This is a prelude to the reality of soft exports and rising imports impacting GDP reports:

U.S. Goods Exports Plummet as Dollar Rises, Commodity Prices Fall

Sept 29 (WSJ) — Exports of goods slid a seasonally adjusted 3.2% to $123.09 billion as overseas sales of industrial supplies—which includes oil—autos, consumer goods and foods all fell, according to the Commerce Department’s advance report on trade in goods. Imports, meanwhile, advanced 2.2% to $190.28 billion on a surge in consumer goods and a smaller rise in capital goods, widening the trade gap. The goods deficit expanded 13.6% to $67.19 billion last month. The Commerce Department is due to release the full report on trade on Oct. 6.

This is still happening nearly a year after oil prices collapsed.

Energy layoffs still in progress, including nat gas companies:

Chesapeake cuts 15% of workforce on oil slump

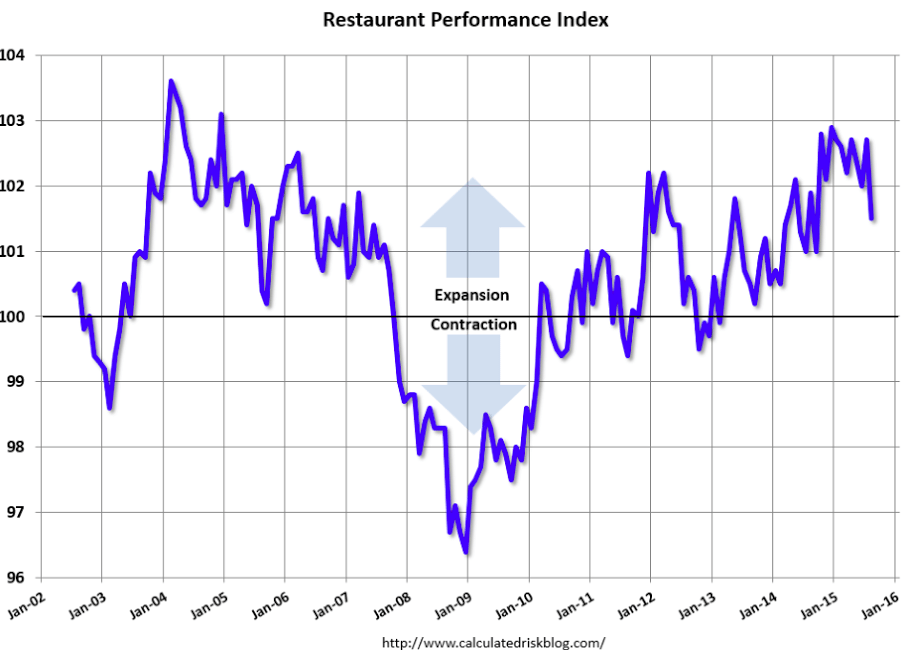

Looks like historically this chart leads the cycle down:

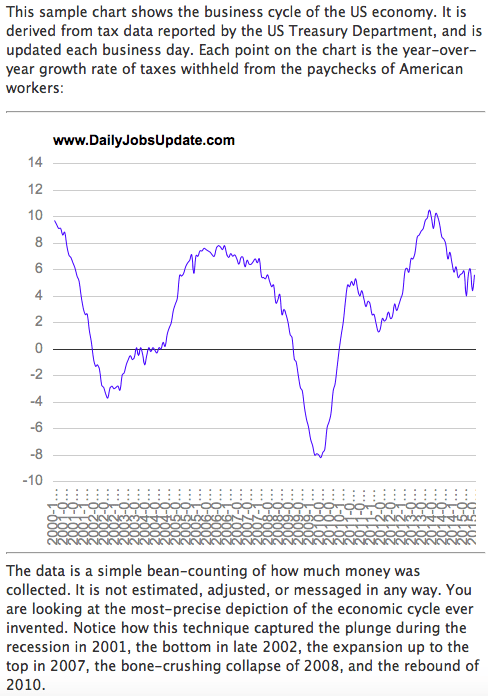

Now looking like it’s faded after oil prices collapsed, vs expectations of the opposite: