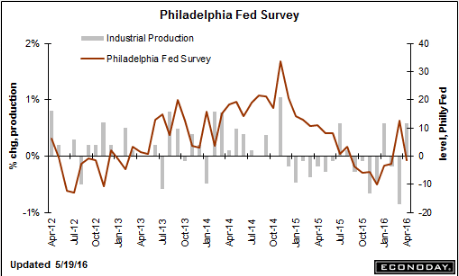

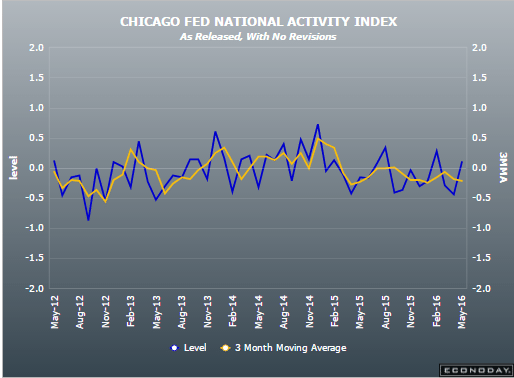

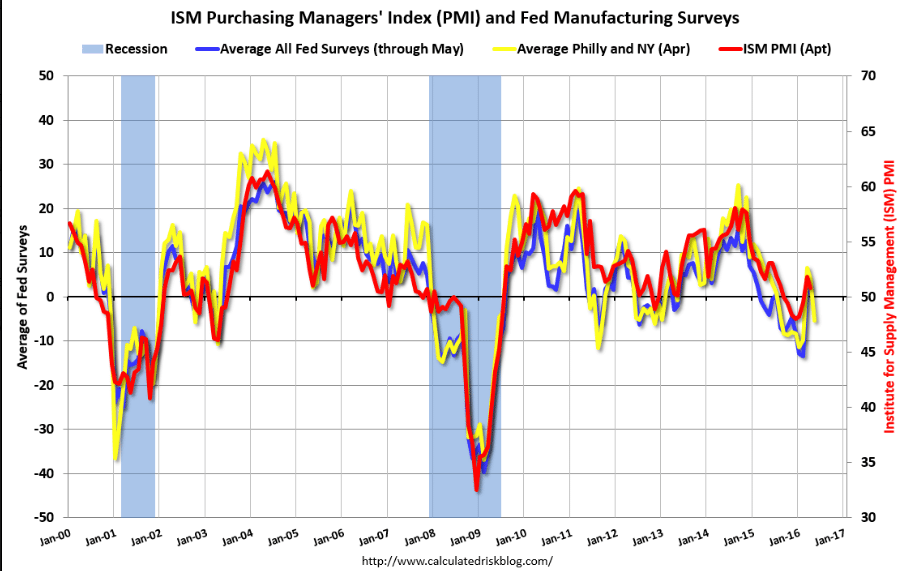

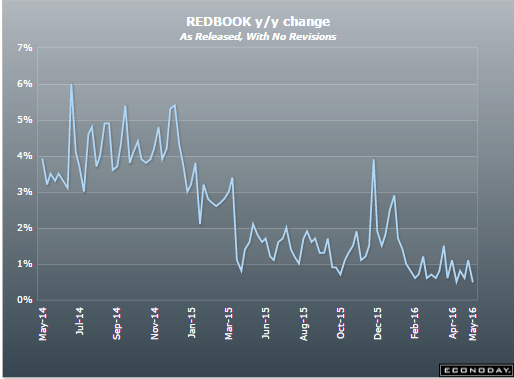

From bad to worse:

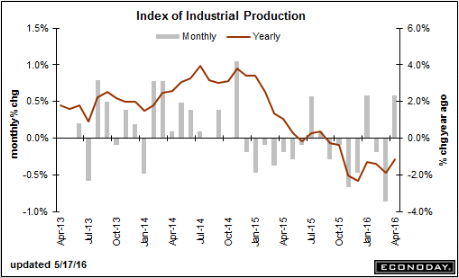

Another May reversal from a hopeful April gain:

Richmond Fed Manufacturing Index

Highlights

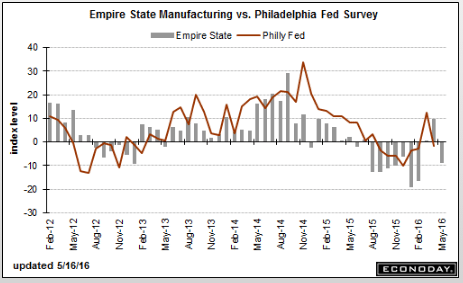

The Richmond Fed index fell a sharp 15 points in May to minus 1, adding further evidence of a serious slowdown in manufacturing activity as also indicated in last week’s Empire State and Philly Fed reports for May. Several of the survey’s key measures dropped steeply and went into contraction from previous strength, with shipments down 22 points from April to -8, backlog orders down 24 points to -13 and capacity utilization down 24 points to -6. New orders which were particularly strong in the previous two months, dropped 18 points to 0. On the employment side, wages remained at a respectable plus 15, but the average workweek fell 4 points to 6 and the number of employees index shed 4 points to 4. Only inventories and prices were a positive for manufacturing in the Richmond Fed region during May, with finished inventories up 5 points to 19 and raw materials inventories up 10 points to 25, while prices received finally showed a small improvement, rising to an annualized rate of 0.77 percent.

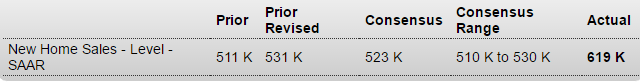

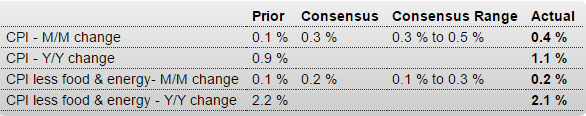

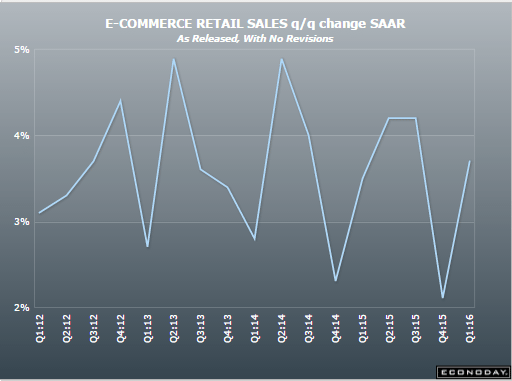

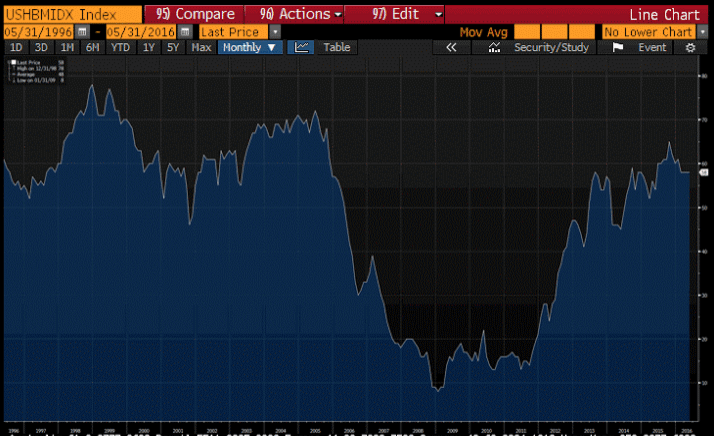

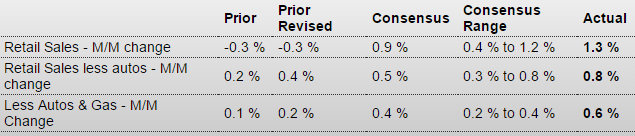

Unexpectedly large April jump in this volatile series. Best to wait and see what May brings before jumping to conclusions?

New Home Sales

Highlights

The new home sales report has sealed its reputation as the wildest set of data around. April’s annualized rate came in at 619,000 which is not a misprint. This is the highest rate since January 2008 and dwarfs all readings of the recovery. February 2015’s rate, way behind at 545,000, is the next highest rate this cycle. The data even include a very large 39,000 net upward revision to the two prior months, a gain that reflects annual revisions which are included in the data. The monthly 16.6 percent surge is not only far beyond expectations but is the biggest monthly gain since way back in January 1992.

The data also include a big jump in prices, up 7.8 percent in the month to a record median $321,100 while the year-on-year rate, which was negative in the March report, is at plus 9.7 percent year-on-year.

But the surge in sales is a negative for supply as supply relative to sales fell very sharply to 4.7 months from 5.5 months. The total number of new homes for sale was little changed, down 1,000 at 243,000.

Regional data show a more than 50 percent jump in the Northeast where however the number of sales relative to other regions is very low. The same is true of the Midwest where sales fell 4.8 percent in the month. The two main regions for new home sales both show outsized gains with the South up 15.8 percent and the West up 23.6 percent.

Year-on-year, total sales are suddenly up 23.8 percent, this at the same time that the median price is now well past the 6 percent rate where housing appreciation had been trending. Even though new home sales are volatile, which reflects the report’s small sample sizes, and even though low supply will limit future gains, the outlook for housing just got a big boost. Talk will build for a greater contribution from housing to overall growth. Watch for FHFA house price data on tomorrow’s calendar where another month of solid appreciation is expected.

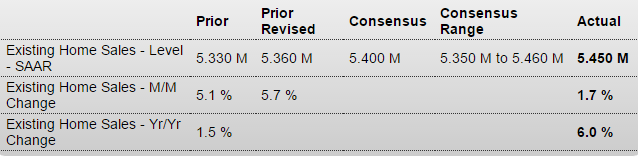

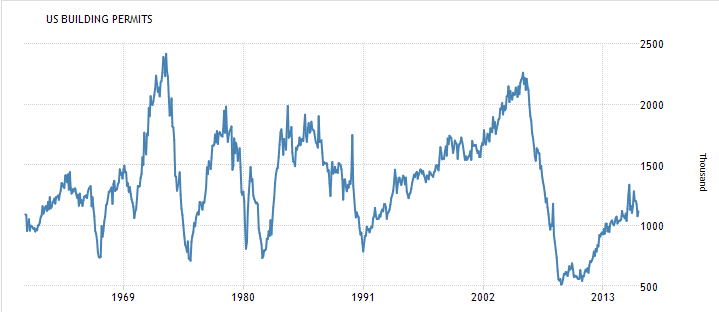

Nice move higher but still at very low levels: