Challenger Job-Cut Report

Highlights

In perhaps the first warning of serious trouble from the oil patch, Challenger’s layoff count starts off the year with an elevated reading, at 53,041 for the highest reading since February 2013 and the highest January reading since 2012. Readings in December and November were much lower, at 32,640 and 35,940.

The energy sector represented roughly 40 percent of January’s cuts, at 20,193. Cuts in the energy sector were minimal in the fourth-quarter, averaging only 1,330 per month. The sector seeing the second largest number of cuts in January is retail, at 6,699 in downsizing following the holidays.Jobless Claims

Highlights

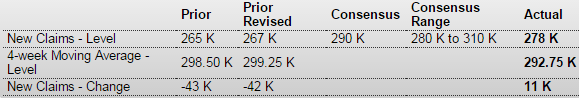

The jobs market is healthy based on jobless claims where initial claims, though up 11,000, came in at a much lower-than-expected 278,000 in the January 31 week, keeping the bulk of the improvement from the prior week’s revised 42,000 fall. The 4-week week average, down a sizable 6,500 in the week to 292,750, is trending right at the month-ago level in a comparison that points to another healthy monthly employment report for tomorrow.

Continuing claims, reported with a 1-week lag, are also at healthy levels though the month-ago comparison is less favorable. Continuing claims in the January 24 week rose 6,000 to 2.400 million while the 4-week average, though down 22,000, is at a 2.421 million level that is slightly above the month-ago trend. The unemployment rate for insured workers is holding at a recovery low of 1.8 percent.

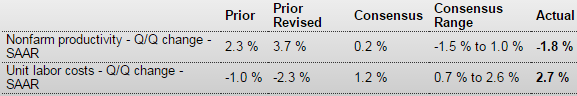

Negative productivity/jump in unit labor costs = over hiring given actual output?

Productivity and Costs

Highlights

Nonfarm productivity growth for the fourth quarter declined an annualized 1.8 percent, following a 3.7 percent jump in the third quarter. Expectations were for a 0.2 percent rise. Unit labor costs increased 2.7 percent after falling an annualized 2.3 percent in the third quarter. Analysts projected a 1.2 percent gain.

Output growth softened to 3.2 percent in the fourth quarter, following a 6.3 percent jump the prior quarter. Compensation growth posted at 0.9 percent annualized after 1.3 percent the quarter before.

Year-on-year, productivity was unchanged in the fourth quarter, down from 1.3 percent in the third quarter. Year-ago unit labor costs were up 1.9 percent, compared to up 0.9 percent in the third quarter.

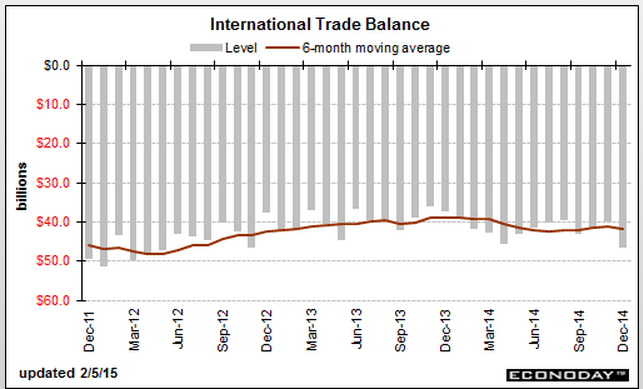

International Trade

Highlights

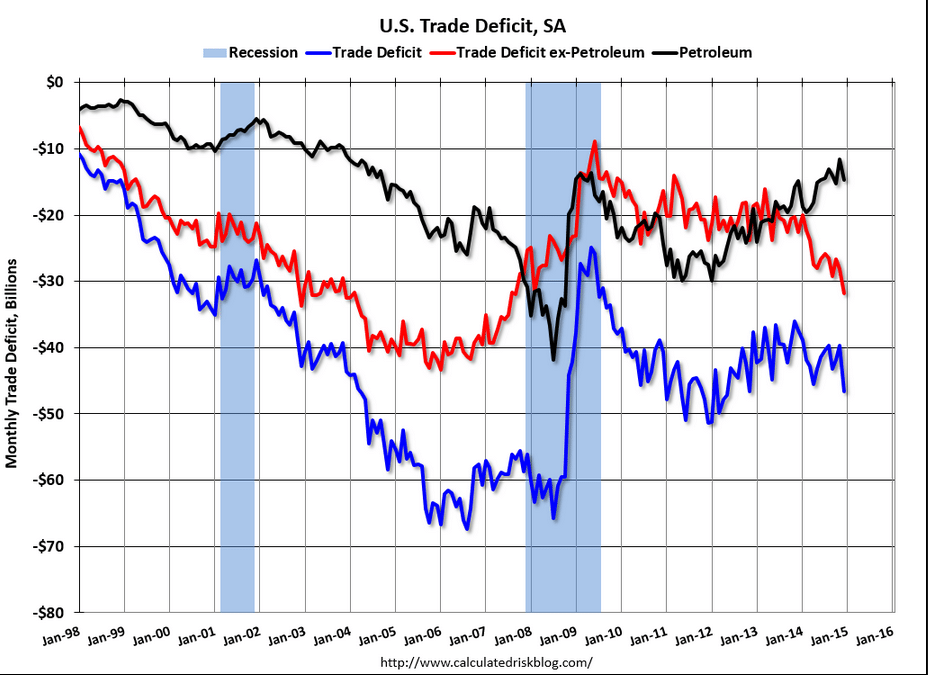

The U.S. trade balance for December widened instead of narrowing as expected. Lower oil prices actually cut into petroleum exports.

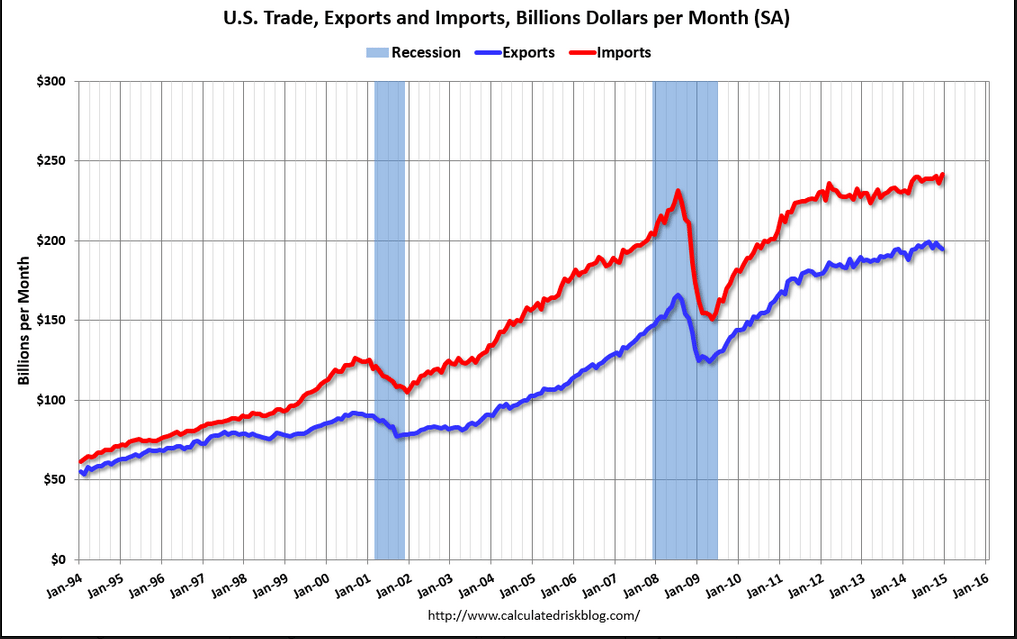

In December, the U.S. trade gap grew to $46.6 billion from a revised $39.8 billion in November. Analysts forecast the deficit to narrow to $37.9 billion. Exports were down 0.8 percent after declining 1.1 percent the month before. Imports rebounded 2.2 percent after falling 1.8 percent in November.

Expansion in the overall gap was led by the goods excluding petroleum gap which increased to $49.7 billion from $46.3 billion in November.

The petroleum goods trade gap posted at $14.7 billion from $11.6 billion in November. Petroleum imports were up 7.7 percent while exports decreased 11.6 percent.

The services surplus was essentially unchanged at $19.5 billion.

On a seasonally adjusted basis, the December figures show surpluses, in billions of dollars, with

with South and Central America ($2.6), Brazil ($0.4), and United Kingdom ($0.1). Deficits were recorded, in billions of dollars, with China ($30.4), European Union ($12.7), Germany ($5.6), Mexico ($5.6), Japan ($5.4), Canada ($3.3), South Korea ($2.7), OPEC ($2.3), India ($2.1), Italy ($2.1), France ($1.1), and Saudi Arabia ($1.0).

Overall, the December number will likely lower estimates for fourth quarter GDP growth. But the good news is that the import numbers suggest that demand is moderately healthy.