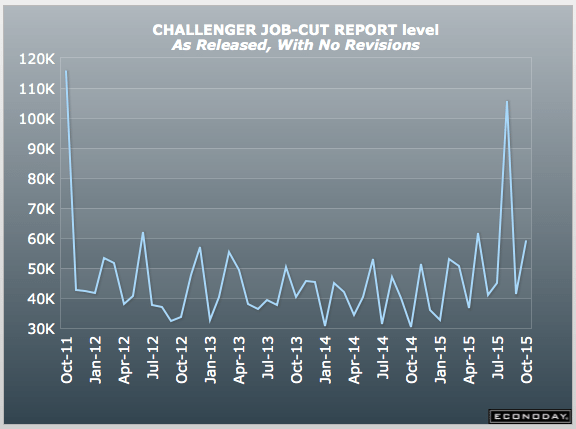

Looks like it started trending higher after oil prices collapsed:

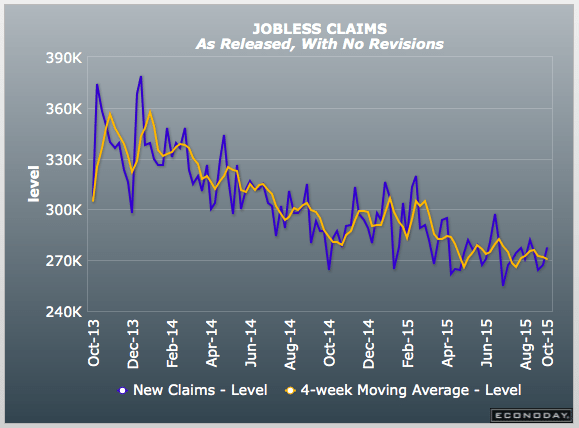

Nothing happening here yet, I suspect it’s at least partially about restrictions on eligibility, etc.

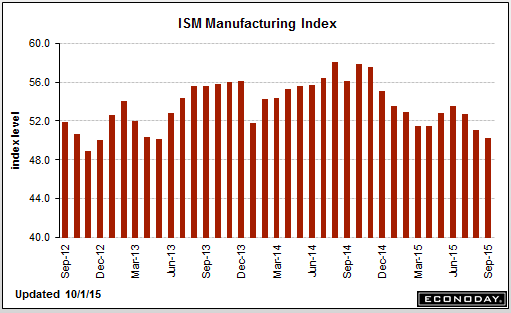

Bad:

United States : ISM Mfg Index

Highlights

The ISM index, like nearly all other September indications, is pointing to trouble for the factory sector. At 50.2, the index is at its lowest point since May 2013. New orders, at 50.1, are at their lowest point since August 2012. Backlog orders, at a very low 41.5, are in their fourth month of contraction and won’t be giving manufacturers much breathing room to keep up production. Export orders, at 46.5, are also in their fourth month of contraction and are a key factor behind the general weakness.

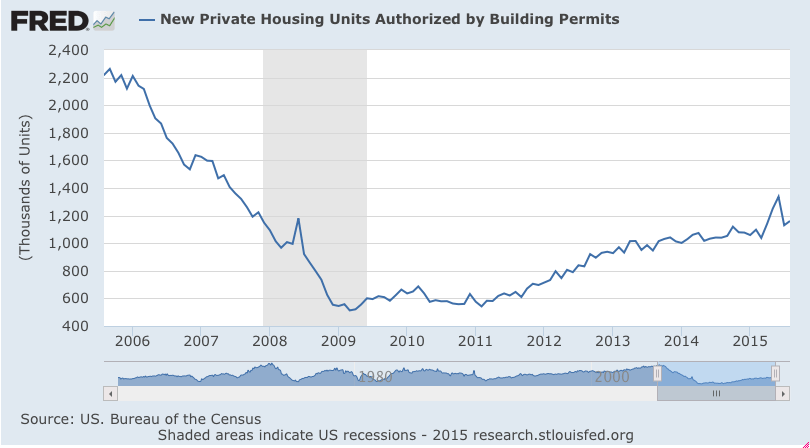

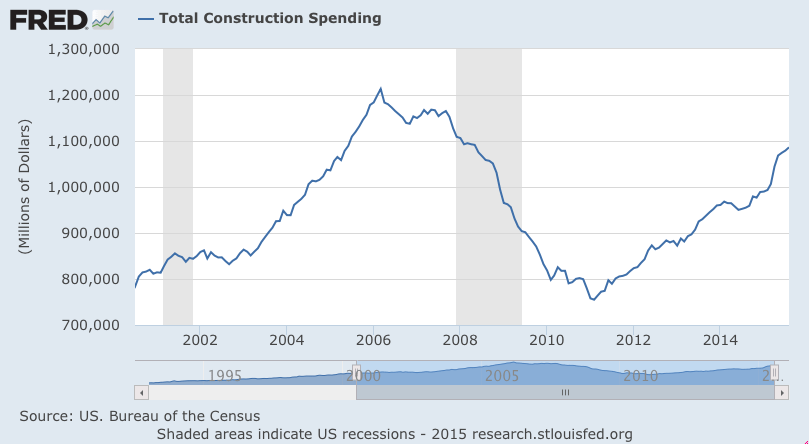

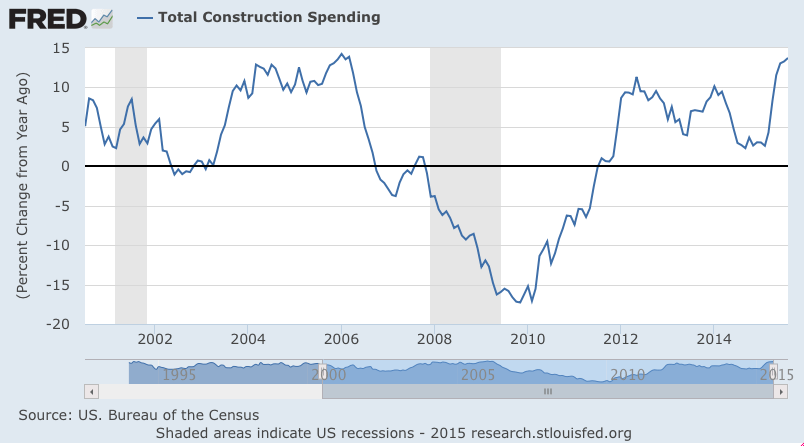

July revised down .3 and August .1 higher than expected. And the elevated year over year growth rate is vs a dip last year. Looking at the chart below you can see the rate of growth has resumed at the lower, prior levels, and that the level of spending spending, which is not inflation adjusted, remains below prior levels, and on an inflation adjusted basis construction remains depressed. Not to mention the spike in permits, exacerbated by NY tax breaks that expired June 15, seems to have reversed:

United States : Construction Spending

Highlights

Construction spending is picking up, at plus 0.7 percent in August for a year-on-year gain of 13.7 percent. Construction of single-family homes rose a solid 0.7 percent in the month with continuing gains certain given strength in permits. Multi-family construction, driven by rising rents, jumped 4.8 percent in the month and is up 25 percent year-on-year. The year-on-year gain for single-family homes is lagging but is still very strong at 14.0 percent.

Gains were also posted in private non-residential construction, at 0.2 percent following July’s 1.6 percent jump, with gains continuing to be centered in manufacturing in strength that belies other indications of weakness in business investment. Year-on-year, non-residential construction is up 17 percent. Public construction remains subdued with year-on-year gains in related components in the mid-single digits.

Strength in construction, including strength in new homes, looks to offset not only unevenness in existing home sales but also what appears to be a breaking down in the factory sector.