From DB:

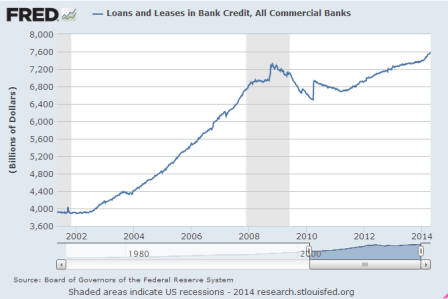

The weekly bank lending data just came out and we continue to see an acceleration in credit growth, see also the chart below. The latest observation in the chart is April 23 2014.

Full size image

Yes, lending has picked up some.

Here’s some longer term perspective and note how said lending is a seriously lagging indicator, which makes sense.

We could be seeing borrowing to pay utility bills, fund unsold inventories, etc. etc. All of which is followed by less spending.

Or it could be proactive borrowing to spend due to ‘feeling good about things’ that leads to a ‘virtuous’ up cycle.

Problem is, IMHO, the federal deficit is too small and the auto stabilizers too aggressive for the ‘borrowing to spend’ to get ahead of it, which is why I’ve been writing about the downside risk for the last few quarters, with that narrative still intact and, to me, supported by the data. (yes, others see it differently)

Note real GDP % change from a year ago below. Still looks to me like it’s working its way lower as the shrinking federal deficit provides less and less help overcoming the demand leakages.

Full size image

Full size image

Full size image

Full size image

Full size image