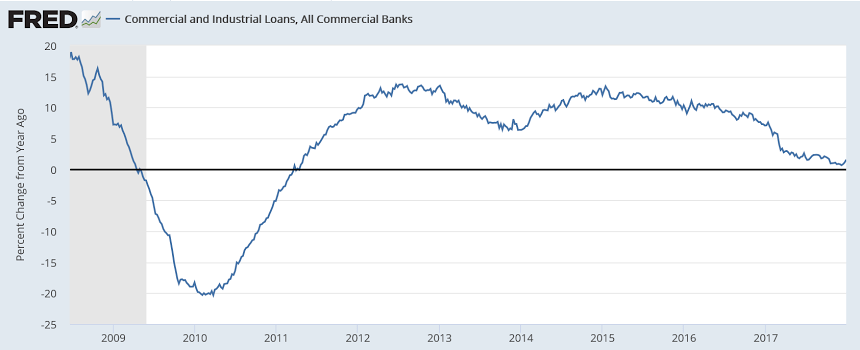

Bank lending began to decelerate after oil related capital spending collapsed late in 2014, and then collapsed further about the time of the presidential election:

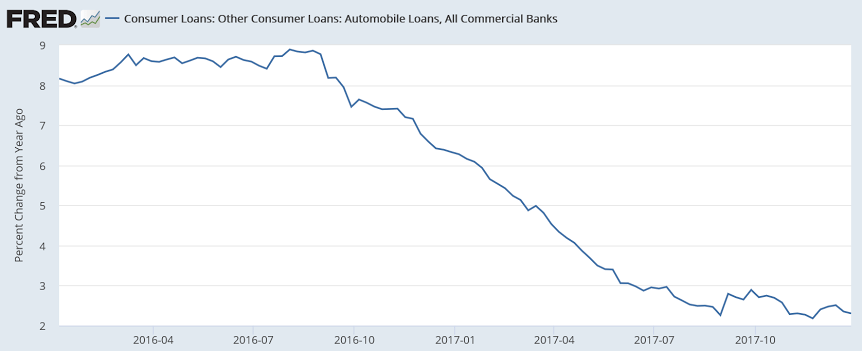

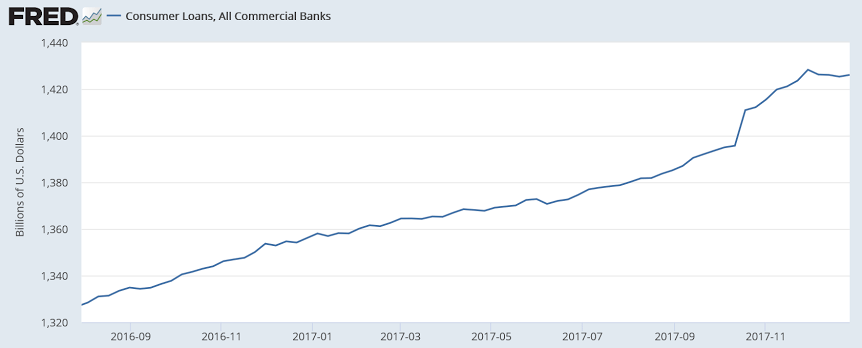

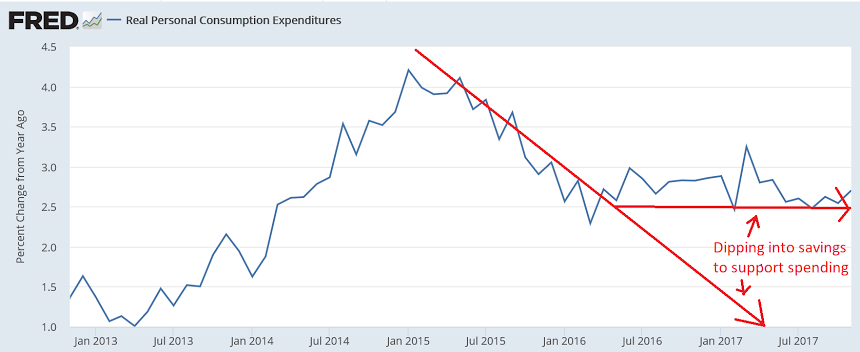

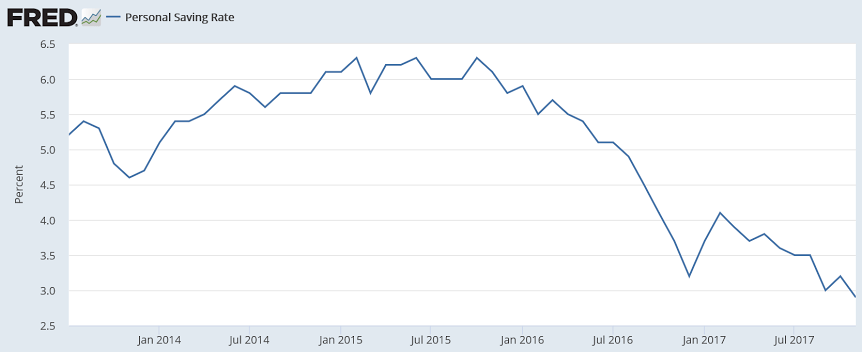

Note the consumer ‘dipping into savings’ some to sustain consumption via borrowing into year end as personal income flattened:

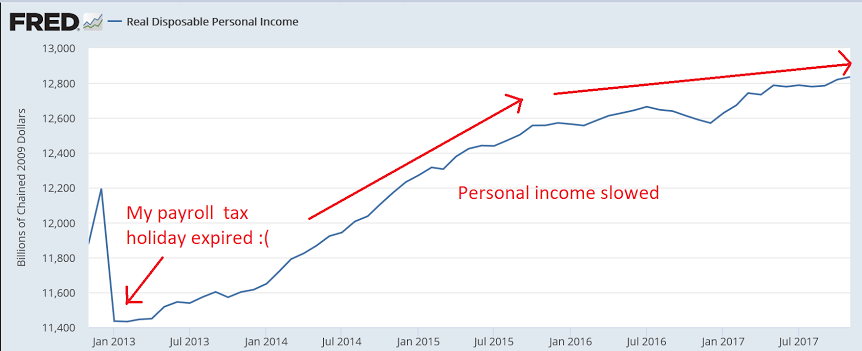

Real disposable personal income flattened and consumer spending slowed but not as much as income, and was instead supported by consumers ‘dipping into savings’:

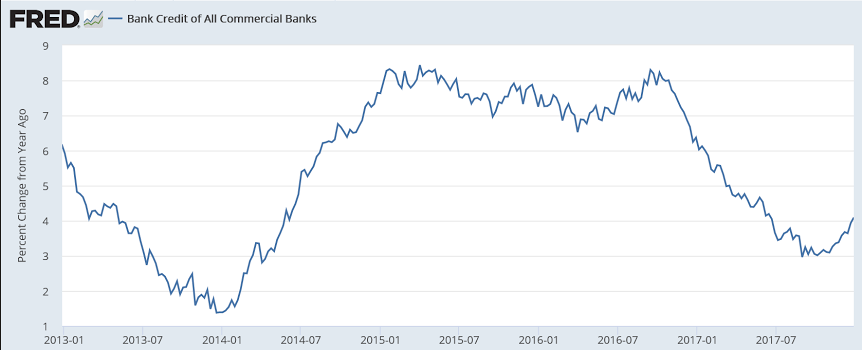

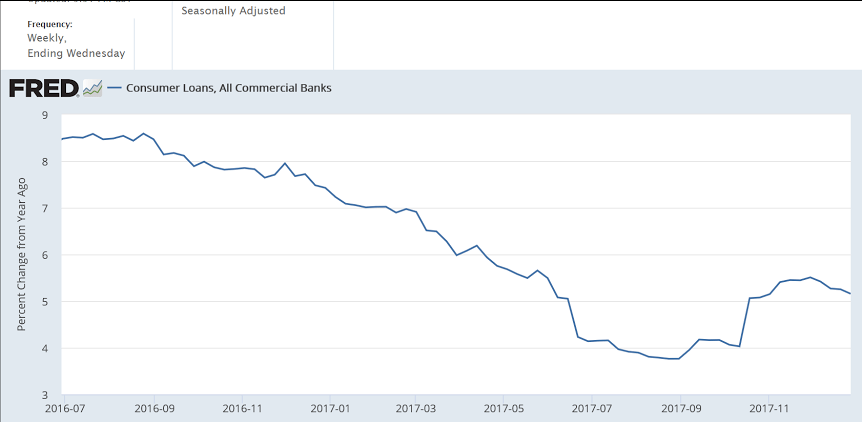

This is now impossibly low, given the deceleration in credit:

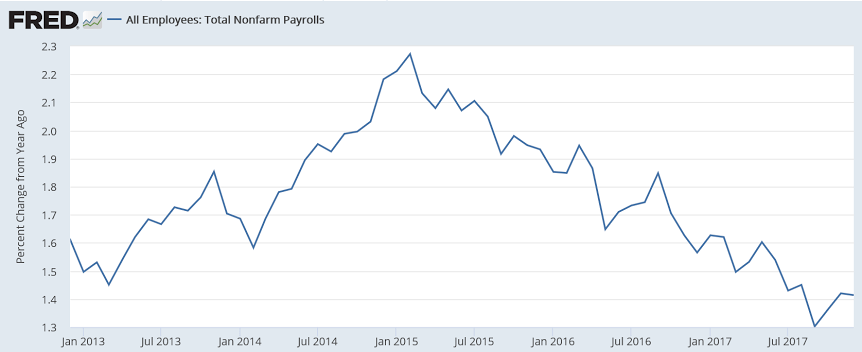

Employment gains continue to decelerate:

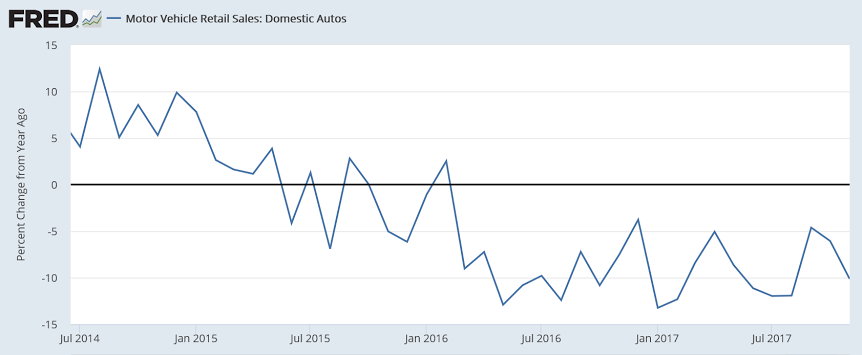

Total vehicle sales were lower in 2017 vs 2016, with domestic autos particularly weak. This is through November:

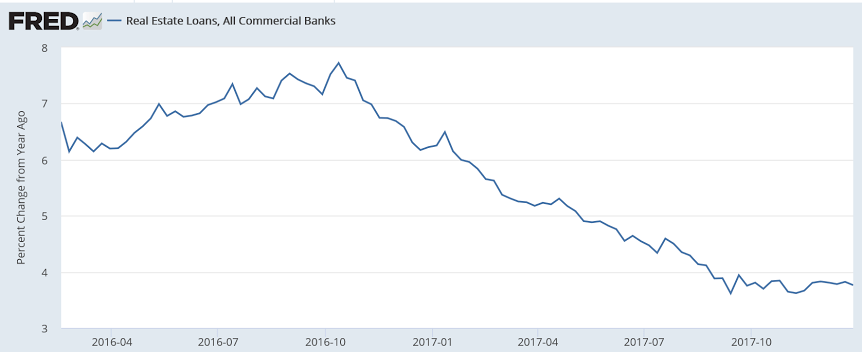

Slowing growth here as well:

With income and employment decelerating I can’t see the upside?