First this, supporting what I’ve been writing about all along:

Here’s Proof That Congress Has Been Dragging Down The Economy For Years

By Shane Ferro

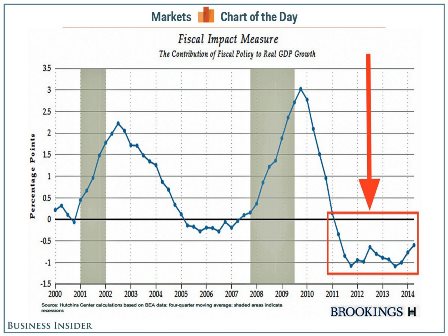

Oct 8 (Business Insider) — In honor of the new fiscal year, the Brookings Institution released the Fiscal Impact Measure, an interactive chart by senior fellow Louise Sheiner that shows how the balance of government spending and tax revenues have affected US GDP growth.

The takeaway? Fiscal policies have been a drag on economic growth since 2011.

Full size image

And earlier today it was announced that August wholesale sales were down .7%, while inventories were up .7%. This means they produced the same but sold less and the unsold inventory is still there. Not good!

Unfortunately the Fed has the interest rate thing backwards, as in fact rate cuts slow the economy and depress inflation. So with the Fed thinking the economy is too weak to hike rates, they leave rates at 0 which ironically keeps the economy where it is. Not that I would raise rates to help the economy. Instead I’ve proposed fiscal measures, as previously discussed.

Fed Minutes Show Concern About Weak Overseas Growth, Strong Dollar (WSJ) “Some participants expressed concern that the persistent shortfall of economic growth and inflation in the euro area could lead to a further appreciation of the dollar and have adverse effects on the U.S. external sector,” according to the minutes. “Several participants added that slower economic growth in China or Japan or unanticipated events in the Middle East or Ukraine might pose a similar risk.” “Several participants thought that the current forward guidance regarding the federal funds rate suggested a longer period before liftoff, and perhaps also a more gradual increase in the federal funds rate thereafter, than they believed was likely to be appropriate given economic and financial conditions,” the minutes said.

The case for patience strengthens yet further by a consideration of the risks around the outlook. Across GS economics and markets research, we have recently cut our 2015 growth forecasts for China, Germany, and Italy, noted the continued weakness in Japan, and made a further upgrade to our already-bullish dollar views. So far, our analysis suggests that the spillovers from foreign demand weakness and currency appreciation only pose modest risks to US growth and inflation. But at the margin they amplify the asymmetric risks facing monetary policy at the zero bound emphasized by Chicago Fed President Charles Evans. If the FOMC raises the funds rate too late and inflation moves modestly above the 2% target, little is lost. But if the committee hikes too early and has to reverse course, the consequences are potentially more serious given the limited tools available at the zero bound for short-term rates.

Germany not looking good:

German exports plunge by largest amount in five-and-a-half years (Reuters) German exports slumped by 5.8 percent in August, their biggest fall since the height of the global financial crisis in January 2009. The Federal Statistics Office said late-falling summer vacations in some German states had contributed to the fall in both exports and imports. Seasonally adjusted imports falling 1.3 percent on the month, after rising 4.8 percent in July. The trade surplus stood at 17.5 billion euros, down from 22.2 billion euros in July and less than a forecast 18.5 billion euros. Later on Thursday a group of leading economic institutes is poised to sharply cut its forecasts for German growth. The top economic priority of Merkel’s government is to deliver on its promise of a federal budget that is in the black in 2015.

UK peaking?

London house prices fall in Sept. for first time since 2011: RICS (Reuters) The Royal Institution of Chartered Surveyors said prices in London fell for the first time since January 2011. The RICS national balance slid to +30 for September from a downwardly revised +39 in August. The RICS data is based on its members’ views on whether house prices in particular regions have risen or fallen in the past three months. British house prices are around 10 percent higher than a year ago, and house prices in London have risen by more than twice that. Over the next 12 months, they predict prices will rise 1 percent in London and 2 percent in Britain as a whole. Over the next five years, it expects average annual price growth of just under 5 percent.

British Chambers of Commerce warns of ‘alarm bell’ for UK recovery (Reuters) “The strong upsurge in manufacturing at the start of the year appears to have run its course. We may be hearing the first alarm bell for the UK,” said British Chambers of Commerce director-general John Longworth. The BCC said growth in goods exports as well as export orders for goods and services was its lowest since the fourth quarter of 2012. Services exports grew at the slowest rate since the third quarter of 2012. Manufacturers’ growth in domestic sales and orders slowed sharply from a record high in the second quarter to its lowest since the second quarter of 2013. However, sales remained strong in the services sector and confidence stayed high across the board.

Not to forget the stock market is a pretty fair leading indicator.

Some even say it causes what comes next: