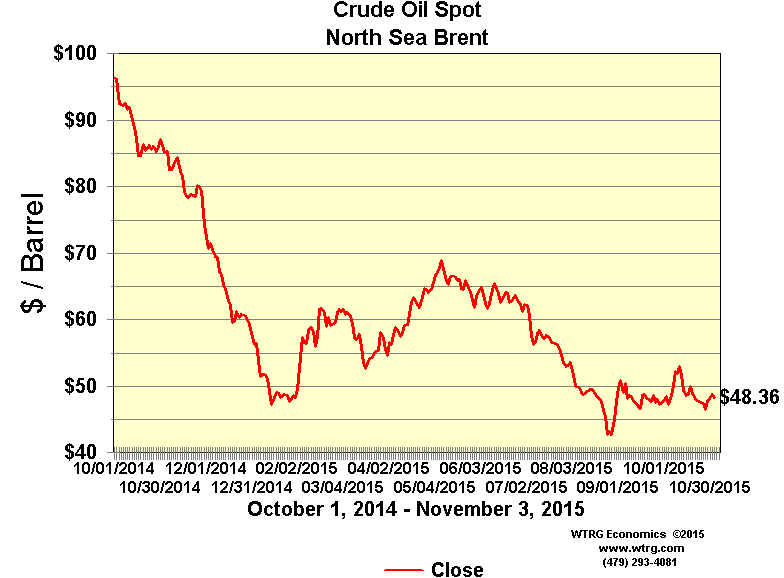

So when the Saudis widened their discounts on October 5 it looked to me like they were inducing a downward price spiral that would continue until either they altered pricing or their output increased to full capacity so they couldn’t sell any more at those discounts. So far neither has happened:

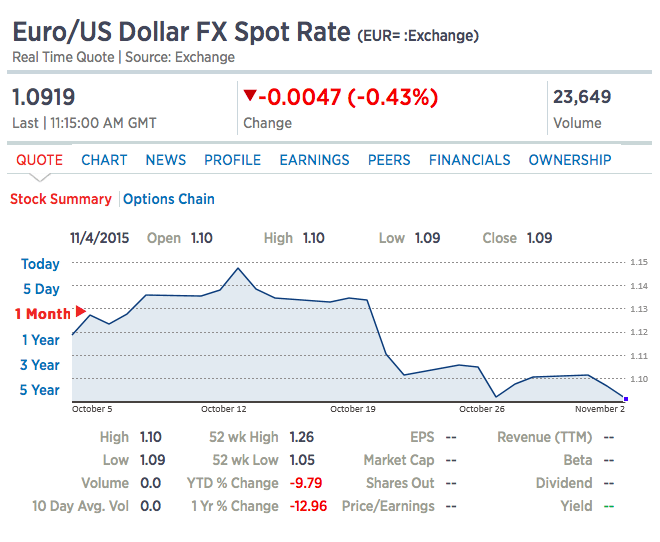

Fundamentally the euro also looks very strong to me, with a large and rising trade surplus vs a rising trade deficit for the US, and negative rates and QE ultimately further remove euro income from the economy likewise fundamentally making it stronger, while higher rates ultimately do the reverse. And deflation *is* a stronger currency, and inflation *is* a weaker currency. Yet the euro has most recently been moving lower on threats from Draghi of lower rates and more QE. So portfolio type selling, until exhausted, continues to dominate even as the fundamentals continue to improve. And there is only one portfolio that can sell indefinitely, and that’s the ECB. And I’ve been assured by all I’ve spoken to that the ECB is not selling euro:

It’s not just OPEC, but most entities with oil related income seem to have only partially cut back on spending as prices collapsed, perhaps ‘betting’ on a price recovery. This includes US states with oil and gas revenues, oil companies, and individuals collecting royalty checks. So seems there’s lots more to go:

OPEC Moves to Rein in Costs Amid Oil Price Slump

By Benoit Faucon

Nov 3 (WSJ) — The Organization of the Petroleum Exporting Countries is moving to rein in costs as its members struggle to pay their dues amid a protracted period of low oil prices, OPEC officials said. The producers’ group has delayed new hires, reduced training sessions for staff and scaled back travel. Staff-level OPEC officials are meeting this week in Vienna to discuss adjusting spending at the secretariat, the organization’s central body, officials said. Other topics over three days of talks ending Wednesday include the group’s long-term strategy report, they said.