And 2 fewer shopping days…

Holiday Sales Sag Despite Blitz of Deals

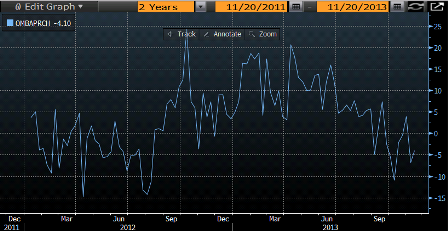

(WSJ) — Estimated total spending over Thanksgiving weekend fell to $57.4 billion, down 2.7% from a year ago, according to the National Retail Federation. It said it still expects total holiday sales through year-end to rise by 3.9% from a year ago. The retail trade group said the number of people who went shopping over the four-day weekend that kicked off with Thanksgiving rose slightly to 141 million, up from 139 million last year. Store traffic on Black Friday rose just 3.4% to 92 million shoppers. Preliminary results from ShopperTrak suggested that sales on Thursday and Friday combined rose 2.3% from a year earlier to $12.3 billion. The firm has forecast that this holiday-shopping season will be the worst since 2009, with retail sales in November and December rising by 2.4% from a year earlier, less than last year’s 3% increase and below gains of around 4% in 2011 and 2010.