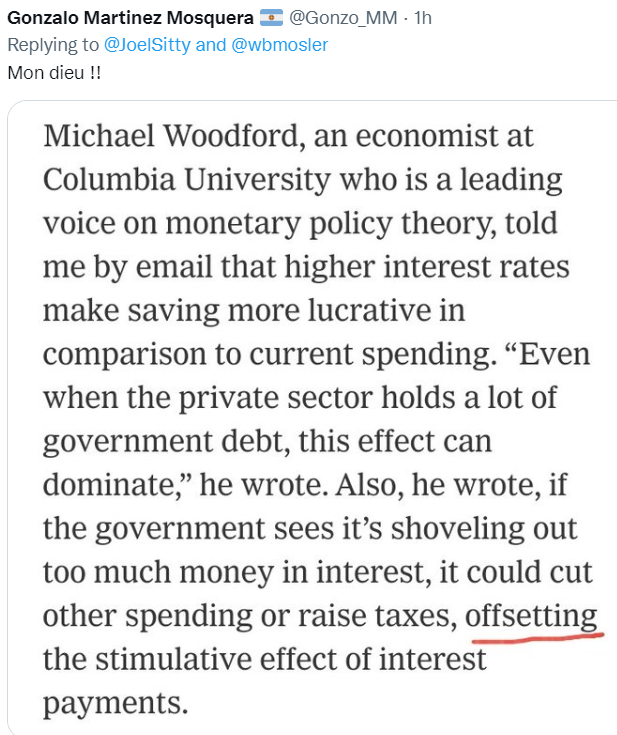

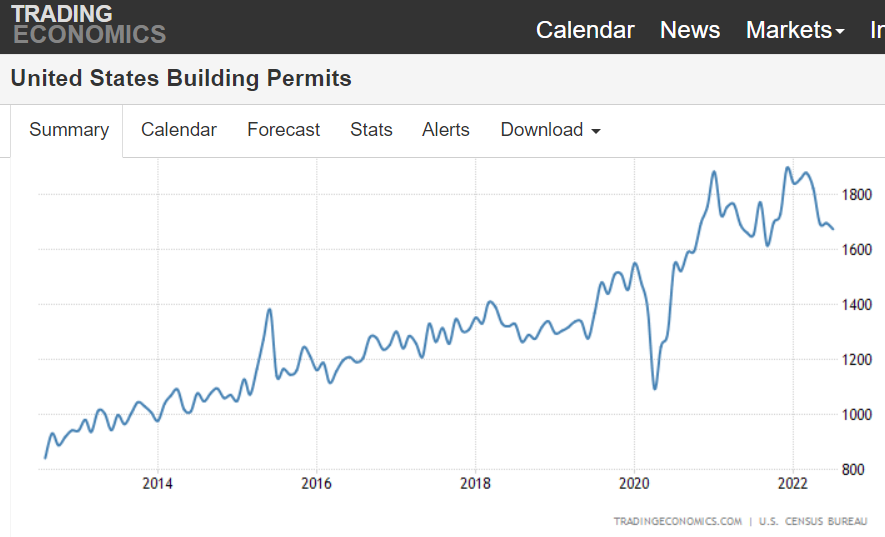

Permits and starts have fallen off but are still above pre-Covid levels. This particular sector is presumed to be the target of Fed rate hikes. I suspect it is a temporary setback with buyers taking a wait and see attitude, as employment continues to grow:

The post-Covid bounce continues with no sign of recession.

US energy costs are relatively low which is helping drive the export component:

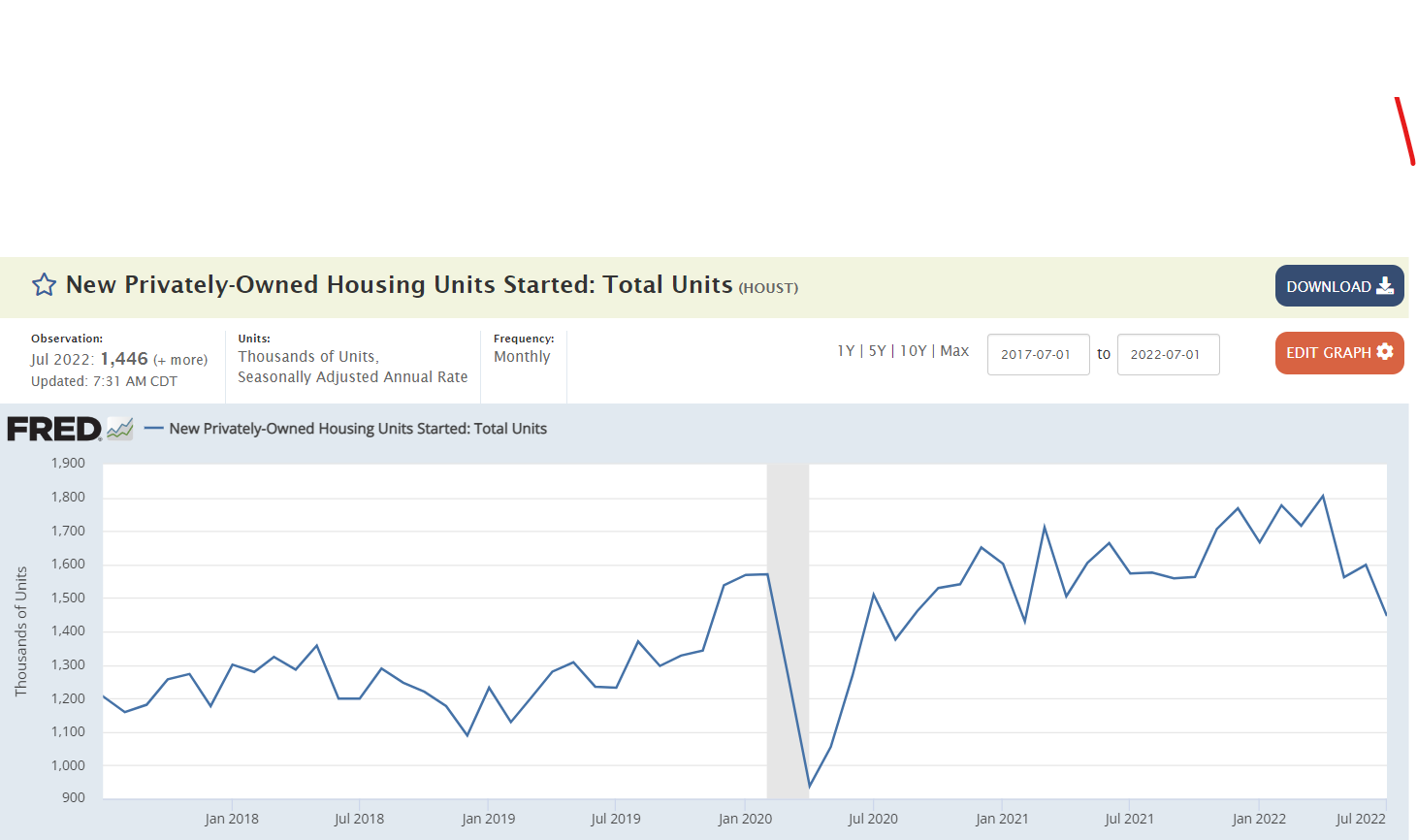

Peter Coy’s NYT article today was about my assertion that rate hikes are adding to inflation, which was confirmed by his quote from Prof. Michael Woodford, who is considered the #1 mainstream monetary economist and the Fed’s ‘go to’ economist: