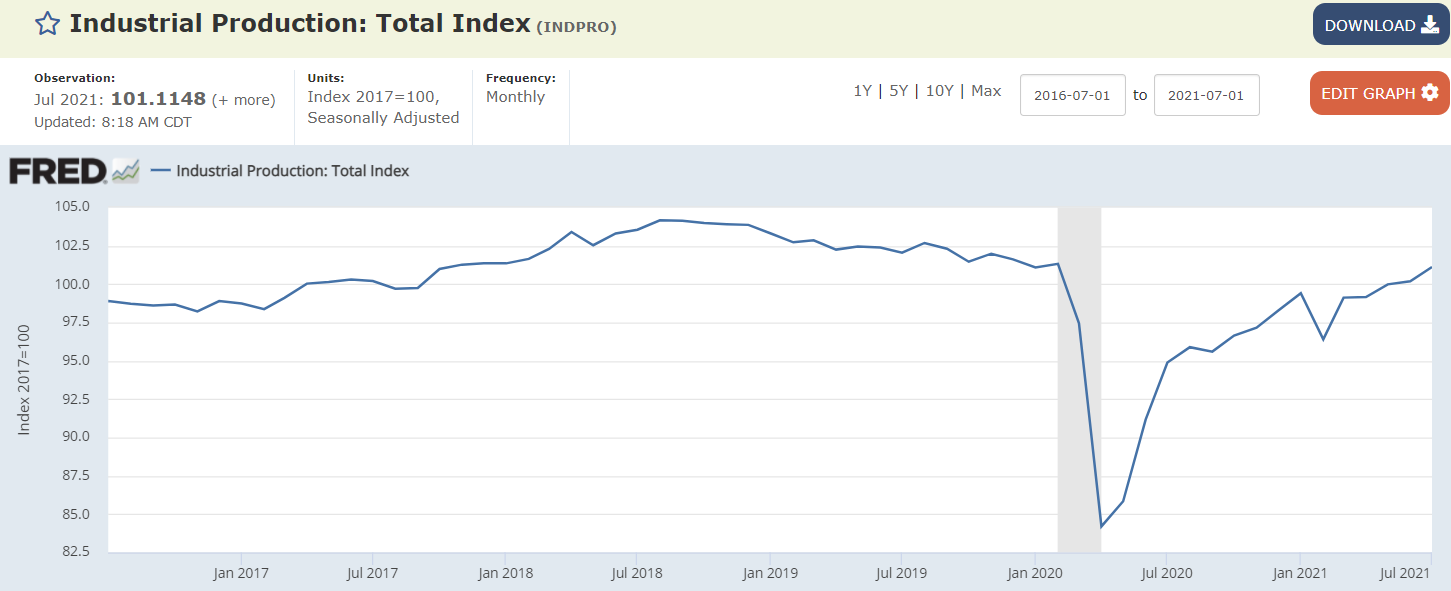

This number is seasonally adjusted, and was higher in July because auto plants typically shut down in July didn’t this year due to prior production issues:

Industrial production in the United States increased 0.9 percent in July 2021, following a downwardly revised 0.2 percent growth in June and beating market expectations of 0.5 percent. Manufacturing output rose 1.4 percent, mainly due to a jump of 11.2 percent for motor vehicles and parts, as a number of vehicle manufacturers trimmed or canceled their typical July shutdowns. Despite the large increase last month, vehicle assemblies continued to be constrained by a persistent shortage of semiconductors. The output of utilities decreased 2.1 percent in July, while the index for mining rose 1.2 percent. source: Federal Reserve

Steel and industrial production are also somewhat related:

Working its way lower:

Inflation fears may be fading?

Getting worse. I guess low rates aren’t the end all for housing…

;)

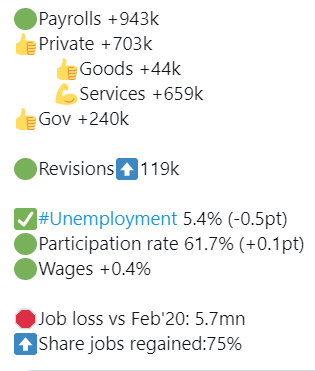

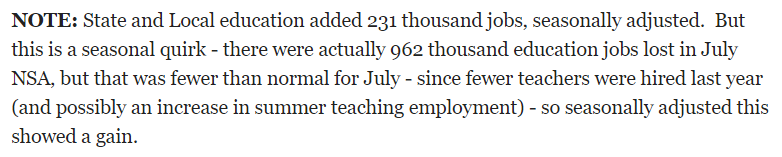

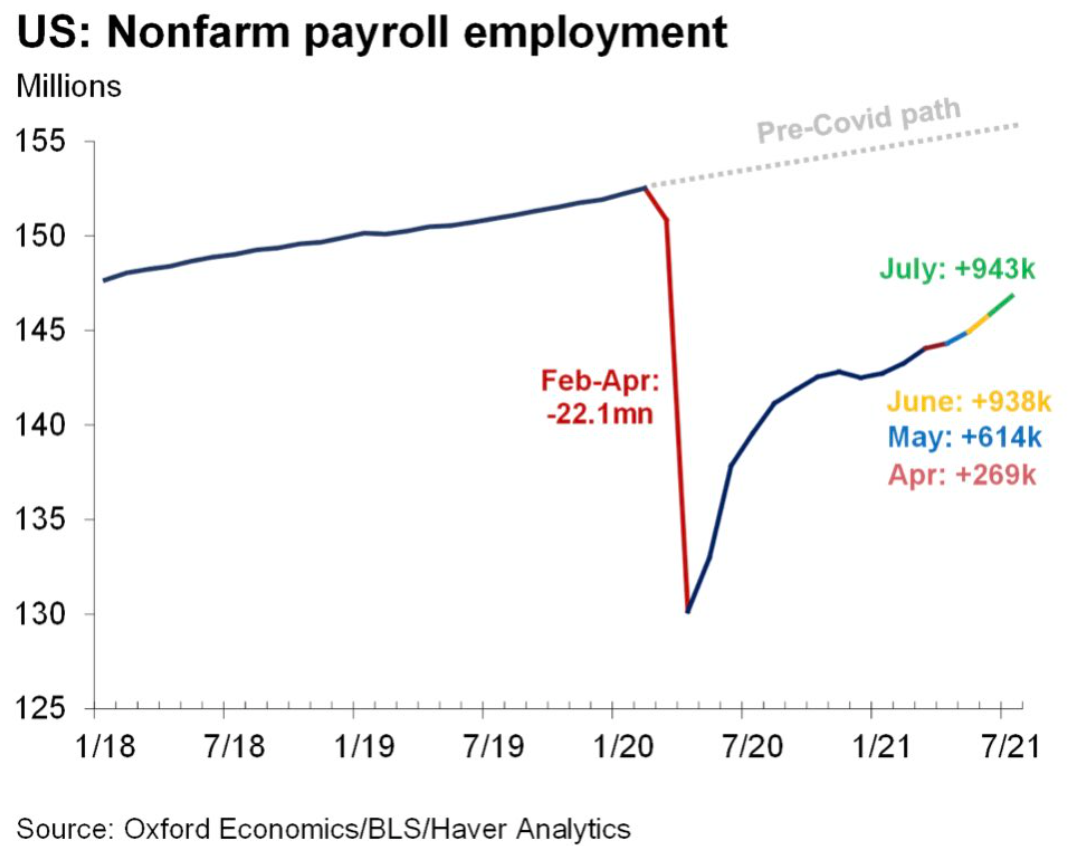

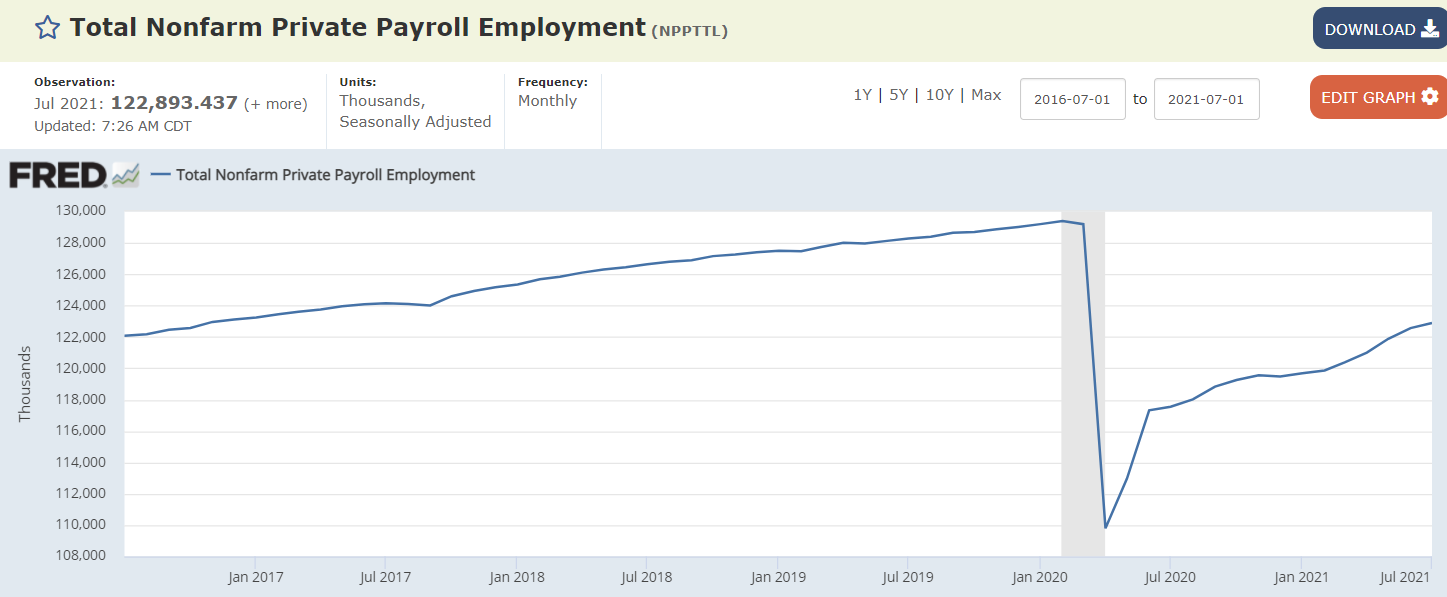

Steady improvement but still a ways to go:

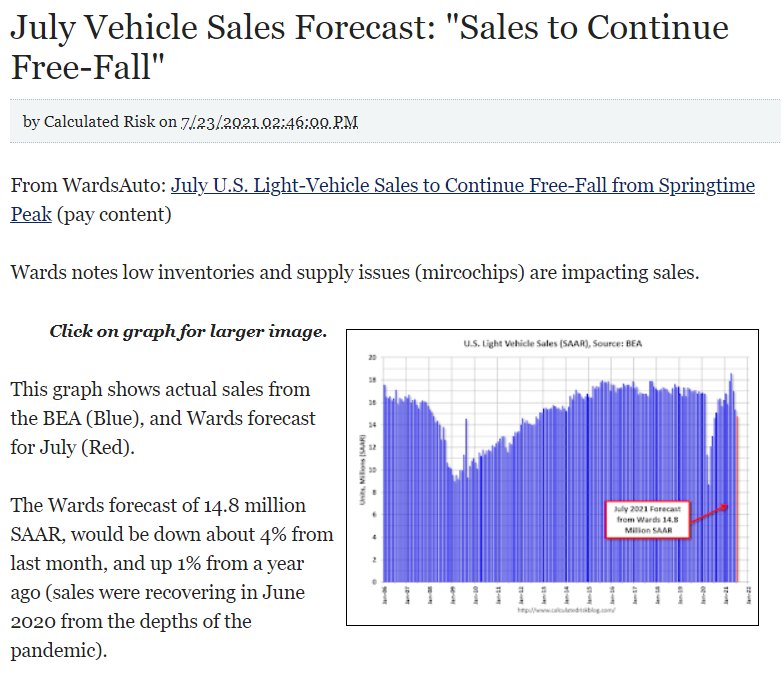

And this doesn’t look good:

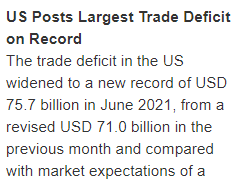

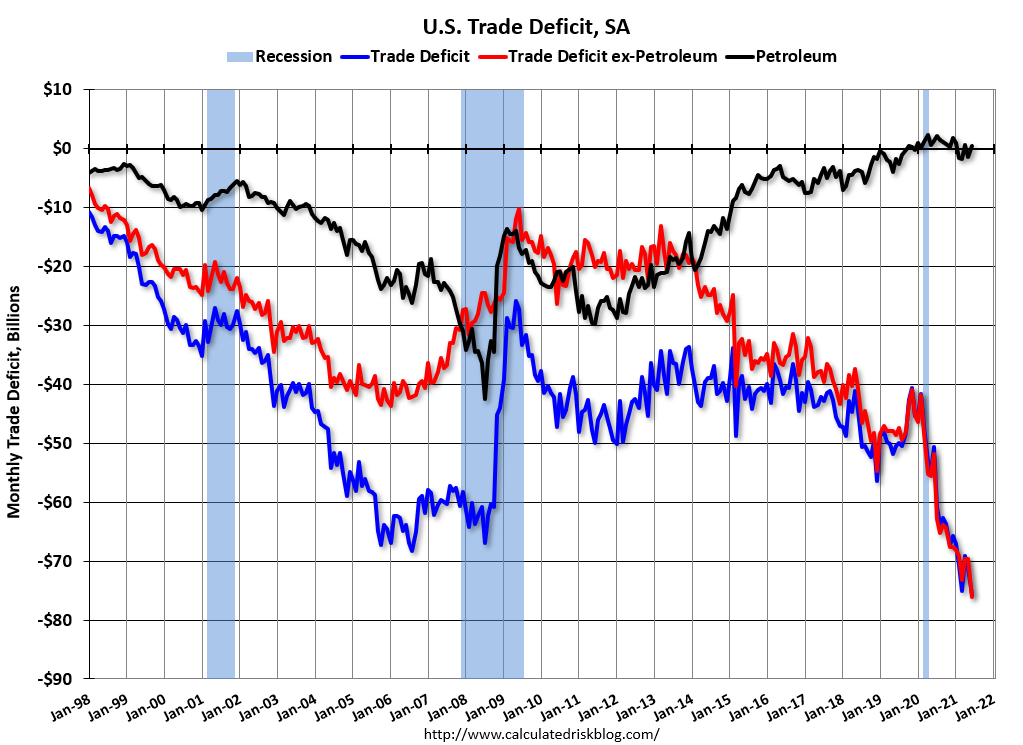

We’re spending more on net imports which is fundamentally a direct benefit for us, if only our govt. knew the appropriate policy response:

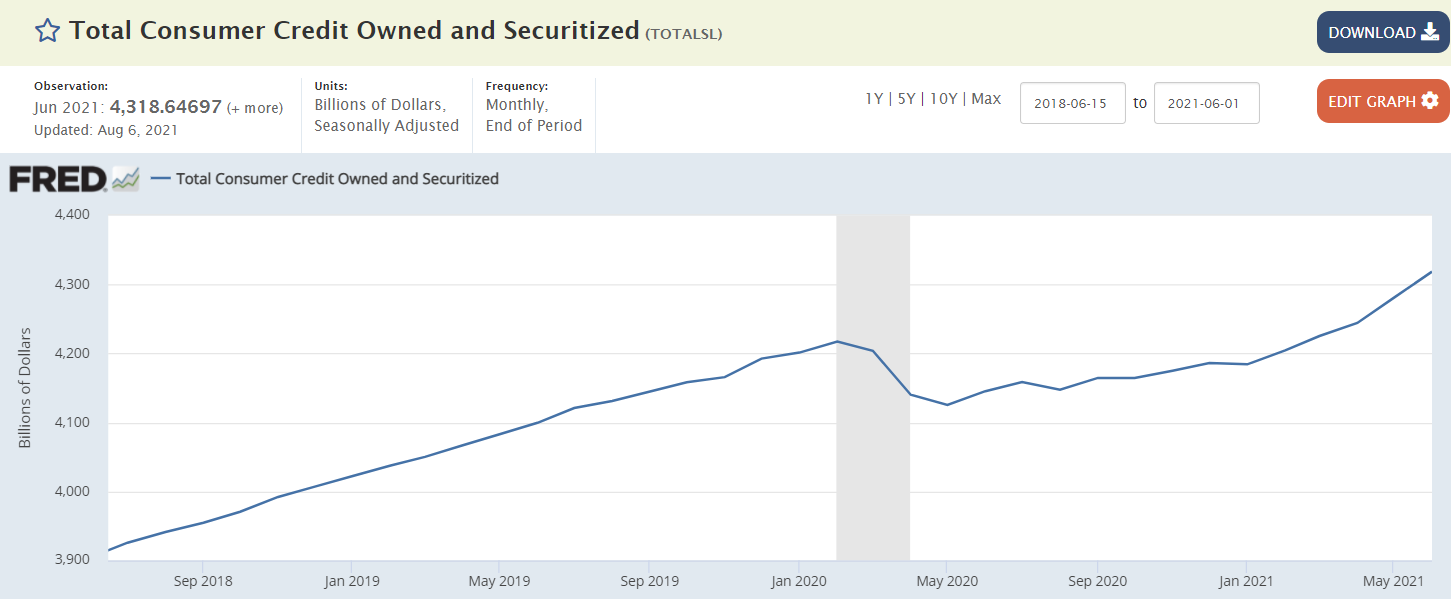

Consumer credit growth has picked up as jobs are added and as Federal unemployment benefits expire:

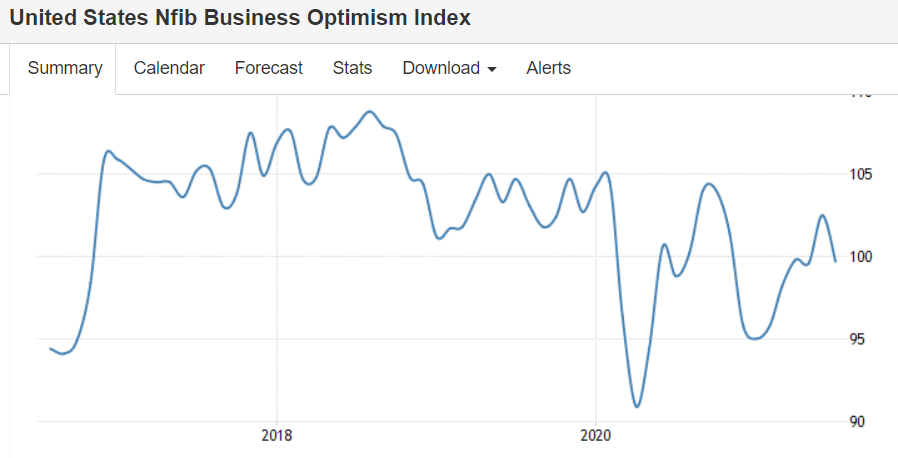

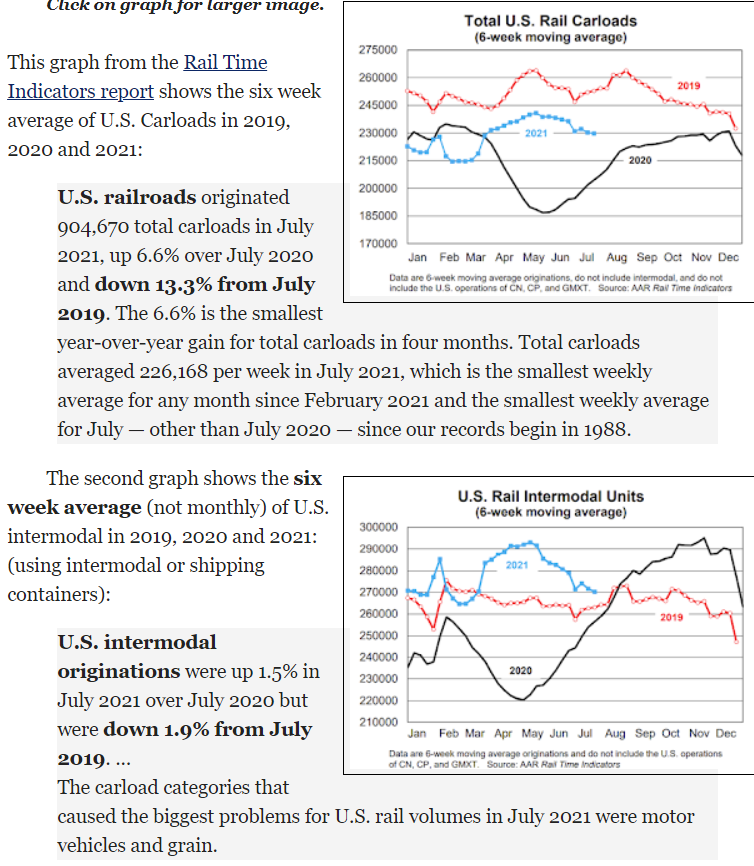

These charts have turned down:

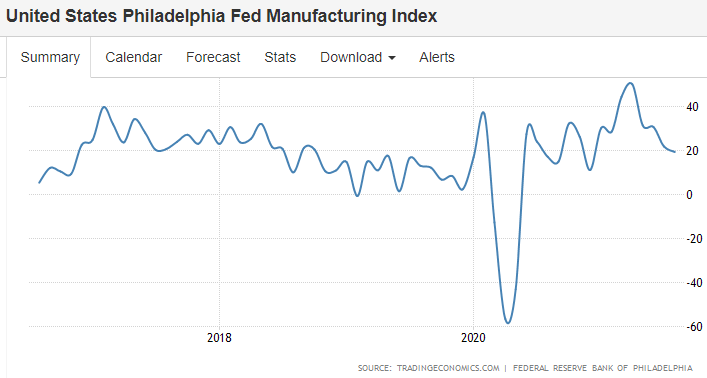

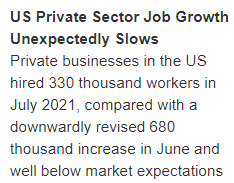

Not good. Analysts/politicians/voters expected more gains as Federal benefits expired:

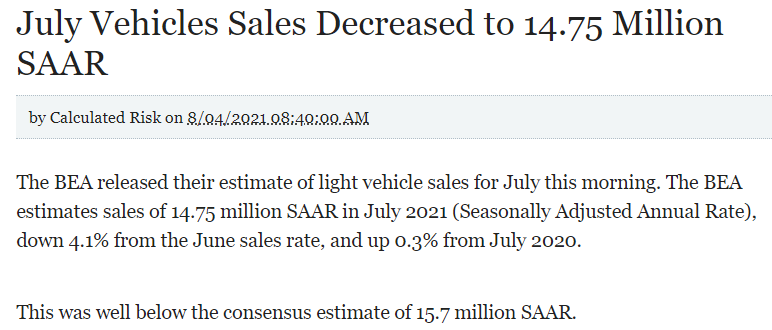

Not good:

Not good:

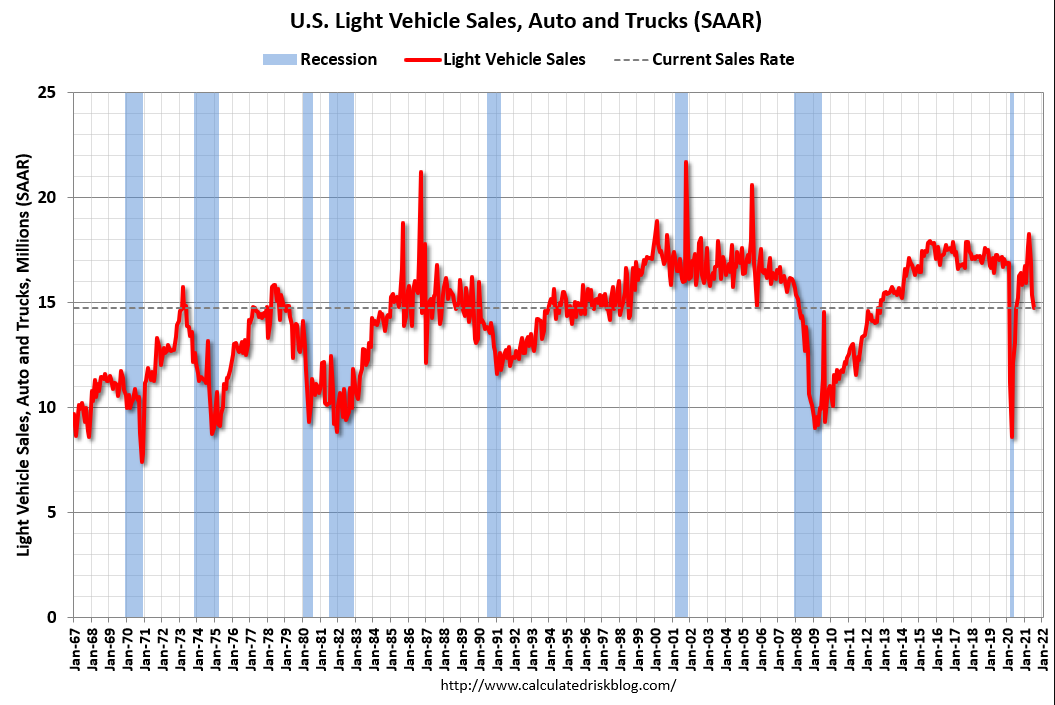

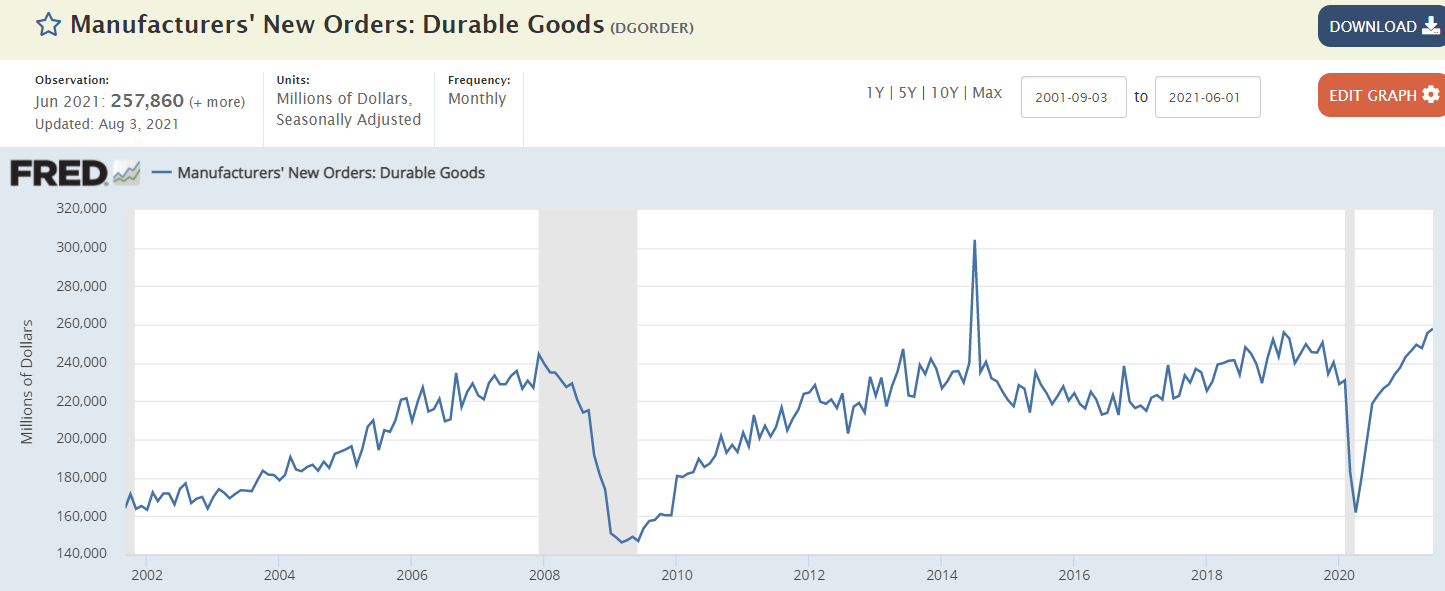

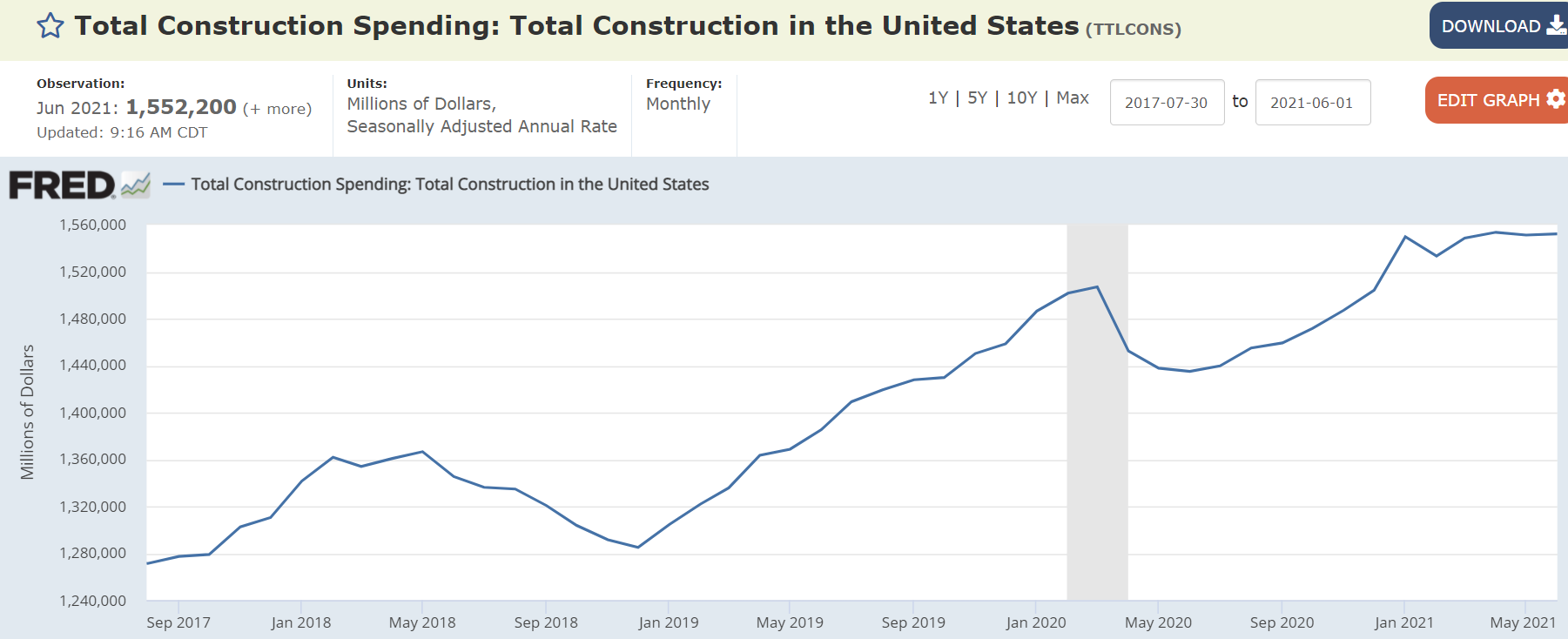

Typical bounce after the covid dip that followed the tariff decline, but so far only back to prior levels, and less when adjusted for inflation:

Same pattern:

Also same pattern of covid dip, recovery, then weakness most recently:

US Factory Growth Slows in July

The ISM Manufacturing PMI fell to 59.5 in July of 2021, the weakest in 6 months, compared to 60.6 in June and below forecasts of 60.9. New orders, production, and supplier deliveries increased less and inventories contracted. Meanwhile, employment rebounded and price pressures eased.

Looks like price hike mode?

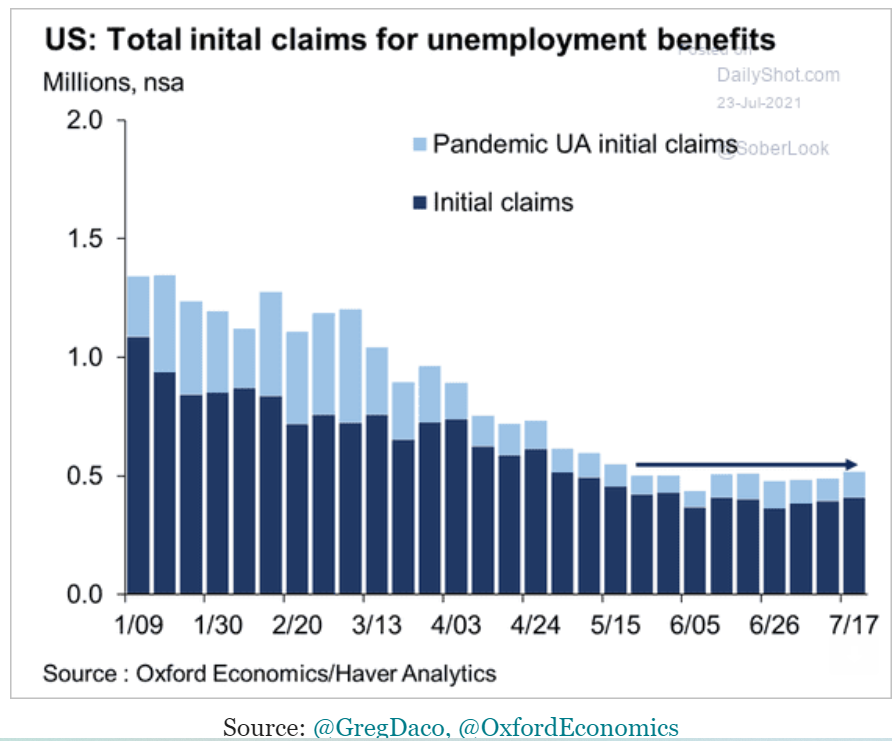

New claims still running high, as are continuing claims. Federal unemployment benefits expire in about 6 weeks:

Same pattern- covid dip, recovery, fade, continuing the weakness that traces back to the tariffs:

Covid dip, recovery, and now a decline:

Covid dip, recovery, and now sideways at levels of some 25 years ago when there were a lot fewer people:

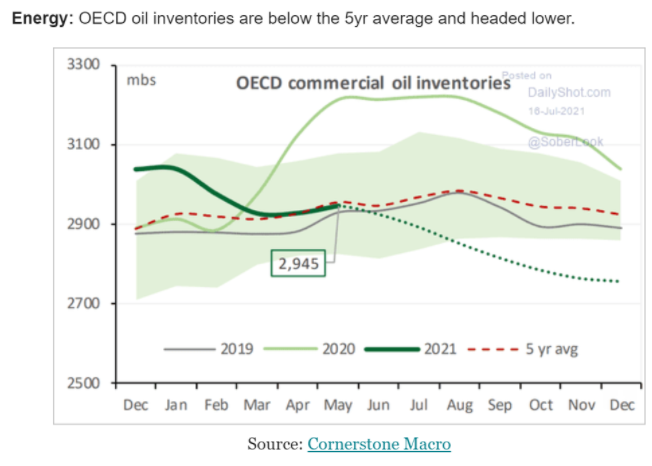

Through June,

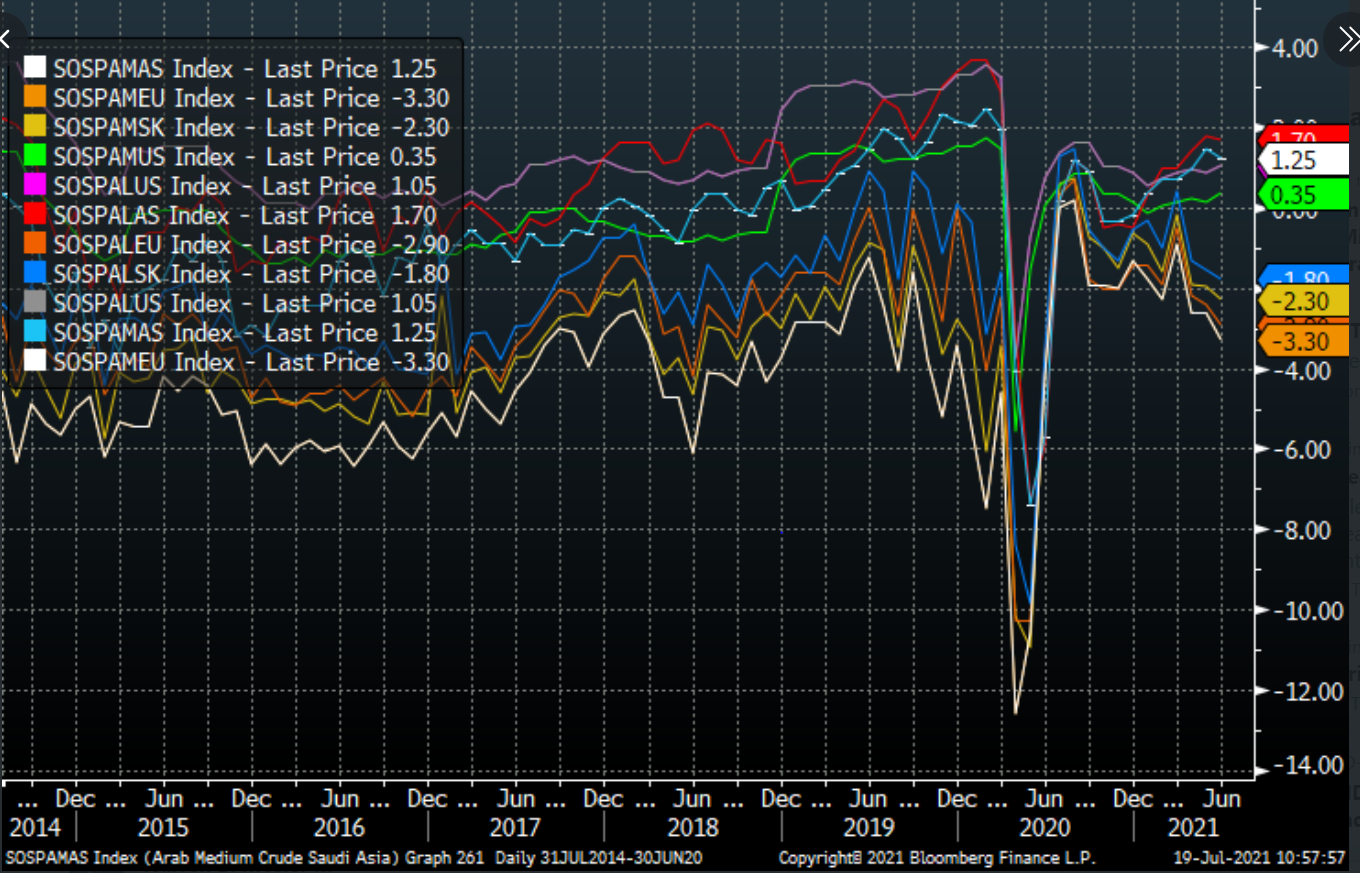

Saudis caused the big dip and recovery, then attempted to stabilize.

The most recent Reuters report suggested price increases vs benchmarks,

which is a move to firm prices over time: