Up some but still at depressed levels, and not enough to indicate a general bounce in spending. Personally I sold come small condos in Chicago I’d owned since working there in the early 1980’s. I got tired of fooling with them, net rental income was low, and prices weren’t going anywhere, And I still have 2 nice houses for sale, one in Jupiter Farms, another outside of Orlando, that haven’t sold yet and are priced well below 2007 levels. They are reconditioned foreclosures from the portfolio of the bank I sold 2 years ago.

So activity is up some, prices are up but not to replacement cost and also because to some extent the bid hitting from distressed selling has subsided. And there also could have been a few sales in front of the anticipated rise in rates, as often happens.

And watch for all the cheer leading on this report, as below:

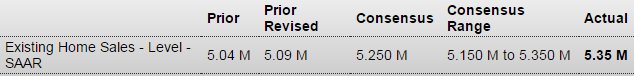

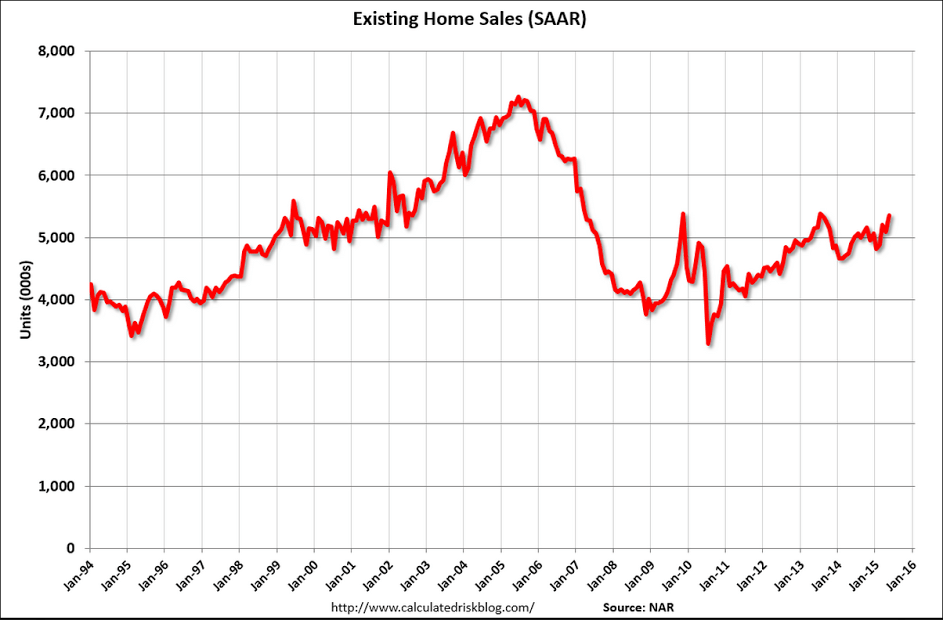

Existing Home Sales

Highlights

The housing sector is lifting off, as existing home sales jumped 5.1 percent in May to a 5.35 million annual rate that hits the top end of the Econoday consensus. The year-on-year rate tells the story, at plus 9.2 percent which, outside of March’ s 11.9 percent, is the strongest rate in nearly two years. And prices are rising, up 7.9 percent year-on-year at a median $228,700.

In a special sign of strength, sales are strongest for single-family homes, up 5.6 percent in the month to 4.73 million. Year-on-year, single-family sales are up 9.7 percent. Condo sales have been flat in recent reports, up 1.6 percent in May to a 620,000 rate for a year-on-year gain of 5.1 percent. And in yet another special strength, first-time buyers are back in the market, making up 32 percent of all sales vs 27 percent this time last year.

Gains sweep the regional data with the Midwest up 4.1 percent and the West and South up 4.3 percent each. Year-on-year, the biggest gain is in the Midwest at 12.4 percent with the West at 9.0 percent and the South up 6.9 percent.

Holding down sales has been a lack of supply which, relative to sales, is at 5.1 month vs 5.2 in April. In another sign of tightness, the median sales time held steady at 40 days. But the rising sales rate together with the rise in prices are certain to bring new homes to the market. And homes are coming onto the market, to 2.29 million vs 2.20 and 2.01 in the prior two readings.

No bounce here:

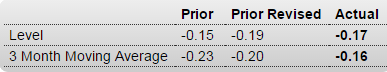

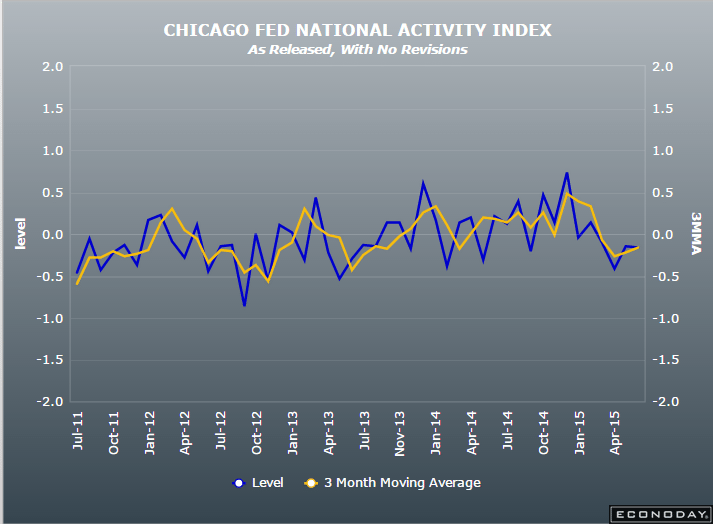

Chicago Fed National Activity Index

Highlights

There was net improvement in May’s run of economic data but not much at least based on the national activity index which comes in at minus 0.17 vs a downward revised minus 0.19 in April. The 3-month average is telling the same story of weakness, at minus 0.16 vs a revised minus 0.20 in April.

Much stronger payroll growth, at 280,000, was May’s highlight but the gain was offset by a 1 tenth tick higher in the unemployment rate to 5.5 percent which leaves the month’s total employment contribution to the index unchanged at plus 0.10. Other readings were also little changed and all soft: production-related indicators at minus 0.17 vs April’s minus 0.19, sales/orders/inventories at zero vs minus 0.1, and personal consumption & housing at minus 0.09.

The big bounce, according to today’s report, that was expected following the transitory factors of a very soft first quarter has yet to appear.

Remember the cheer leading last year when the high prints were recorded, just before oil prices fell? And then how the drop in oil price would be fueling/accelerating GDP with forecasts in the 4% neighborhood?

It now looks like the Greek leaders have thrown in the towel and offered something likely to be accepted, all as previously discussed (though it was never even close to a ‘sure thing’), showing that deep down the leadership are ‘Europeans’ first who see nationalism as the greater risk, and will work for progressive change within the context of the EU, however slim their odds of success.

And not to say it’s a ‘done deal’ or that rough spots won’t continue. This is politics, with all the associated risks.

DB: Greece: Finally some positive news, much more to go

The details of the new Greek proposal have not been published, but press reports so far suggest they represent a material change in stance for the Greek government. Details reported include the following:

– A broad based increase in VAT rates, inclusive of some foodstuffs and restaurants by 10%;

– An elimination of early retirement benefits from 2016 to be phased in over three years;

– Most importantly, a broad-based increase in pension contributions, reported to be 2% for wage-earners and 2% for corporations;

– An increase in a special “healthcare” charge on pensions equivalent to an across the board cut of 1% in main and 5% cut in supplementary pensions;

– Cuts in defense spending;

– Increases in corporate tax rates to those firms earning more than 500mio EUR profits;

– Increases in income tax rates to those earning above 30k EUR.

Our assessment of the reported changes above is that they represent meaningful concessions from the Greek side, if they are to be confirmed, bringing them closer to the creditor proposals.