Headed back south before the shutdown…

If Congress doesn’t let up we’re on the way to negative GDP this quarter

Full size image

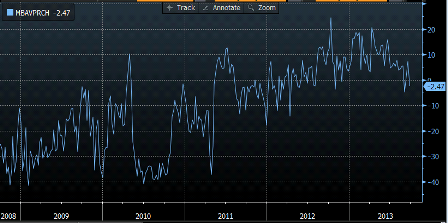

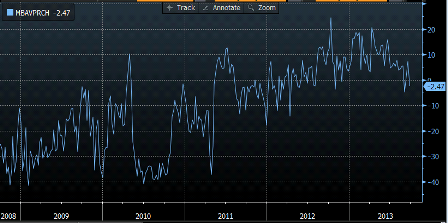

Y/Y has gone negative!

Full size image

Headed back south before the shutdown…

If Congress doesn’t let up we’re on the way to negative GDP this quarter

Y/Y has gone negative!

Interesting chart- inventory of existing homes for sale vs the labor force participation rate…

new home sales track closely as well…

;)

As we used to say, sometimes it’s all one piece…

Looks something like the labor force participation rate…

Real GDP, income, and consumption per capita no great shakes either.

Home sales ‘last hurrah’ for next 12 months

By Diana Olick

September 1 (Bloomberg) — U.S. home sales in August rose to their highest level in six years, even higher than during the recent home buyer tax credit. This news came on the heels of the Federal Reserve’s announcement that it would continue to fuel the mortgage market, keeping rates from rising dramatically. Still, Realtors were uncharacteristically pessimistic in their predictions for sales this fall.

“We are getting early signals from lock boxes that show a significant change in direction in August,” said Lawrence Yun, chief economist for the National Association of Realtors, referring to the small key boxes that hang on the doors of for-sale homes. The number of times they were opened in August dropped dramatically, signaling a big drop in potential buyer traffic.

Yun claimed the jump in August sales was based on fear of rising rates. August numbers are based on closings for contracts that were likely signed in June. June saw the biggest spike in mortgage interest rates.

“That hurried people into making a decision,” said Yun. “It was the last hurrah for the next 12 to 18 months.”

Decide for yourself if the year end tax hikes, sequesters, and the latest rate spike has bent the curve…

Not to forget housing has traditionally been the sector driving the ‘borrowing to spend’ needed to offset the demand leakages as govt ‘gets out of the way’/deficit reduction.

Mortgage Purchase Applications:

Housing Starts Y/Y:

Foreclosure sales fall causing total sales to fall

DataQuick on California Bay Area: Sales “Dip” in August, Distressed Sales Down

Report: New Home Sales soft in August

By Bill McBride

Graph looks like it fell off a cliff.

Who would’ve thought…

U.S. Mortgage Applications Down

September 11 — The number of mortgage applications filed in the U.S. last week fell 13.5% from the prior week on a seasonally adjusted basis as interest rates increased, the Mortgage Bankers Association said Wednesday.

On an unadjusted basis, MBA reported the market composite index declined 23%. The refinance index slipped 28% from a week earlier, while the seasonally adjusted purchase index slid 2.7%.

Higher rates had curbed demand for buy new homes and made refinancing less attractive.

The share of applications filled to refinance existing mortgages fell to 57% from 61% a week earlier. In the latest week, adjusted-rate mortgages, or ARMs, represented 7.1% of total applications.