Central Banks Are Stocking Up On Gold

Which Countries Own the Most Gold | SchiffGold

“Central banks purchase a net 270 tons of gold through the first half of the year. This fell in line with the five-year H1 average of 266 tons.”

This is the driving force behind gold. When central banks buy it, they pay for it by crediting a central bank member bank’s account on their own books. It is spending that adds to currency depreciation and ‘inflation’ in general. I call it off balance sheet deficit spending as it ‘doesn’t count’ as deficit spending as reported by the local government or international agencies like the IMF and World Bank. Note that Turkey was the largest buyer which I calculate to be about $5 billion of gold purchases.

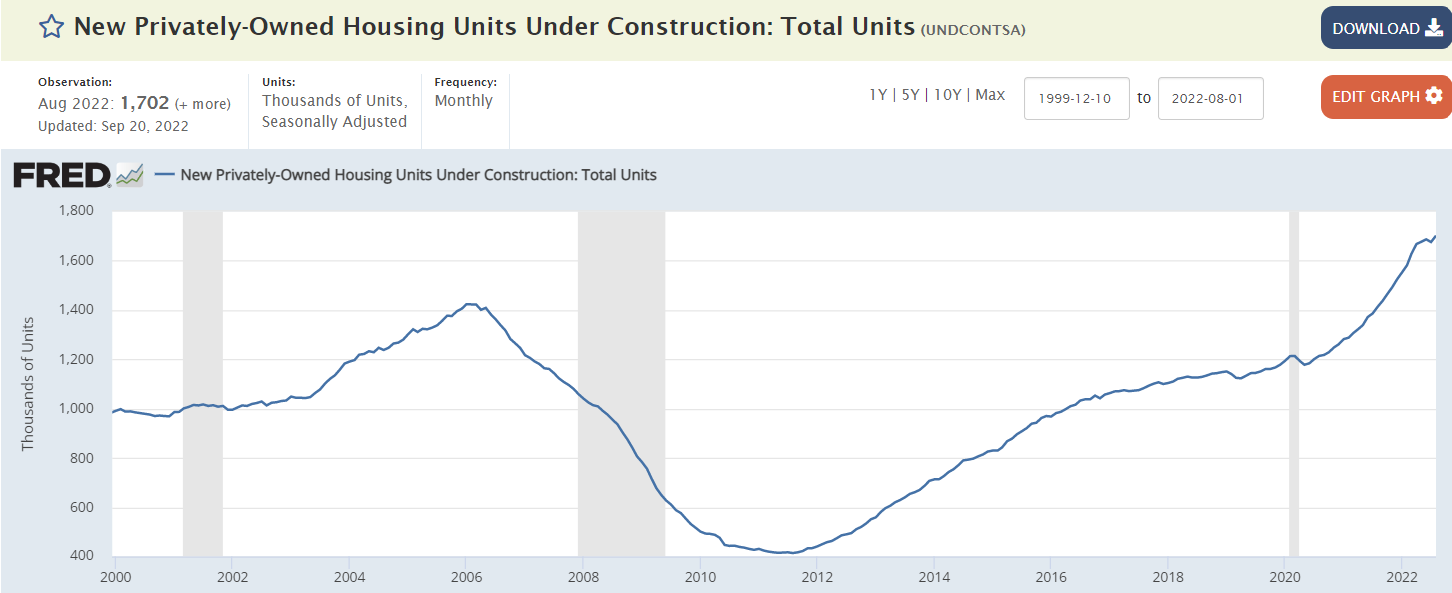

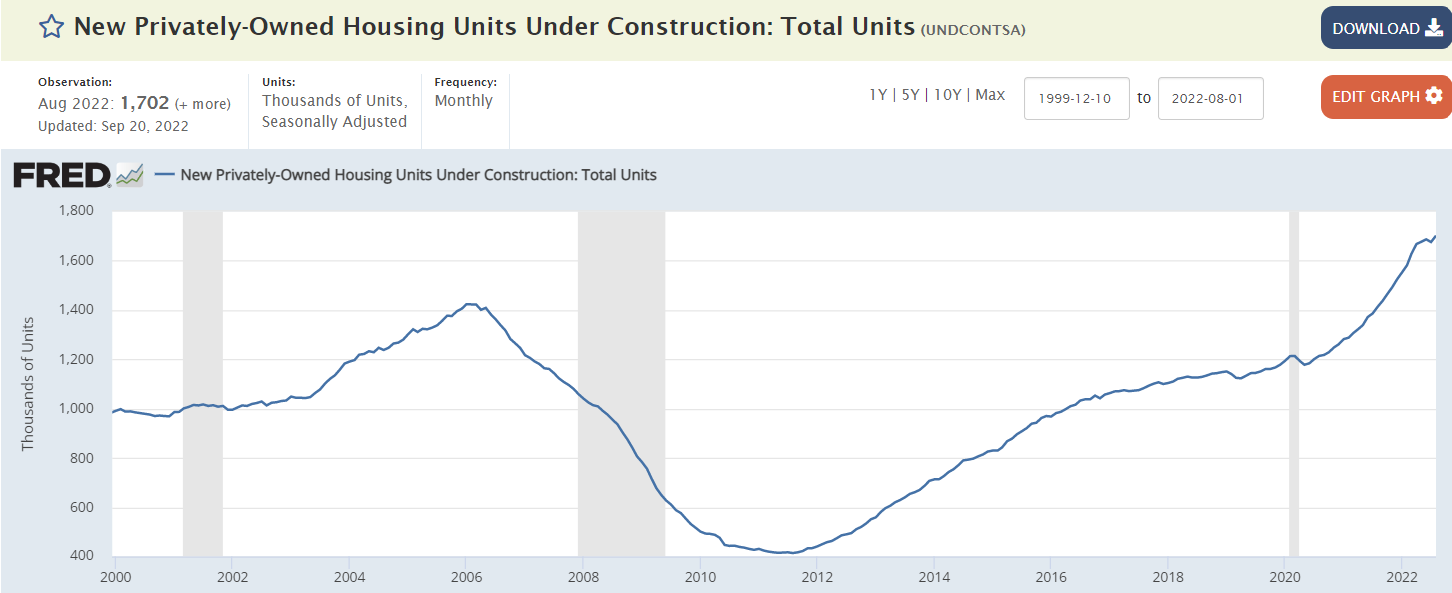

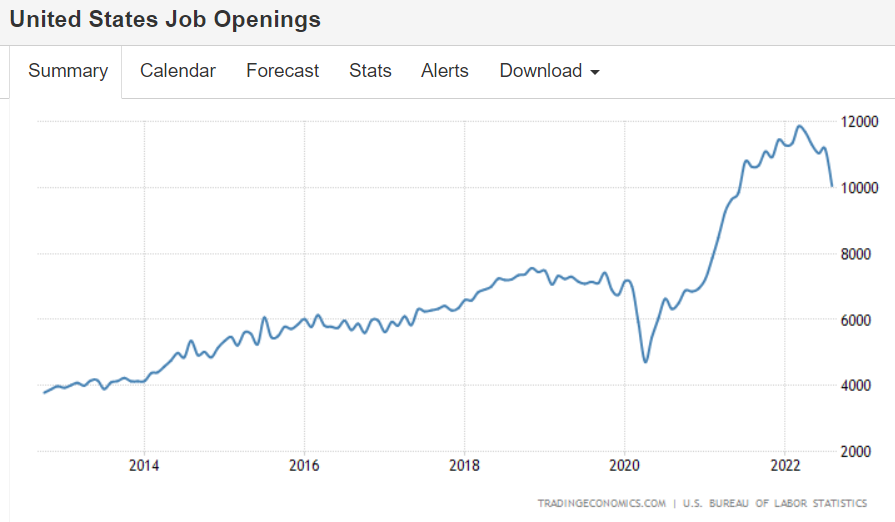

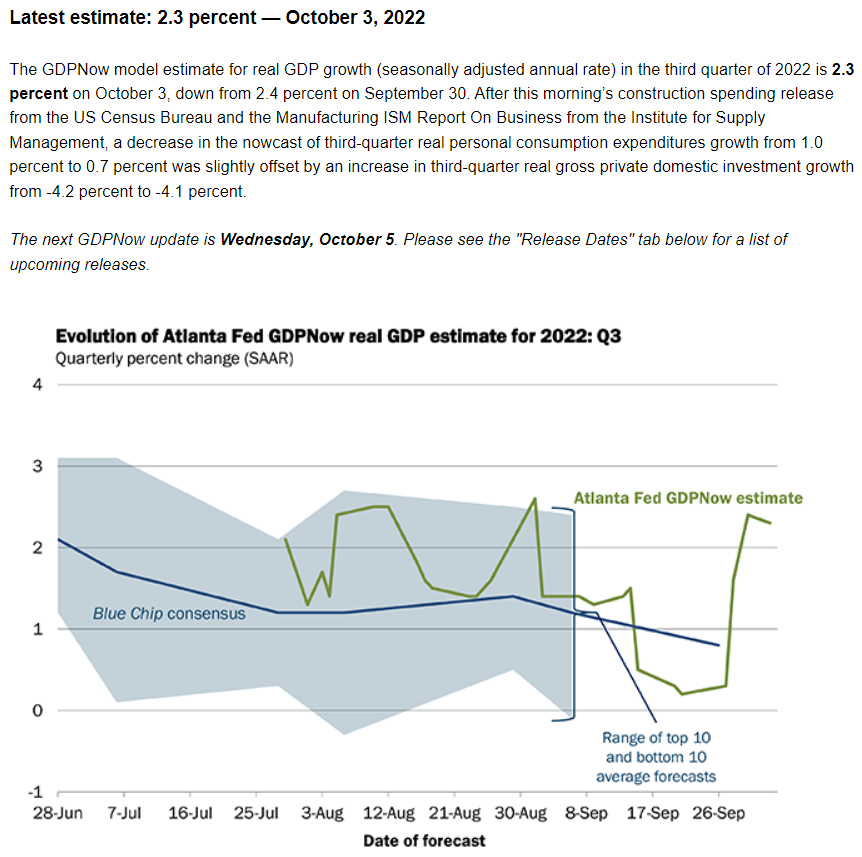

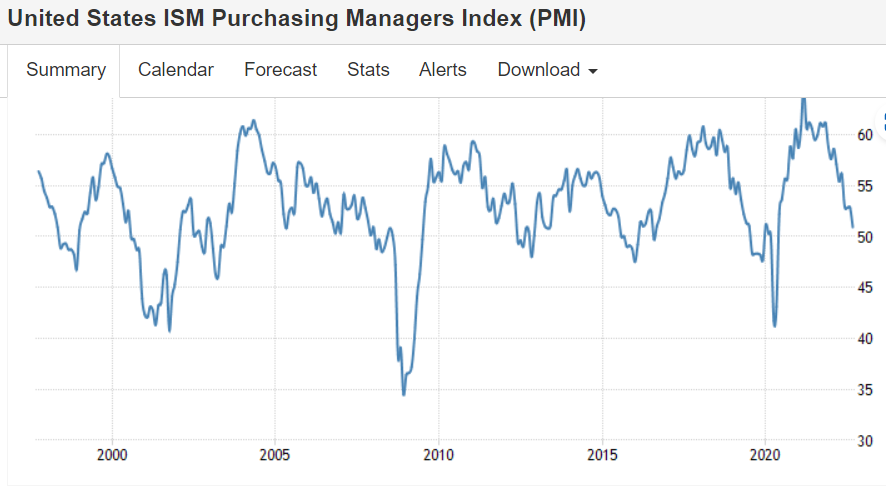

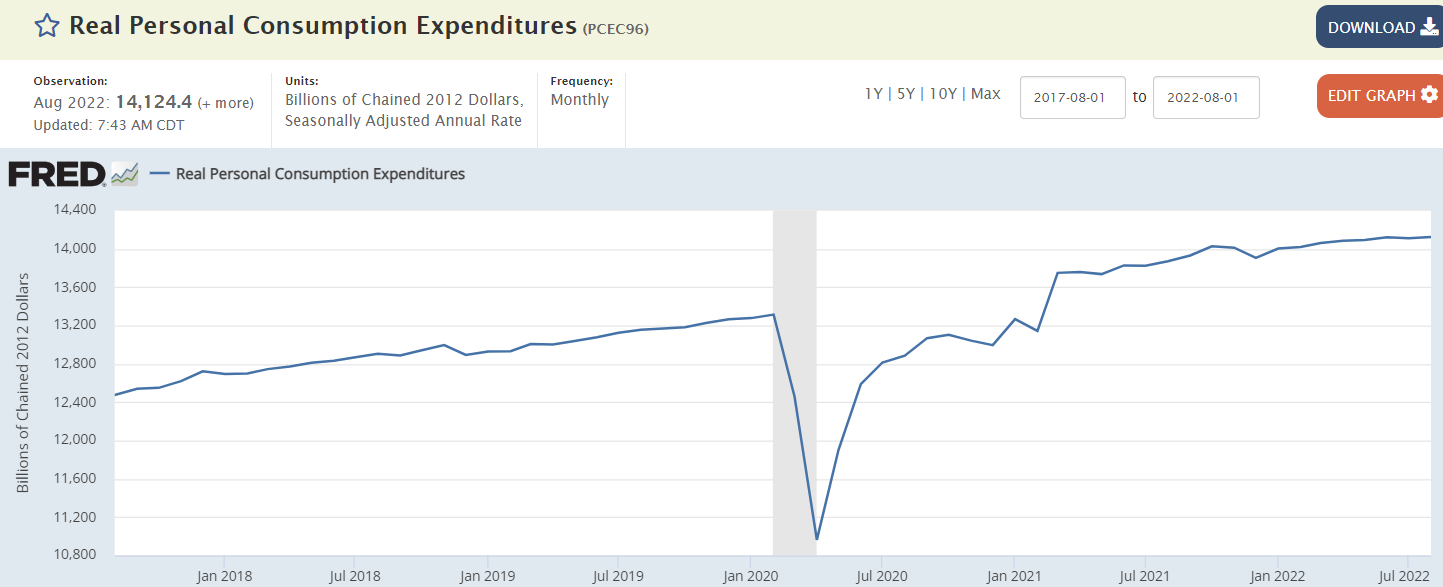

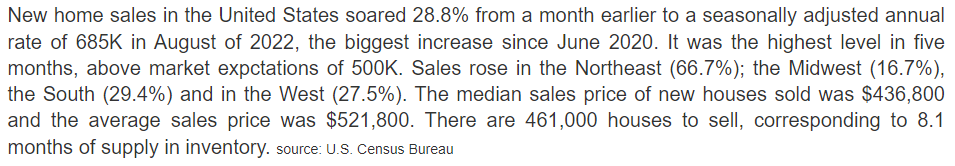

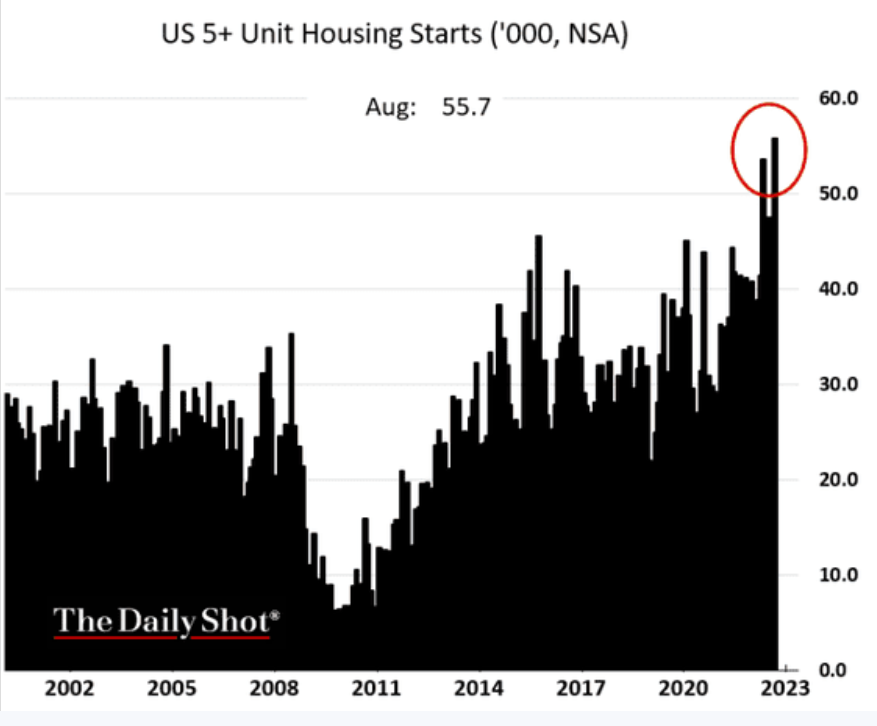

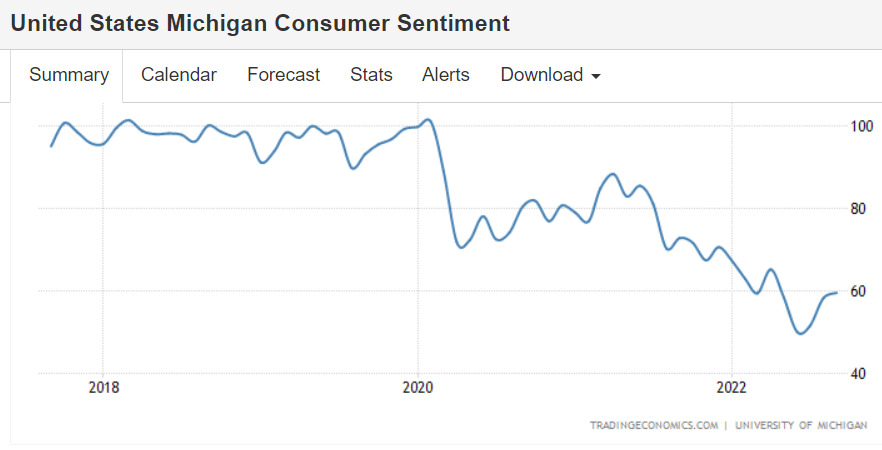

No sign of recession from rate hikes here:

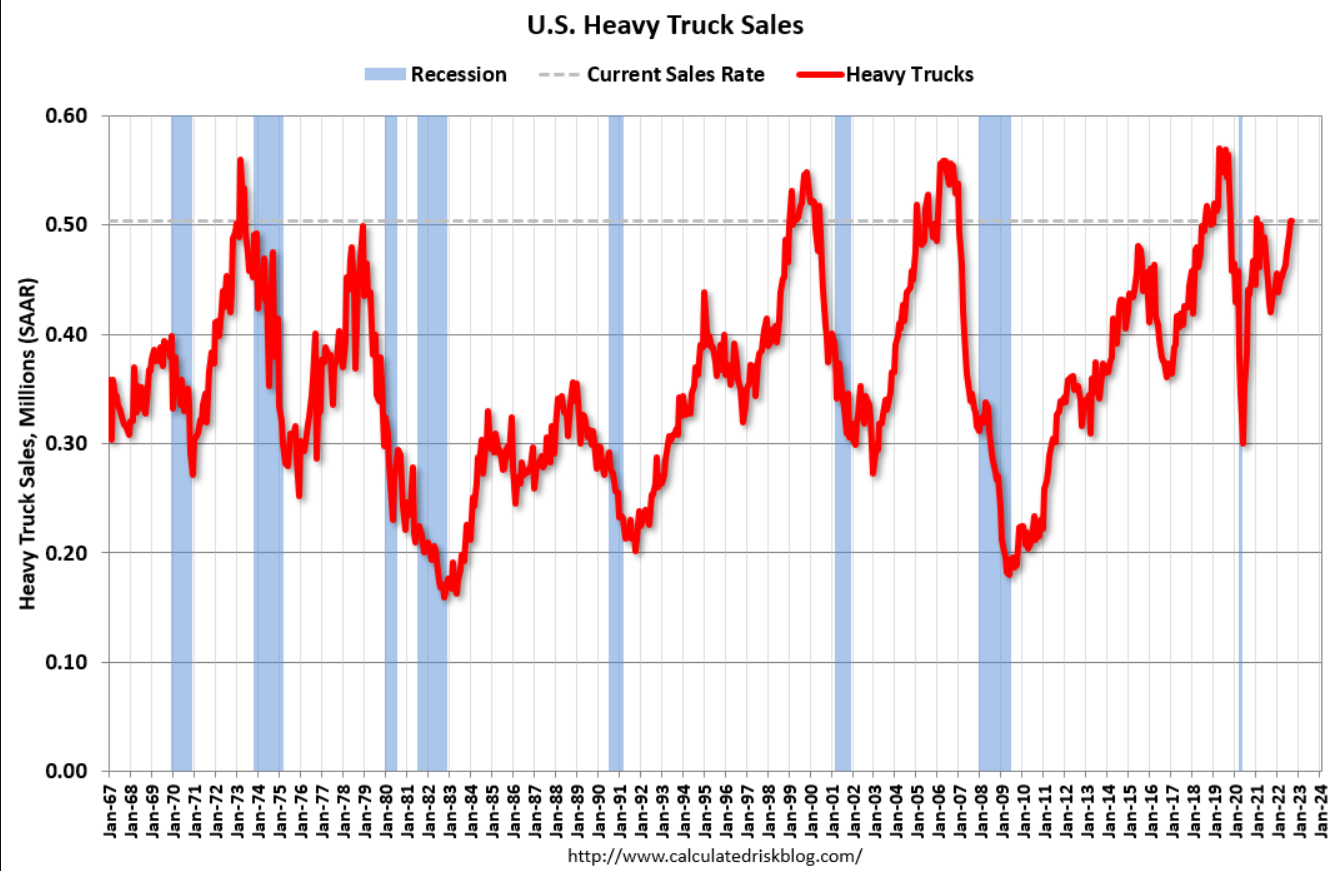

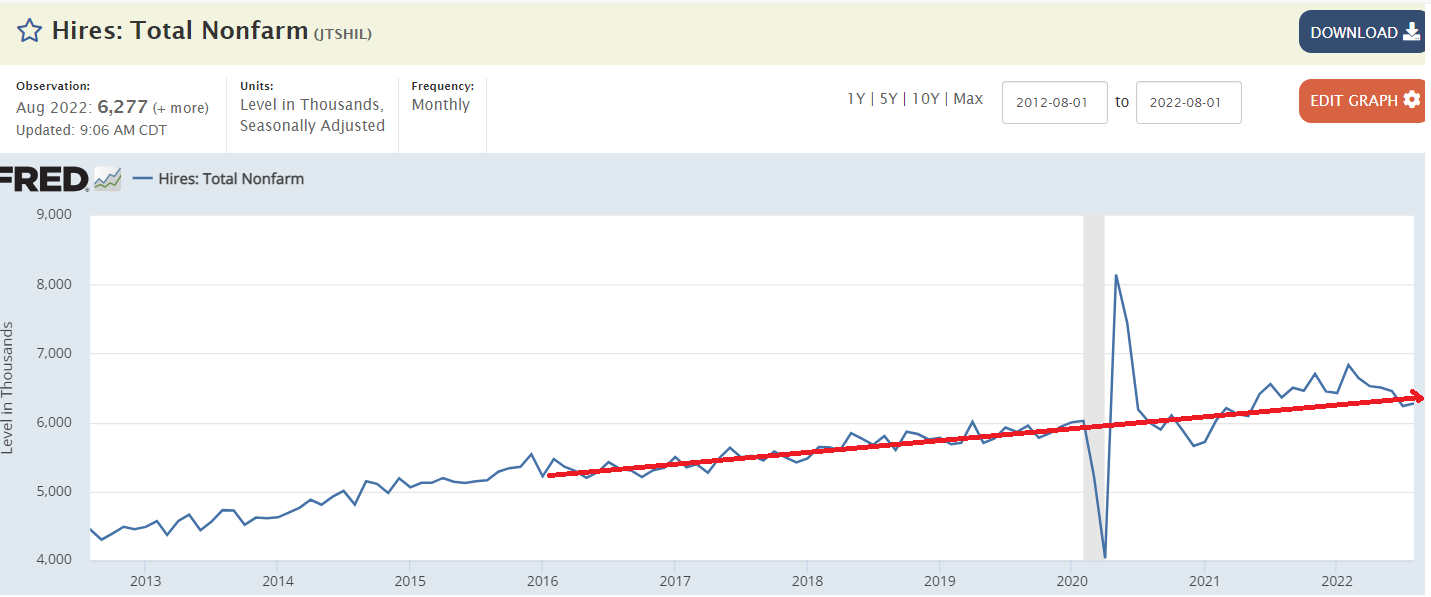

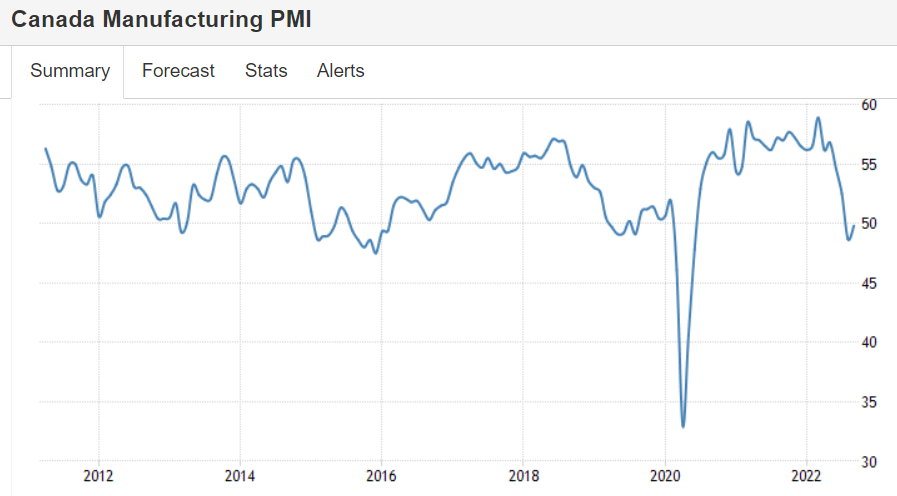

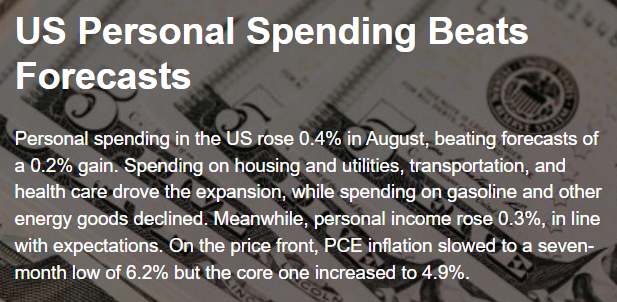

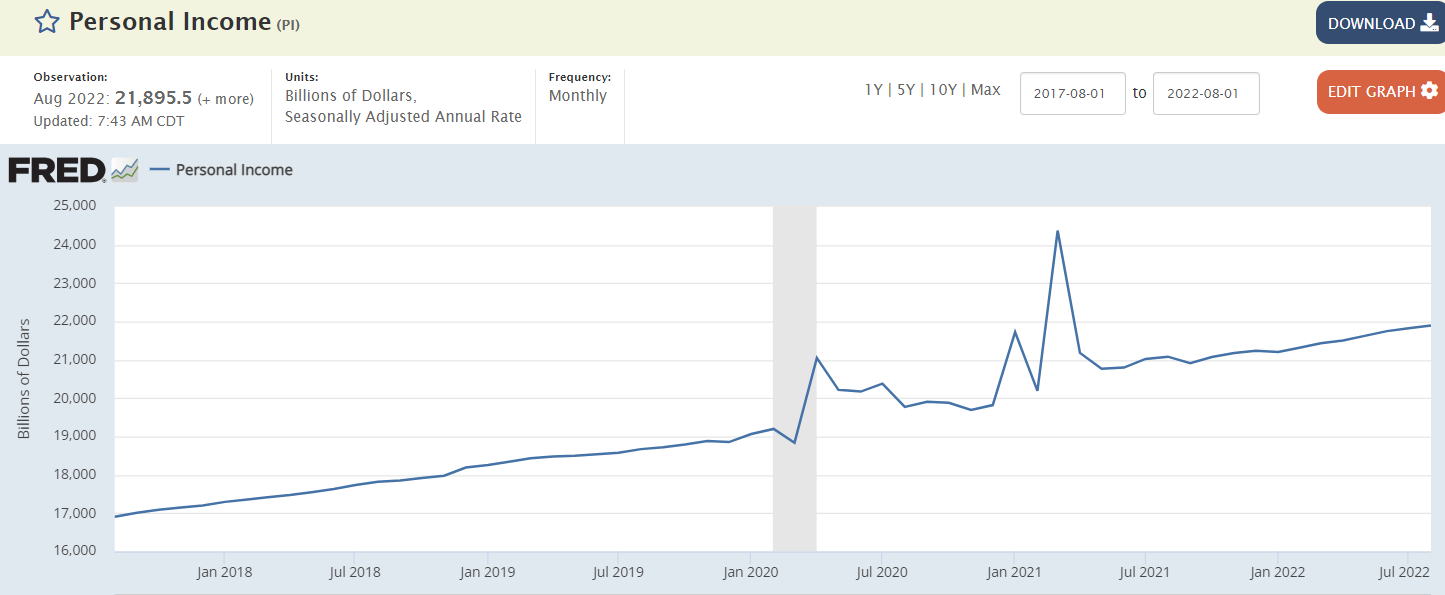

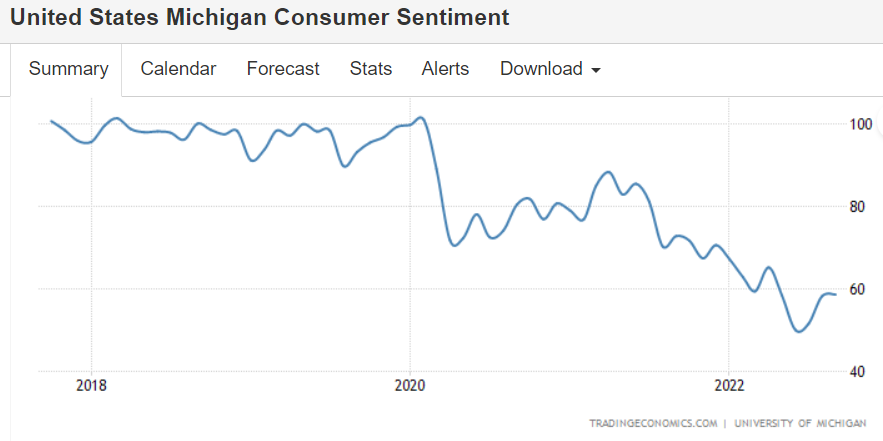

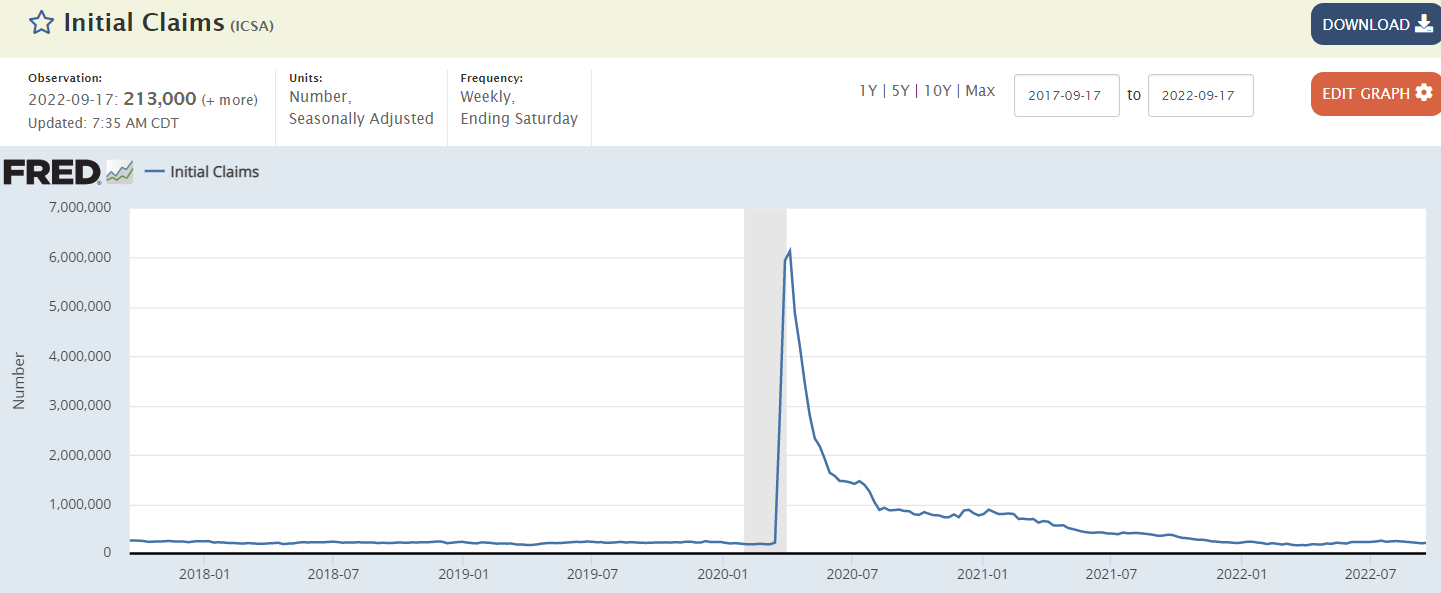

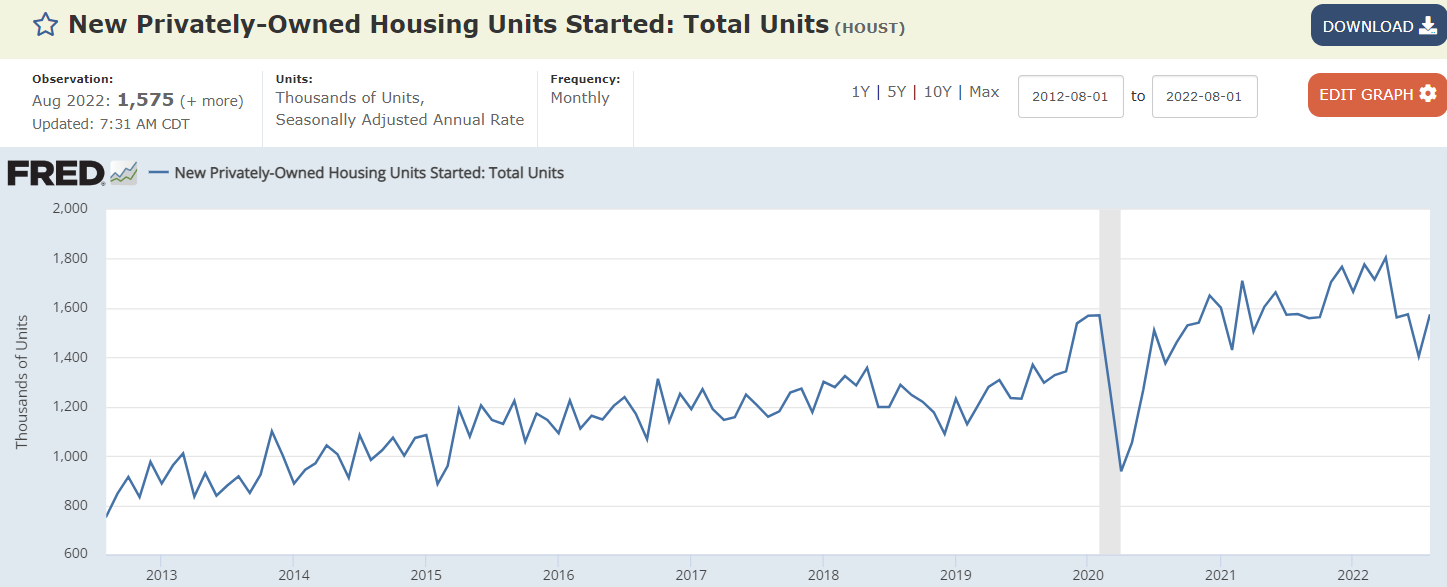

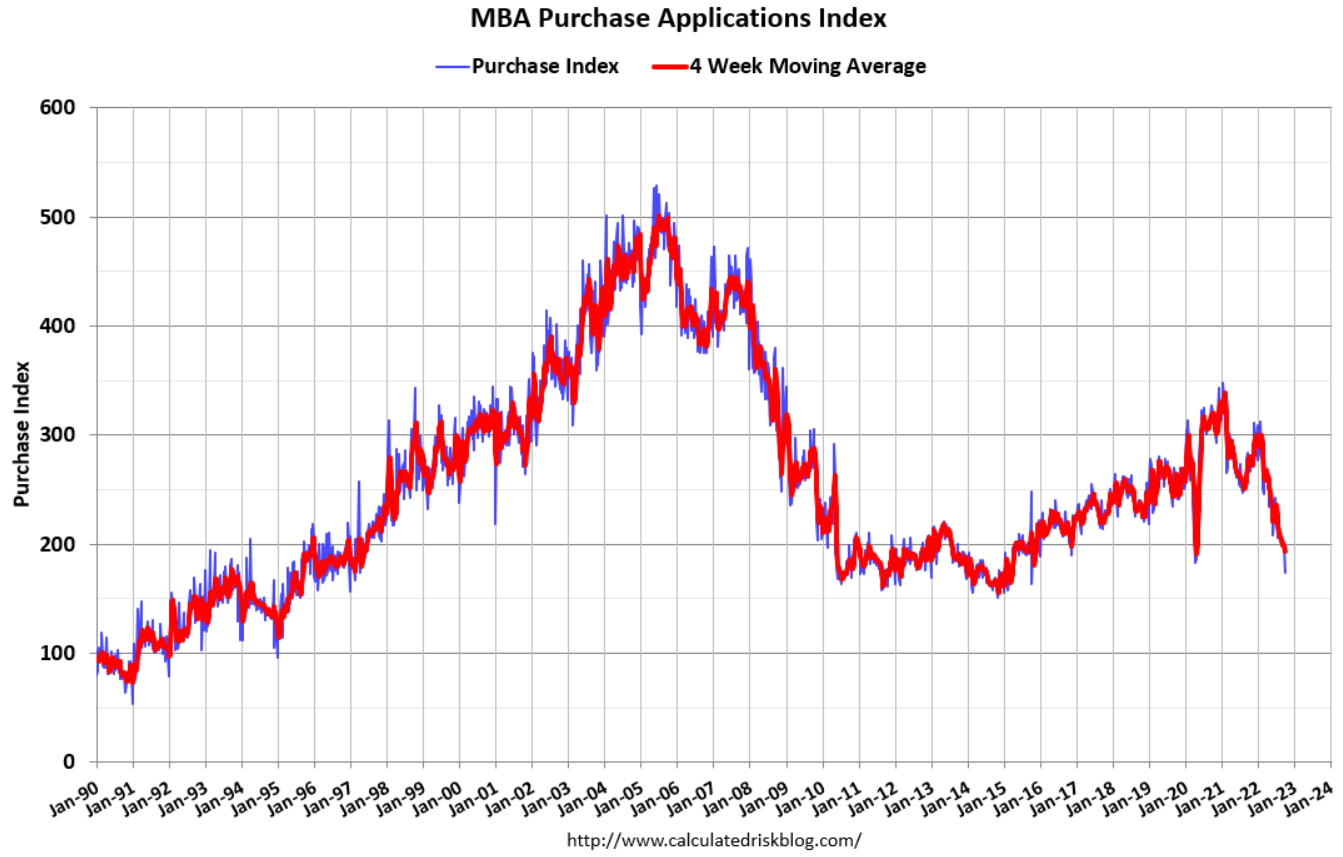

Lower than pre-Covid level, but seems to be going sideways since the rate hikes:

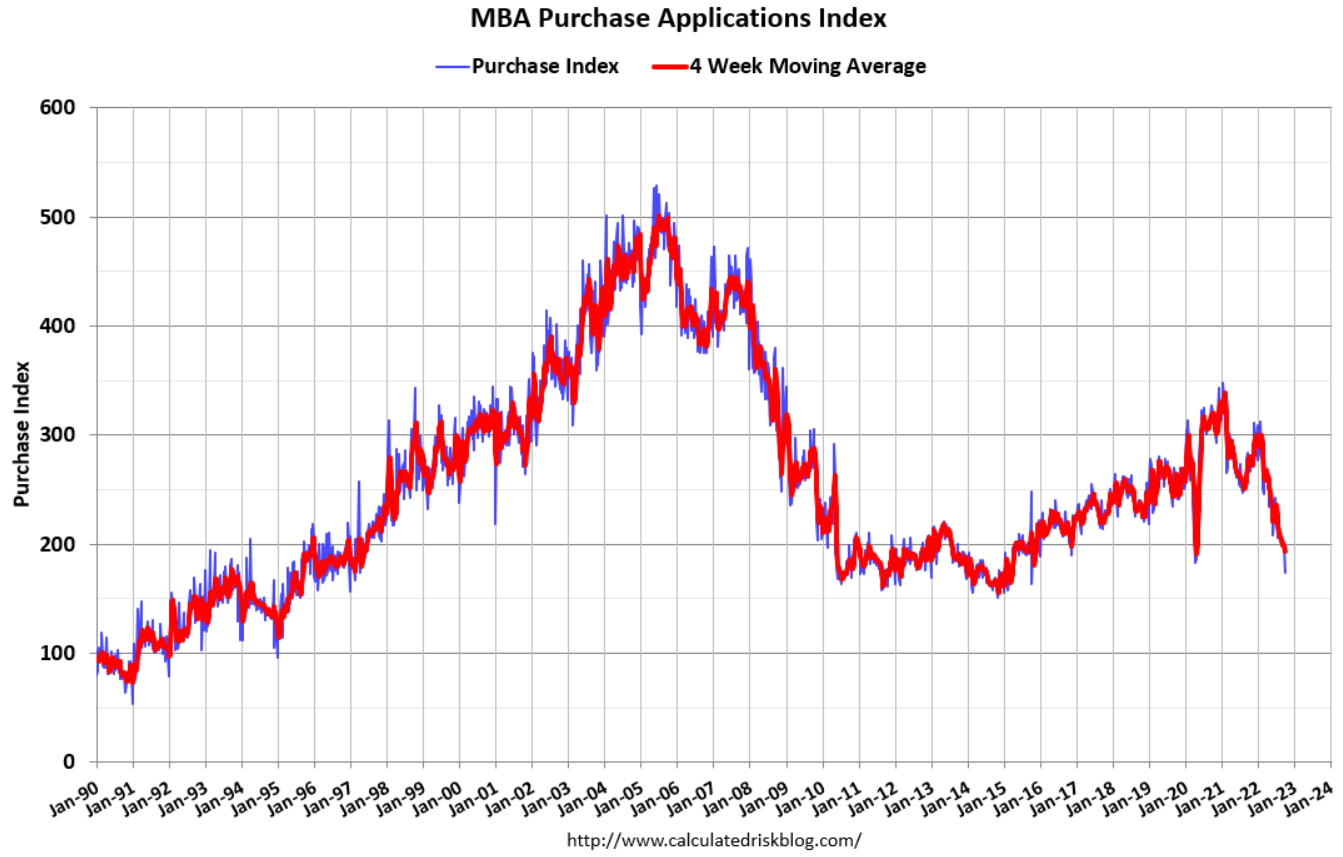

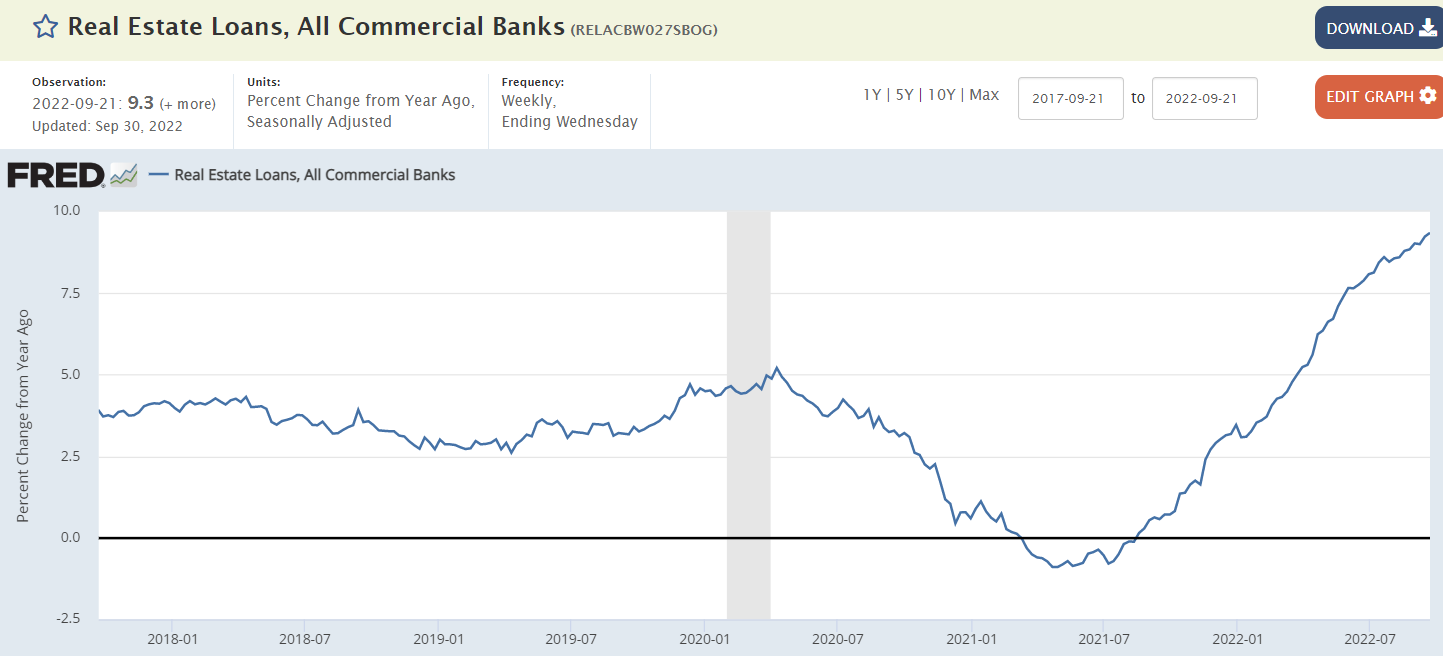

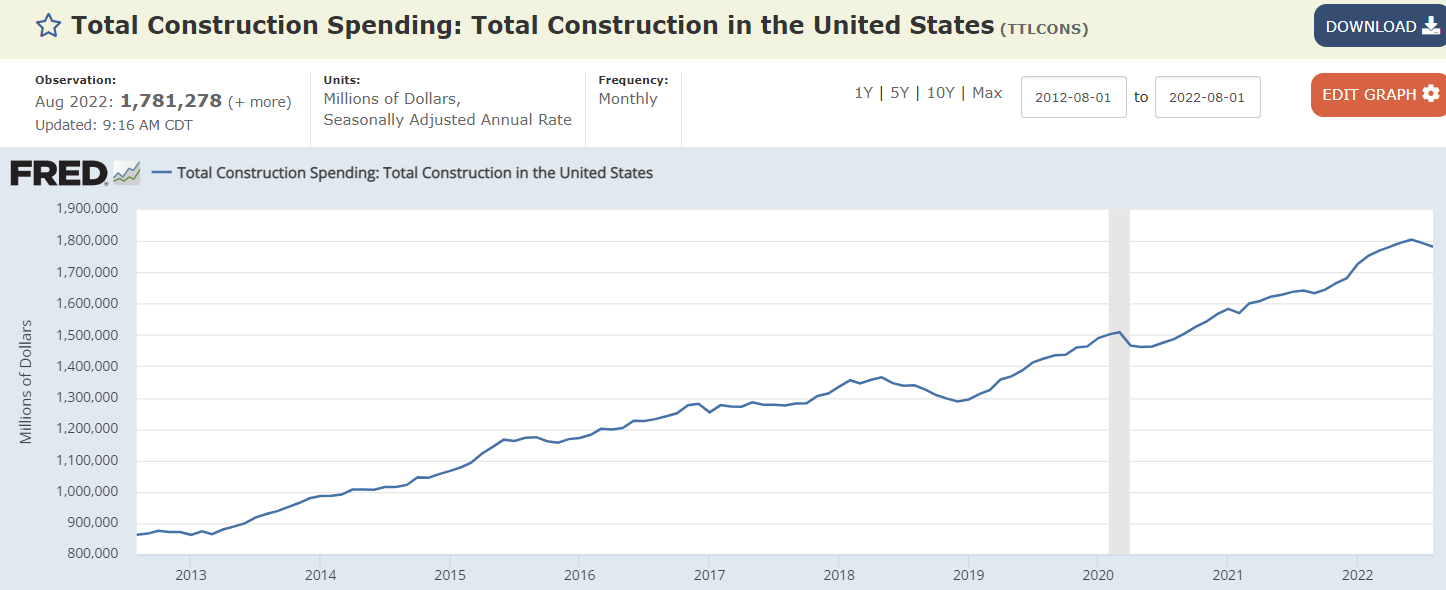

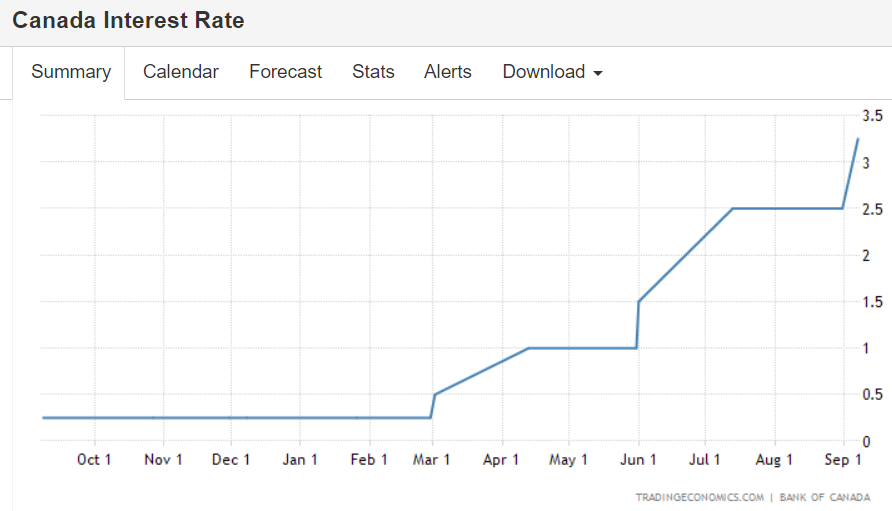

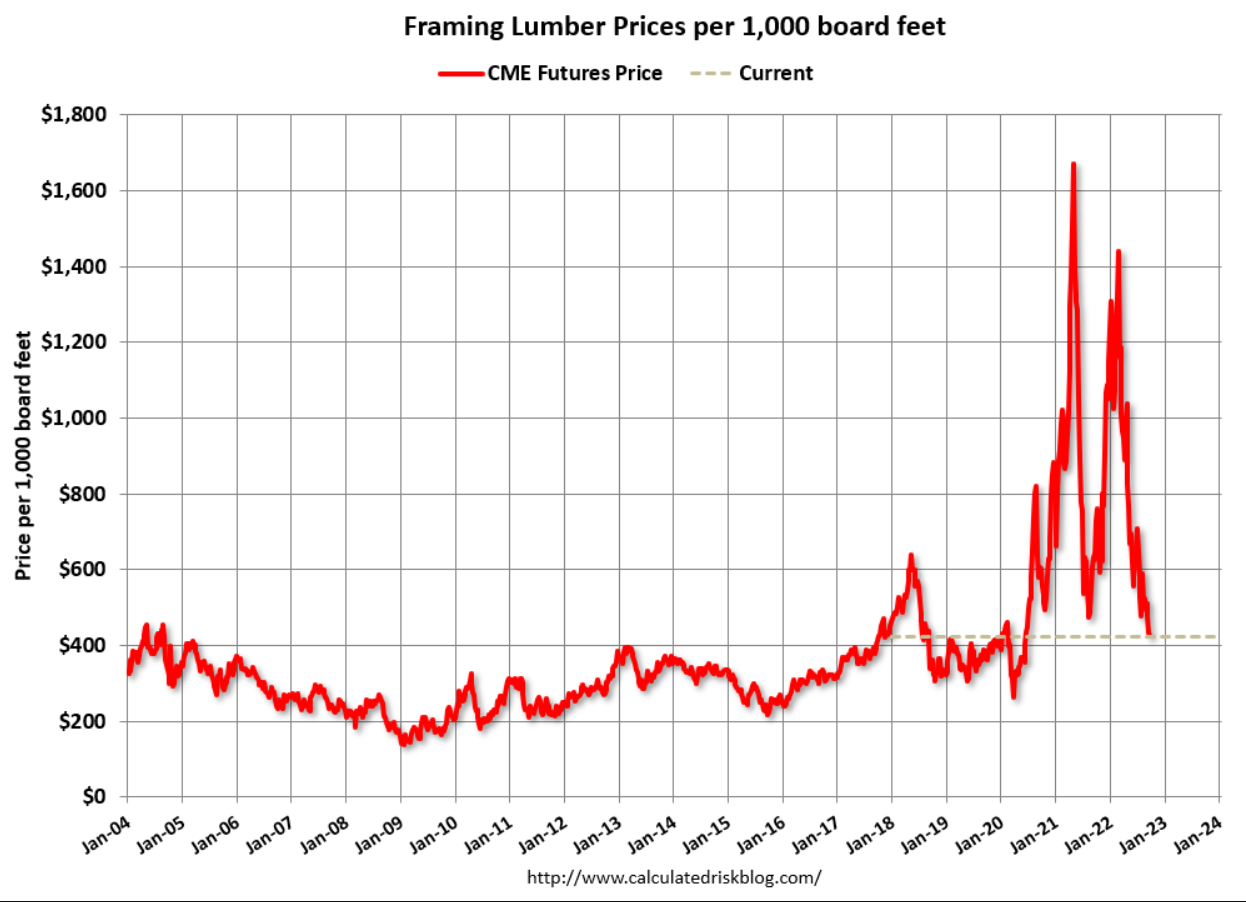

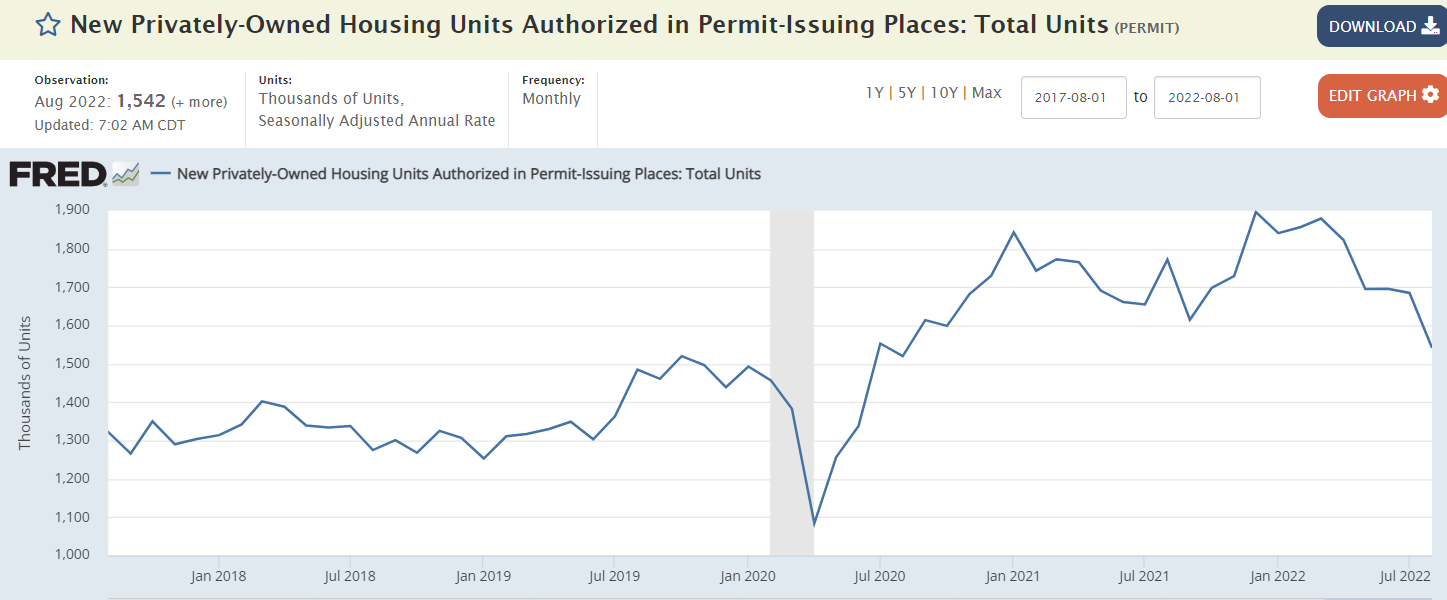

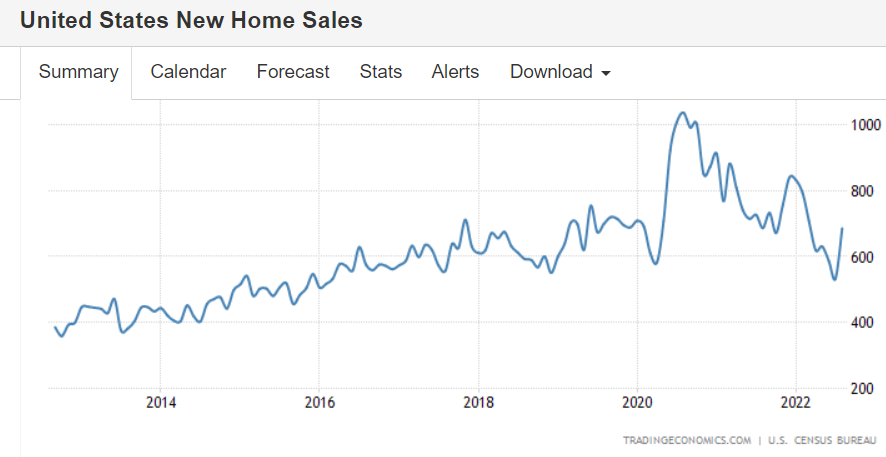

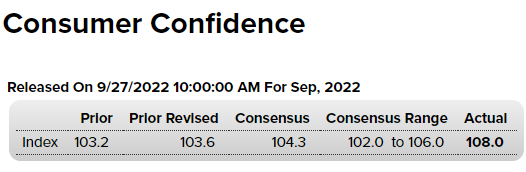

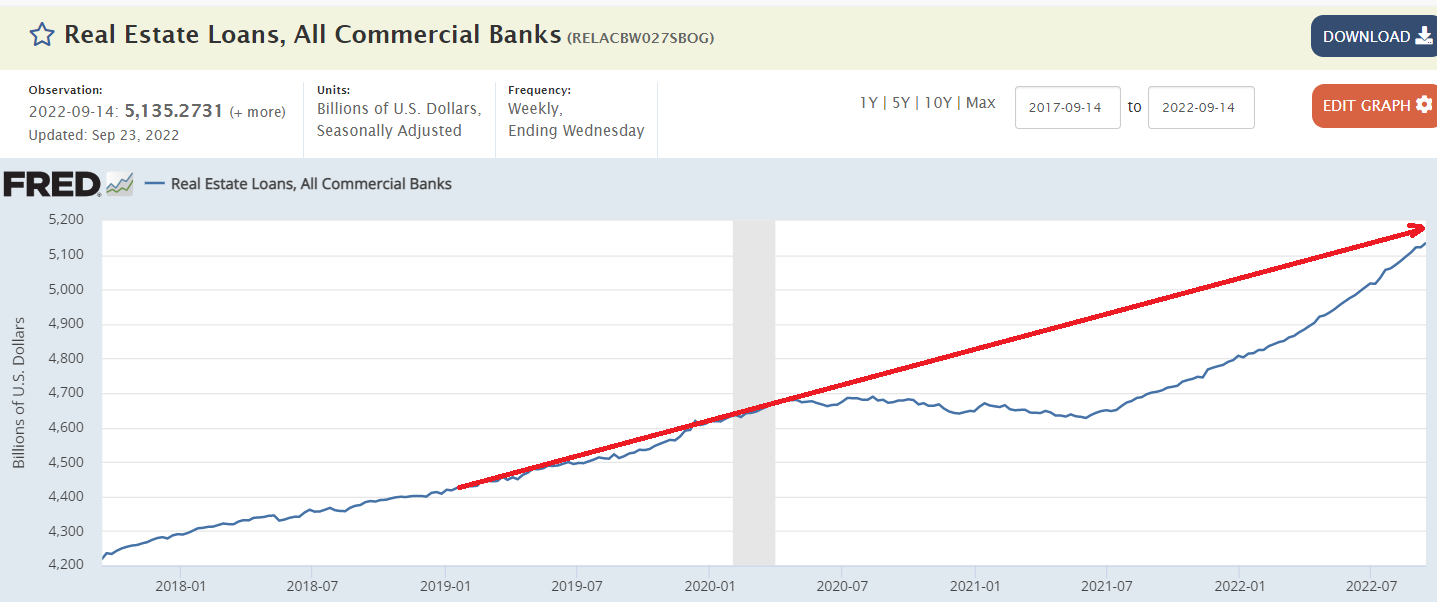

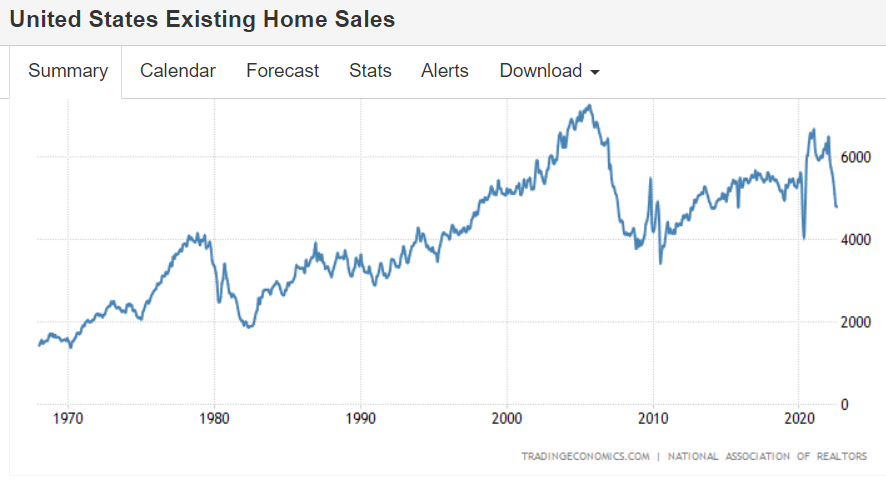

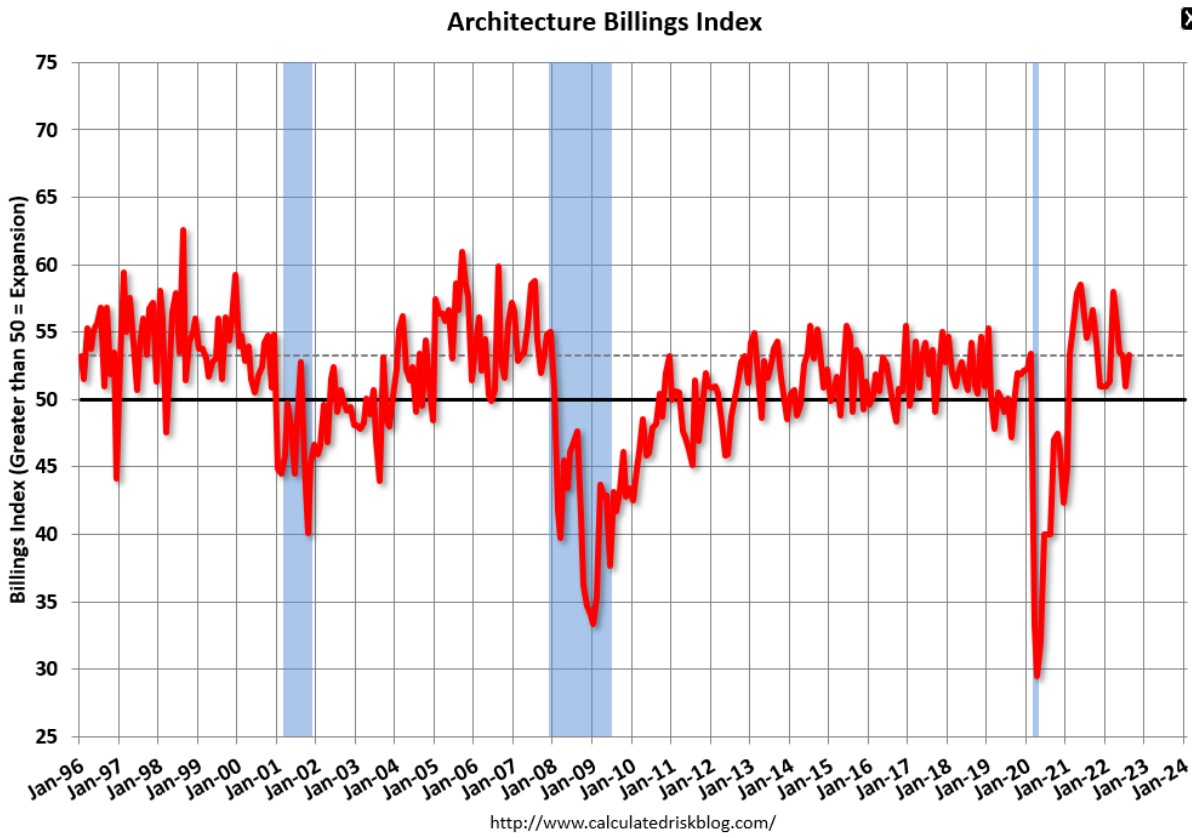

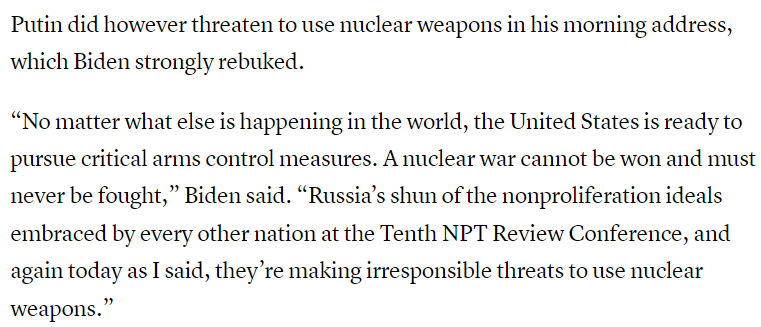

This series has continued to weaken since the rate hikes, even as real estate lending continues to grow and new home construction is at an all time high:

“Mortgage application in the US sank 14.2% in the last week of September, the biggest drop since April 2020, pushing the index to the 218.7, the lowest since 1997. Higher borrowing costs continue to weigh on demand but “there was also an impact from Hurricane Ian’s arrival in Florida last week, which prompted widespread closings and evacuations. Applications in Florida fell 31%, compared to 14% overall, on a non-seasonally adjusted basis“, Joel Kan, an MBA economist said.”