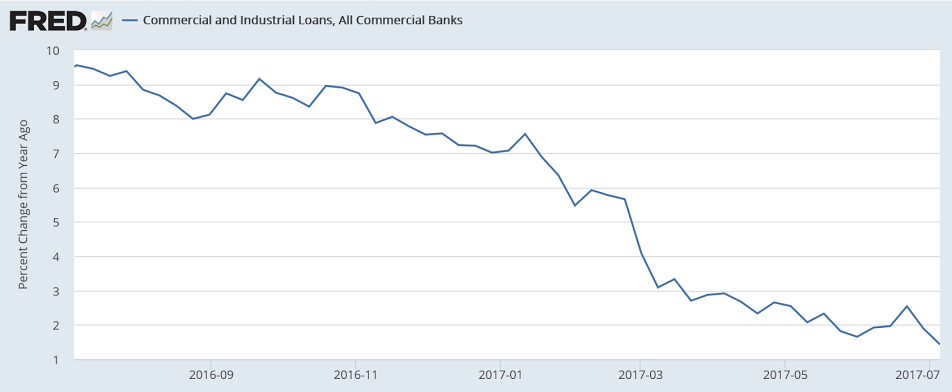

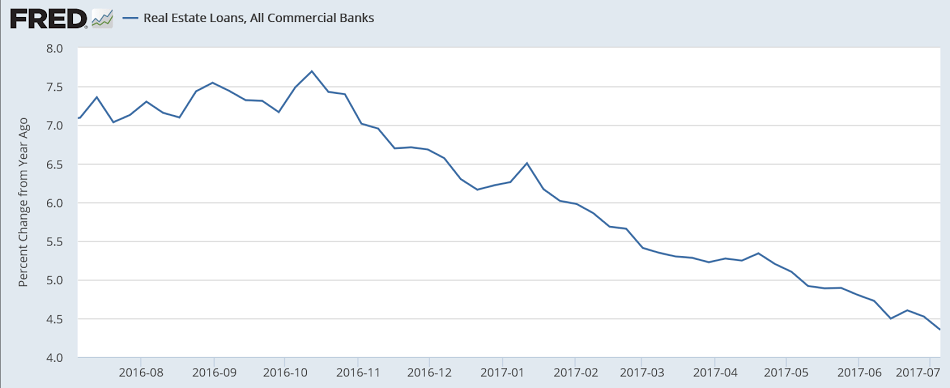

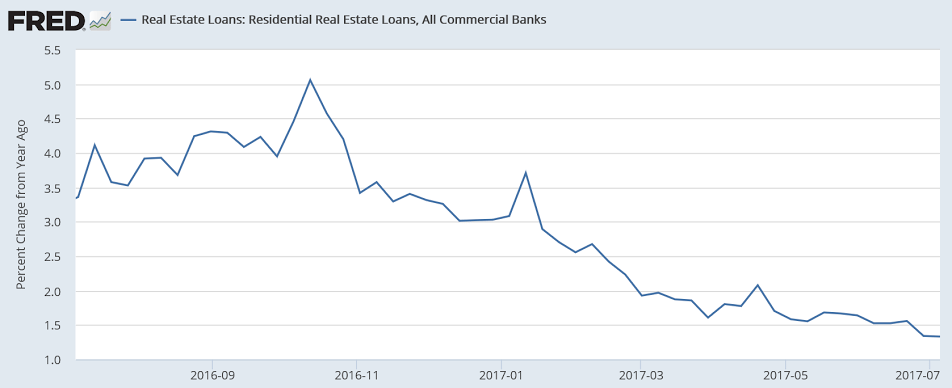

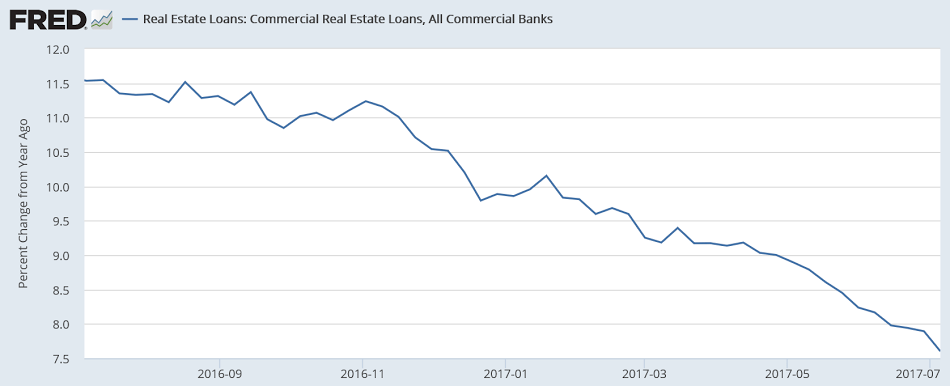

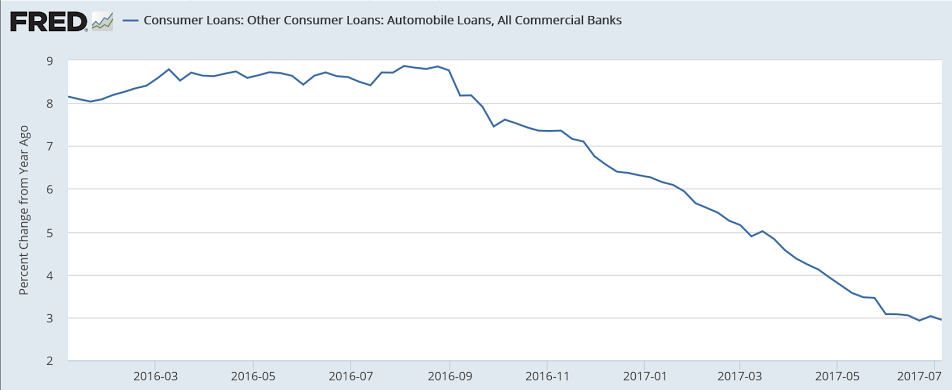

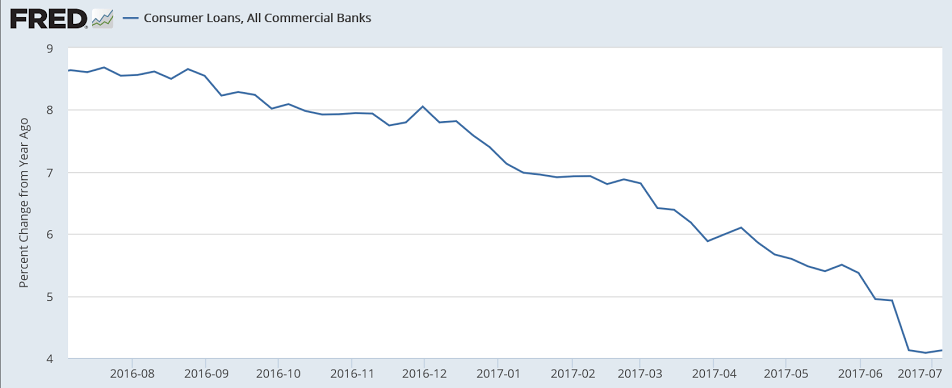

Still decelerating, and data releases seem to confirm that the credit deceleration is reflecting something similar in the macro economy:

Annual growth is down to about 1.5%:

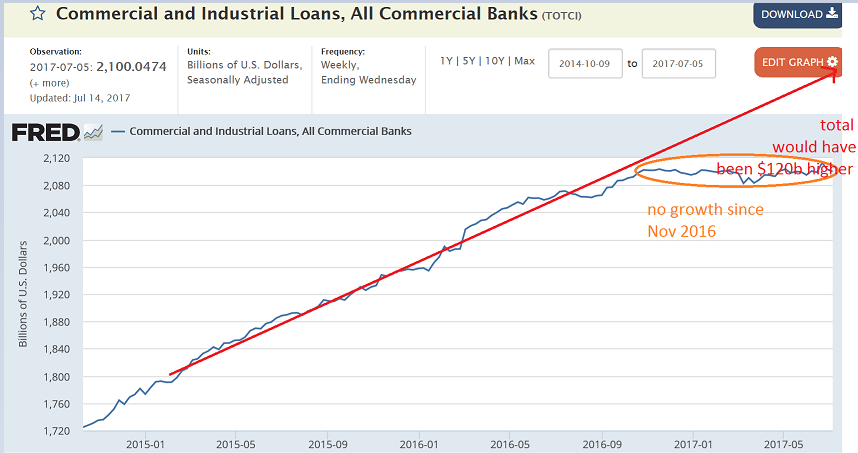

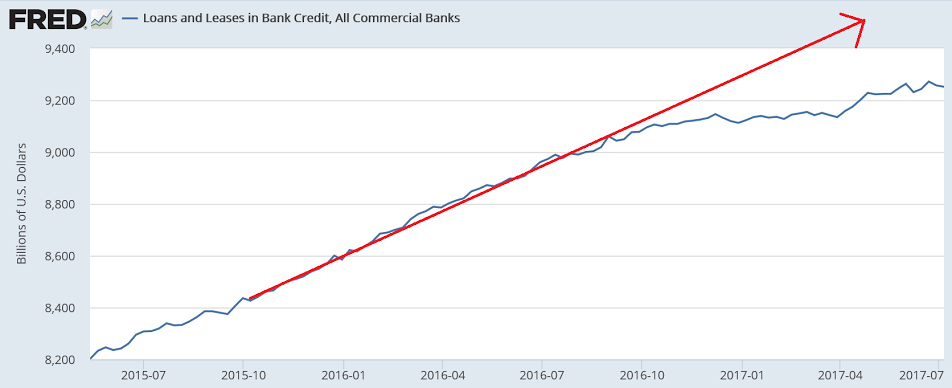

This would have been maybe $500 billion higher if it had not decelerated:

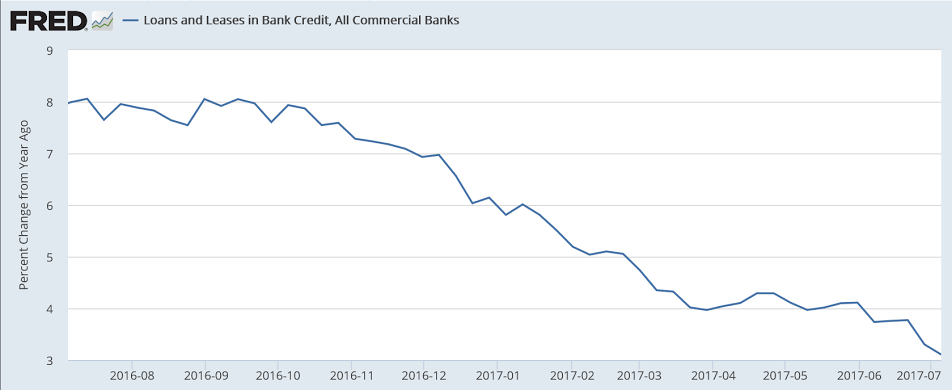

Housing and cars contribution to growth also looking a lot lower than last year:

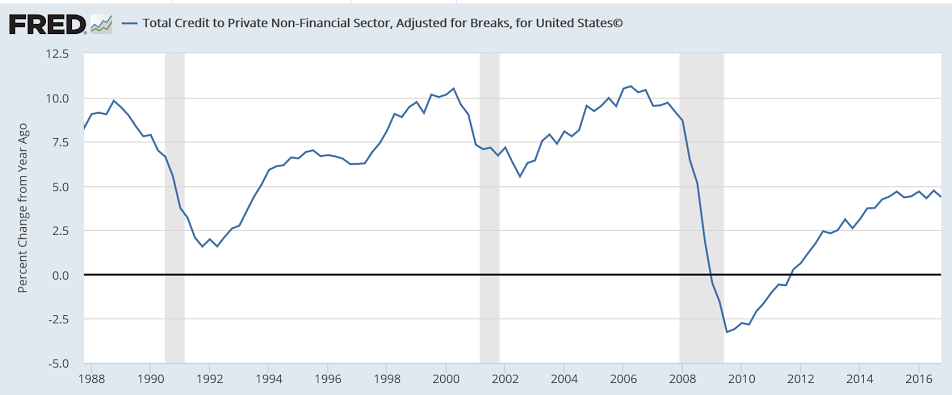

This chart is only through year end. It’s since decelerated as per the above current charts. Note how the downturn in credit growth tends to lead recessions:

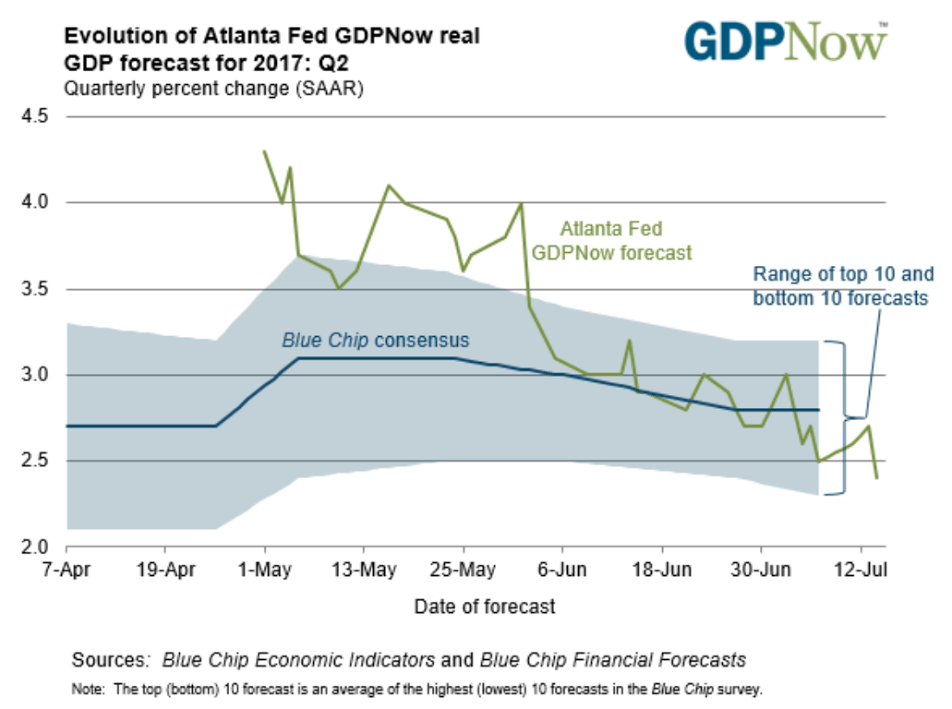

And forecasts for last quarter, Q2, continue to fall: