So a Fed rate hike is nothing more than the federal government deciding to pay more interest on what’s called ‘the public debt’.

By immediately paying more interest on balances in reserve accounts at the Fed the cost of funds to the banking system is supported at that higher level, all of which influences the interest paid on securities accounts at the Fed as well, which influences the term structure of rates.

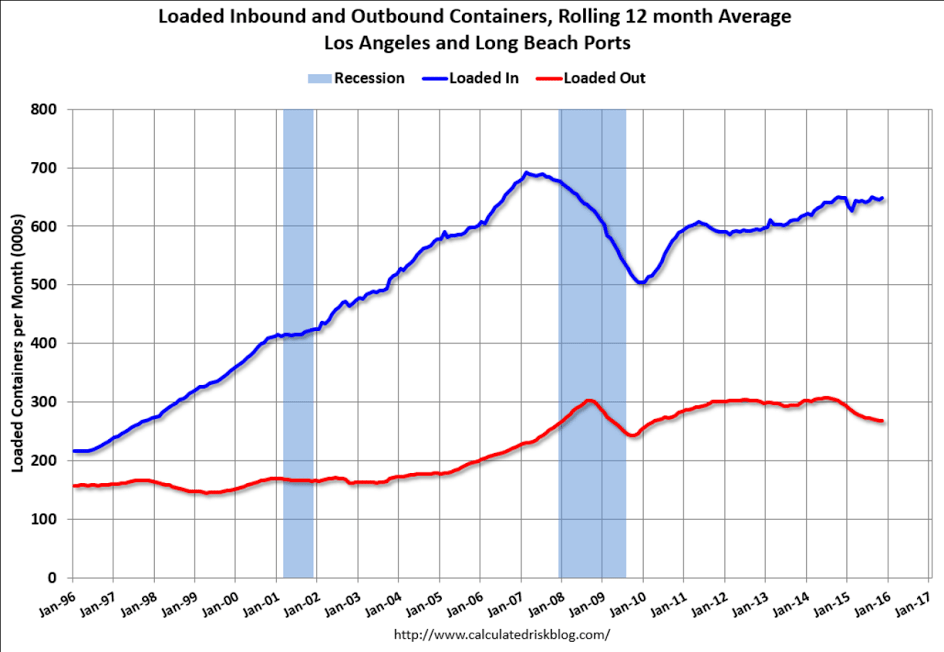

Imports up, exports down:

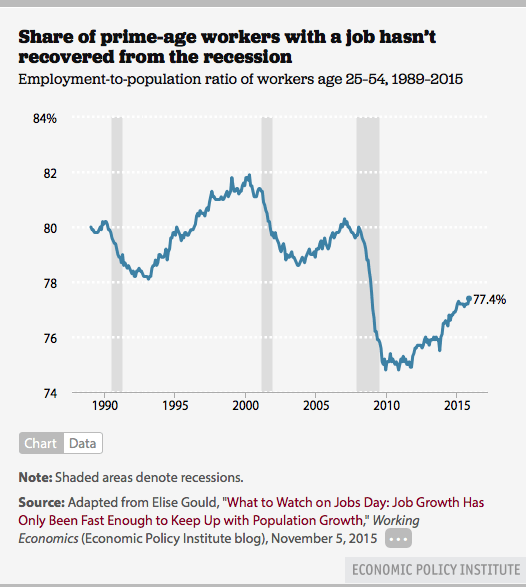

Seems to me there’s a substantial number of people who can ‘get by’ without a job, but would work if they could get a meaningful paycheck to allow them to, for example, remodel a room, or take a nicer vacation, etc. but won’t take a minimum wage job that doesn’t ‘move the needle’ in that respect. And they are not considered to be part of the labor force as defined, and therefore not unemployed. And this includes older people as well. However, as macro economic forces cause a certain amount of ‘desperation’ some do ‘trickle down’ to the lower paying jobs out of necessity, which accounts for quite a bit of the reported employment growth.

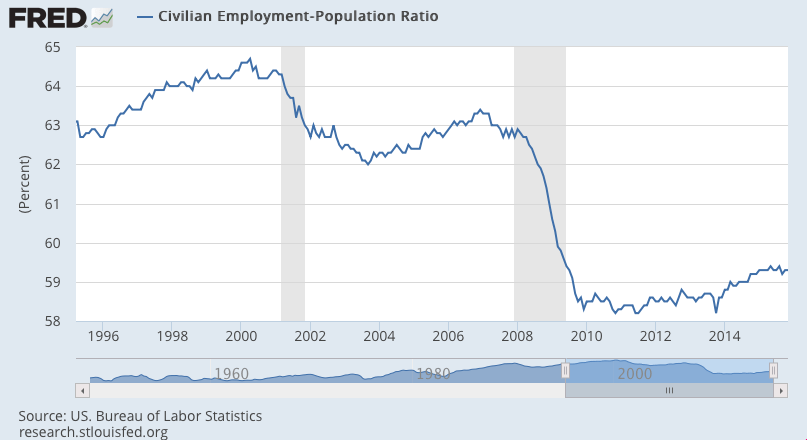

Comes back to the same thing- a whopping shortage of aggregate demand vs pre 2008 and pre 2001 levels, where people who can ‘get by’ were able to get good enough paying jobs to justify working:

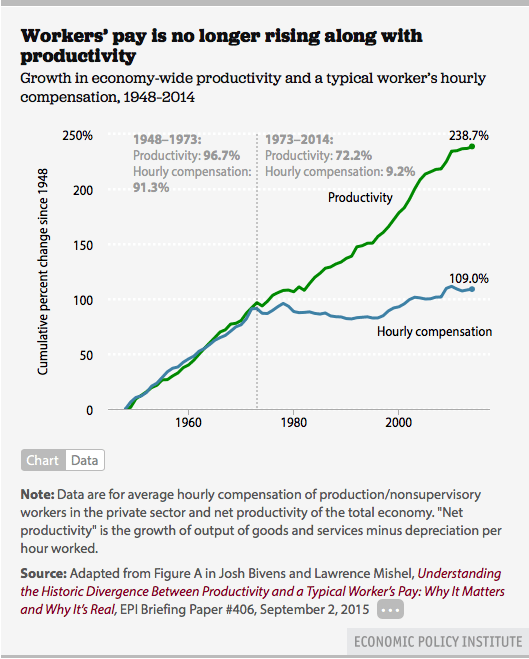

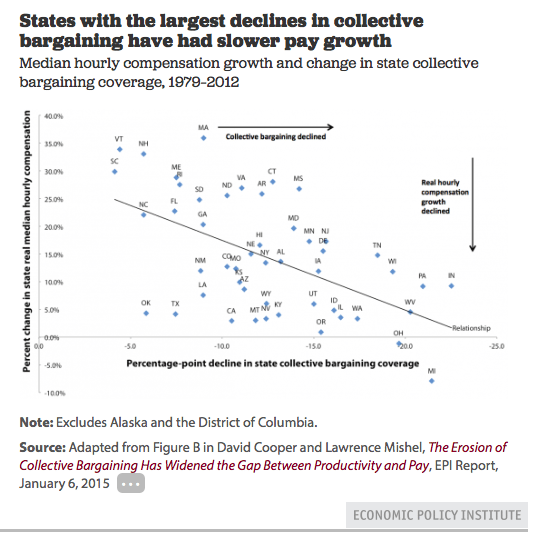

As previously discussed, mainstream game theory says the ‘labor market’ isn’t a ‘fair game’ as workers need to work to eat, and business hires only if it ‘wants to.’ The charts show what happened as support for labor was phased out: