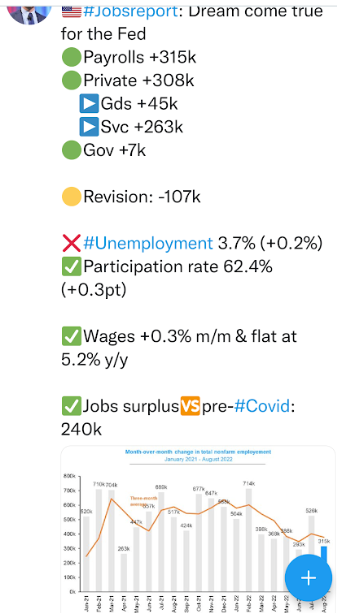

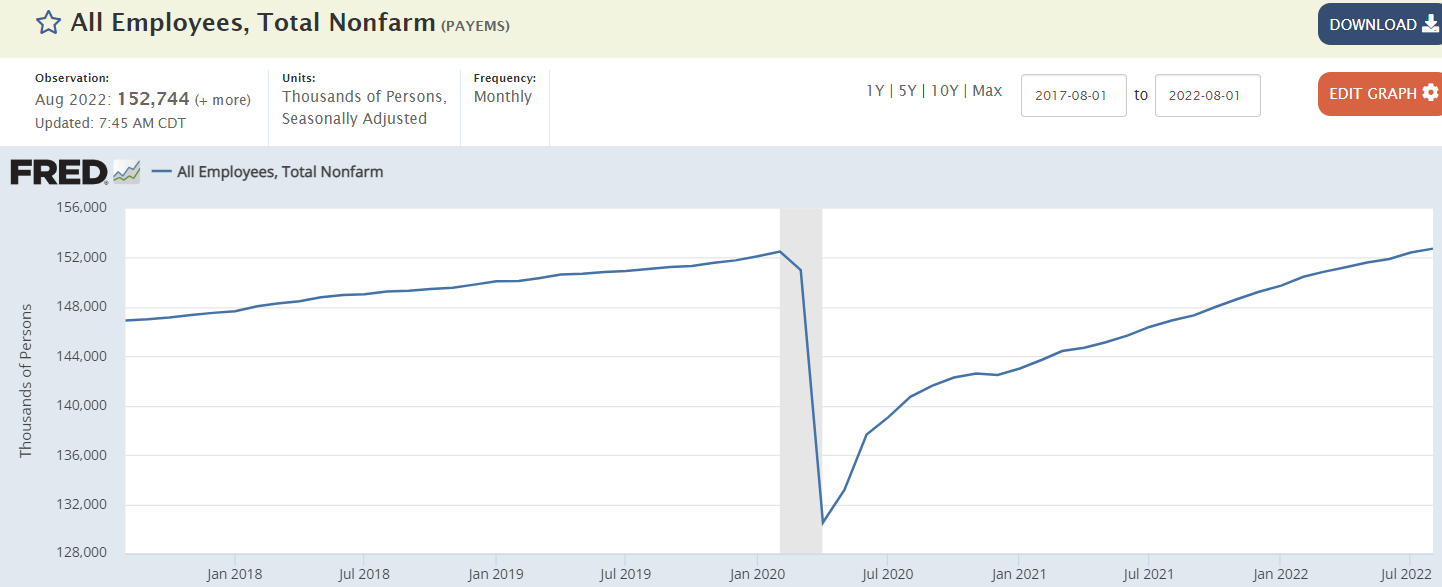

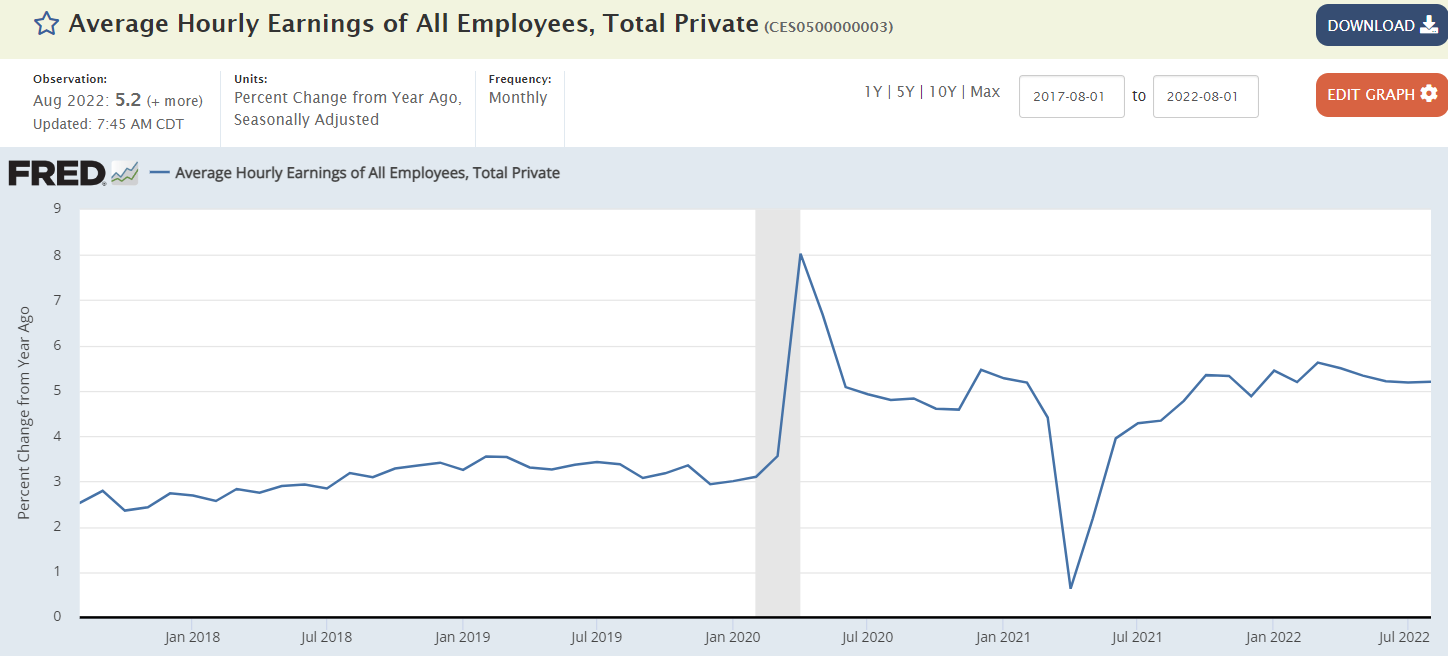

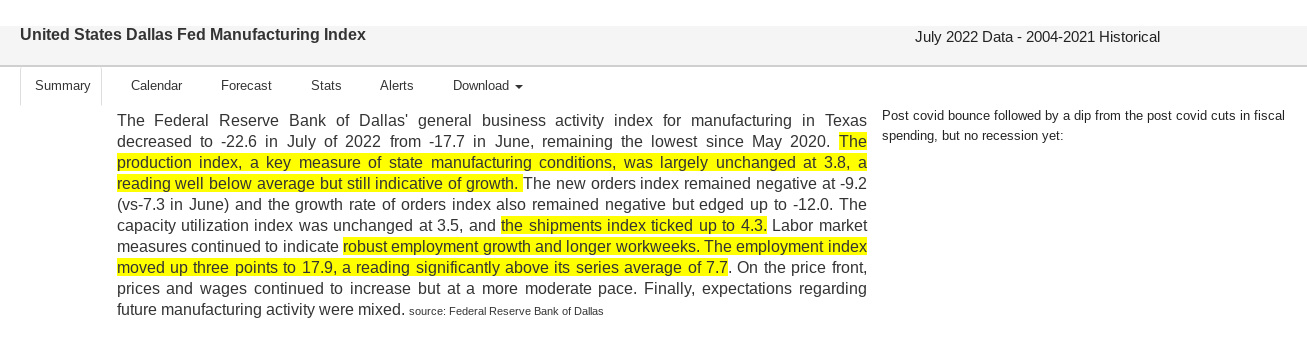

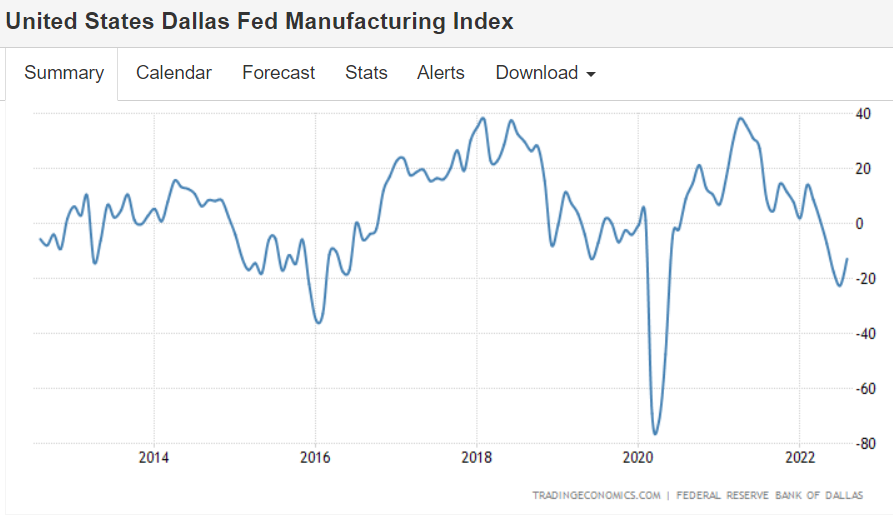

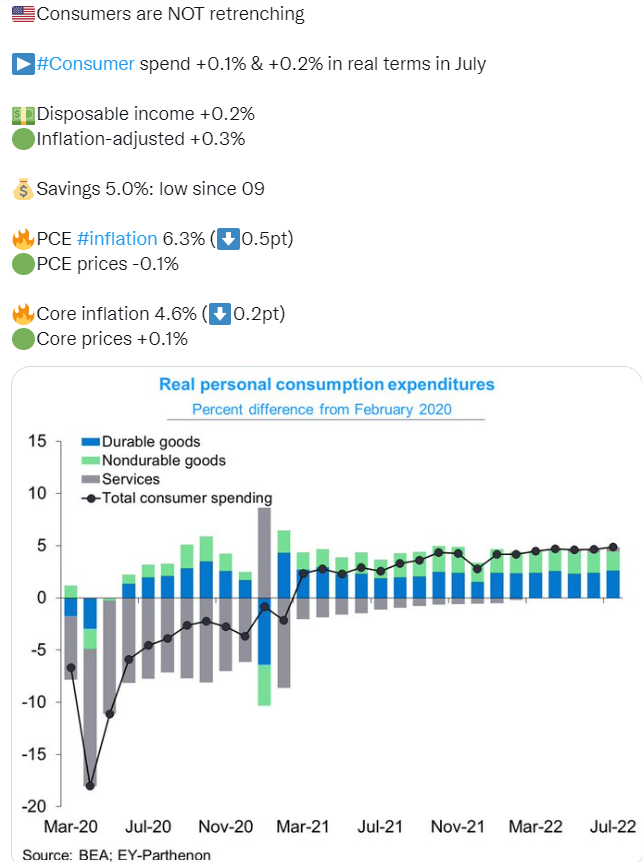

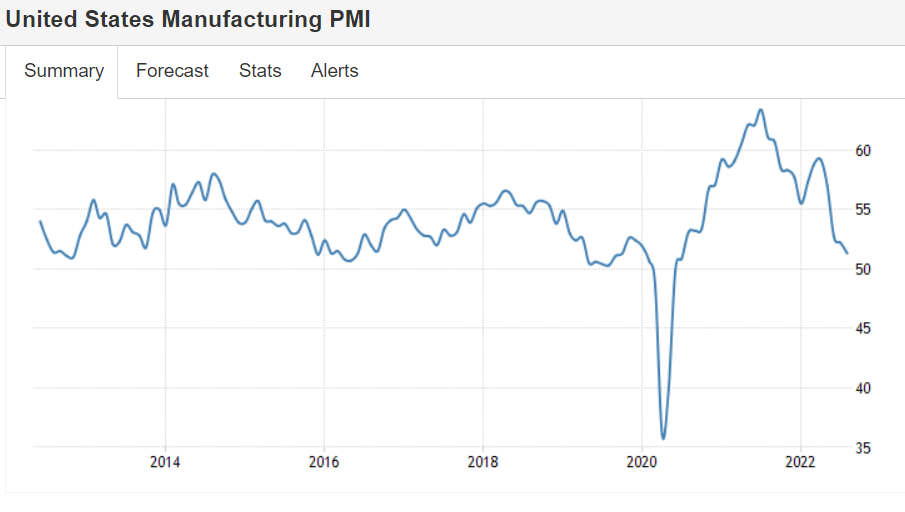

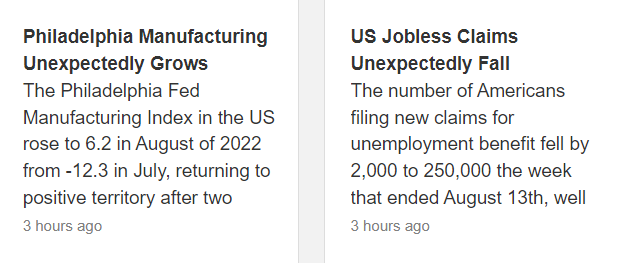

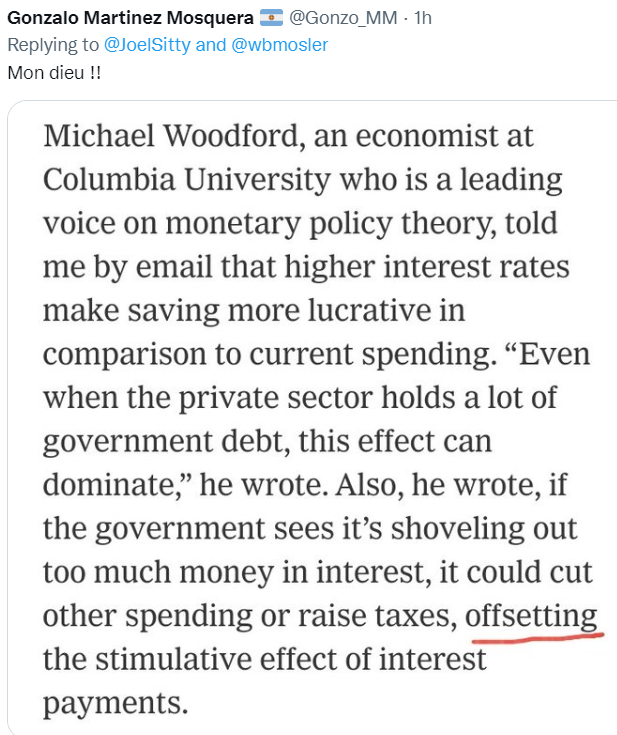

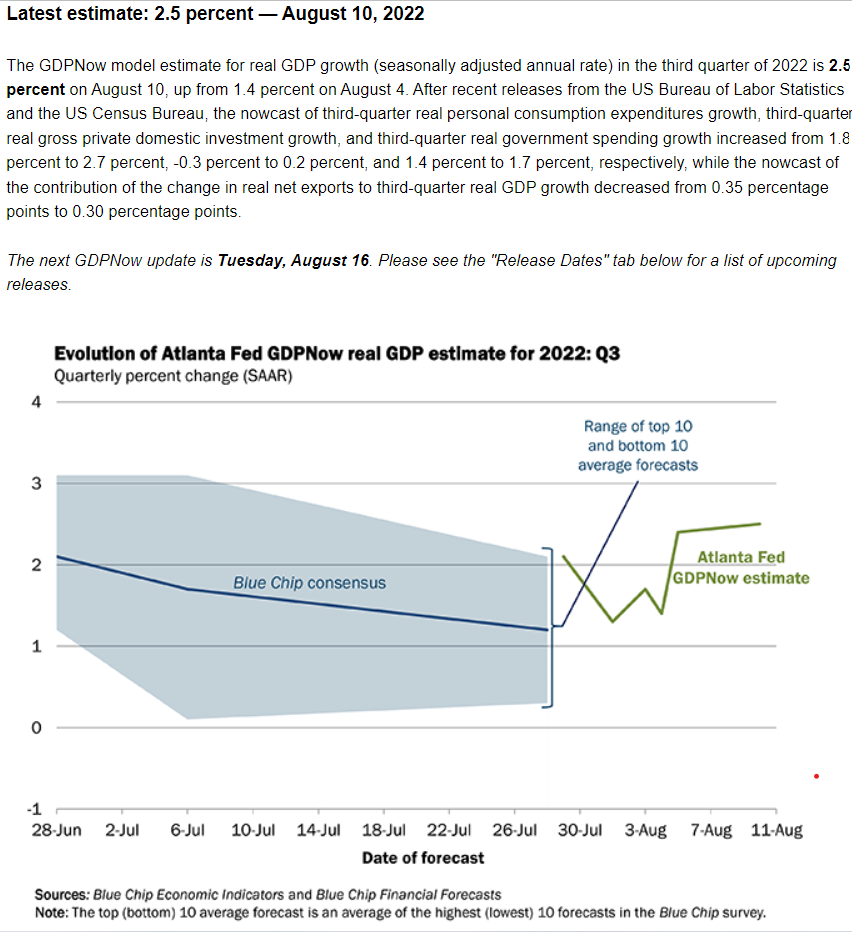

No sign of recession, and lots of indications the rate hikes that are adding to deficit spending as supporting the economy and prices, and not depressing them, and more rate hikes will only do more of same.

And it doesn’t end until the Fed understands it has had it all backwards:

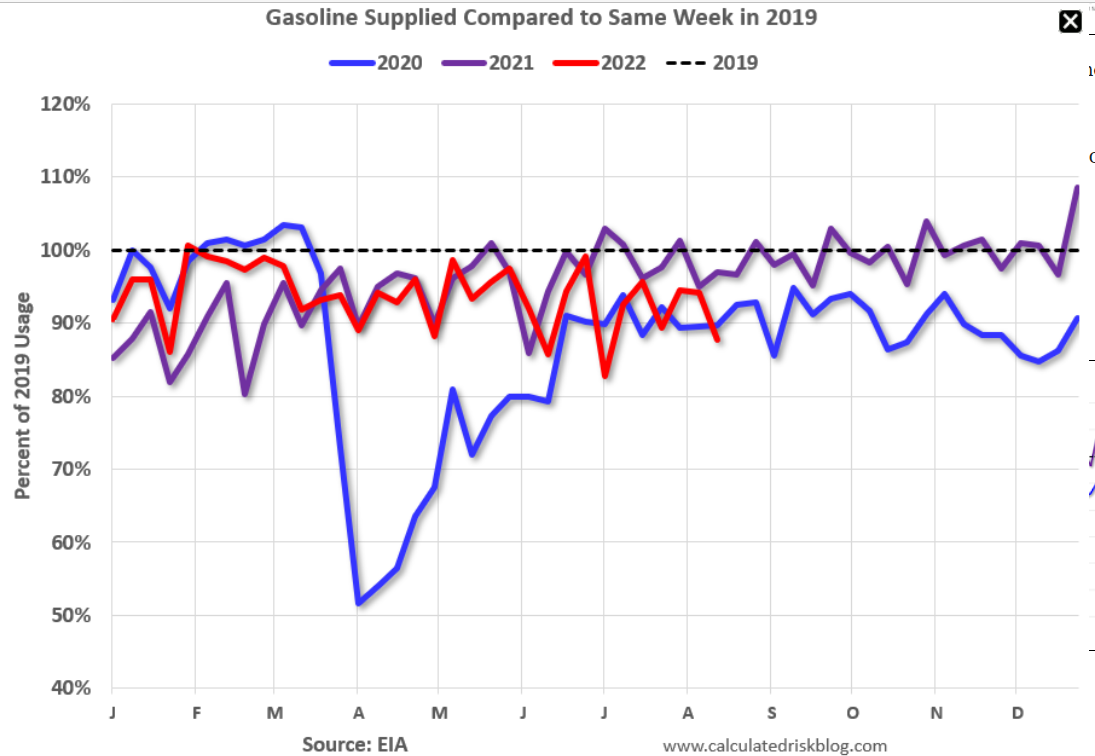

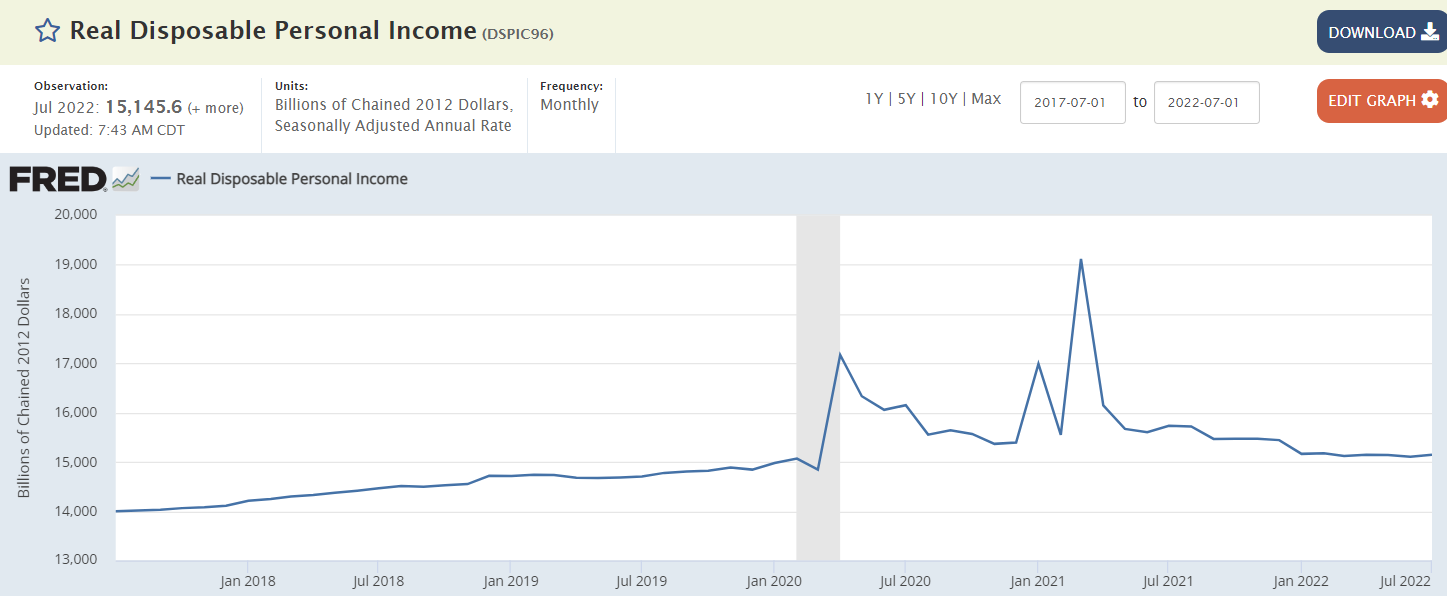

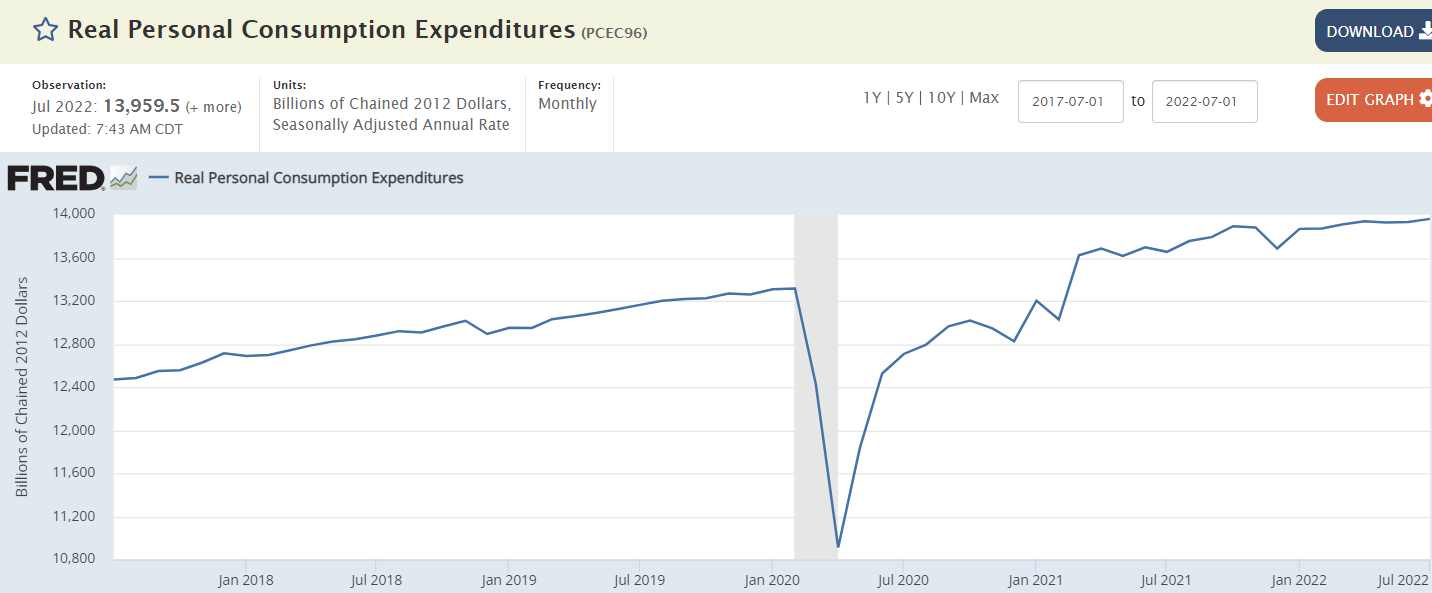

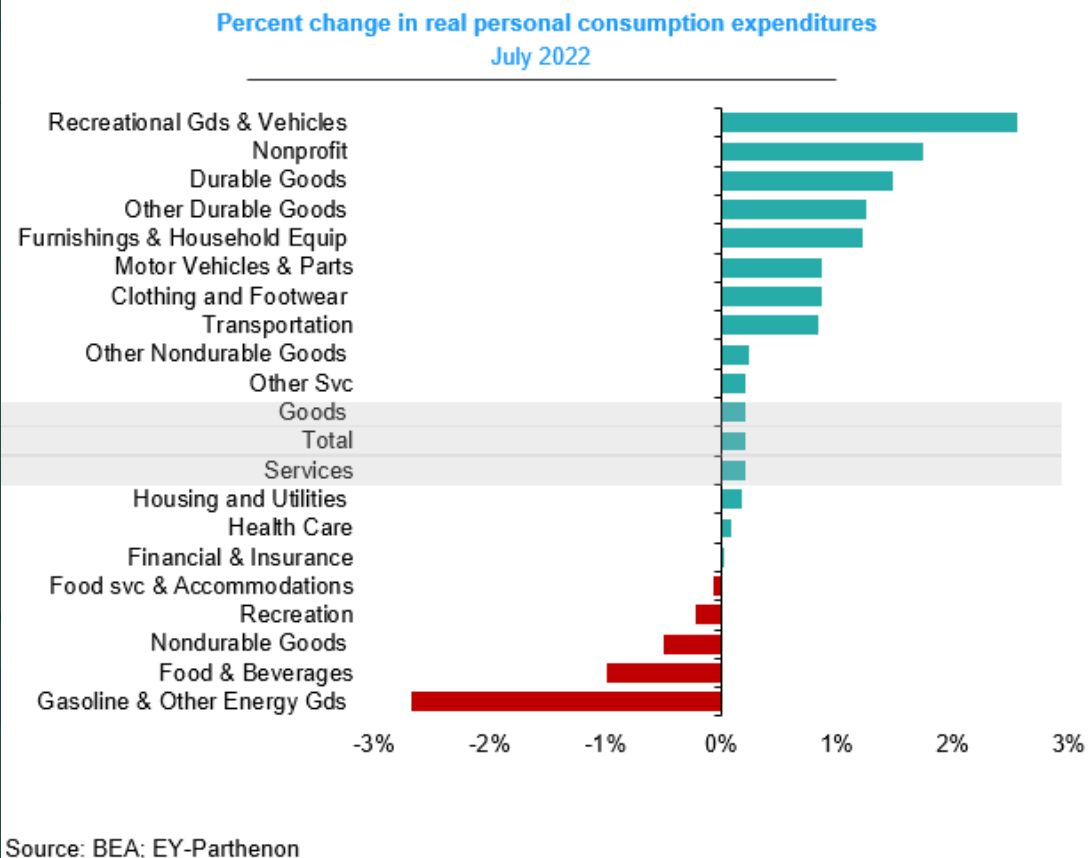

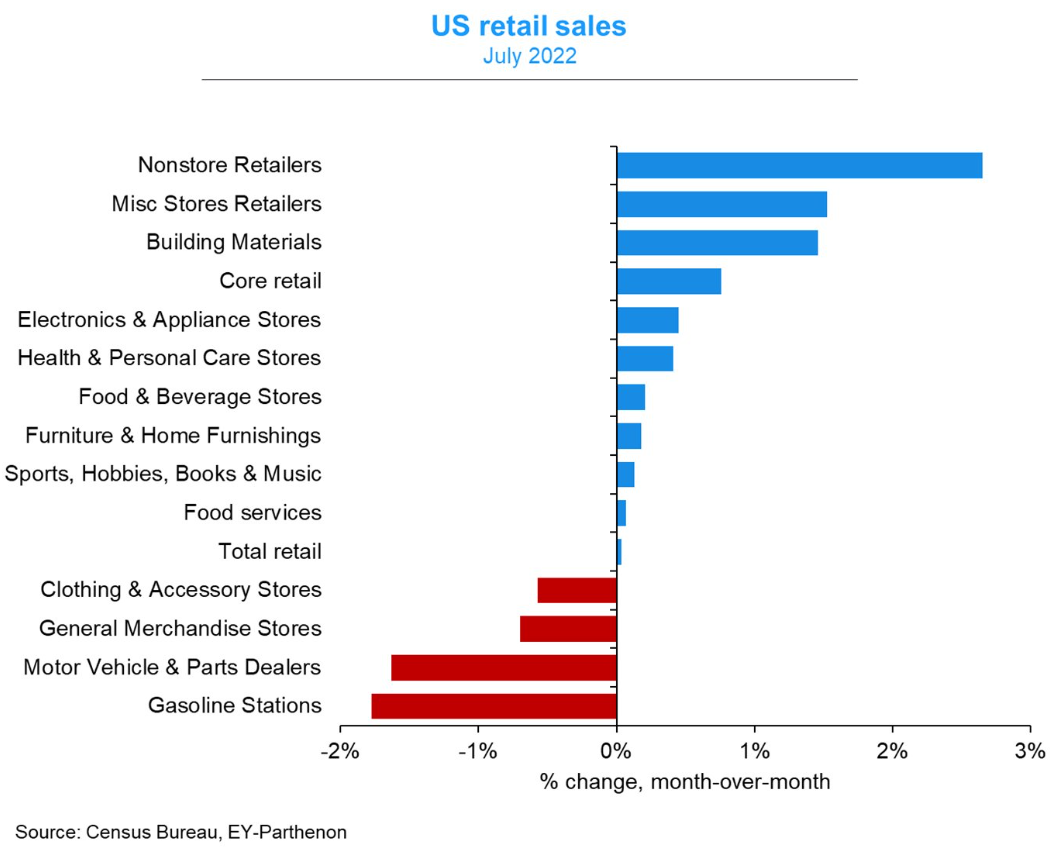

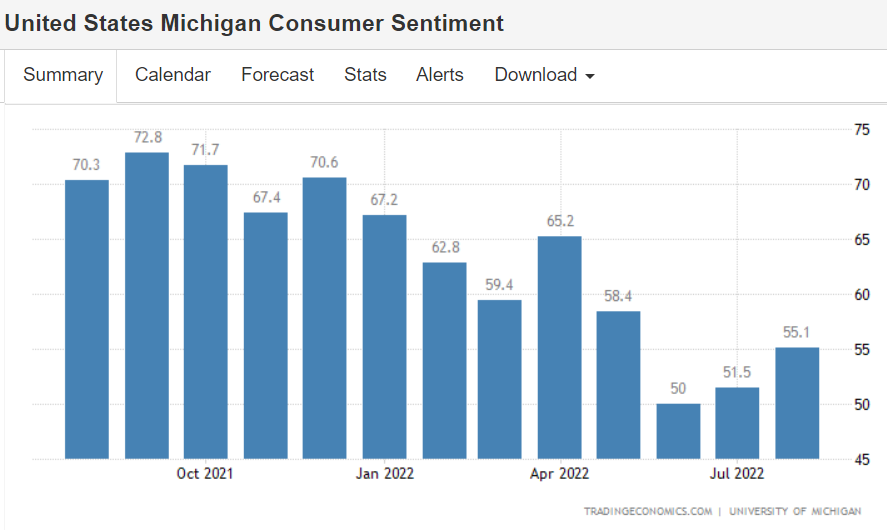

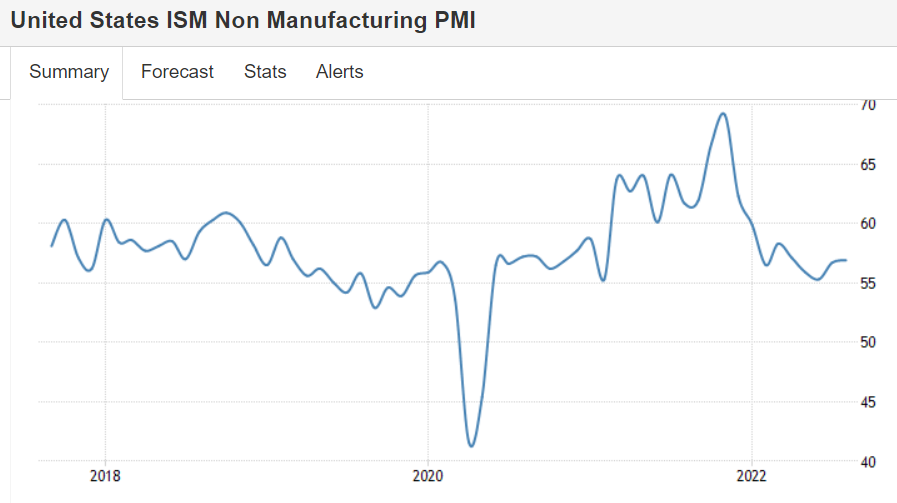

This is about 85% of the economy.

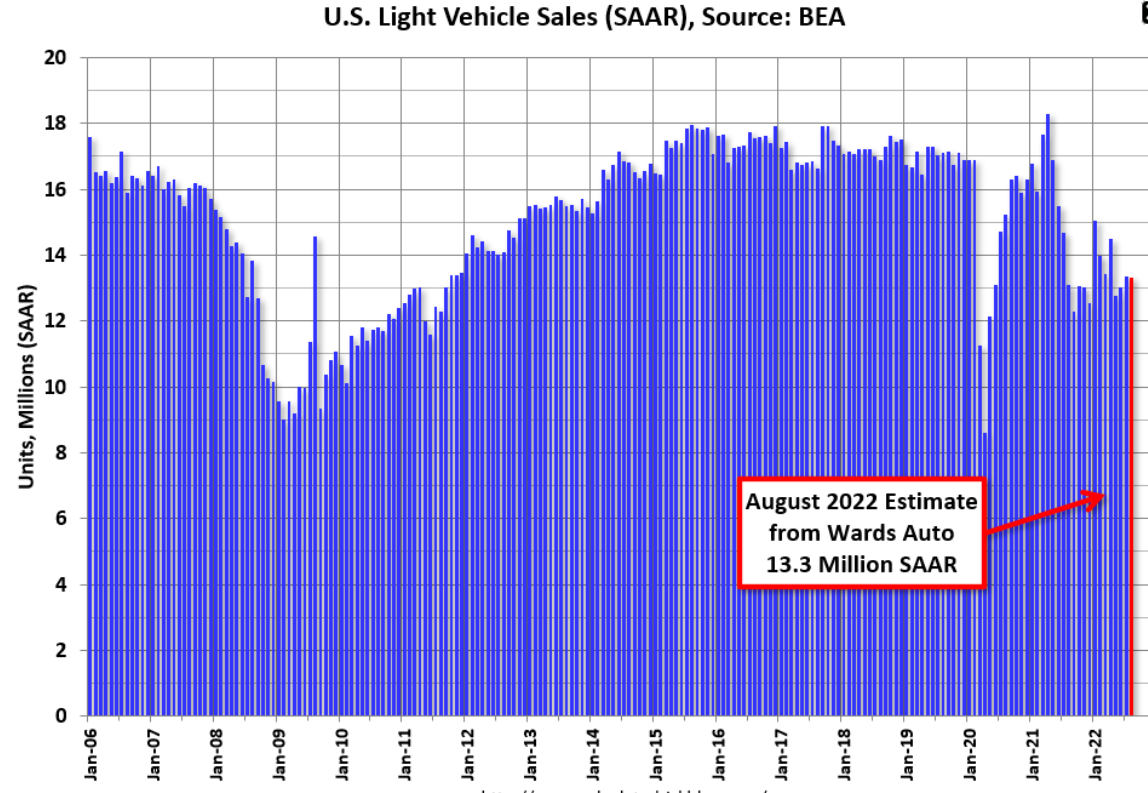

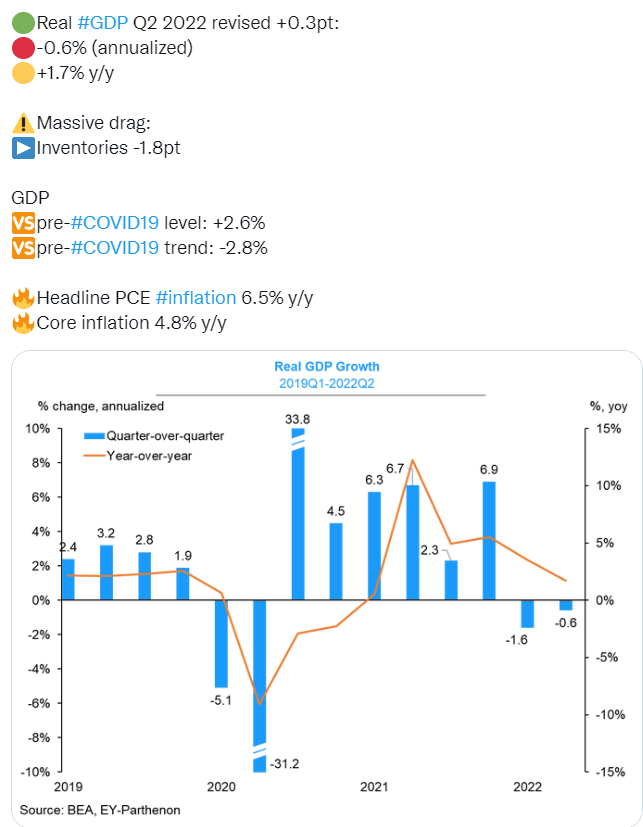

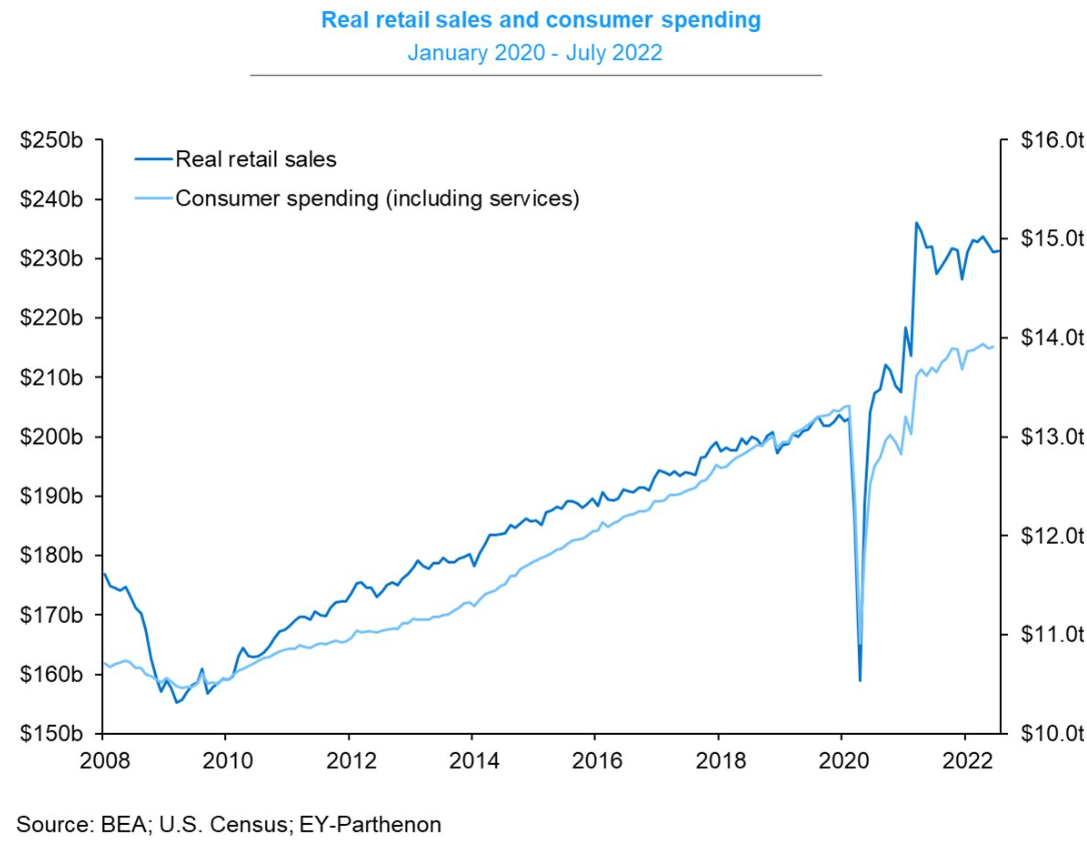

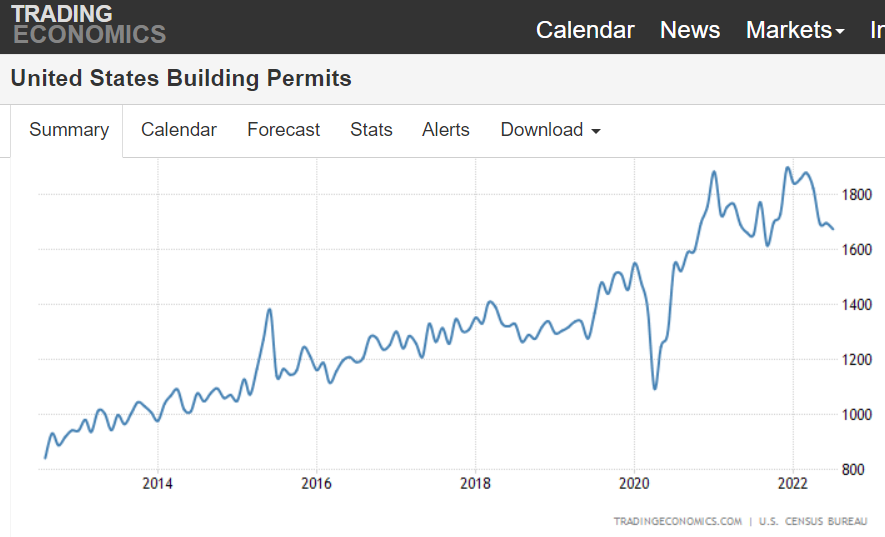

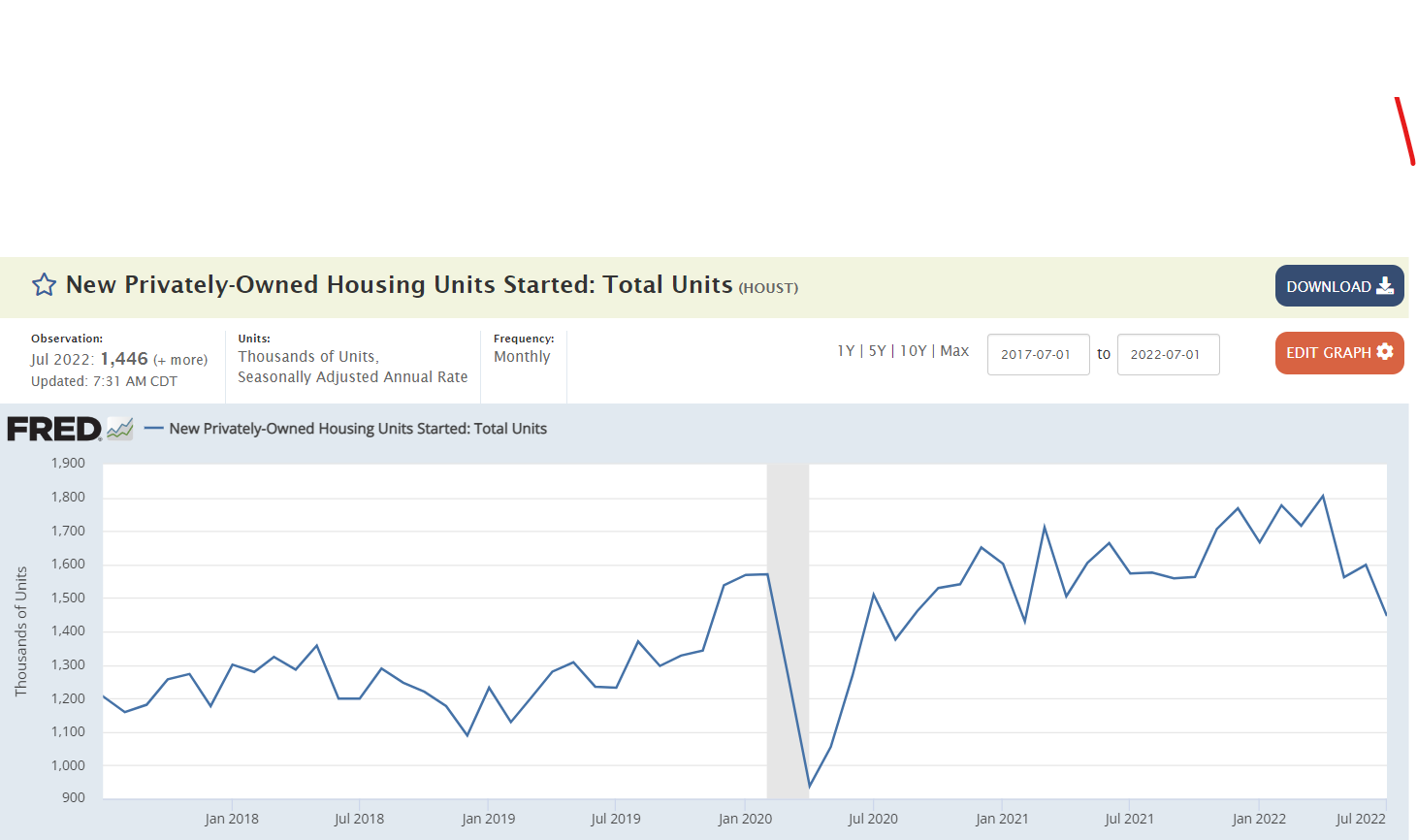

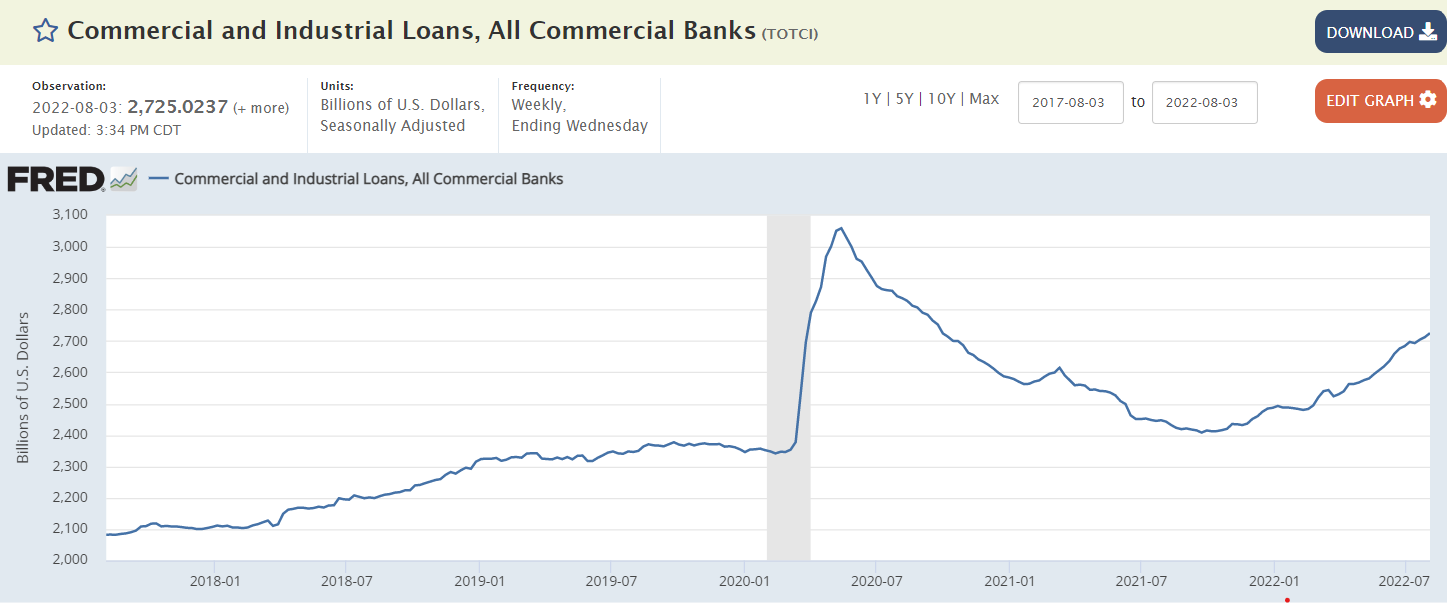

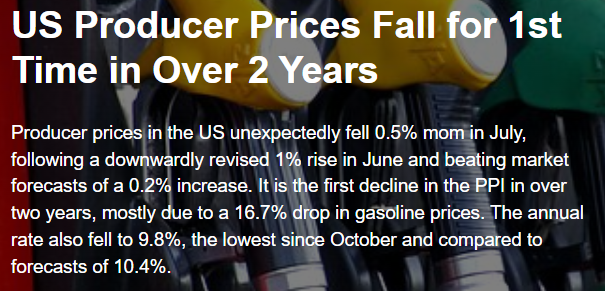

No recession yet. More and more the data is telling me debt/gdp is plenty high for rate hikes to be supportive of total spending in the economy:

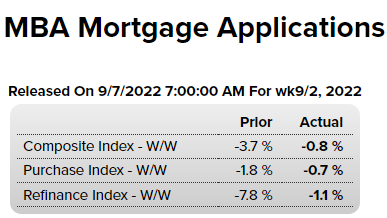

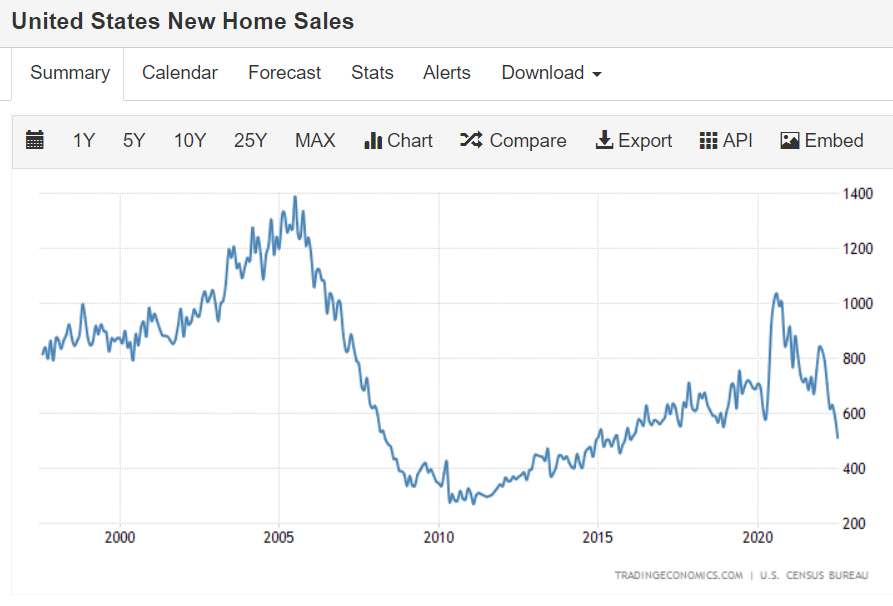

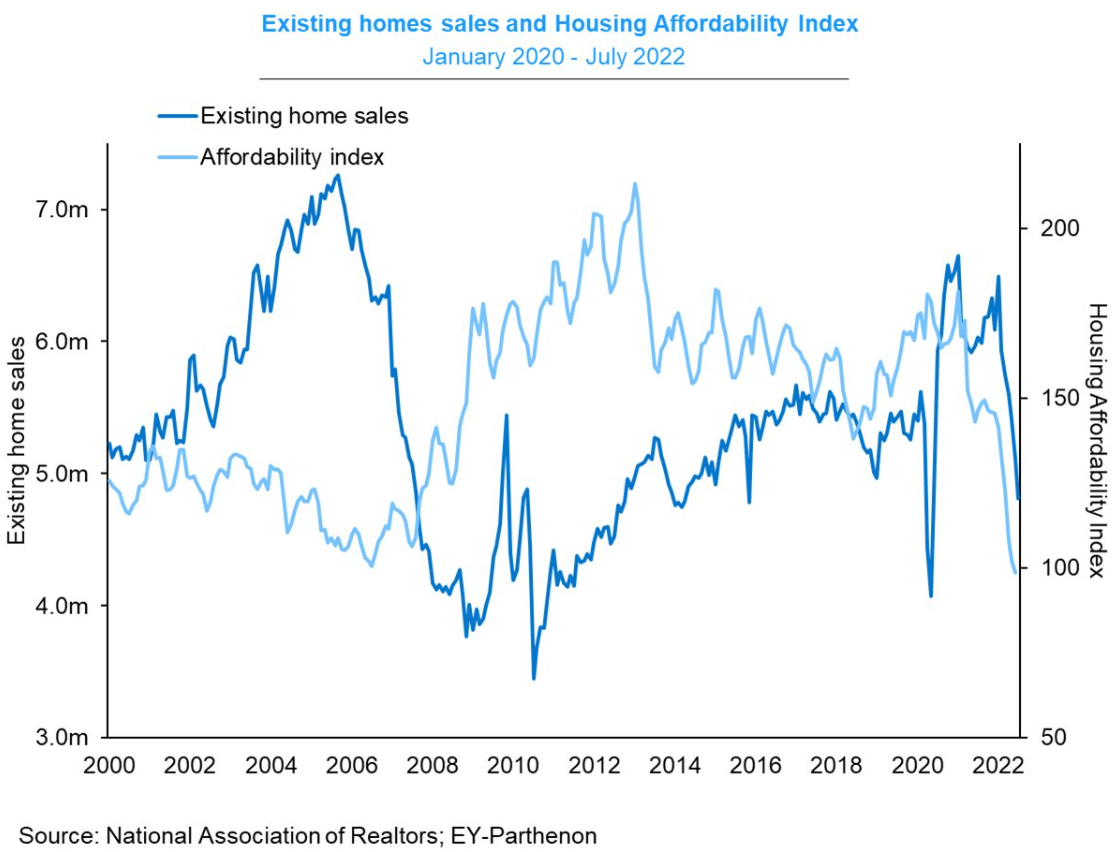

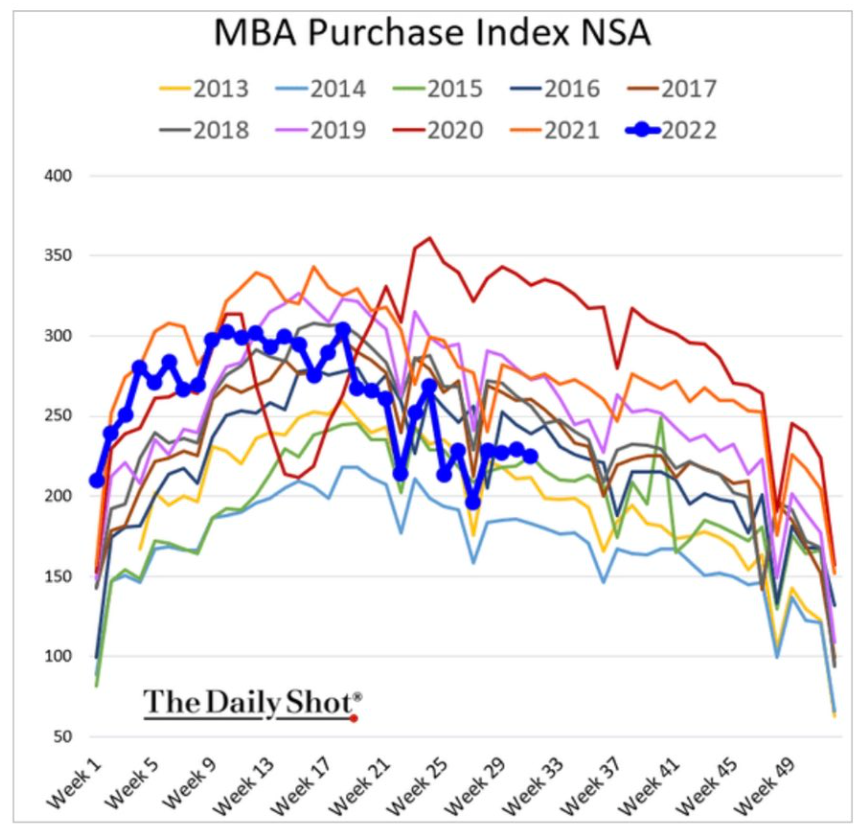

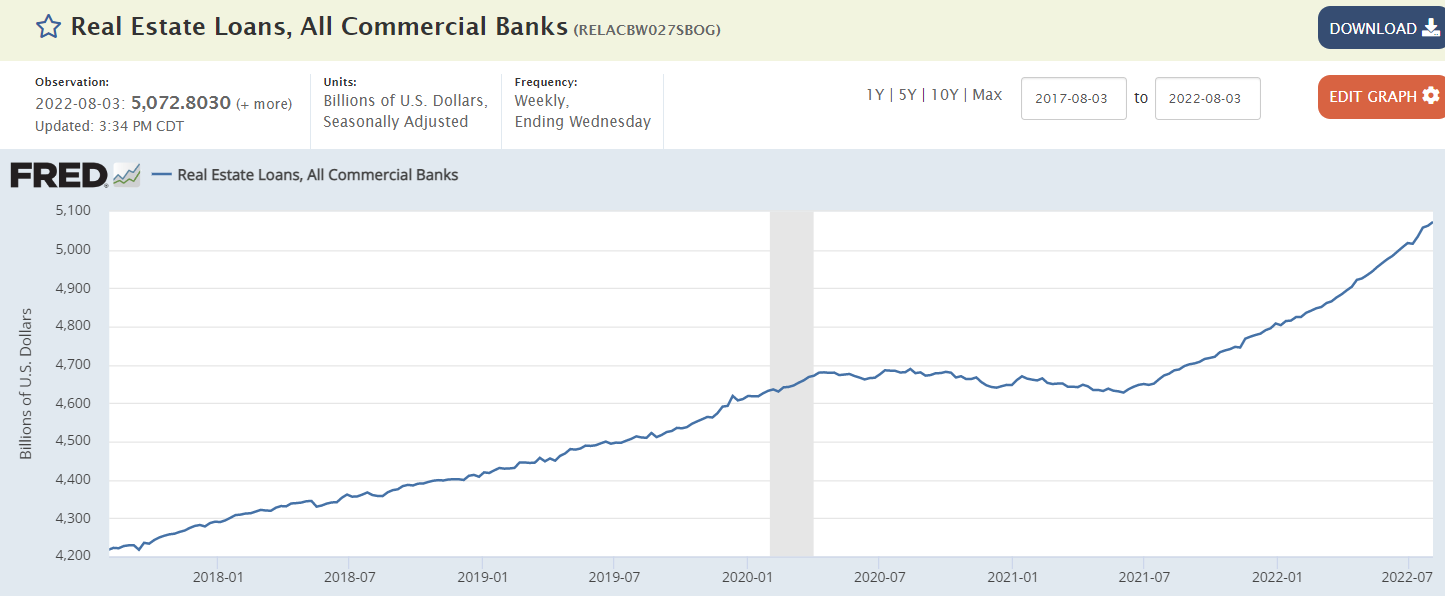

Housing has been weak since the rate hikes, but the declines have been diminishing and with the continuously increasing personal income from (lower but still high) government deficit spending.

I’m expecting housing to show modest growth going forward, in line with the rest of the economy.

Note that applications are down but lending is still growing rapidly: