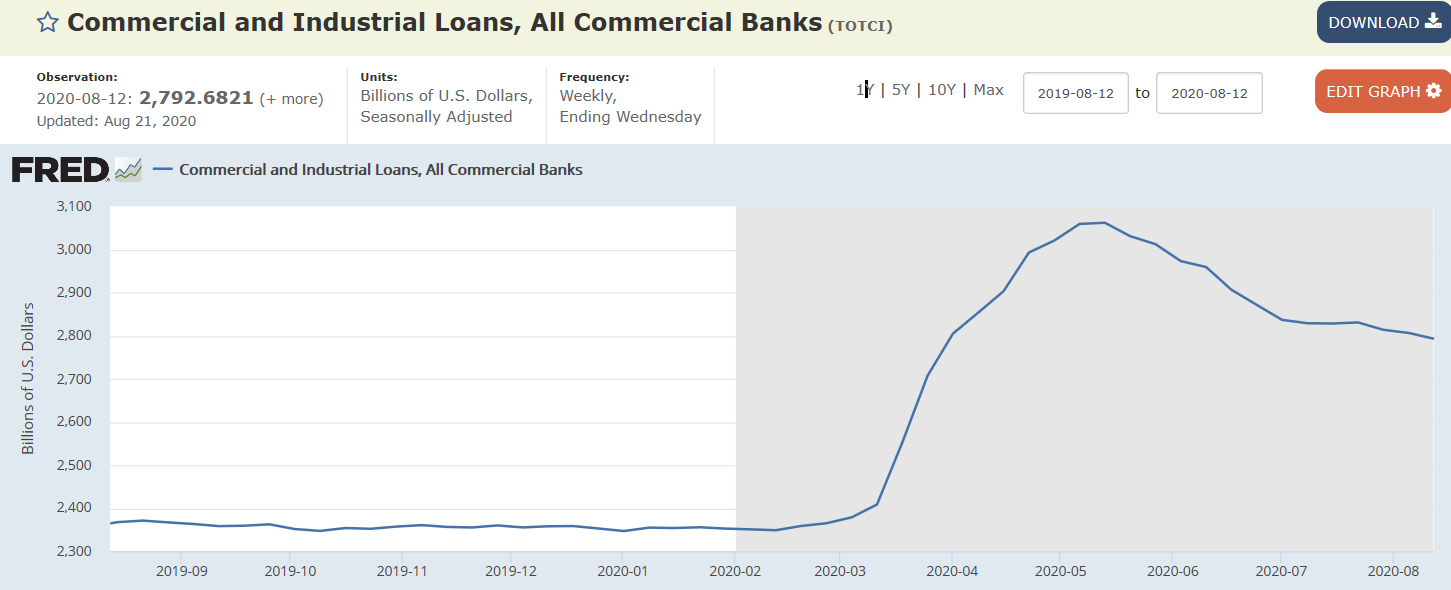

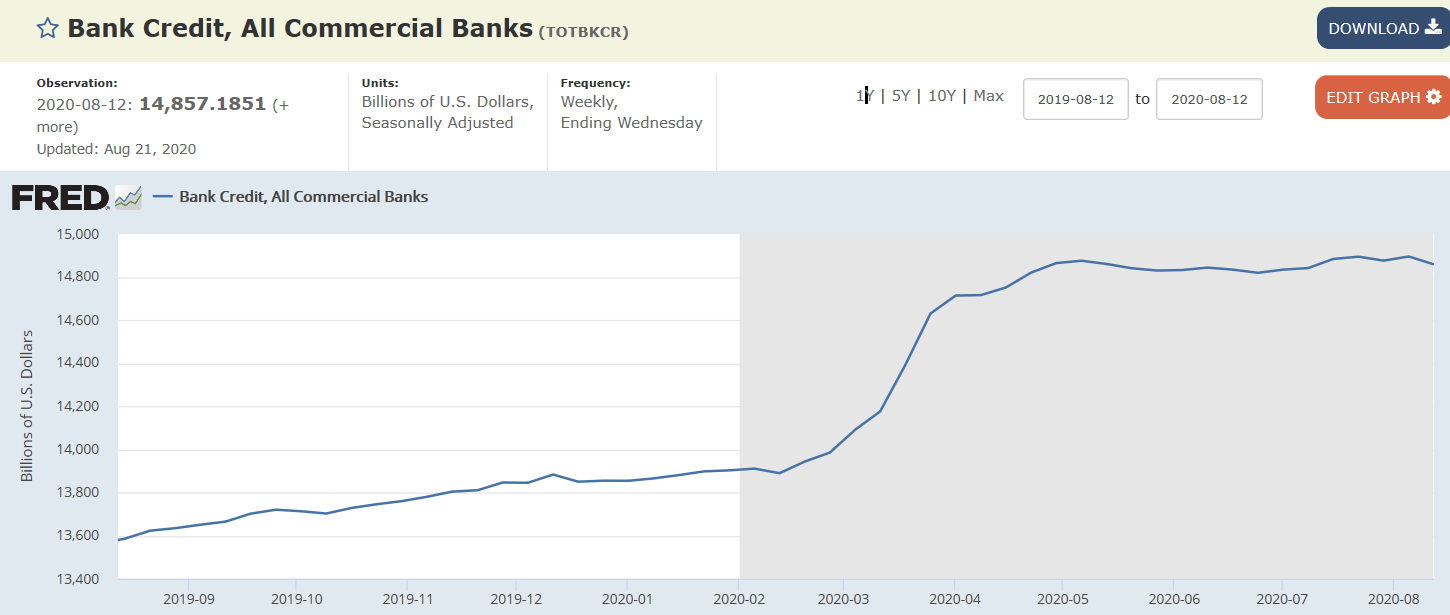

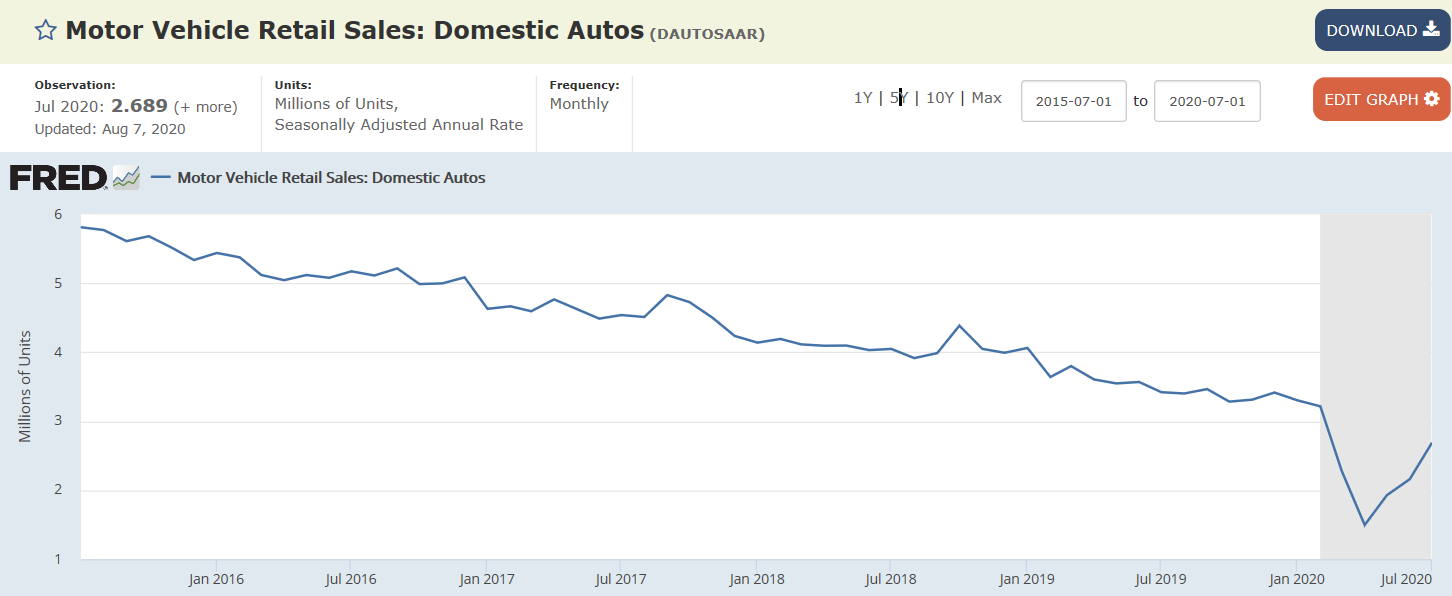

Business precautionary draw downs of lines of credit caused the spike, followed by a contraction as operational needs contract:

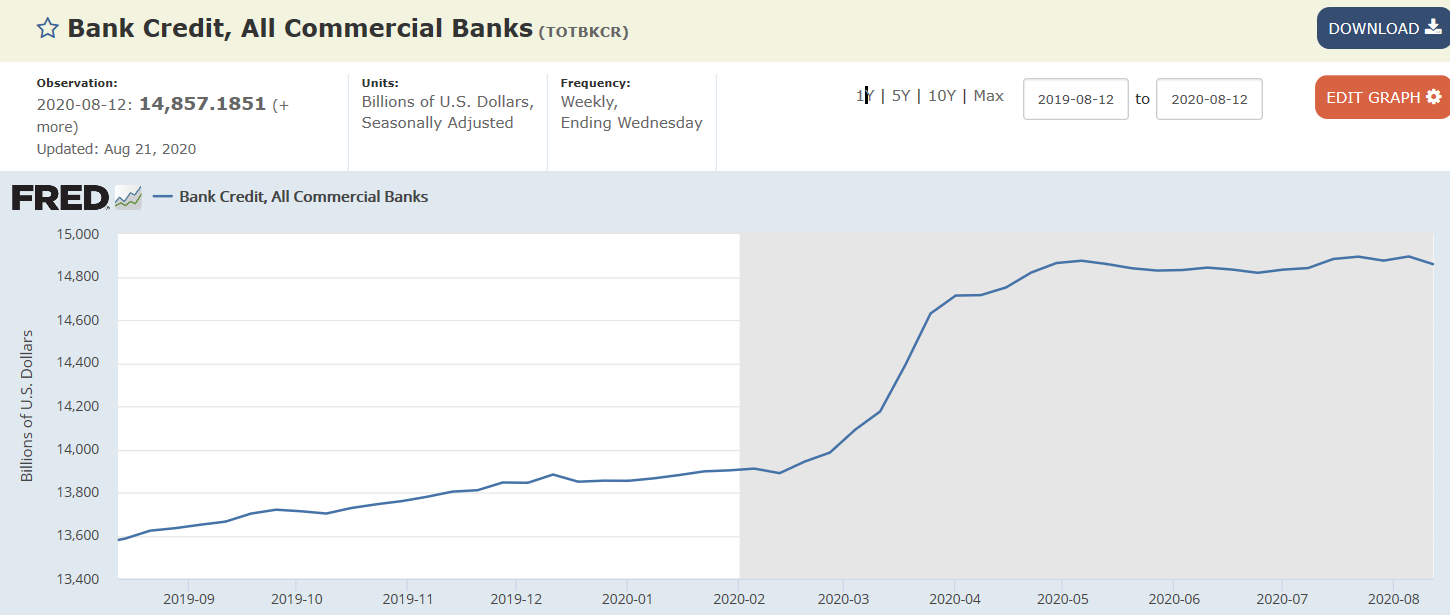

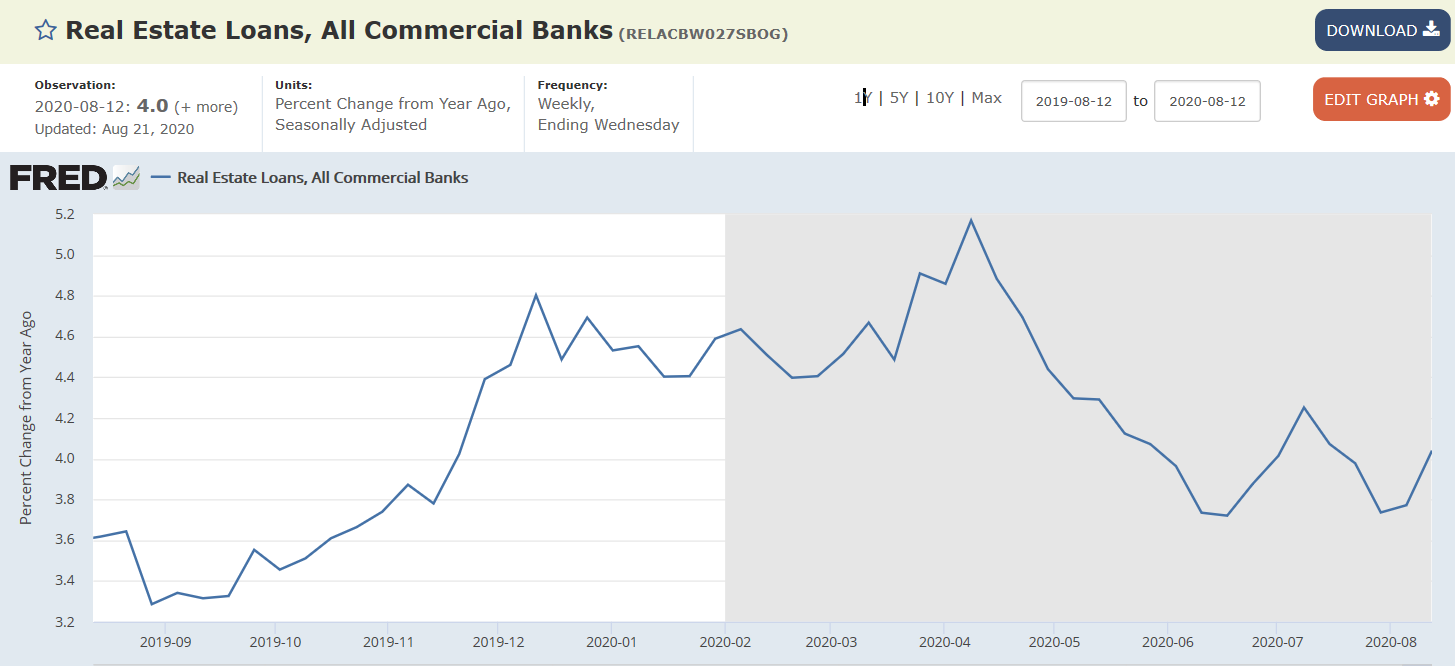

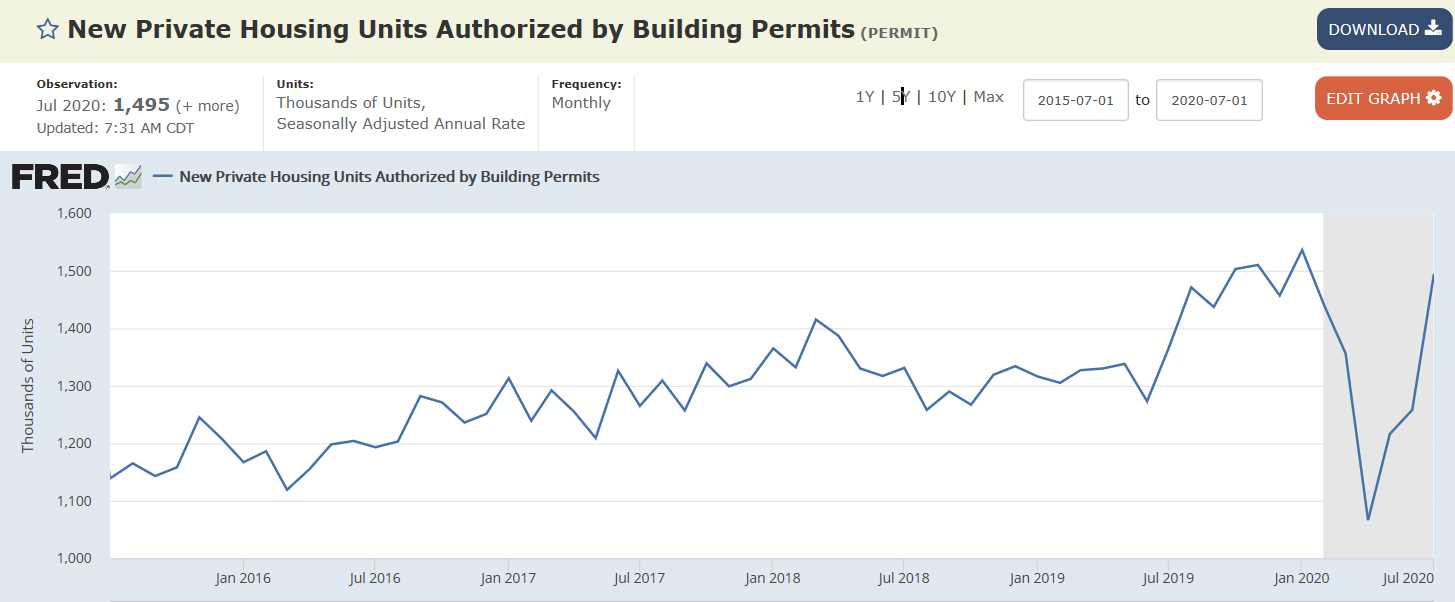

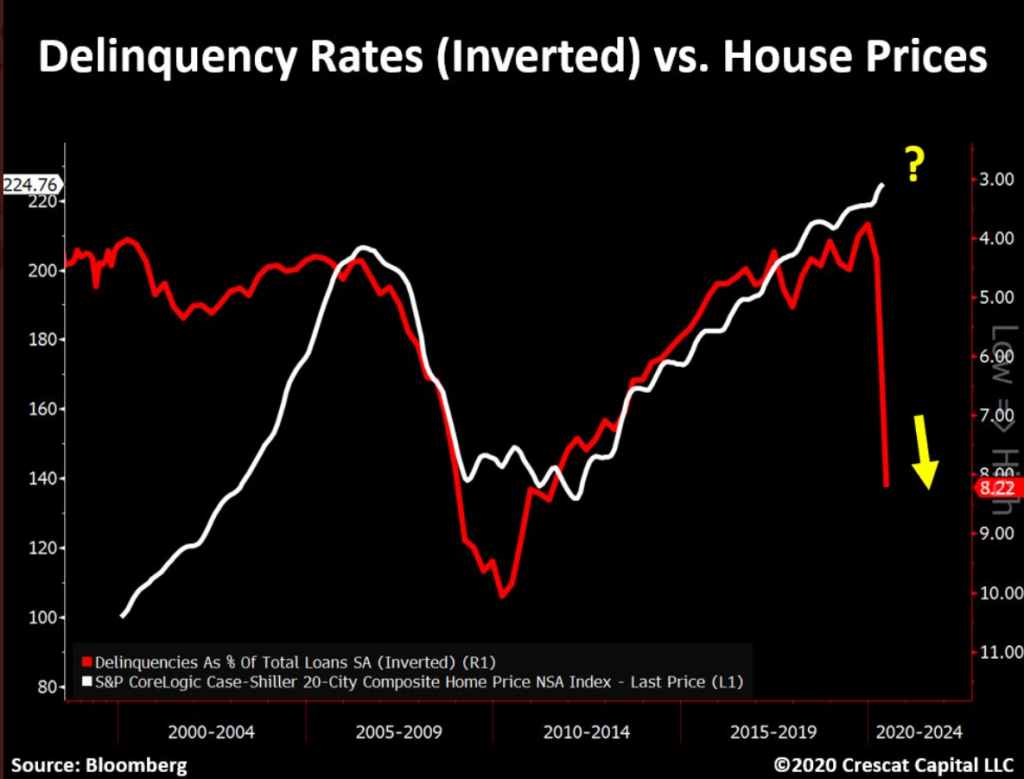

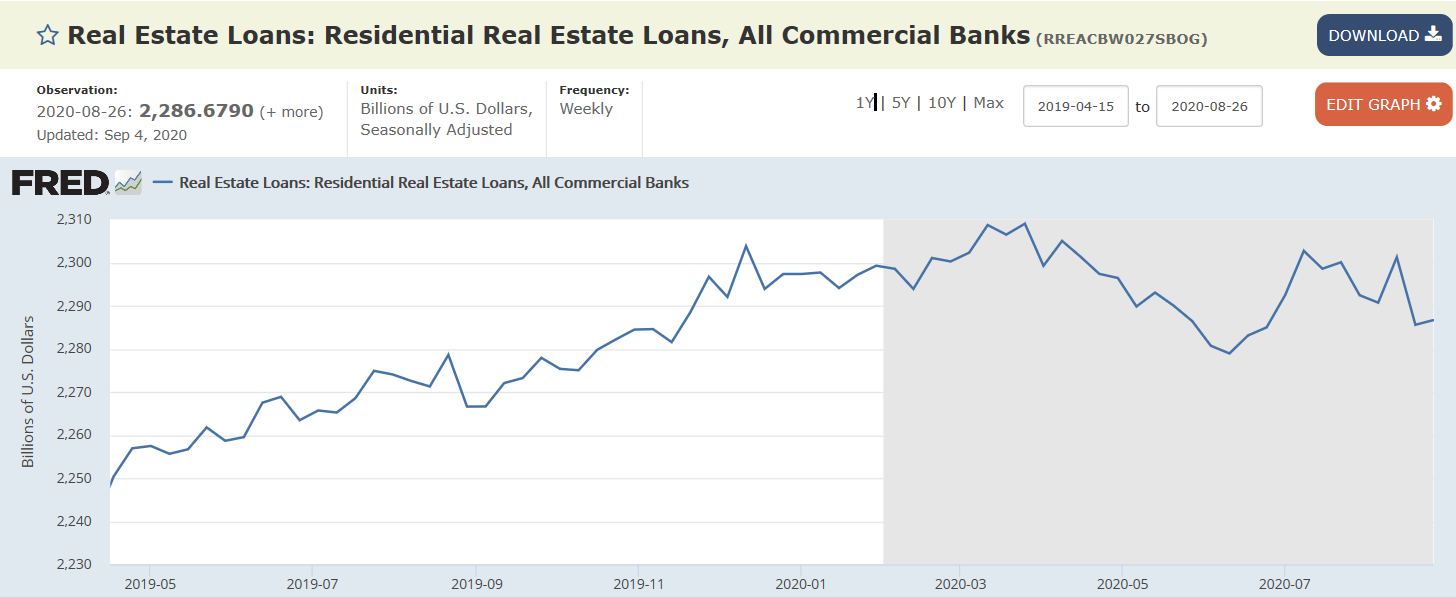

Growth in real estate loans is slowing:

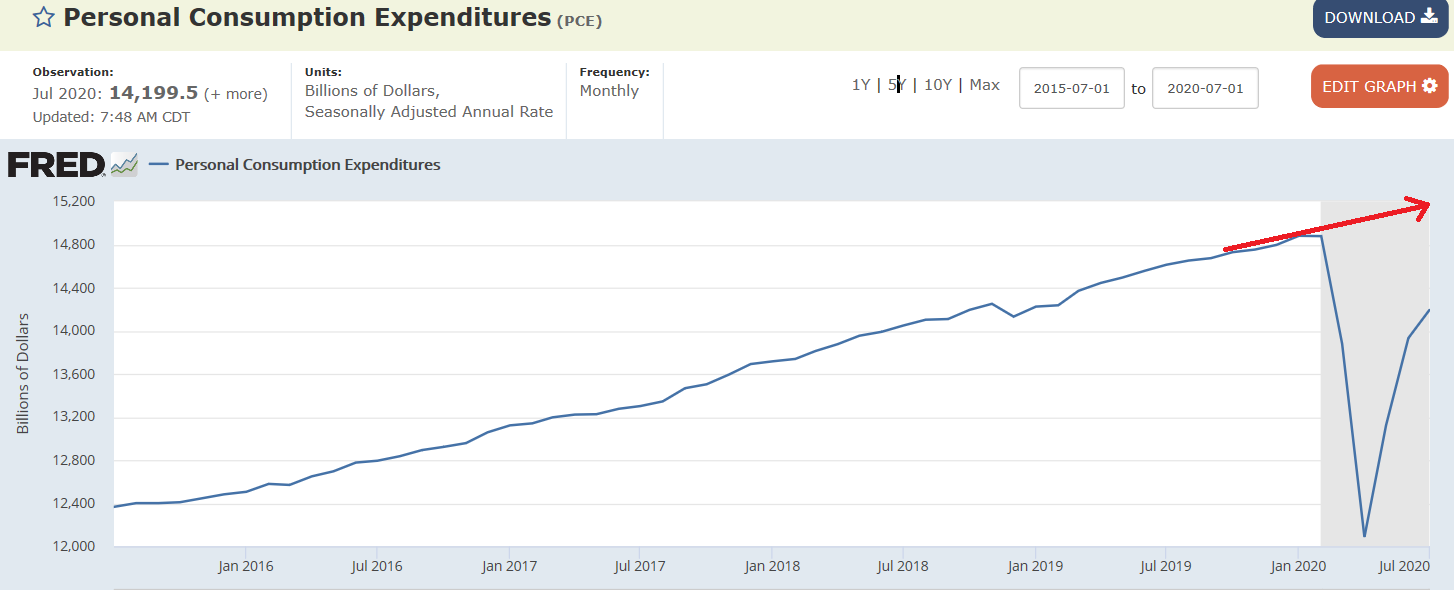

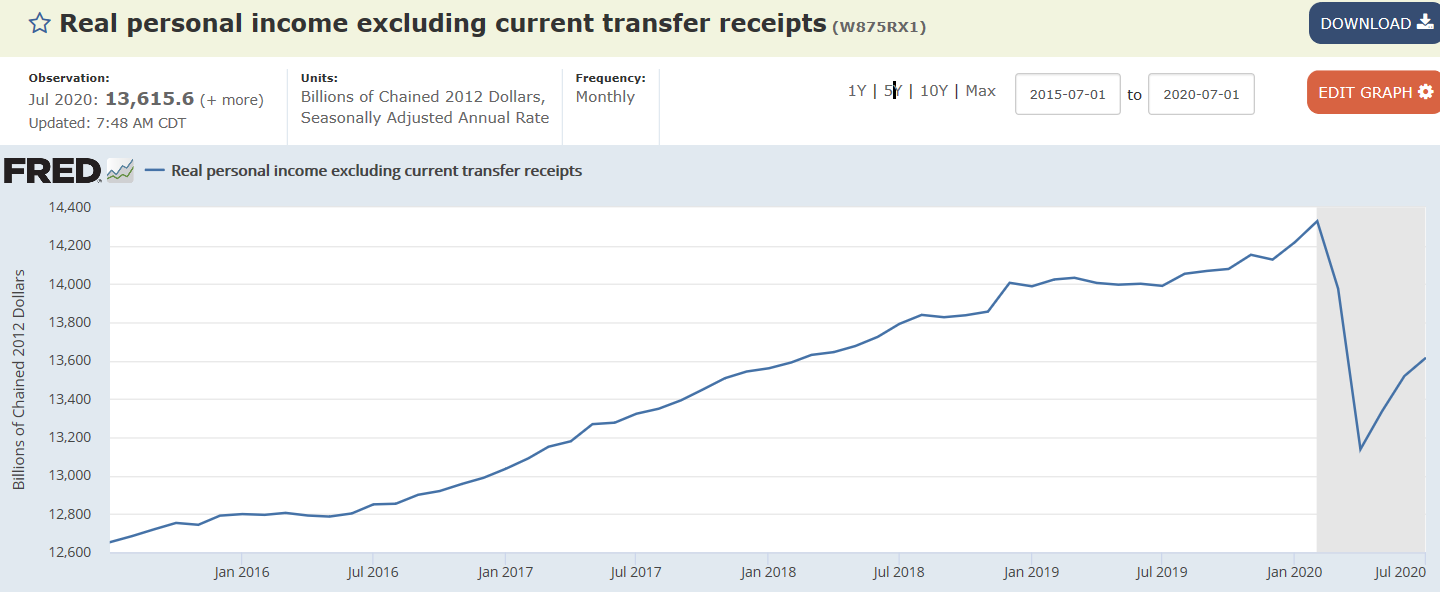

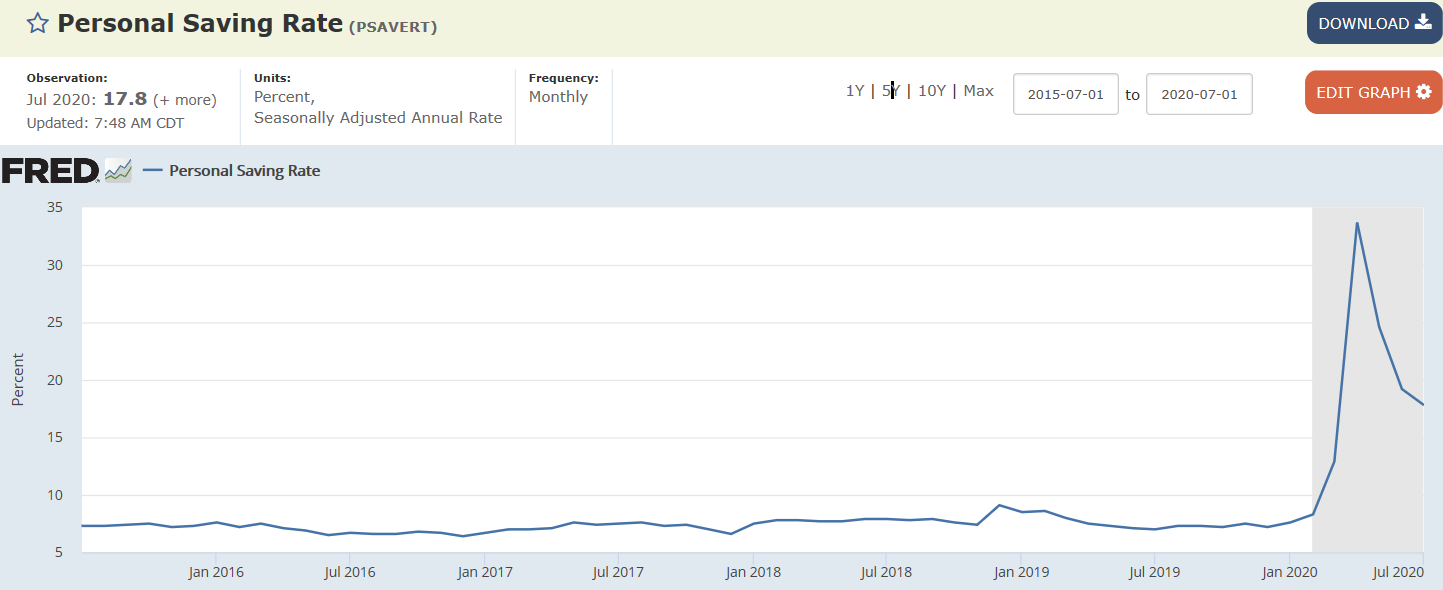

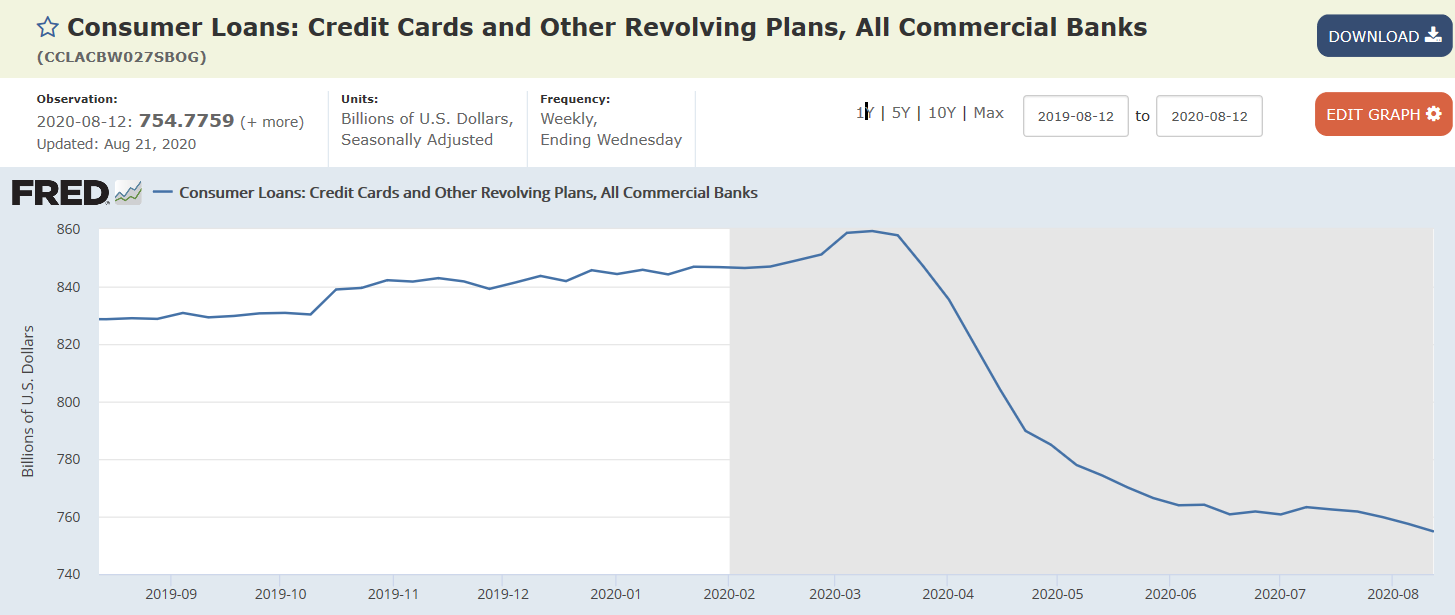

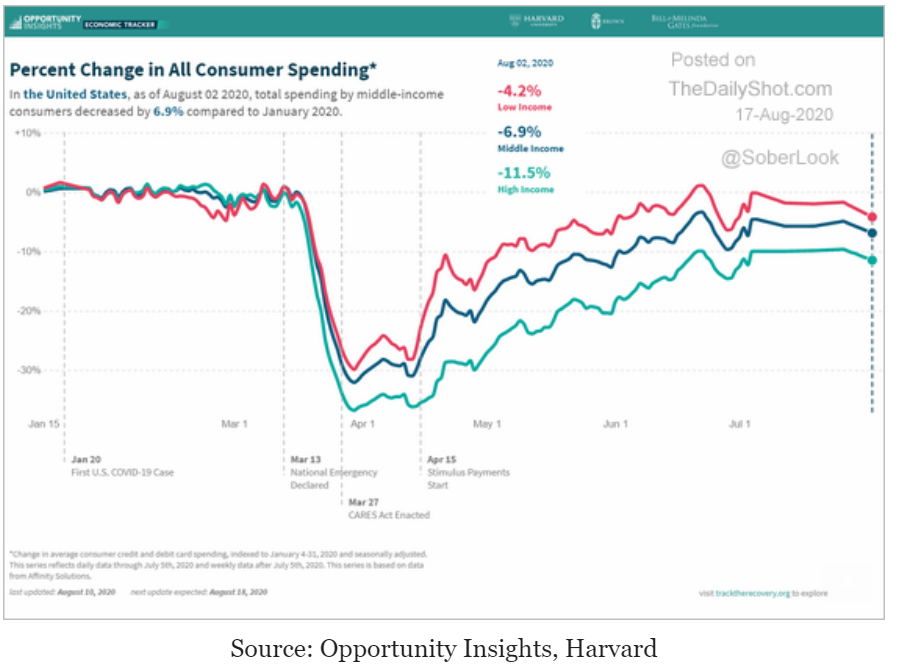

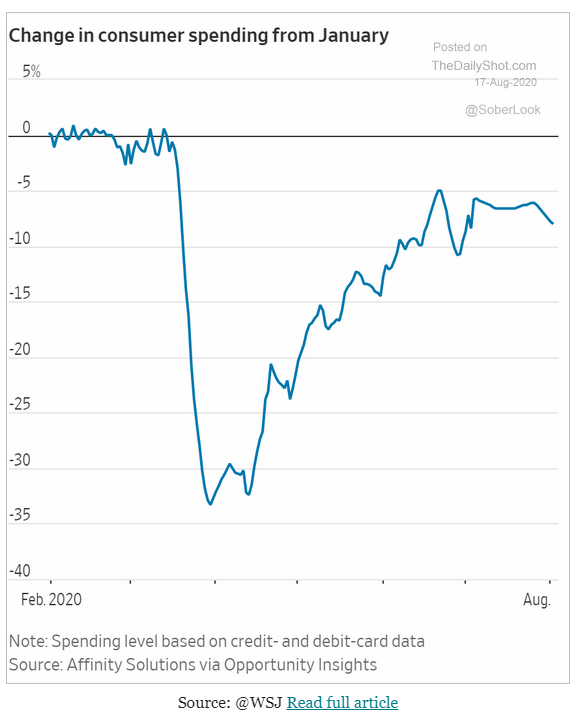

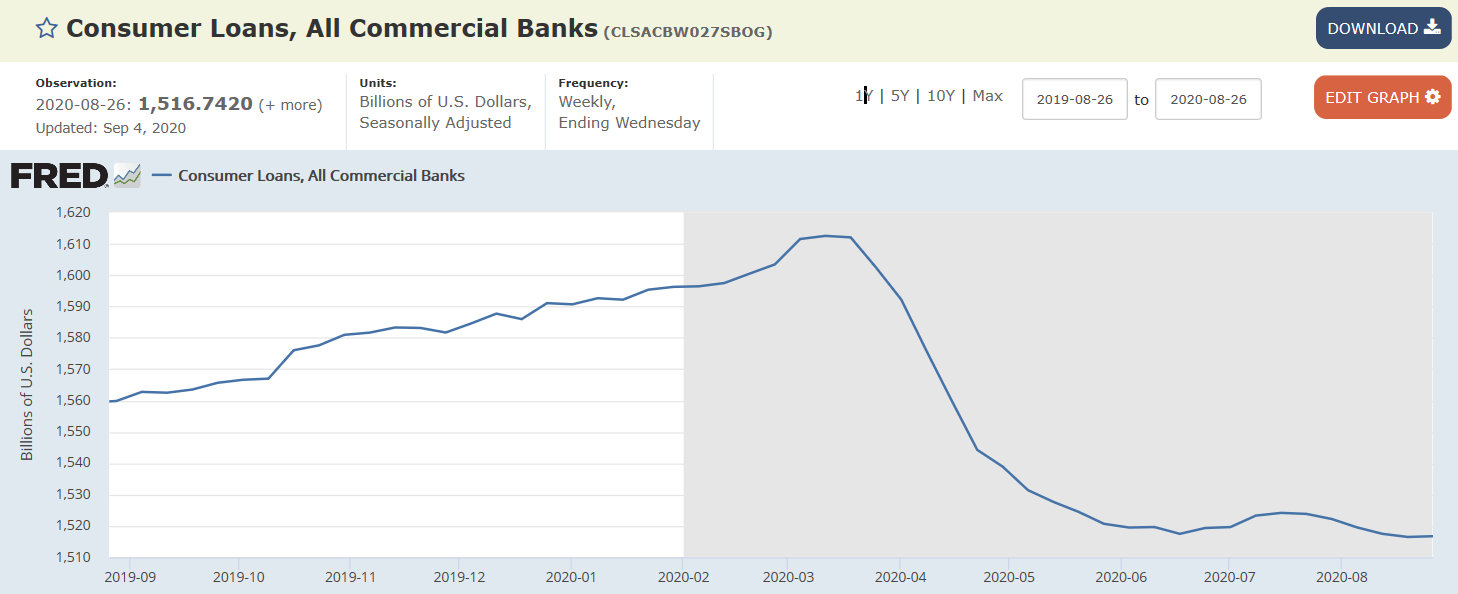

Consumer borrowing dropped with the stimulus checks and then has flattened:

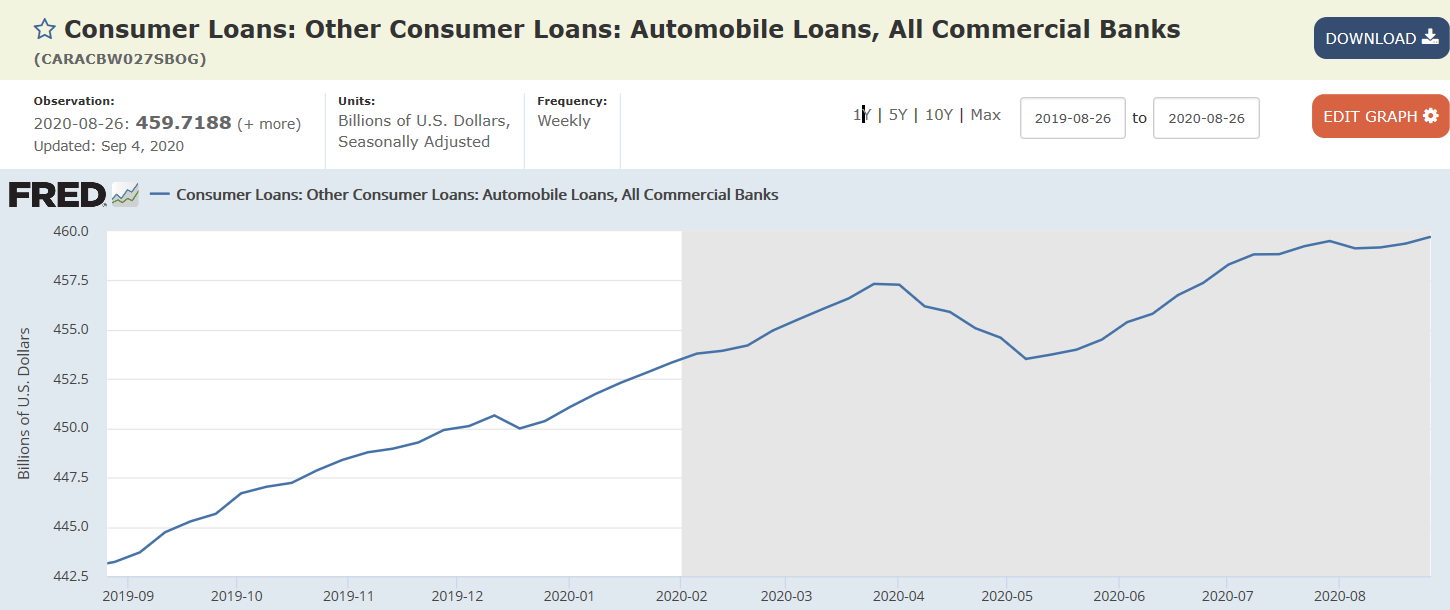

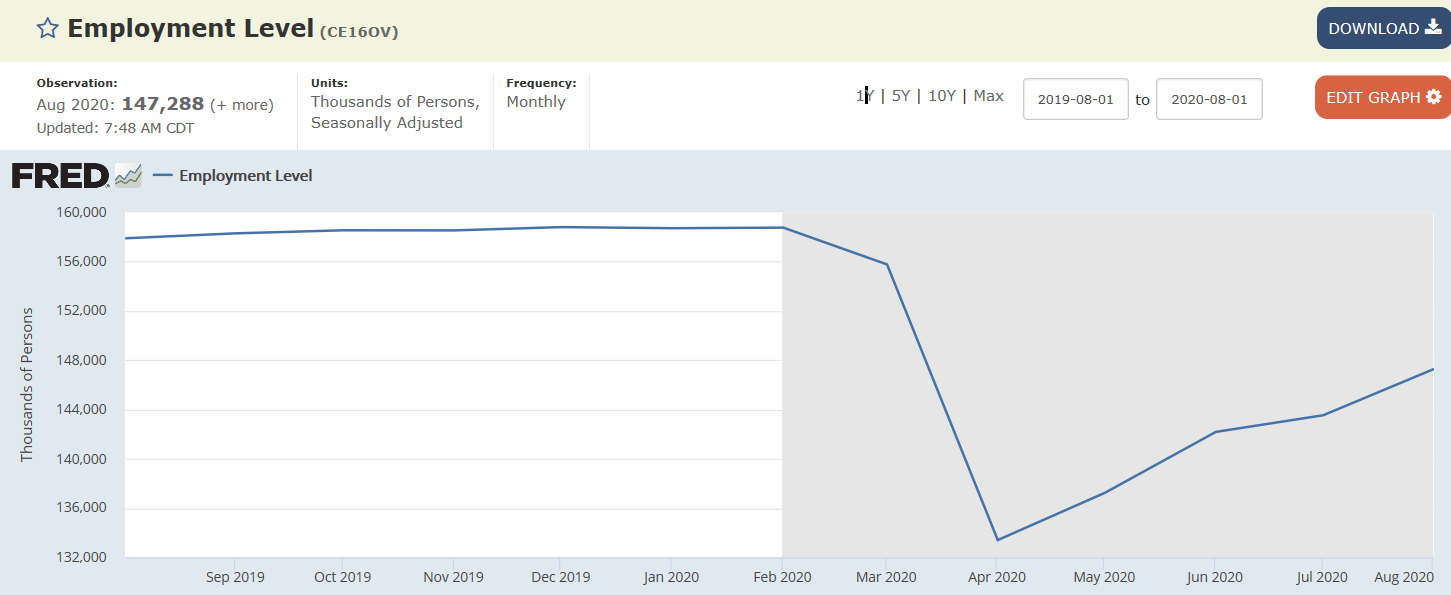

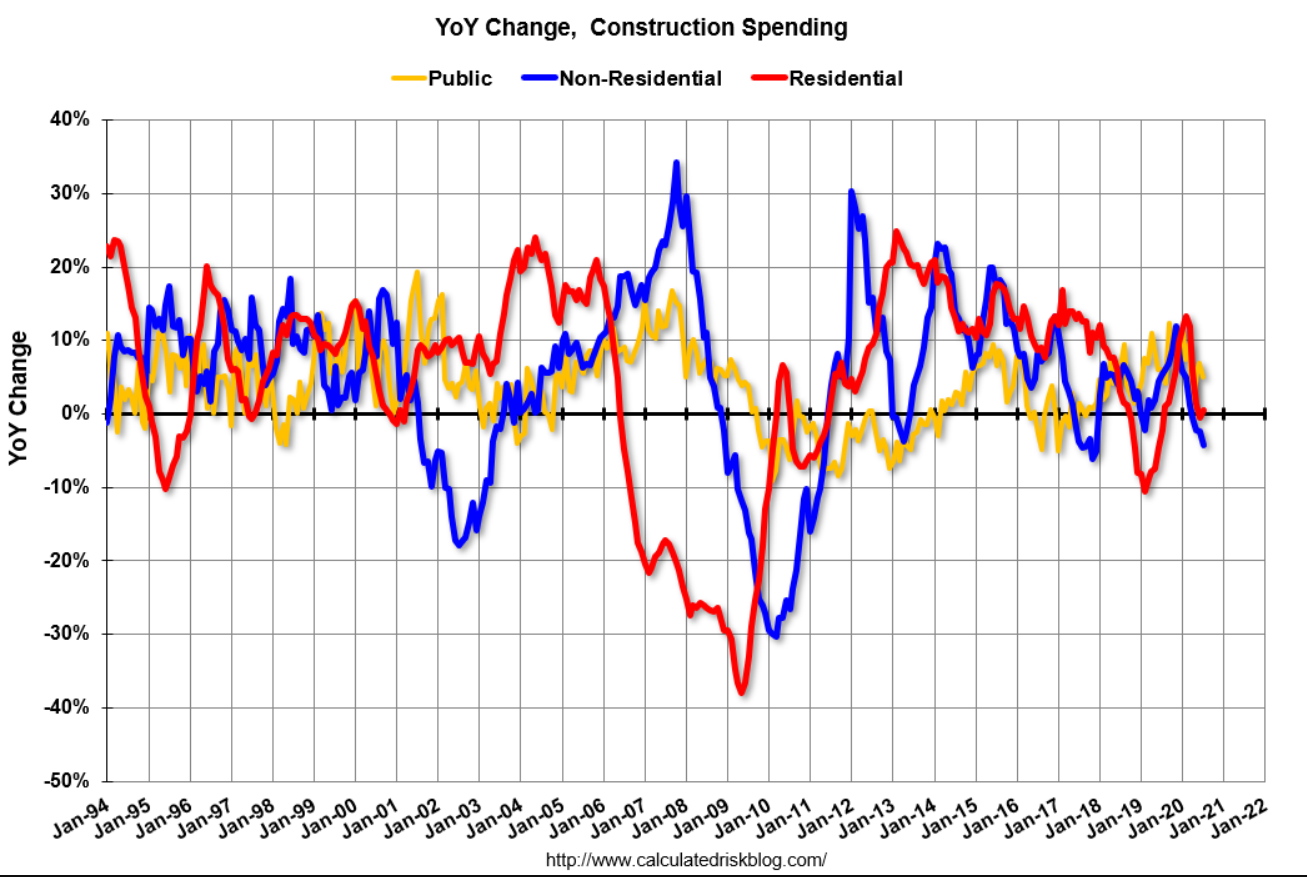

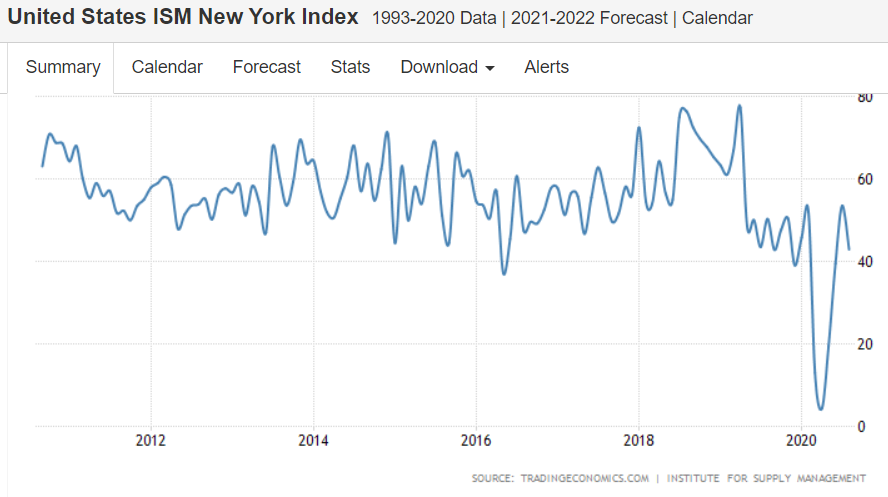

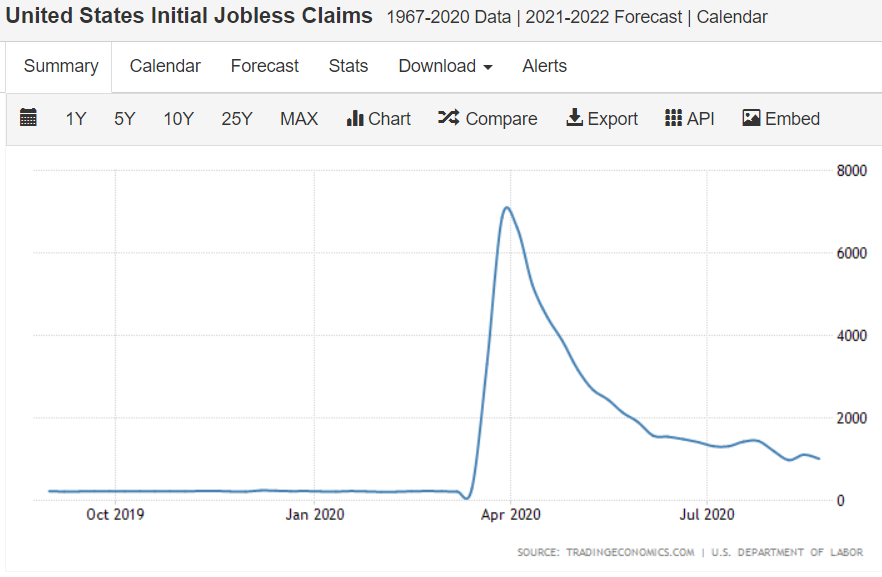

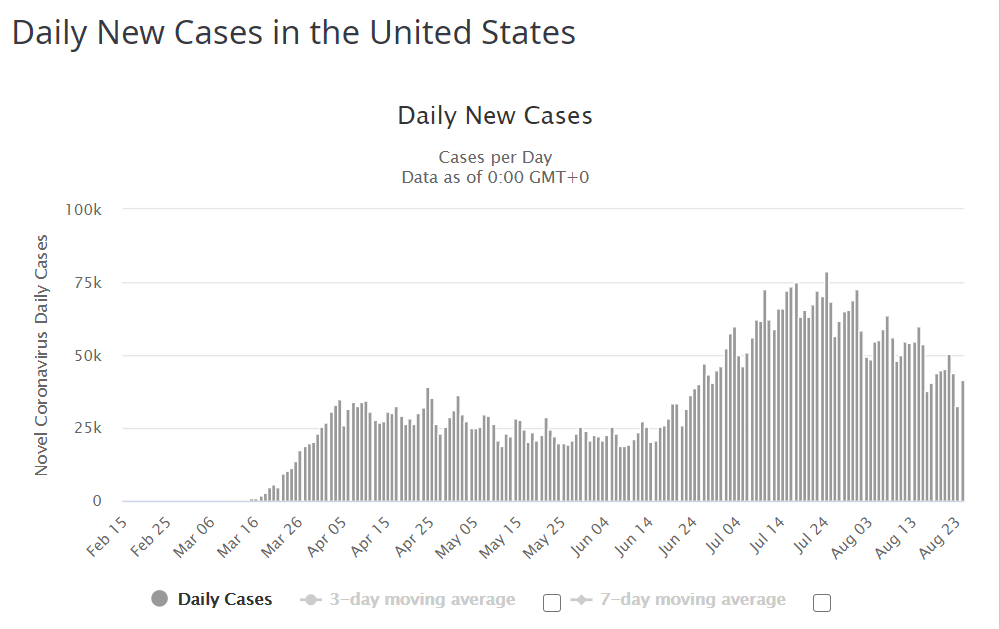

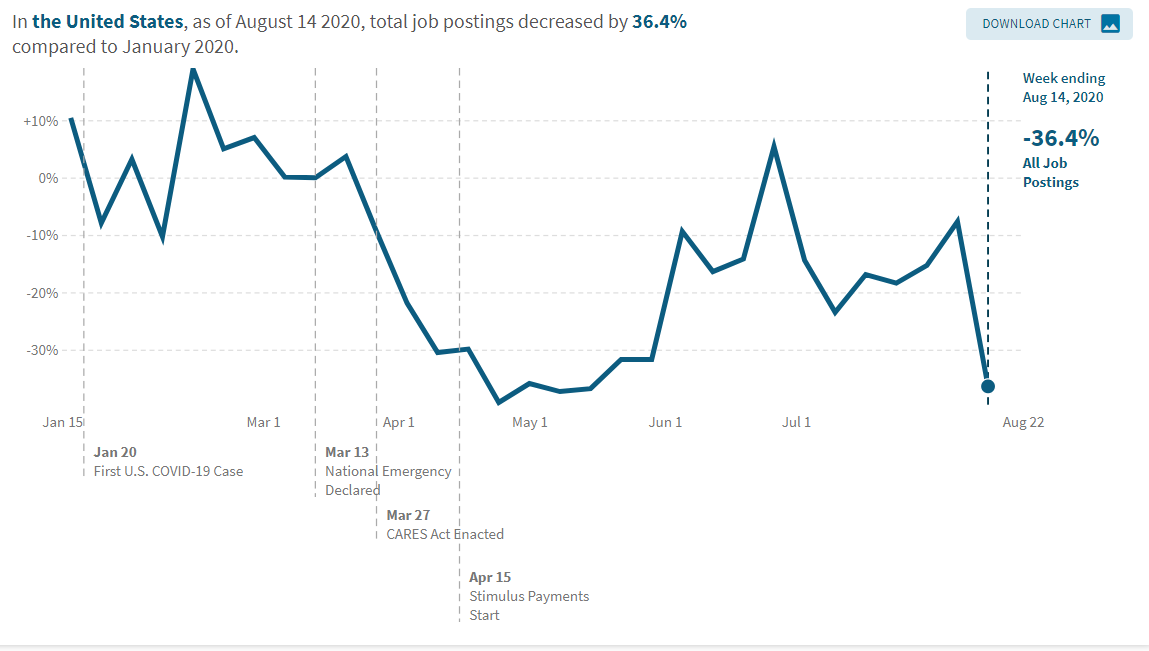

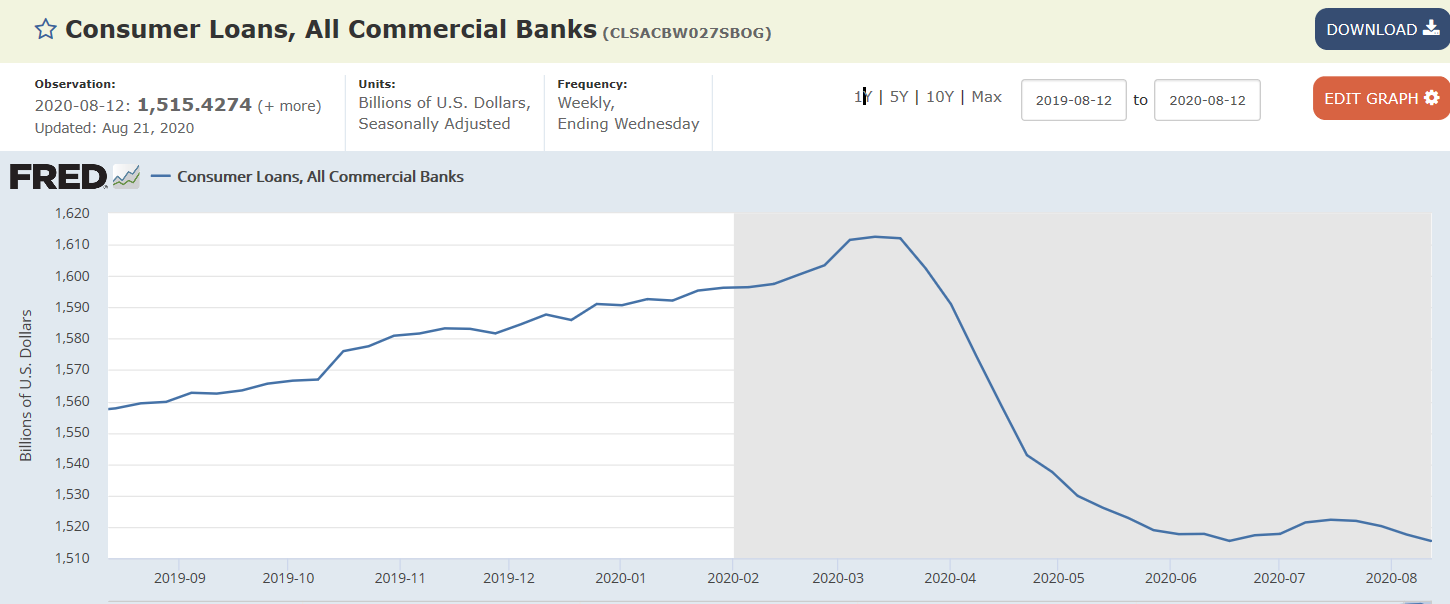

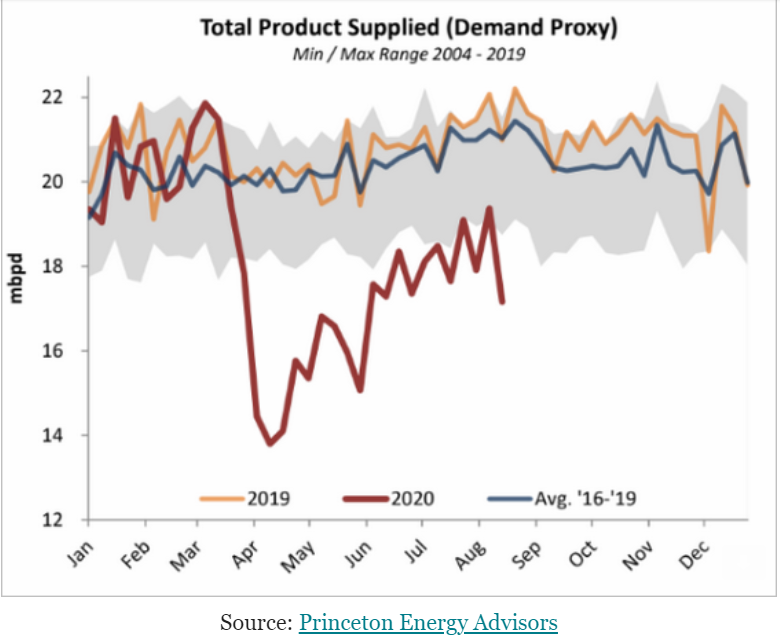

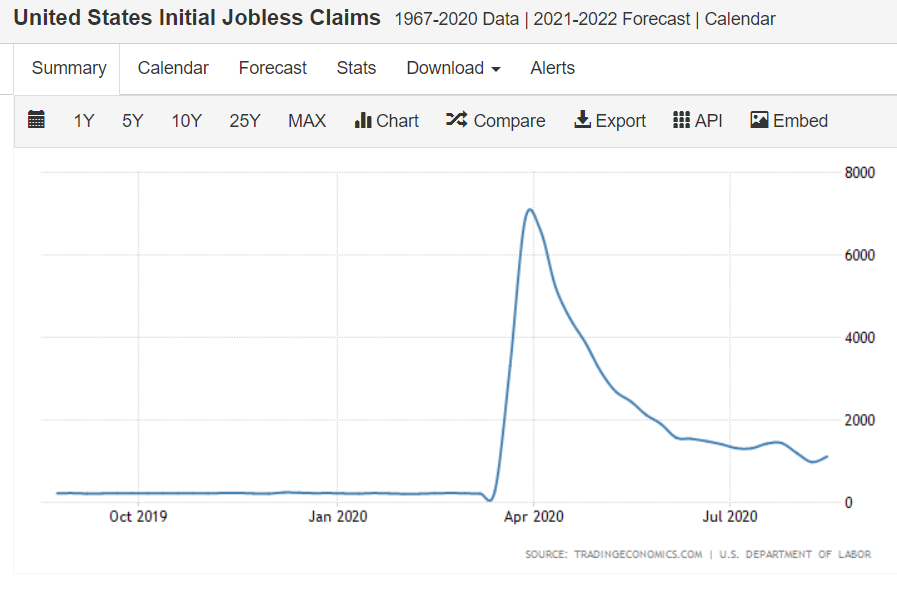

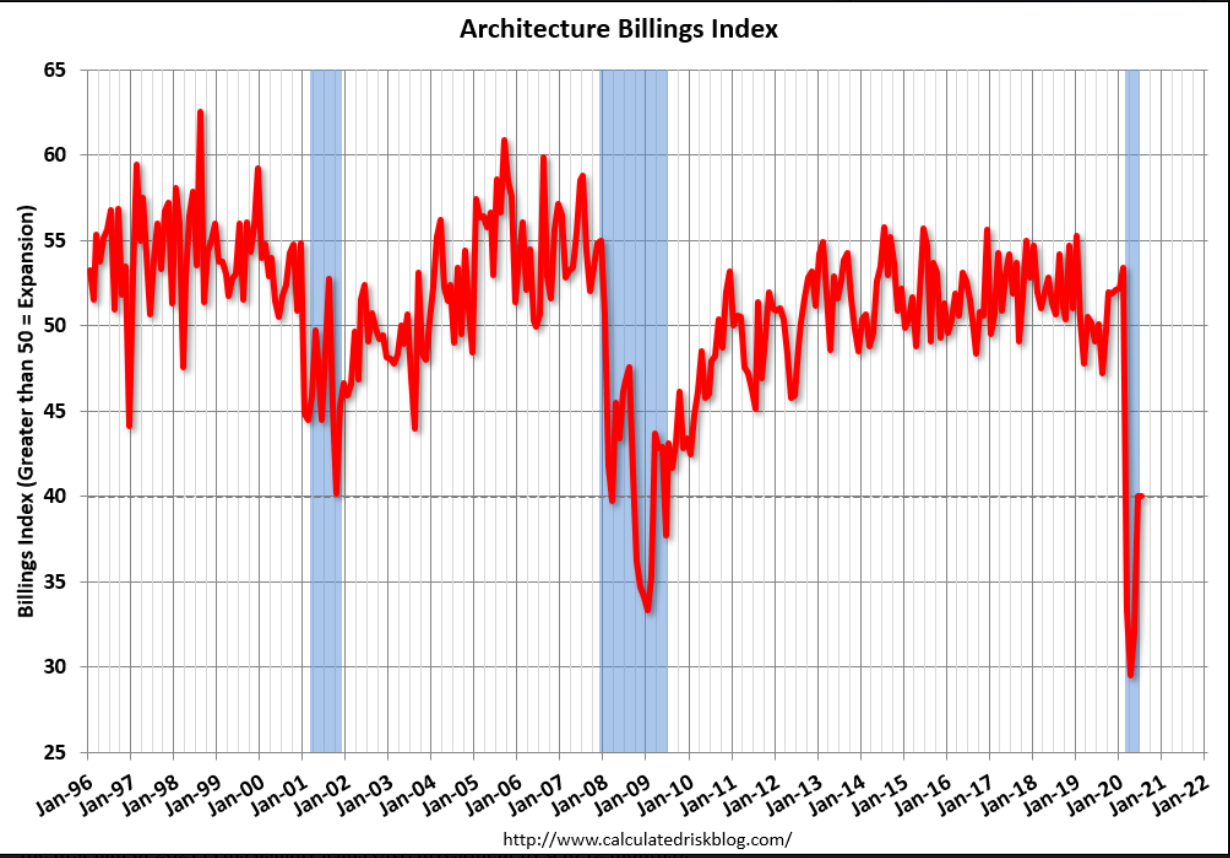

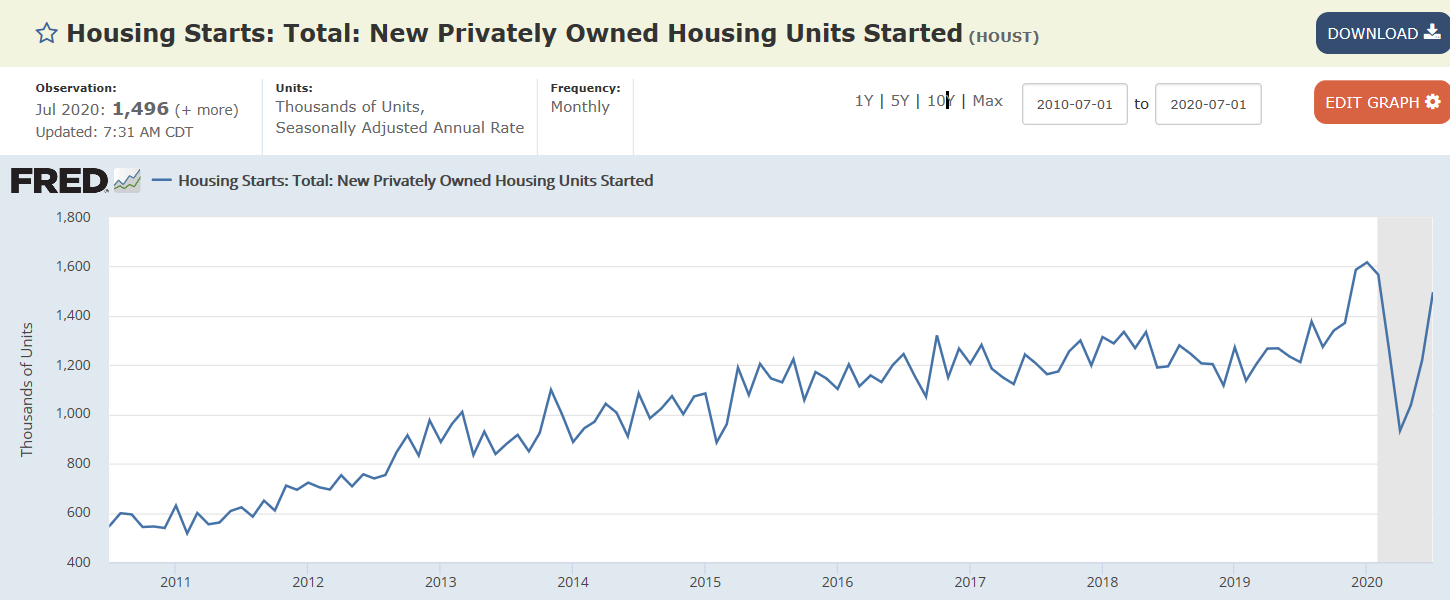

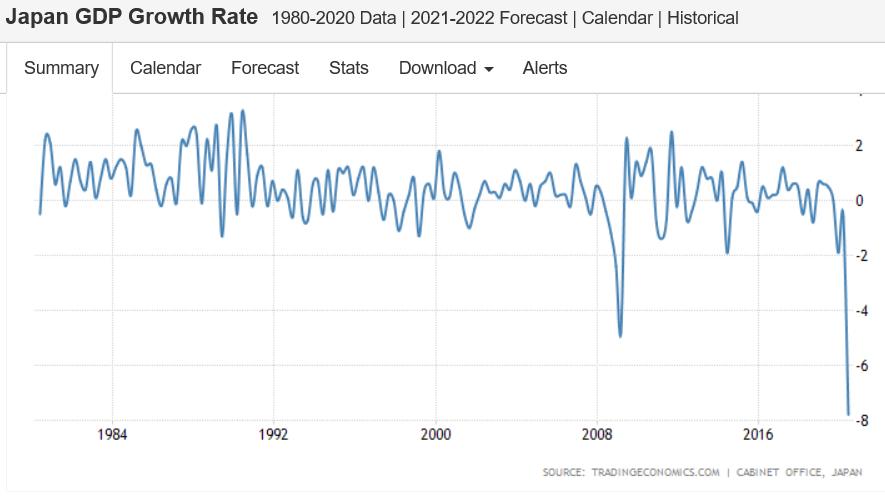

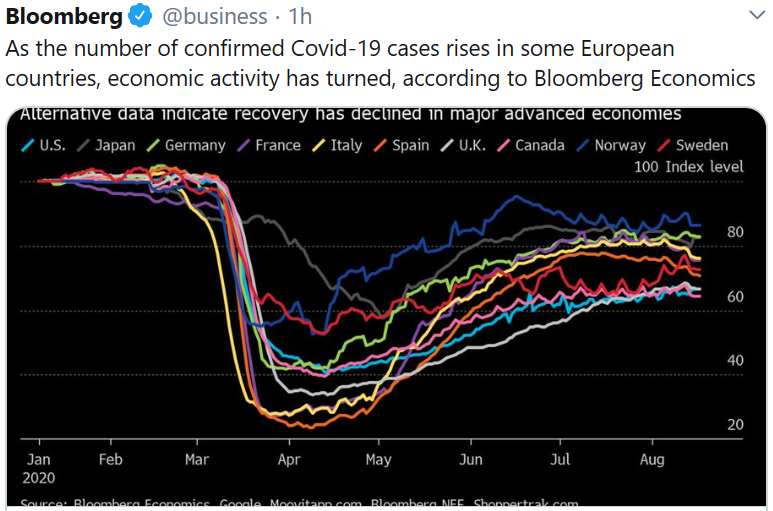

Pause, recovery, and then a leveling off: