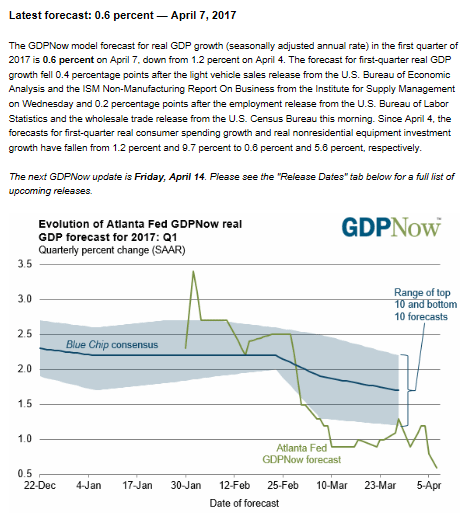

An indication that the fx value of the euro has been a function of foreign government buying and selling:

WASHINGTON — The following is a partial transcript of President Trump’s interview with The New York Times’s Maggie Haberman and Glenn Thrush. It has been lightly edited for content and clarity, and omits several off-the-record comments and asides.

At least six White House aides were sitting in: Gary D. Cohn, President Trump’s lead economic adviser and a former president of Goldman Sachs; Reed Cordish, an assistant to the president; Sean Spicer, the press secretary; Hope Hicks, a long-serving Trump aide; and eventually Vice President Mike Pence and the chief of staff, Reince Priebus.

MAGGIE HABERMAN, White House correspondent: Seems like it’s actually not been a terrible process for [Judge Neil M.] Gorsuch, right? I mean, it’s been pretty smooth.

PRESIDENT TRUMP: It’s never an easy process. I think it’s been very smooth considering there’s tremendous hostility on the other side. I think it’s been pretty smooth.

HABERMAN: You talk to Democrats privately that will admit —

TRUMP: I do.

HABERMAN: But do they admit to you that they don’t actually have a huge objection to Gorsuch, they think that he’s probably —

Continue reading the main story

TRUMP: They do. They admit that.

HABERMAN: Right. In private.

TRUMP: Elijah Cummings [a Democratic representative from Maryland] was in my office and he said, “You will go down as one of the great presidents in the history of our country.”

HABERMAN: Really.

TRUMP: And then he went out and I watched him on television yesterday and I said, “Was that the same man?”

[Laughter.]

TRUMP: But I said, and I liked him, but I said that was really nice. He said, in a group of people, “You will go down as one of the great presidents in the history of our country.” And then I watched him on television and I said, “Is that the same man that said that to me?”

GLENN THRUSH, White House correspondent: Why do you think Democrats feel the need to oppose Gorsuch? What do you think the politics is?

TRUMP: Well, I think that some of it had to do with the election. They thought they were going to win. You know, winning the Electoral College is, for a Republican, is close to impossible and I won it quite easily. And I think they are still recovering from that, but they are recovering now. I think the Susan Rice thing is a massive story. I think it’s a massive, massive story. All over the world, I mean other than The New York Times.

HABERMAN: We’ve written about it twice.

TRUMP: Huh?

HABERMAN: We’ve written about it twice.

TRUMP: Yeah, it’s a bigger story than you know. I think —

HABERMAN: You mean there’s more information that we’re not aware of?

TRUMP: I think that it’s going to be the biggest story.

THRUSH: Why? What do you think —

TRUMP: Take a look at what’s happening. I mean, first of all her performance was horrible yesterday on television even though she was interviewed by Hillary Clinton’s P.R. person, Andrea Mitchell [the NBC News journalist]. Course you’ve been accused of that also.

HABERMAN: Mostly by you, though.

TRUMP: No, no, no. Mostly by a lot of people. So you know, we’ll see what happens, but it looks like it’s breaking into a massive story.

THRUSH: What do you think are — what other shoes are there to drop on this?

HABERMAN: Yeah, what else could we learn on this?

TRUMP: I think you’re going to see a lot. I think you’ll see a lot.

HABERMAN: In terms of what she did and in terms of [unintelligible]?

TRUMP: I think in terms of what other people have done also.

HABERMAN: Really?

TRUMP: I think it’s one of the biggest stories. The Russia story is a total hoax. There has been absolutely nothing coming out of that. But what, you know, what various things led into it was the story that we’re talking about, the Susan Rice. What’s happened is terrible. I’ve never seen people so indignant, including many Democrats who are friends of mine. I’ve never seen them acting this way. Because that’s really an affront on them, you know, they are talking about civil liberties. It’s such an affront, what took place.

THRUSH: What other people do you think will get ensnared in this? Can you give us a sense? How far this might extend —

HABERMAN: From the previous administration.

TRUMP: I think from the previous administration.

THRUSH: How far up do you think this goes? Chief of staff?

TRUMP: I don’t want to say, but —

THRUSH: President?

TRUMP: I don’t want to say, but you know who. You know what was going on. You probably know better than anybody. I mean, I frankly think The Times is missing a big thing by not writing it because you’re missing out on the biggest story there is.

[Mr. Trump makes a comment off the record, and mentions the Fox News host Bill O’Reilly.]

THRUSH: We’re back on the record?

HABERMAN: Yeah, back on the record, do you think that he’s being unfairly treated? I mean, I watched it because I was curious how he was dealing with everything.

TRUMP: I think he’s a person I know well. He’s a good person. I think he may, you know, I think he shouldn’t have settled, personally, I think he shouldn’t have settled.

HABERMAN: How come?

TRUMP: Because you — should have taken it all the way. No, I know Bill. Bill’s a good person.

HABERMAN: Yeah.

TRUMP: I don’t think Bill would do anything wrong.

HOPE HICKS, White House director of strategic communications: Can we get to infrastructure? [Laughter.] Because I know we are sensitive about time.

HABERMAN: I understand. I just want to ask one last follow-up on that note, and then we’ll move on, not on O’Reilly.

TRUMP: You certainly covered O’Reilly big. Not Susan Rice, boy, O’Reilly [unintelligible]. He’s taking my place. He’s taking my place.

HABERMAN: Sir, if you could give us more information about Rice. If the administration would give us more information —

TRUMP: No, you have a lot of information. No, you have so much information.

HABERMAN: If you would have given it to us last week, we would have written it. Would you declassify some of the information so that —

TRUMP: I don’t want to talk about that.

HABERMAN: No? O.K.

TRUMP: No. I just don’t want to talk about that. It’s such an important story for our country, for the world. What took place.

HABERMAN: Why not talk about it then? With all due respect.

TRUMP: At the right time, I will be.

THRUSH: One last thing on that. Have you actually seen intelligence that leads you to believe that people other than Susan Rice are involved.

TRUMP: I don’t want to comment on anything about — other than to say I think it’s a — I think it’s truly one of the big stories of our time.

THRUSH: Do you think she might have committed a crime?

TRUMP: Do I think?

THRUSH: Yeah.

TRUMP: Yes, I think.

HABERMAN: On infrastructure, just generally speaking, there’s been a lot of reports floating around about this package that you’re looking at. Can you give us the broad outlooks?

TRUMP: We want to do a great infrastructure plan, and on that side I will say that we’re going to have, I believe, tremendous Democrat support. We are also going to have some good Republican support, and I think it’s going to be one of the very bipartisan bills and it’s going to happen. I may put it in with health care.

FROM CUMMINGS:

“During my meeting with the president and on several occasions since then, I have said repeatedly that he could be a great president if … if … he takes steps to truly represent all Americans rather than continuing on the divisive and harmful path he is currently on,” Cummings said in a statement Thursday.

At that same meeting, Cummings said that he confronted Trump about his unfounded claims of massive voter fraud and the offensive way in which he characterized the black community during his campaign.

“When we hear those words about carnage and we are living in depressed situations, I told him it was very hurtful,” Cummings said last month.