Another setback for construction, which a ‘borrowing to spend’ item:

Construction Spending

Highlights

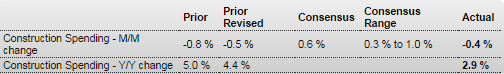

Construction outlays unexpectedly declined in September on public outlays and somewhat on the private nonresidential component. Private residential spending was a positive for the month. . Construction spending declined 0.4 percent in September after a 0.5 percent decrease in August. Market expectations were for a 0.6 percent boost.

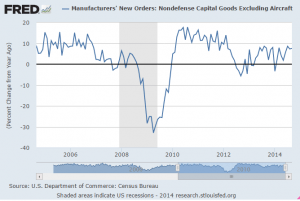

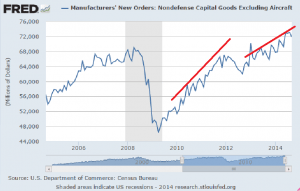

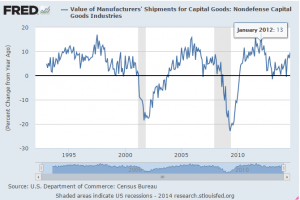

Meanwhile, manufacturing is chugging along as it usually is:

ISM Mfg Index

Highlights

The ISM report stands out starkly from the net result of other anecdotal surveys on October’s manufacturing sector, showing outstanding growth at a composite index of 59.0 vs 56.6 in September. This level matches August’s level with the two the strongest since February 2011.New orders, the most important reading in the report, rose a strong 5.8 points to a blistering 65.8. This points to rising activity across the supply chain in the months ahead. Export orders slowed in the month, as they did for Markit’s sample released earlier this morning, which implies that domestic demand is especially strong. In two signs of strength, total backlog orders rose while supplier deliveries, reflecting ongoing congestion in the supply chain, slowed.

Production, at 64.8, is strong and in line with orders. Inventories show slight accumulation. Price pressures moderated as they have in most reports for October, the result of lower oil prices.

This report may be just a bit too strong, given that ISM’s data have not been tracking well this year with hard data on the manufacturing sector where growth has been flat.