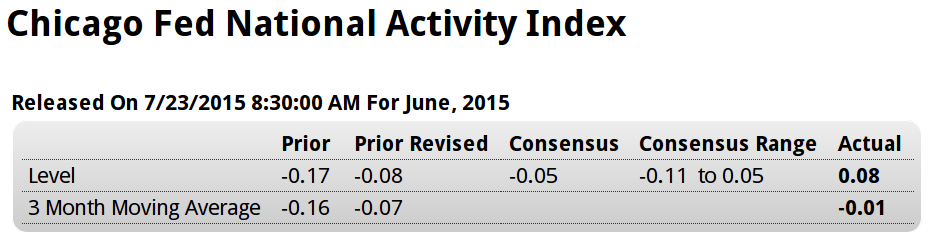

Note the details and the conclusion:

source: Econoday

Highlights

June proved to be a slightly stronger month for the economy than expected, based on the national activity index which came in at plus 0.08 vs Econoday expectations for a 0.05 dip. The 3-month average is still in the negative column though just barely at minus 0.01.

Production indicators showed the most improvement in June, at minus 0.01 vs minus 0.08 in May. The gain here reflects strength in the utilities and mining components of the industrial production report where, however, manufacturing remained flat. Employment also improved, to plus 0.12 from May’s plus 0.06, here reflecting the 2 tenth downtick in the unemployment rate to 5.3 percent. This dip, however, was tied to a decrease in those looking for work which is not a sign of job strength. Personal consumption & housing, at minus 0.07, was little changed as was the sales/orders/inventories component at plus 0.03.

This report is a bit of a head fake, not reflecting the weakness in manufacturing and the special factor behind the decline in the unemployment rate. In sum, growth in the economy is no better than the historical average which is a disappointment, showing little bounce from the weak first quarter.

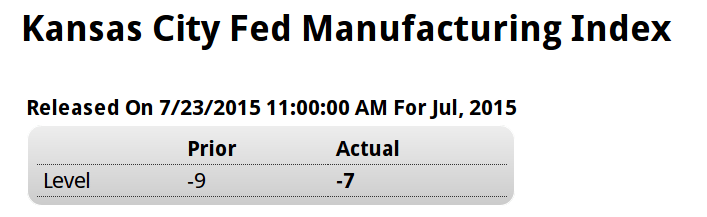

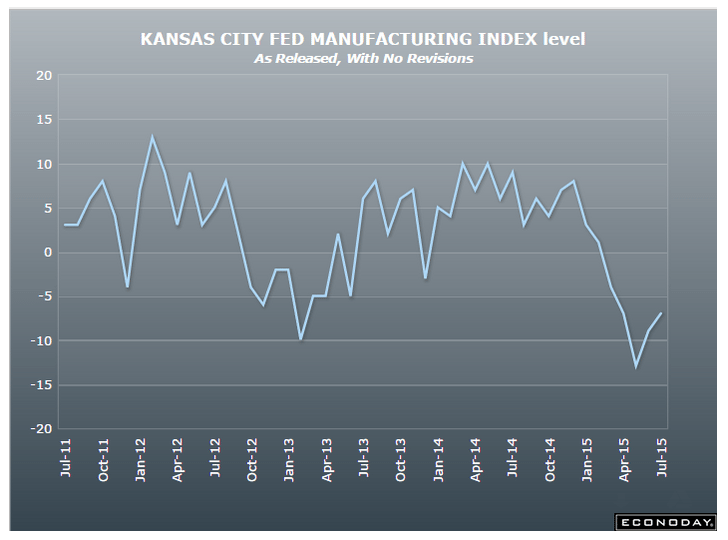

Unambiguously negative, again:

source: Econoday

Highlights

Deep continuing contraction is the score for the Kansas City manufacturing report where the headline index is little changed at minus 7. Order readings point to more trouble ahead with new orders at minus 6 and backlog orders at minus 14. Weakness in export orders, at minus 10, is a central negative for the report, as is hiring, at minus 19 and the workweek at minus 18. Price readings are steady and mute. This region’s manufacturing sector, hurt by both exports and the energy sector, is badly depressed as is the Dallas manufacturing sector. Regional July reports from Dallas and Richmond will be posted early next week to round out the view for what looks to be another weak month for manufacturing.

More signs the US trade deficit will be larger for Q2.

From Japan:

Exports to Asia were up 10.1 percent on the year while those to China were 5.9 percent higher. Exports to the European Union added 10.8 percent. It was the seventh consecutive increase. Exports to the U.S. climbed for the tenth straight month, this time by 17.6 percent.