So someone on high sees it much like I do…

;)

In a white paper dissecting the U.S. central bank’s actions to stem the financial crisis in 2008 and 2009, Stephen D. Williamson, vice president of the St. Louis Fed, finds fault with three key policy tenets.

Specifically, he believes the zero interest rates in place since 2008 that were designed to spark good inflation actually have resulted in just the opposite. And he believes the “forward guidance” the Fed has used to communicate its intentions has instead been a muddle of broken vows that has served only to confuse investors. Finally, he asserts thatquantitative easing, or the monthly debt purchases that swelled the central bank’s balance sheet past the $4.5 trillion mark, have at best a tenuous link to actual economic improvements.

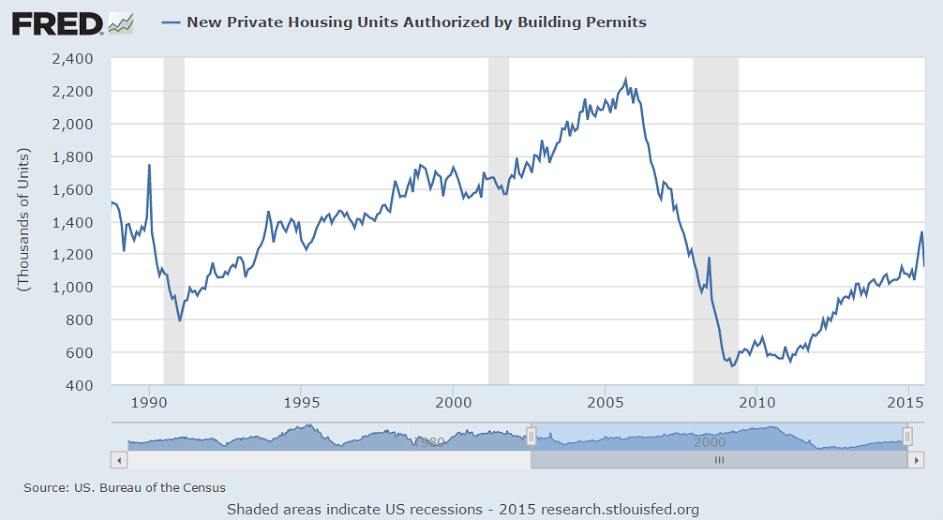

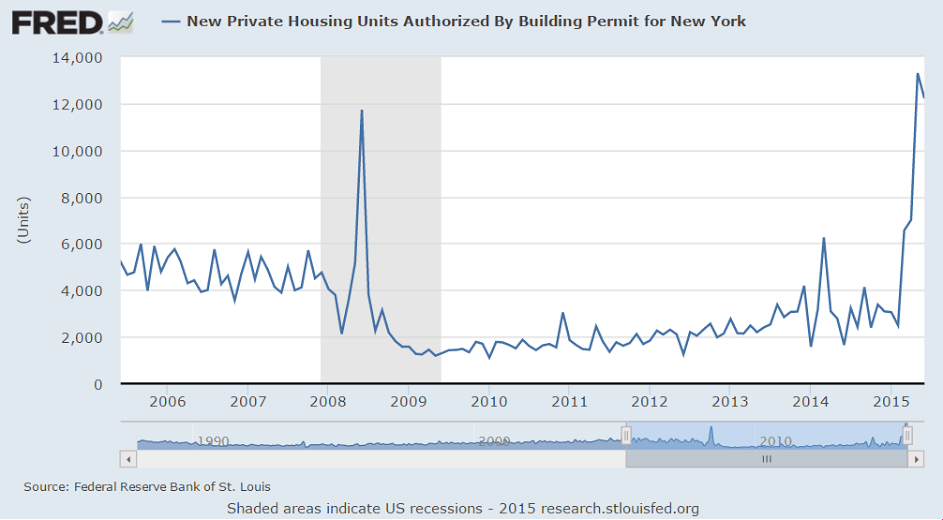

Remember last month cautioning about how a spike up in building permits has sometimes been followed by recession?

And the NY benefits that expired June 15 were supporting the total numbers and are likely to be followed by much lower numbers:

Once again Varoufakis reconfirms he’s clueless with regard to public finance:

Varoufakis Proposal for Eurozone Sovereign Debt

August 18 (Econintersect) — Former Greek finance minister Yanis Varoufakis has proposed a debt restructuring process for over-indebted Eurozone countries that does not involve writing down debt or bailing out insolvent countries. It is based on an idea proposed by Varoufakis with Stuart Holland and James K. Galbraith (link below).

The proposal is for a complex and costly process functionally identical to a simple, no cost, ECB guarantee.

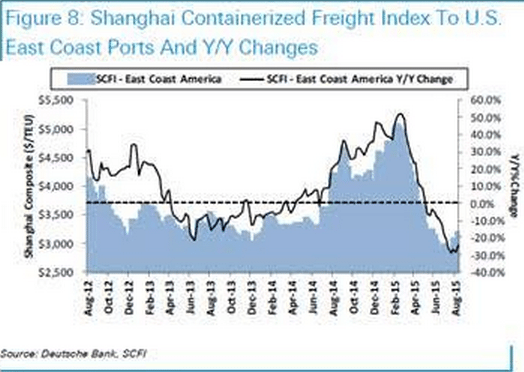

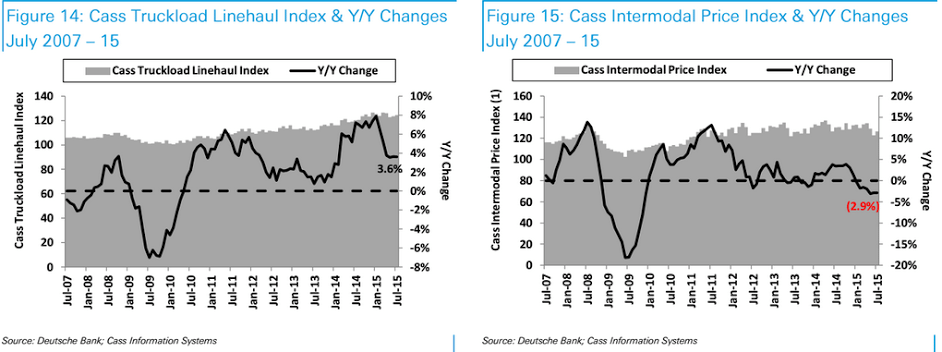

DB Charts:

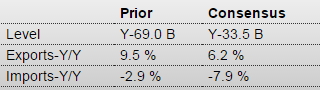

Exports growing though at a slower rate, imports declining at a faster rate: