I got this email supporting the idea that bank credit expansion has been at the expense of non bank lenders, with low total credit growth.

As previously discussed, I don’t see the credit growth necessary to sustain the 3%+ GDP growth being forecast. Instead, I see the q1 negative growth and H1 total growth of only 1.2% as indicative of the underlying trend.

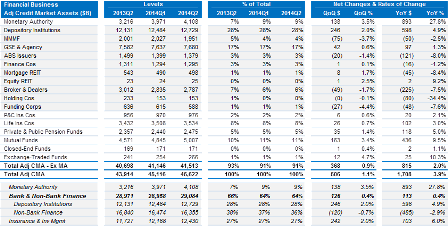

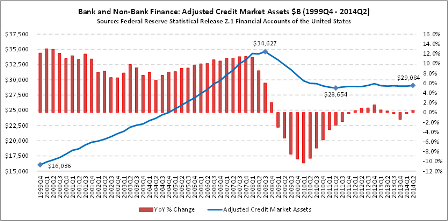

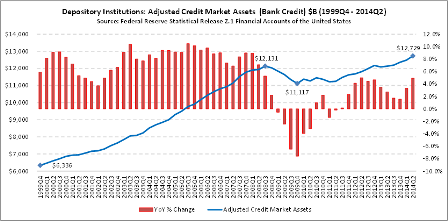

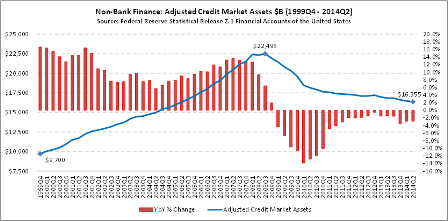

Warren: With respect to the recent “surge” in bank credit, please see below info that I prepared from Z.1. I recall you once suggesting that the expansion in bank credit may be attributed to banks taking share from non-bank lenders. Based on below table and graphs, that appears to be the case. When you combine bank and non-bank lenders (what I refer to as “Bank & Non-Bank Finance”), growth in credit market assets is essentially zero/nominal over recent periods, and you can see the recent increase in bank credit appears to be largely offset by a decrease in non-bank credit. Most non-banks are essentially “agents” of banks in my opinion so should view together for macro perspective. Note below that my definition of “Adjusted Credit Market Assets” is the FRB’s definition plus money market, rev repo and security credit. Not sure if this is the “correct” way to view things and I could be way off base but figured may be worth passing along. Also, for the “Insurance & Inv Mgmt” Sectors, I think the growth there may support your demand leakage narrative (but excludes equities). Thx

Full size image

Full size image

Full size image

Full size image