Professor Kelton hit the ground running in January and has been making serious inroads!

This article has the usual misrepresentations, of course, but now Stephanie’s position gives her the opportunity to respond publicly and decisively.

U.S. Senate economist explains why deficits aren’t always evil: Walkom

By Thomas Walkom

Stephanie Kelton is part of a new generation of economists trying to figure out how things work in our grim, new world.

Rail Week Ending 23 May 2015: Contraction Worsens On Rolling Averages

(Econintersect) — Week 20 of 2015 shows same week total rail traffic (from same week one year ago) declined according to the Association of American Railroads (AAR) traffic data. Intermodal traffic improved year-over-year, which accounts for half of movements – but weekly railcar counts continues deep into contraction.

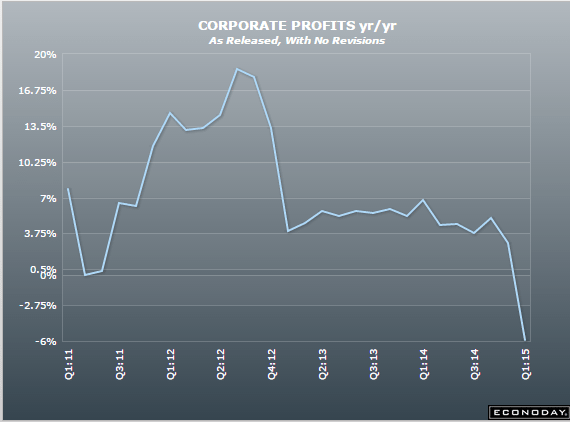

June 2015 Economic Forecast: Significant Decline In Our Economic IndexBy Steven Hansen

(Econintersect) — Econintersect’s Economic Index continues to weaken. Most tracked sectors of the economy are relatively soft with most expanding well below rates seen since the end of the Great Recession. When data is this weak, it is not inconceivable that a different methodology could say the data is recessionary. The significant softening of our forecast this month was triggered by marginal declines in many data sets which are dancing closer and closer to zero growth.

The currency depreciation a while back took away real spending power as did the tax increase, shifting income from people to businesses, and helping exports as well:

Japan : Household Spending

Highlights

April household spending was down 1.3 percent from a year ago. This was the thirteenth consecutive month of decline. The retreat in spending began when the sales tax was increased from 5 percent to 8 percent in April 2014. Consumers went on a spending frenzy prior to the enactment of the increase and shut off the spending spigot when it was introduced. The weak consumption figures could threaten to keep inflation subdued in the months ahead, though recent commentary from the BoJ suggests the bank is optimistic about the economy’s resilience.

First they credit reforms and THEN oil and the euro:

Italy:

Early efforts with labor and bank reform show progress and Italy’s economy is showing signs of life, expanding 0.3 percent in the first quar ter – the first uptick since the third quarter of 2013 — as a weaker euro and lower oil prices help push the country out of its longest recession on record.

The economic figures tie with recent business confidence data and yet unemployment is still ticking higher – hitting 13 percent in March. As one Italian worker told me in Milan: “If recovery is happening, it isn’t happening fast enough.”

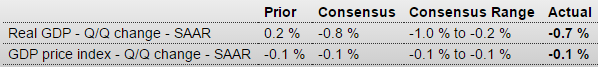

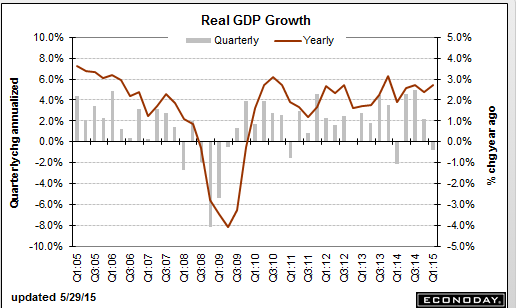

Revised lower as expected. The question is q2 which so far isn’t looking so good.