Debt to GDP over 200%

0 rates for decades

Strong currency

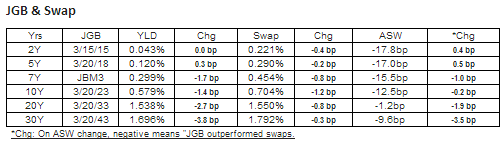

Alarmingly low term structure of rates

Recent yen weakness looking ‘fundamental’ as trade goes negative maybe until nukes are restarted and ‘replacement’ gas and oil imports go back to where they were.

Trade going negative after initial yen weakening due to ‘j curve’ effect where initially actual quantities of imports stay pretty much the same but prices are higher. Only some time later do quantities respond to the higher price.

Yen:

Full size image