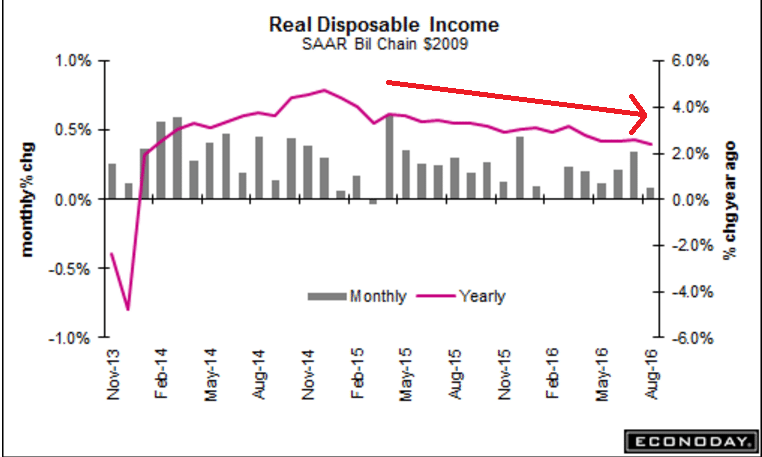

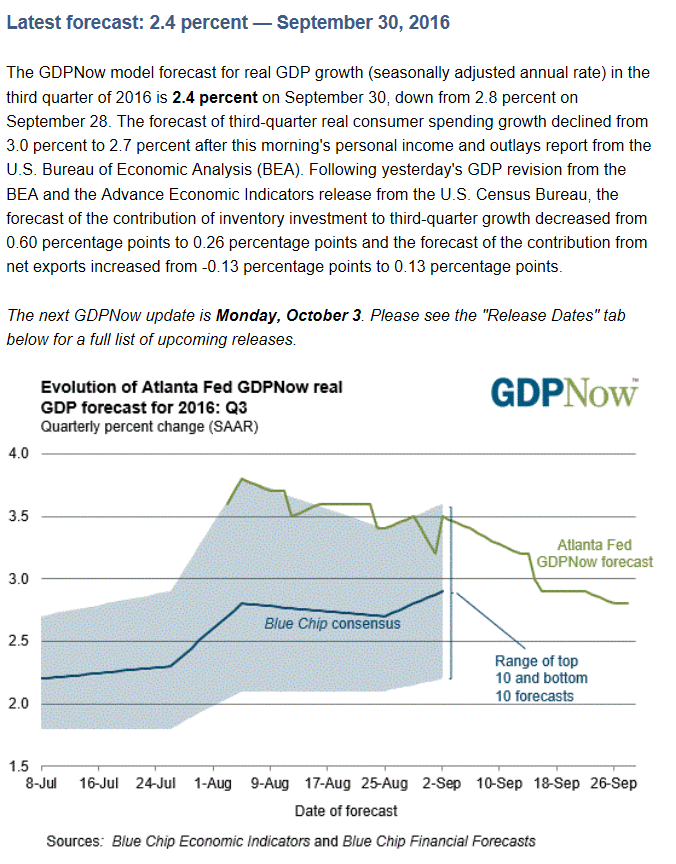

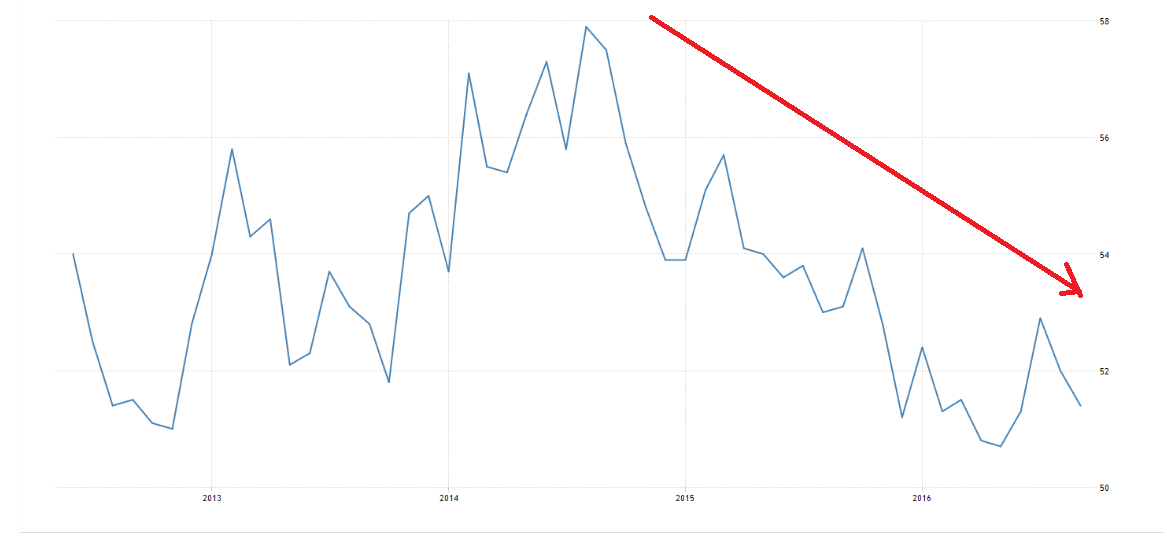

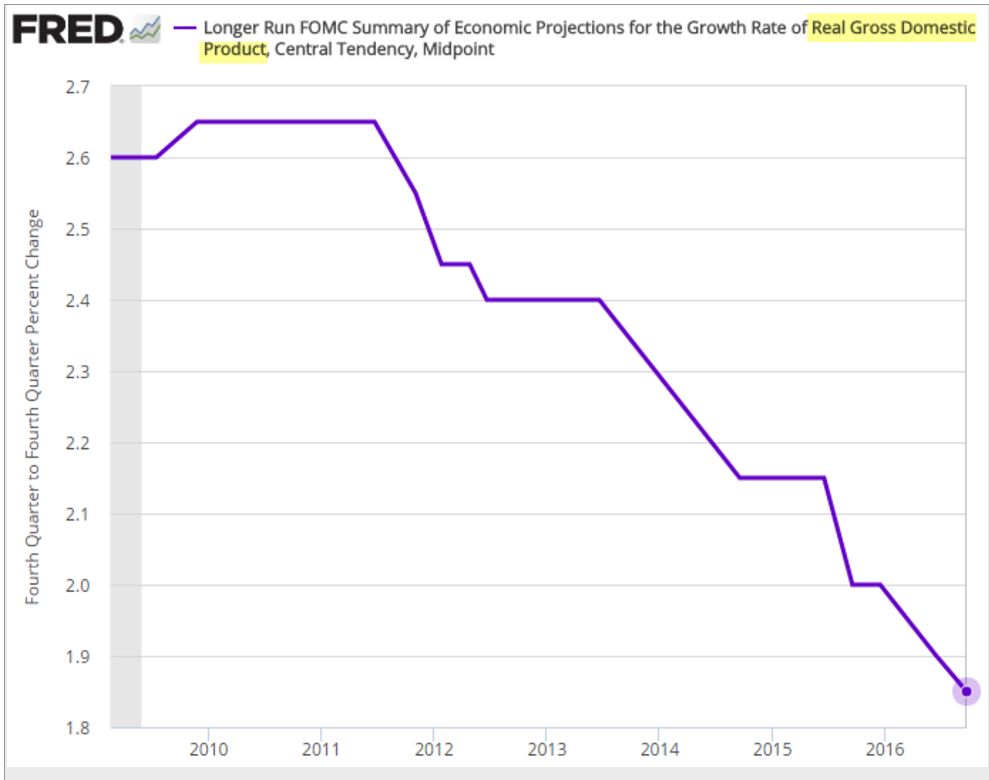

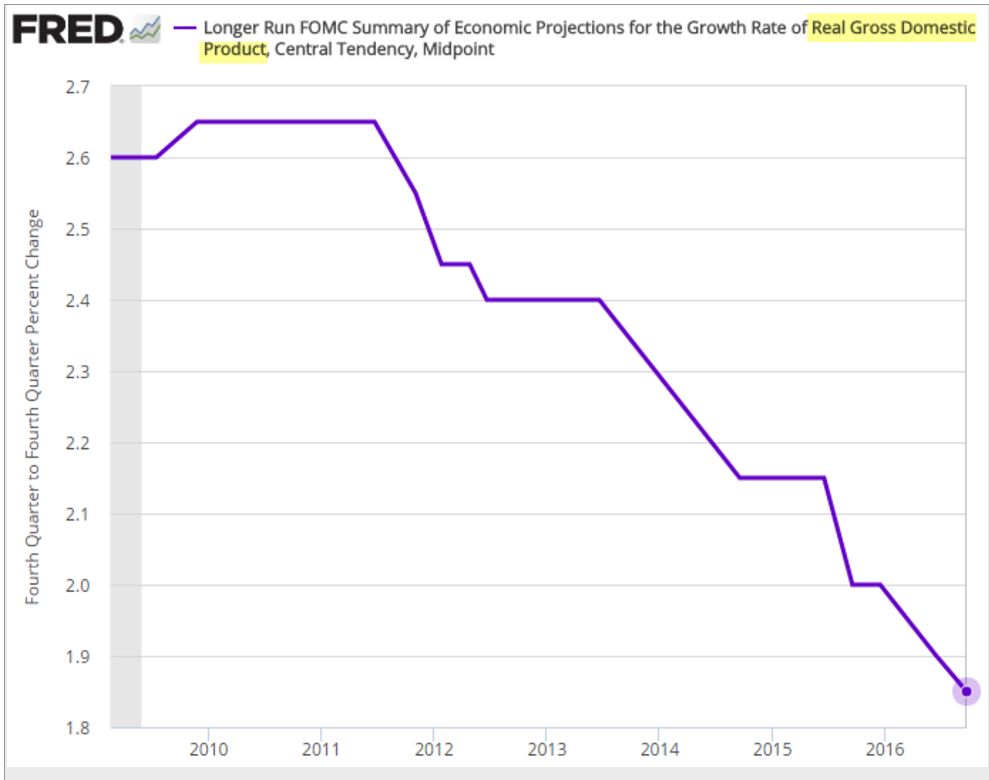

So growth and employment prospects are lower than those of their prior meeting, when they didn’t raise rates. And their forecasts continue to decelerate:

By Michael S. Derby

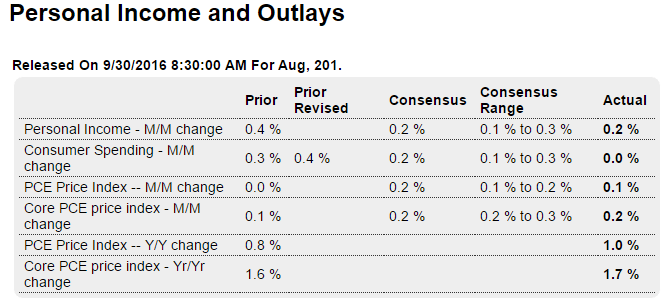

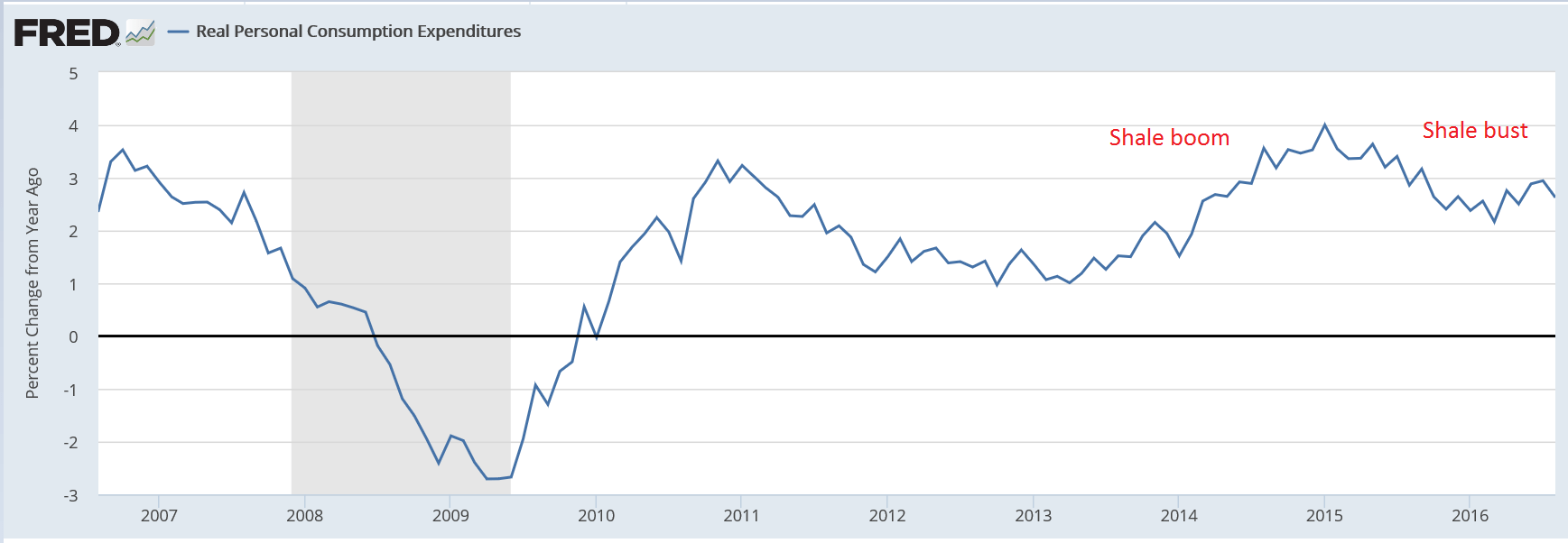

Sept 21 (WSJ) — Federal Reserve officials cut their growth forecast for this year to 1.8%, from 2.0% in June, and held steady their view for next year at 2.0%. Notably, they lowered their long-run view on the economy’s growth rate to 1.8% from 2%. In their forecasts, central bankers’ median projection for the jobless rate this year rose slightly to 4.8%, versus 4.7% in June. For 2017 officials see the jobless rate, now at 4.9%, coming in at 4.6%. The long run jobless rate is still seen at 4.8%. For this year they project the personal-consumption expenditures price index to come in at 1.3%, from June’s 1.4%, with 2017 inflation at 1.9%. Inflation will go back to desired 2% levels in 2018.

Seems the Fed is still doesn’t understand that it’s always an unspent income story.

By Andrea Ricci

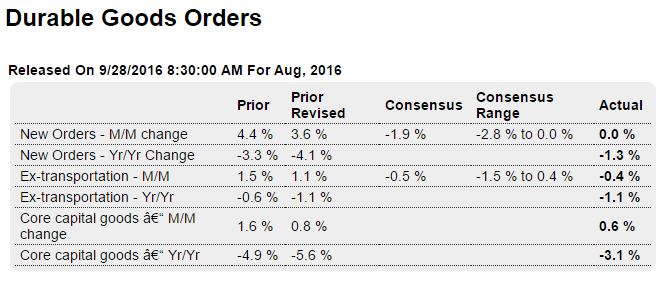

Sept 21 (Reuters) — “Investment spending really has been quite weak for some time and we are really not certain exactly what is causing that. Part of it of course has been the huge contraction in drilling activity associated with falling oil prices, but the weakness in investment spending extends beyond that sector and I’m not certain of exactly what explains that … I’m not aware of evidence that suggests that it’s political uncertainty.” “Since monetary policy is only modestly accommodative, there appears little risk of falling behind the curve in the near future, and gradual increases in the federal funds rate will likely be sufficient to get to a neutral policy stance over the next few years.

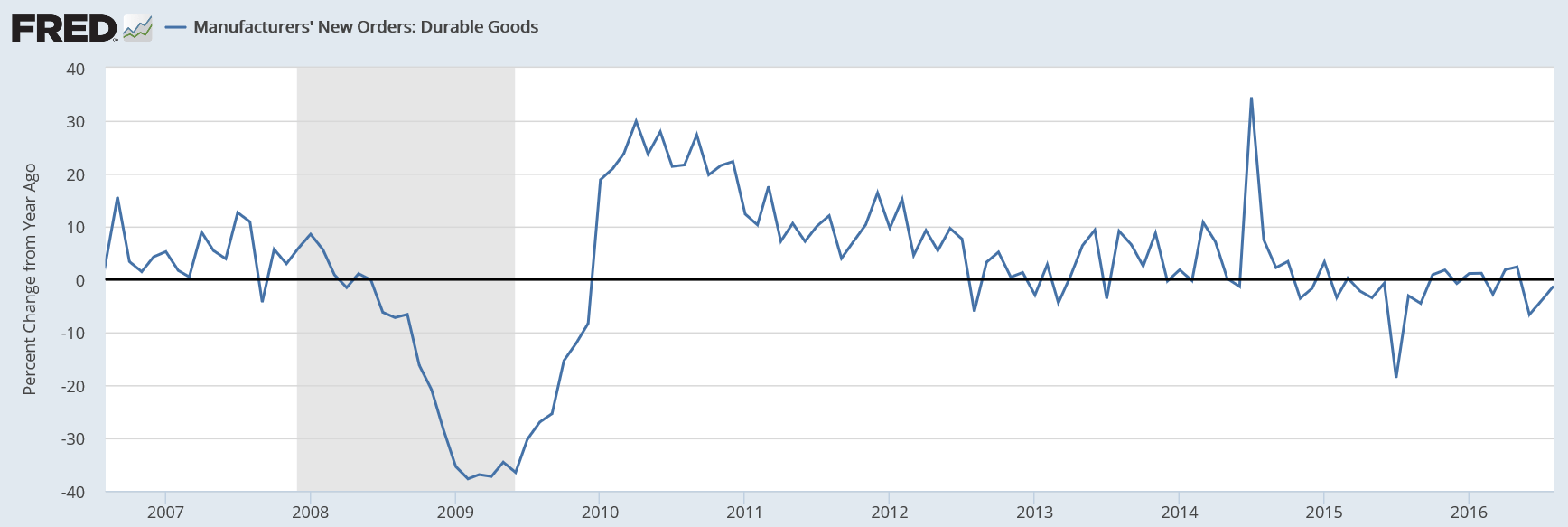

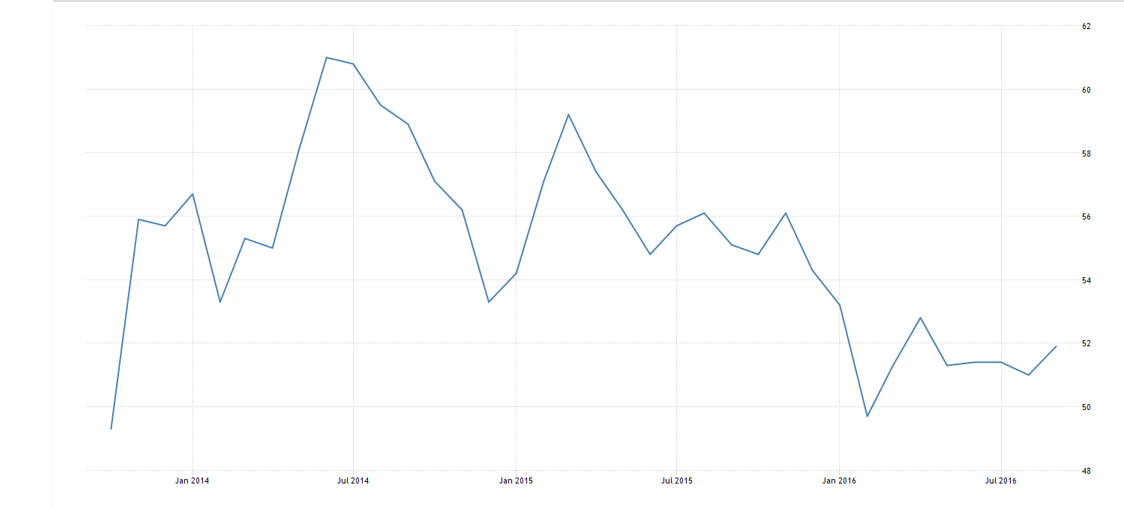

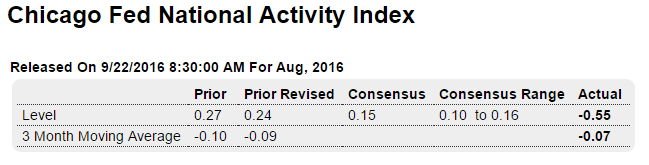

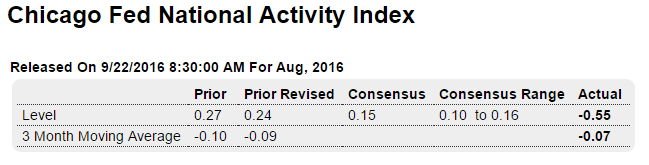

3 month average remains in negative territory:

Highlights

August was a soft month for the bulk of the economy, a monthly dip that is now confirmed by the national activity index which fell to minus 0.55 from July’s revised plus 0.24. All four main components posted monthly declines and all four are in the negative column. Production-related indicators, after a brief pop higher into the plus column in July, pulled the index down 0.33 in the month. The decline here largely reflects broad weakness in the August production industrial report. Employment-related indicators came in at minus 0.09 followed by personal consumption & housing, at minus 0.08, and sales, orders & inventories at minus 0.05. What indications we have for September are limited but do include this morning’s dip in jobless claims which is a positive indication for the month’s employment component.

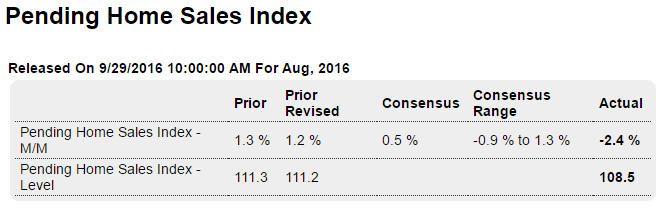

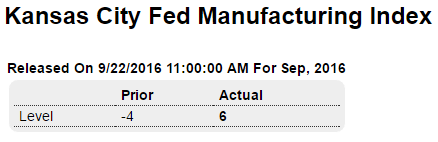

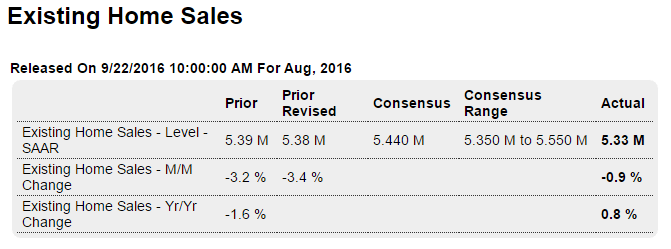

Another disappointment for the hawks:

Highlights

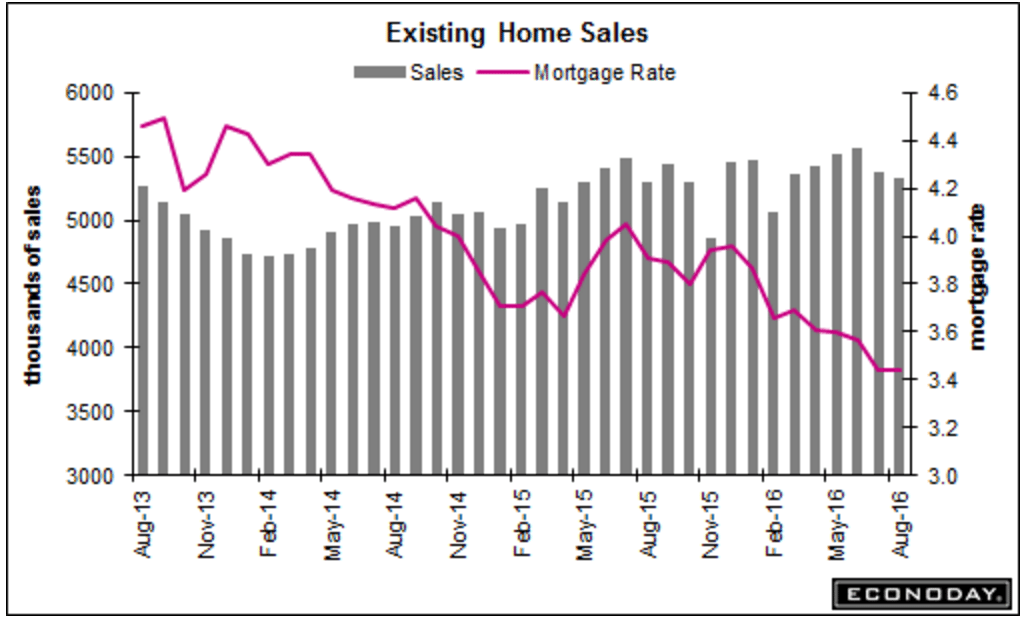

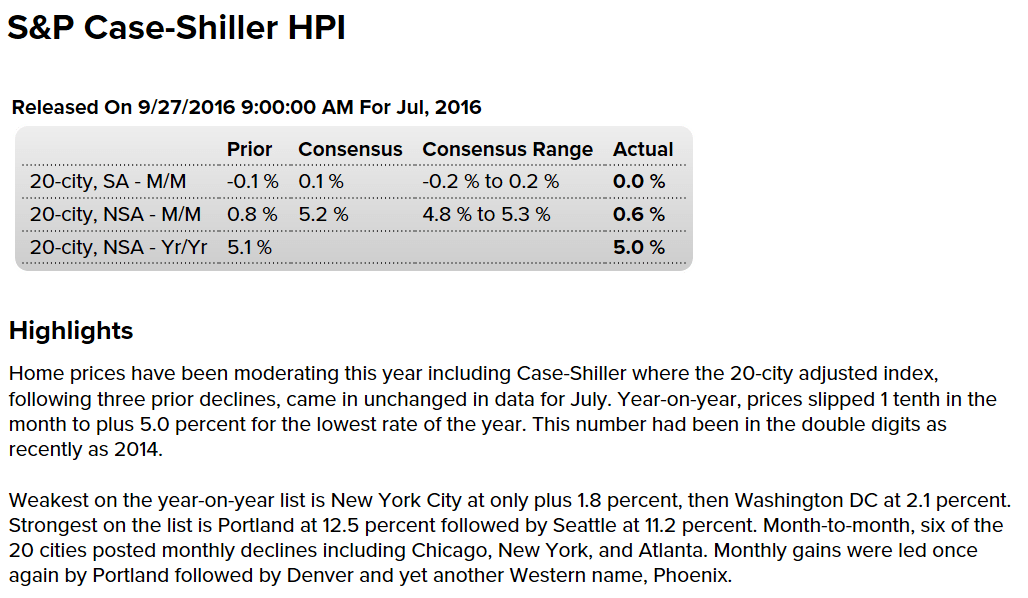

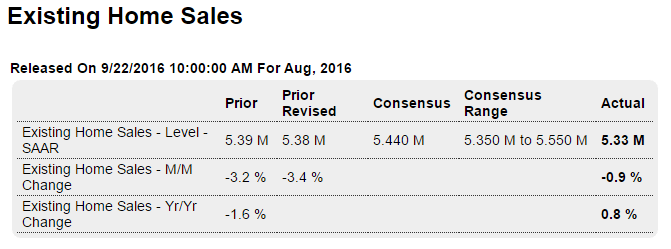

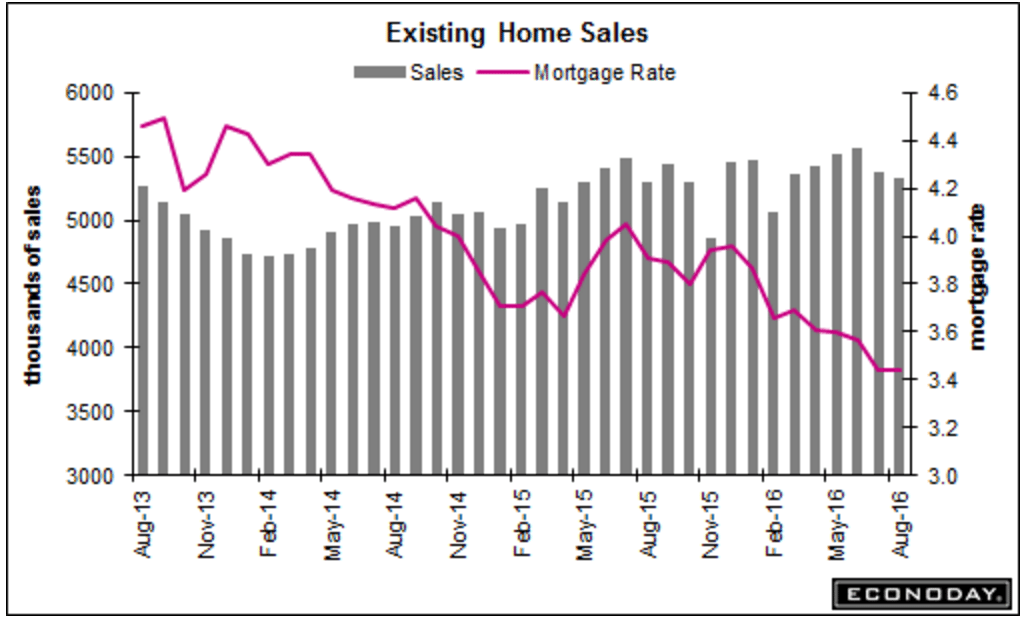

Prices are soft and resales aren’t coming into the market. Existing home sales fell a monthly 0.9 percent in August to a 5.33 million annualized rate, roughly the same rate where it was a year ago at 5.29 million for a thin 0.8 percent gain. And the single-family component isn’t showing much life, down 2.3 percent in the month and up only 0.6 percent on the year. Saving the August report are condos which jumped 10.5 percent in the month to a 630,000 rate for a year-on-year gain of 1.6 percent.

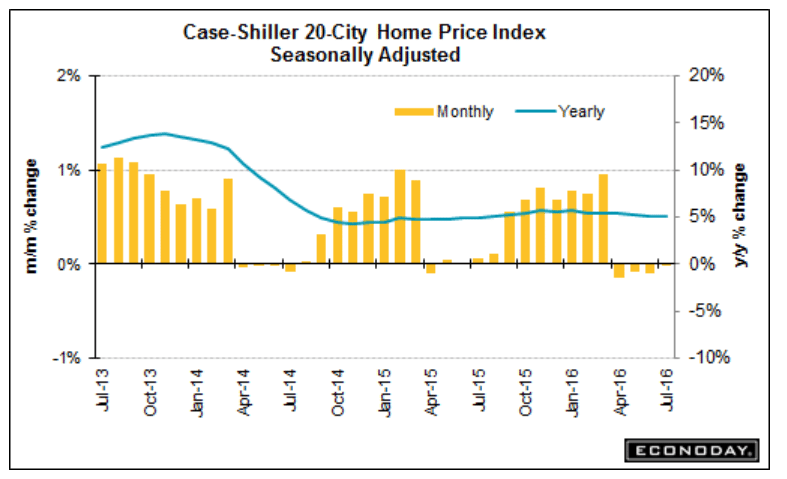

Supply is very thin and is holding down sales. Supply on a monthly basis is at 4.6 months with 3.3 percent fewer existing homes for sale, at 2.04 million from July’s 2.11 million. Prices aren’t offering great incentives for possible sellers, with the median down 1.3 percent in the month to $240,200 for a year-on-year rate of 5.1 percent which, however, is still respectable in a low wage growth economy.

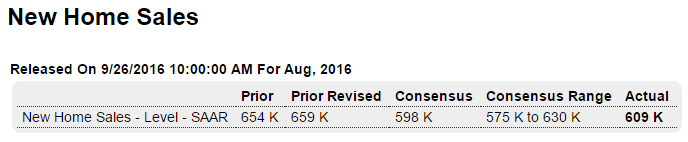

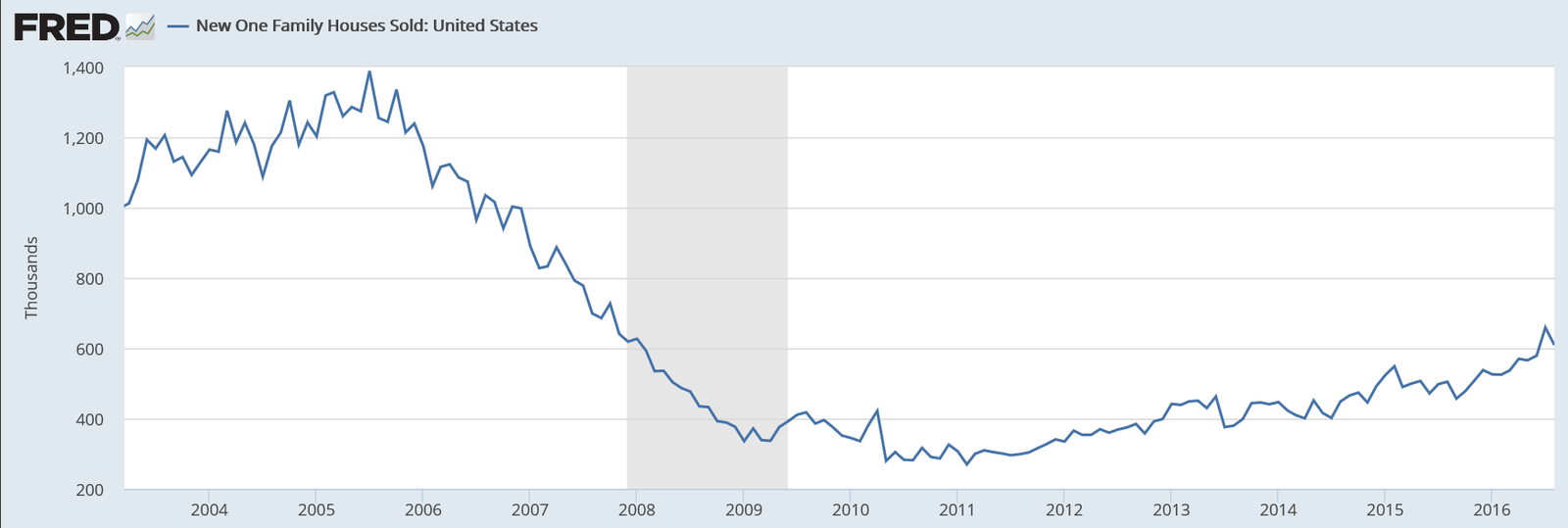

There hasn’t been a lot of action this year in the resale market though the new home market is definitely showing life and, by itself, is likely to make housing a modest positive for the 2016 economy. In a final note, regional sales data are evenly balanced in today’s report, ranging from no year-on-year change for the Northeast to only a 0.9 percent gain for the South.