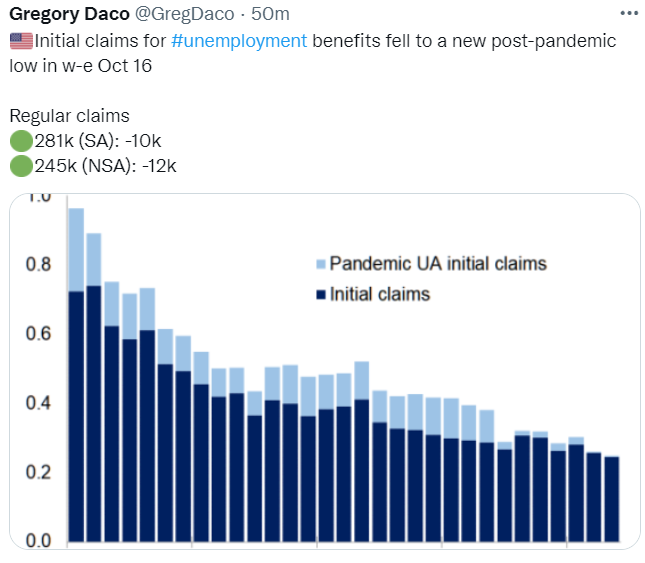

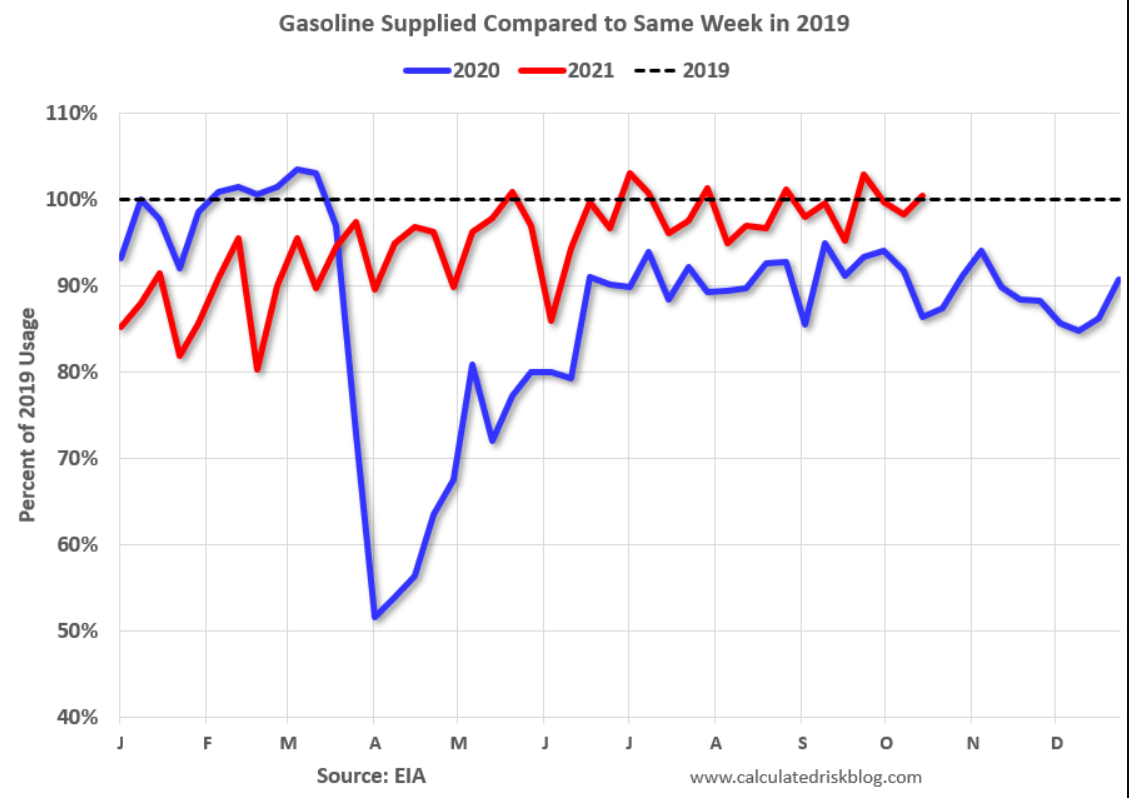

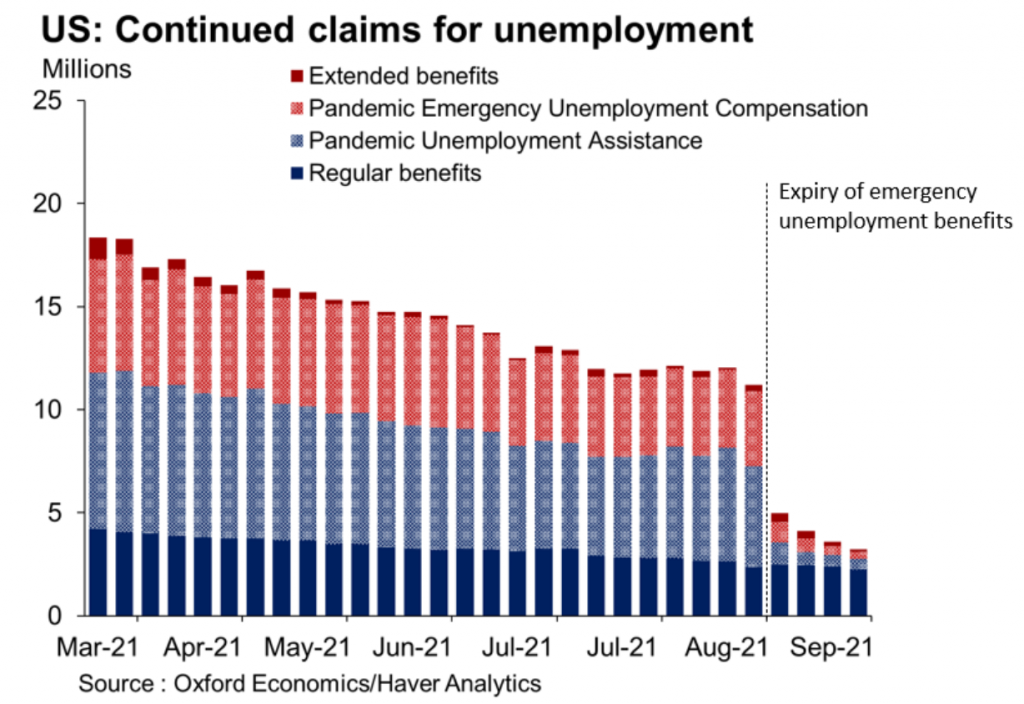

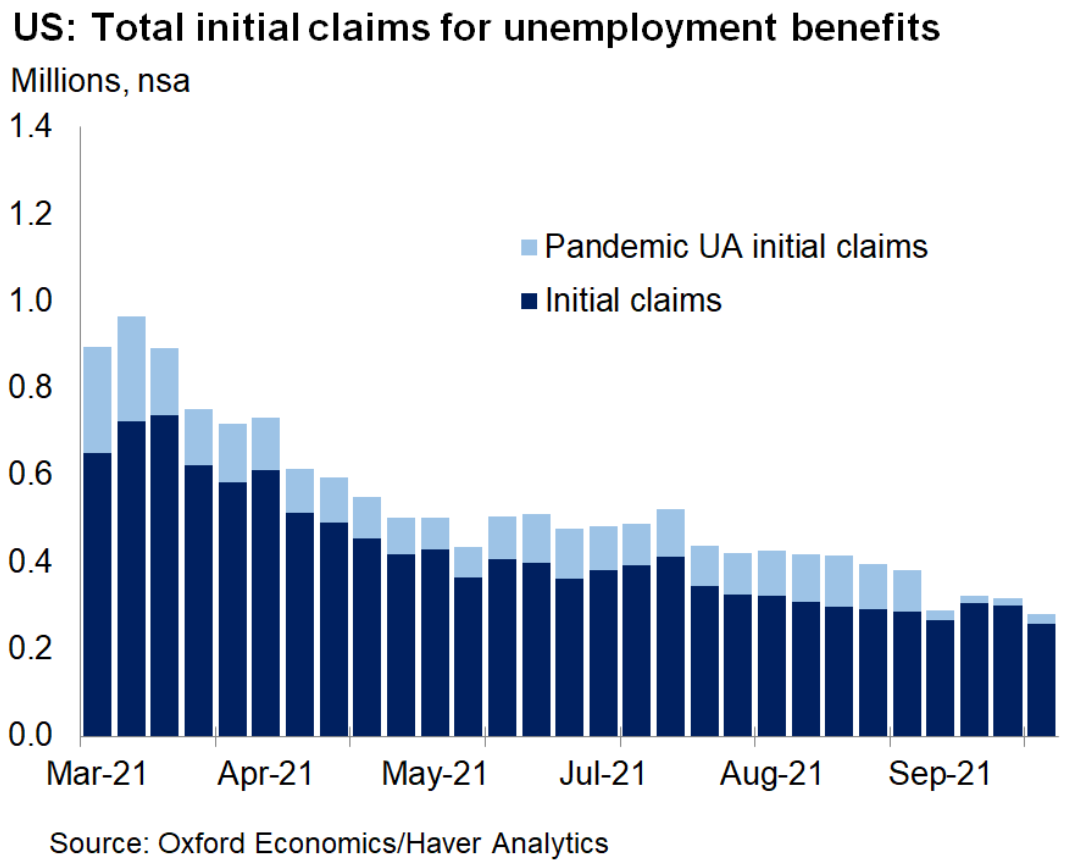

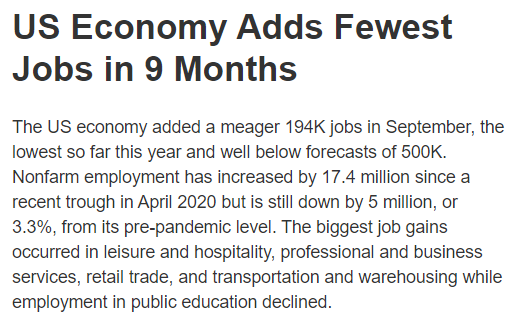

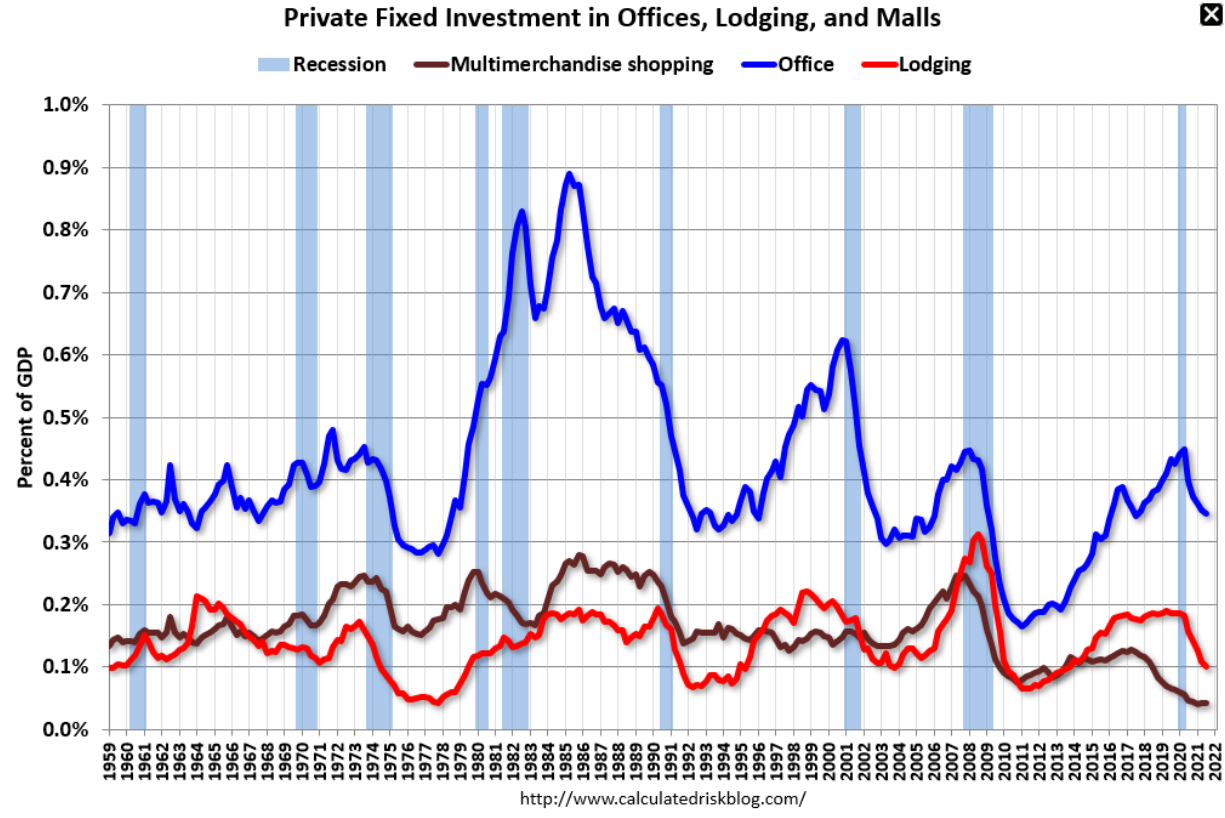

Still way down:

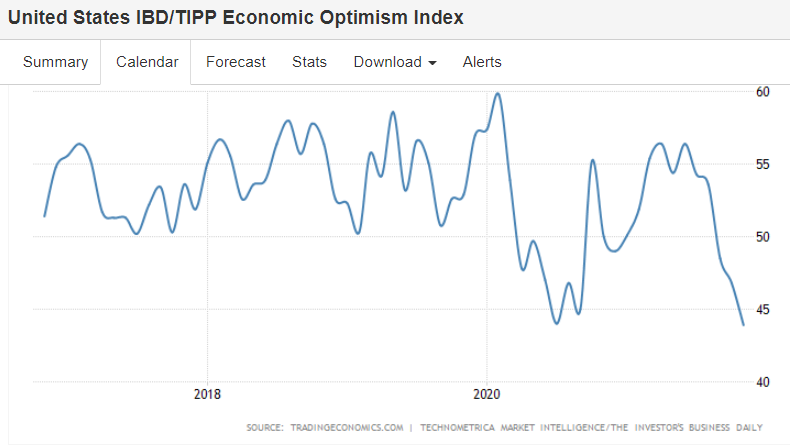

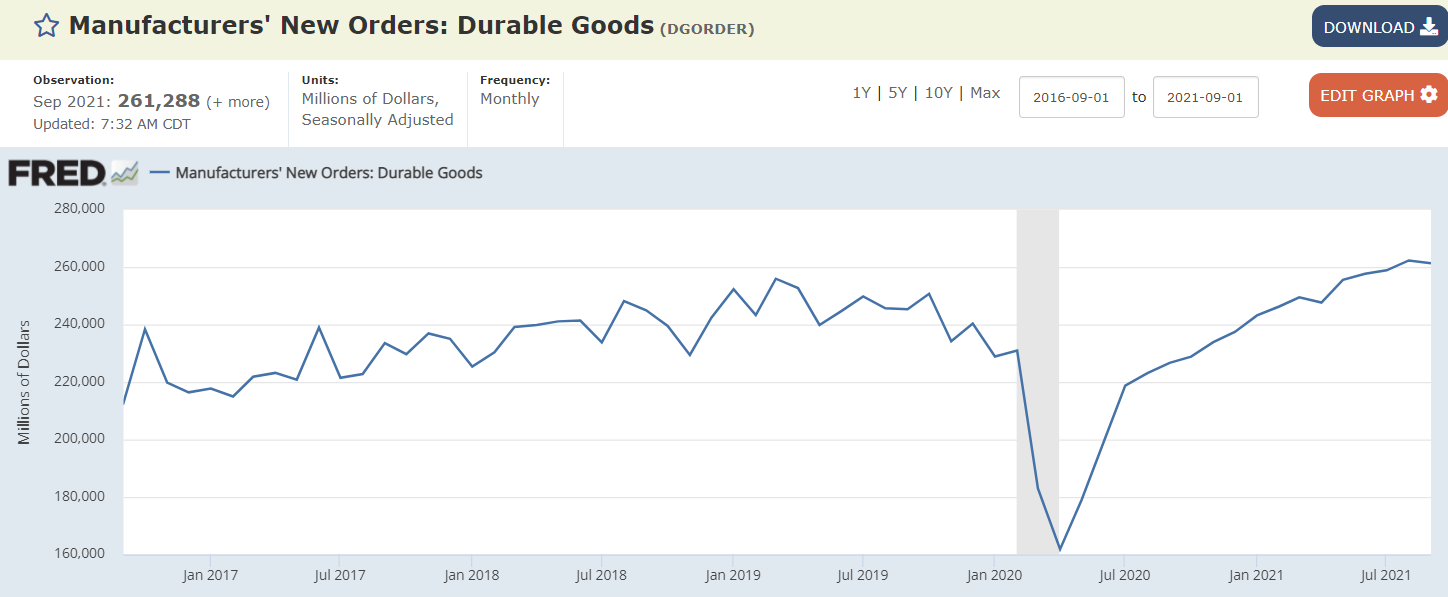

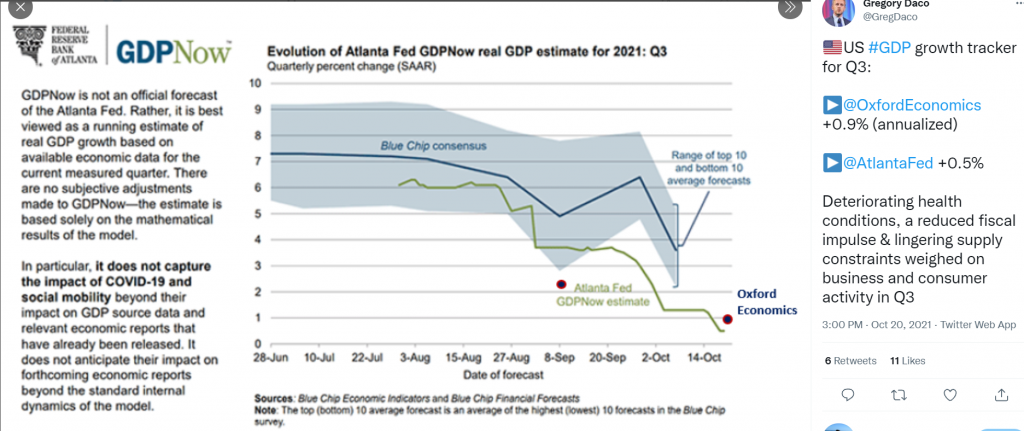

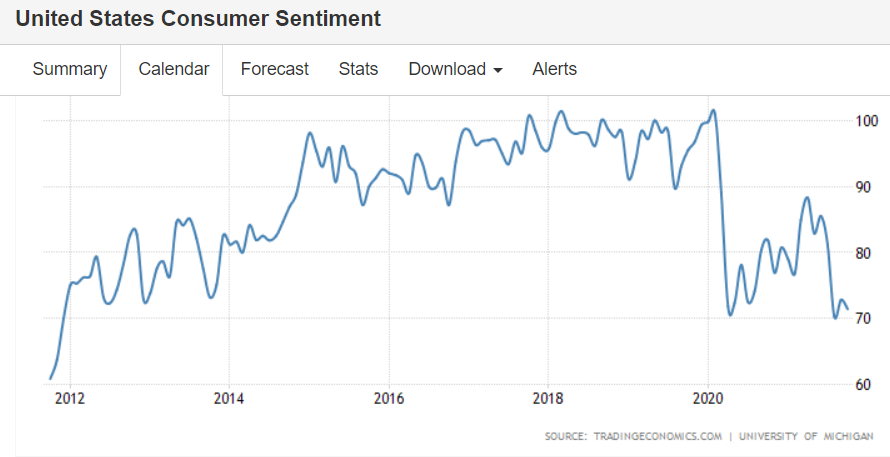

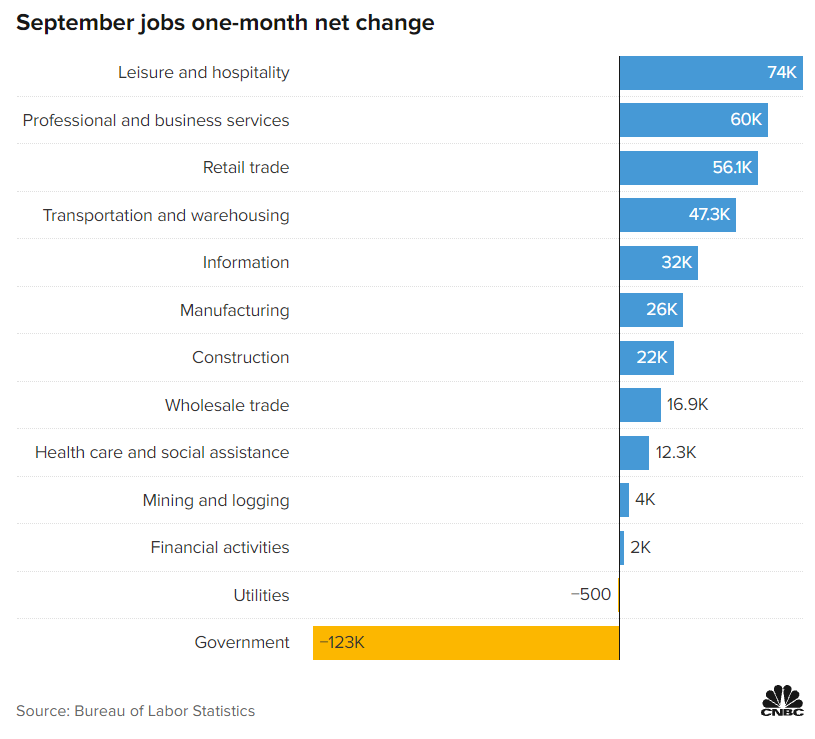

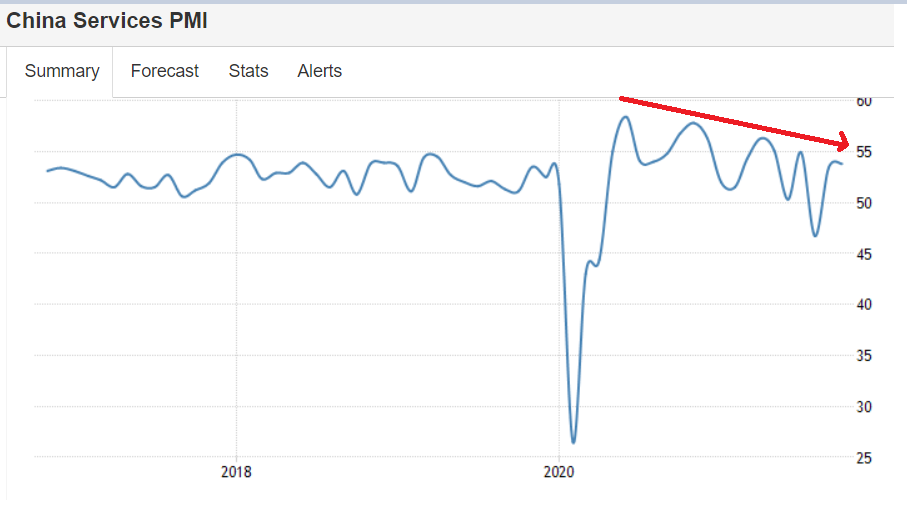

I like the headline but the chart not so much:

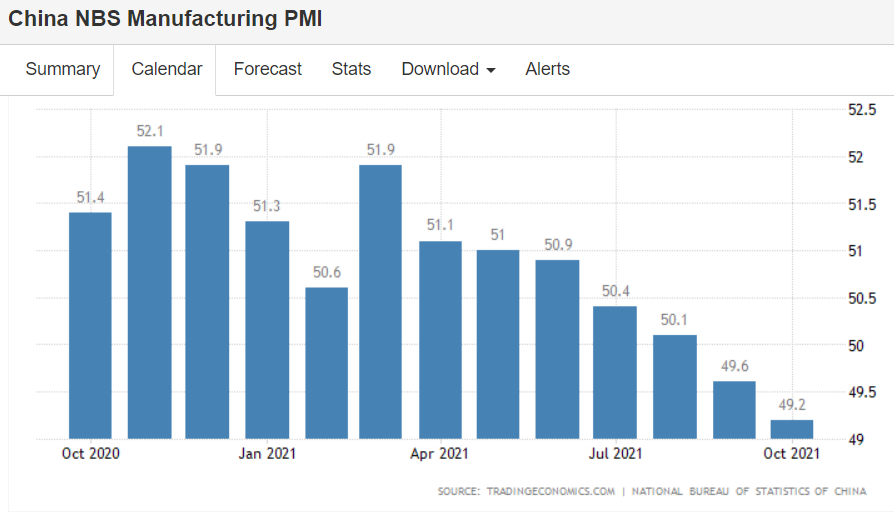

China Services PMI Rises to 3-Month High

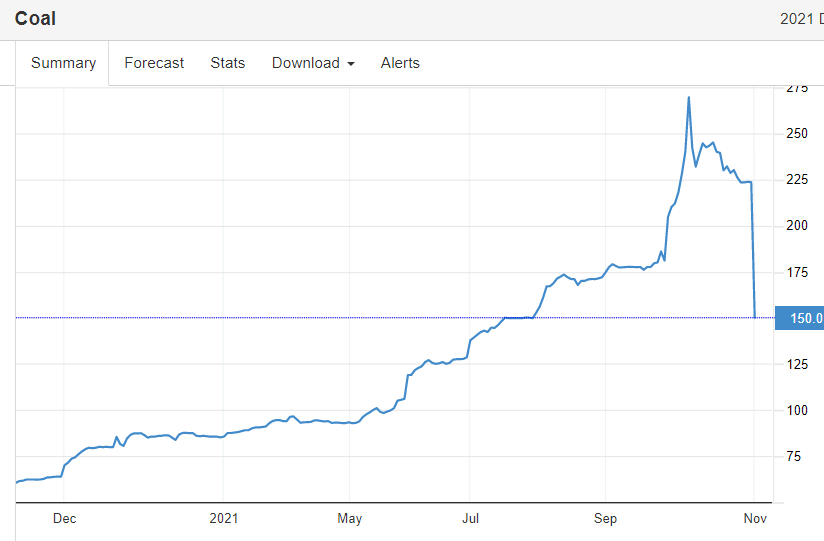

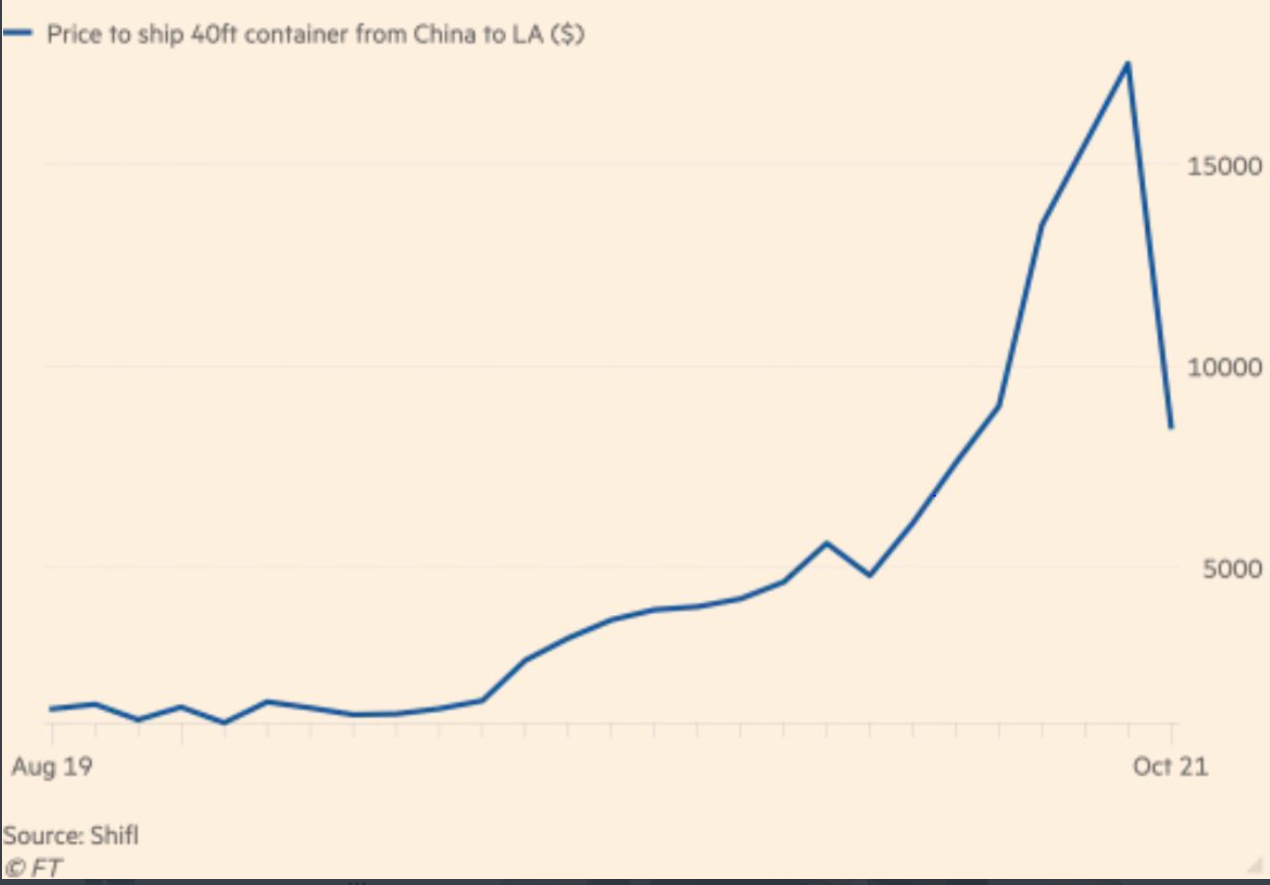

The Caixin China General Services PMI increased to 53.8 in October 2021 from 53.4 in the prior month, pointing to the second straight month of expansion in the service sector and the steepest pace since July as COVID-19 outbreaks eased. New orders expanded the most in three months, export sales returned to growth, and employment rose for the second month in a row. Meantime, backlogs of work were unchanged following a three-month sequence of accumulation. On the cost front, input prices rose for the 16th straight month and increased at the fastest pace in three months on rising labor, and raw material costs; while output cost inflation accelerated to the quickest since July. Looking forward, sentiment weakened to a four-month low, due to concerns over rising costs and supply chain disruption.

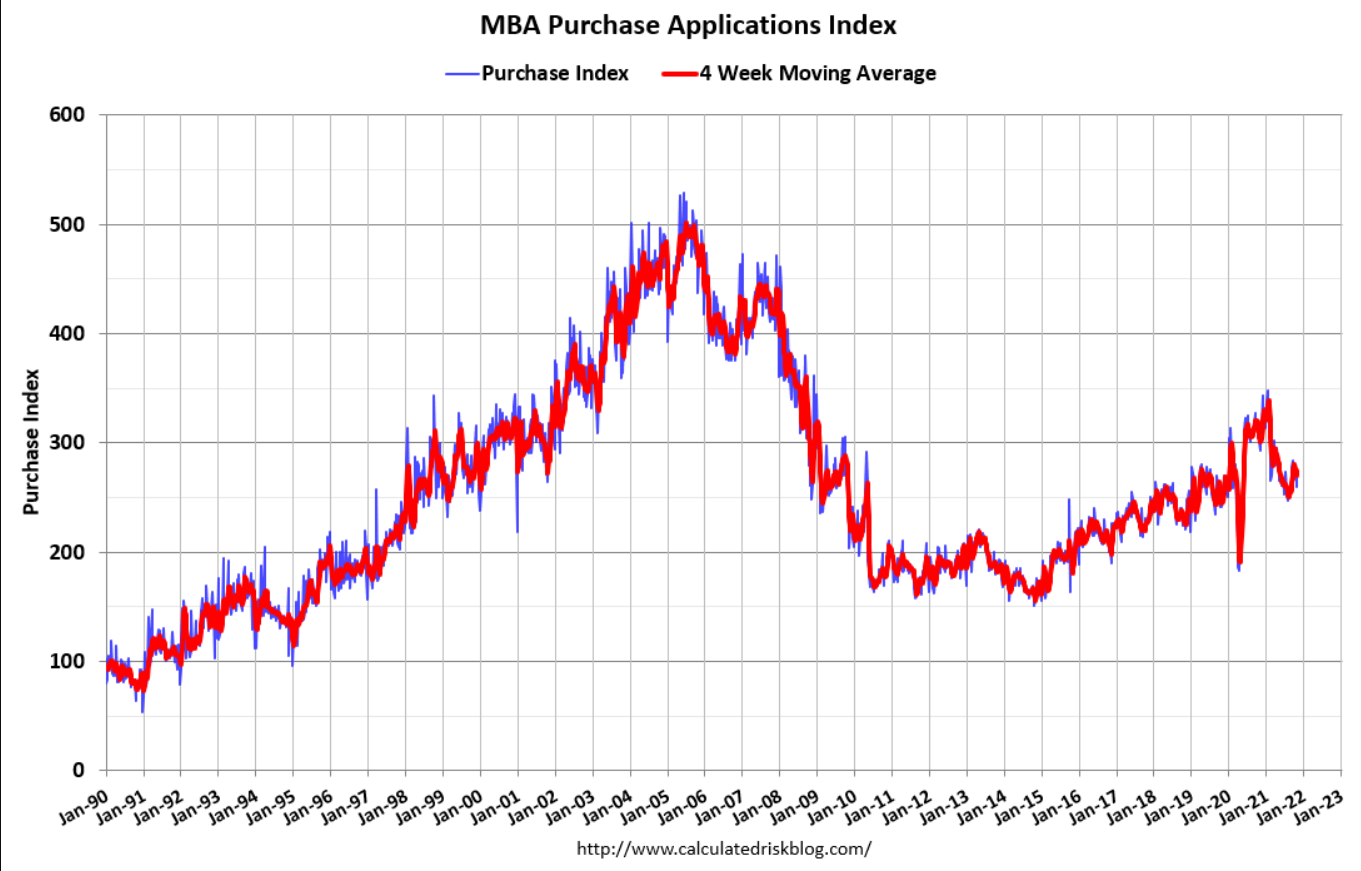

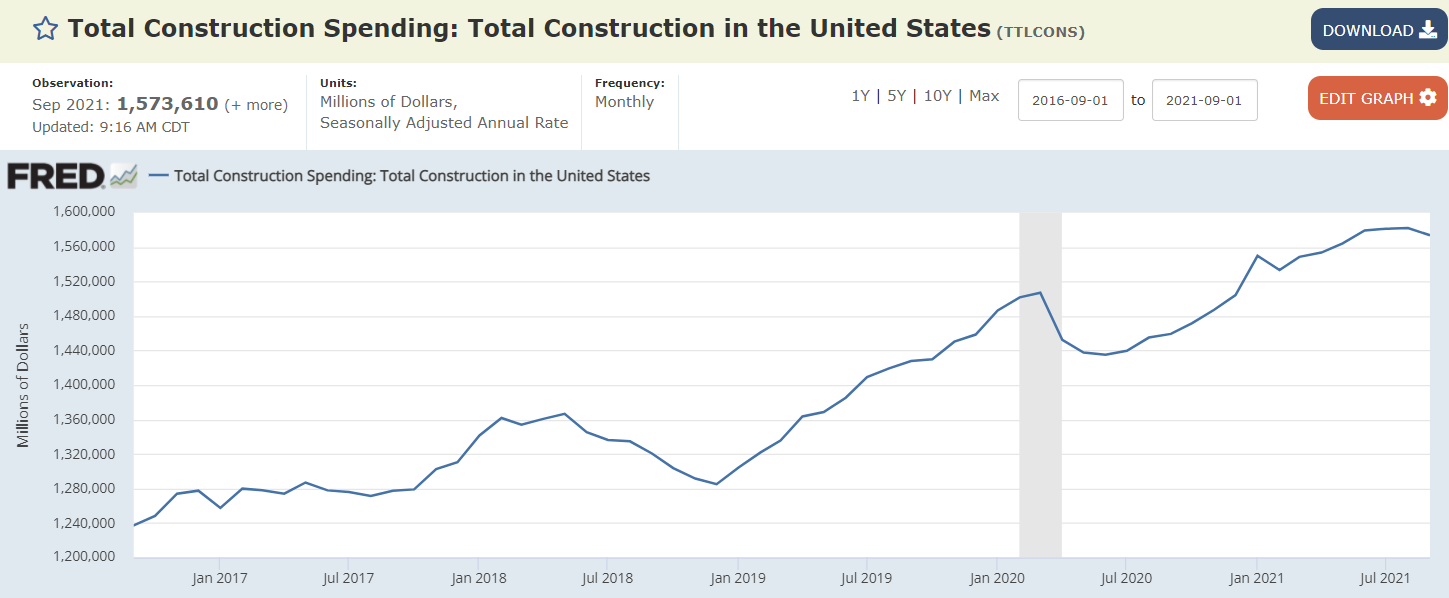

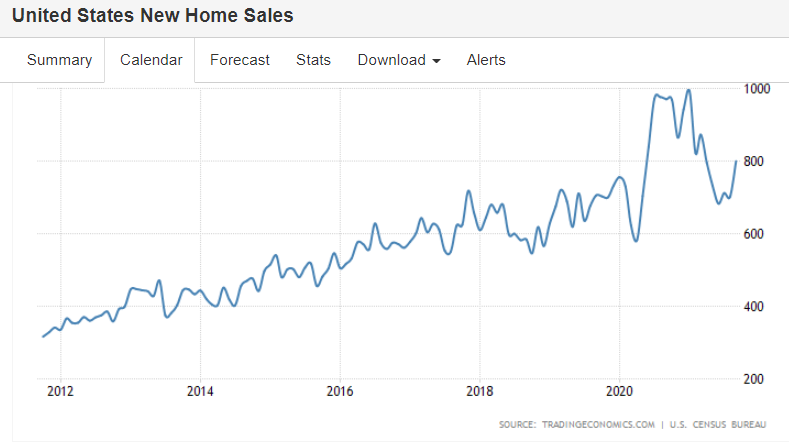

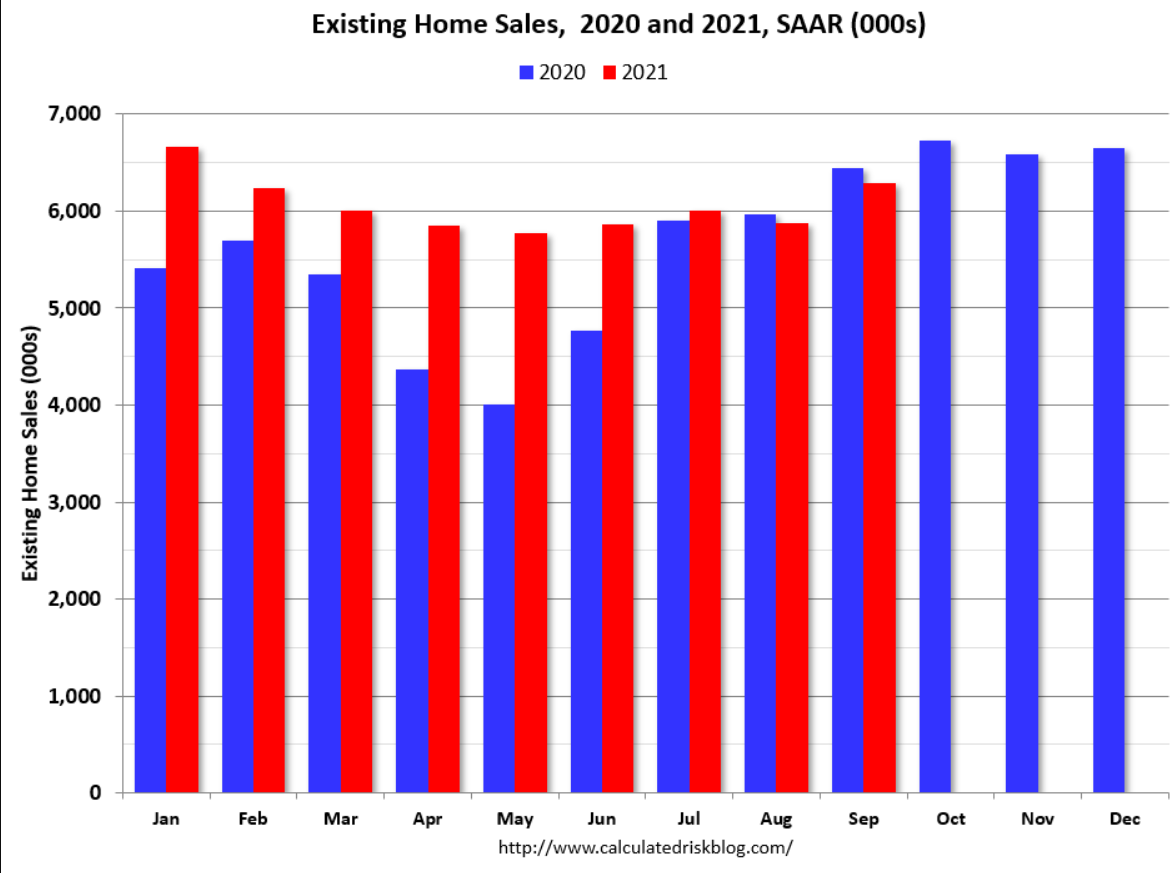

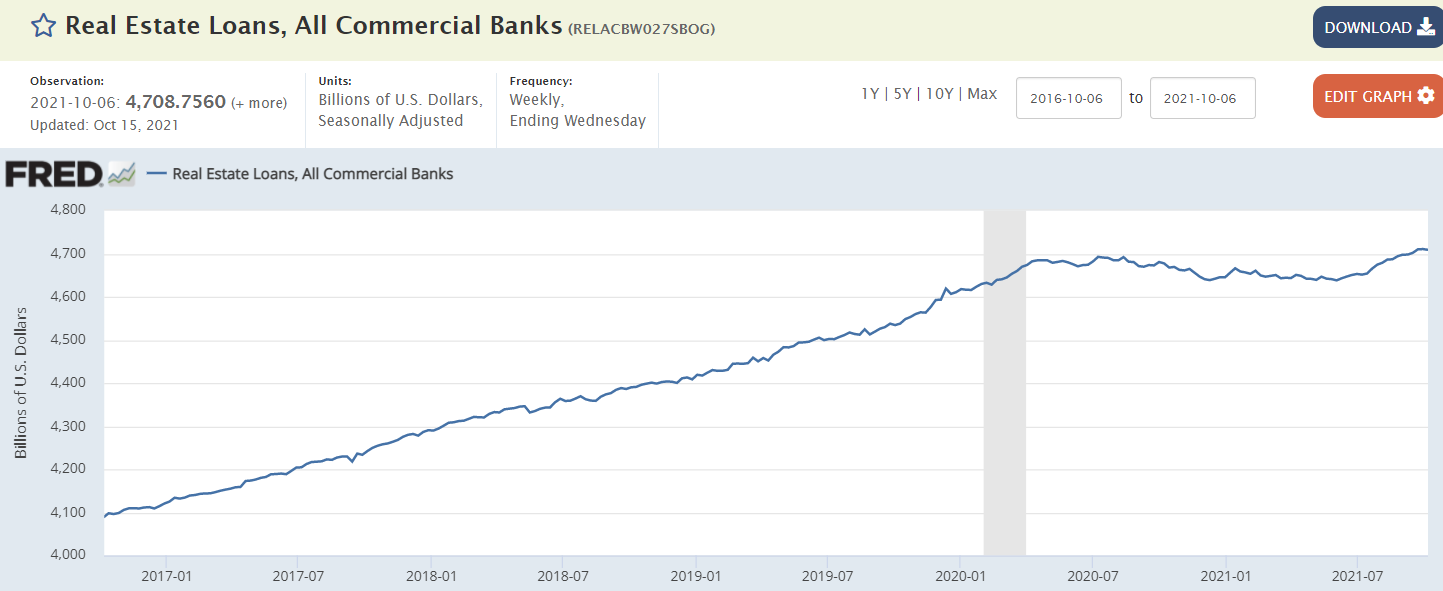

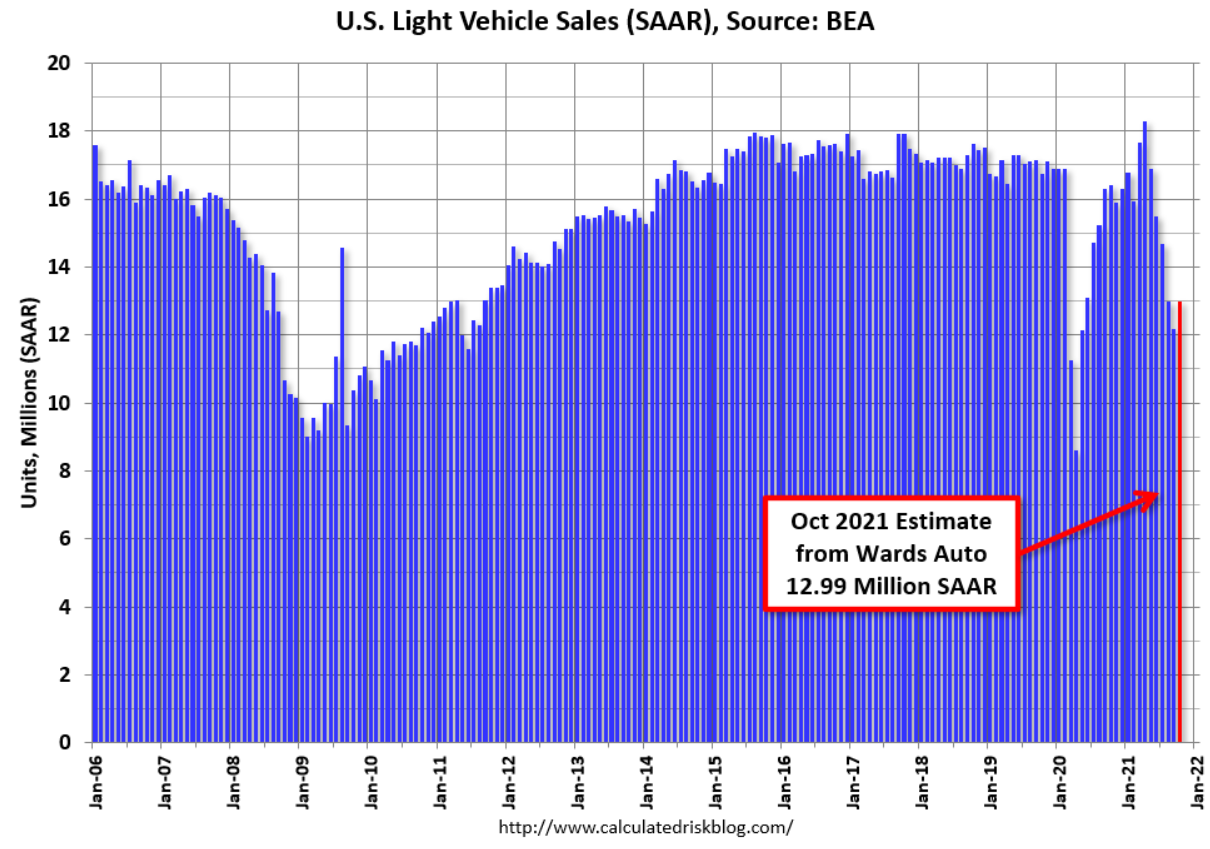

In case you thought the housing market is about interest rates:

“Mortgage applications to purchase a home fell 2% for the week and were 9% lower than the same week one year ago.”