Category Archives: Uncategorized

no income growth=no spending growth

CFOs signal fears of consumer spending slump

By Matt Clinch

February 20 (CNBC) — With wage rises failing to match the flickering signs of an upturn in the global economy, chief financial officers have told CNBC that a lack of consumer spending is a major fear for their companies.

CNBC asked 51 chief financial officers (CFO) from Europe and Asia who make up the CNBC CFO council to give their insight on the state of the world economy and conditions for doing business. Nearly half of the respondents ranked weakening consumer demand as their strongest concern for their business. No other risk factor even came close, with fears of a China slowdown receiving 16 percent for their highest ranked concern.

The results match a similar signal from CFOs in the America. In December, the U.S.-based members of the exclusive Global CFO Council ranked weakening consumer demand as one of biggest issues keeping them up at night.\

G-20 delays making things worse until at least November

The G-20 said it would “significantly raise global growth” without overtaxing national finance through measures to promote competition and increase investment, employment and trade.

As an initial step toward achieving the $2 trillion target, each country will present a comprehensive growth strategy to a summit of leaders scheduled for November in the Australian city of Brisbane.

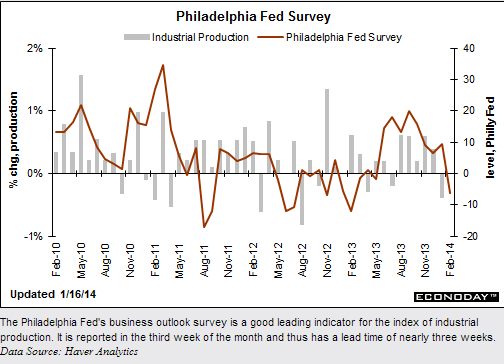

philly fed chart and details

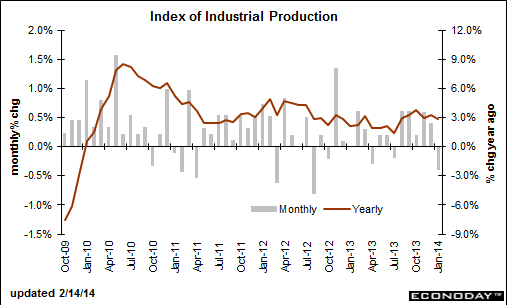

IP Chart

More downward revisions on the way, with expectations of a reversal when the weather issues subside.

But with the federal deficit probably south of 3%, which seems to be struggling to keep pace with the demand leakages, the income lost due to the reduced growth of sales/output/employment means there is that much less support for any post weather rebound in spending/GDP.

“But freezing temperatures boosted demand for heating last month, causing utilities production to jump 4.1 percent.”

Industrial Production

Highlights

The manufacturing sector is losing traction-weather related or not. Overall industrial production fell 0.3 percent in January, following a 0.3 percent gain the month before. Analysts expected a 0.3 percent rise for the latest month.

Turning to major components, it was worse for manufacturing which dropped 0.8 percent after a 0.3 percent increase in December. The consensus projected a 0.1 percent increase for January. Atypically adverse weather helped the overall number from being weaker as utilities jumped 4.1 percent in January, following a 1.4 percent dip the prior month. Mining slipped 0.9 percent after gaining 1.8 percent.

Looking at detail for manufacturing, durables fell 0.8 percent in January, led down by a 5.0 percent drop in motor vehicles and parts. Nondurables declined 0.8 percent in January.

Manufacturing excluding motor vehicles decreased 0.5 percent in January, following a 0.3 percent rise in December.

Capacity utilization declined to 78.5 percent from 78.9 percent in December.

Today’s report adds to the argument that the first quarter will be sluggish. It also calls to attention as to whether the Fed will pause in its “measured steps” for tapering quantitative easing. But the Fed clearly will watch the next employment report before making that decision in mid-March.

The traditional non-NAICS numbers for industrial production may differ marginally from the NAICS basis figures.

Big incentives likely as inventories of new vehicles pile up

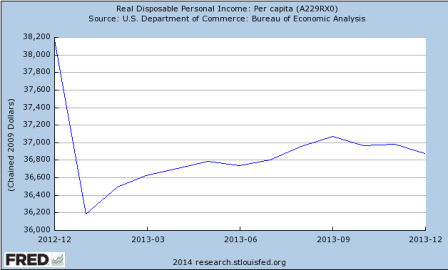

GEI comments on incomes

Given this healthy economic growth, the US electorate should be thrilled happy to be part of one of the fastest growing developed economies.

Yet they are clearly less than thrilled with the economy, let alone the administration or their representatives in Congress. Why? With real household income stagnant and still below where it was in 2012, the electorates view of the economy differs substantially from these numbers.

Unlike their elected representatives, they have to deal with the real world problems of making ends meet while juggling debt loads at credit card rates. It is likely that they have a deep and abiding sense that either these numbers are a bureaucratic fiction, or (more troubling) they are benefiting someone else:

The headline unemployment numbers mask a major deformation of the work force with fewer people choosing to look for work and more being forced to accept multiple part time jobs. People on the street understand the difference between an increasing quantity of part-time work and the quality of full-time jobs.

Real per capita disposable income was down -0.85% during 2013. And to maintain the prior years standard of living, the household savings rate plunged 2.3%.

For many households (and especially the 18-35 demographic) the Affordable Care Act (aka ObamaCare) will result in increased net monthly outlays for health insurance.

The per capita numbers continue to mask an ongoing shift in income distribution: although the average per capita income data has grown some 3.3% since October 2008 (per the BEA), the median household income has shrunk some 7% over that same time span (per Sentier Research). The typical member of the electorate lives at the median, and they are not sharing the growth reported by the BEA.

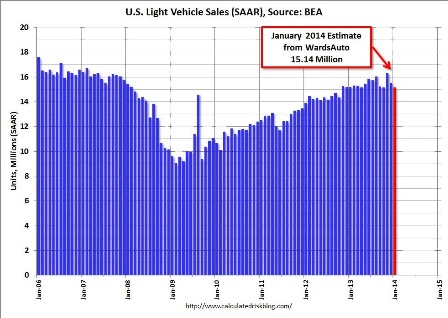

Car sales worse than expected

I know, it was cold in January…

And the inventory to sales ratio isn’t too high based on November’s sales rate…

U.S. Light Vehicle Sales decrease to 15.1 million annual rate in January

By Bill McBride

Based on an estimate from WardsAuto, light vehicle sales were at a 15.14 million SAAR in January. That is down slightly from January 2013, and down 2.5% from the sales rate last month.

This was below the consensus forecast of 15.7 million SAAR (seasonally adjusted annual rate).

Full size image

Jackson on high auto inventories

Slow down! We have too many cars: AutoNation CEO

Automakers should watch their bloated inventories even though 2014 seems like it will be a good year for car sales, AutoNation Chairman and CEO Mike Jackson told CNBC on Thursday.

The automakers have a “pretty bizarre” way of calculating inventories to justify these levels, he said in a “Squawk Box” interview. “But if you cut through the bogus calculations and look at dealer inventory for the Detroit 3, it’s over a 100-day supply. And it simply doesn’t need to be there.”

In response, Joe Hinrichs president of the Americas at Fordtold CNBC: “We have been cutting some production in the fourth quarter of last year and in the first quarter of this year on a couple of our product lines where we saw the inventory grow a little bit.”

But Hinrichs added, “The industry is a little different now. With our capacity running max out, we actually grow an inventory in the winter, come down in the spring and summer because we run our plants full all year round. In the old days when we had excess capacity, we’d take the plants down in the winter and work overtime in the spring/summer to supply to the demand.”

He added: “We’re watching it carefully, but I think we’re going to be OK.”

Jan US auto sales news

With 15 days down they are looking for only minuscule growth of total vehicle sales for January, year over year, as the growth rate looks to have dropped to near 0.

And that was before stocks got shaky…

J.D. Power and LMC Automotive Report