This is interesting in that it isn’t showing any

pickup in consumer spending from the lower oil prices:

Redbook

Highlights

Retail sales picked up in the January 31 week based on Redbook’s sample whose year-on-year same-store sales rate rose 6 tenths from the prior week to plus 3.8 percent. TV sales and sales of food & beverages got a lift from the Super Bowl but other sales were held down by the week’s heavy weather which kept shoppers at home and closed stores. Clearance sales are expected to dominate sales activity in the weeks ahead as winter goods are moved out and spring goods moved in. Sales rates from Redbook were no better than moderate in January and are not pointing to a sales surge for the government’s ex-auto ex-gas reading, a reading that posted a disappointing decline in December.

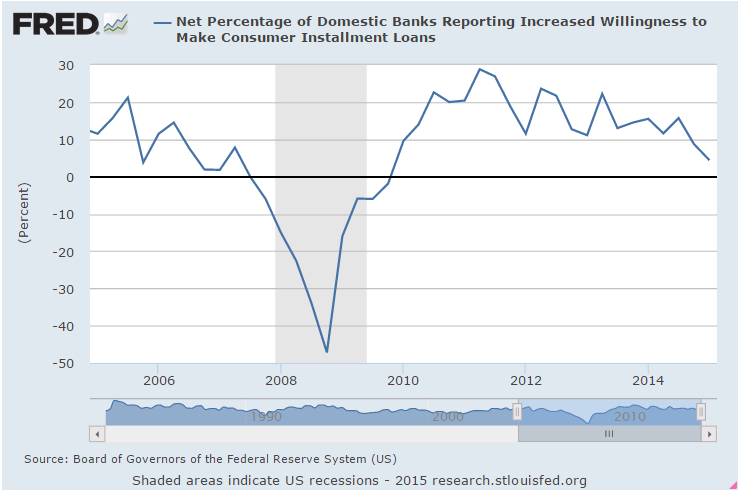

Nor are the banks impressed by the supposed new found consumer savings on fuel:

Even worse than the low expectations:

Factory Orders

Highlights

The headlines are once again very weak for the factory sector masking core readings that are less weak. Factory orders fell a very steep 3.4 percent in December for a 5th straight decline. This is the longest losing streak since the collapse of late 2008 and early 2009. Not helping is a full percentage point downward revision to November to minus 1.7 percent.

Turning first to the durables component, durables orders fell 3.3 percent in December, revised 1 tenth higher from the initial reading posted last week. But when excluding defense goods and civilian aircraft, which are two components subject to volatile monthly swings, durables orders actually rose 0.1 percent, breaking a string of three negative readings. Another core reading is also worth noting and that’s nondefense capital goods excluding aircraft which slipped only 0.1 percent for, however, a 4th straight decline.

Factory orders falls 3.4% in December, versus down 2.2% estimate

Feb 3 (Reuters) — New orders for U.S. factory goods fell for a fifth straight month in December, but a smaller-than-previously reported drop in business spending plans supported views of a rebound in the months ahead.

The Commerce Department said on Tuesday new orders for manufactured goods declined 3.4 percent as demand fell across a broad sector of industries.

November’s orders were revised to show a 1.7 percent drop instead of a previously reported 0.7 percent fall. Economists polled by Reuters had forecast new orders received by factories sliding 2.2 percent.

Manufacturing is slowing, constrained by weak global demand and falling crude oil prices, which have caused some companies in the energy sector to either delay or cut back on capital expenditure projects.

Business spending on equipment in the fourth quarter was the weakest since mid-2009. The soft trend in business investment likely persisted early into the first quarter, with a report on Monday showing a manufacturing sector gauge falling in January.

Factory activity has also been hampered by an ongoing labor dispute at the nation’s West Coast ports, which has caused shipment delays. But there is cautious optimism that firming domestic demand will limit the slowdown in manufacturing.

In December, factory orders excluding the volatile transportation category fell 2.3 percent, the biggest drop since March 2013, after declining 1.3 percent in November.

The Commerce Department also said orders for non-defense capital goods excluding aircraft—seen as a measure of business confidence and spending plans—slipped 0.1 percent instead of the 0.6 percent drop reported last month.

Overall orders for durable goods, manufactured products expected to last three years or more, fell 3.3 percent instead of the previously reported 3.4 percent decline.