Twin themes remain:

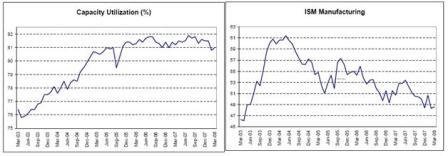

- Weakening demand continues from Q2 2006

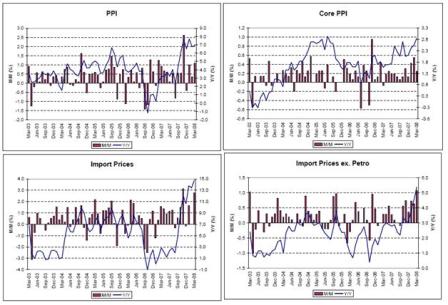

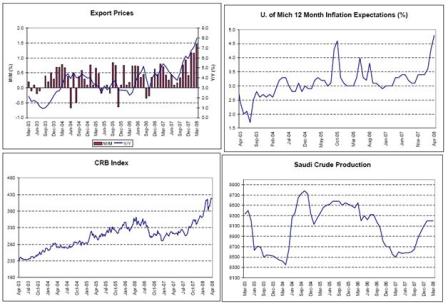

- Price indexes continue higher as Saudis continue to hike prices and let quantity adjust

Markets are pricing in the end of Fed Funds cuts due to diminished systemic deflationary risk and escalating inflation readings.

Down, but not out.

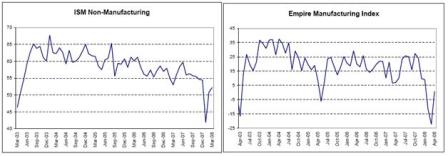

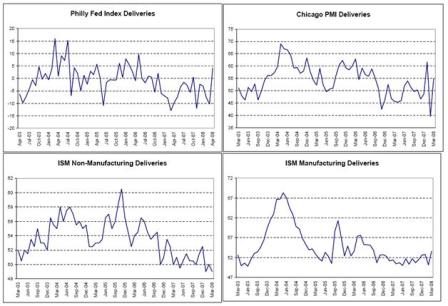

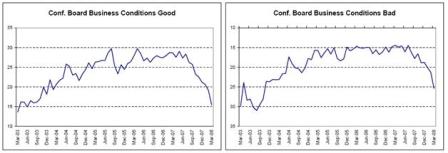

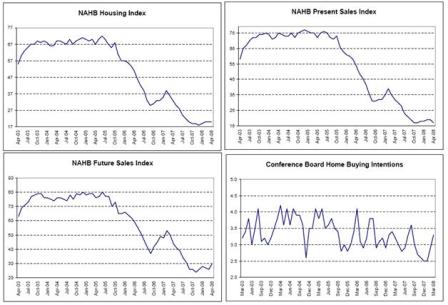

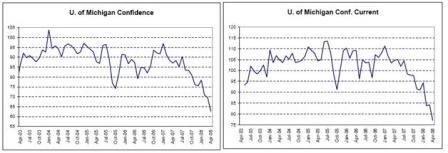

Most surveys are still trending down but not in collapse.

Actual deliveries still on the low side but exceeding expectations.

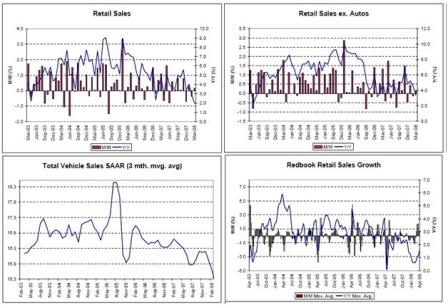

Weak but could be worse. Looking more and more like an export economy.

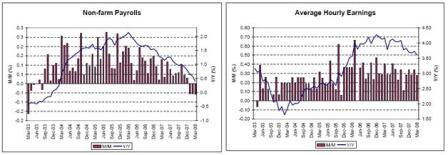

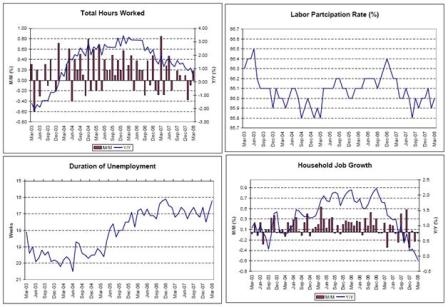

A weak first quarter for payrolls but above previous recession levels.

Weakness, but not all that bad yet, and jobless claims fell again last week.

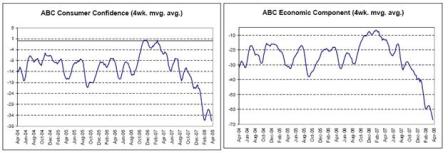

These kinds of surveys still looking very negative.

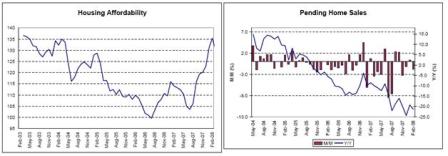

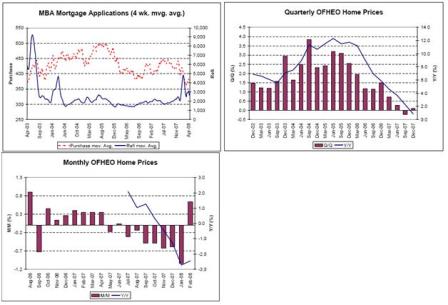

Housing may have stopped subtracting from GDP as of Q2.

Applications may be turning up after a slow Q1. Some signs home prices are stabilizing as well.

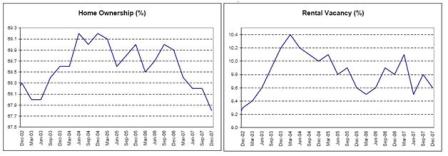

Low rental vacancies might support rent increases and the OER calculation in CPI.

Low home ownership due to negative sentiment means pent up buying demand.

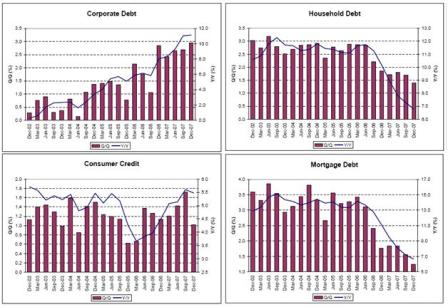

Households are recharging their debt batteries?

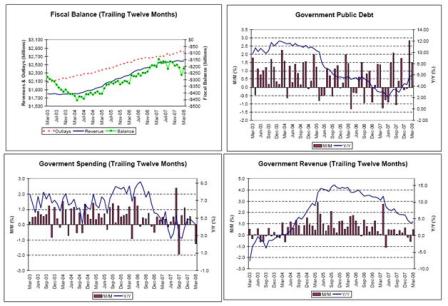

Net Federal spending on the rise this year, with fiscal package kicking in next week.

March government spending was down due to a timing issue – expect a strong increase in the June report.

Revenues muddling through at better than recession levels.

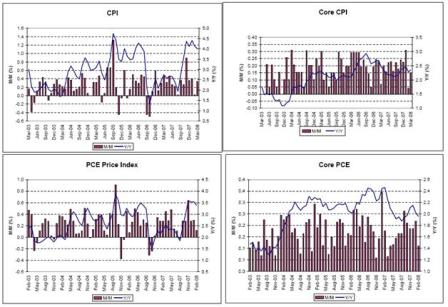

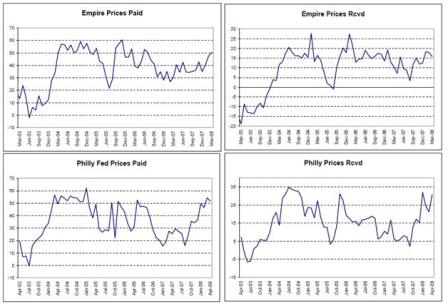

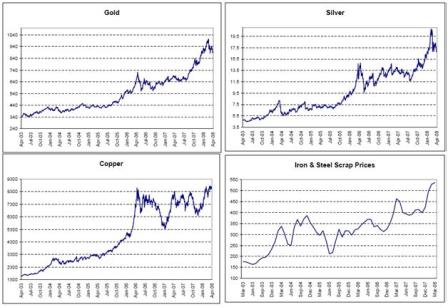

Inflation is ripping, and we will see next week if the Fed finally considers it the greater risk.

Many in the mainstream have thought it the greater risk all along with only the threat of catastrophic systemic deflationary risk due to ‘market functioning’ possibly the greater risk.

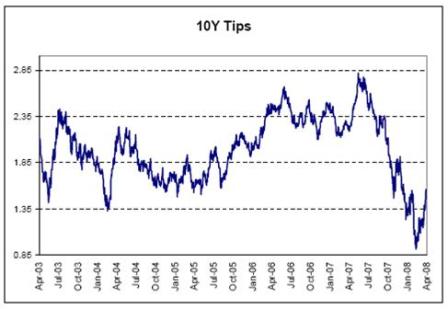

With the fear of catastrophic systemic risk fading and the Fed Funds rate below most inflation measures, markets have priced in a higher chance of the Fed not cutting the Fed Funds rate.

Saudi production remains firm at current prices; so, I expect more hikes.

Confidence remains very low, as the realities of an export economy and reduced real terms of trade hurt the lower income groups disproportionately.

Tips are starting to discount higher real rates from the Fed.

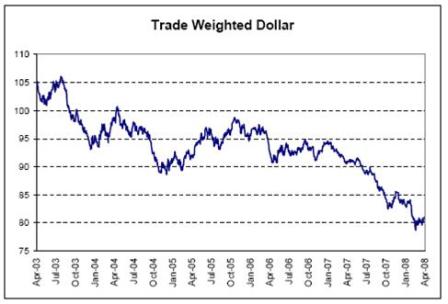

The dollar continues under pressure.

Without the support of the CBs and Monetary authorities, it may continue lower until the US trade gap narrows substantially.