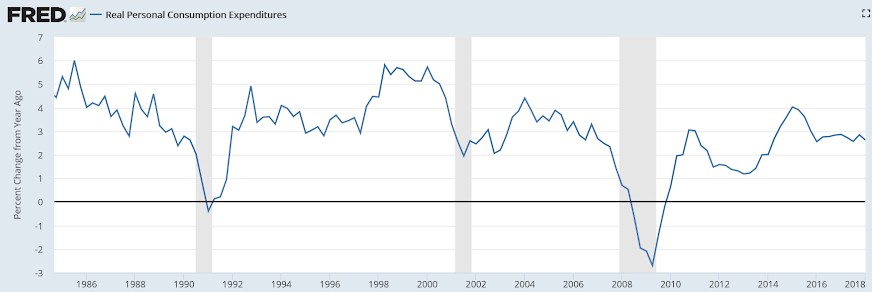

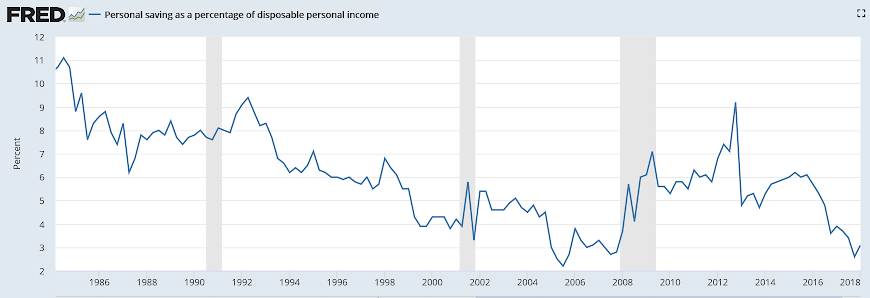

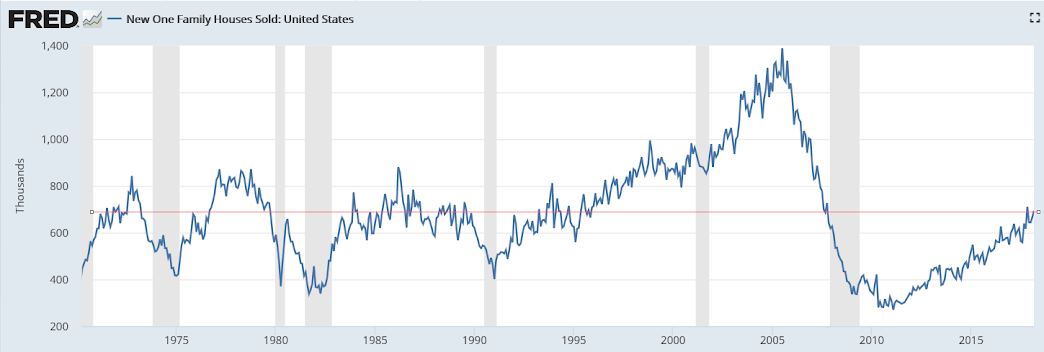

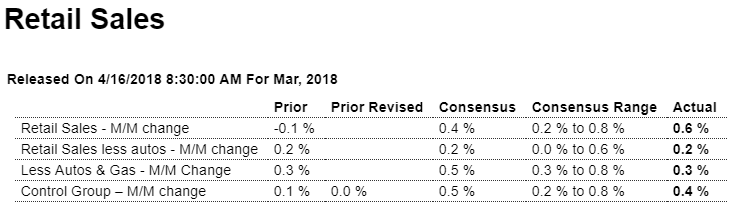

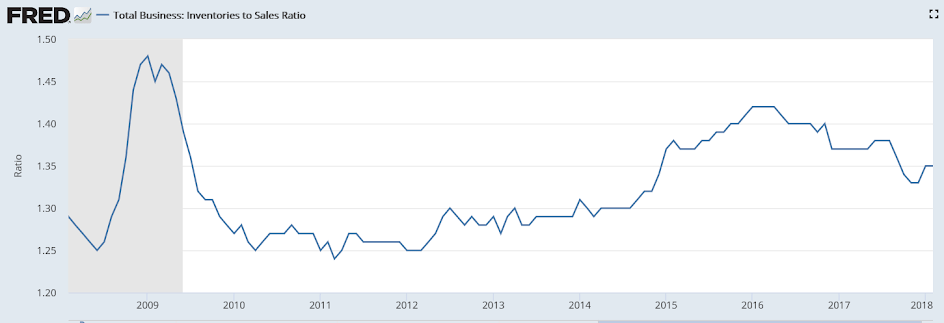

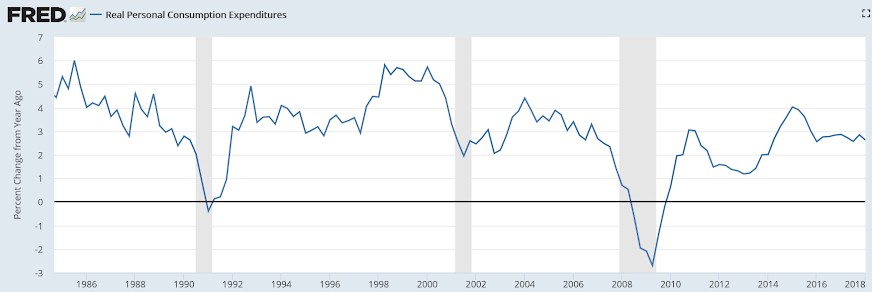

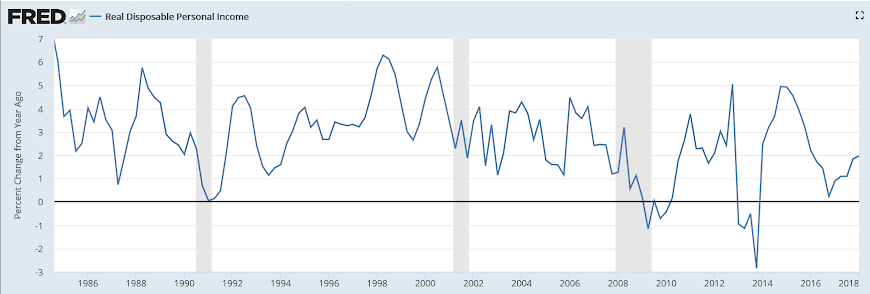

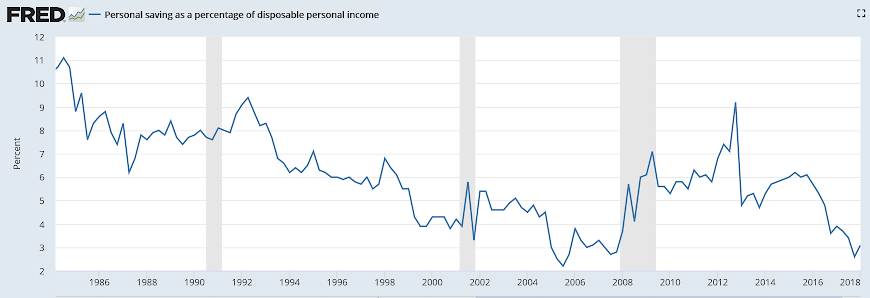

As previously discussed, something has to give to bring the savings rate inline, and the low reported personal consumption expenditures are a step in that direction, and housing has also been soft, as were prices. Also, while inventory building adds to GDP, combined with slower sales growth it doesn’t bode well for the future:

Highlights

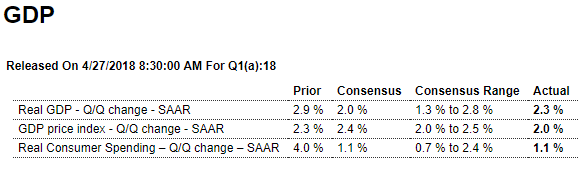

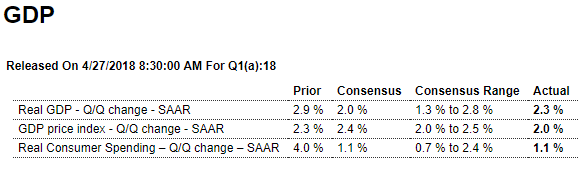

A sharp rise in service spending helped keep first-quarter GDP in the respectable range, at an annualized 2.3 percent rate and 3 tenths above Econoday’s consensus. Service spending contributed nearly 1 full point to the result and offset a sharp decline in spending on durables. Consumer spending in total rose at a 1.1 percent pace, subdued but still positive.

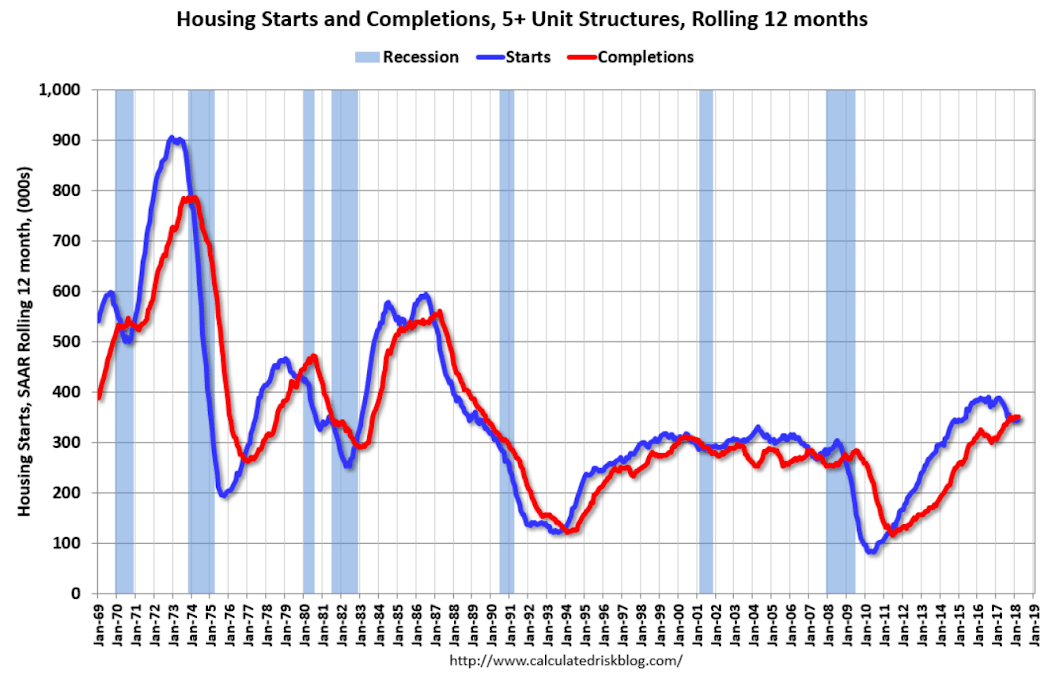

Business spending also helped the quarter, contributing 8 tenths of a point with strength here including both structures and equipment. But residential investment, after spiking in the fourth quarter, couldn’t pull its weight and contributed zero to the latest quarter.

Inventories, which had been too low relative to demand, are a welcome positive in the report, rising $33.1 billion and adding 4 tenths to the quarter. Imports are once again the biggest negative, subtracting 4 tenths in a quarter that marked the imposition of metal tariffs. But in more than an offset, exports rose 0.6 percent to make for a 6 tenths positive contribution from net exports. Government purchases are also a positive, adding 2 tenths.

Price readings are a negative surprise in the report, with the chain-weight GDP price index rising at only a 2.0 percent rate which is well short of expectations for 2.4 percent.

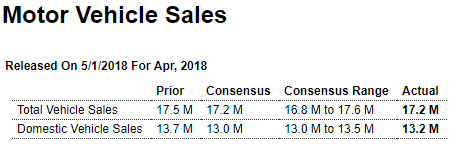

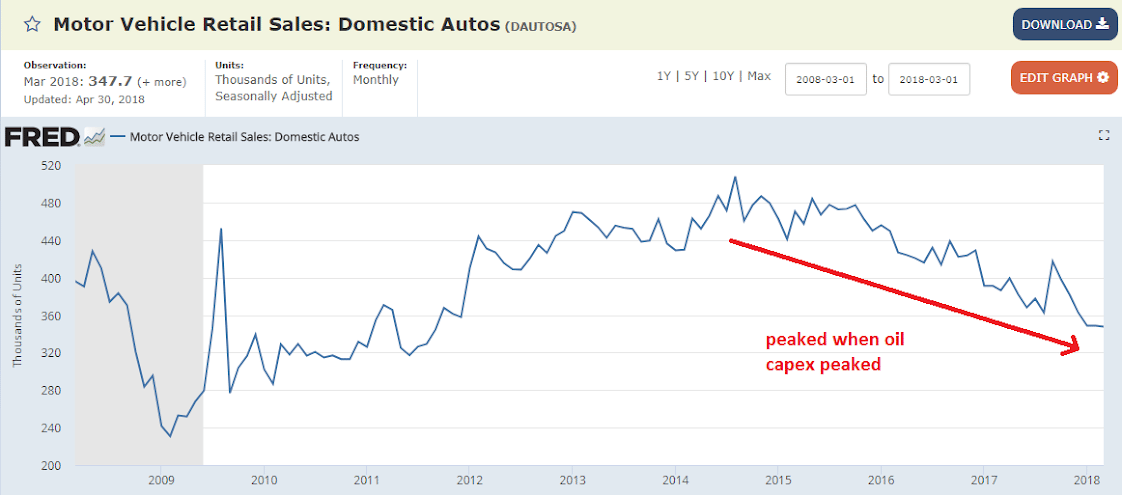

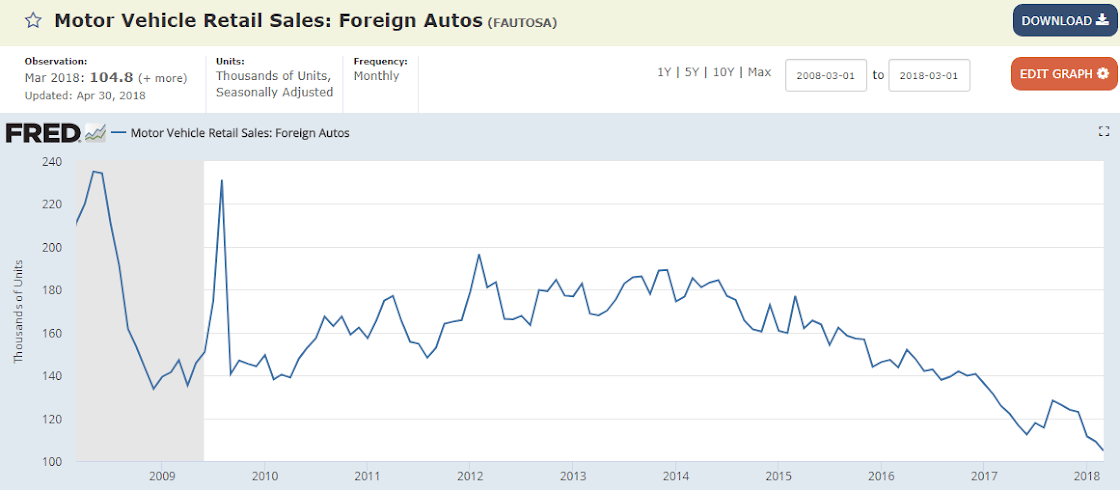

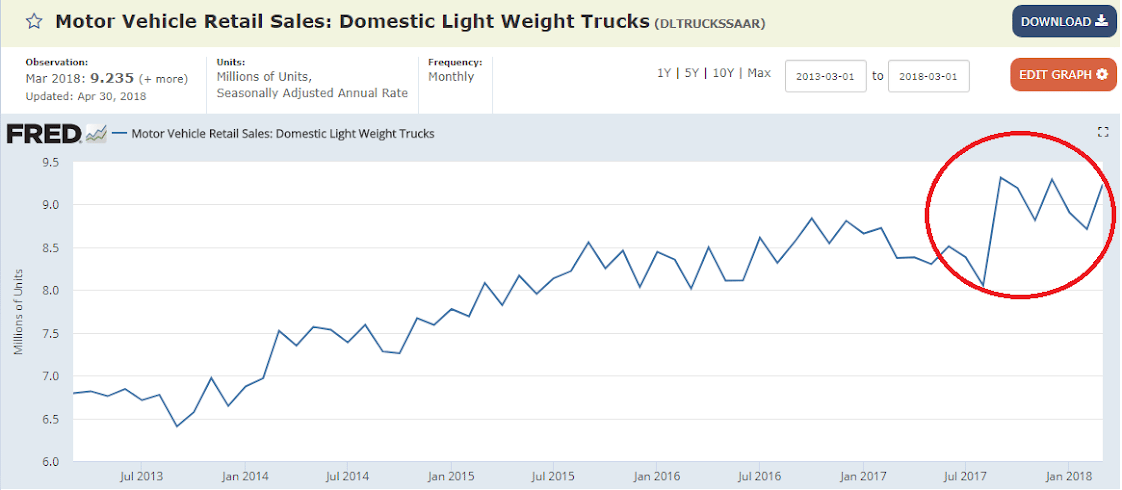

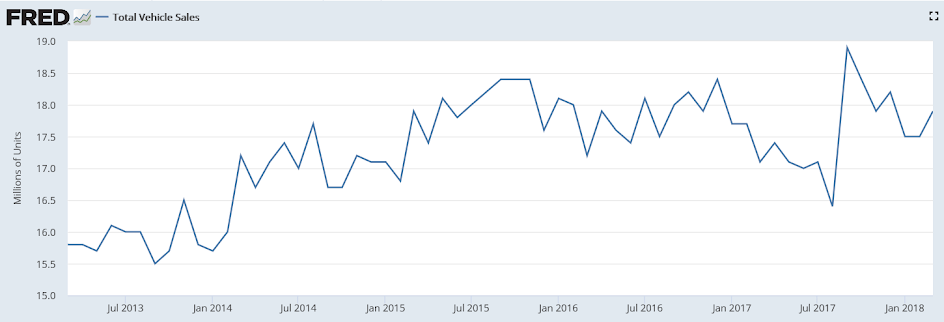

It was a moderate quarter for the economy especially for the consumer whose spirits waned a bit despite the big tax cut and continuing strength in the labor market. As for spending, given the moderate gains for services in February and January, the strength in this component in today’s report implies a sharp gain for services in Monday’s personal income & outlays report which will unbundle March’s contributions to the quarter. Also note the decline in durable spending largely reflects the quarter’s soft showing for vehicle sales which however did show promise going into April with the first indication on second-quarter consumer spending coming from next week’s unit vehicle sales results.

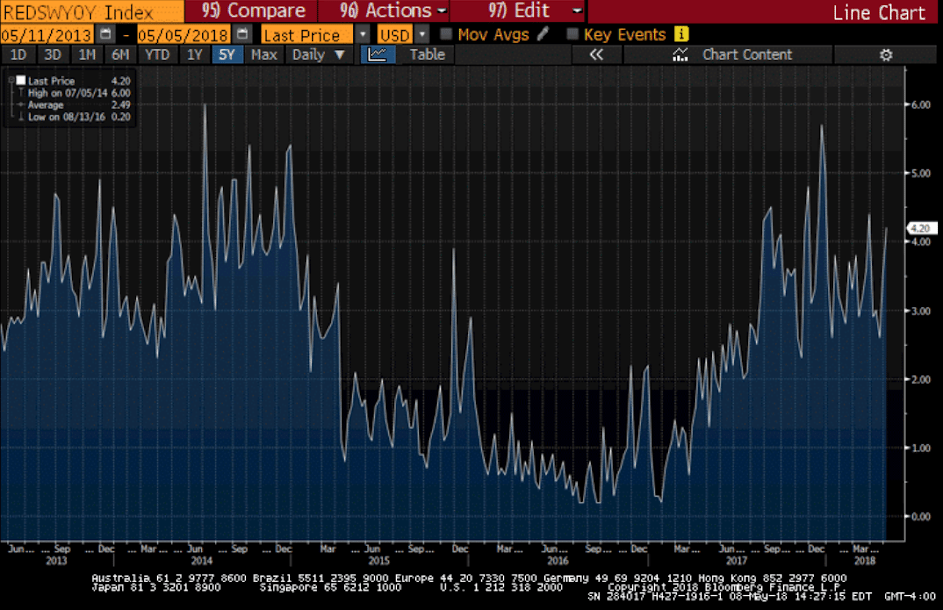

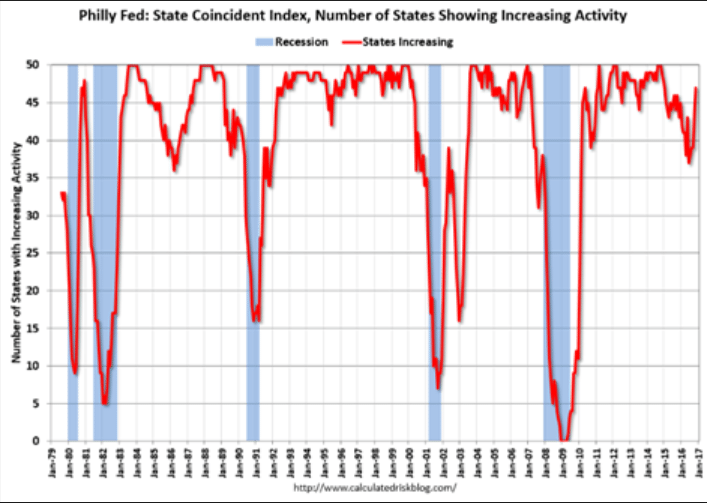

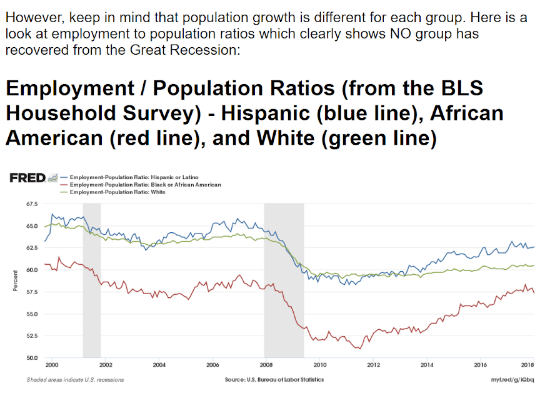

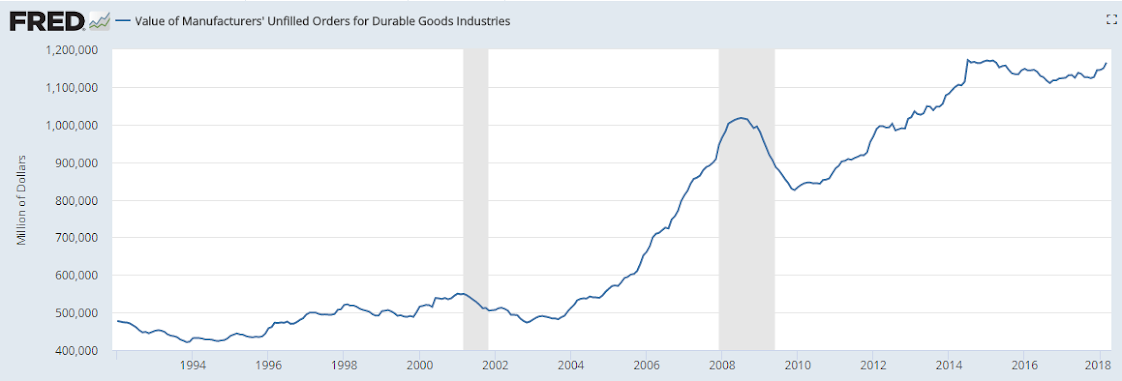

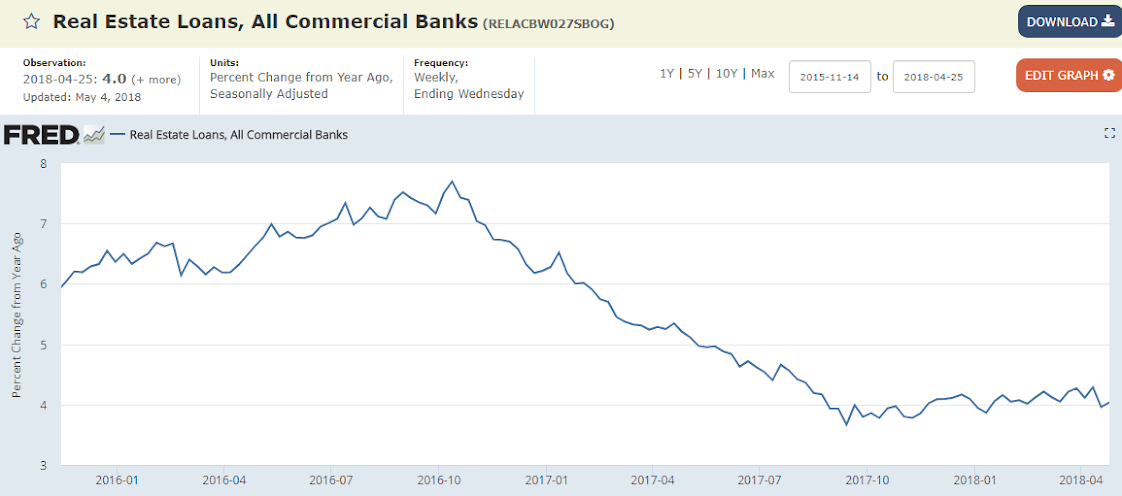

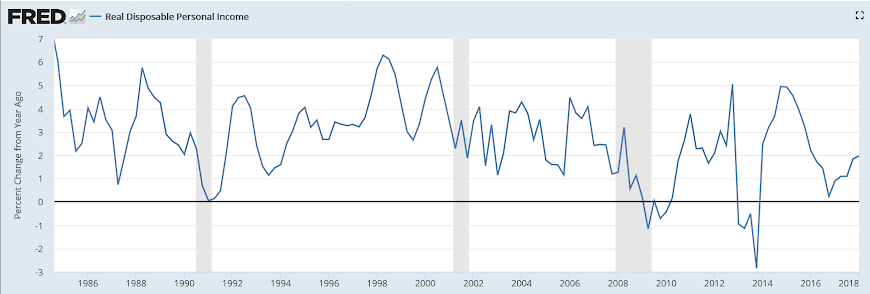

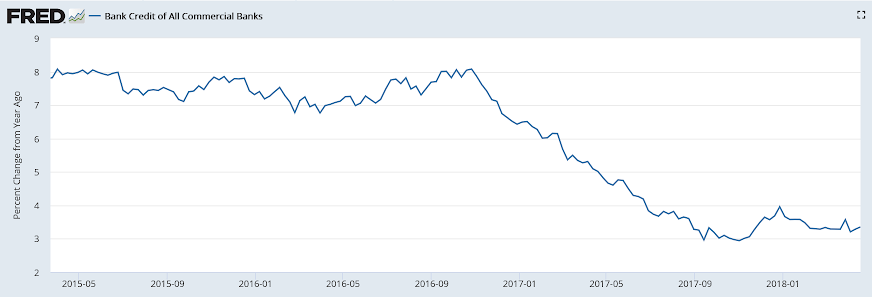

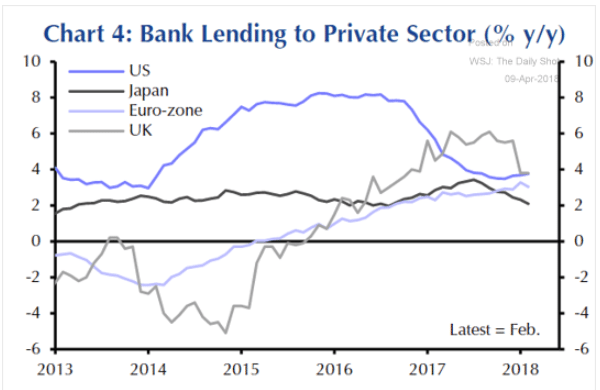

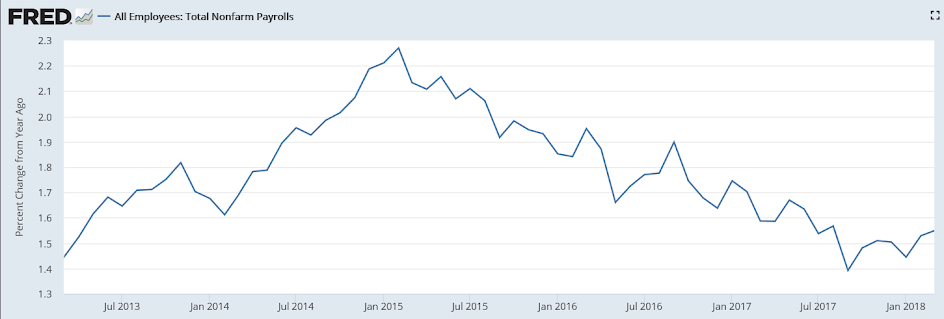

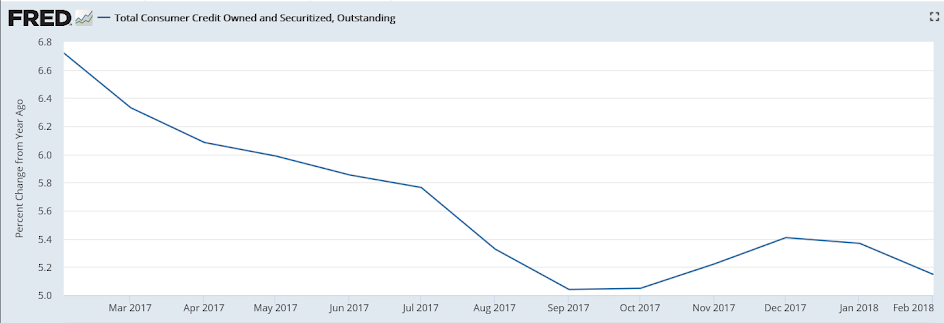

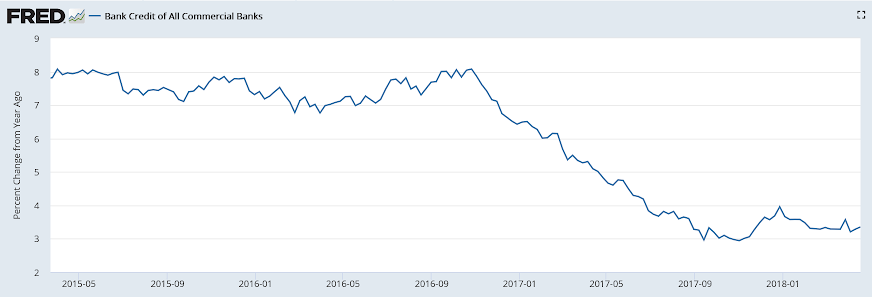

Growth has stabilized after dropping by about 4.5% which is about $570 billion per year or about 3% of GDP per year:

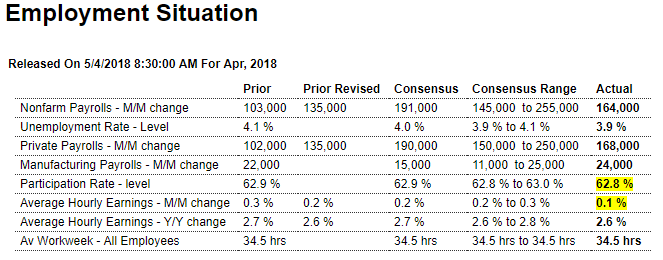

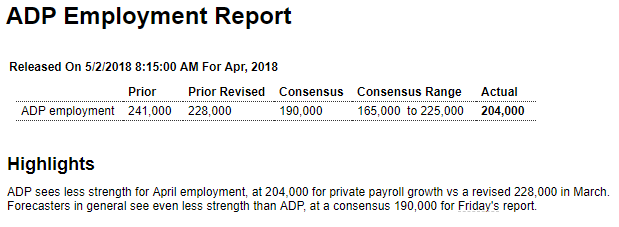

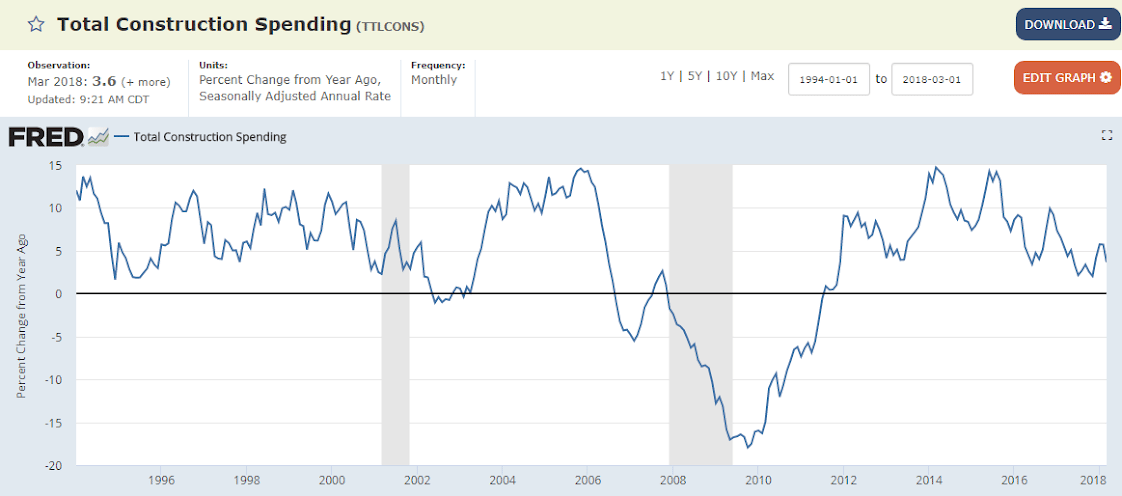

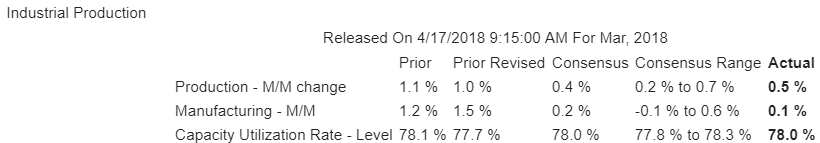

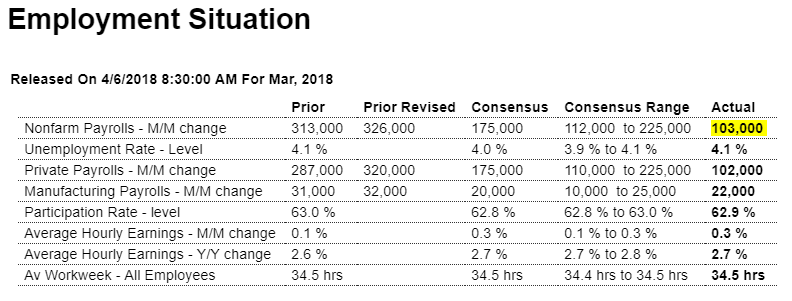

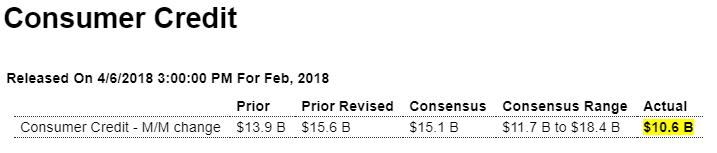

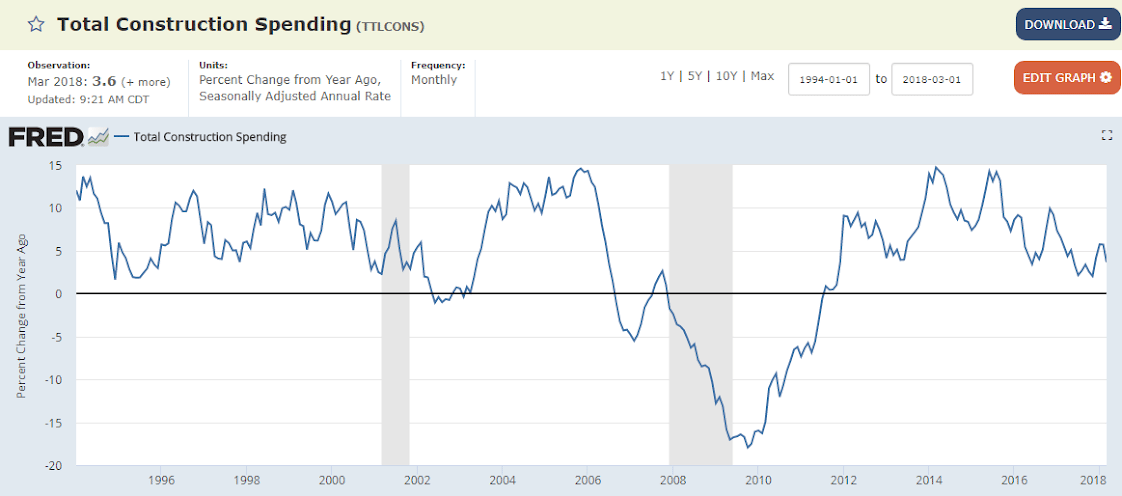

Last month revised up, but this month down that much and more, indicating q1 was weaker than first reported:

Highlights

Construction spending data are known for their volatility which should limit the surprise from a very unexpected 1.7 percent decline in March, far below Econoday’s consensus range. The housing sector is the weakness in the report with residential spending down 3.5 percent in the month including dips for both single-family homes, down 0.4 percent, and multi-units, down 2.7 percent. Home improvements, which have been soft, fell 8.0 percent in the month.

But the minus signs don’t stop here with private non-residential spending, held down by continuing weakness in factory spending and a monthly downturn for commercial spending, falling 0.4 percent in the month. Spending on public building is mixed with highways & streets showing a gain offset by a flat result for educational building.

Today’s data are a surprise for forecasters but are offset by a heavy upward revision to February, now at plus 1.0 percent from an initial 0.1 percent gain, and may paradoxically build up expectations for a construction rebound in coming reports. Watch for housing comments in tomorrow’s FOMC statement and also construction payrolls, which have been strong, in Friday’s employment report.

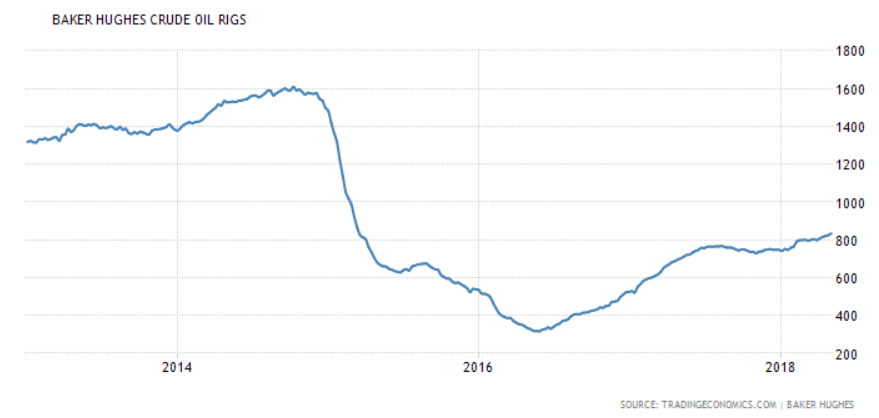

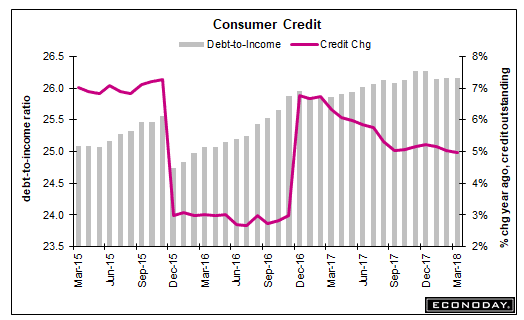

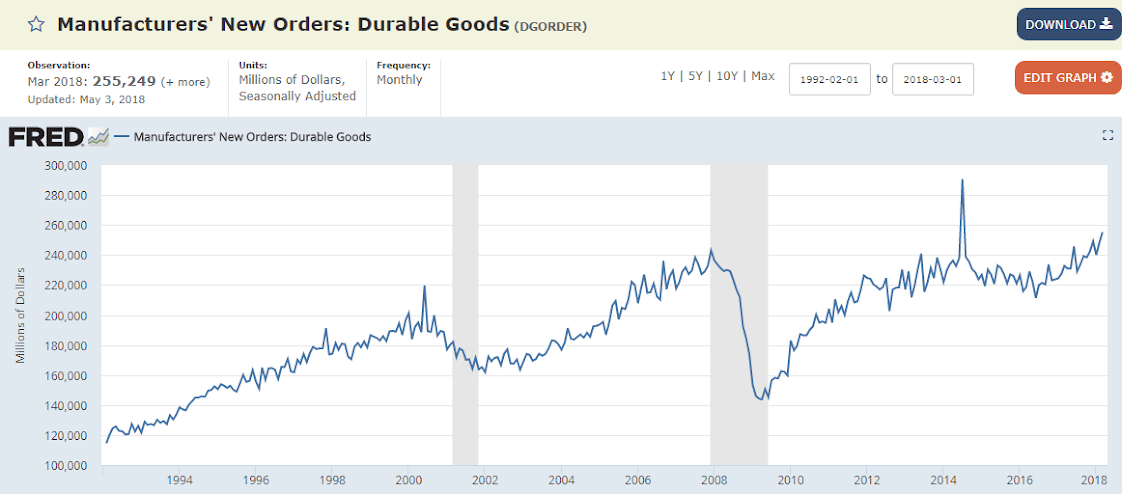

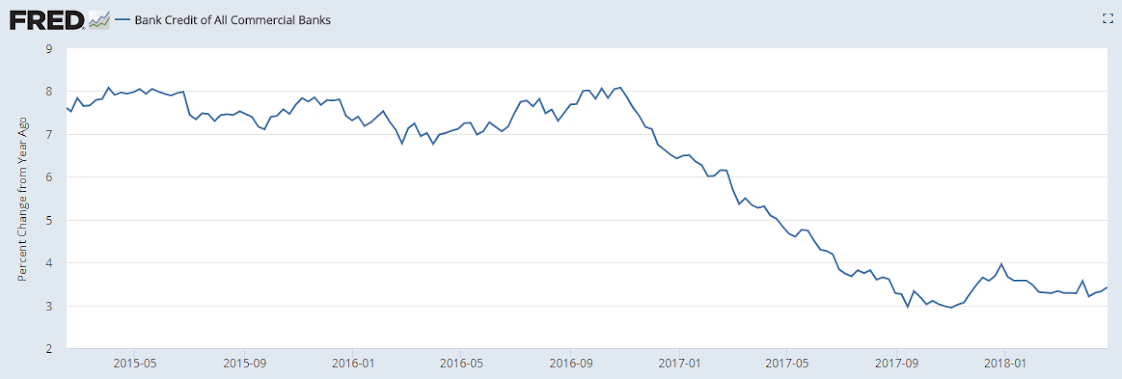

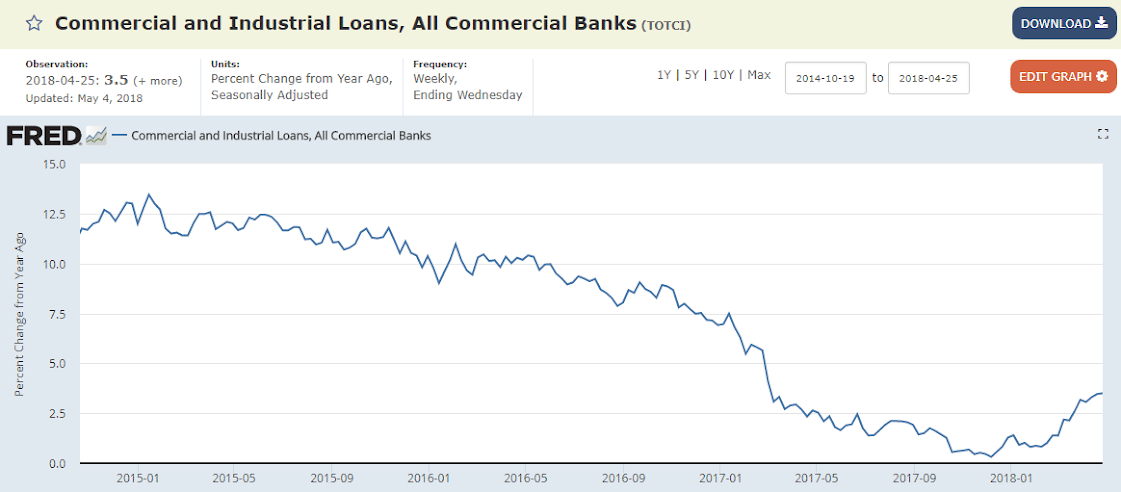

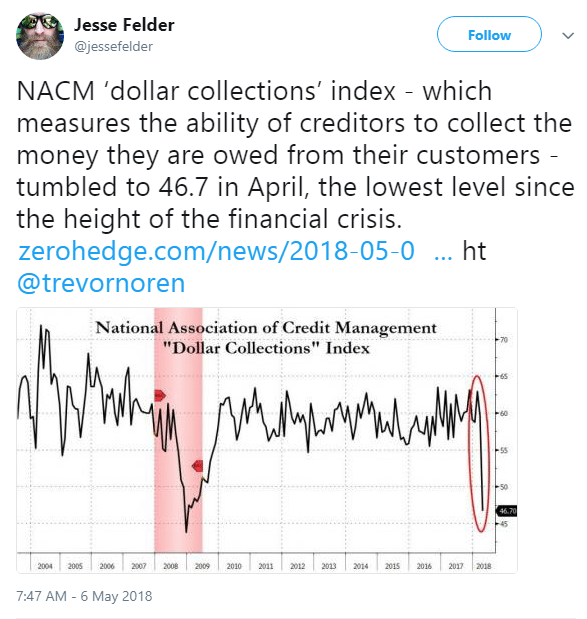

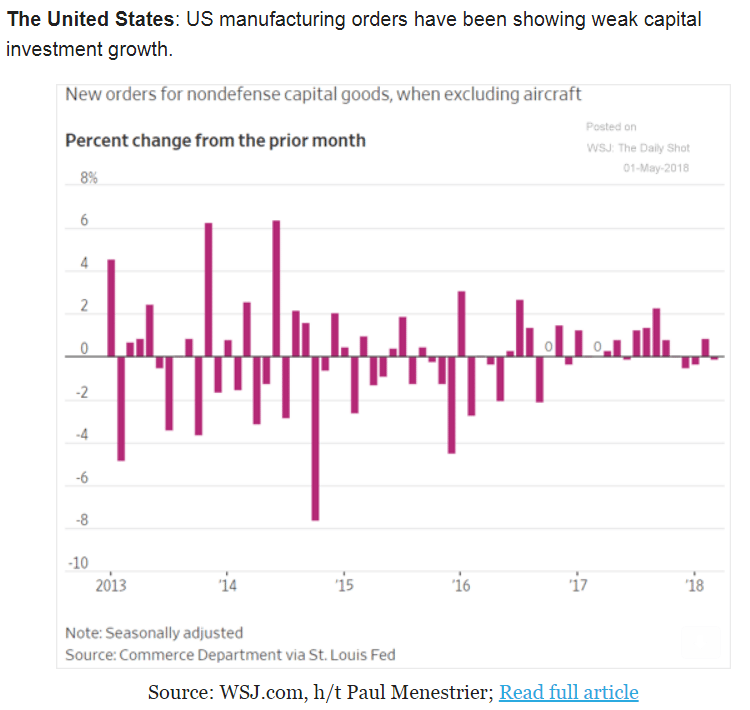

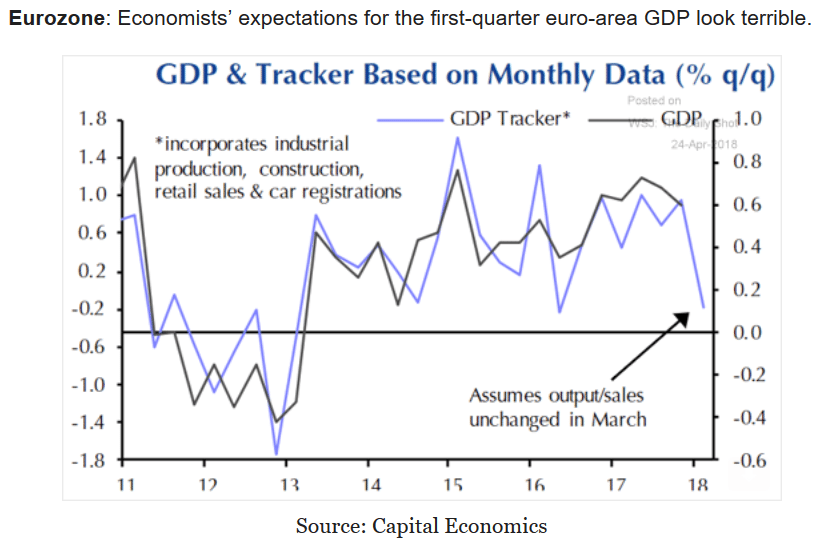

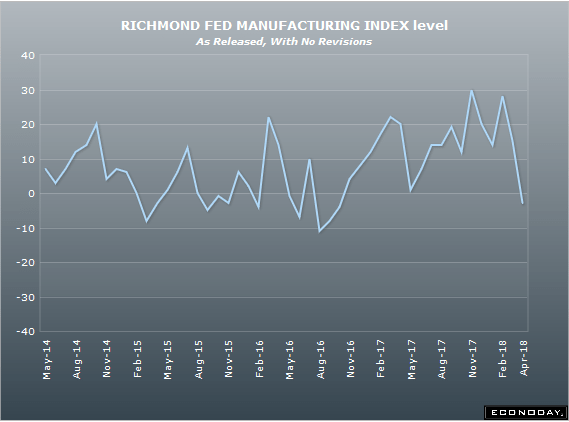

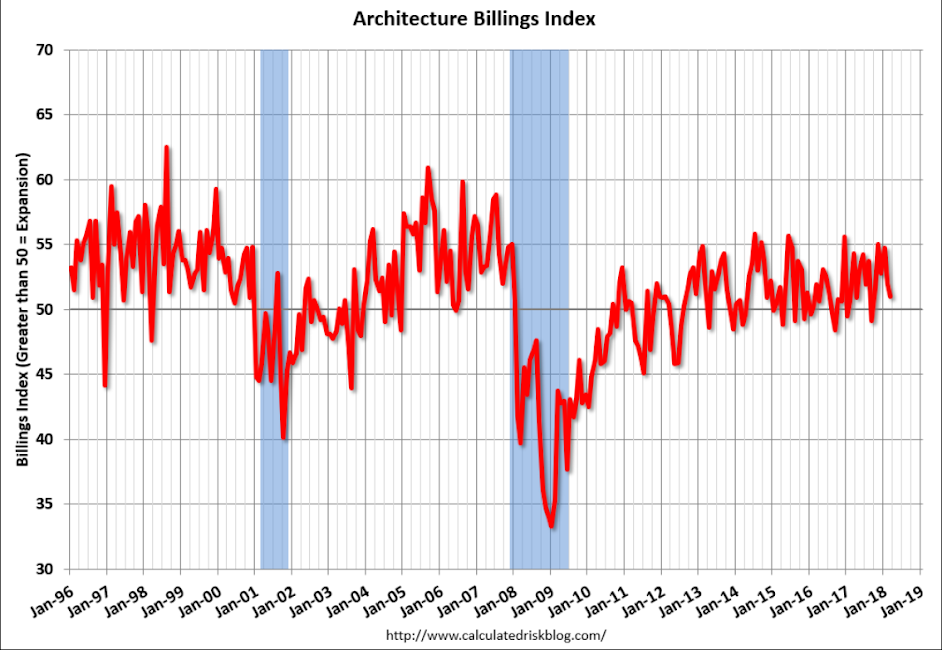

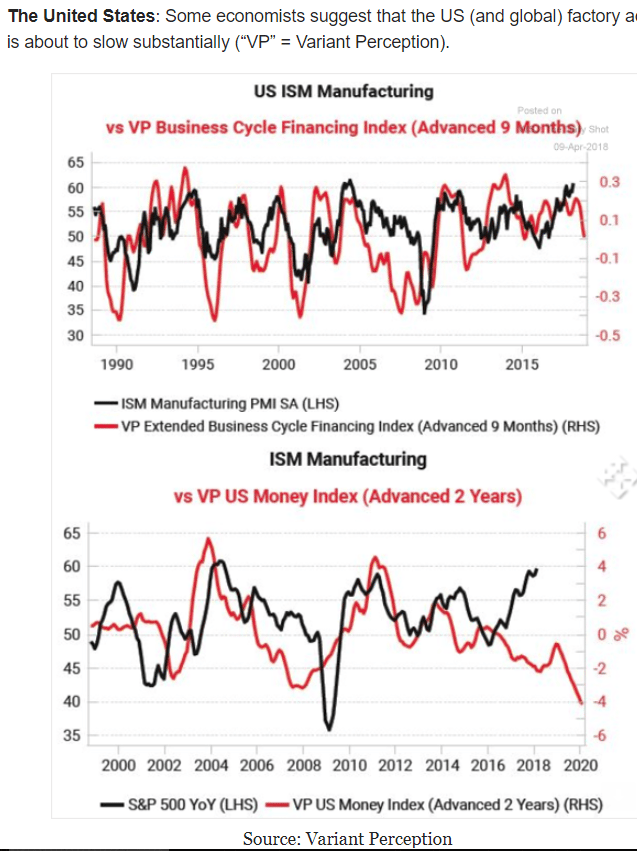

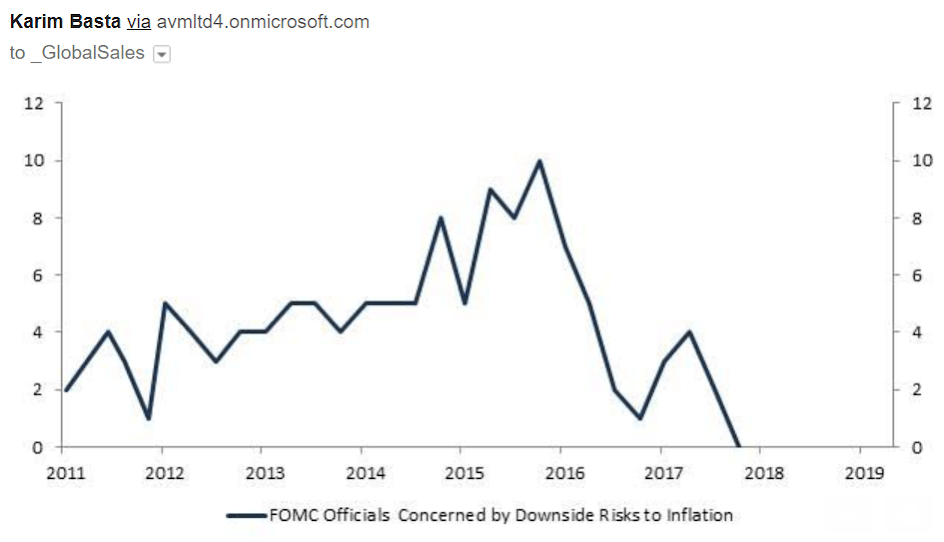

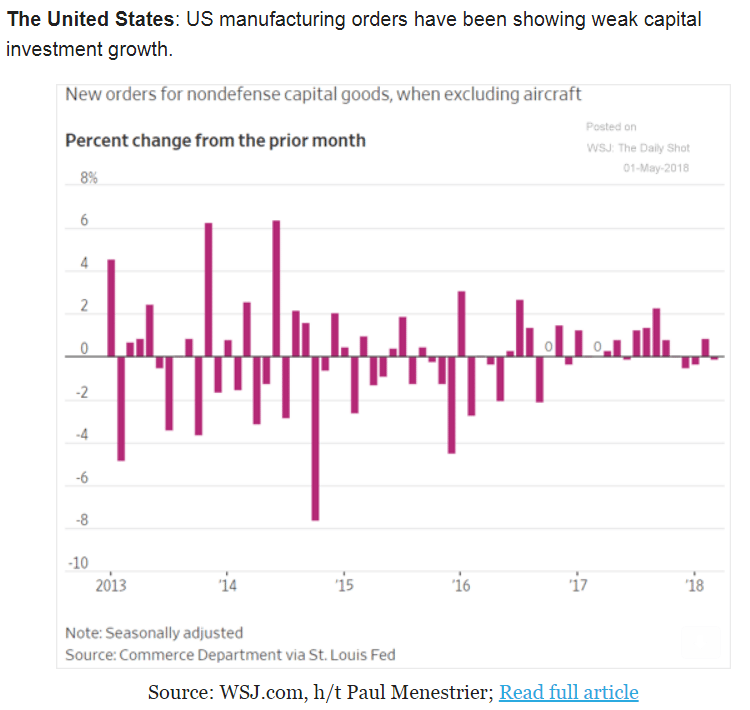

Another chart that indicates we could already be in recession:

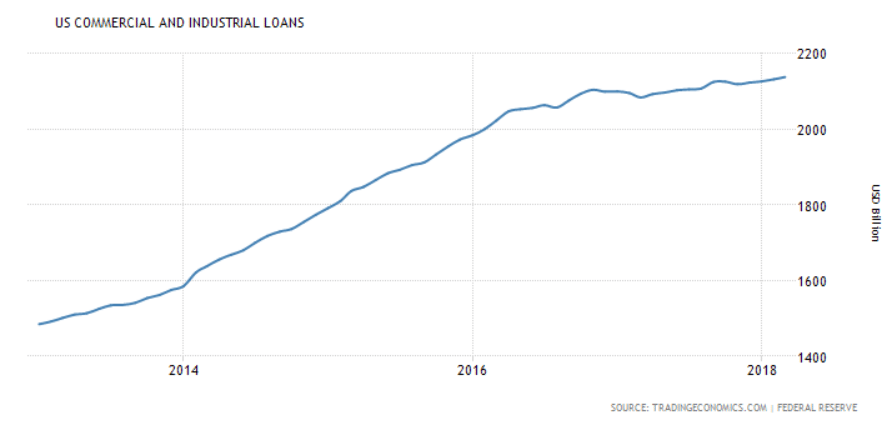

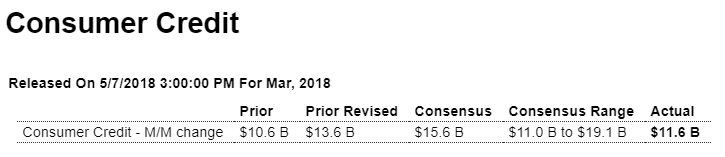

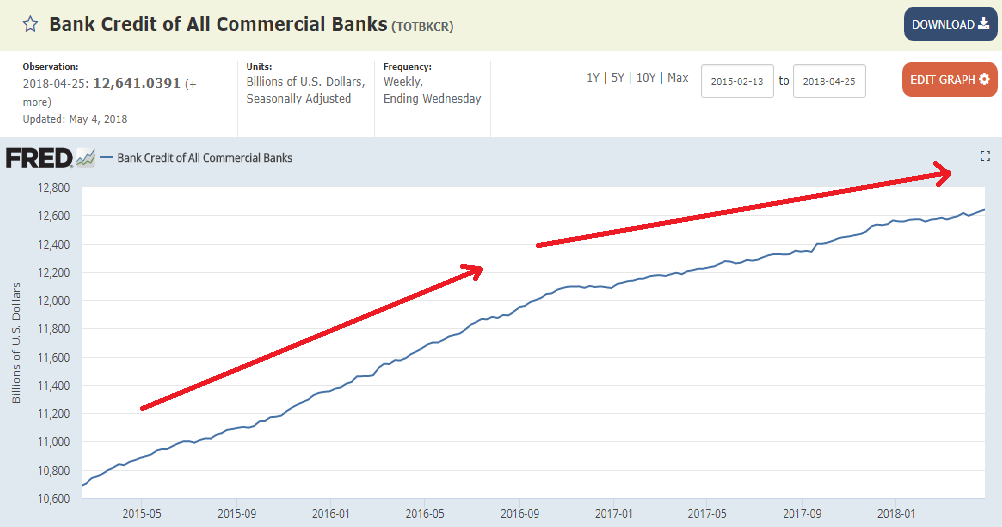

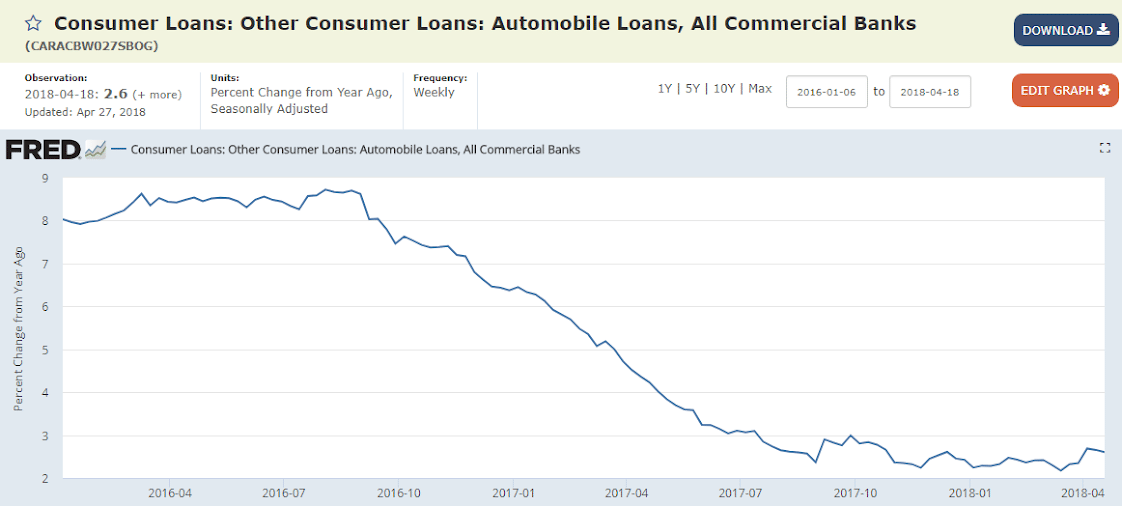

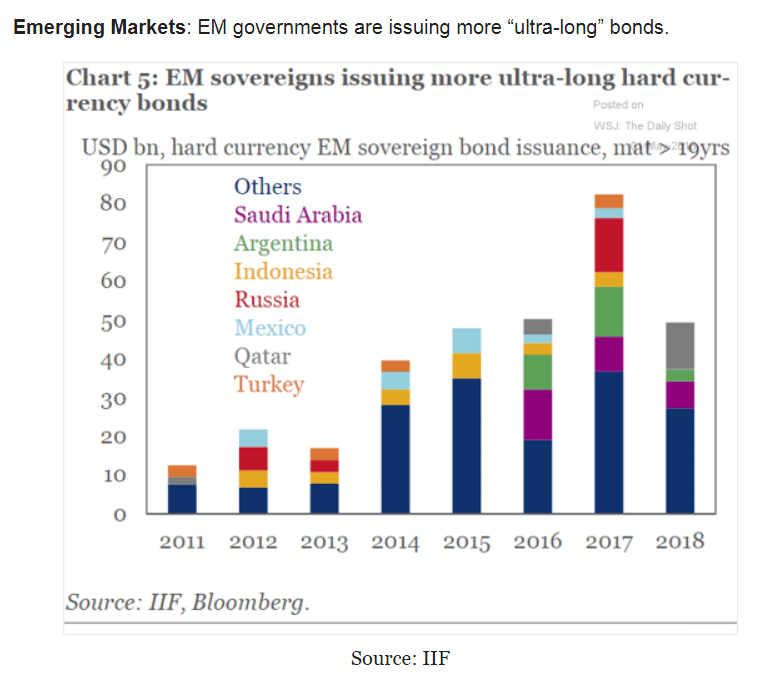

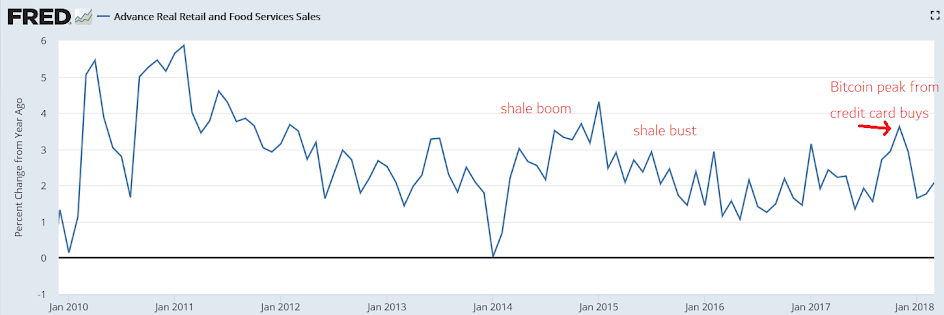

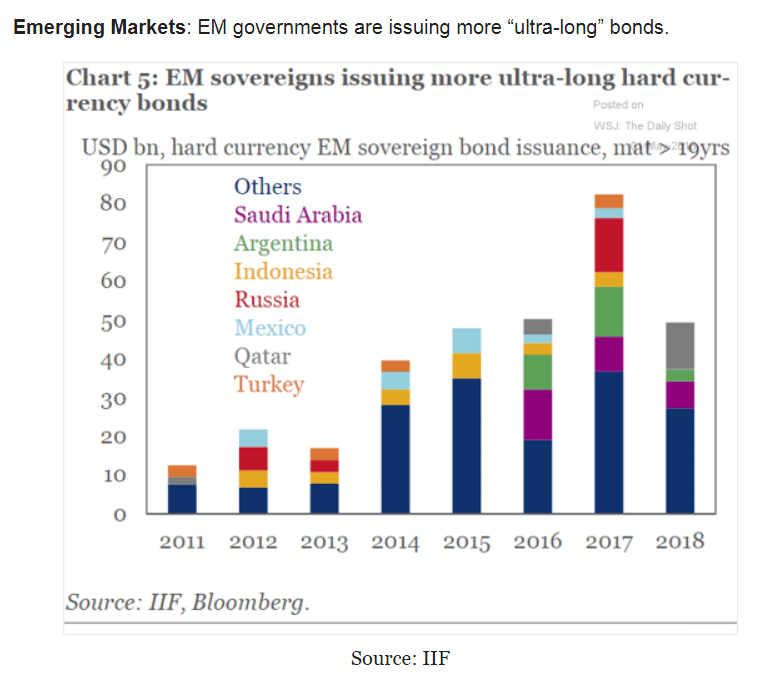

Yet another source of credit growth for 2017 I hadn’t seen:

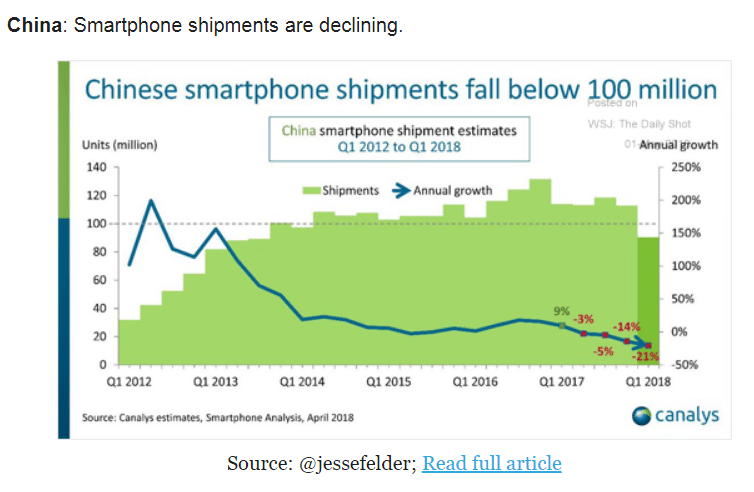

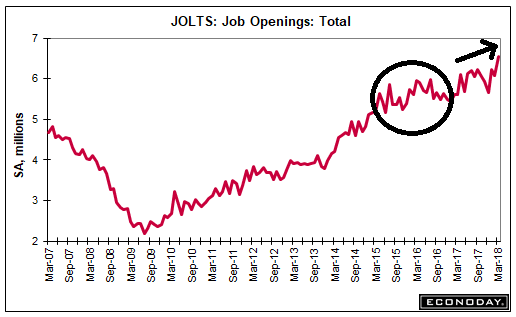

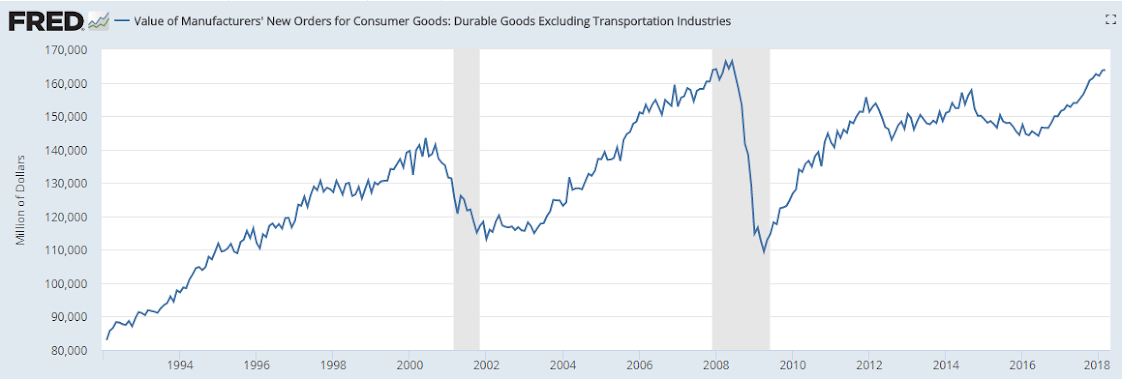

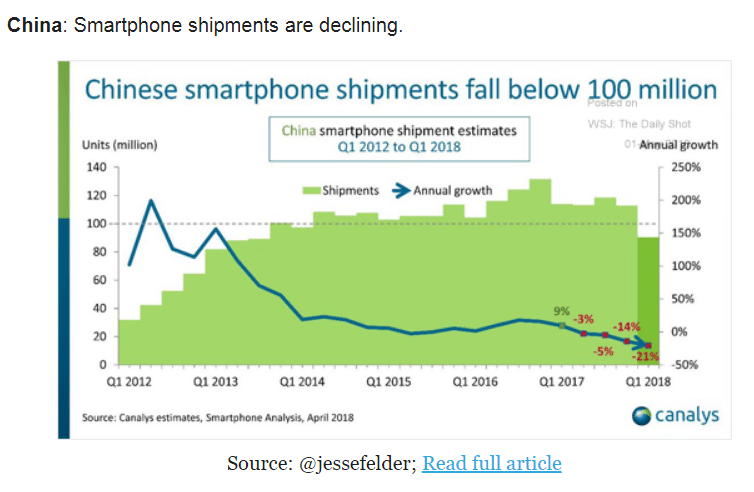

Smartphone sales have been a substantial source of US GDP growth: