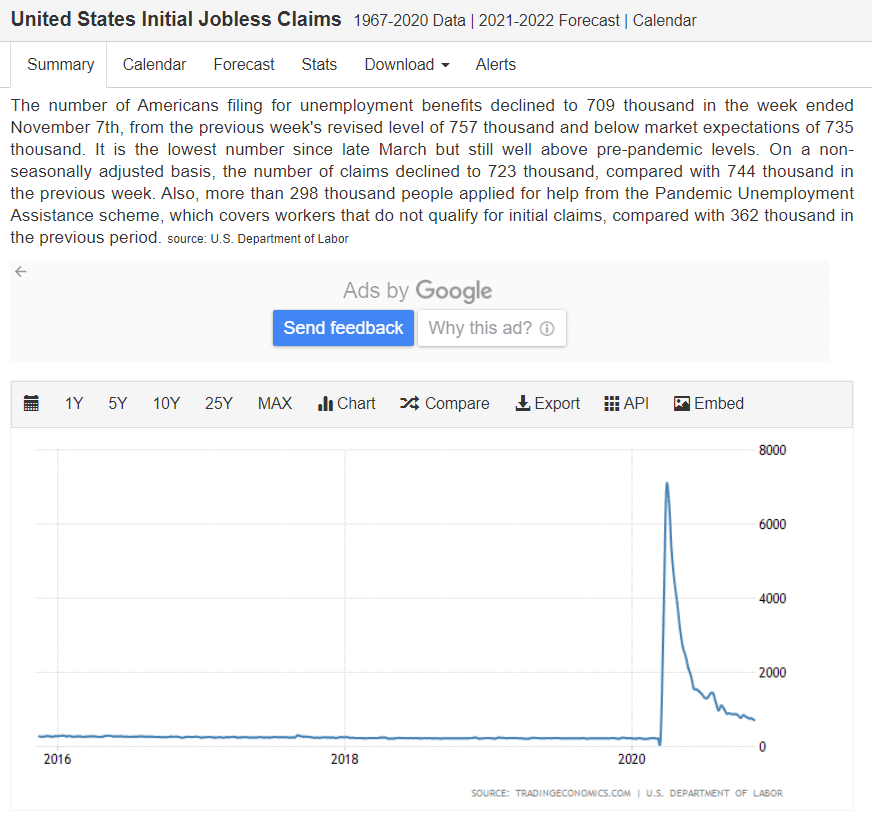

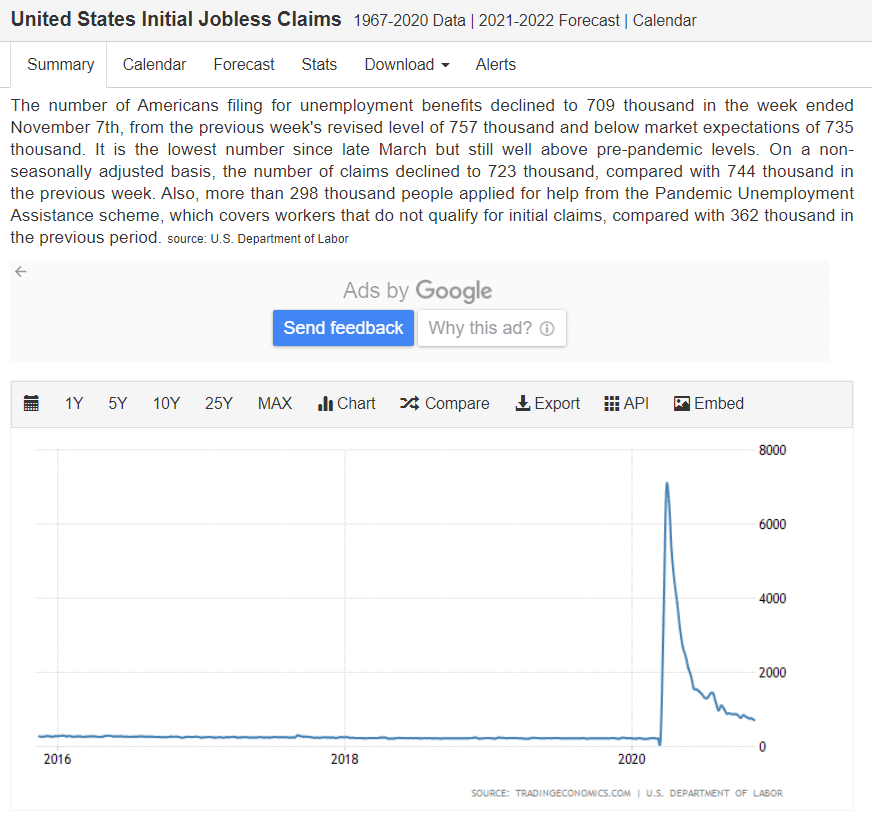

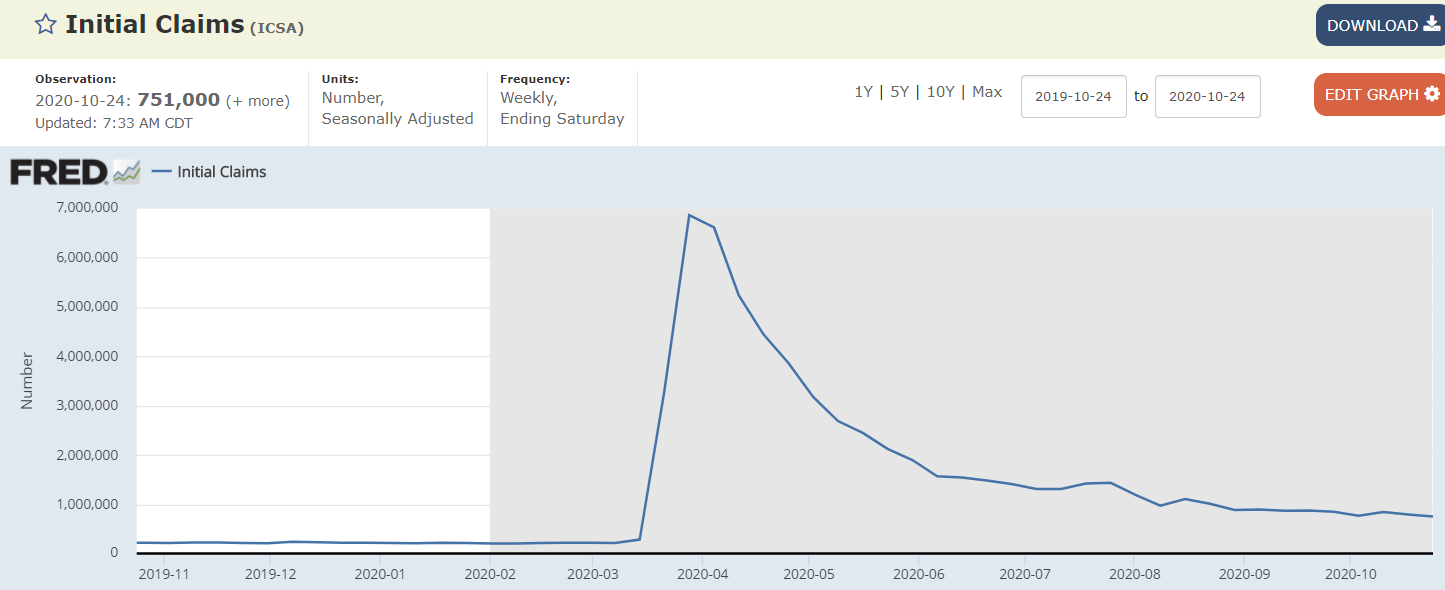

Still over 700,000 new claims this long after the collapse:

Still hasn’t recovered from the 2008 collapse:

Still over 700,000 new claims this long after the collapse:

Still hasn’t recovered from the 2008 collapse:

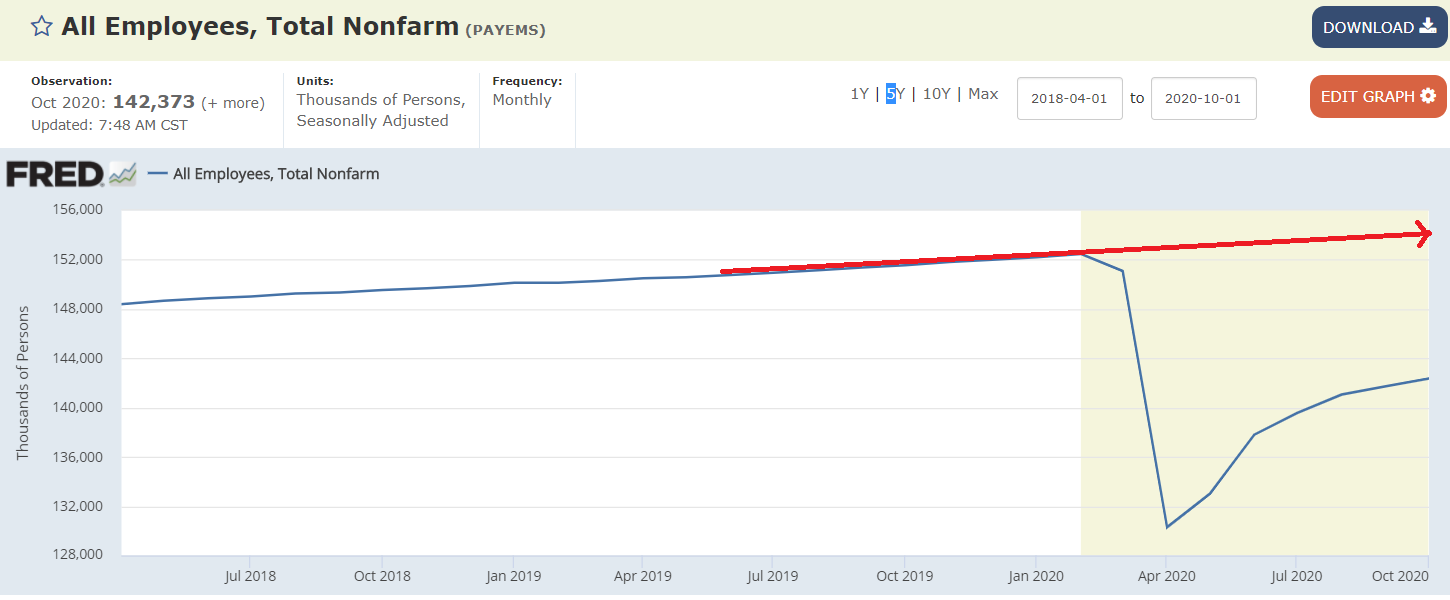

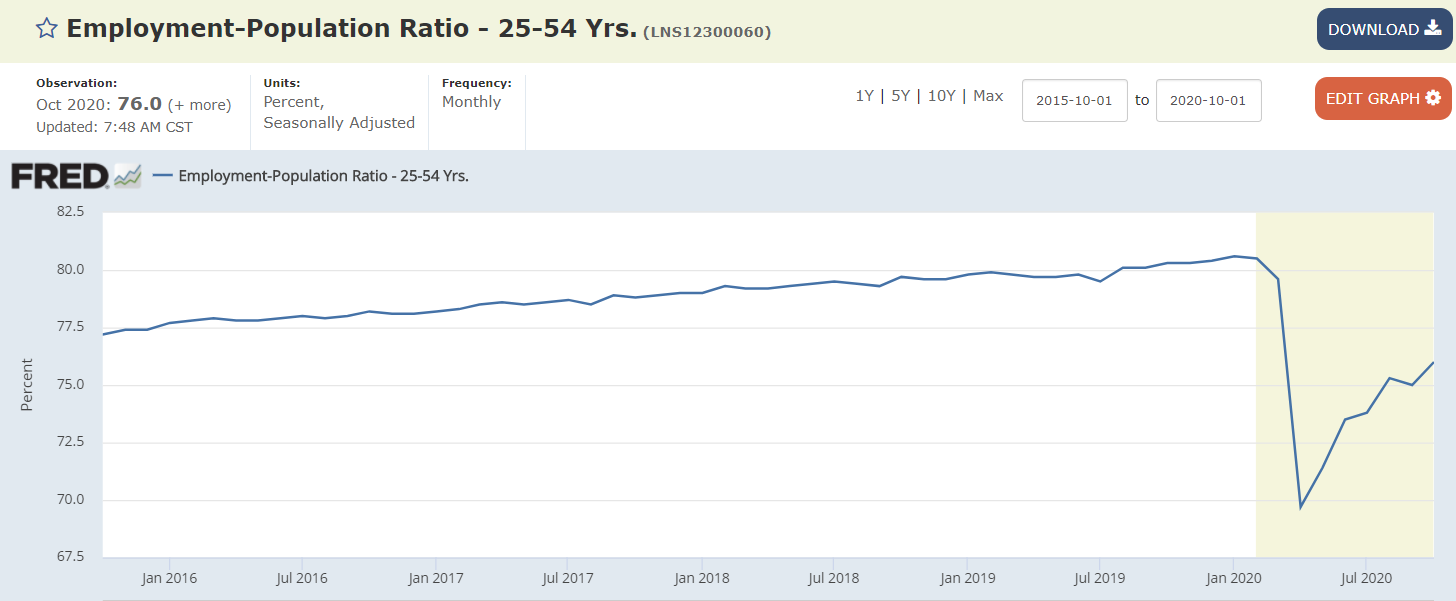

Still down over 10 million jobs vs pre covid:

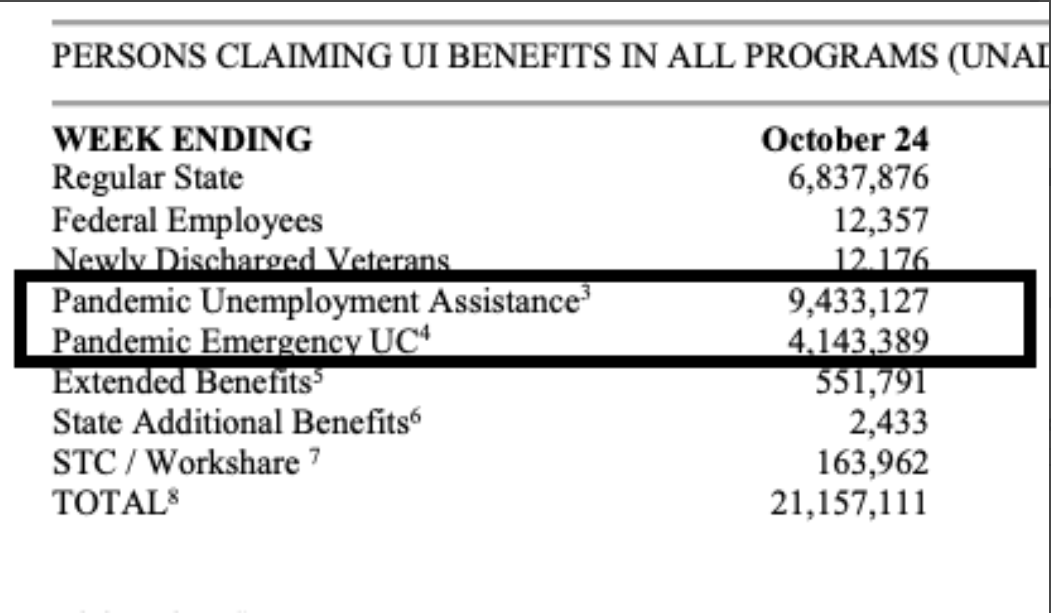

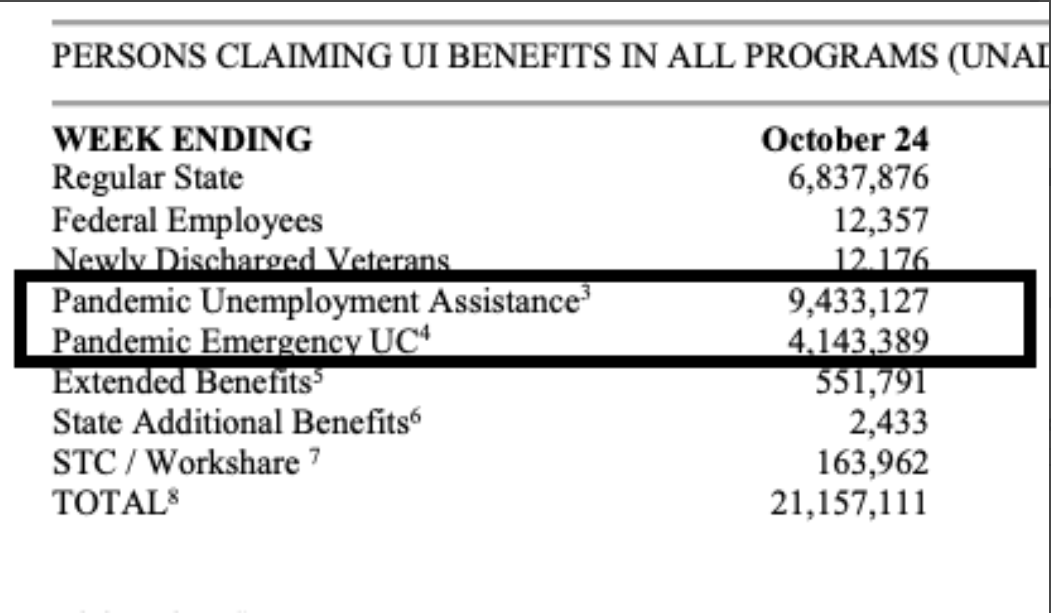

The Cares Act expenditures are winding down…

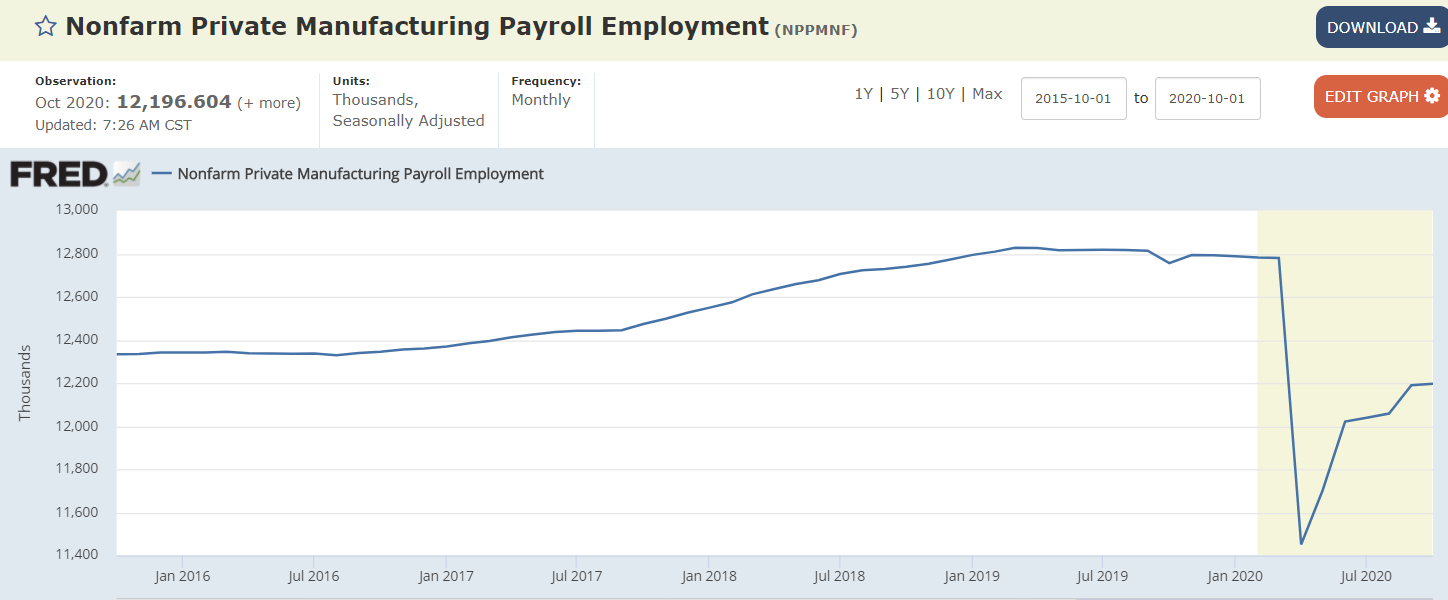

Private payroll recovery leveling off:

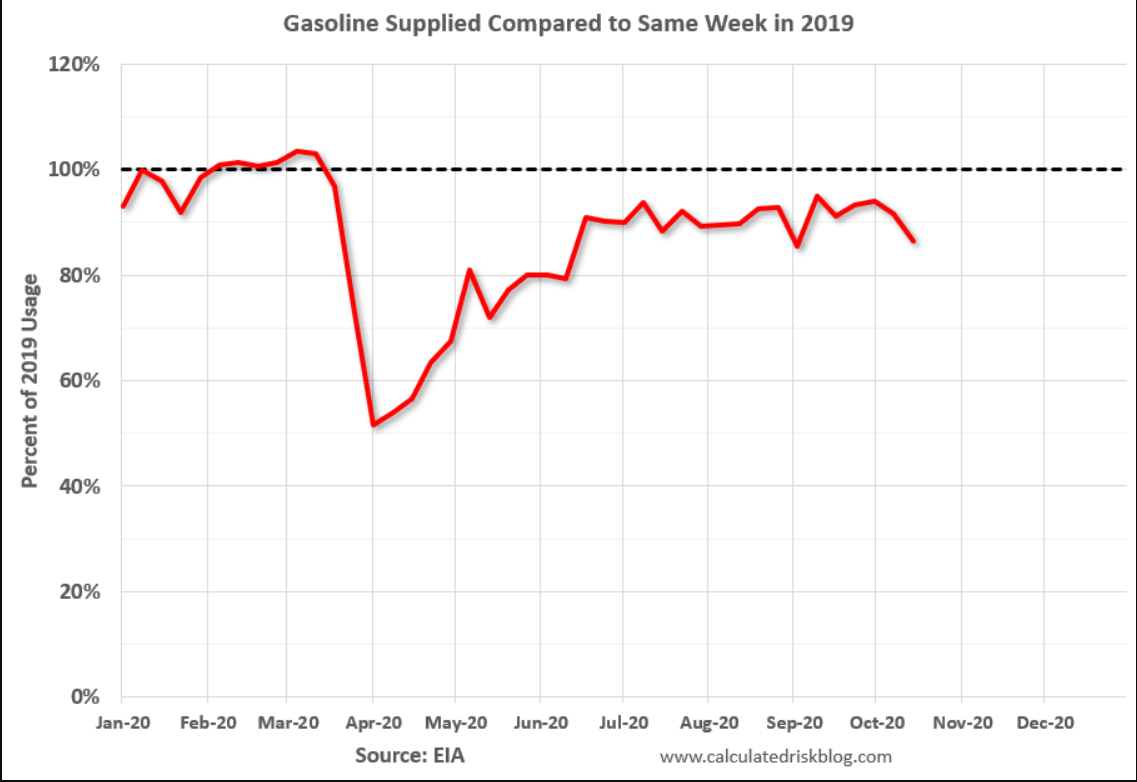

Same pattern. Collapse, partial recovery, then sideways to down:

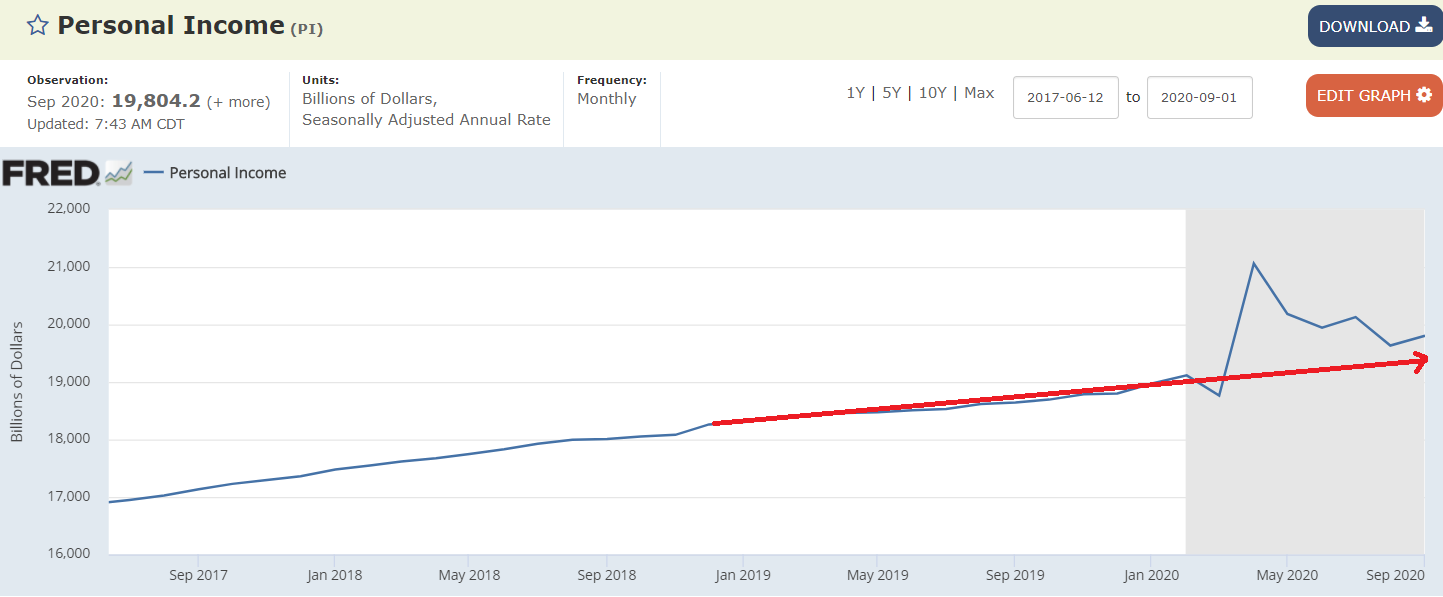

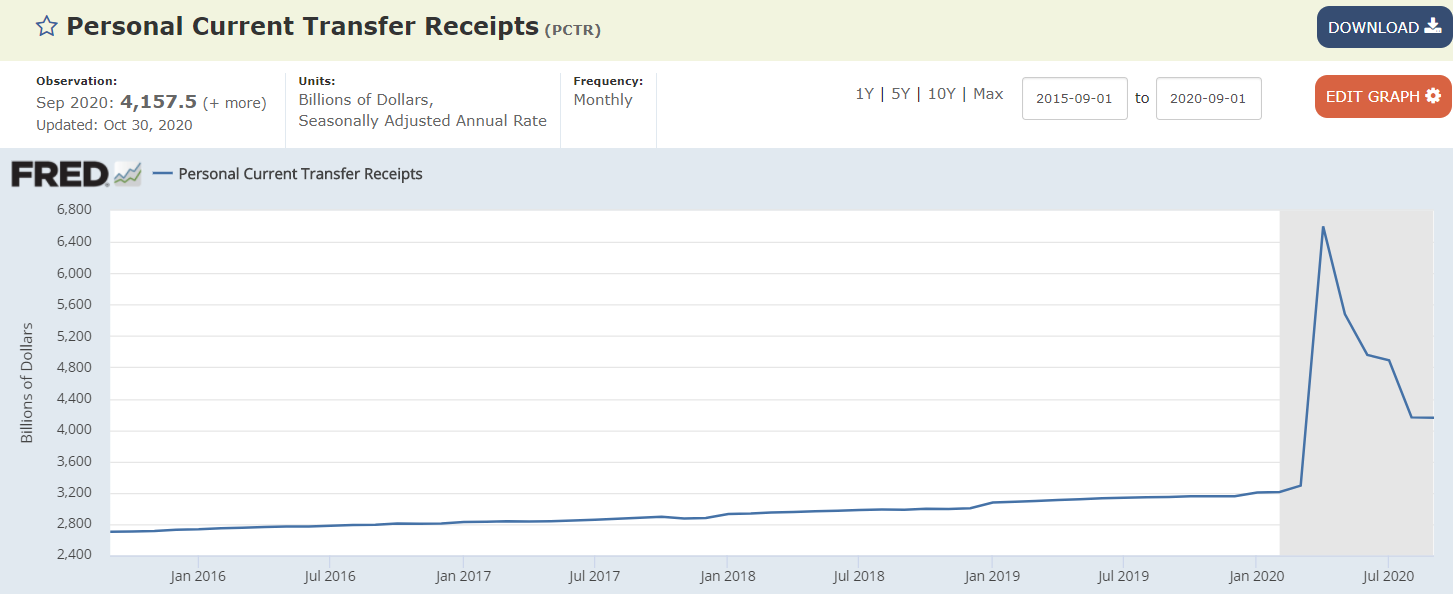

Personal income, which includes gov transfer payments, is coming down in steps after spiking for the fiscal adjustments, and still remains a bit higher than it would have been as transfer payments wind down:

Transfer payments are coming down, but remain elevated largely due to unemployment:

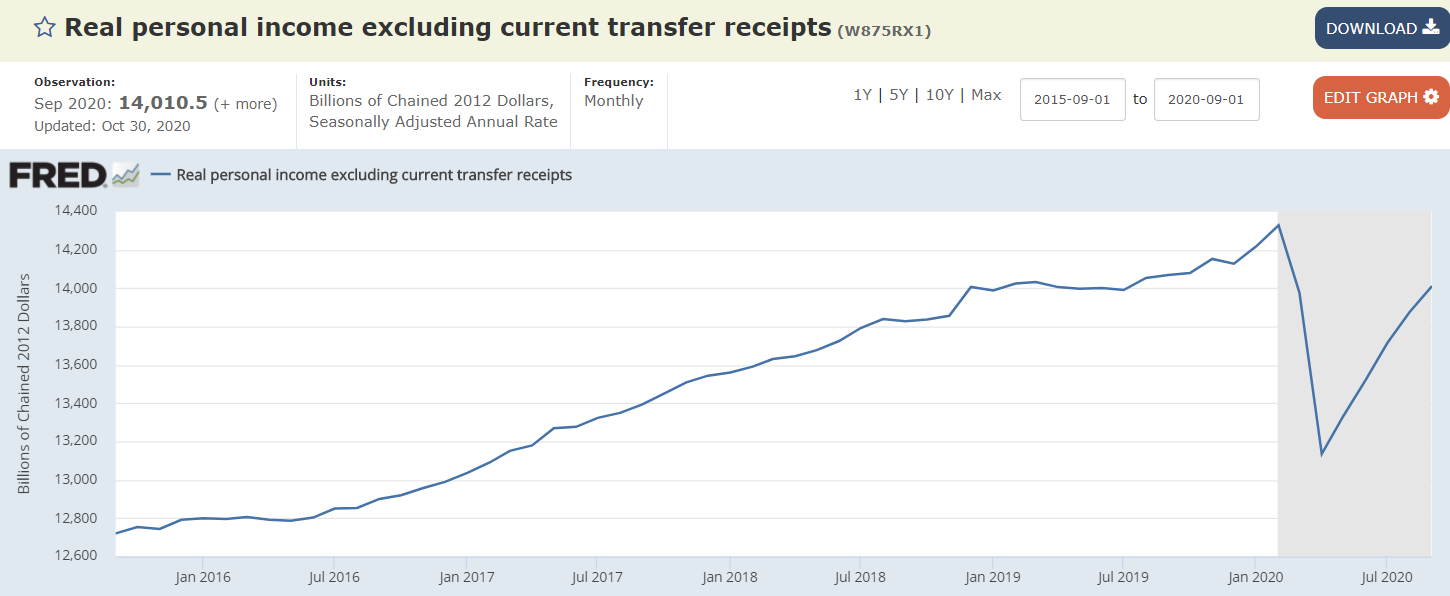

Excluding transfer payments it’s still well short of where it was:

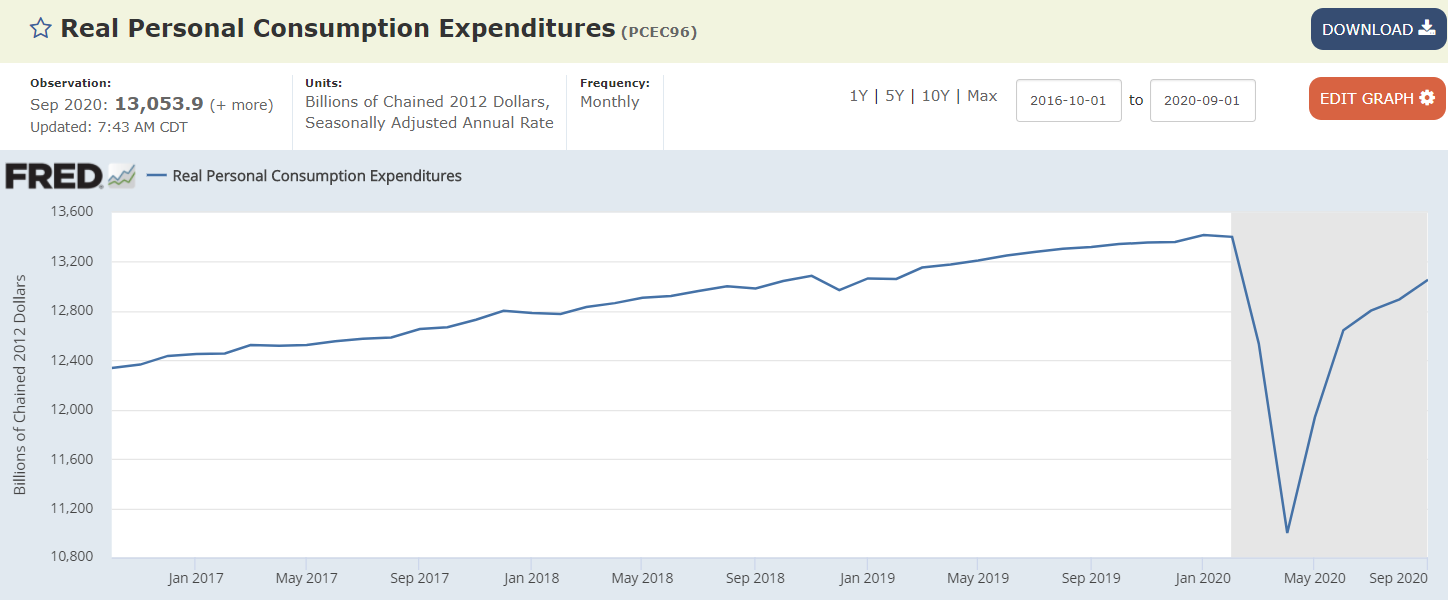

Real consumption, supported by transfer payments, has come back but is leveling off below pre-covid levels:

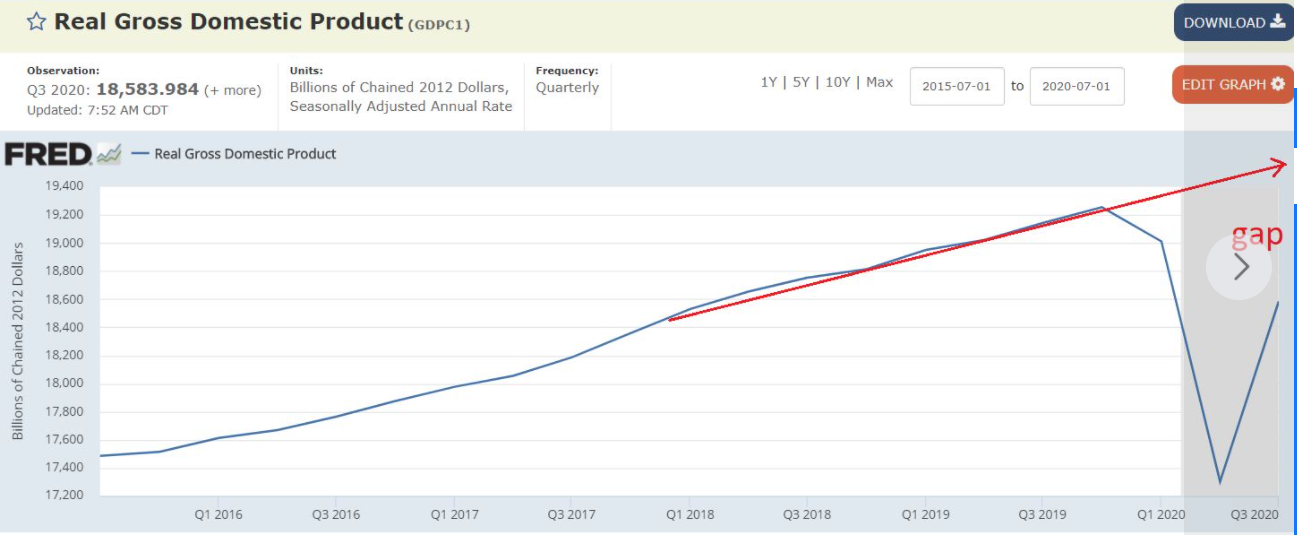

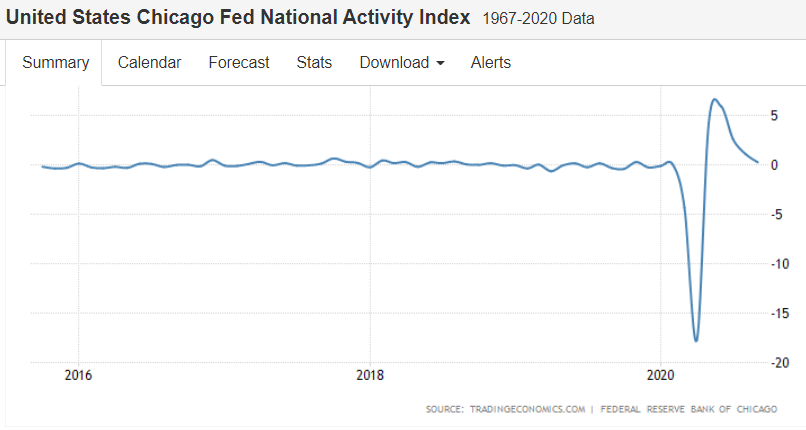

Partial recovery but recent data shows growth stalling while a large gap (unemployment) persists

as tariffs, covid, and no additional fiscal support continue:

The gap initially closed relatively quickly, but progress has slowed:

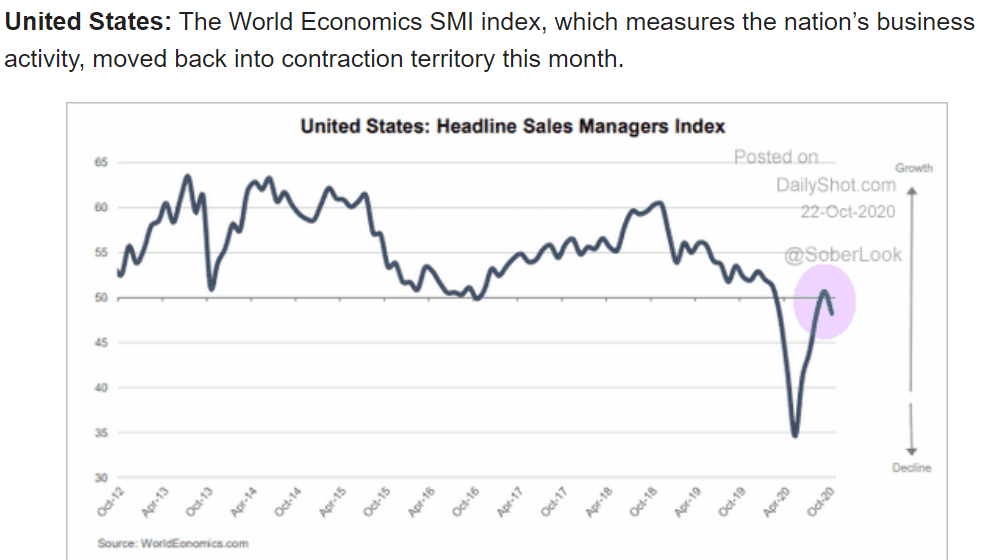

Still trending lower:

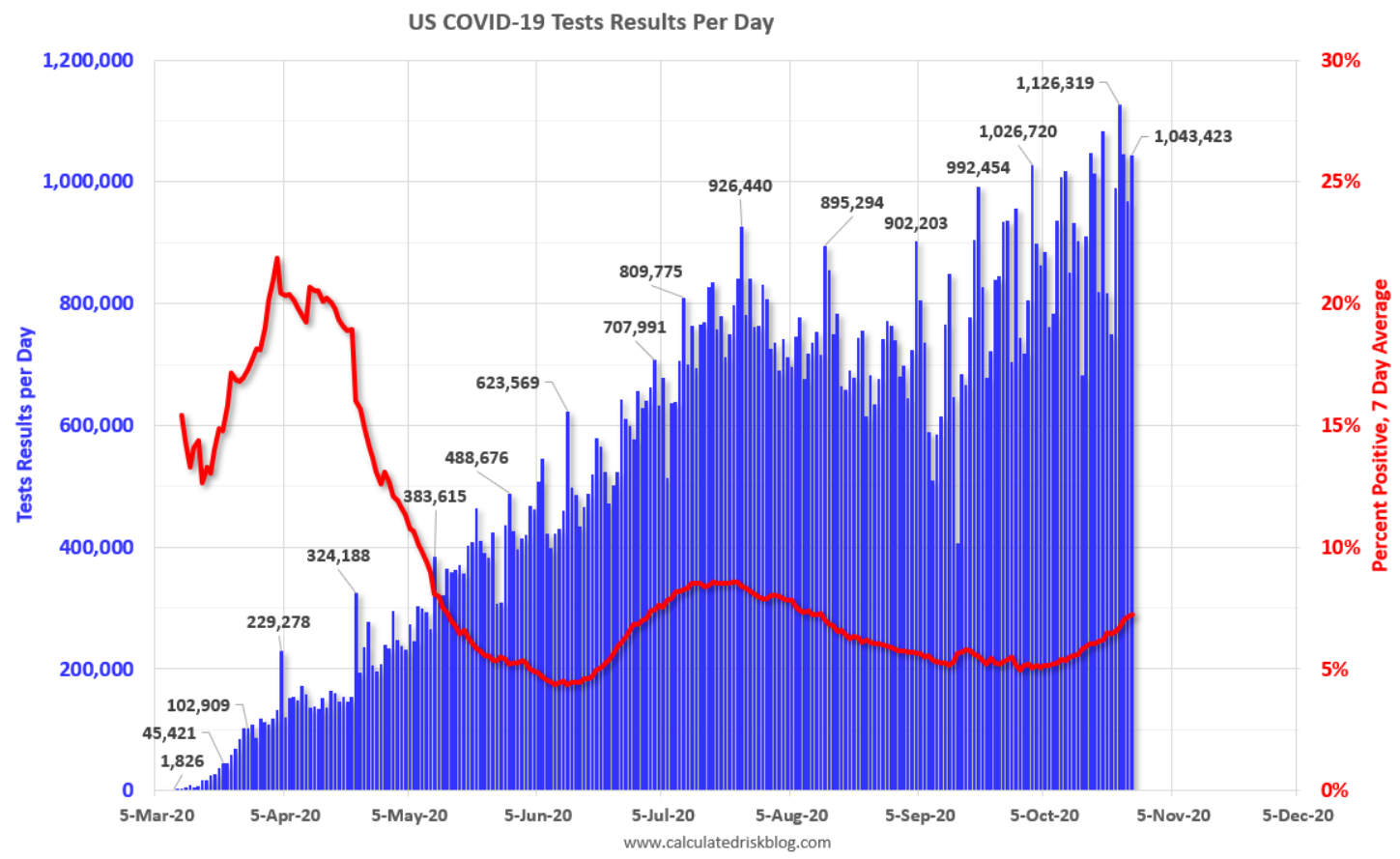

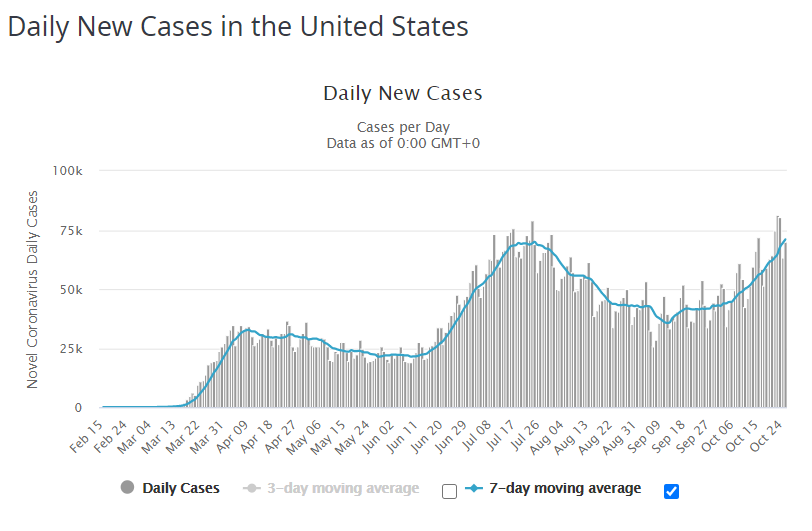

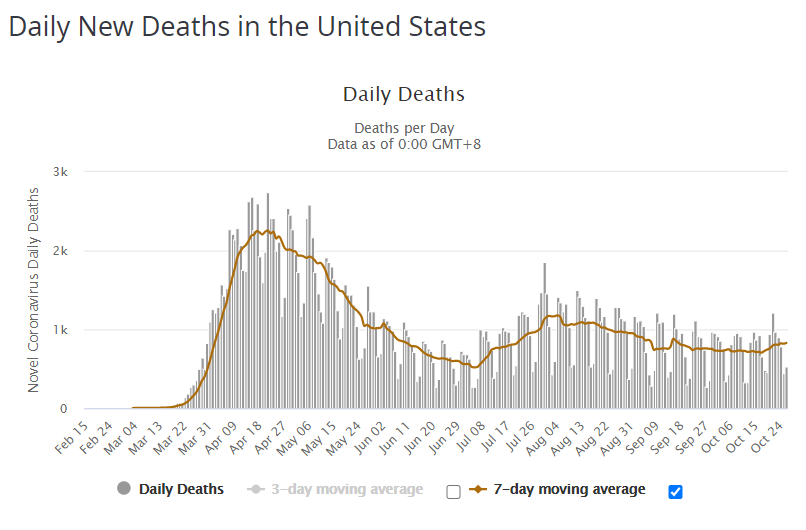

More testing AND the % positive is up as new cases and deaths, which lag new cases, increase:

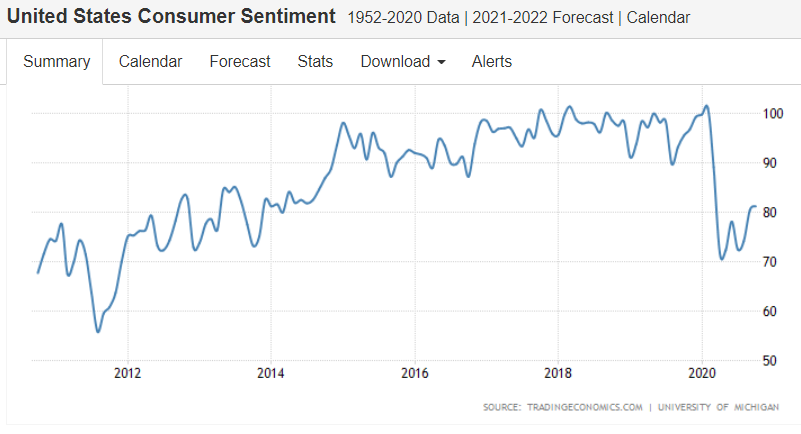

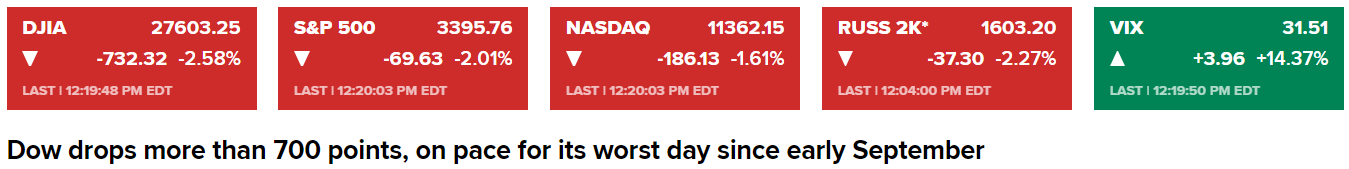

Weakening:

Trump looks to be losing by a substantial margin at the moment, which means

to me that there won’t be a fiscal adjustment before January’s new Congress,

and without a sufficient majority in the Senate all initiatives may be blocked indefinitely.

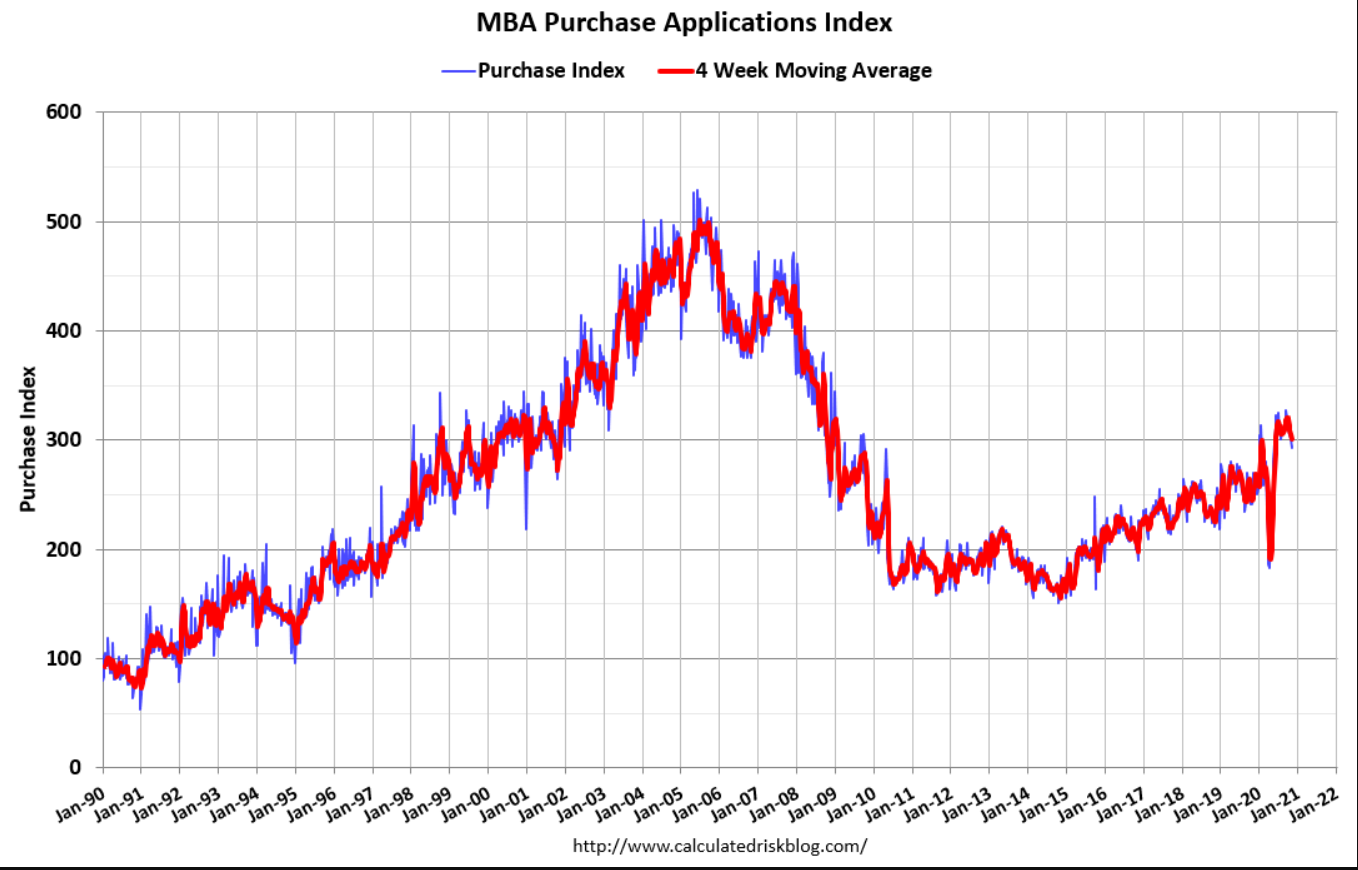

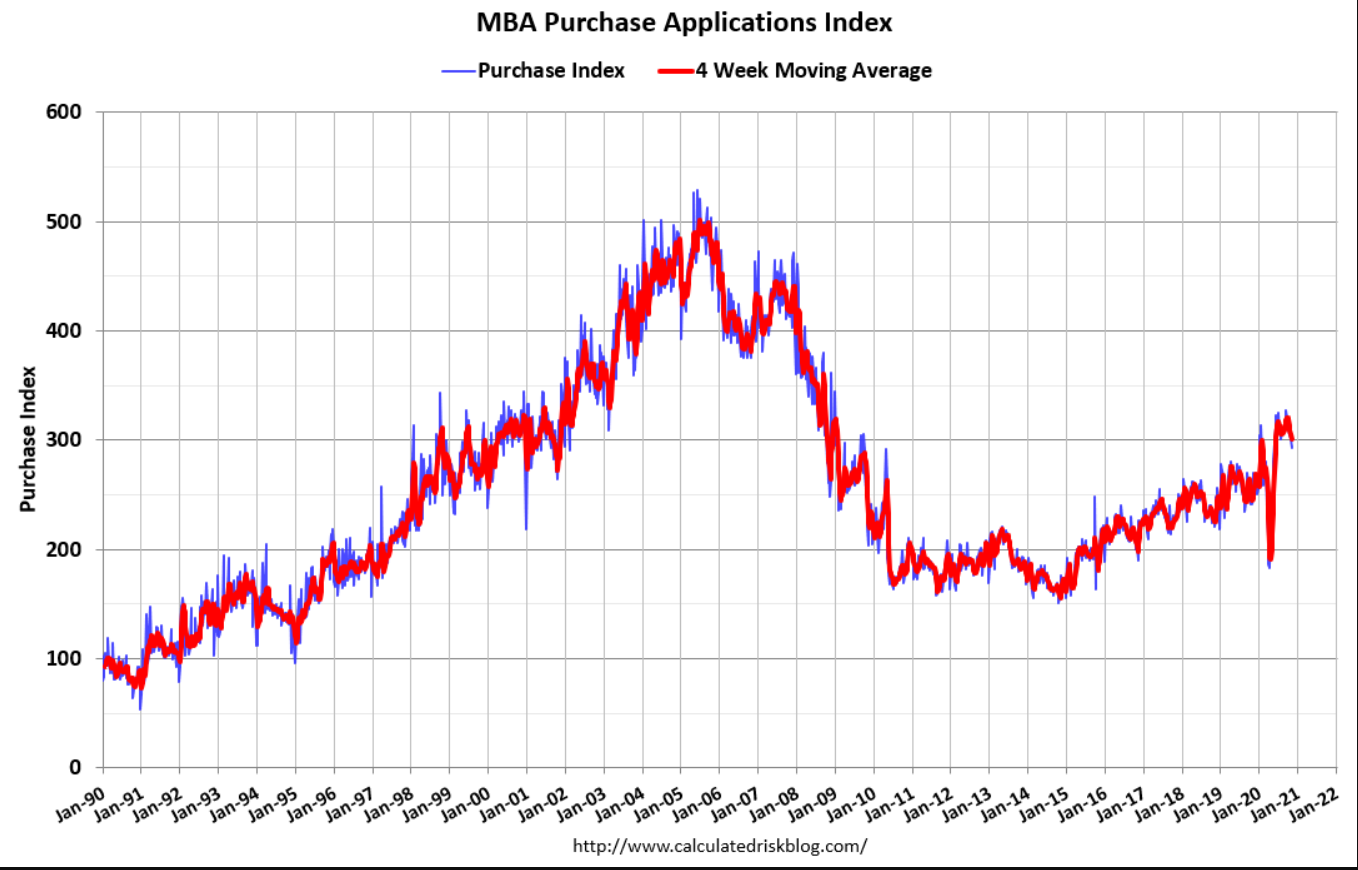

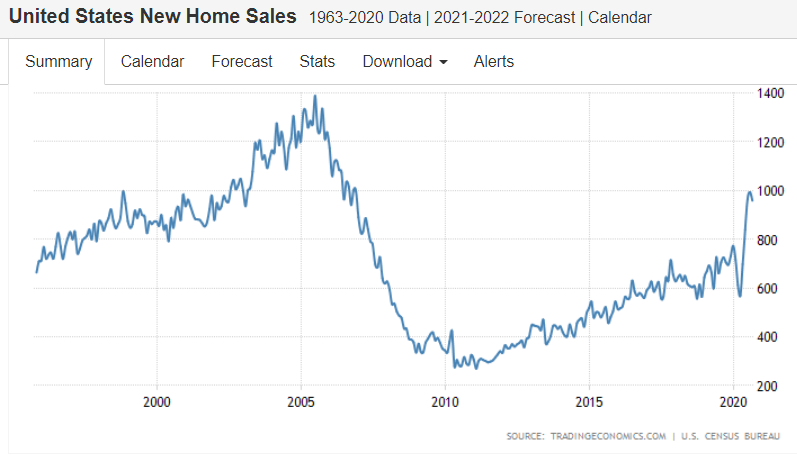

Most likely new home sales at best return to their pre covid growth path:

Trump was upset with Canada because they weren’t charging us enough for lumber:

Lumber prices across North America have nearly tripled since 2019. Based on a weekly price report by the B.C. Ministry of Forests, Lands and Natural Resources, the price of SPF (spruce, pine, fir) 2×4 lumber – as of Sept. 18 – is at $1,288 per thousand board feet, up from a 2019 average annual of $499.

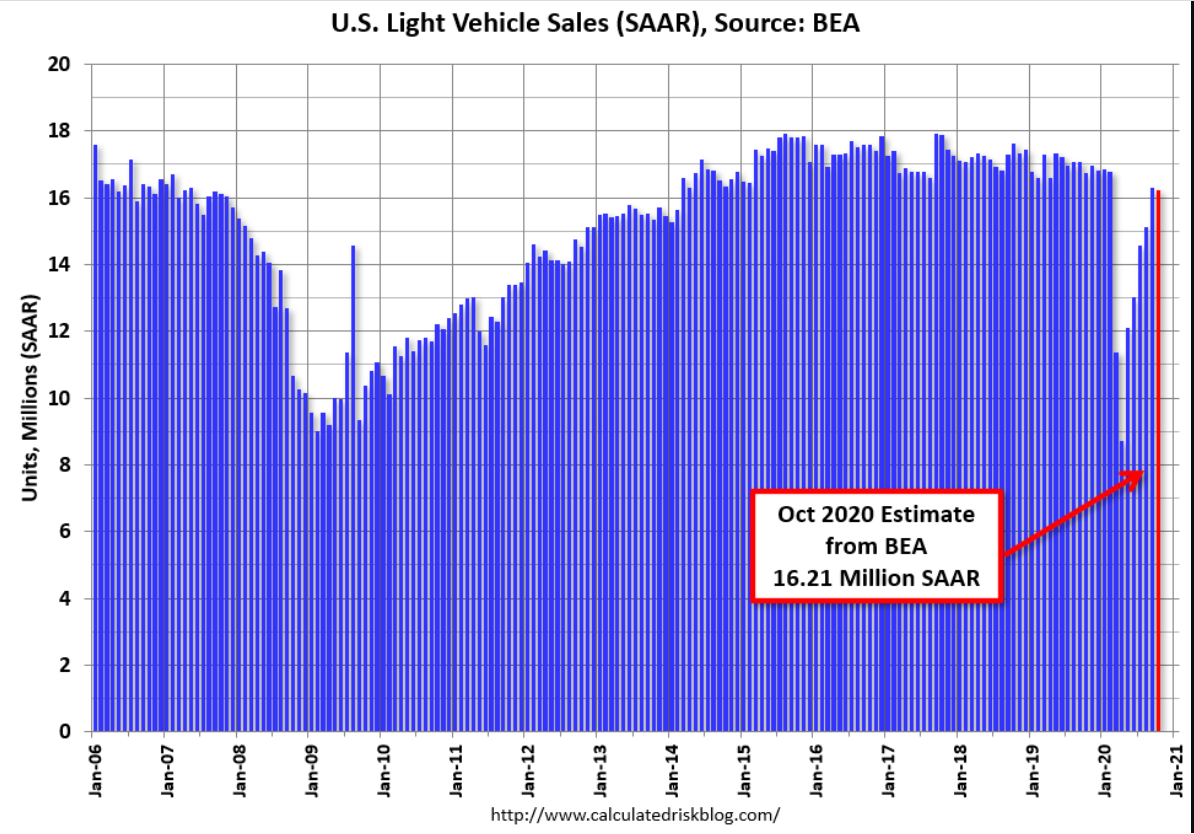

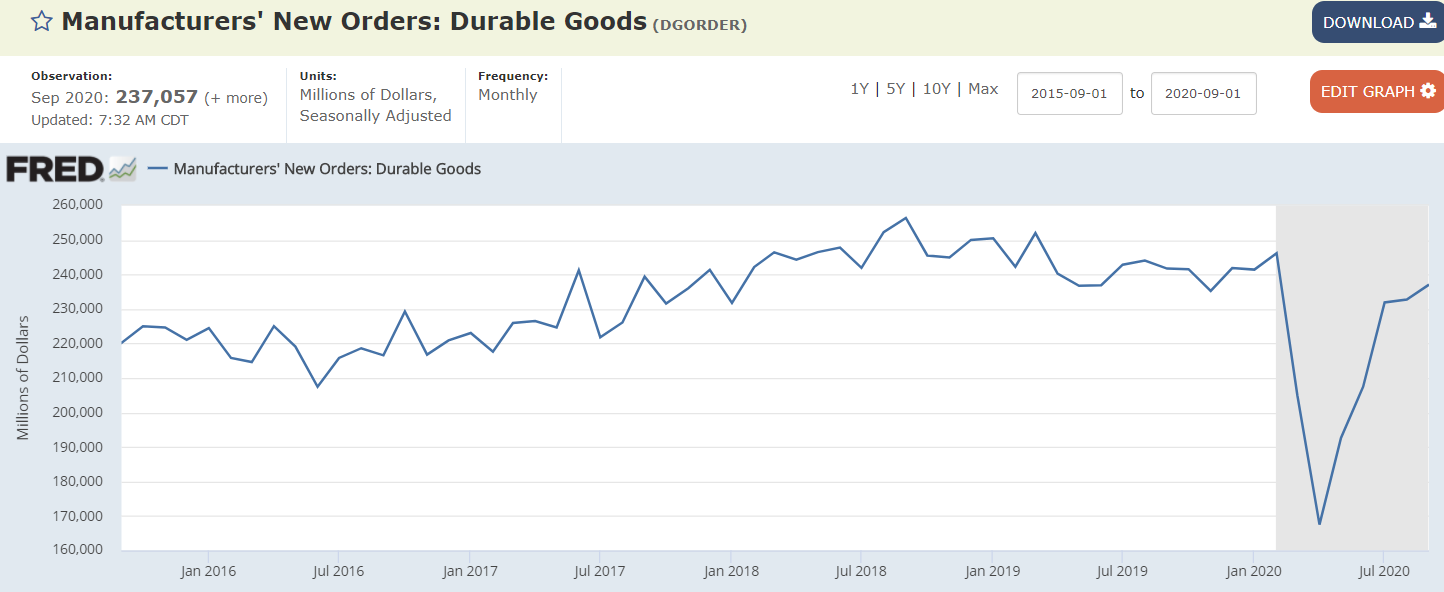

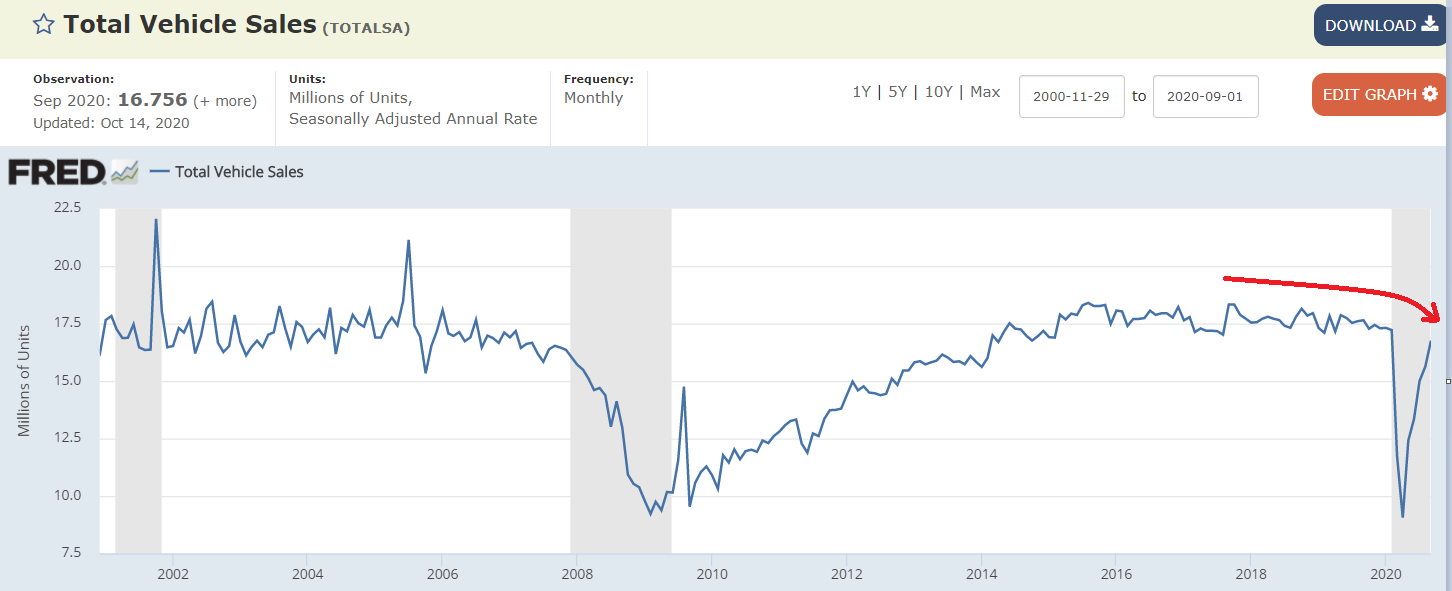

Monthly sales rates peaked in 2016 when oil capex collapsed, then leveled off, then started sliding again with the tariffs, then collapsed with the covid shock, and have nearly recovered to the lower levels:

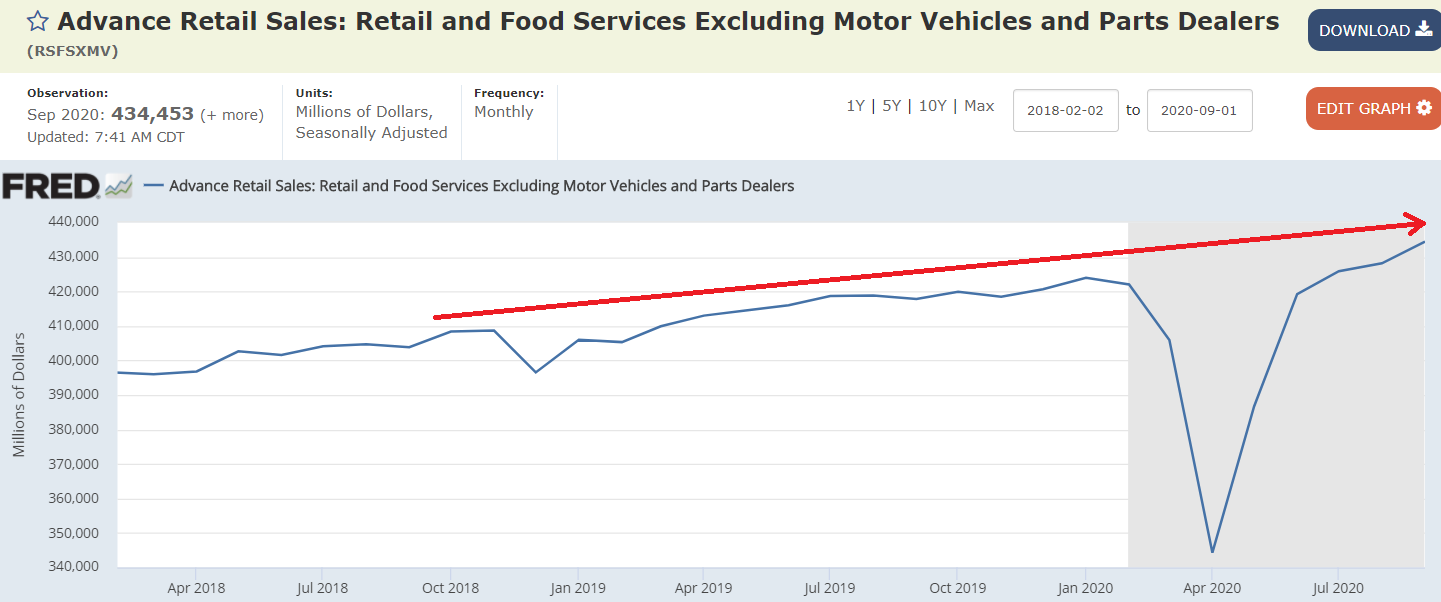

As with vehicles, the rate of monthly sales has recovered to prior levels, but sales lost during the dip weren’t recovered:

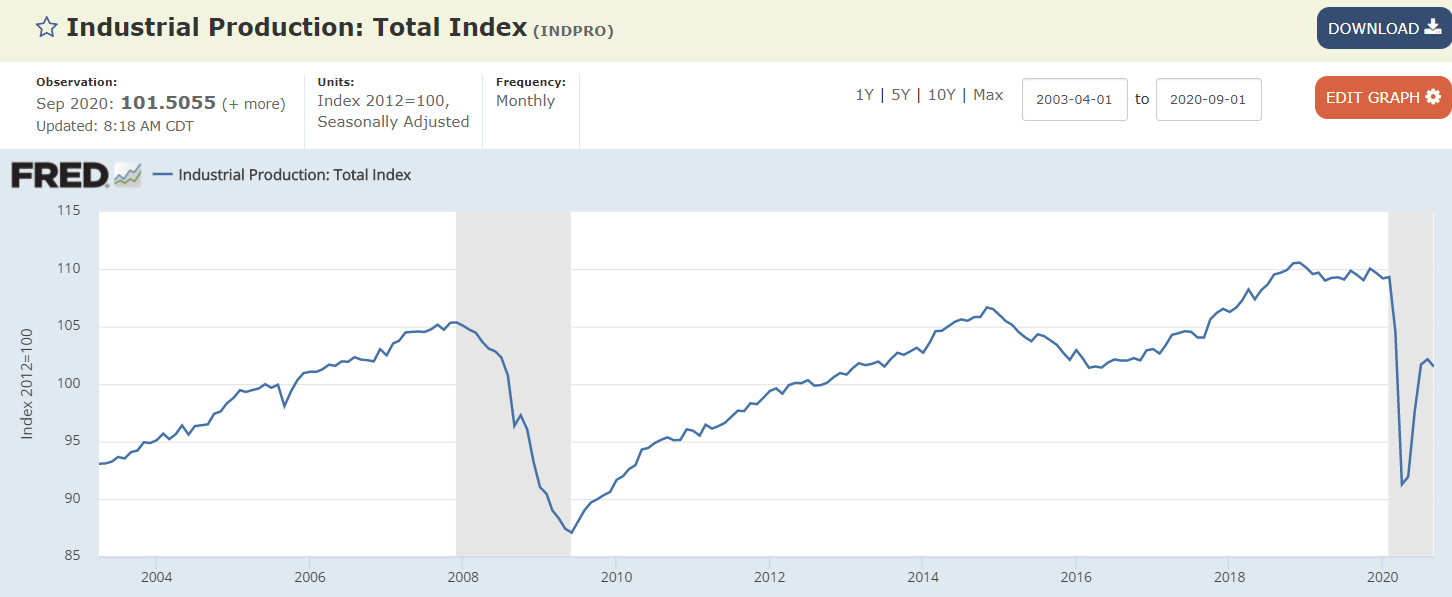

Industrial production has had a much weaker recovery and has turned back down:

Recovered some but still down from pre covid levels: