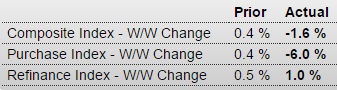

Another setback for those grasping for straws looking for housing to lead a recovery:

MBA Mortgage Applications

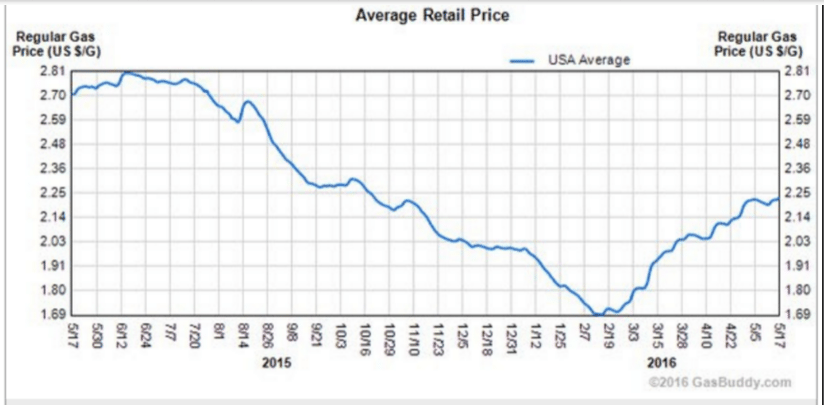

Gas prices up enough to hurt consumers, but not enough boost oil capex.

You might say it’s in the ‘sour spot’:

Again, for all practical purposes this IS full debt forgiveness, and something Greece has yet to recognize as such:

IMF Proposal on Greece Sets Up Battle With Germany

May 17 (WSJ) — A new IMF proposal goes far beyond what Greece’s eurozone creditors have said they are willing to do. Germany is leading the pressure on the IMF to dilute its demands and rejoin the Greek bailout program as a lender. The IMF wants eurozone countries to accept long delays in the repayment of Greece’s bailout loans, which would fall due in the period from 2040 to 2080 under the proposal. The IMF is also pressing for Greece’s interest rate on its eurozone loans to be fixed for 30 to 40 years at its current average level of 1.5%, with all interest payments postponed until loans start falling due.

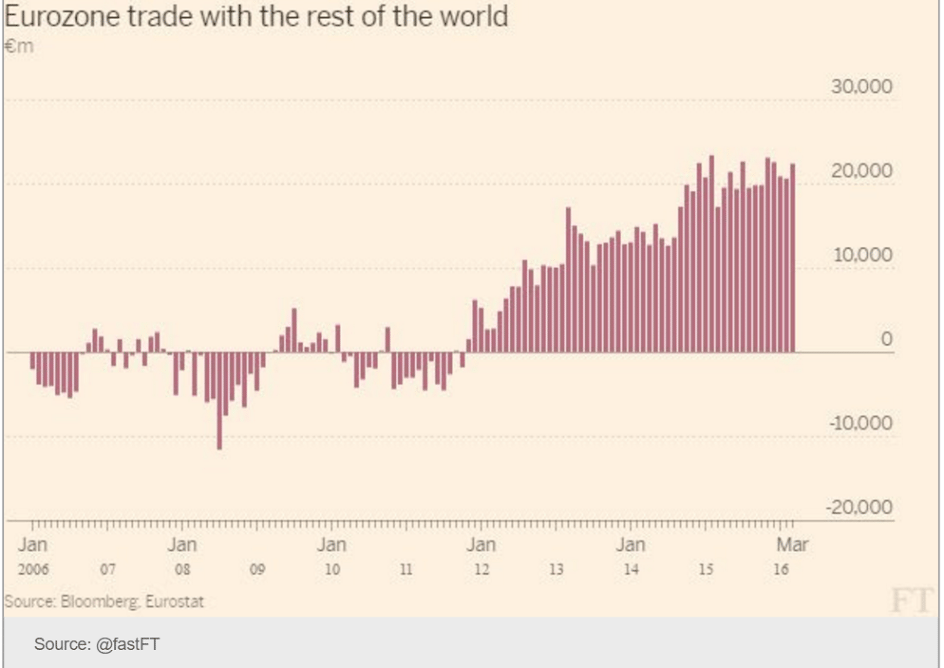

Trade continues to provide serious fundamental support for the euro, much like it did for the yen for two decades, which continued to strengthen even with 0 rates, QE, and perhaps the highest debt/GDP ratios in the world:

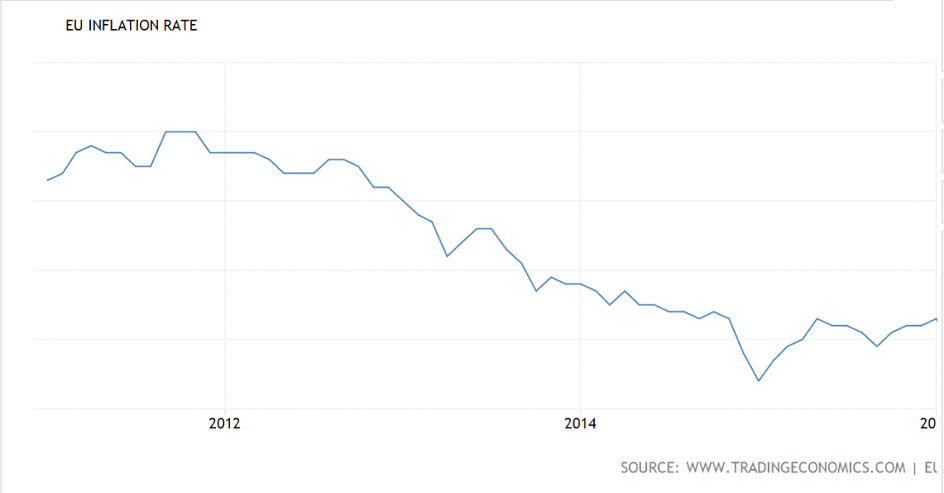

This also provides fundamental support for the euro:

And the recently rising oil prices work to increase the US trade deficit with prices and imports rising, as the price increase isn’t enough to slow the decline in US output. Again, you could call it the ‘sour spot’ for as long as it lasts: