The Fed continues to fail to meet it’s target. They just need a little more time… ;)

And coincidentally this is inline with the credit deceleration as previously discussed:

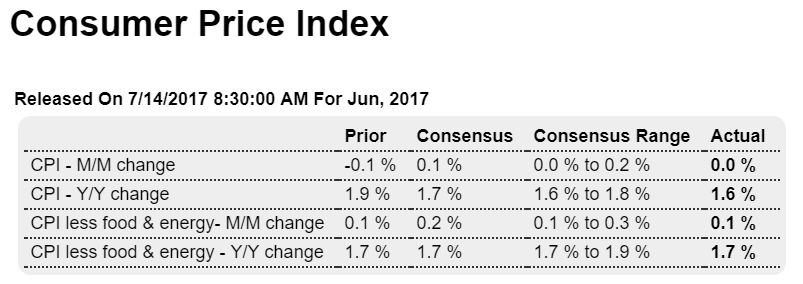

Highlights

In what is one of the very weakest 4-month stretch in 60 years of records, core consumer prices could manage only a 0.1 percent increase in June. This is the third straight 0.1 percent showing for the core (ex food & energy) that was preceded by the very rare 0.1 percent decline in March. Total prices were unchanged in the month with food neutral and energy down 1.6 percent.

Housing, which is a central category, continues to moderate, also coming in at 0.1 percent following a 0.2 percent gain in May. Apparel is down for a fourth month in a row with transportation, reflecting falling vehicle prices, down for a second month. Medical care, which had been moderating, picked up with a 0.4 percent gain while prescription drugs which Janet Yellen has been citing for special weakness, bounced back with a 1.0 percent gain. However wireless telephone services, another area cited by Yellen for weakness, posted another sizable decline, down 0.8 percent in June.

Year-on-year, the core is steady at 1.7 percent with total prices, which fluctuate much more than the core, down 3 tenths to 1.6 percent. The Fed may be blaming this stretch of weakness on special factors, but that argument is losing force.

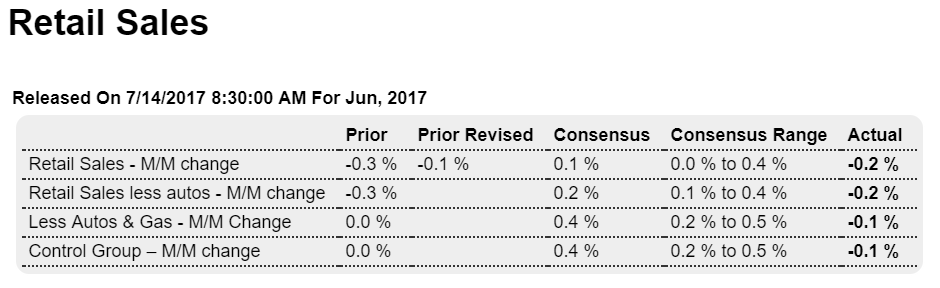

Also decelerating in line with decelerating credit aggregates:

Highlights

Consumer spending in second-quarter GDP will not be getting a lift from the retail component as retail sales fell an unexpected 0.2 percent in June. This follows a revised 0.1 percent decline in May and a revised 0.3 percent gain for April which proved to be the quarter’s only respectable showing.

Readings show wide weakness with vehicle sales coming in with a marginal 0.1 percent increase, the same for furniture and also electronics & appliances. Declines include food & beverage stores, down a sharp 0.4 percent, and department stores down 0.7 percent following the prior month’s 0.8 percent plunge. Restaurants are also weak, down 0.6 percent for the third decline in four months. Gasoline sales fell 1.3 percent reflecting price weakness. Nonstore retailers, which include e-commerce, are a positive in the report with a 0.4 percent gain as are building materials rising 0.5 percent gain.

But there really aren’t very many positives in today’s report, one that points to a surprising lack of consumer spirit and one that will not be raising estimates for second-quarter GDP.

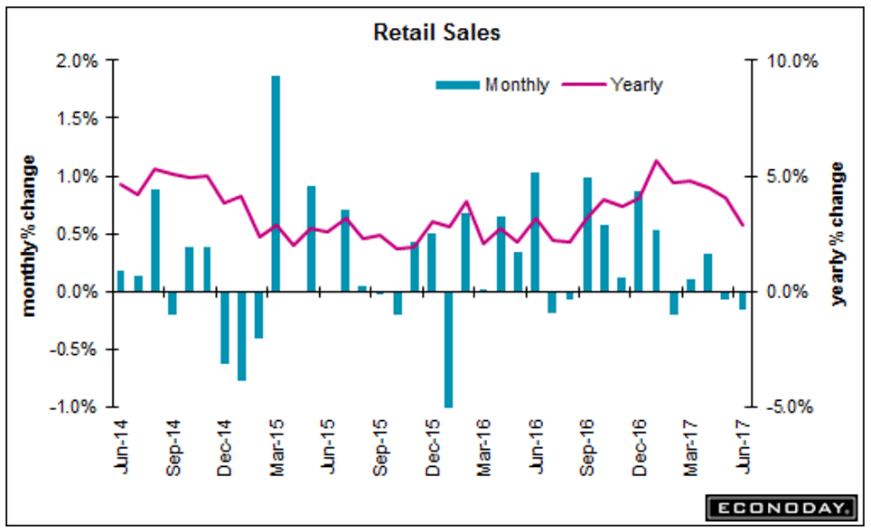

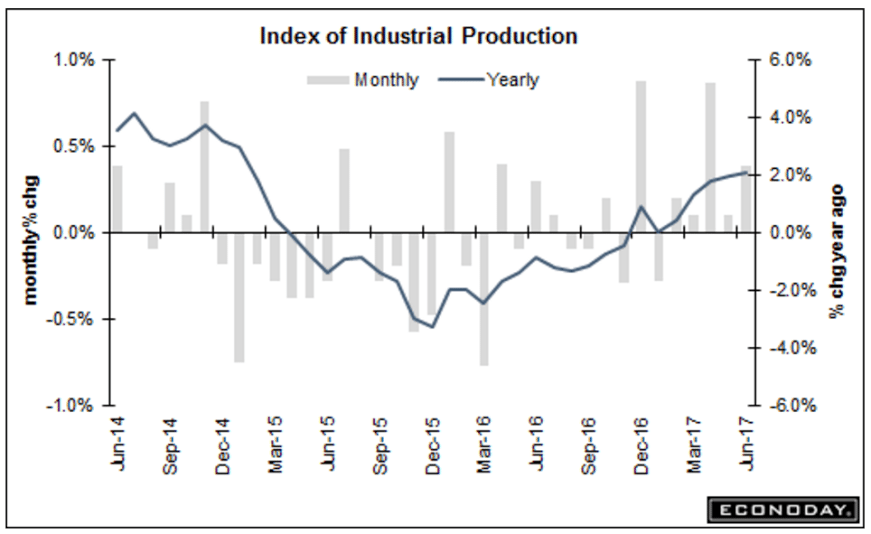

Annual growth chugging along at a modest 2%, leveling off after the setback from the oil capex collapse, as per the chart:

Highlights

Mining is once again the highlight of an otherwise soft industrial production report. Gaining 1.6 percent for a third straight sharp increase, mining pulled industrial production up 0.4 percent in June as utilities posted no change and manufacturing managed an as-expected 0.2 percent gain.

Manufacturing makes up the vast bulk of the industrial sector and a breakdown does show strength with vehicles up 0.7 percent and selected hi-tech up 0.8 percent. But both consumer goods and business equipment came in flat with construction supplies down slightly.

The gain for manufacturing follows May’s 0.4 percent decline with a 1.0 percent surge in April nearly offset by March’s 0.8 percent plunge. The factory sector is moving forward, just not very fast. Today’s report is the first definitive factory data for June; watch next week for the first tentative data on May with Empire State on Monday and Philly Fed on Thursday. Note that traditional non-NAICS numbers for industrial production may differ marginally from NAICS basis figures.

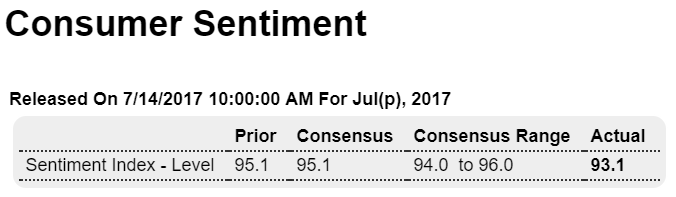

Trumped up expectations have now all but reversed, also in line with the deceleration of consumer lending:

Highlights

Economic expectations are falling while current conditions remain high, a combination that the consumer sentiment report warns points to economic slowing ahead. The consumer sentiment index fell a sharp 2 points in the preliminary results for July to a much lower-than-expected 93.1.

The expectations component is down nearly 4 points to 80.2 for its lowest reading since before the election, in October last year. Republican expectations have been falling sharply from steep highs, down to 108.9 for a more than 7 point decline from June. Democrat expectations are actually improving slightly but remain very low at 63.2.

Current conditions rose slightly in the month to 113.2 which is a positive indication for this month’s consumer activity. But it’s future activity that may be in trouble. Inflation expectations edged higher in the month but remain very low at 2.7 percent for the 1-year outlook and 2.6 percent for the 5-year.

The drop in this index together with the drop in this morning’s retail sales report are new and imposing negatives for the consumer outlook.

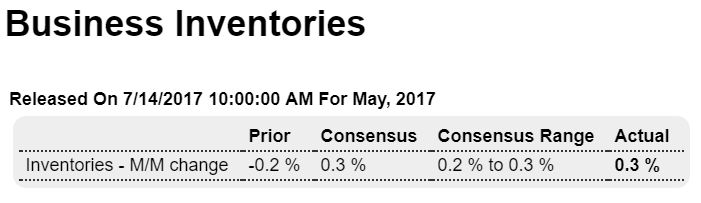

Consequence of falling sales:

No growth of consequence from last year:

From HotelNewsNow.com: STR: US hotel results for week ending 8 July

The U.S. hotel industry reported mixed year-over-year results in the three key performance metrics during the week of 2-8 July 2017, according to data from STR.

In comparison with the week of 3-9 July 2016, the industry recorded the following:

• Occupancy: -3.0% to 65.3%

• Average daily rate (ADR): +1.1% to US$122.73

• Revenue per available room (RevPAR): -2.0% to US$80.11

Read more at http://www.calculatedriskblog.com/#biuKy43OQFvtIM6K.99

Rail Week Ending 08 July 2017: Slowing Continues

Week 27 of 2017 shows same week total rail traffic (from same week one year ago) improved according to the Association of American Railroads (AAR) traffic data. The economically intuitive sectors slowing continues.

Receipts lower than expected due to income slowdowns:

United States Government Budget

The US government posted a USD 90 billion budget deficit in June 2017, larger than market expectations of a USD 35 billion gap and compared with a USD 6 billion surplus in the same month of the previous year. Outlays jumped 33 percent to USD 429 billion while receipts increased at a much slower 3 percent to USD 339 billion.

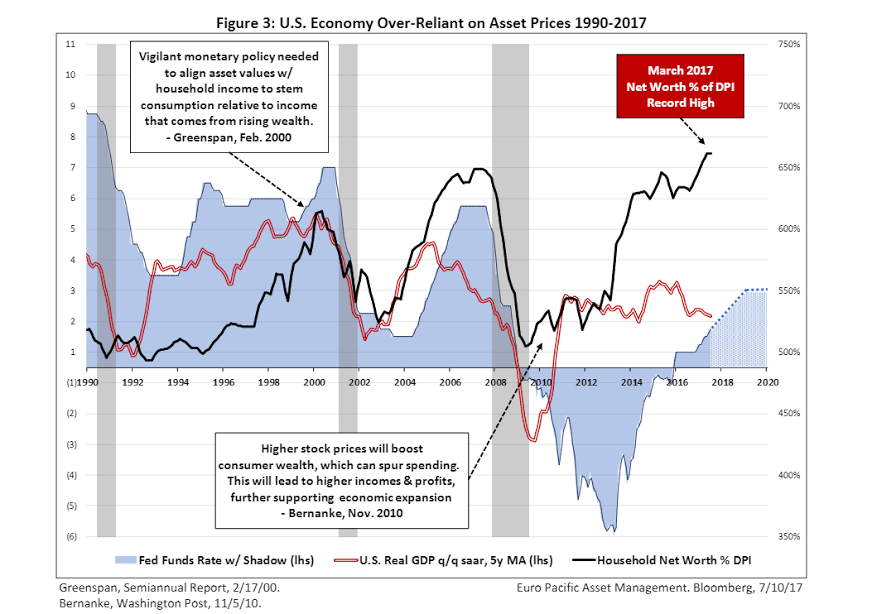

Asset prices as a % of real disposable income:

Question: You were joking about solar, right?

Trump: No, not joking, no. There is a chance that we can do a solar wall. We have major companies looking at that. Look, there’s no better place for solar than the Mexico border — the southern border. And there is a very good chance we can do a solar wall, which would actually look good. But there is a very good chance we could do a solar wall.

One of the things with the wall is you need transparency. You have to be able to see through it. In other words, if you can’t see through that wall — so it could be a steel wall with openings, but you have to have openings because you have to see what’s on the other side of the wall.

And I’ll give you an example. As horrible as it sounds, when they throw the large sacks of drugs over, and if you have people on the other side of the wall, you don’t see them — they hit you on the head with 60 pounds of stuff? It’s over. As cray as that sounds, you need transparency through that wall. But we have some incredible designs.