As the article states, production fell because demand fell. If anything that would be oil unfriendly as the Saudis can only cut maybe another 5 million bpd without ‘permanent’ cutbacks, at which point they lose control of price on the downside.

Market price action, however, might be telling us the cutbacks were due to production issues in which case the risk is loss of control of price on the upside.

Oil Settles Higher After Saudi Arabia Cuts Output

January 10 (Rueters) — Oil futures rose on Thursday on news that top world oil exporter Saudi Arabia had cut back production in response to flagging demand, and after China reported strong demand for its exports.

U.S. light, sweet crude rose to a 14-week high of $94.70 a barrel before settling at $93.82, up 72 cents on the day. Brent crude futures rose as high as $113.29 a barrel before settling at $111.89, up 13 cents.

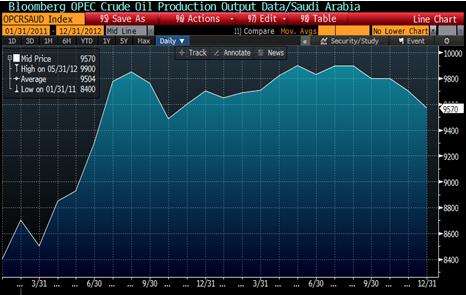

OPEC’s top producer slashed oil production by 700,000 barrels per day (bpd) to 9 million bpd during the last two months of 2012, according to industry sources. Major customers for Saudi crude said the cuts were driven by lower demand.

News of the Saudi supply curbs helped briefly push Brent over $113 a barrel for the first time since mid-October, well above the $100 a barrel price Riyadh has said it favors.

Oil and other markets also got a boost from Chinese trade data that showed strong export growth rebound in December, raising expectations of revived growth in the world’s No. 2 economy that could drive more fuel demand.

Crude pared some gains after the Philadelphia Federal Reserve Bank said its annual revisions showed that factory activity in the U.S. mid-Atlantic region grew at a lower pace in December than originally reported.

“The strong data from China indicates demand might be improving there and the Saudis have cut back production, but the downward revisions by the Philly Fed gave the market a little pause,” said Phil Flynn, analyst at Price Futures Group in Chicago.

Gains in U.S. crude pushed the benchmark to a level of 67 on the 14-day relative strength index. That is close to the 70 mark that, according to traders who follow technical charts, can indicate a commodity has been overbought.

U.S gasoline futures rose along with crude, but heating oil futures in the New York Harbor fell by 0.6 percent to around $3.05 per gallon.

Traders attributed the fall to speculation that cargoes of Russian gas oil may come to the Harbor. Physical oil traders told Reuters that up to six cargoes may be headed for New York.

Also helping oil’s advance on Thursday was news of a pipeline explosion in Yemen that halted most of the country’s oil exports.

Flows of oil through Yemen’s main crude export pipeline stopped on Thursday after it was blown up by unknown attackers, government and oil industry officials said.

“These three factors – Saudi Arabia, Yemen and the China data – are all helping to push up the market,” said Tamas Varga, an oil analyst at broker PVM Oil Associates in London.

Saudi Arabia says it favors an oil price of about $100 a barrel, but recent reports have suggested that the market is well supplied and that output from some regions, particularly North America, will grow rapidly over the next two years. U.S. government data showed that domestic oil output rose above 7 million barrels a day last week for the first time since 1993.

“Short term, the Saudi output figures are bullish, but longer term they are more bearish, because they suggest Saudi Arabia sees the need to cut to balance the market,” Varga said.