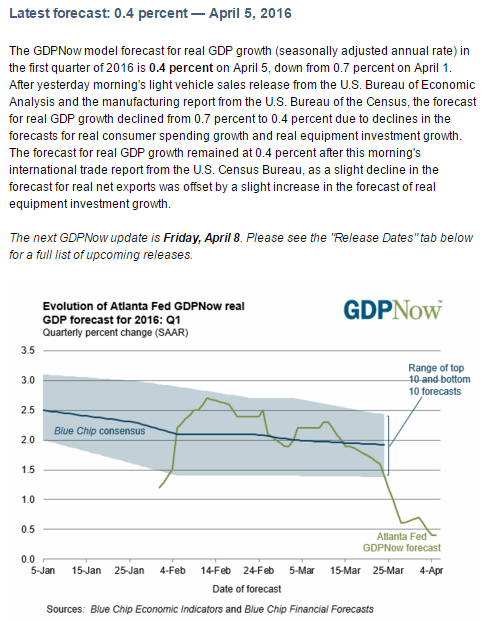

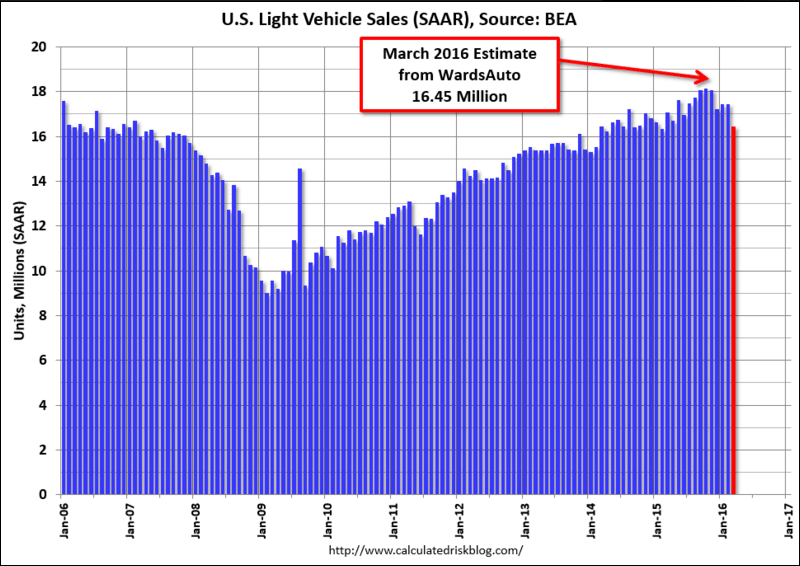

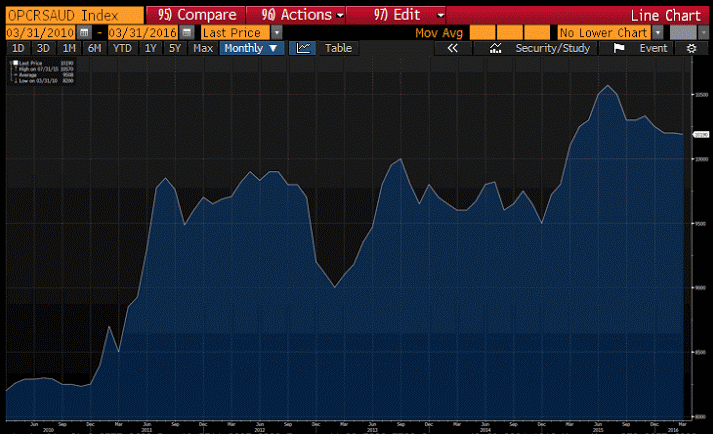

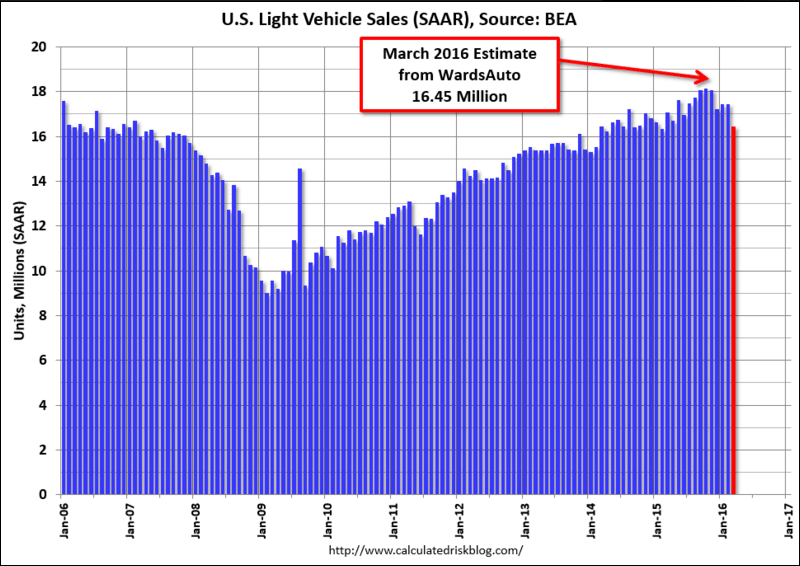

This is the big news today, and there’s nothing good about it. It’s way below expectations and continues the declilne from last year’s peak:

U.S. Light Vehicle Sales decline to 16.45 million annual rate in March

by Bill McBride

Based on an estimate from WardsAuto, light vehicle sales were at a 16.45 million SAAR in March.

That is down about 4% from March 2015, and down about 6% from the 17.43 million annual sales rate last month.

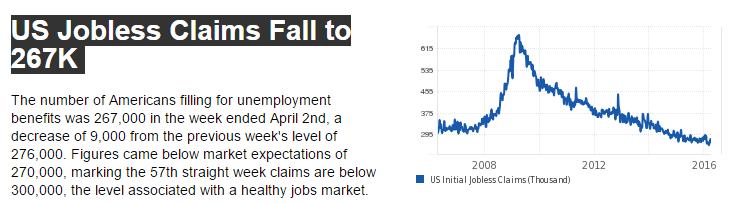

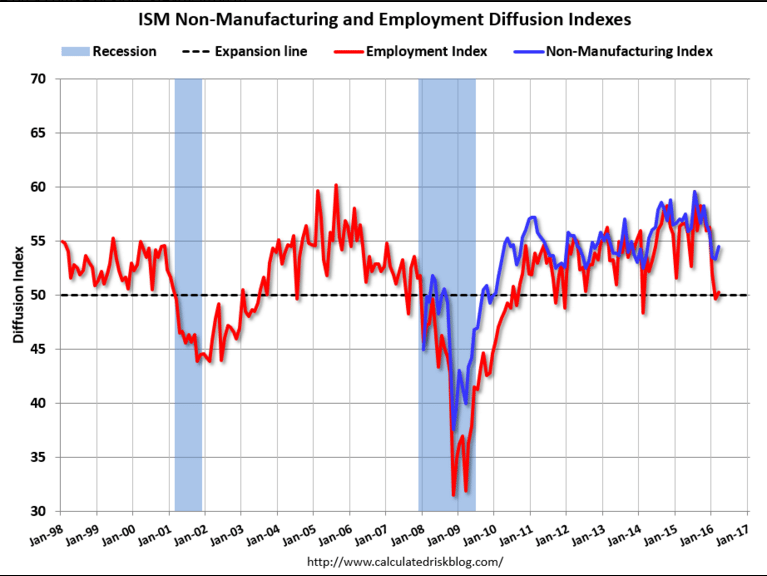

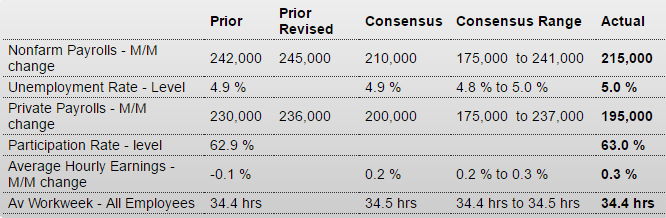

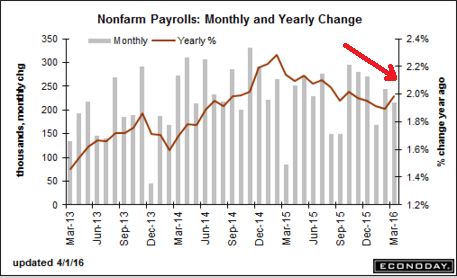

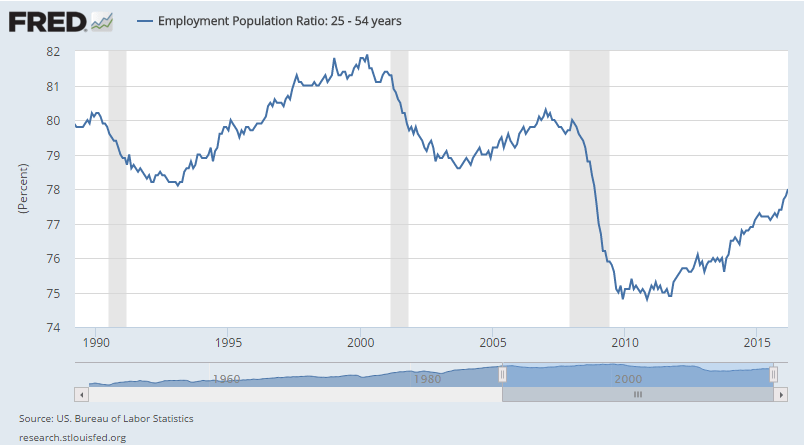

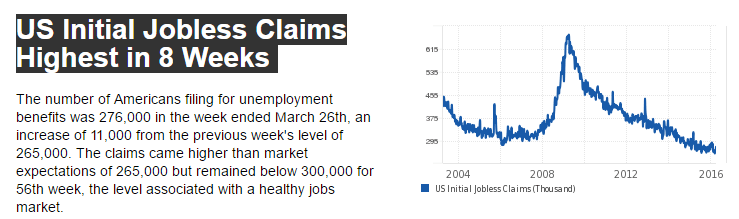

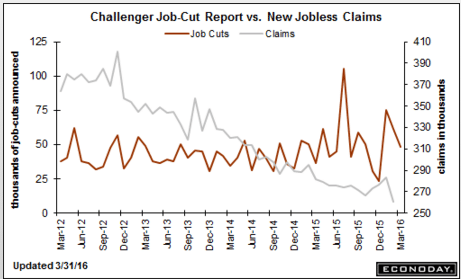

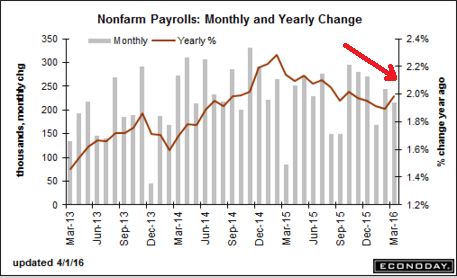

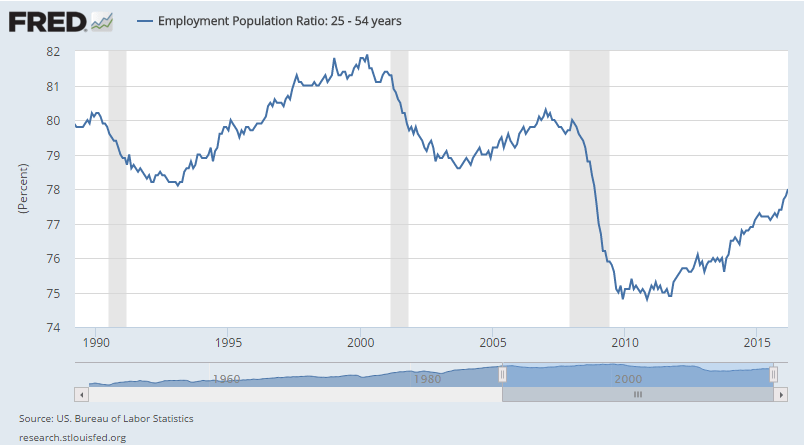

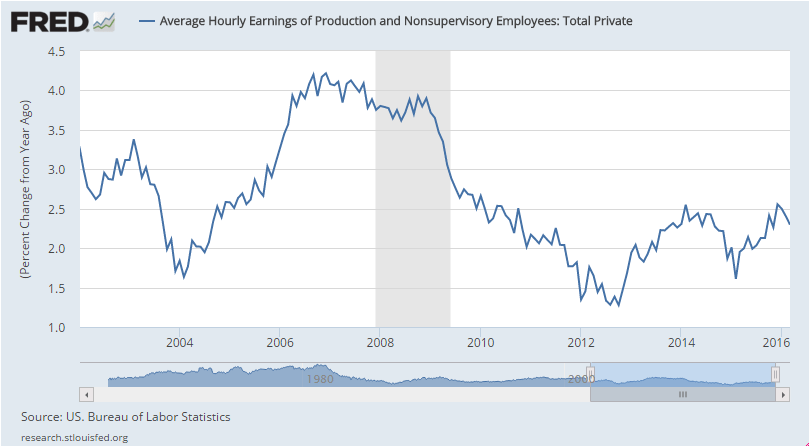

A bit better than expected, and, again, the growth rate (though generally declining) remains above GDP growth, indicating negative productivity growth. Also, it’s becoming more obvious that the ‘functional’ labor force has been a lot larger than most believed ever since the economy collapsed in 2008. Likewise, wage gains remain far below those of prior recoveries.

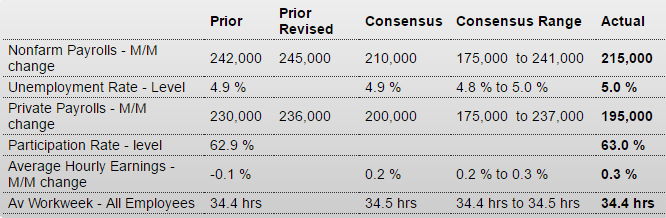

Employment Situation

Highlights

The labor market is growing with nonfarm payrolls up a higher-than-expected 215,000 in March and with the labor participation rate rising 1 tenth to 63.0 percent. The gain in participation, reflecting new job seekers coming into the market, is pulling the unemployment rate higher, up 1 tenth in March to 5.0 percent in what is the result of strength, not weakness, for employment. And there’s pressure in average hourly earnings, at least on the monthly level with a higher-than-expected gain of 0.3 percent that, however, did not lift the year-on-year which is sagging at plus 2.3 percent.

Payrolls by industries show further big gains for trade & transportation, construction and also retail. Professional & business services are also strong suggesting that employers have plenty of jobs to fill. Manufacturing, however, is once again down.

Not showing greater strength is the workweek, steady at 34.4 hours, nor manufacturing hours, with a decline in the latter pointing to another month of disappointment for the factory sector.

Revisions are not a factor in today’s report, one that, despite weak spots, points to accelerating economic growth. Yet the report is probably not strong enough to reawaken talk of a rate hike this month, at least not following Janet Yellen’s dovish speech on Tuesday, though the June FOMC may seem like a rising possibility.

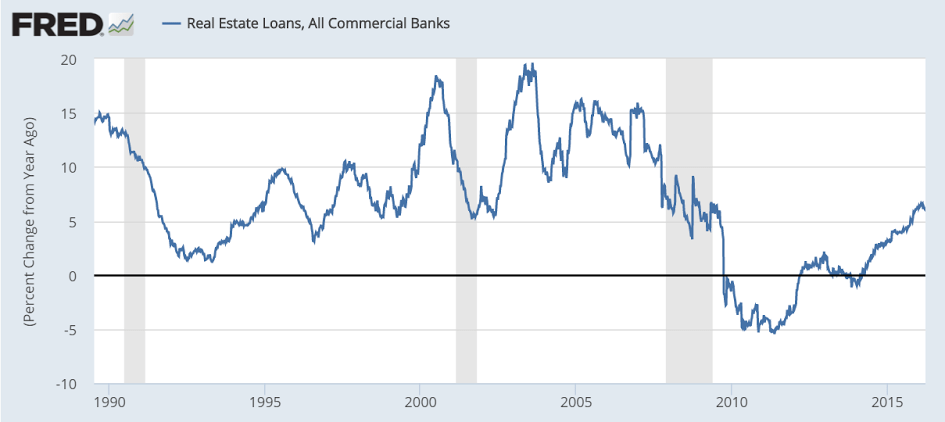

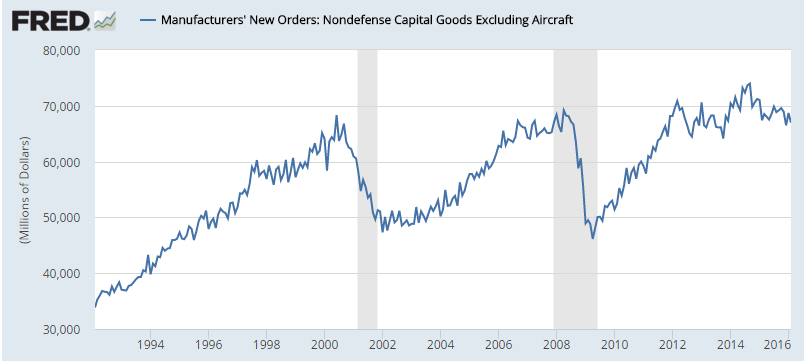

This is only gradually getting back to the LOWS of the last two cycles:

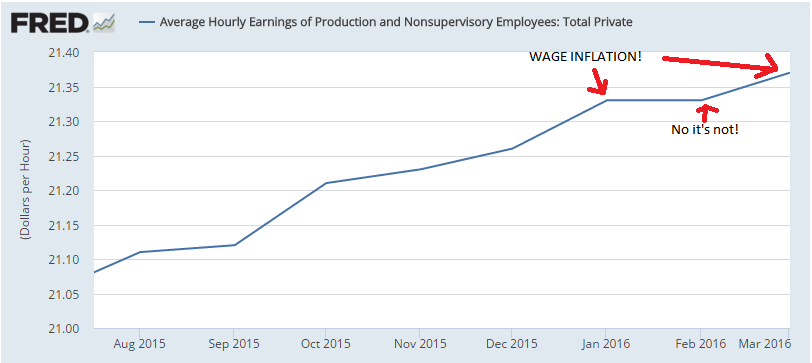

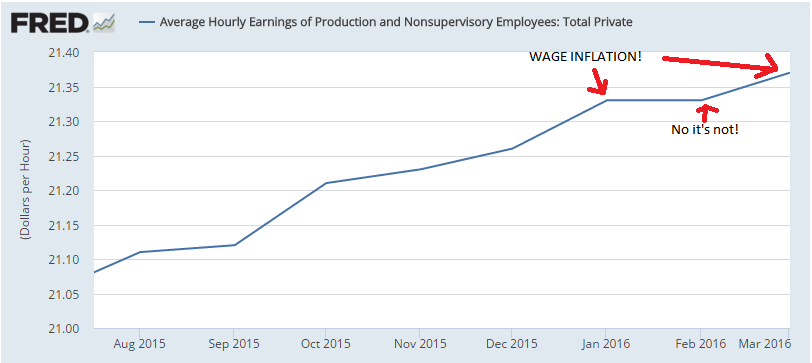

With every little wiggle up they scream WAGE INFLATION, but then wages revert lower and nothing is said. Then a wiggle up this week and it’s “WAGE INFLATION!!!!” again.

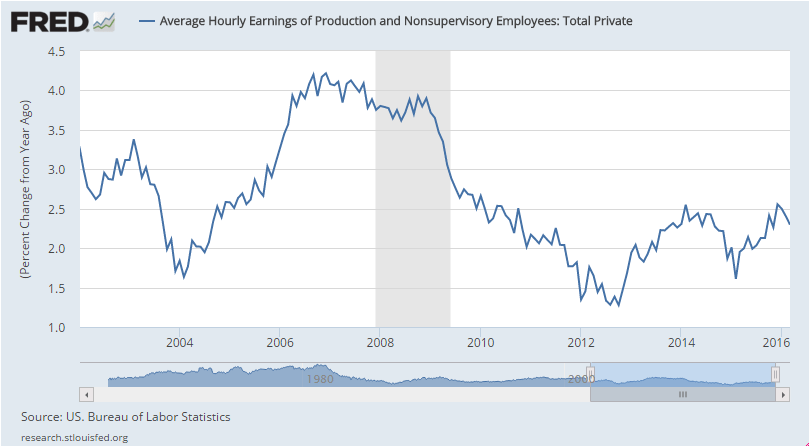

But a look at the year over year growth chart shows wage growth remains both low and depressed, a clear sign of a big whopping shortage of aggregate demand:

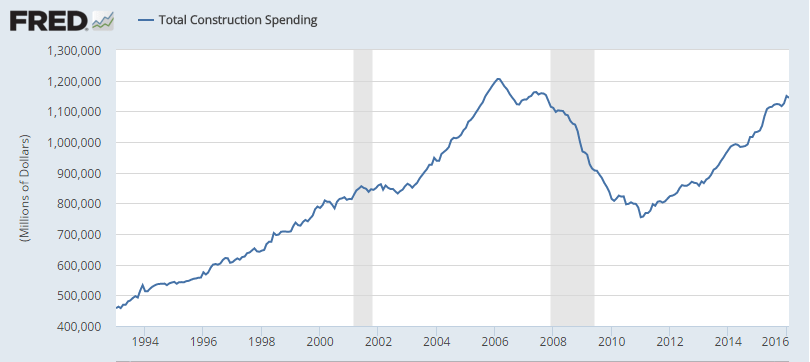

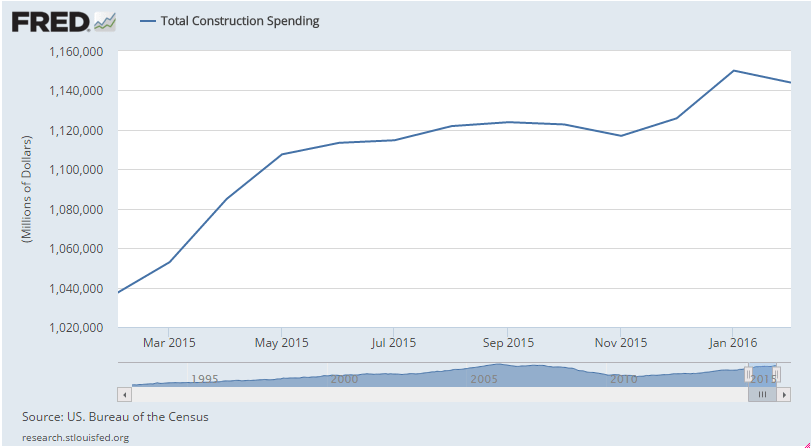

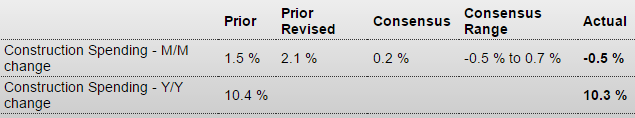

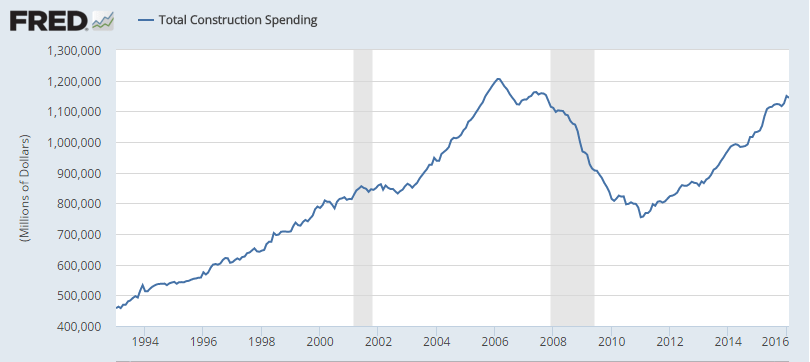

Cold winter last year, warm winter this year. The weather only gets mentioned when they are trying to make low prints look better? Note from the charts it’s still well below pre recession levels without adjusting for inflation:

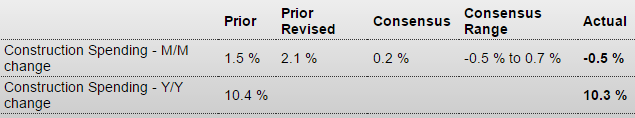

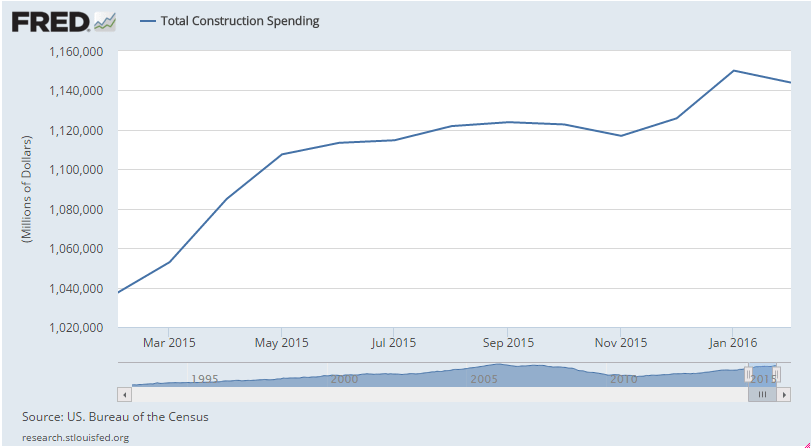

Construction Spending

Highlights

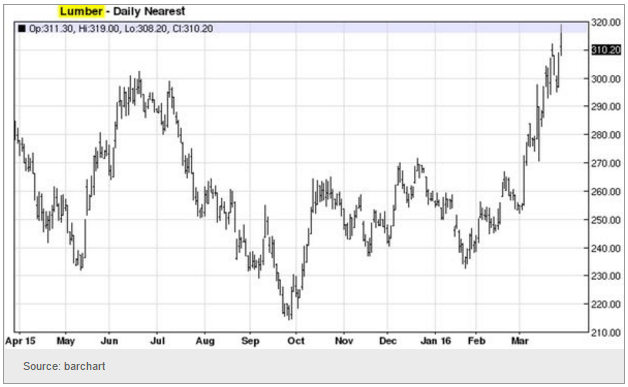

A 0.5 percent decline for February masks what is otherwise a very solid construction spending report that includes upward revisions and gains for the residential component. January is now revised 6 tenths higher to a gain of 2.1 percent with the residential component moving from unchanged to plus 0.9 percent. New single-family homes now show a 0.5 percent gain for January and a very strong 1.2 percent gain for February. Multi-family homes also show a gain, up 0.9 percent following a 3.6 percent January surge. Year-on-year growth for residential spending is now in the double digits at 10.7 percent.

It’s the non-residential component that dragged February’s totals lower, down 1.3 percent with weakness in the manufacturing, educational, and highway & street subcomponents. Still, all together, non-residential construction spending, boosted especially by hotels and also offices, is tracking in line with the residential side, at a year-on-year plus 10.6 percent.

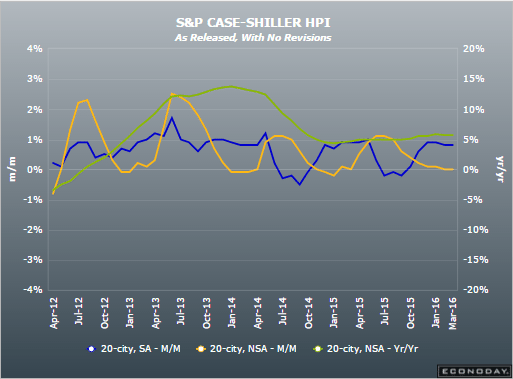

Construction spending, along with building strength for construction employment, are isolated but still fundamental positives for the housing sector where sales growth and price appreciation, however, have stalled.

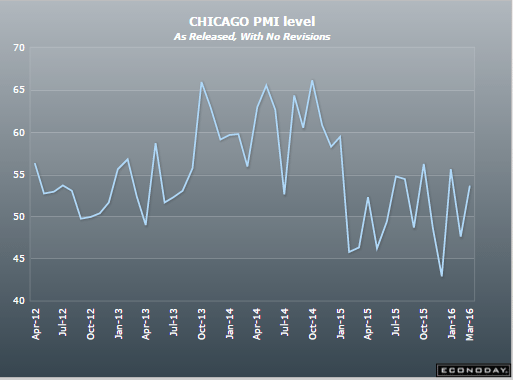

And note how flat it’s been since May:

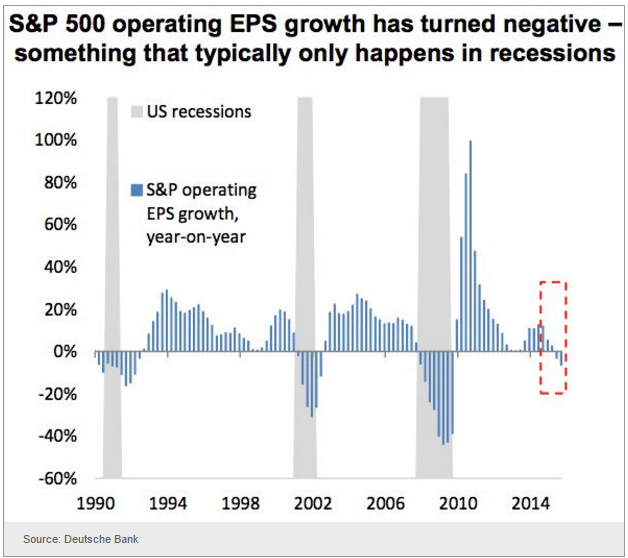

March 31 (WSJ) — First-quarter earnings for S&P 500 companies are forecast to slump 8.5% from the same period last year, according to FactSet. Revenues at S&P 500 companies are forecast to log a drop of 1.1% in the first quarter, according to FactSet, which would mark the fifth consecutive quarter of declining revenues. Analysts polled by FactSet predict earnings at S&P 500 companies will rise 3.8% in the third quarter from the same period of 2015. Revenues are forecast to advance 1.9% in the third quarter. Profits and revenues are expected to accelerate in the fourth quarter, with analysts forecasting an 11% increase in earnings and a 4.3% rise in revenues for S&P 500 companies.

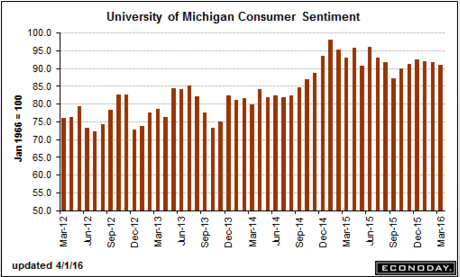

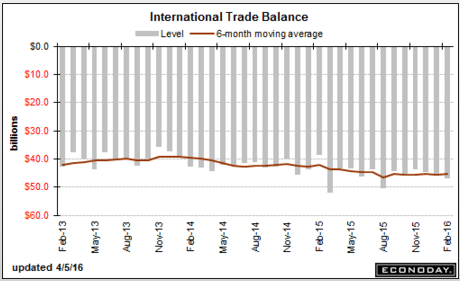

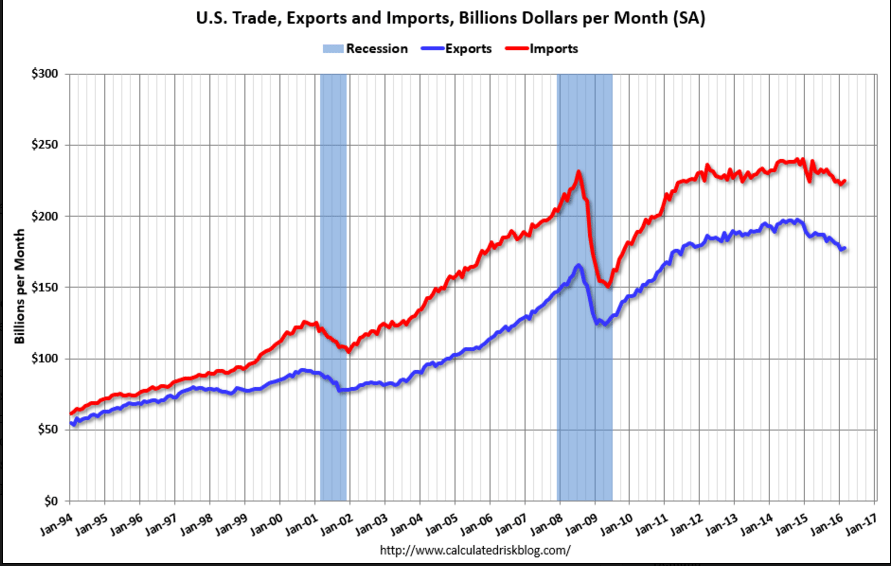

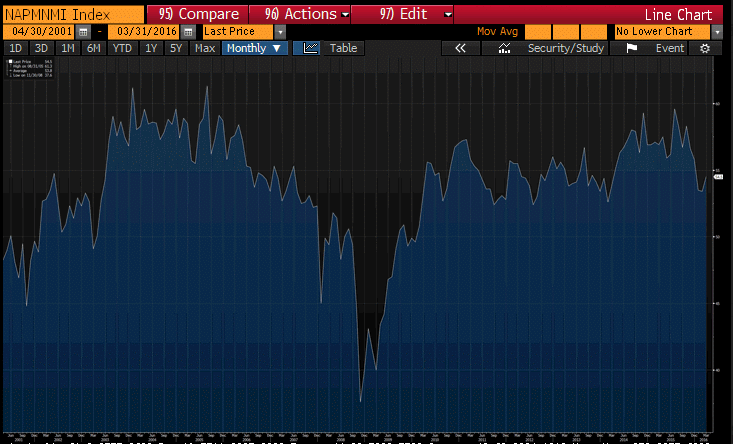

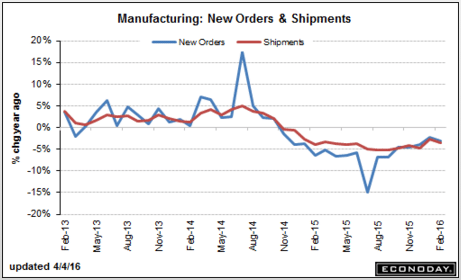

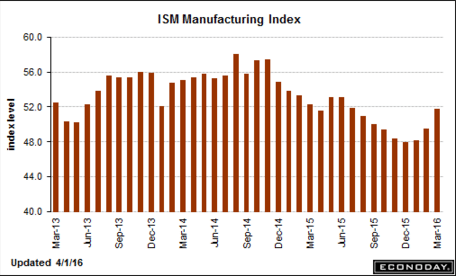

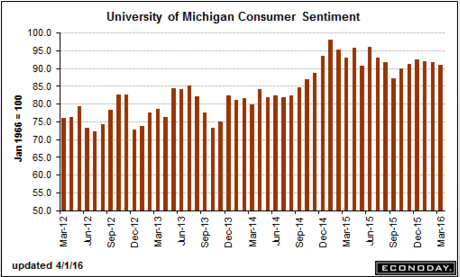

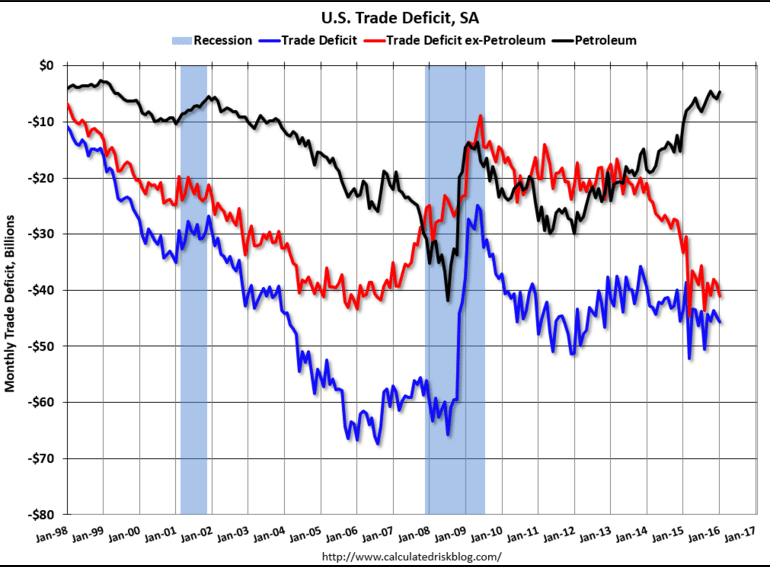

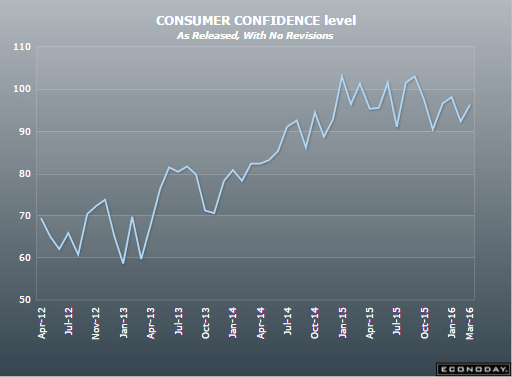

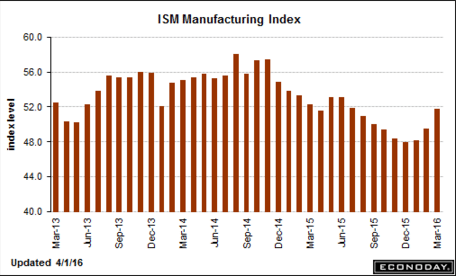

Better than expected but the rest of the news tells me this likely to go back down:

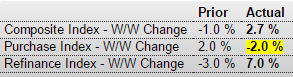

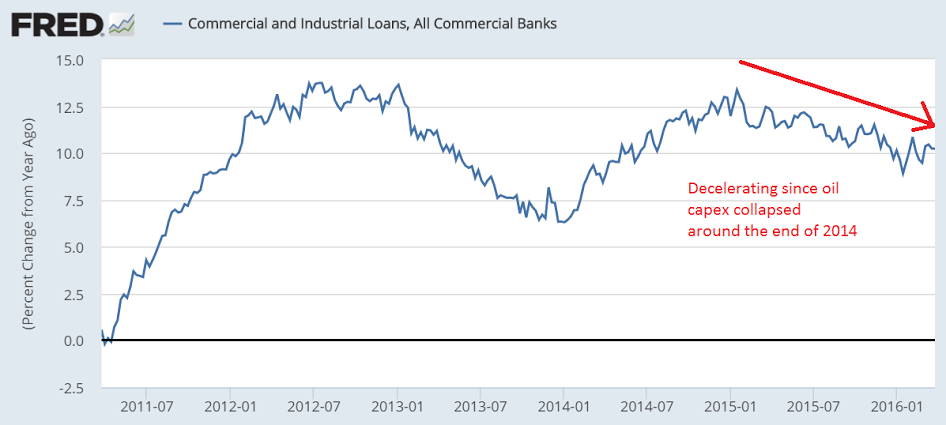

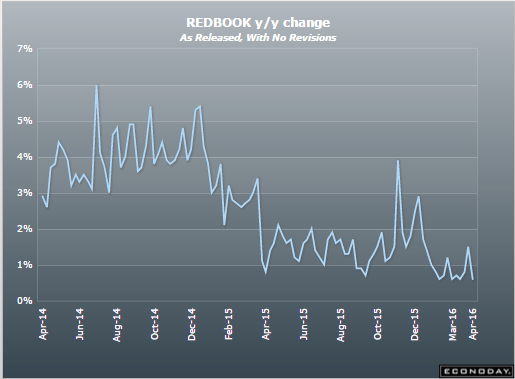

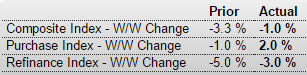

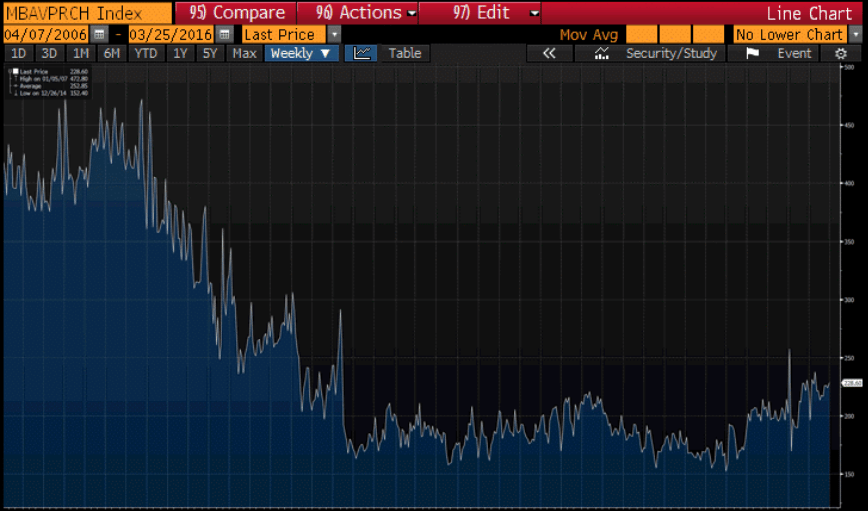

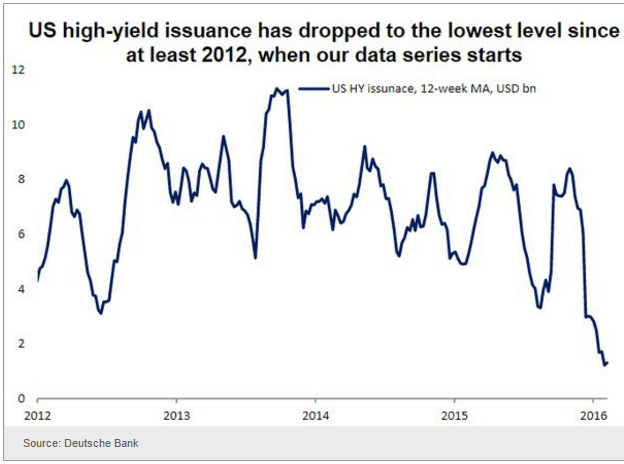

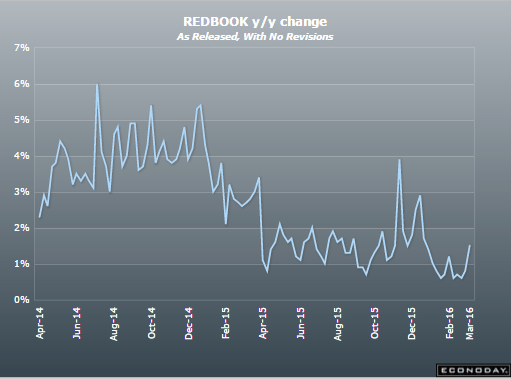

Continues to soften: