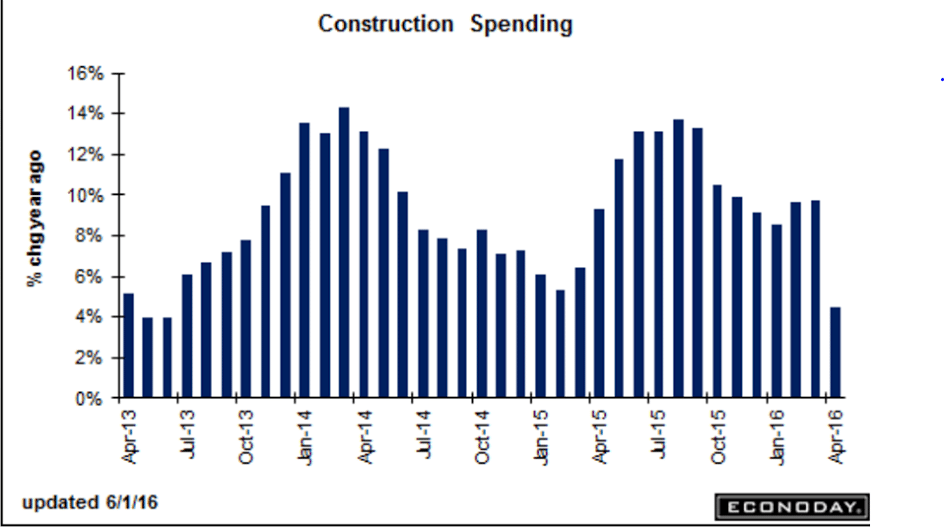

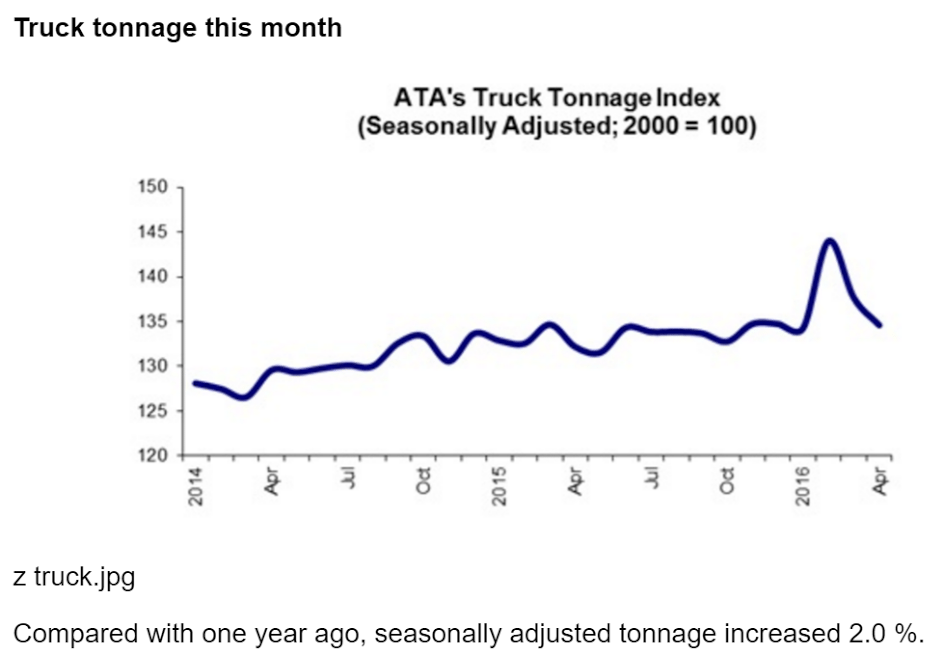

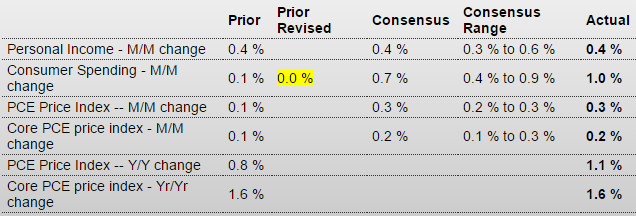

Yet another pretty good April release that I suspect will be reversed in May, as has happened with several other data series. And the increased spending on gasoline due to higher prices coincided with a reduction in the savings rate, as April spending outstripped income. And note that March’s +.1 was revised to 0 with this April number also subject to revision.

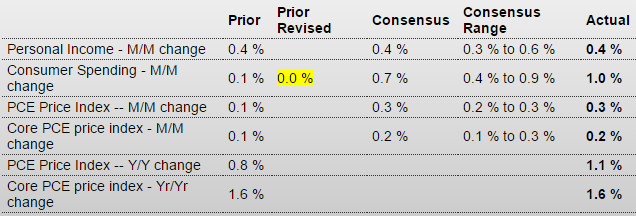

Personal Income and Outlays

Highlights

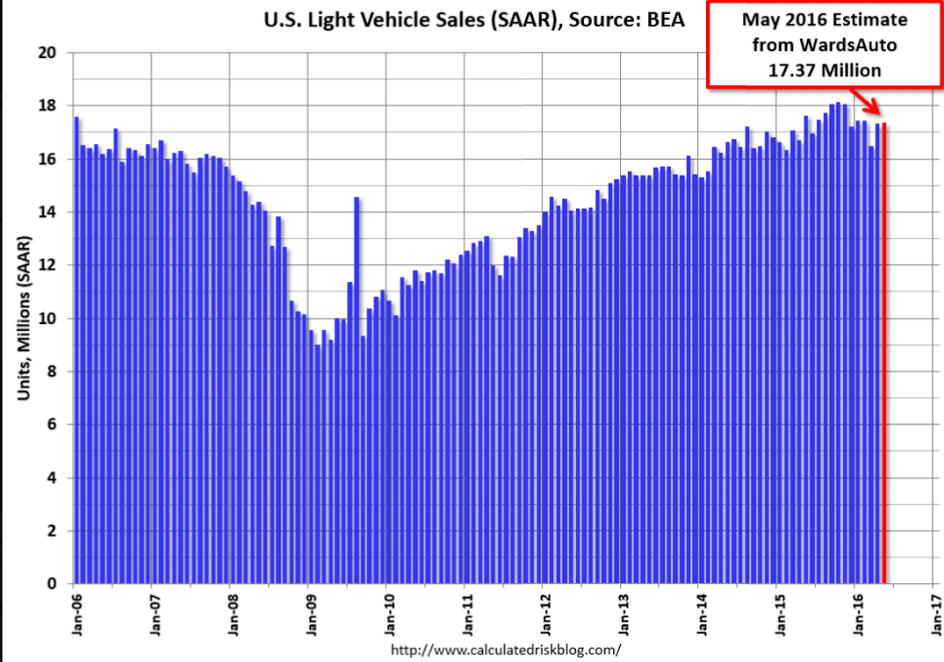

April was definitely the month of the consumer as consumer spending surged 1.0 percent for the largest monthly jump of the economic cycle, since August 2009. The spending gain reflects strength in vehicle sales, which boosted durable spending by an outsized 2.3 percent in the month, and also reflects price effects for gasoline as spending on nondurable goods rose 1.4 percent. Spending on services, which is a bulwark of this report, rose a very solid 0.6 percent in the month.

The income side of today’s report is also strong, up 0.4 percent which includes a 0.5 percent rise for wages & salaries. Consumers tapped into their savings for the spending rush as the savings rate fell 5 tenths to what is still a very solid 5.4 percent.

Price data are mixed as the PCE core rate — which is the Fed’s most important gauge — rose only 0.2 percent with the year-on-year rate decidedly flat at an unchanged 1.6 percent and still, despite the gain for wages, 4 tenths below target. The overall price index shows more life, up 0.3 percent on the month and 3 tenths higher on the year at plus 1.1 percent.

The spending side of this report is an eye catcher and if repeated in May could very well, despite the lack of pressure on core prices, raise the chances for a June FOMC rate hike. Note that unit vehicle sales, to be posted on tomorrow’s calendar, will offer the first substantial clues on consumer spending in May.

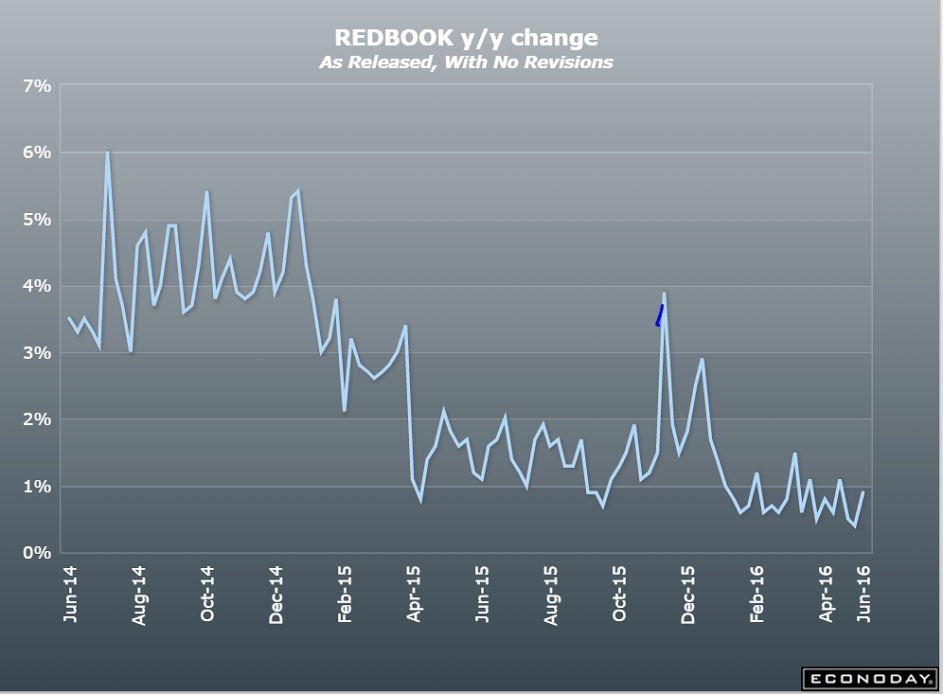

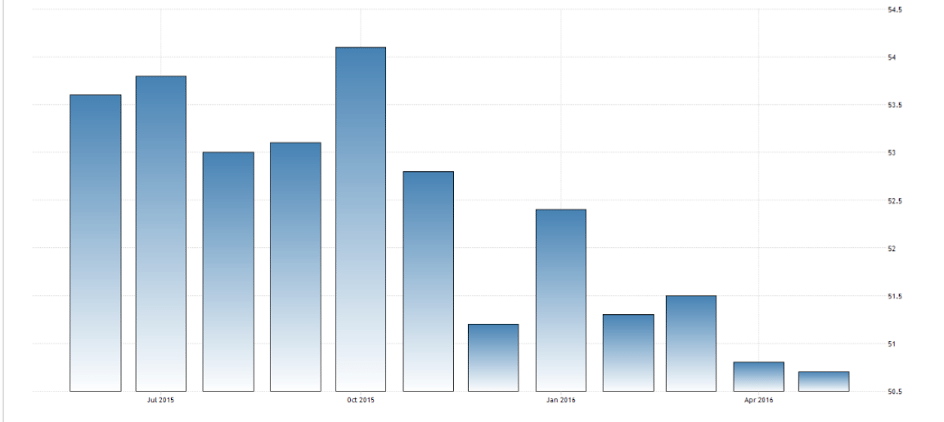

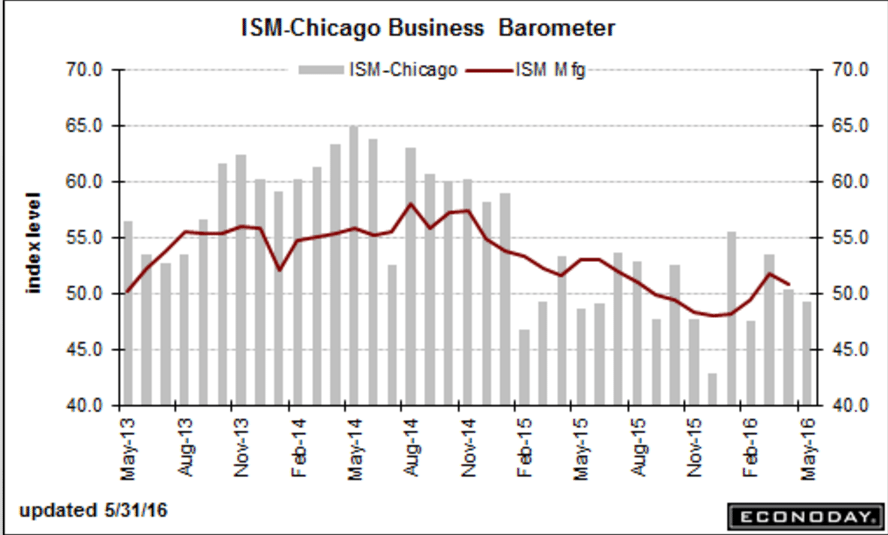

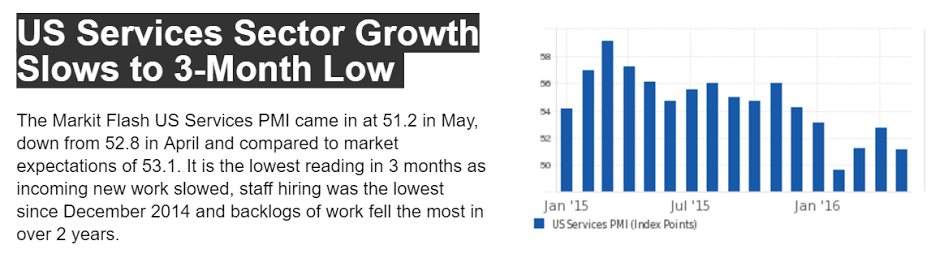

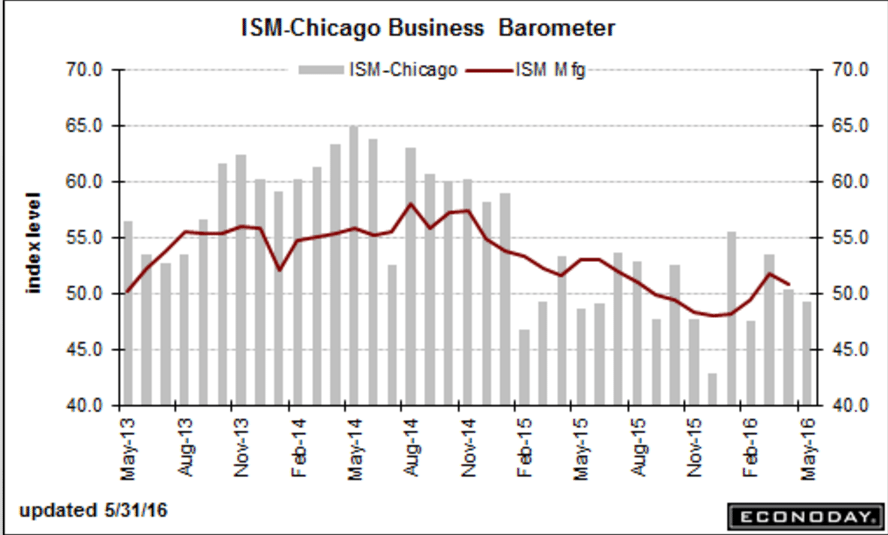

Speaking of firmer April releases that reversed in May, here’s another example:

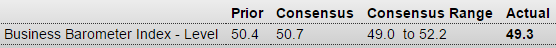

Chicago PMI

Highlights

Businesses in the Chicago area are reporting slowing conditions with the PMI down 1.1 points to a sub-50 contractionary reading of 49.3. New orders, which slowed in the prior month, are now also in outright contraction as are backlog orders. Production is also in contraction while employment, though slowing, is still above 50 — but likely not for long given the weakness in orders and production.

A key indication of overall weakness is sharp contraction underway in inventories which are at their lowest point since November 2009. The decrease in inventories points to caution among businesses which apparently do not see demand improving. The prices paid index slowed but remains above 50 to indicate monthly growth, which is a plus right now as policy makers try to stimulate inflation.

The Chicago PMI has been up and down this year though the trend is pointing lower. Still, this report is dwarfed in importance by the big surge posted in this morning’s consumer income and spending data. The Chicago PMI samples companies from both the manufacturing and non-manufacturing sectors.

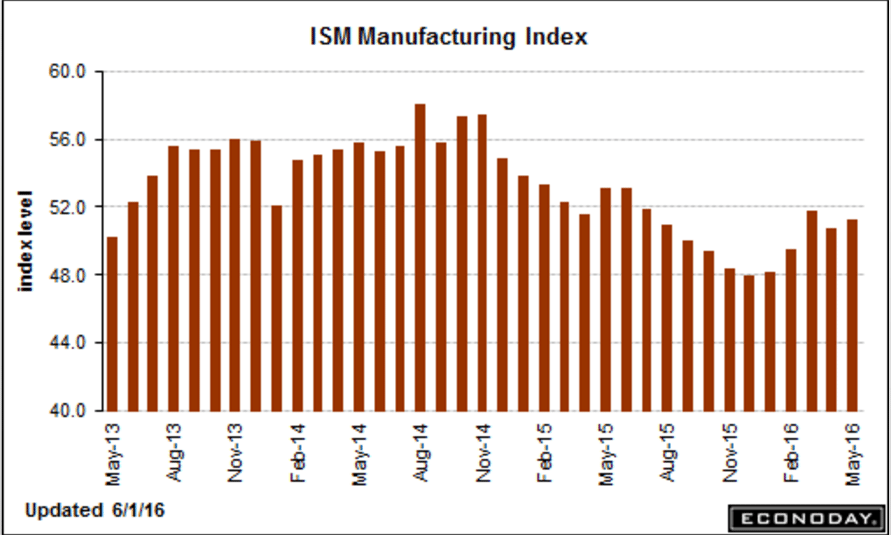

And yet another April uptick reverses in May:

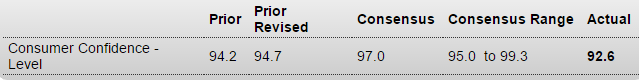

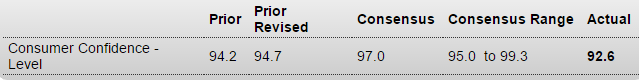

Consumer Confidence

And a big time reversal into contraction from April to May here as well:

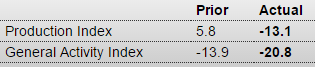

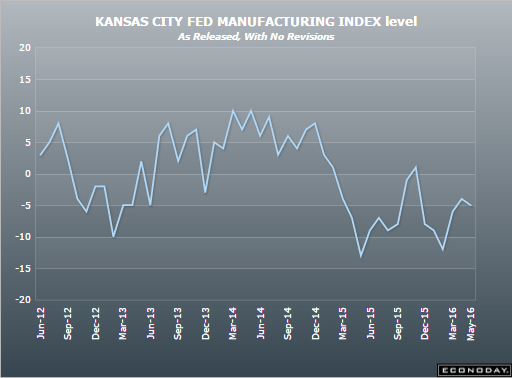

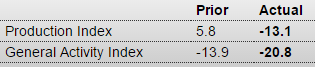

Dallas Fed Mfg Survey

Highlights

The Dallas manufacturing production index fell into negative territory with a reading of minus 13.1 from a positive 5.8 reading in April. At the same time, the May general activity index sank to minus 20.8 from minus 13.9 last time. This was the 17th consecutive negative reading.

New orders also fell back into negative territory. After popping up 6.2 in April after four consecutive declines, new orders dropped to a reading of minus 14.9. Employment remains weak, at minus 6.7 for a fifth straight contraction. Price data showed some life with wages up and raw materials, which had been week, also up. Selling prices, however, remain a negative, at minus 3.3, an improvement from minus 6.6 in April.

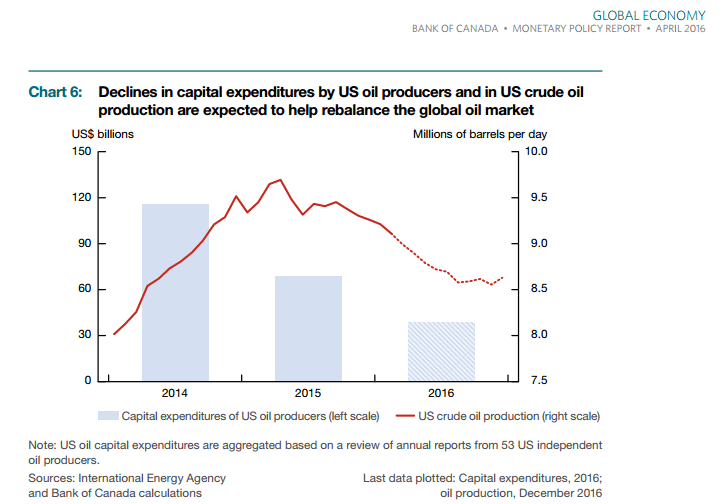

The ongoing recovery for oil is having a positive effect on energy prices and is likely to have a wider positive effect for the Texas manufacturing area eventually. However, this report is a setback.

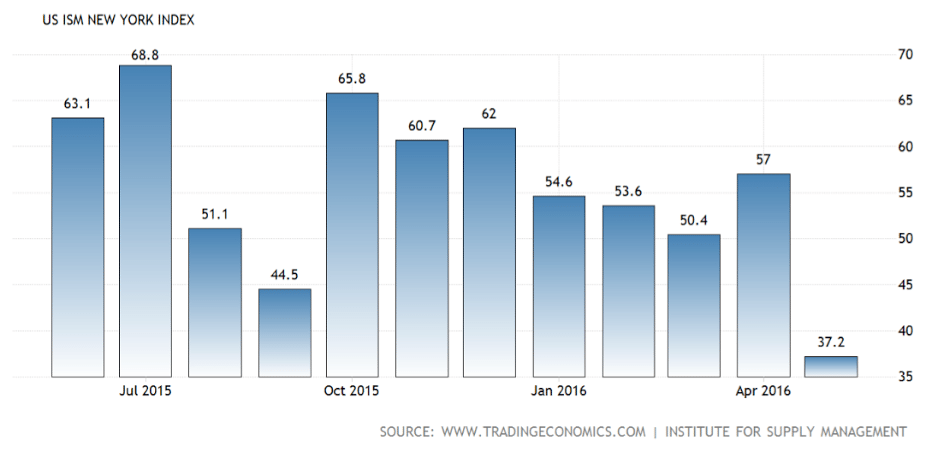

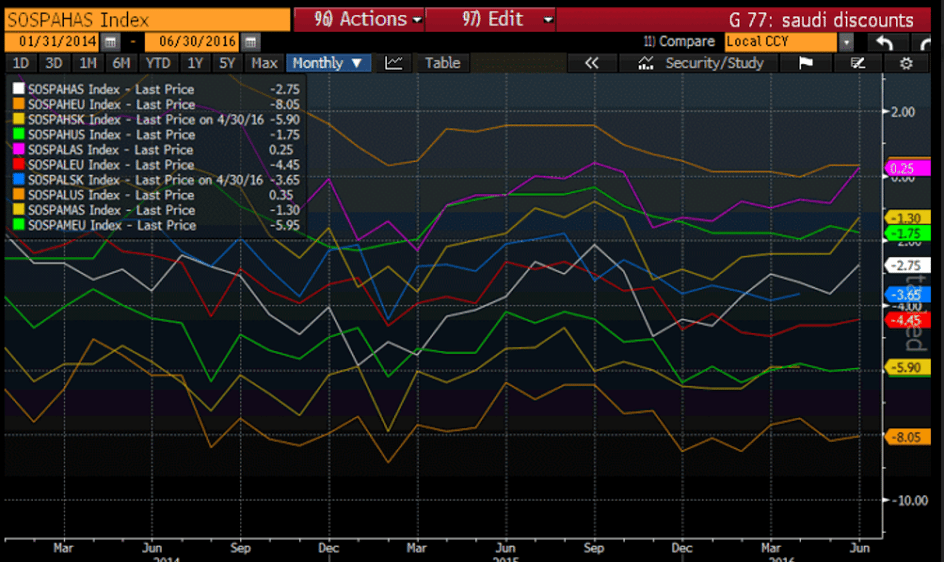

And even this indicator, whatever it is, shows the same pattern:

State Street Investor Confidence Index