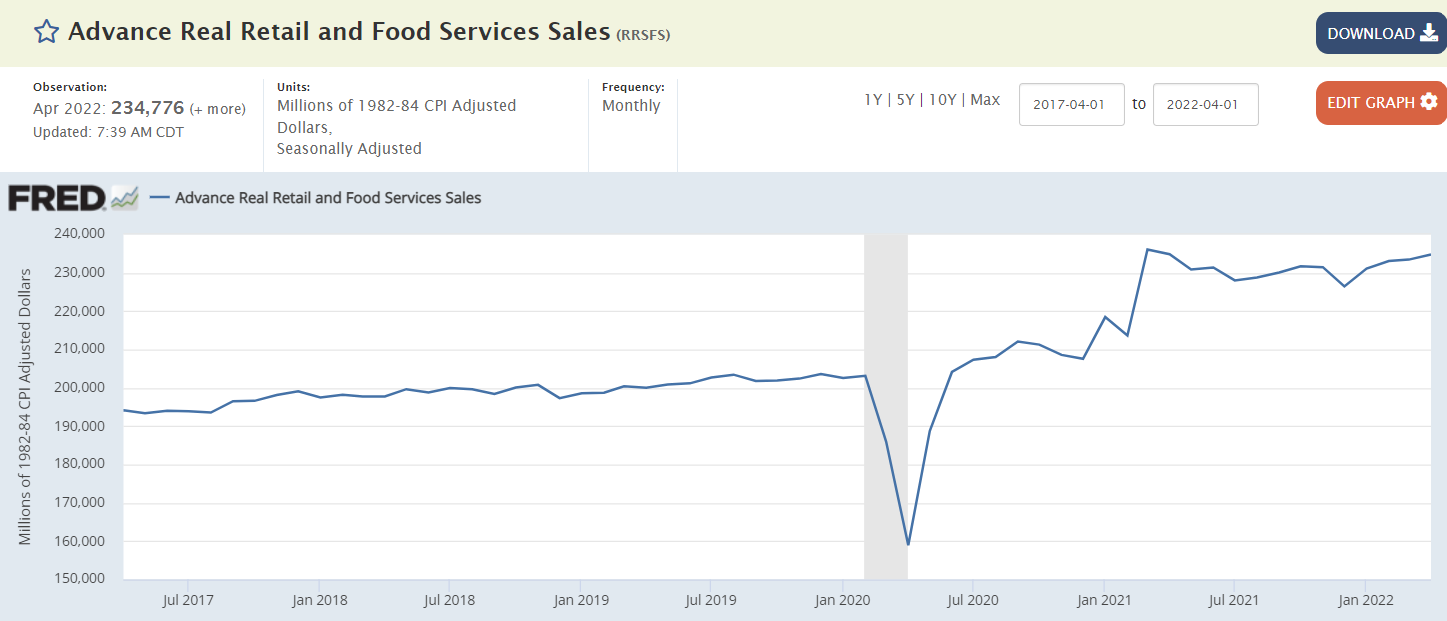

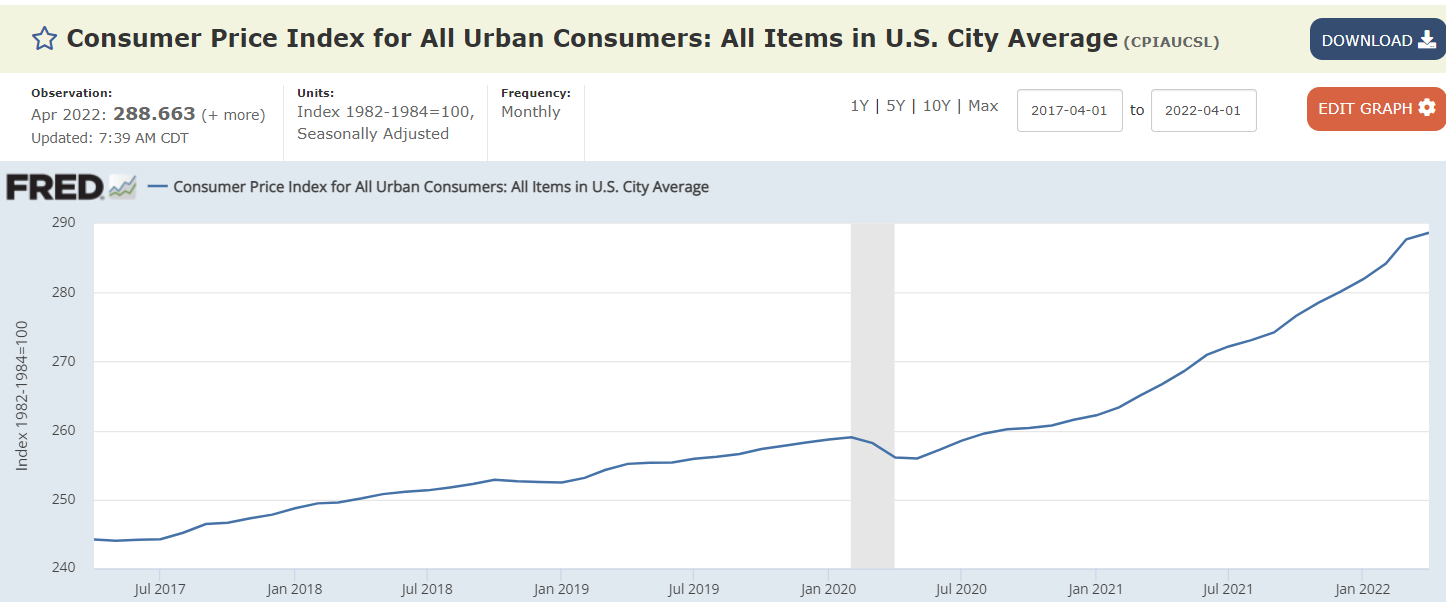

Not growing when adjusted for inflation:

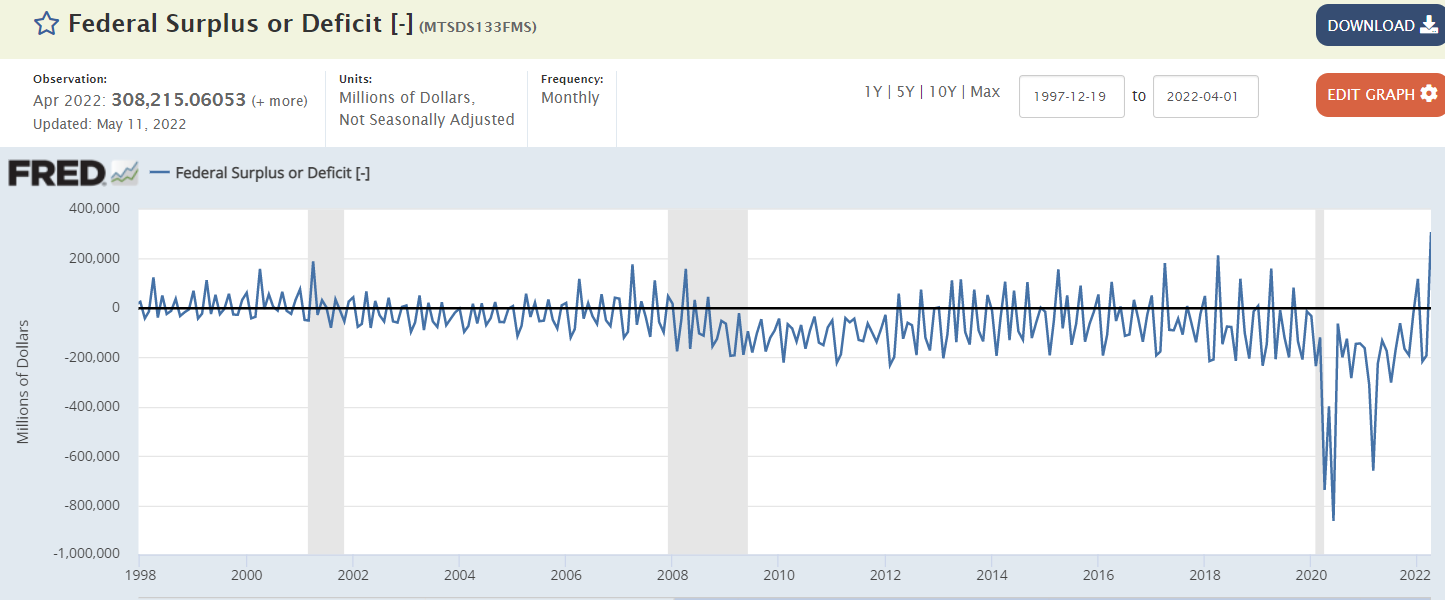

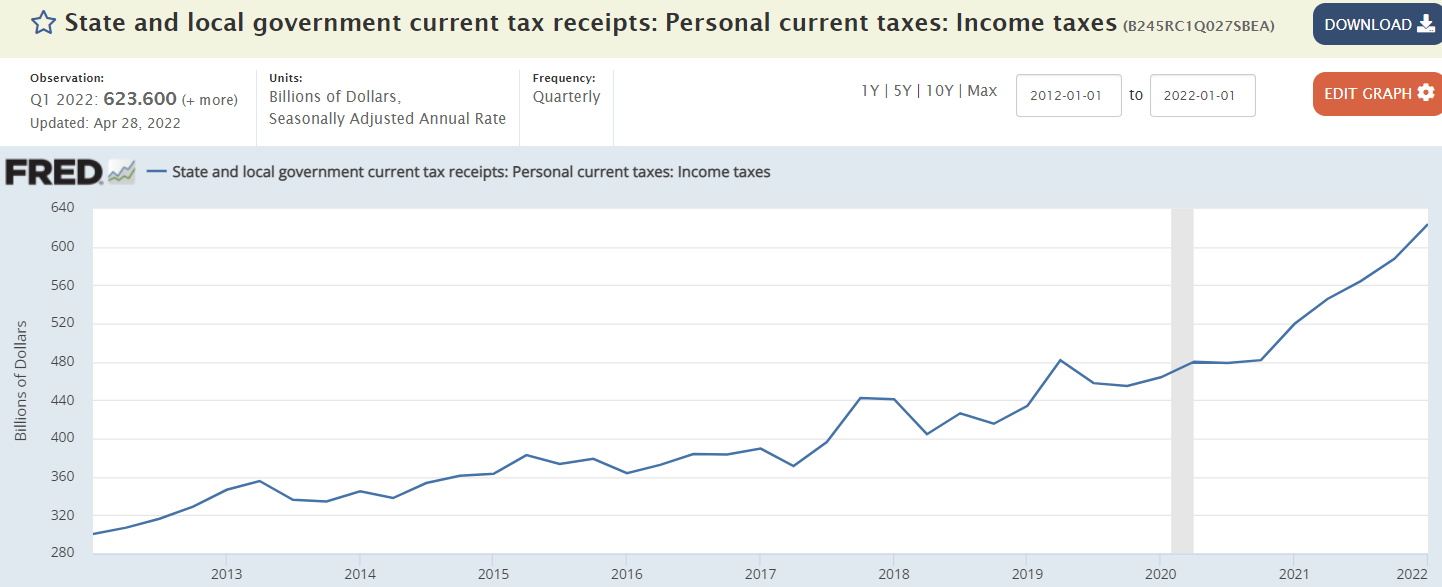

The US posted a budget surplus of USD 308 billion in April of 2022, the highest on record, switching from a USD 226 billion gap in the same period last year and above market expectations of a USD 226 billion surplus. April has traditionally been a budget surplus month due to the traditional April 15 tax filing deadline, except in 2009, 2010 and 2011 after a financial crisis, and in 2020 and 2021 due to the Covid-19 pandemic. Receipts jumped 97 percent to an all-time high of USD 864 billion, underpinned by tax receipts on the back of a strong economic recovery. At the same time, outlays slumped 16 percent to USD 555 billion, reflecting lower spending for COVID-19 relief. For the first seven months of the 2022 fiscal year, the US federal deficit was at USD 360 billion, a 81 percent decline from the same period of fiscal 2021. source: Financial Management Service, US Treasury Monthly Treasury Statement

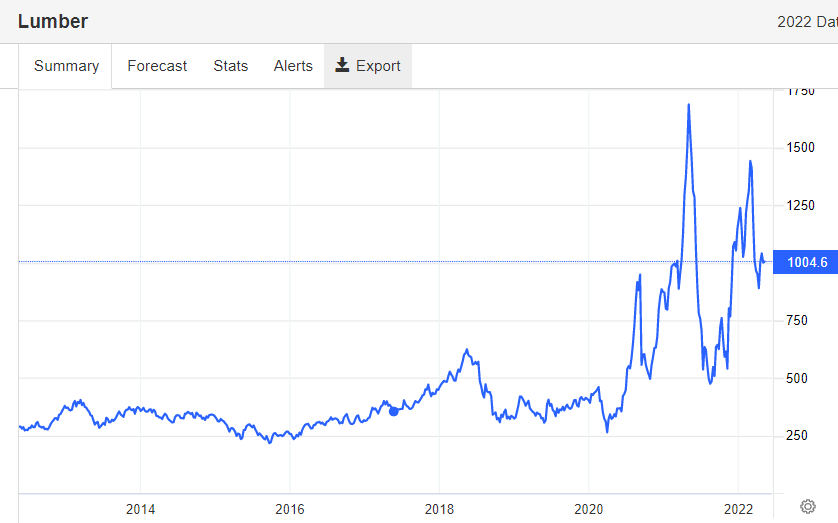

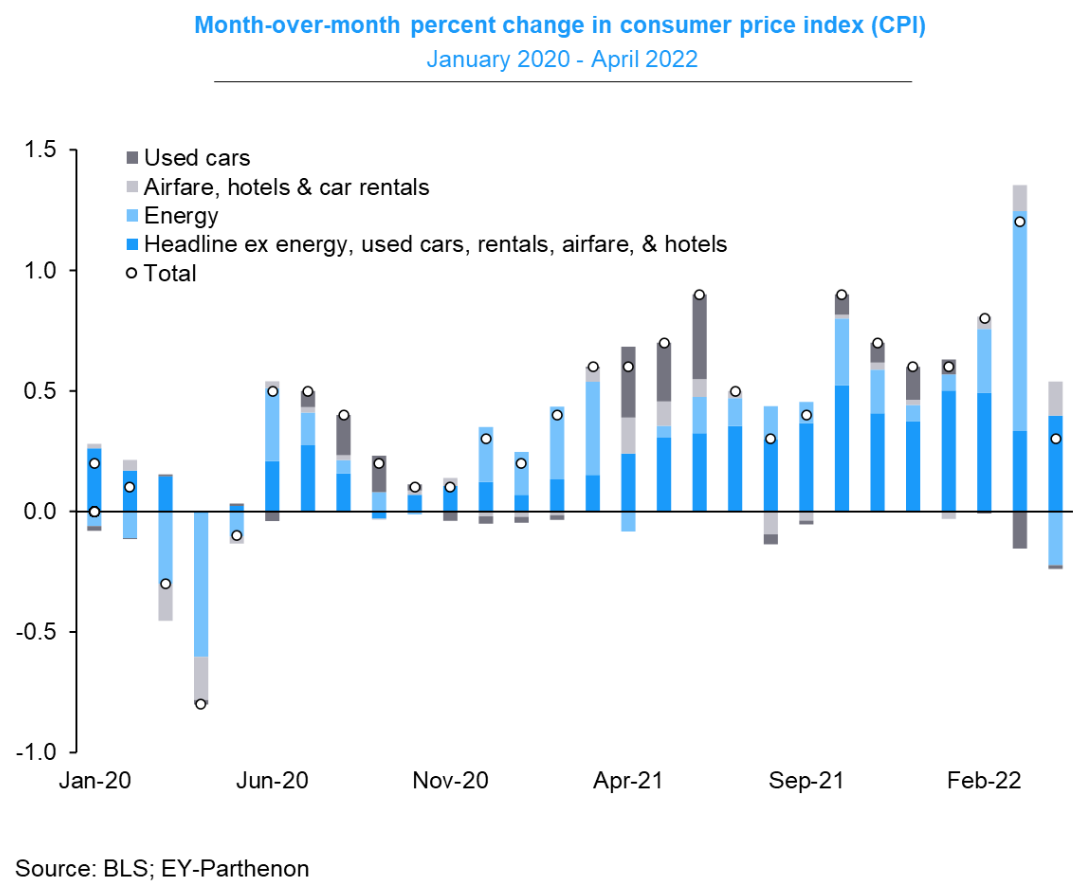

My take is we’ve had a one time upward adjustment in prices due to increased costs from Covid-related supply issues, along with supply side disruptions from the Trump/Biden tariffs.

Prices seem to have begun to level off and go sideways, which would mean CPI increases returning to the lower, pre-Covid monthly increases:

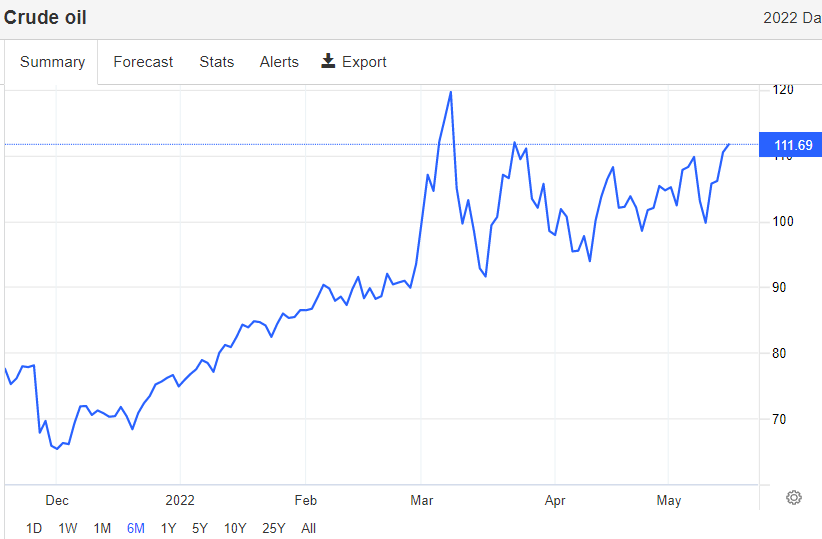

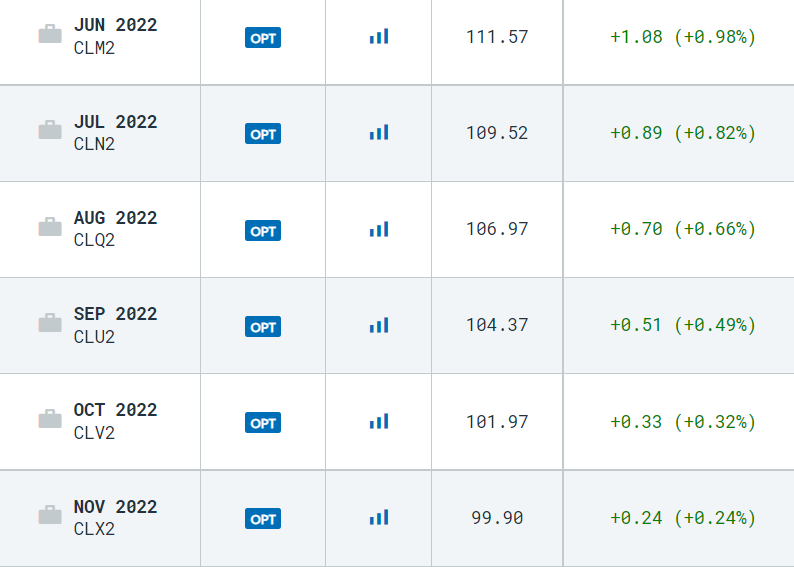

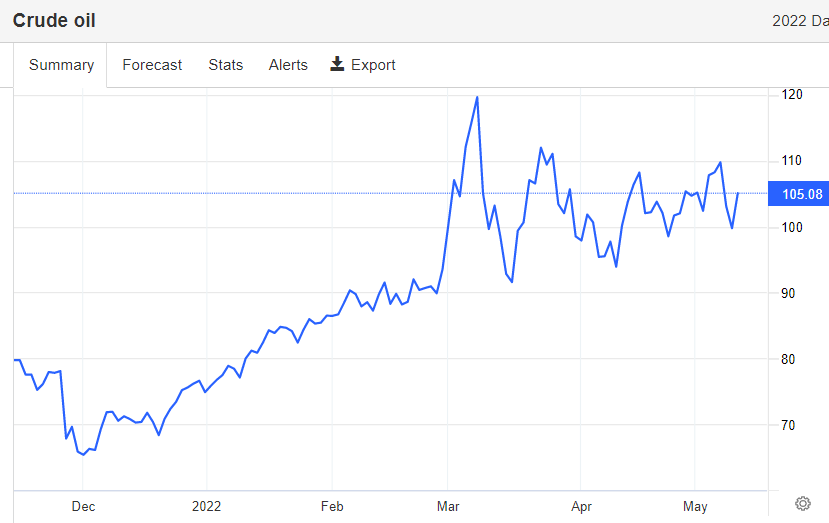

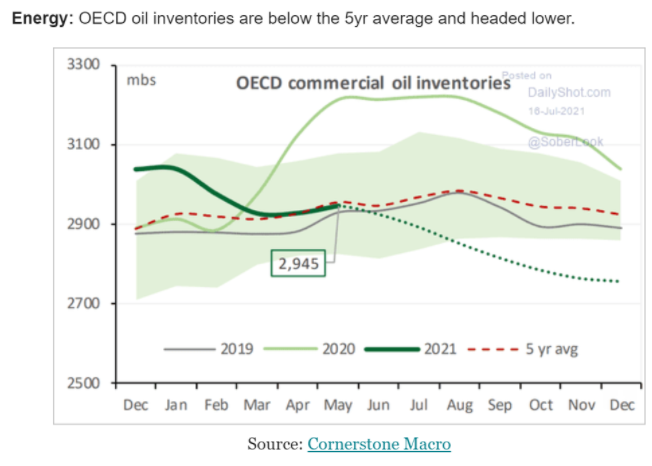

However, if energy costs don’t level off and instead rise dramatically, CPI will be dragged upward as well:

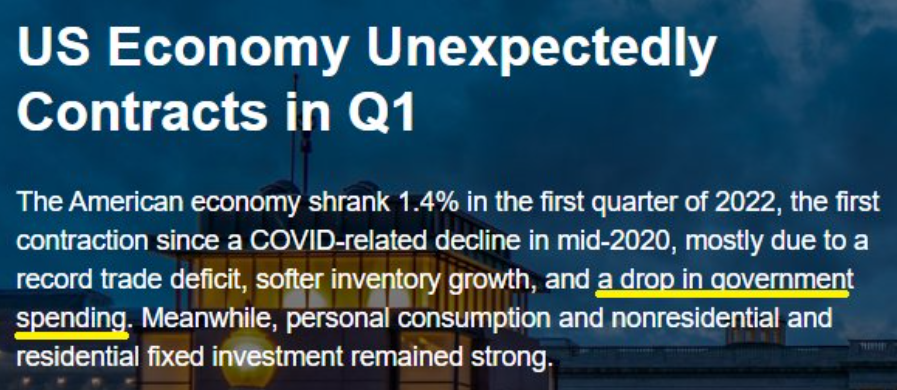

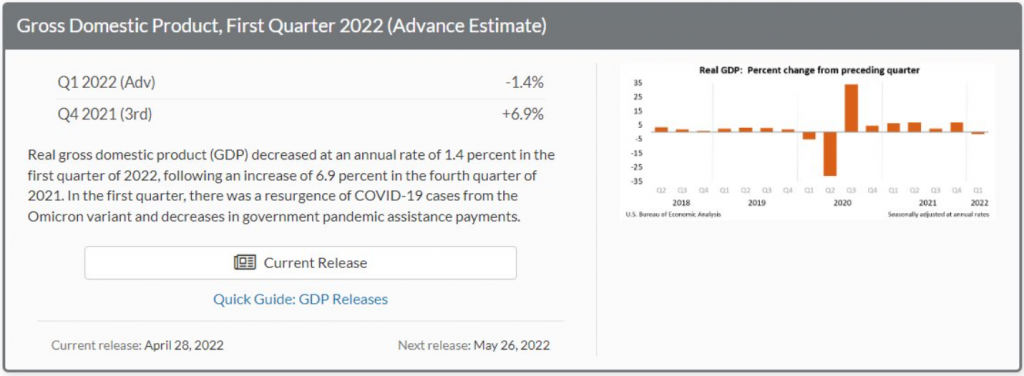

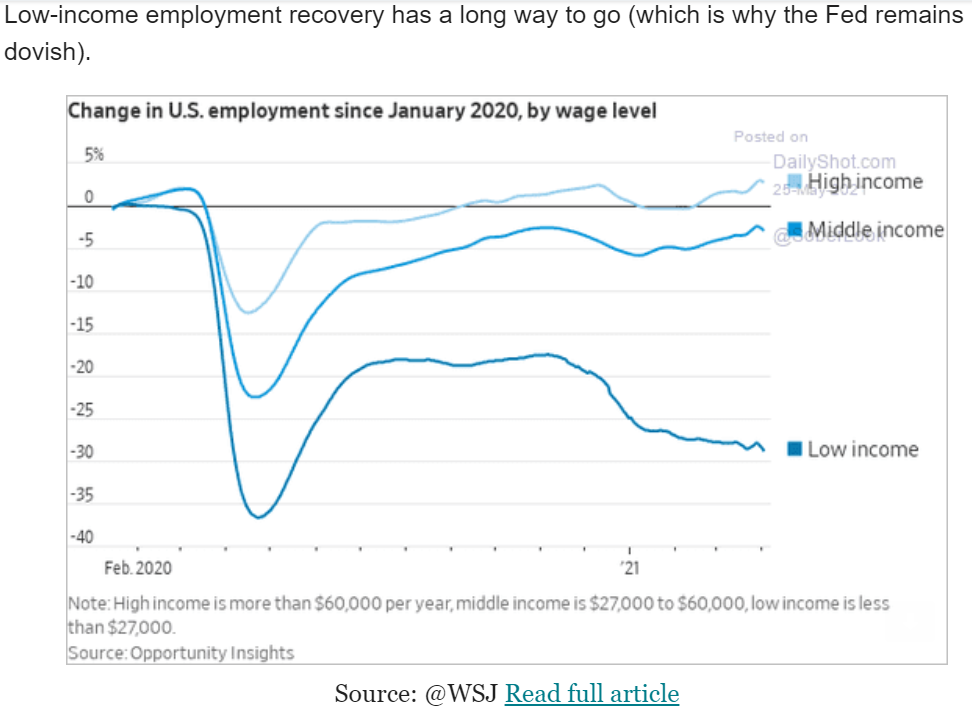

Typical post war recession type of outcome, as previously discussed:

One reason for the low unemployment in the US is that for a lot of people you need a job to get health insurance:

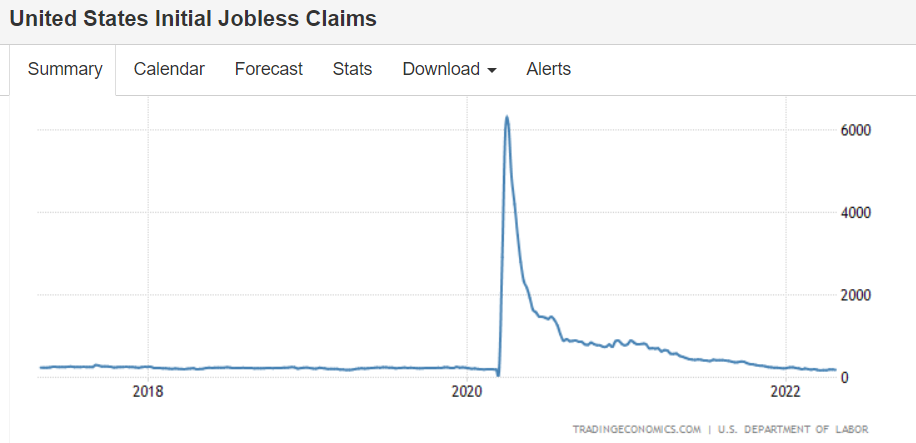

https://tradingeconomics.com/united-states/jobless-claims

Reported inflation will fall rapidly unless energy prices increase from current levels,

which is likely given current Saudi OSP’s and EU responses to the war:

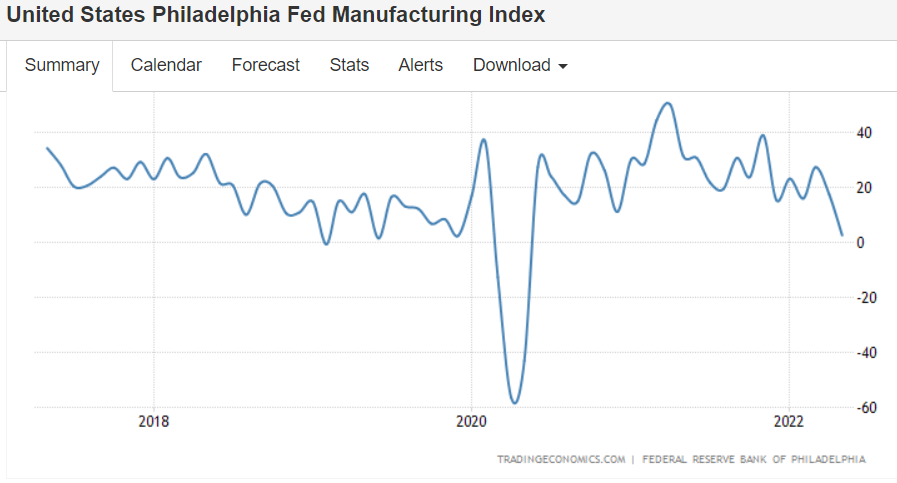

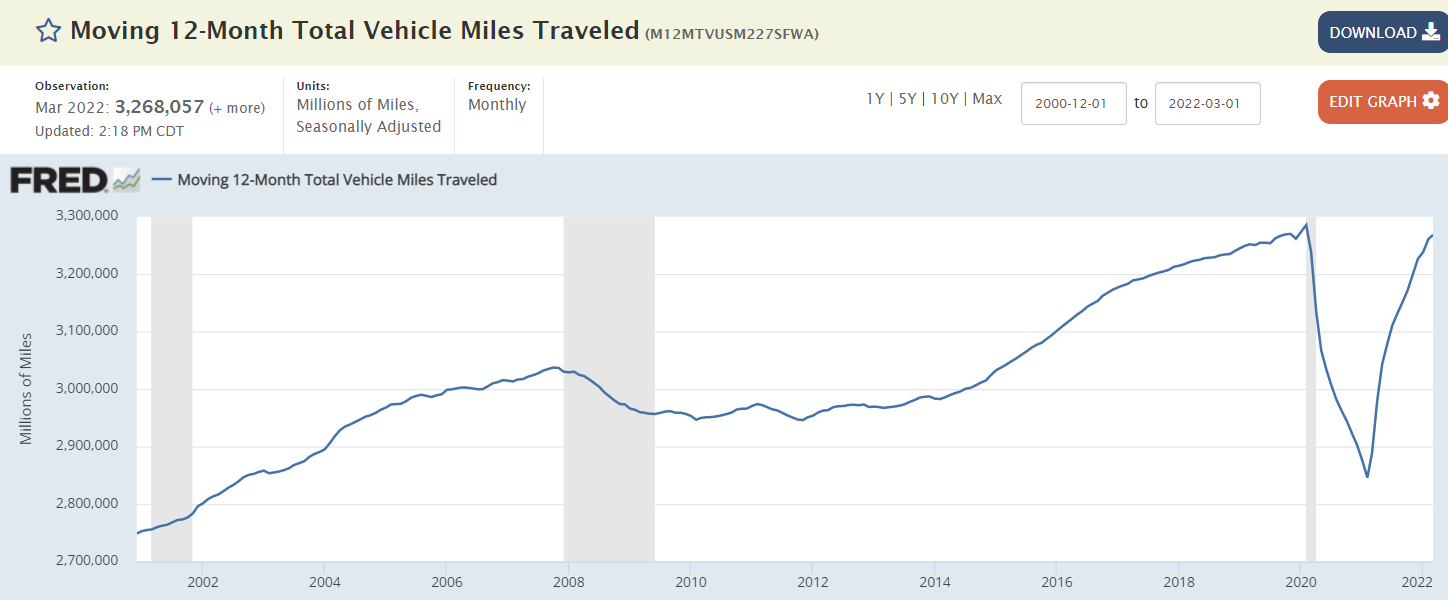

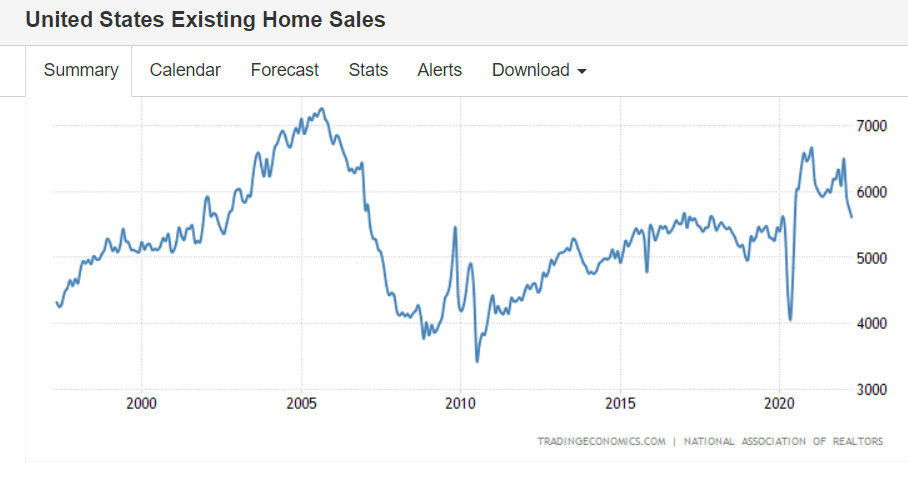

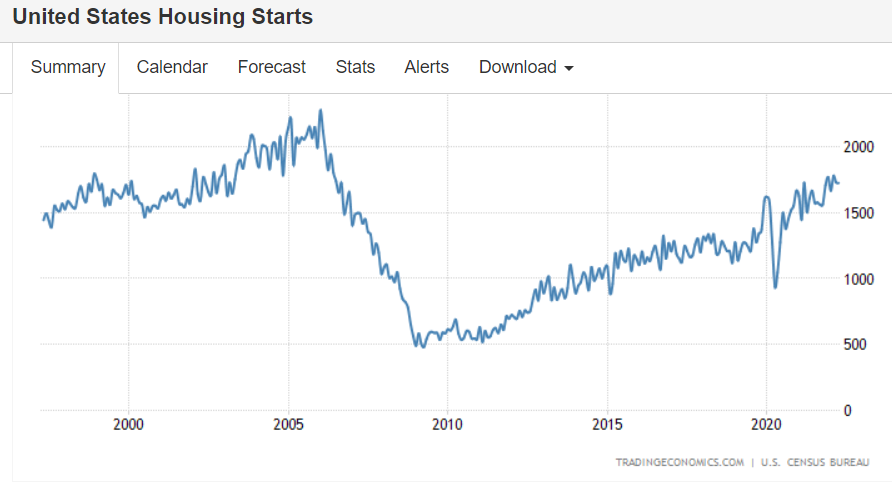

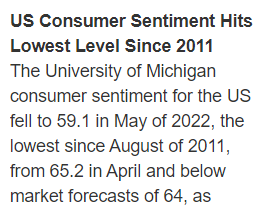

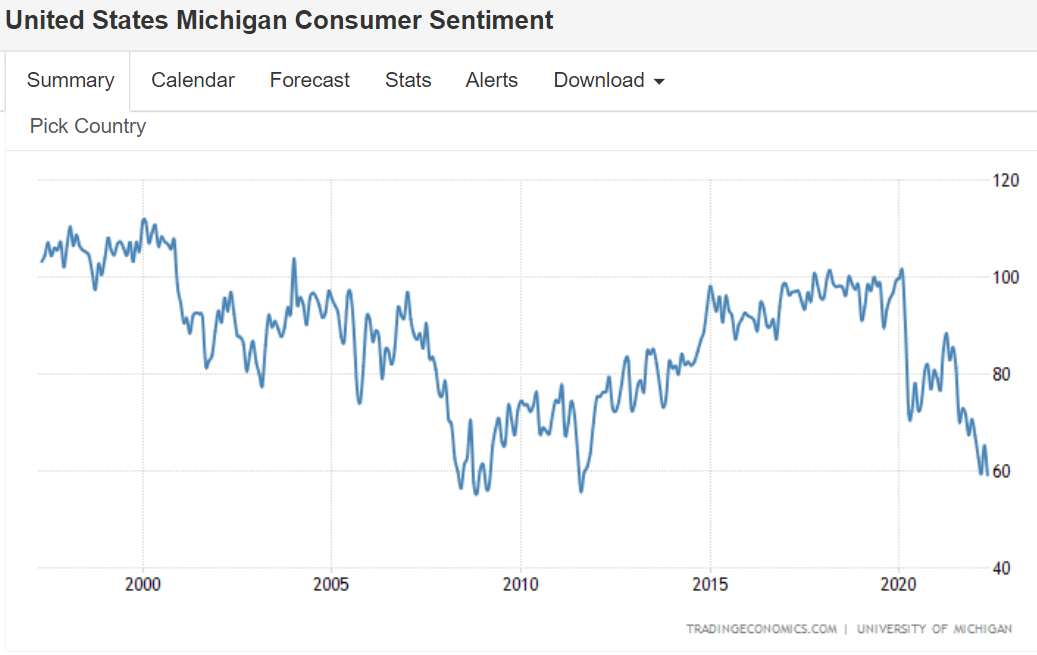

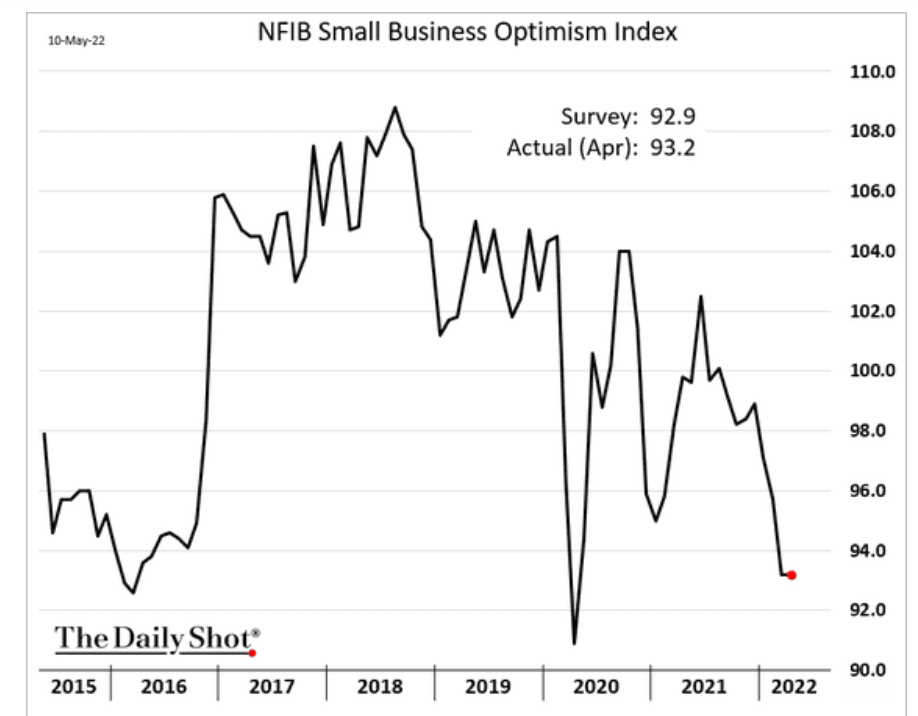

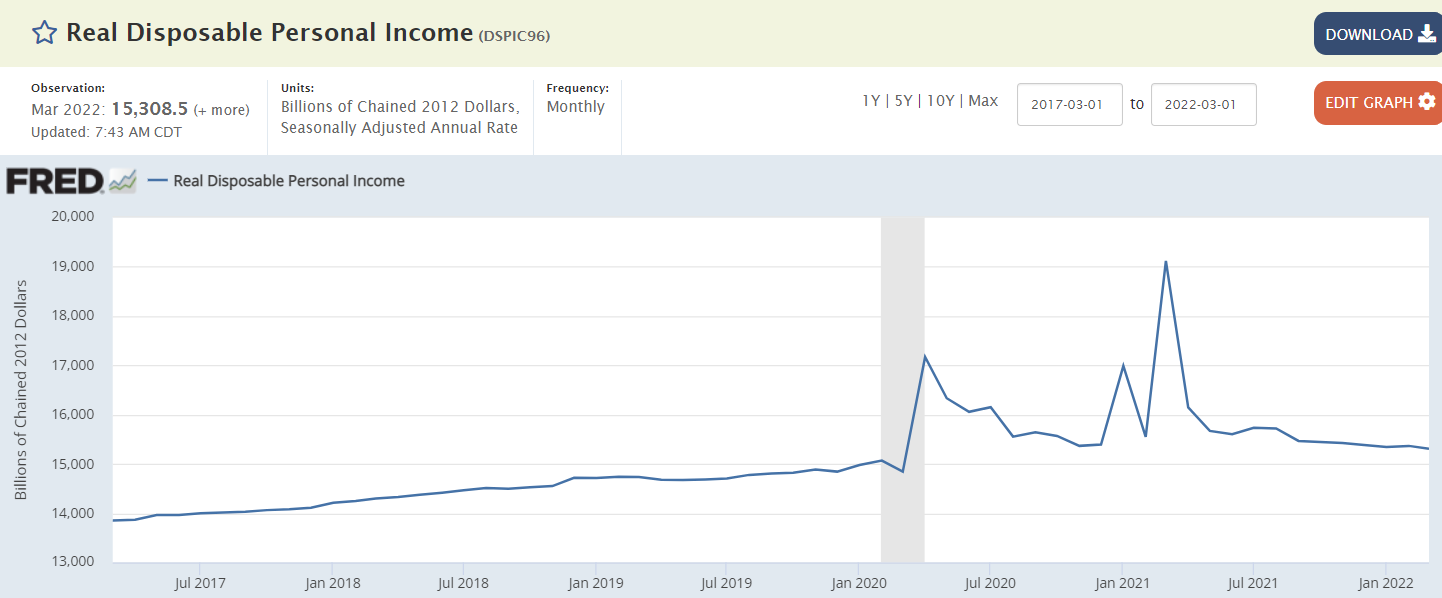

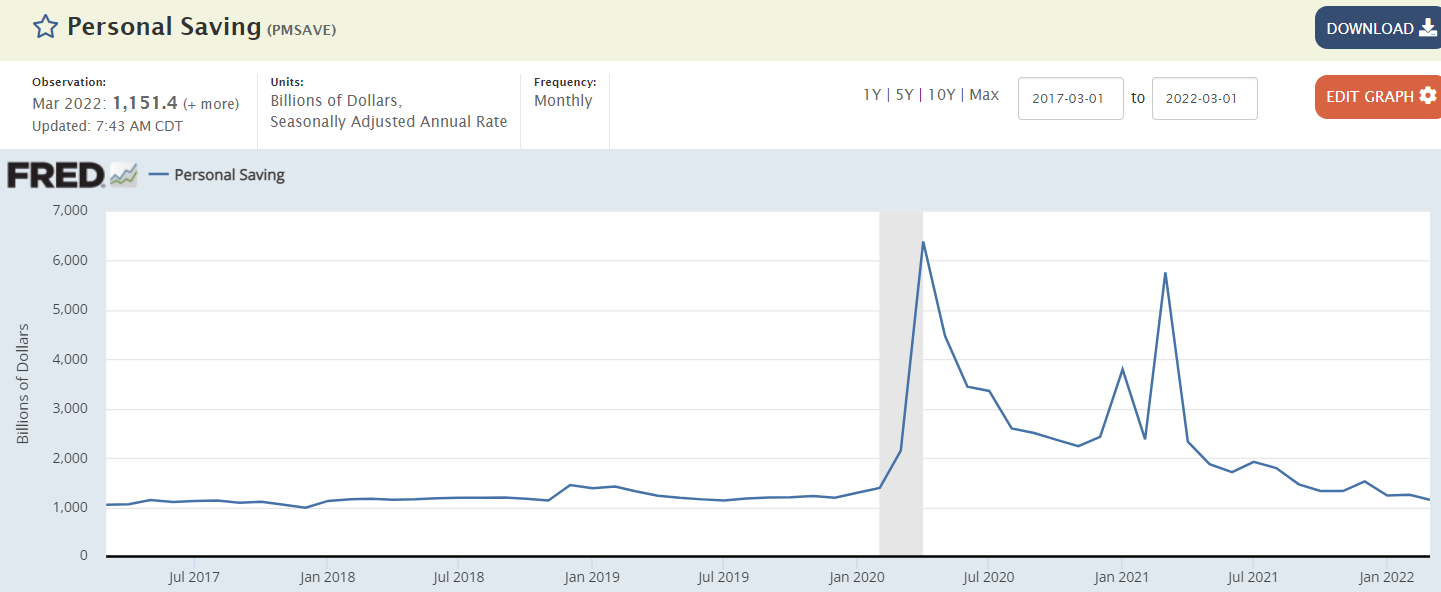

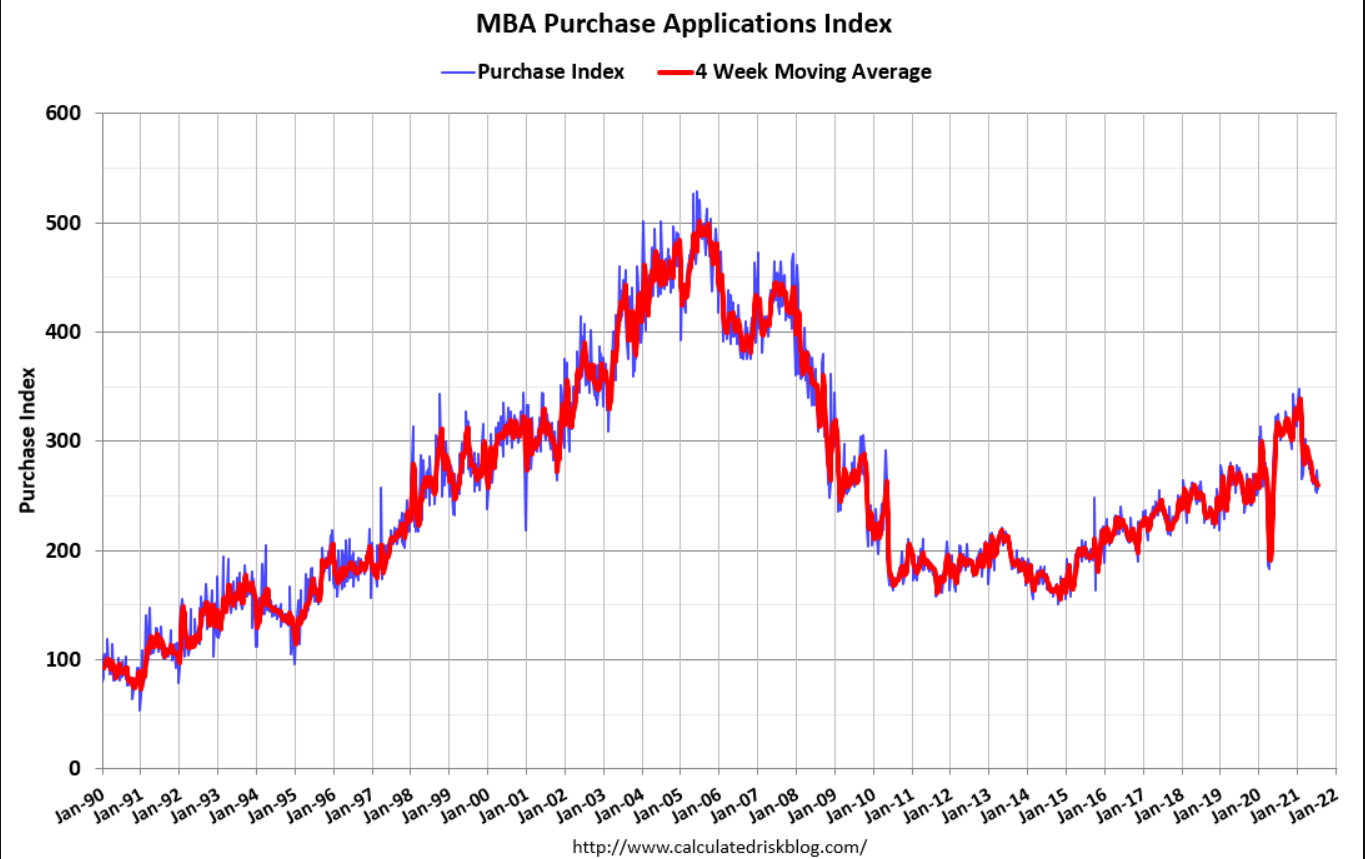

Covid dip, recovery, and now a decline:

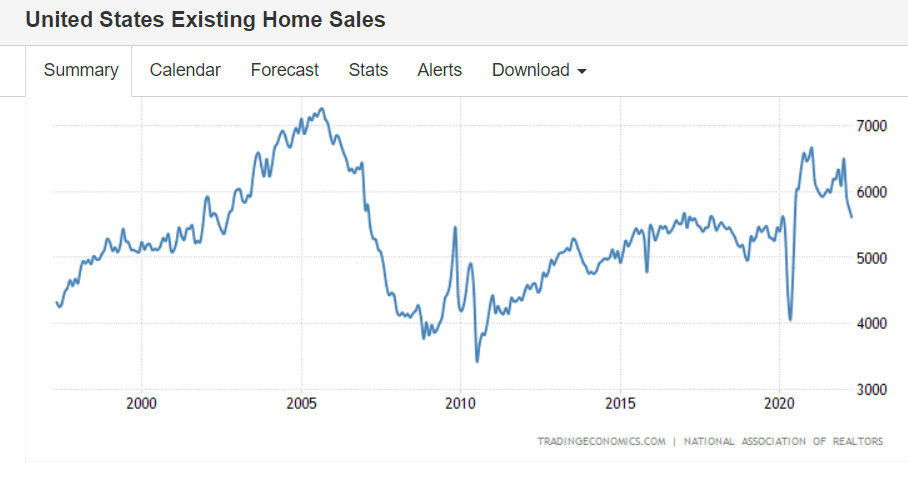

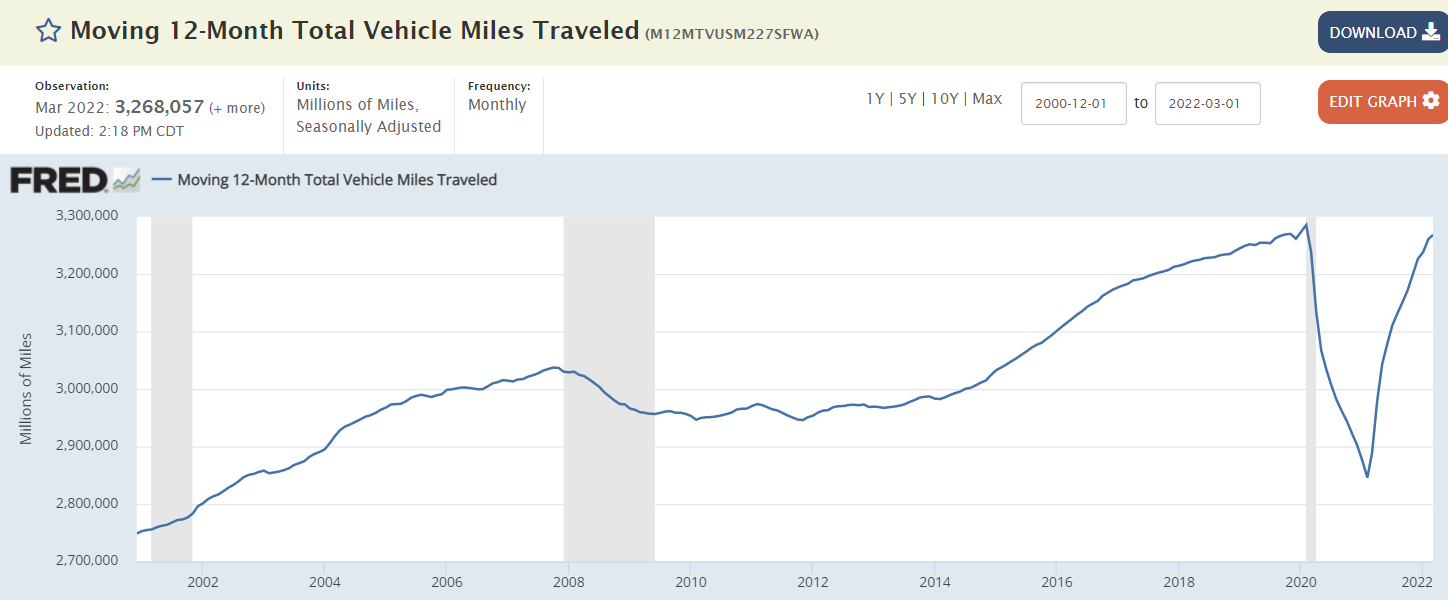

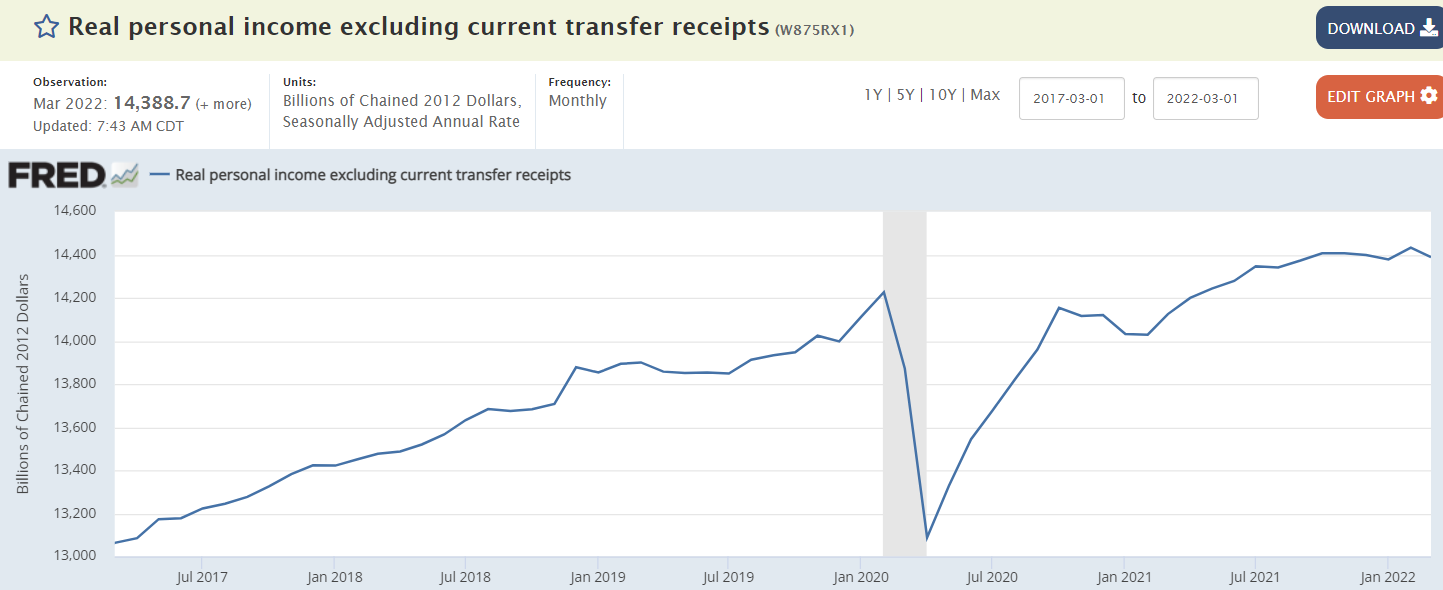

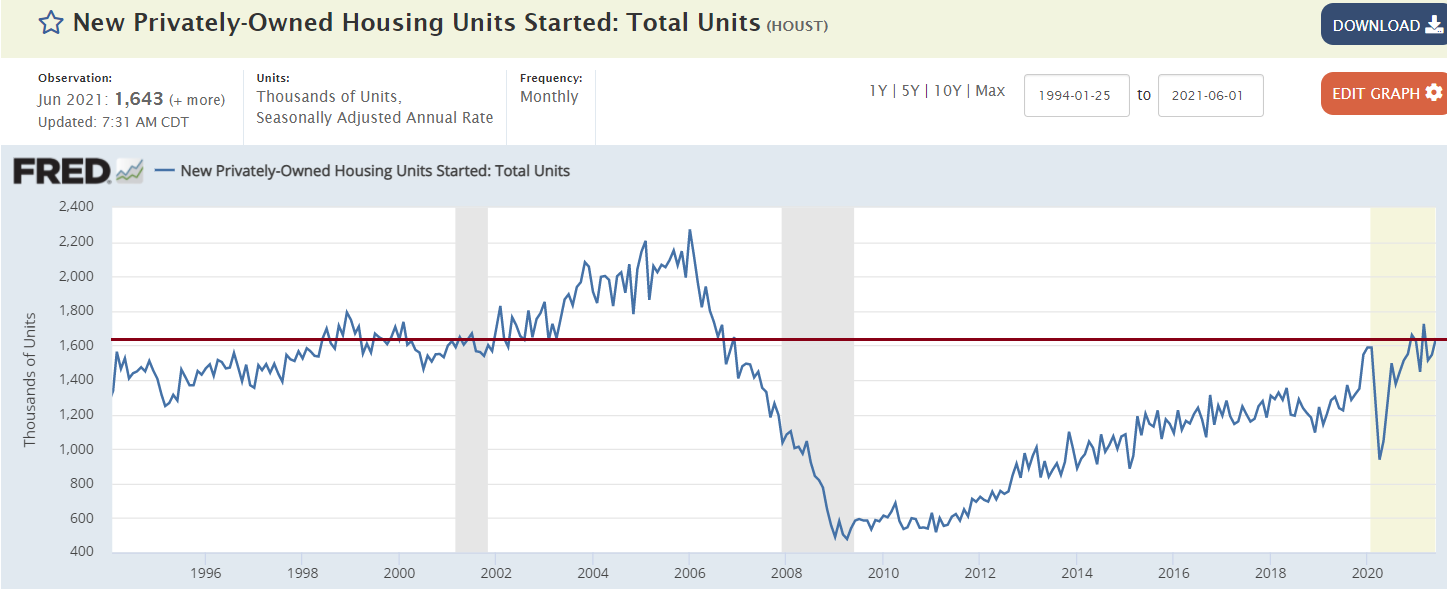

Covid dip, recovery, and now sideways at levels of some 25 years ago when there were a lot fewer people:

Through June,

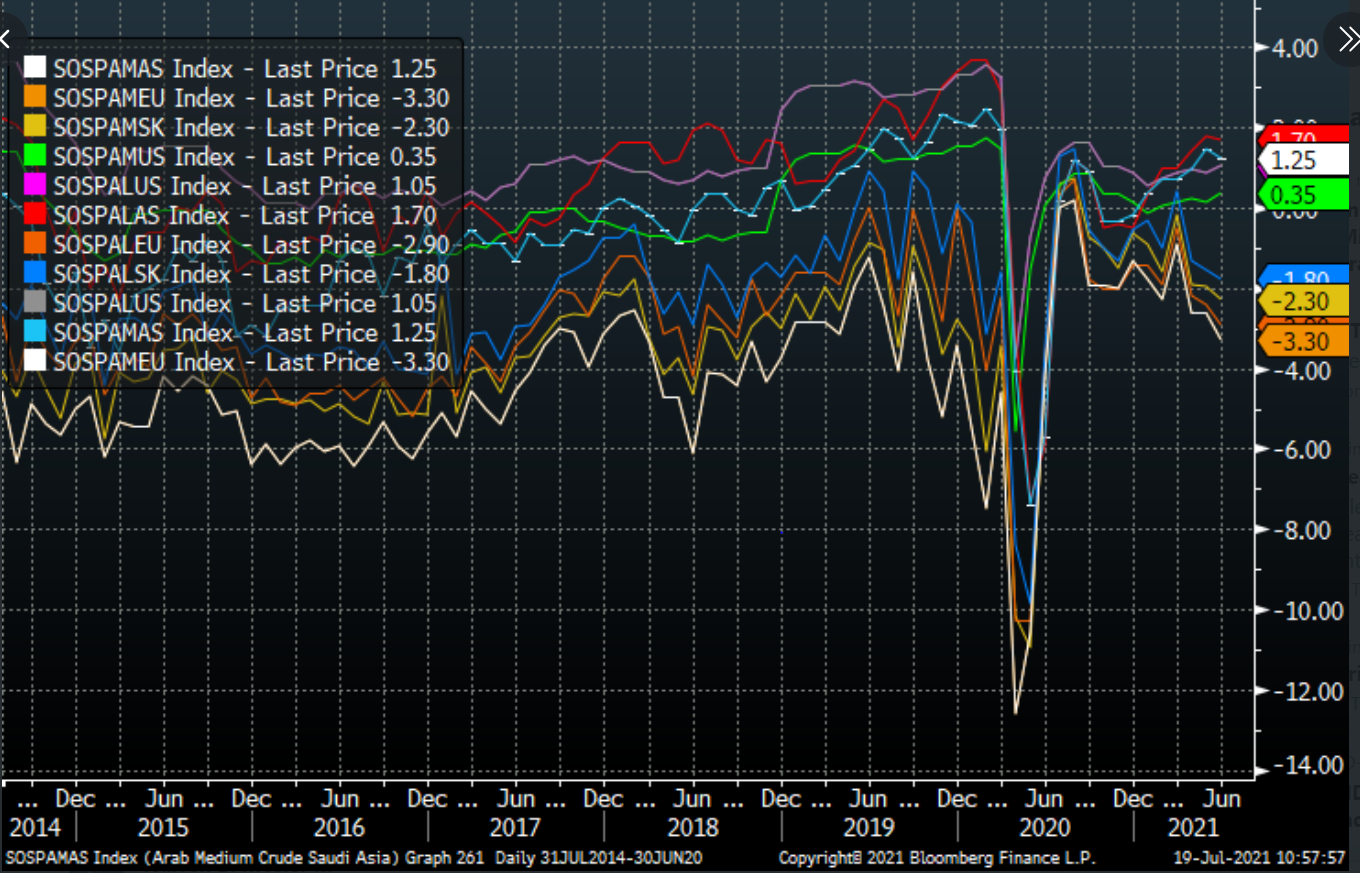

Saudis caused the big dip and recovery, then attempted to stabilize.

The most recent Reuters report suggested price increases vs benchmarks,

which is a move to firm prices over time:

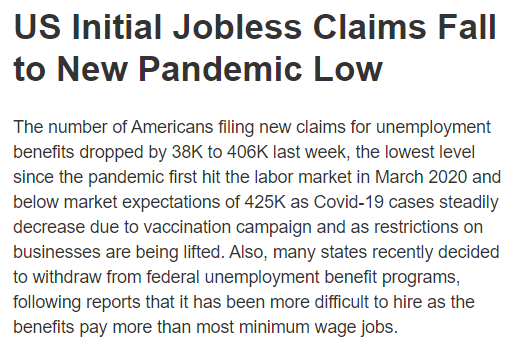

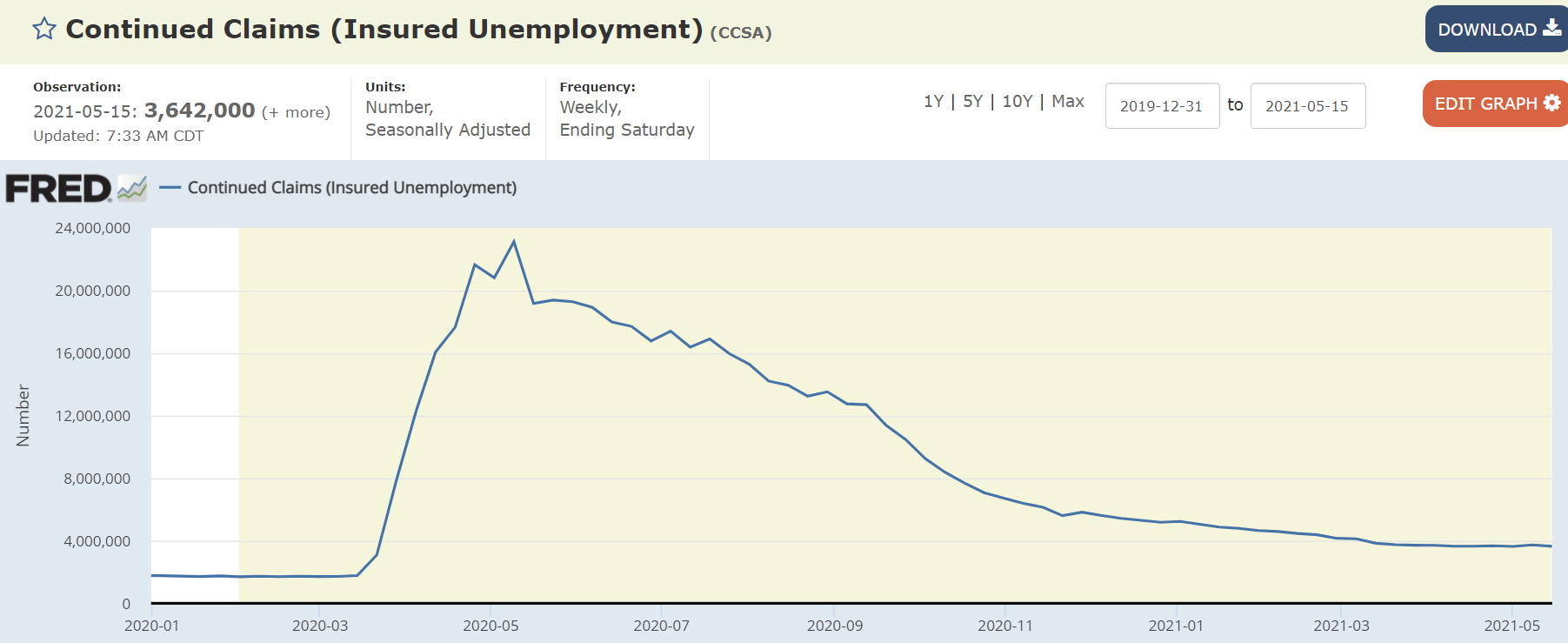

Claims continue to drift lower but are still about double what they were pre covid:

Continued claims are also about double pre covid levels:

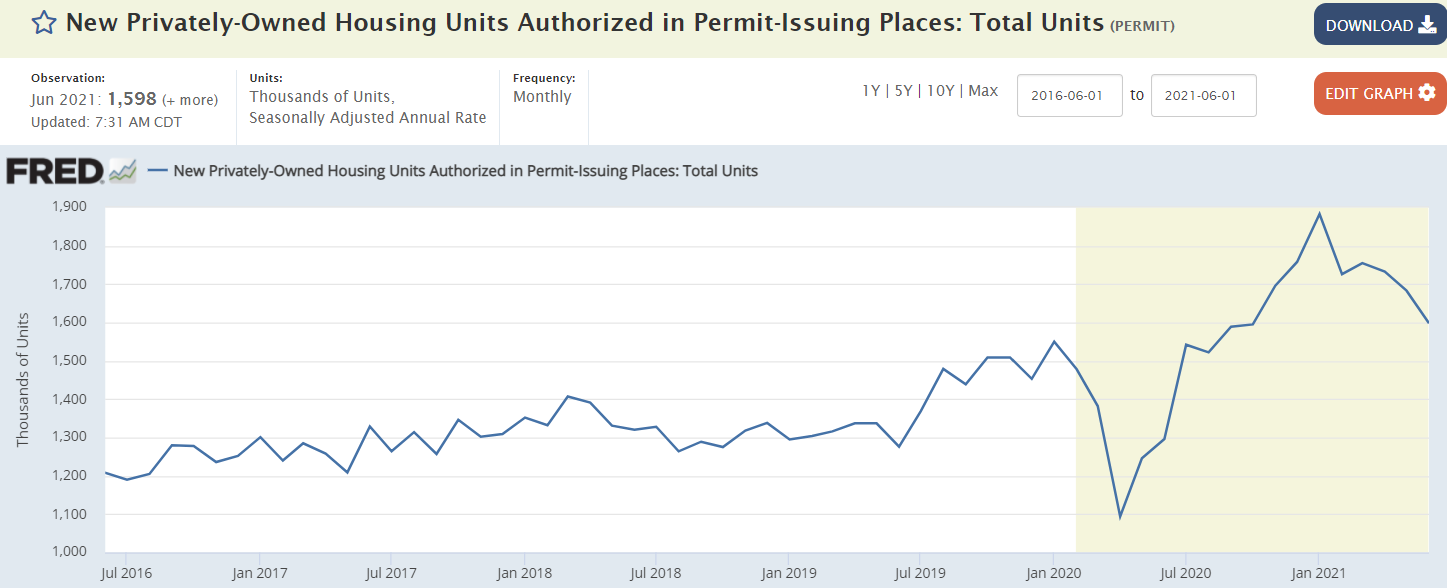

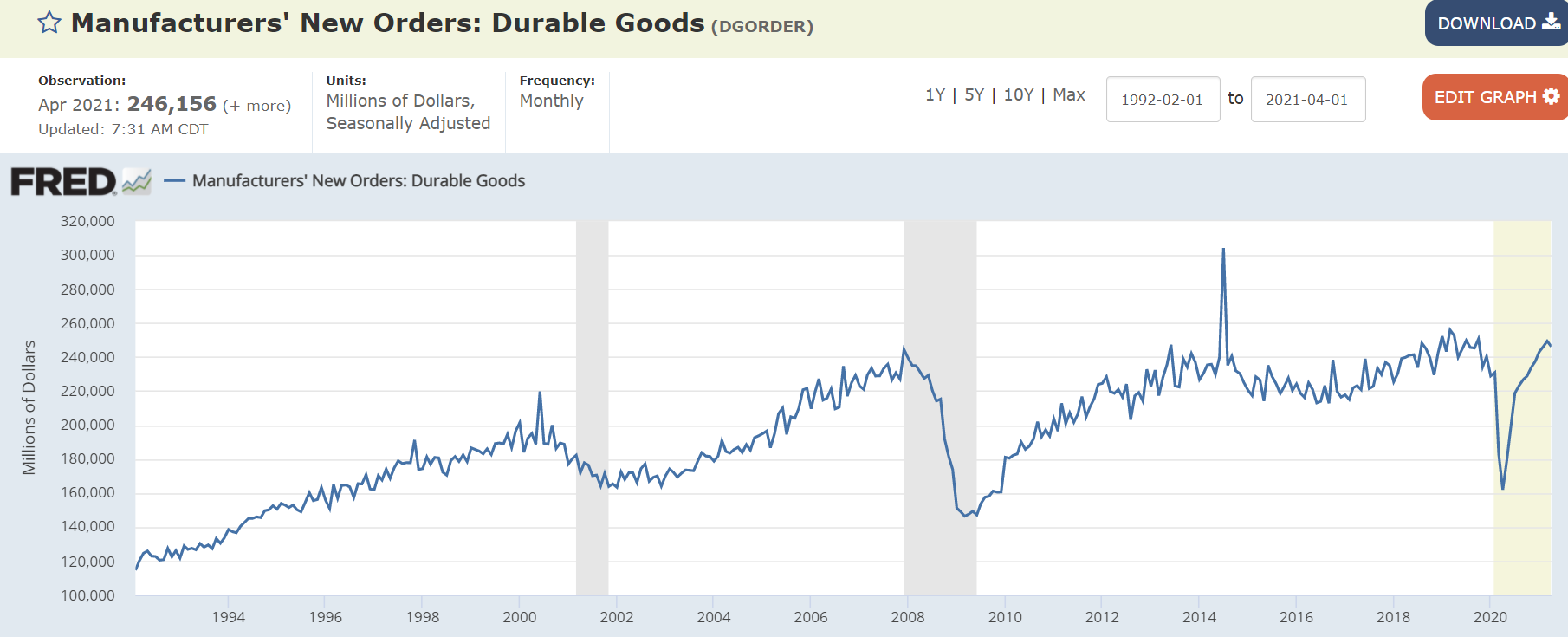

Fell back some and still below pre covid highs.

This chart is not adjusted for inflation:

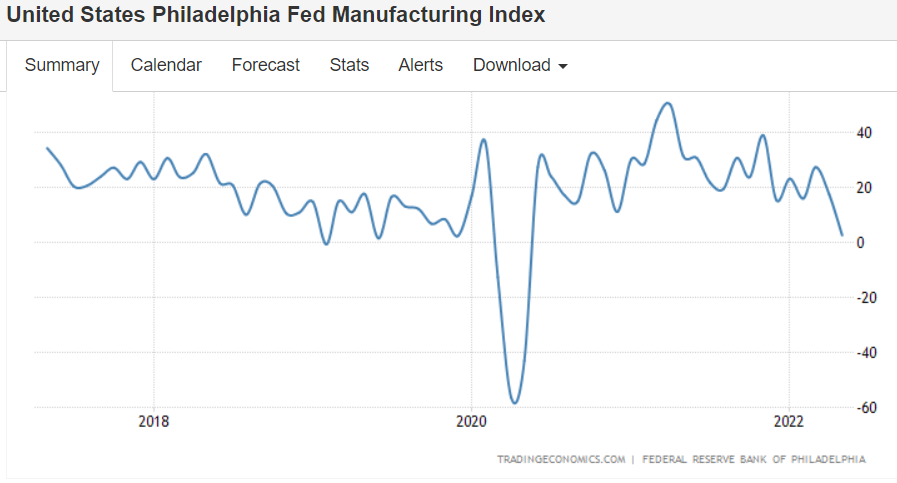

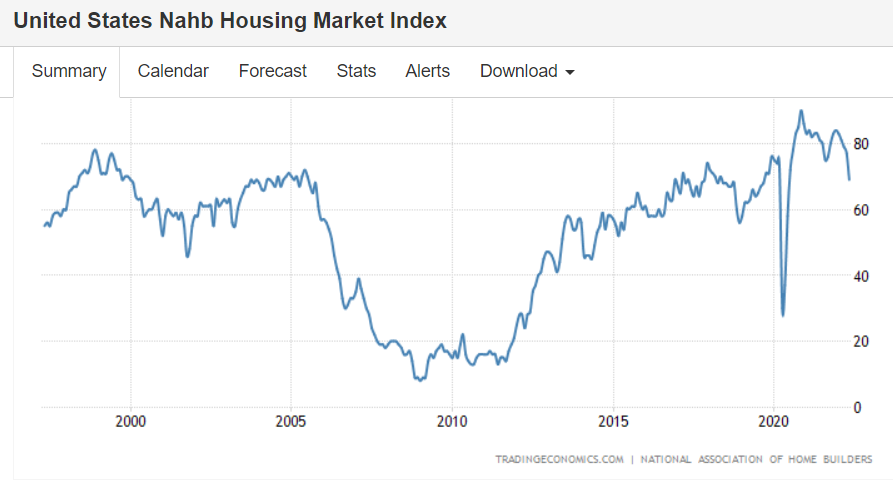

Same pattern of recent weakness:

Pending home sales in the US surged 51.7 percent year-on-year in April of 2021, the biggest increase ever amid a low base effect from last year when sales sank at a record pace because of the pandemic. All four US regions recorded year-over-year increases. On a monthly basis however, pending home sales dropped 4.4 percent, compared to forecasts of a 0.8 percent rise, with only the Midwest witnessing month-over-month gains. “Contract signings are approaching pre-pandemic levels after the big surge due to the lack of sufficient supply of affordable homes,” said Lawrence Yun, NAR’s chief economist. “The upper-end market is still moving sharply as inventory is more plentiful there”. Yun anticipates housing supply to improve as a whole as soon as autumn. He points to an increase in the comfortability of those listing, as well as a rise in sellers after the conclusion of the eviction moratorium or as they exit forbearance. source: National Association of Realtors