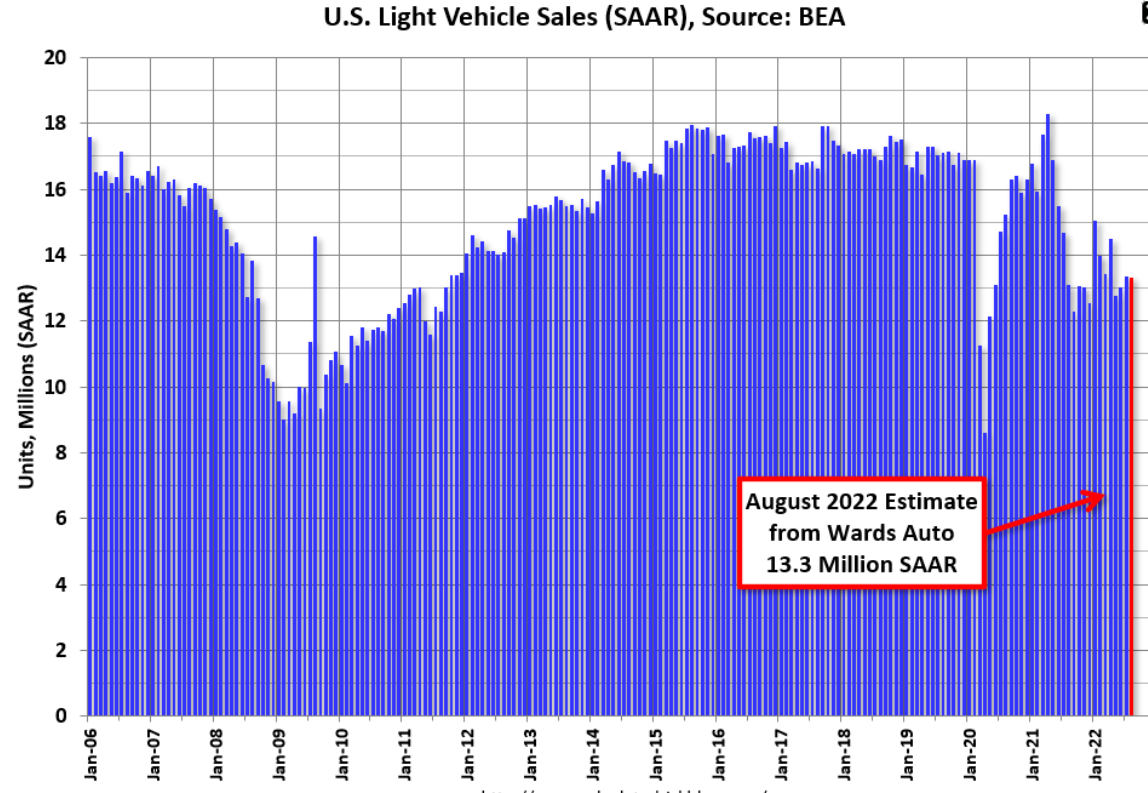

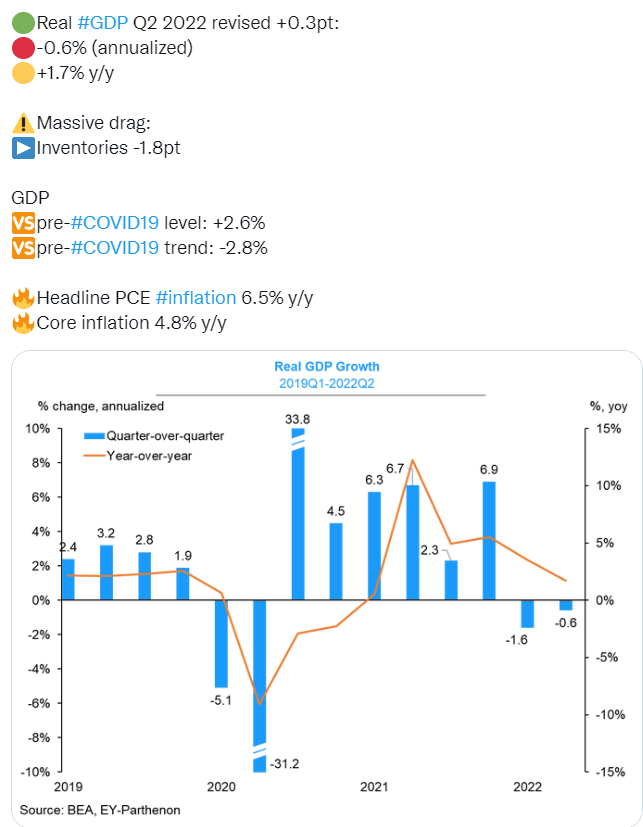

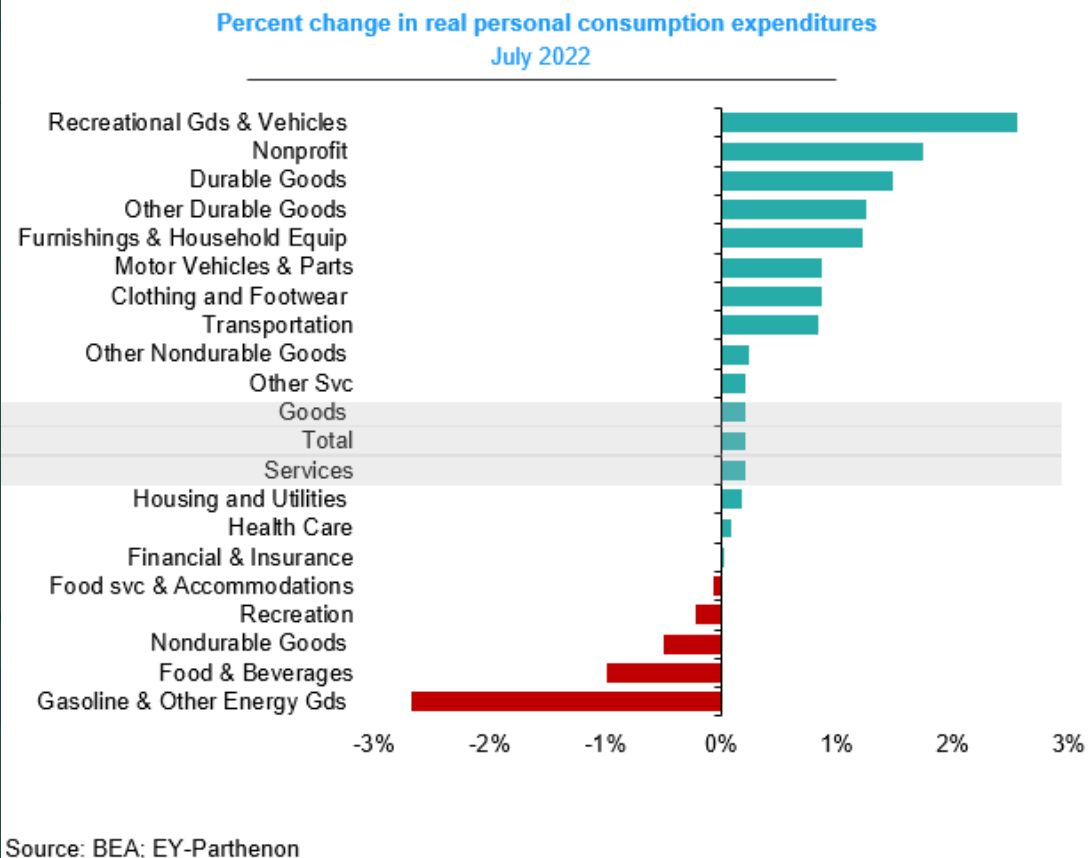

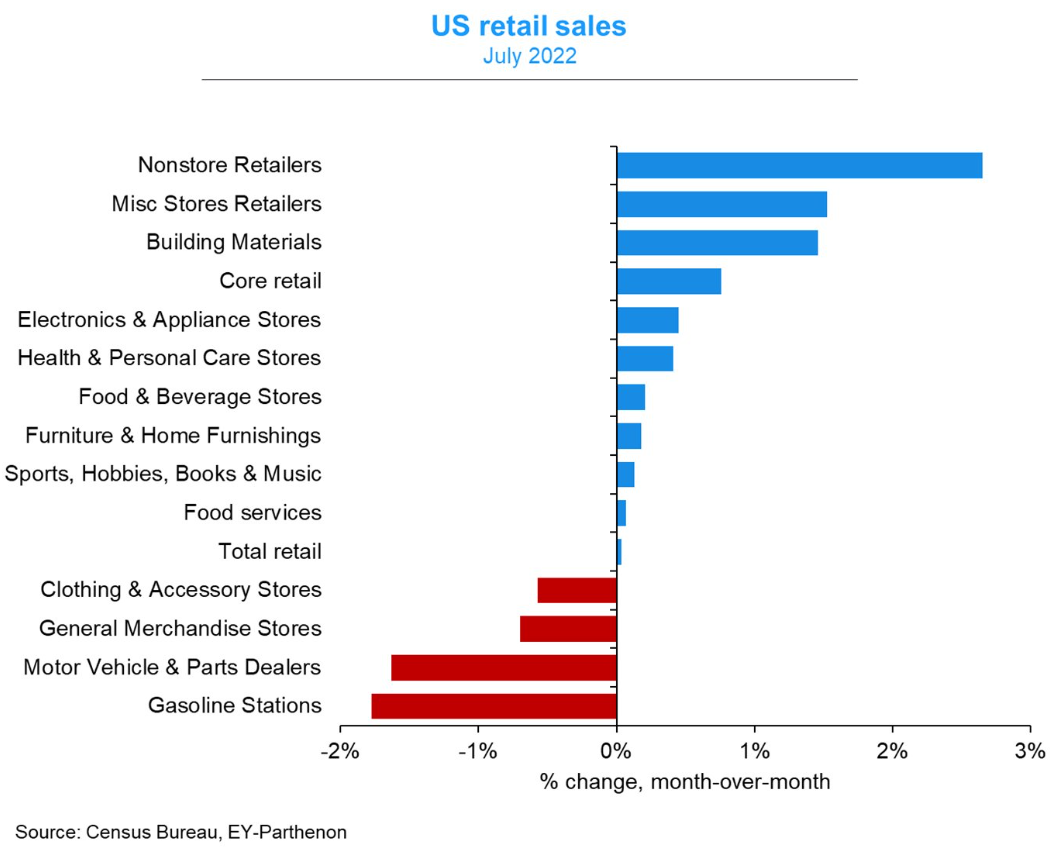

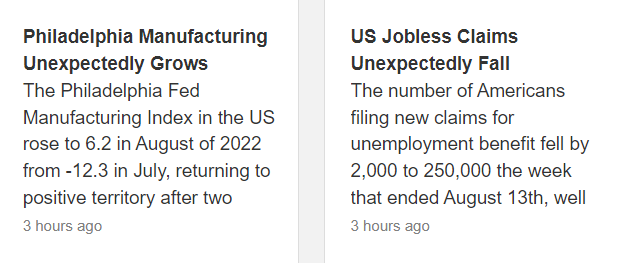

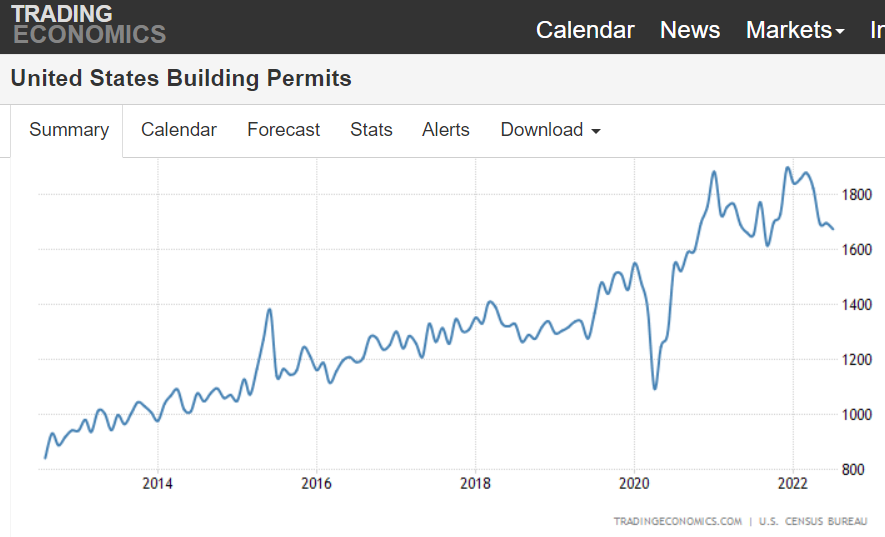

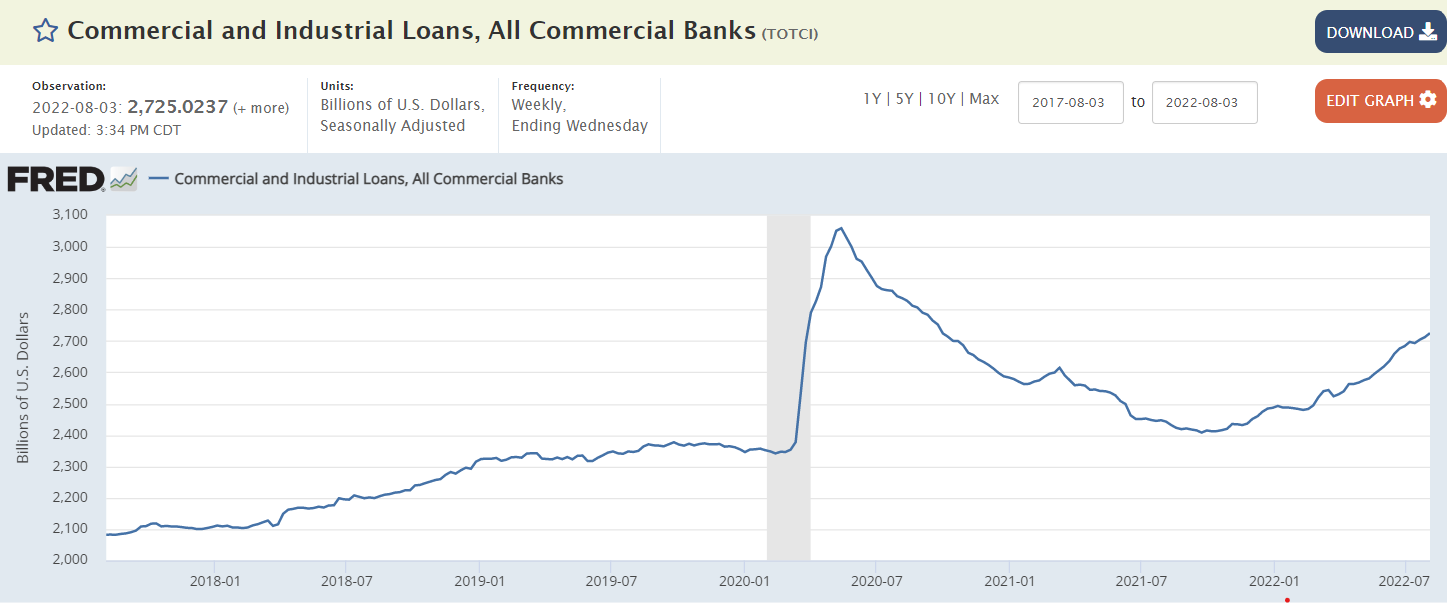

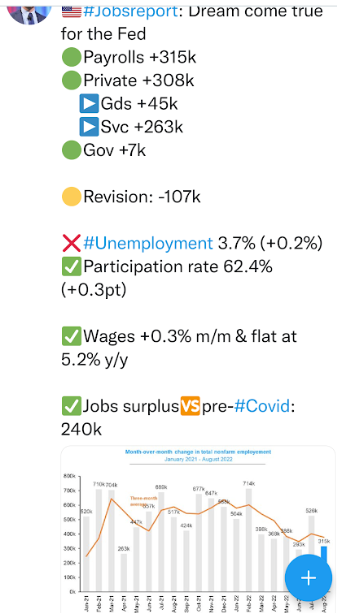

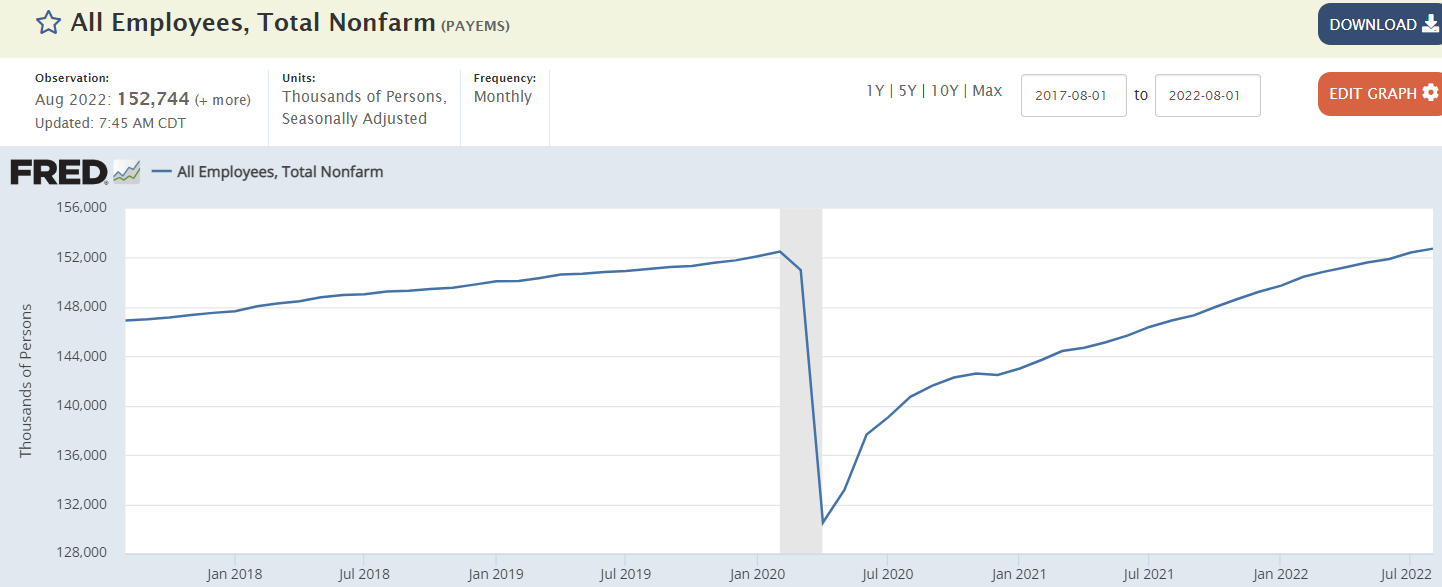

No recession here either:

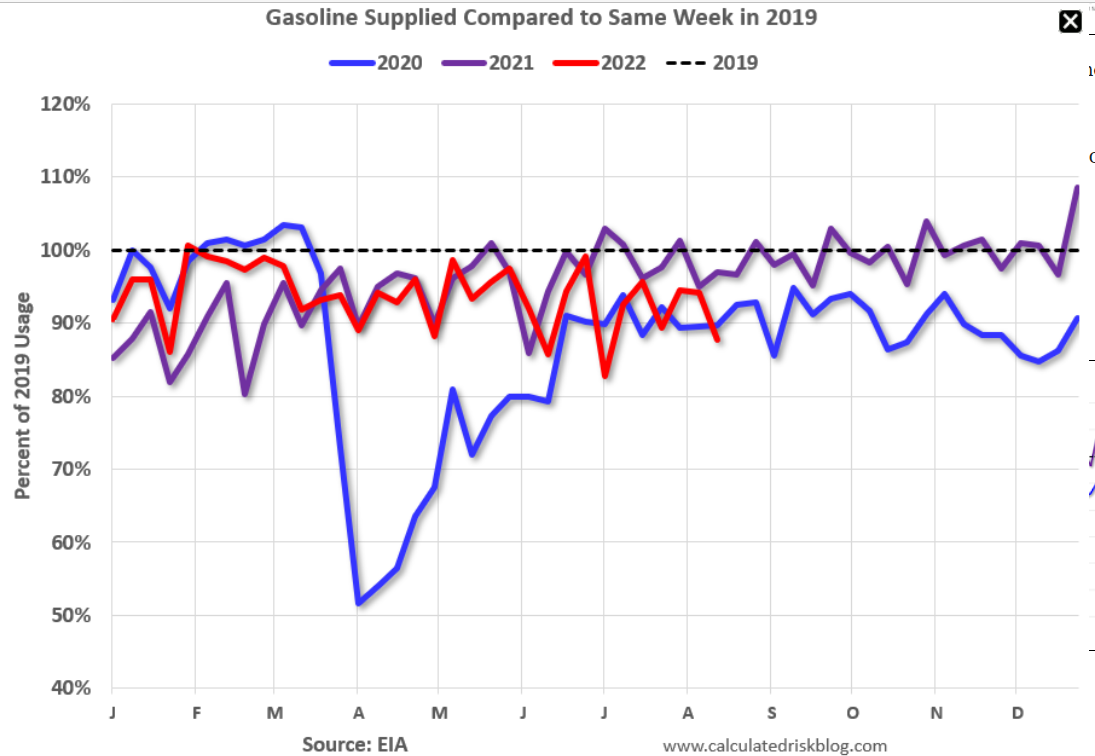

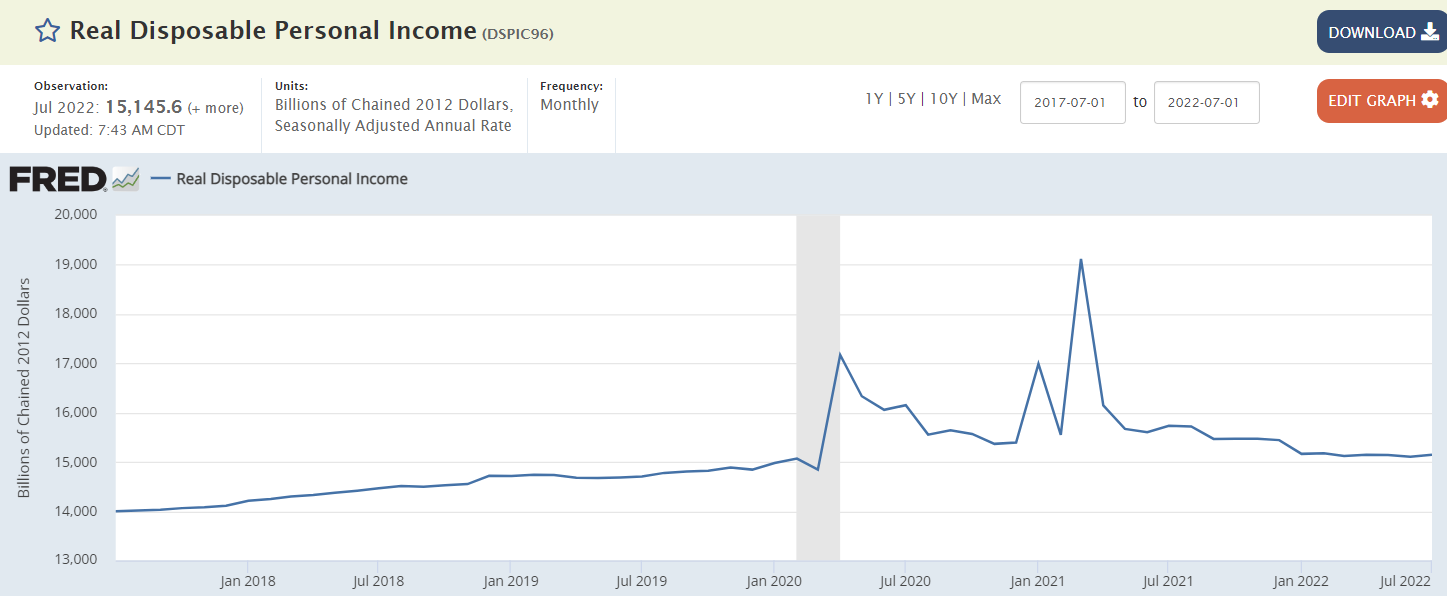

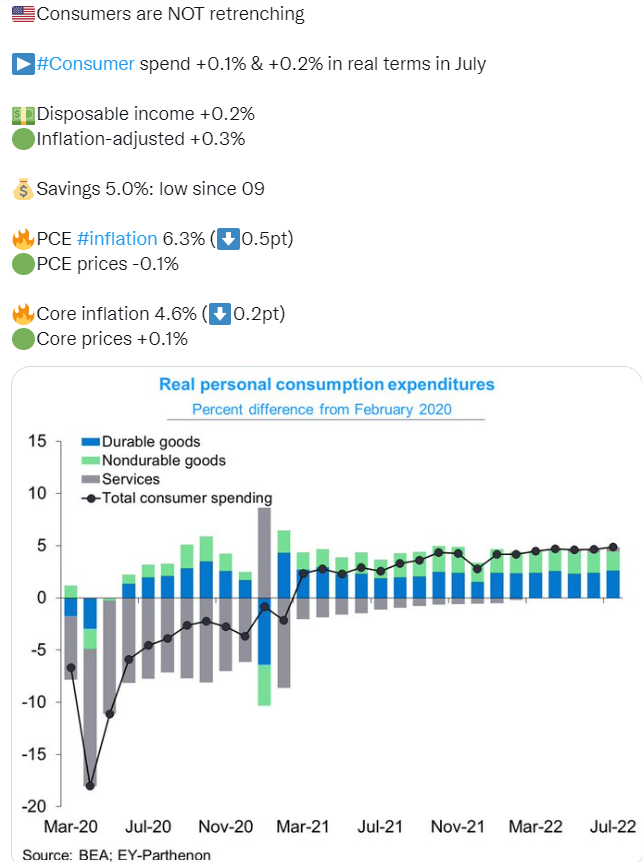

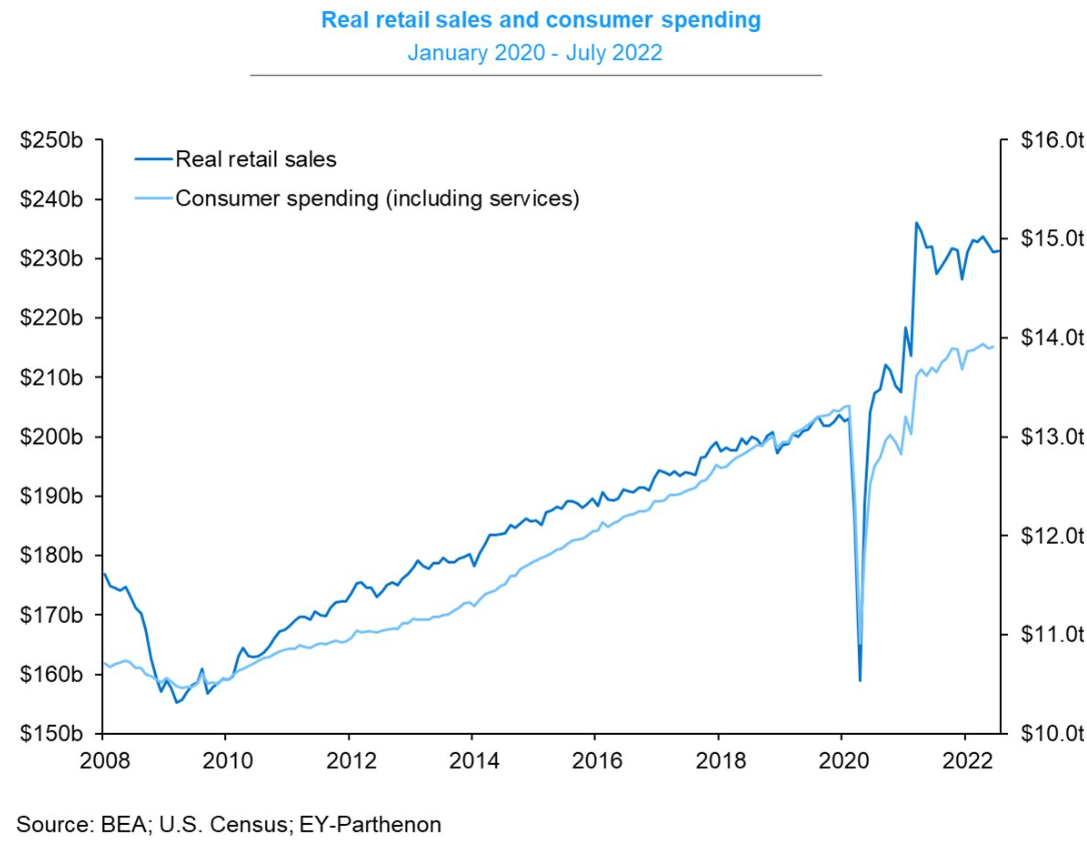

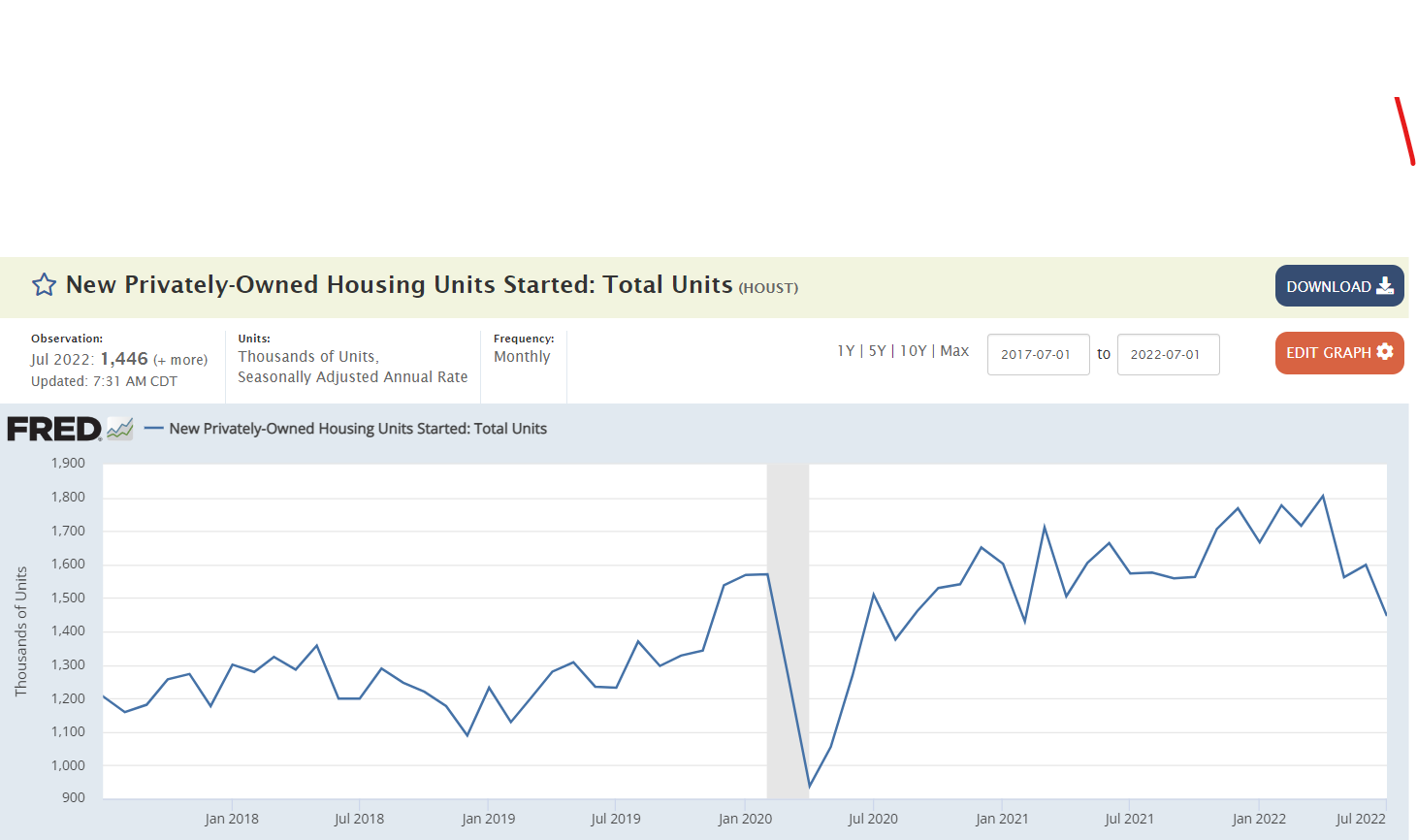

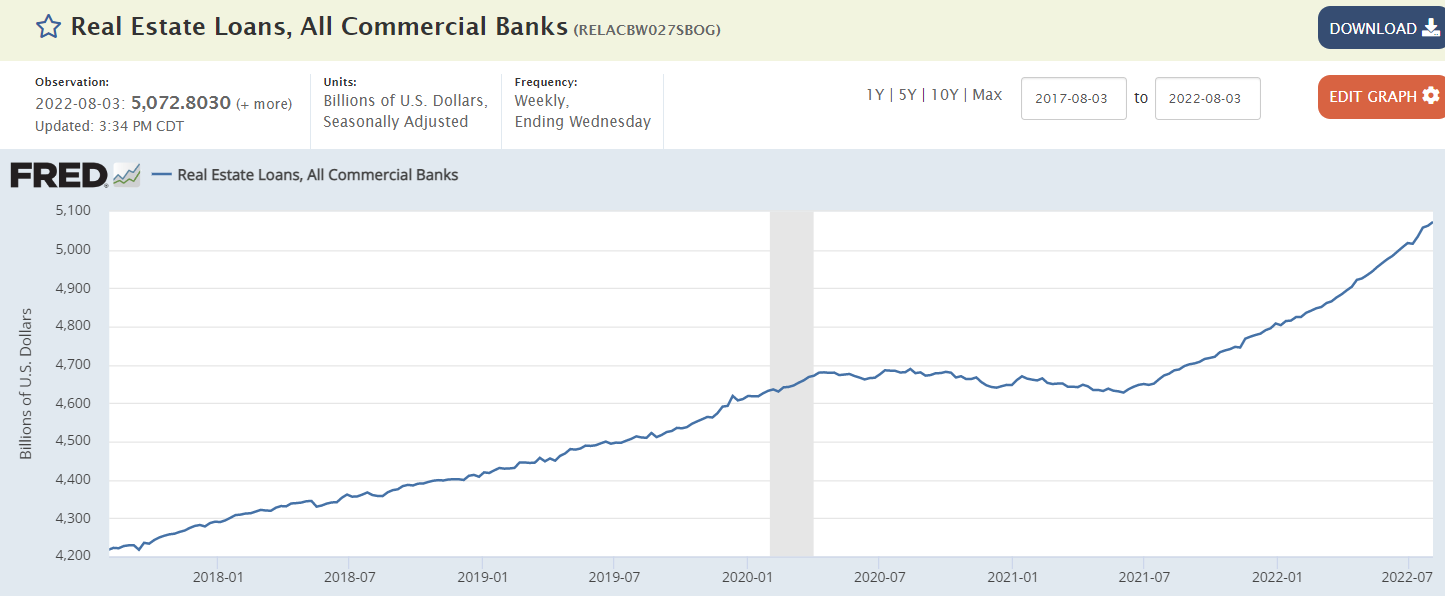

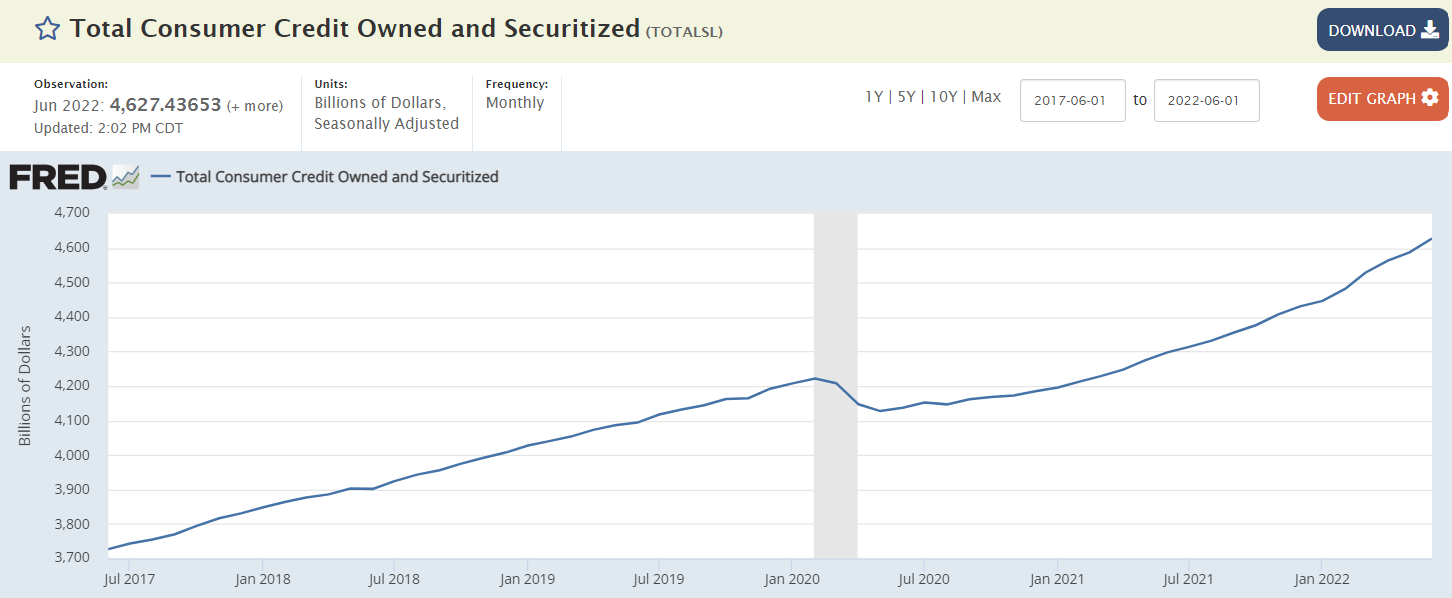

Asymptotically approaching pre-Covid levels:

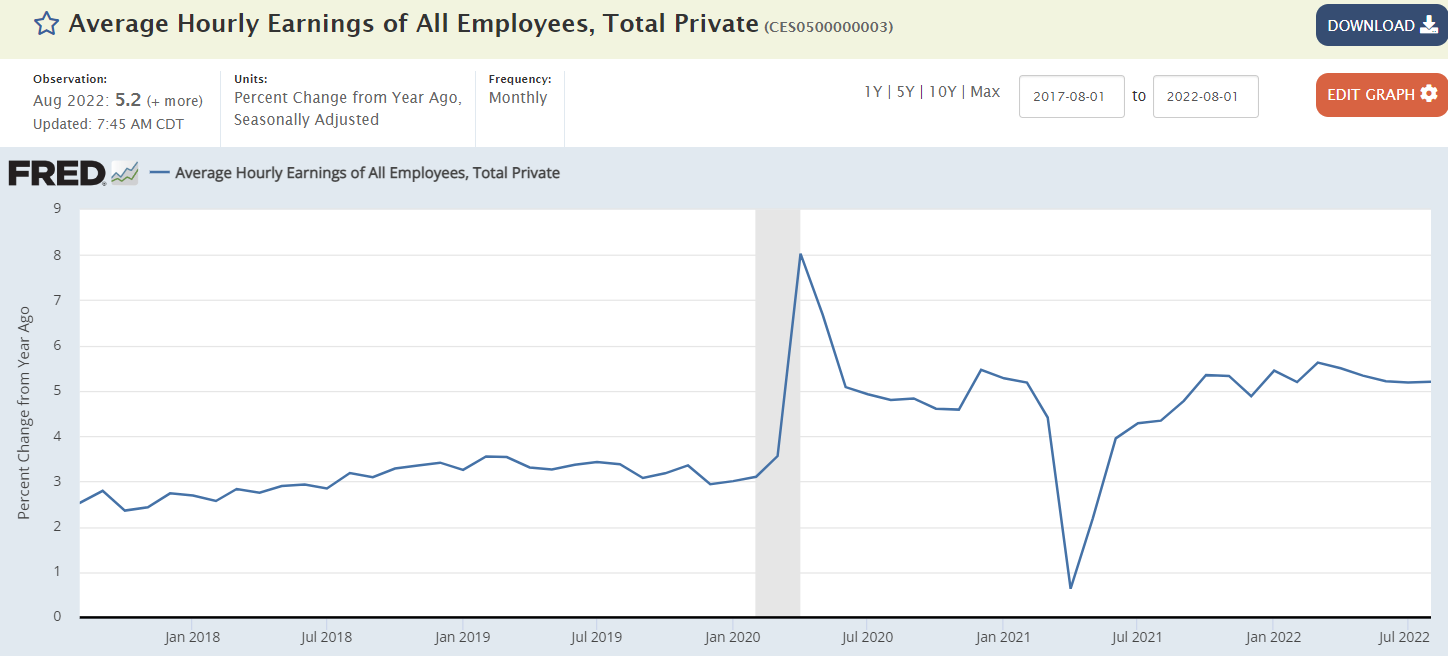

Wage growth continues to lag (not cause) the growth rate of the CPI:

Government had more employees under President Trump vs Presidents Obama and Biden? ;)

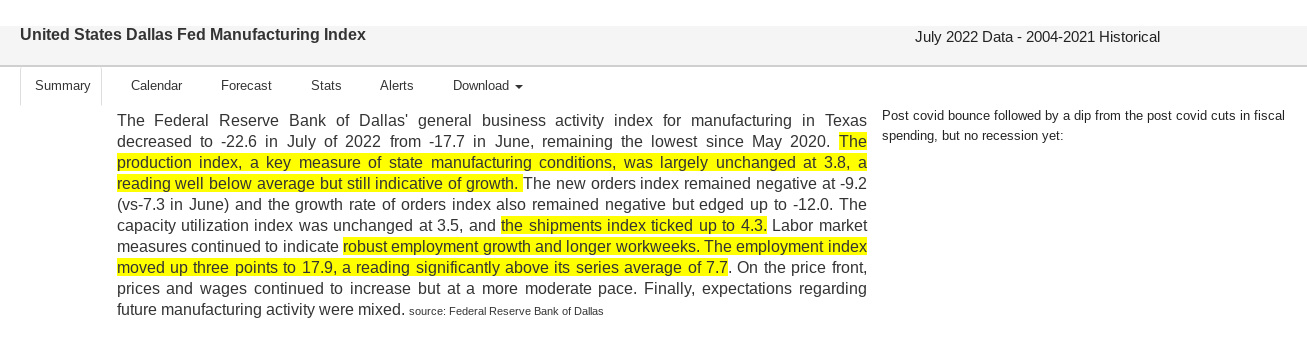

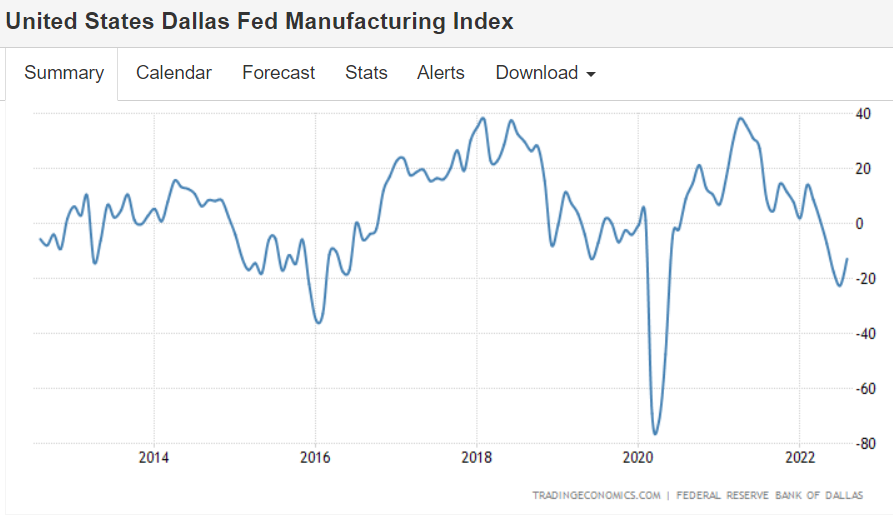

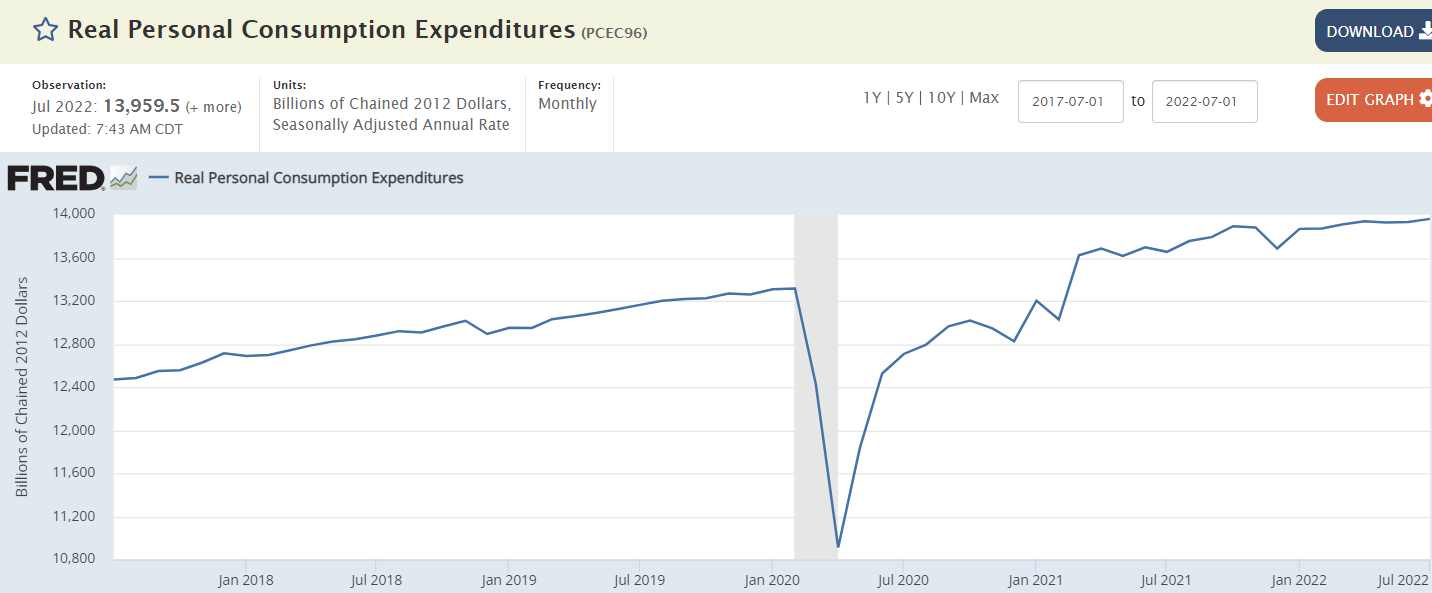

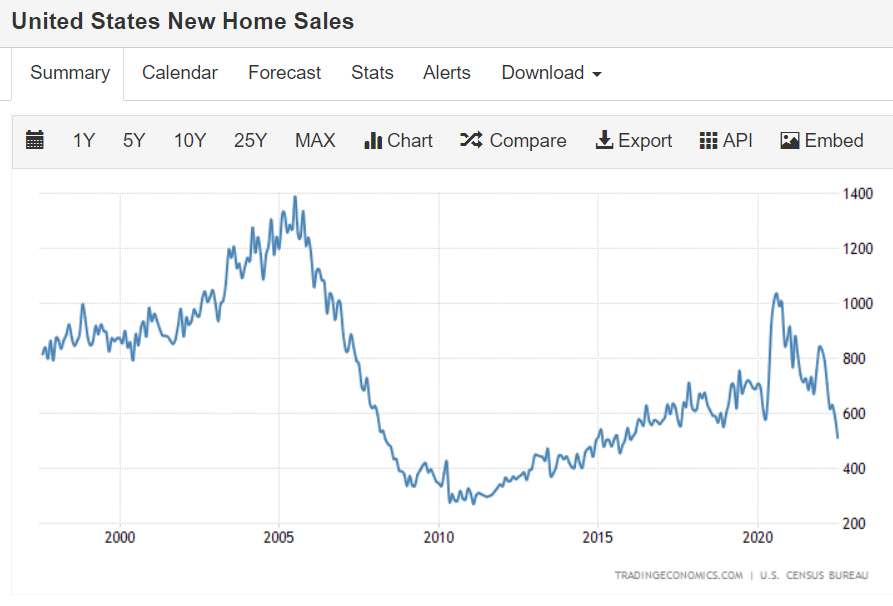

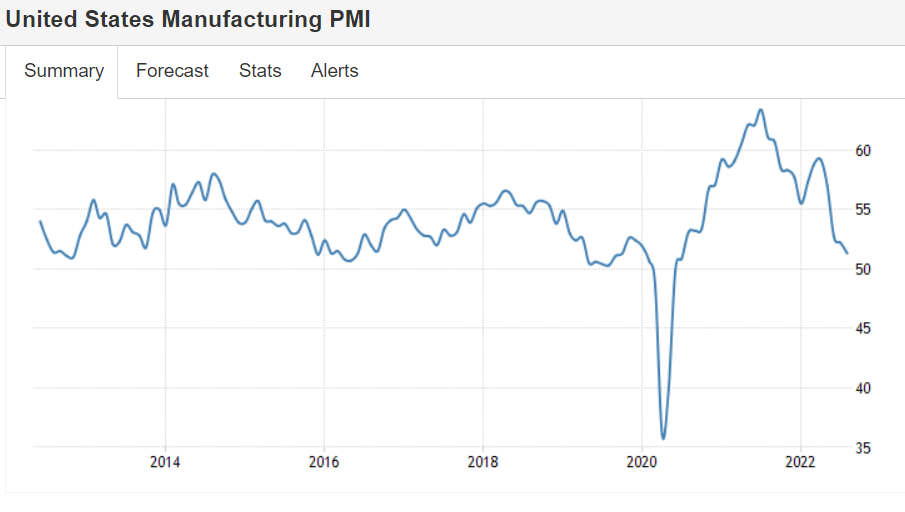

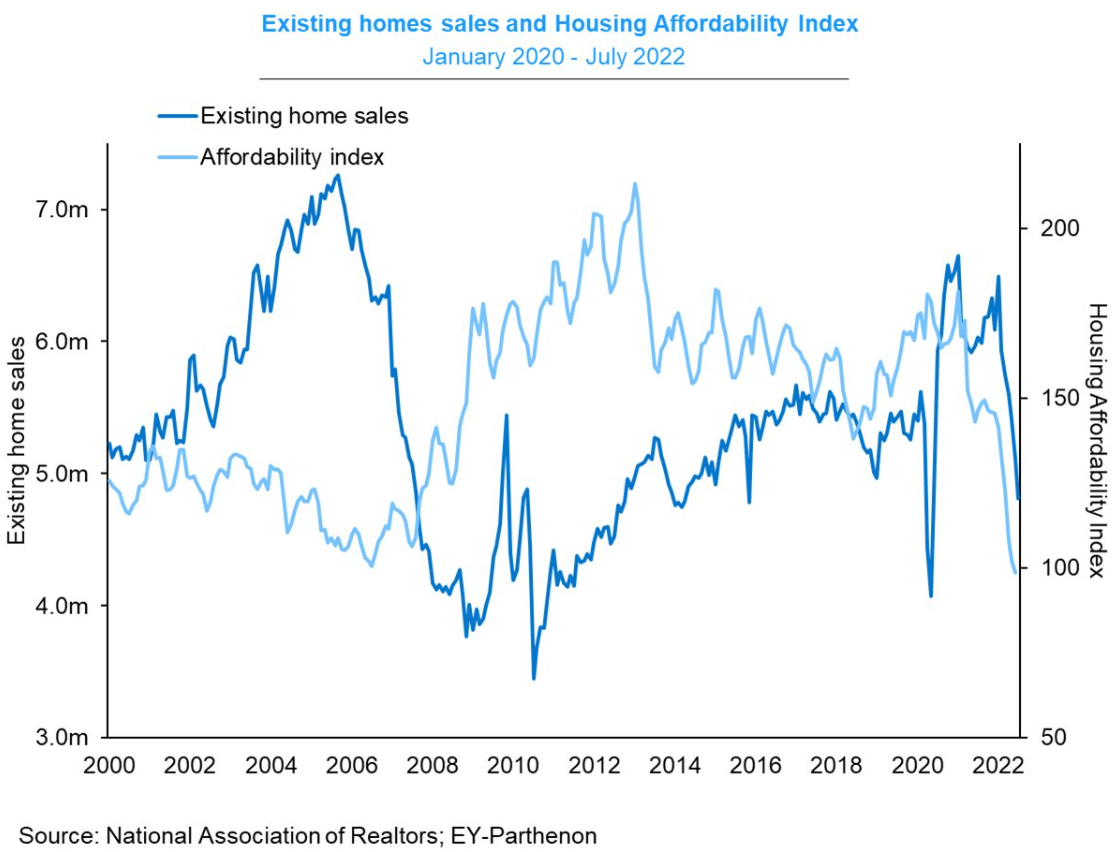

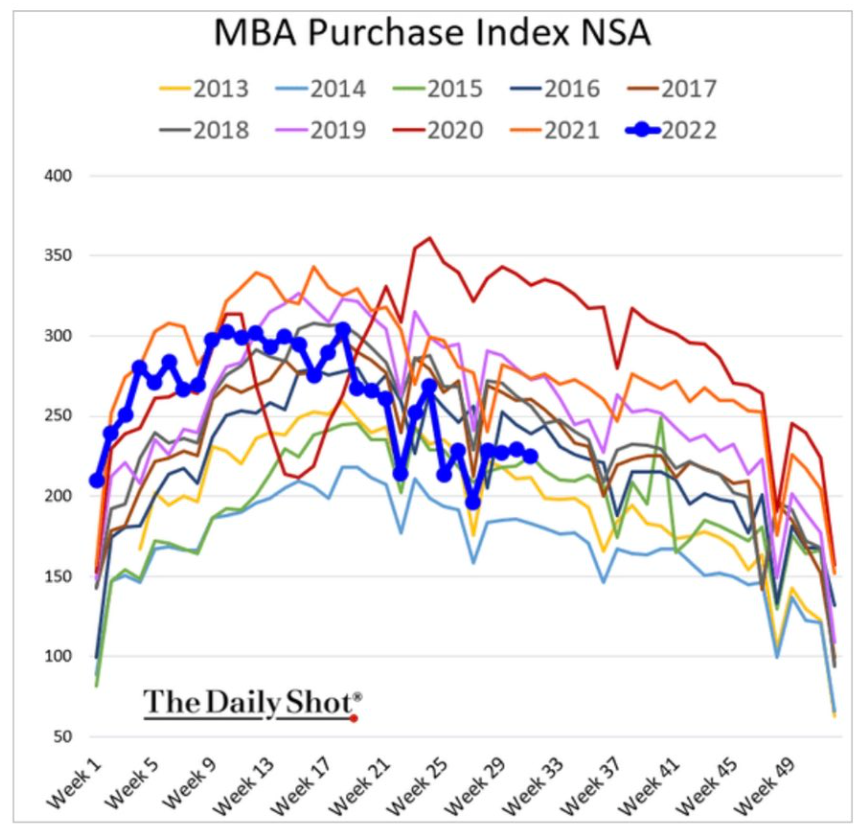

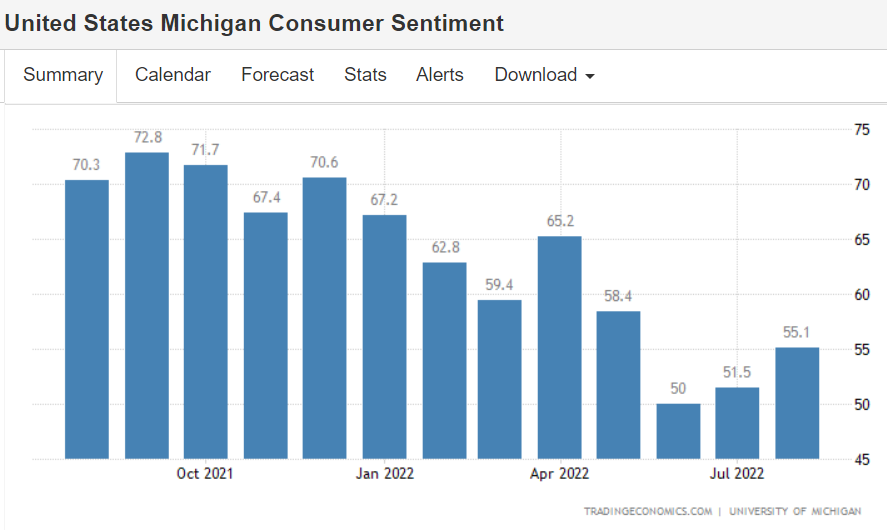

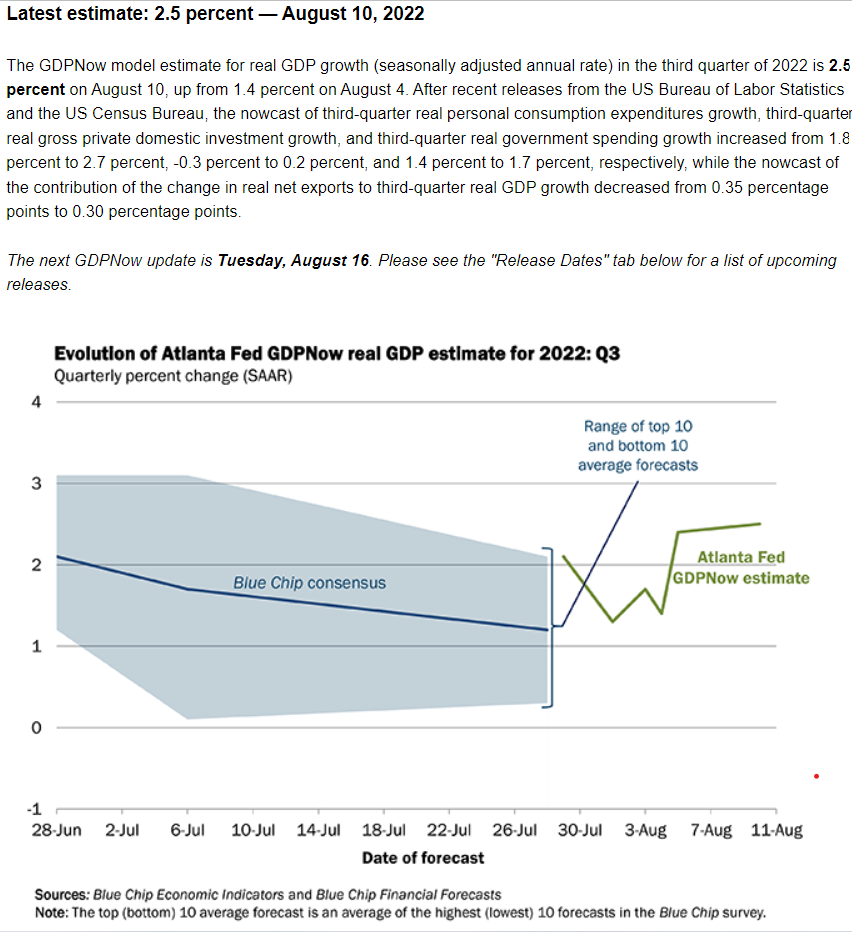

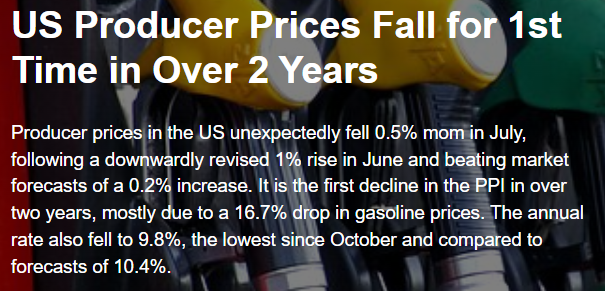

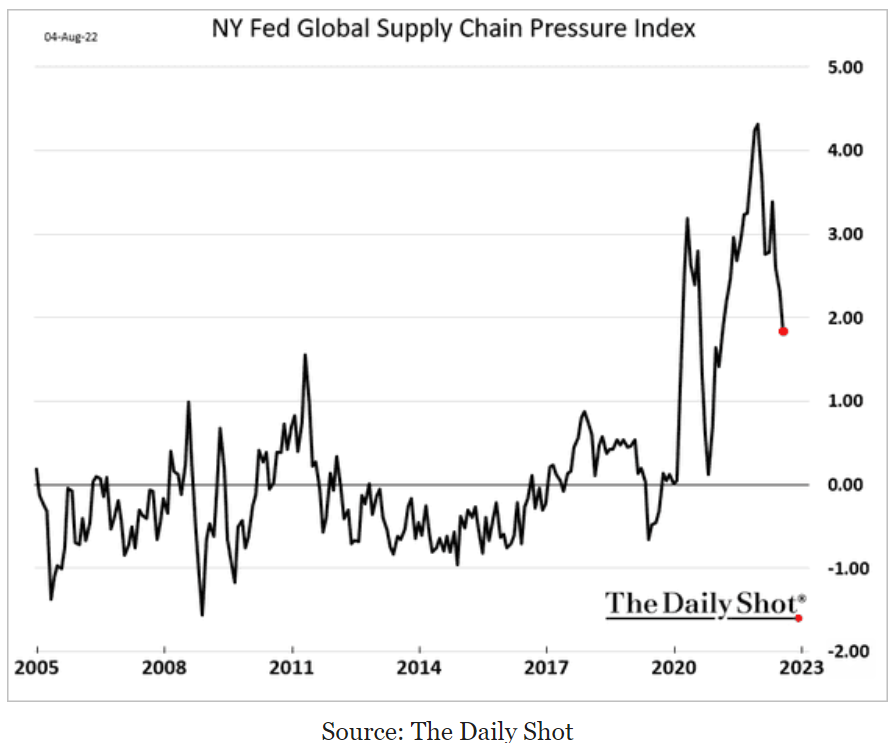

This doesn’t look like a recession either: