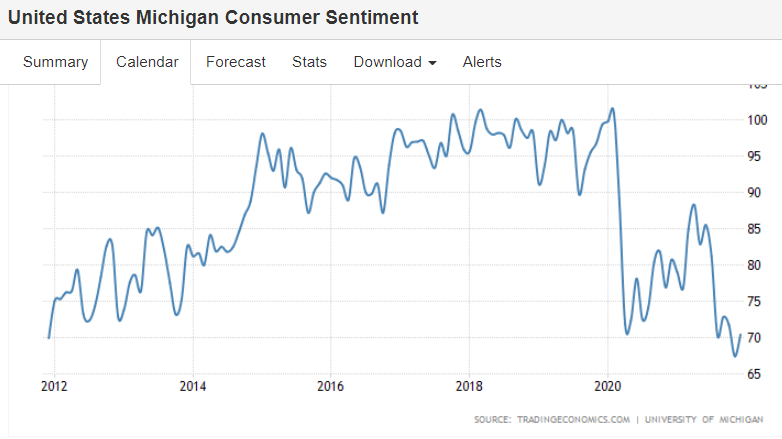

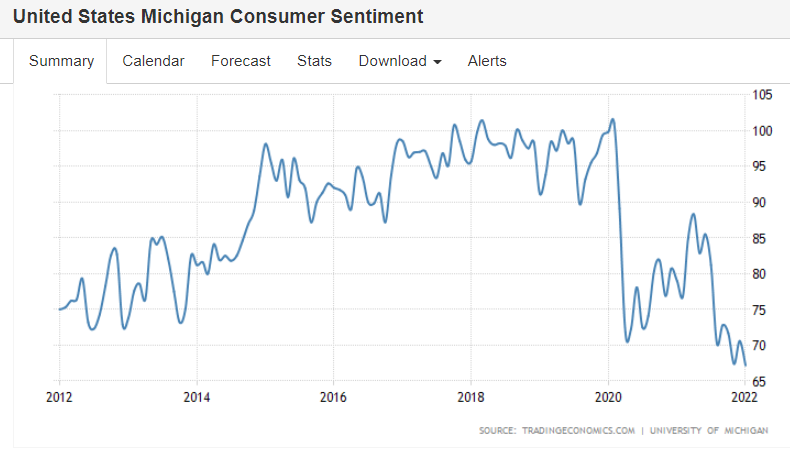

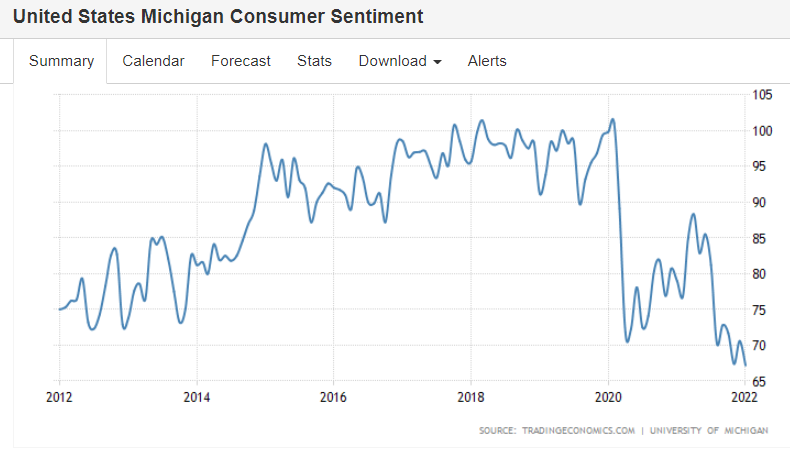

Still fading:

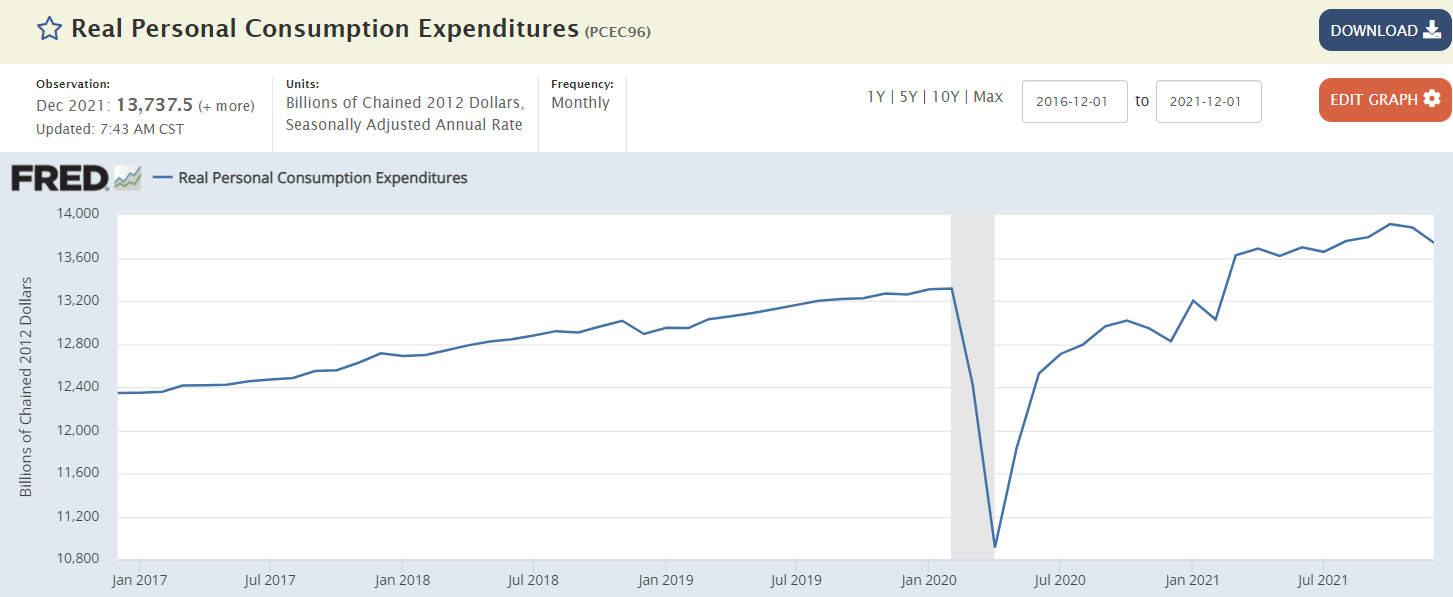

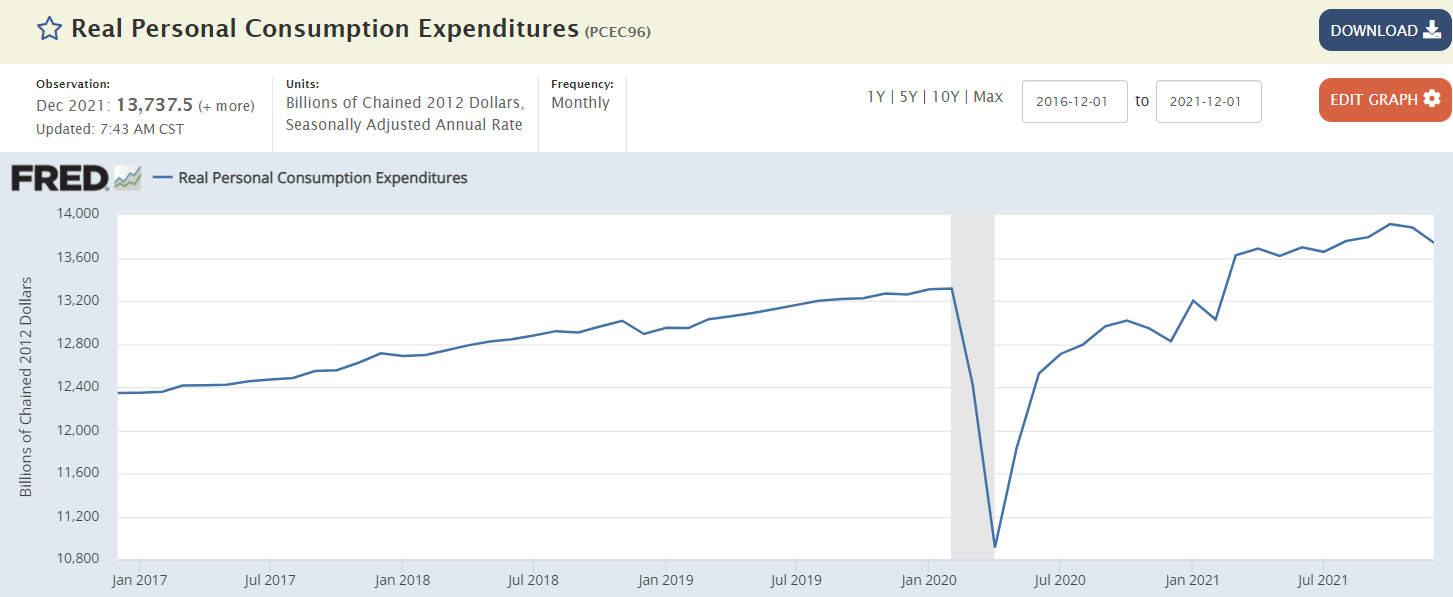

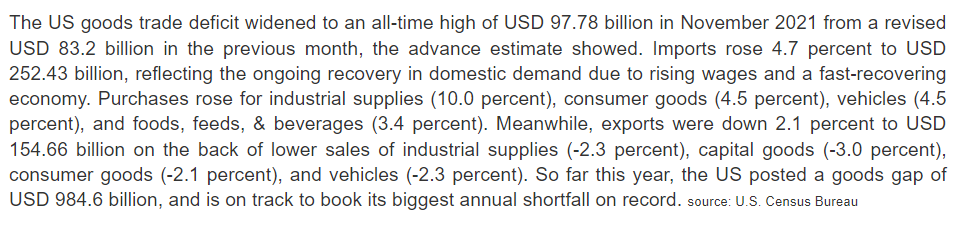

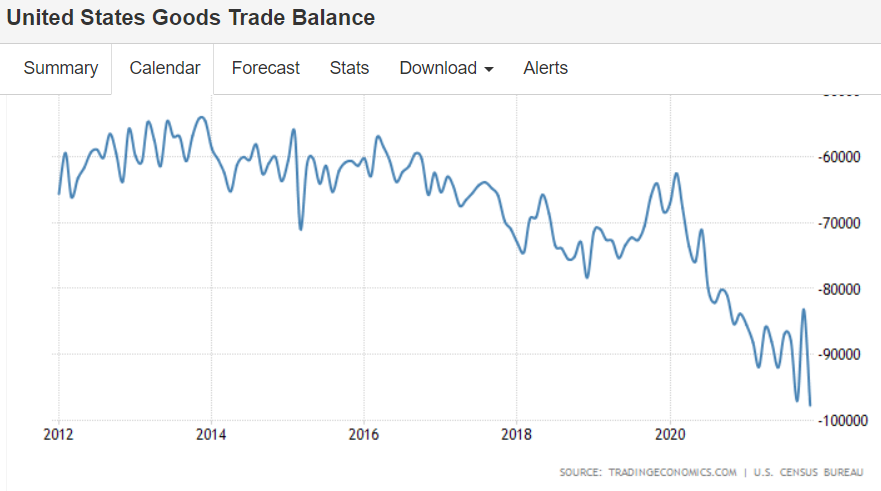

Still not looking like an excess demand problem:

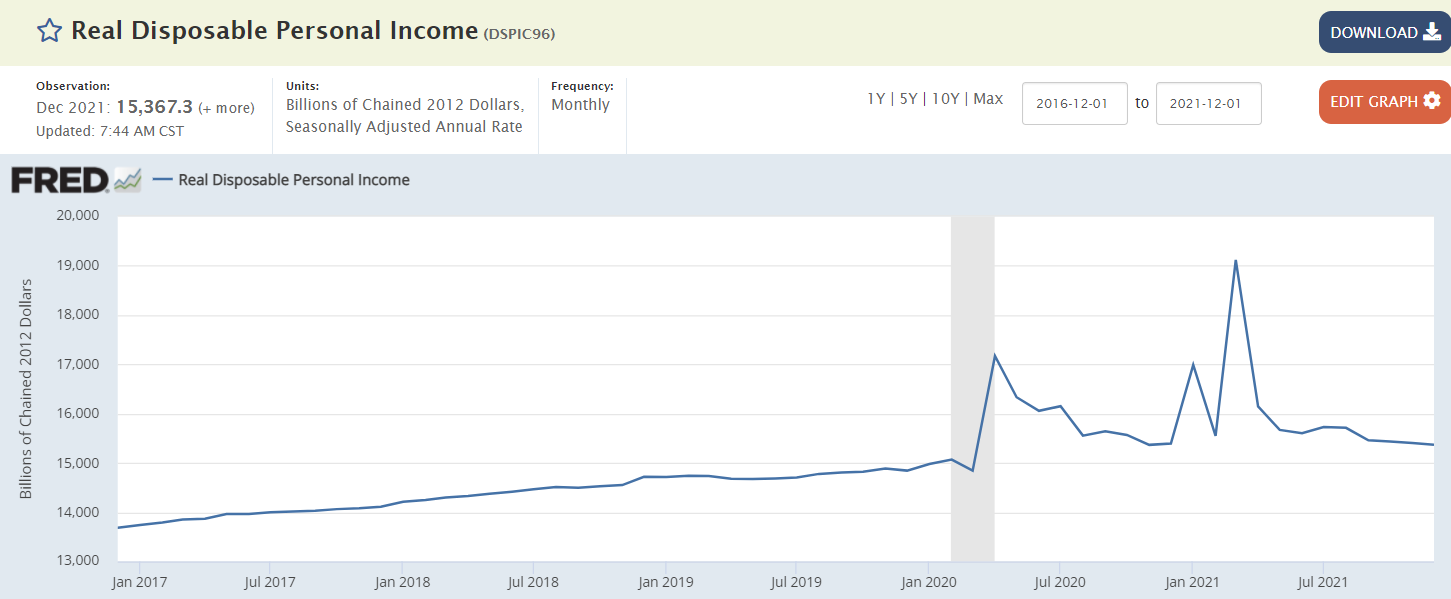

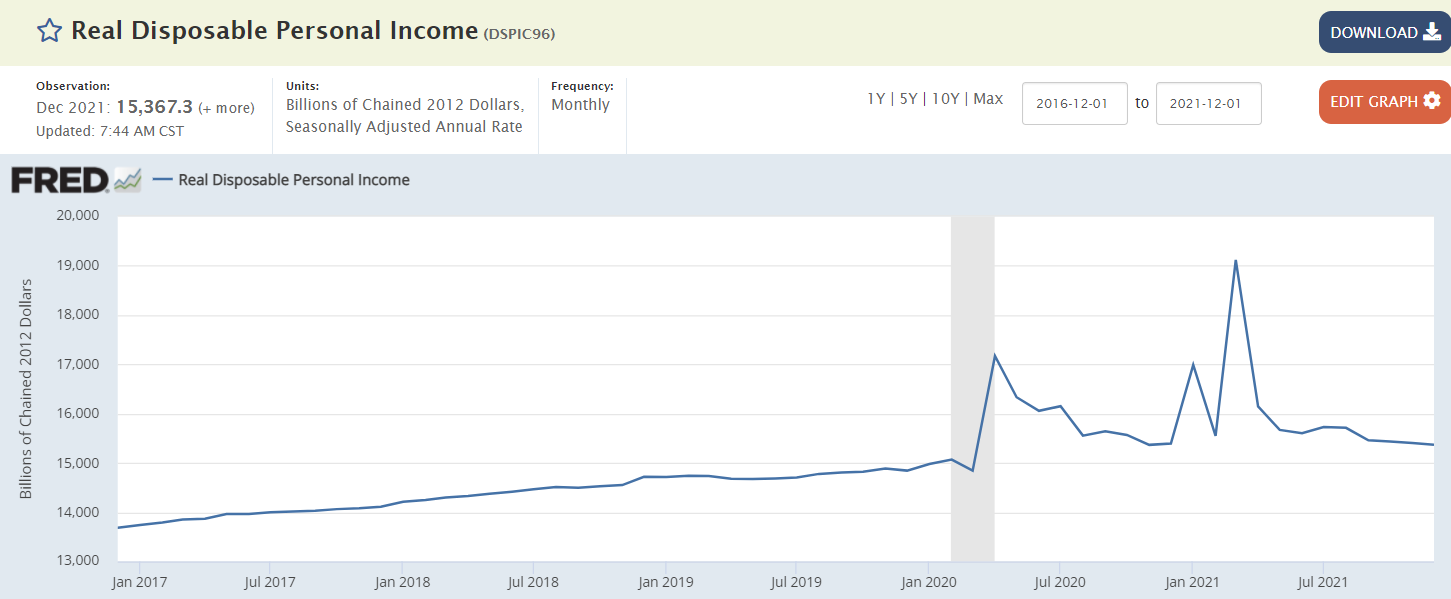

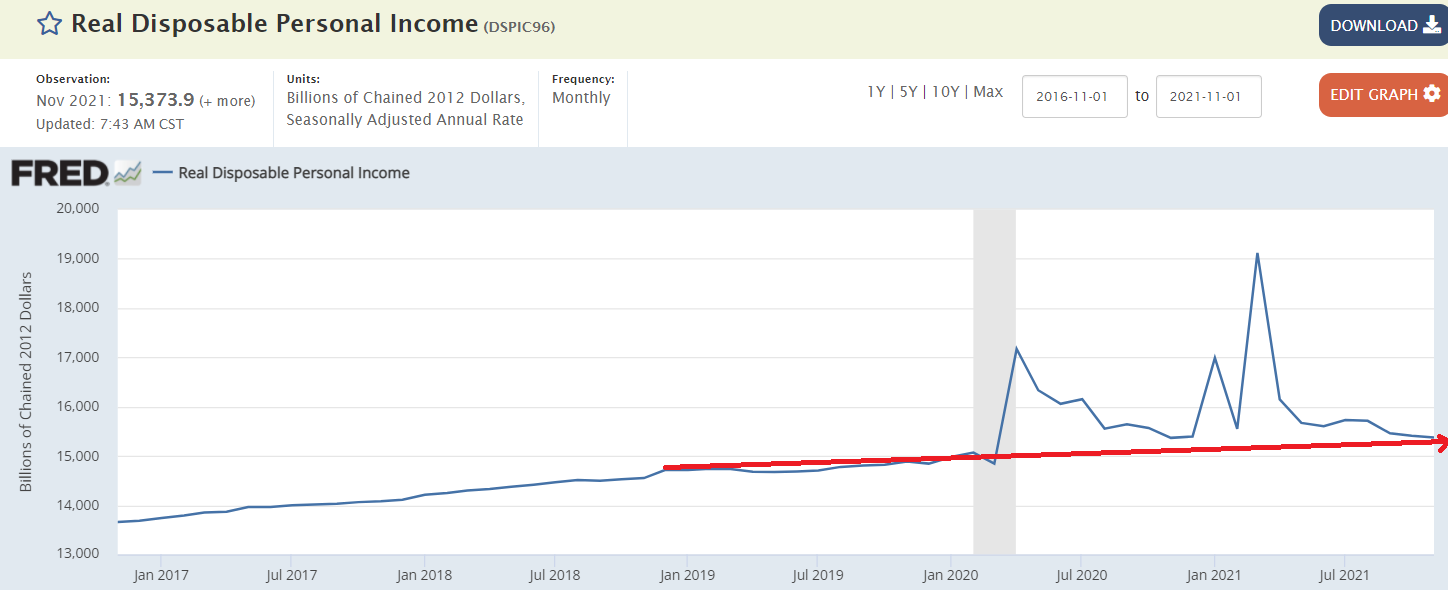

Might be the slowing income growth?

Still fading:

Still not looking like an excess demand problem:

Might be the slowing income growth?

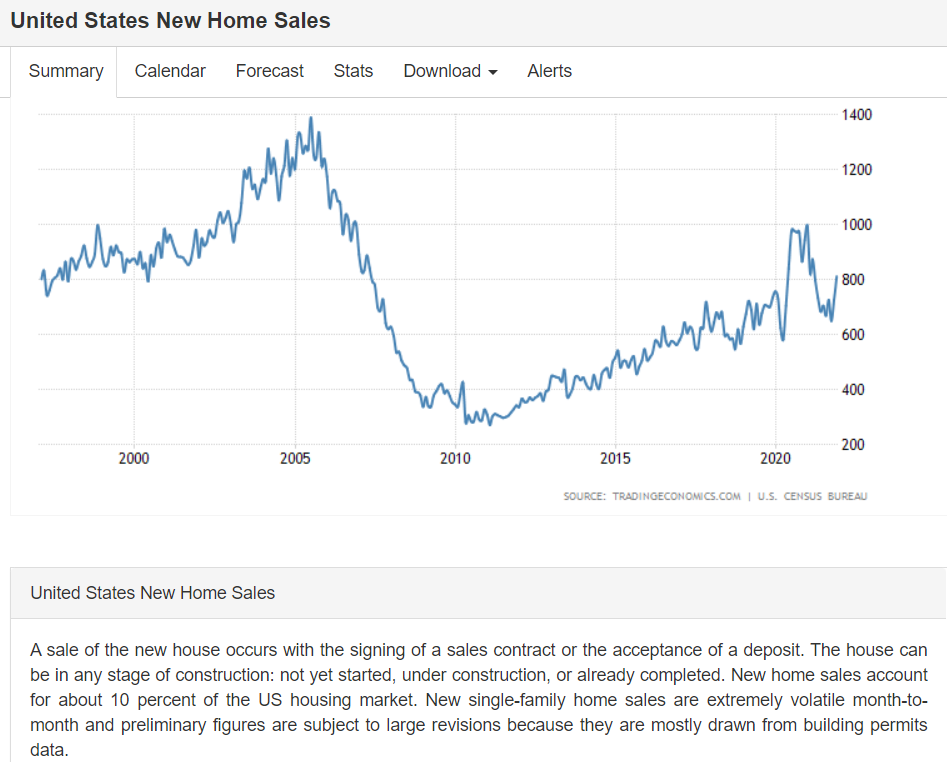

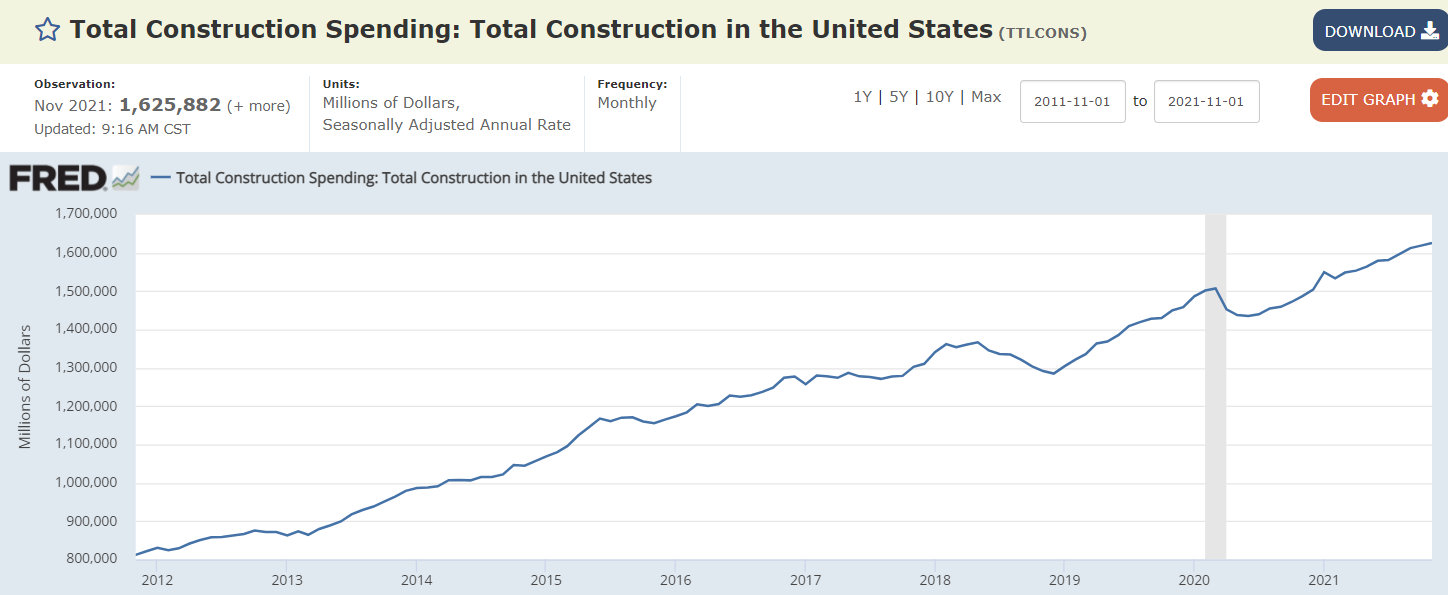

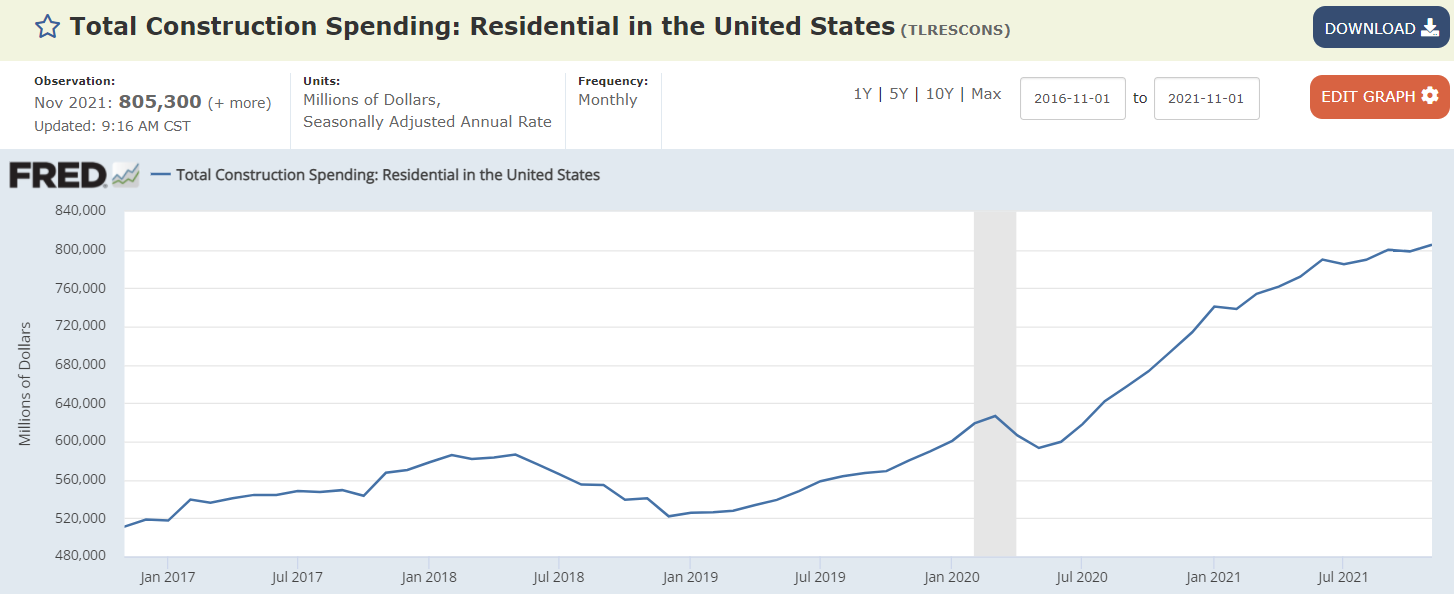

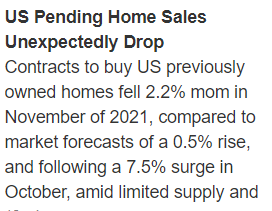

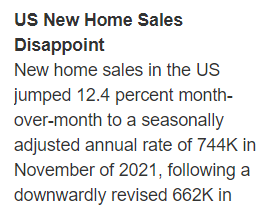

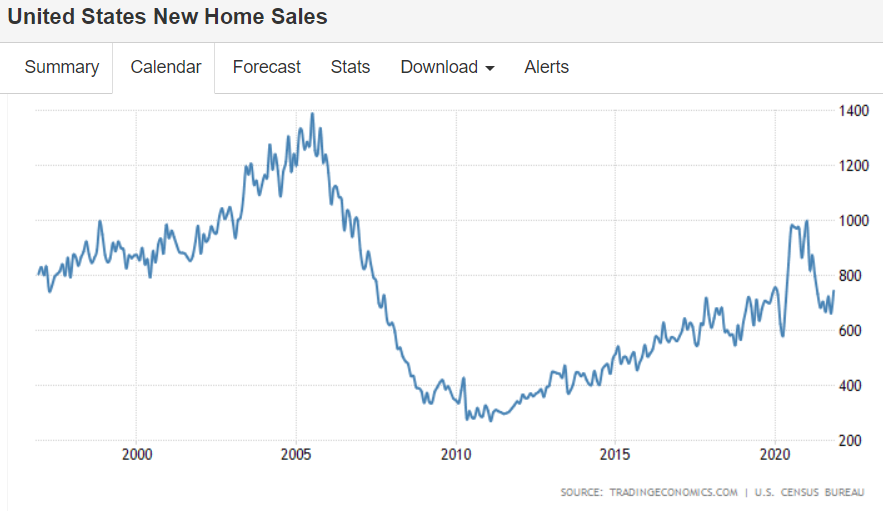

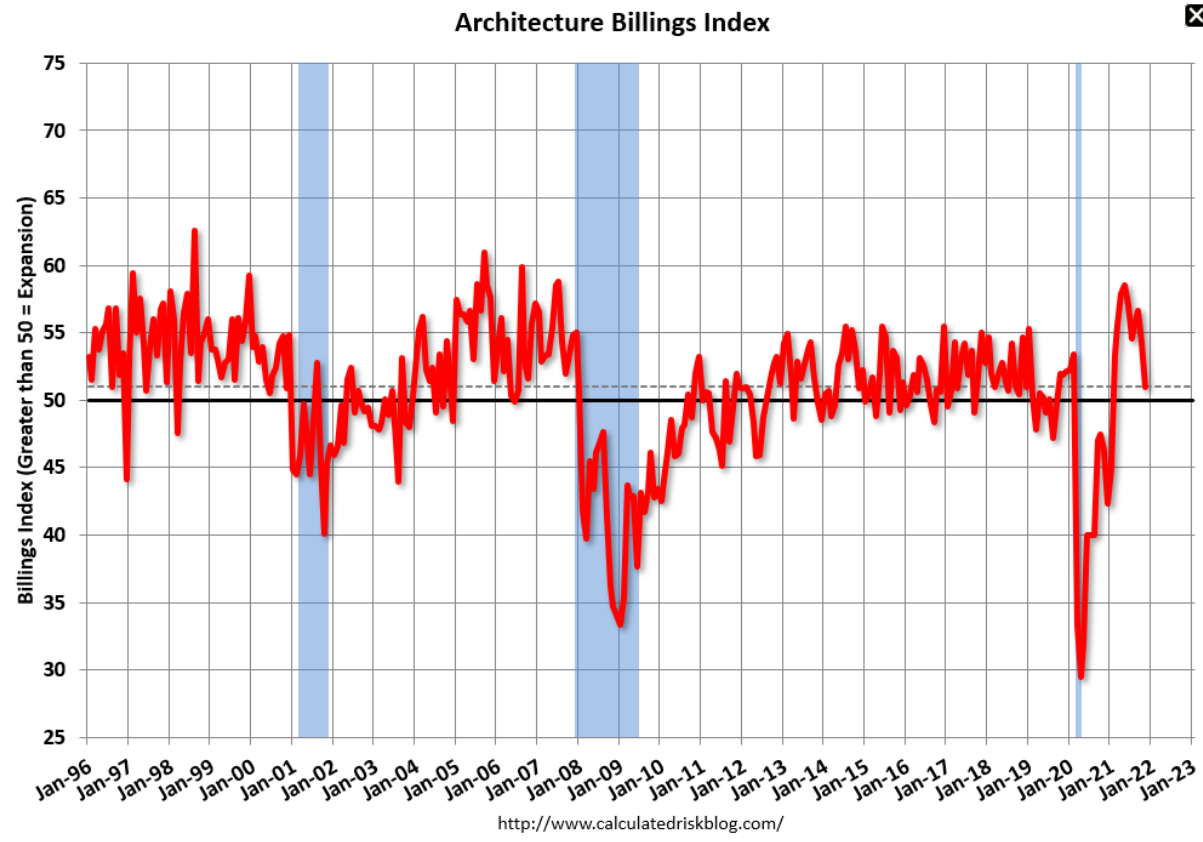

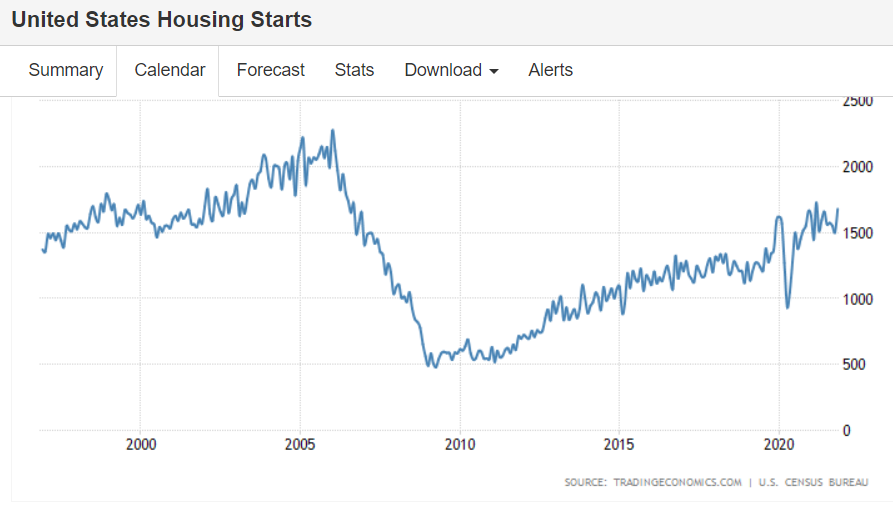

Covid dip, recovery, and now settling back at prior levels. After years of ultra low mortgage rates growth remains slower and absolute levels far below the prior cycle:

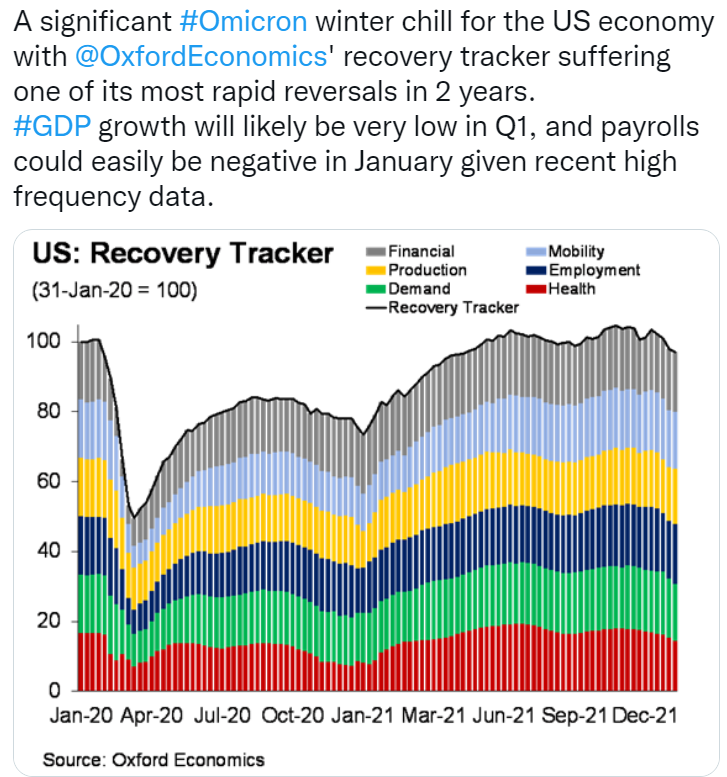

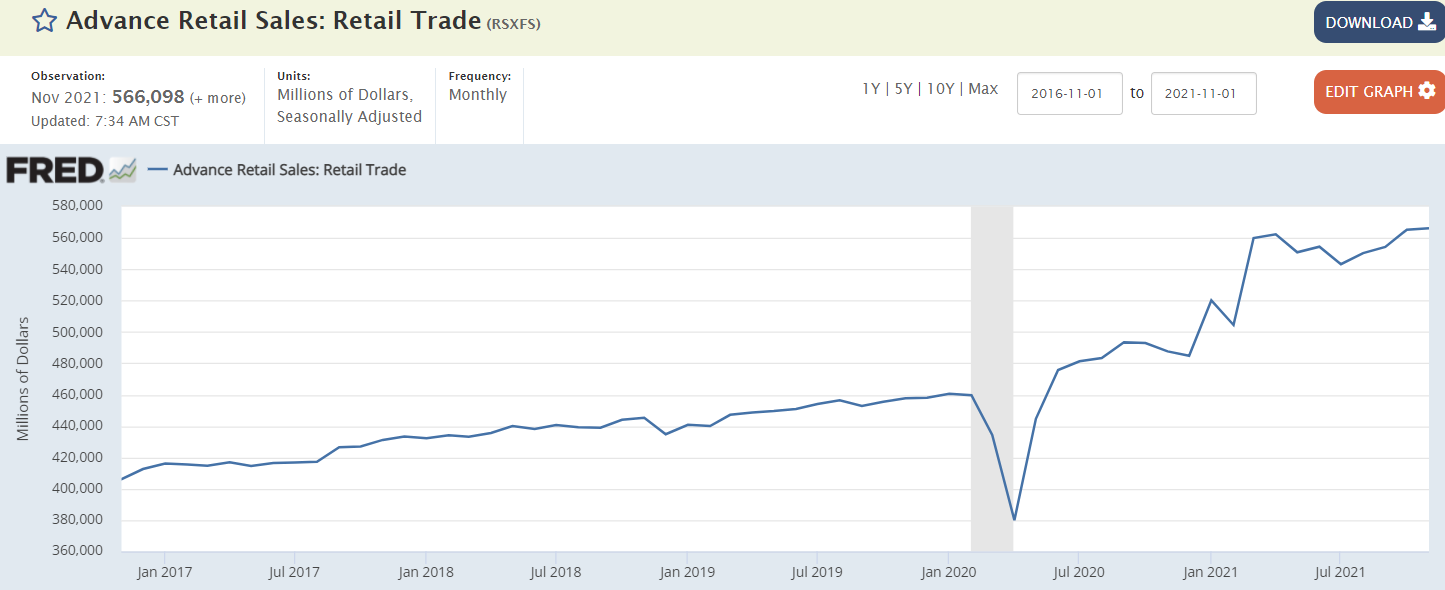

Post war slowdown narrative continues to unfold:

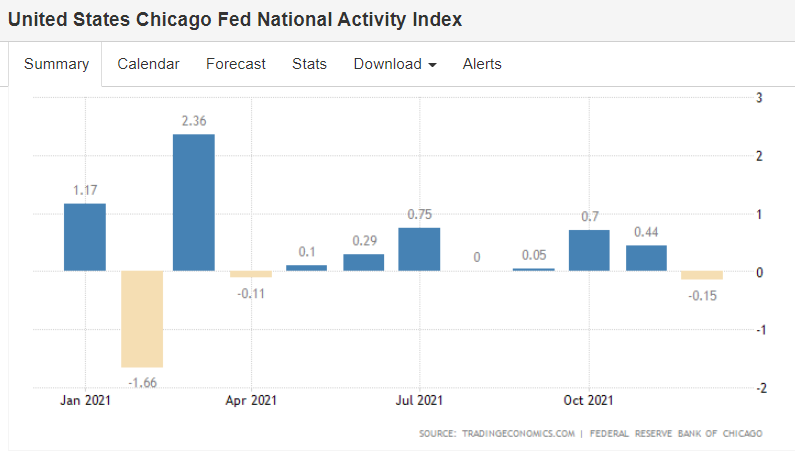

“The Chicago Fed National Activity Index in the US dropped to -0.15 in December 2021 from an upwardly revised +0.44 in the previous month, suggesting there was a contraction in economic activity following a two-month period of expansion.”

Post war deceleration seems to be on track.

Debt/GDP falling fast as Federal Covid spending winds down.

Continues to level off well below the pre covid trend:

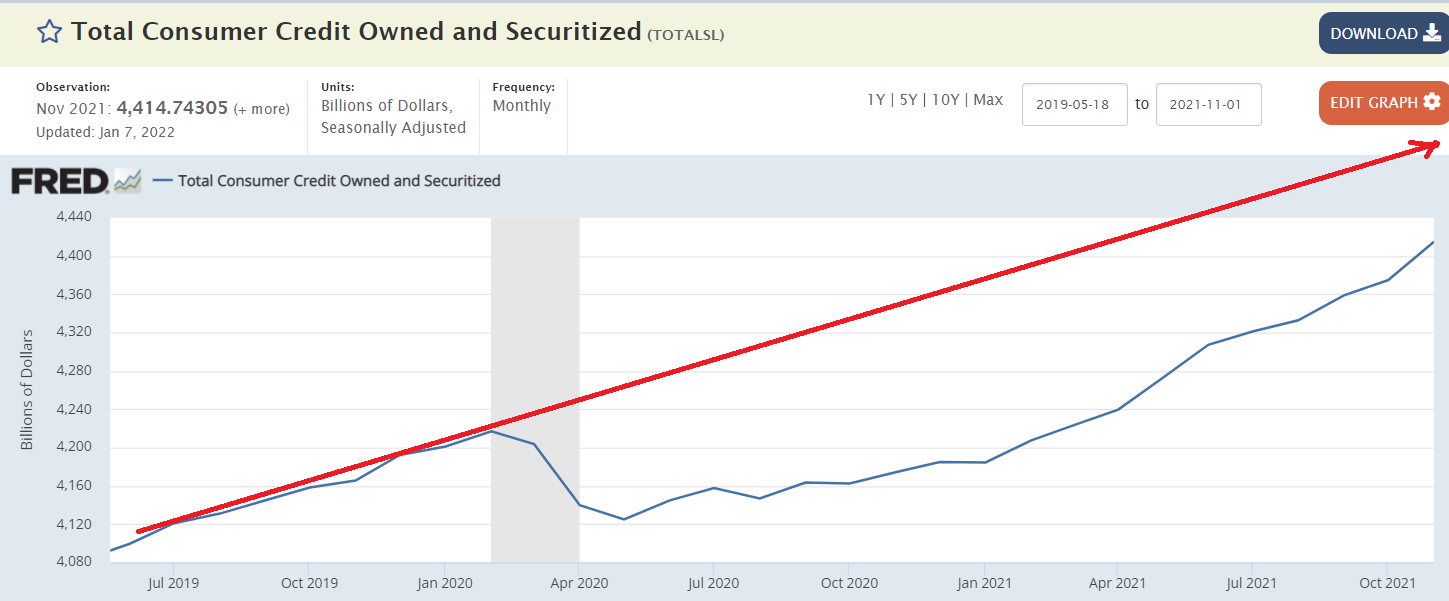

Picking up as Federal transfer payments diminish:

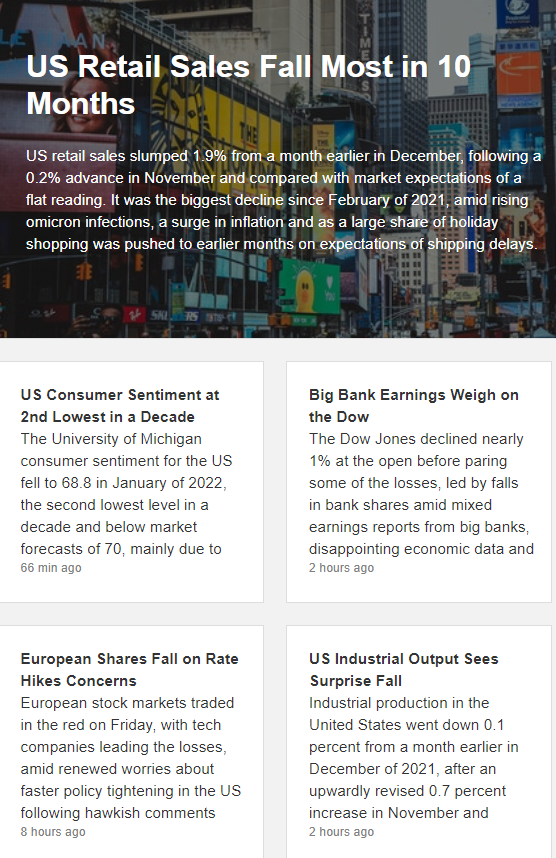

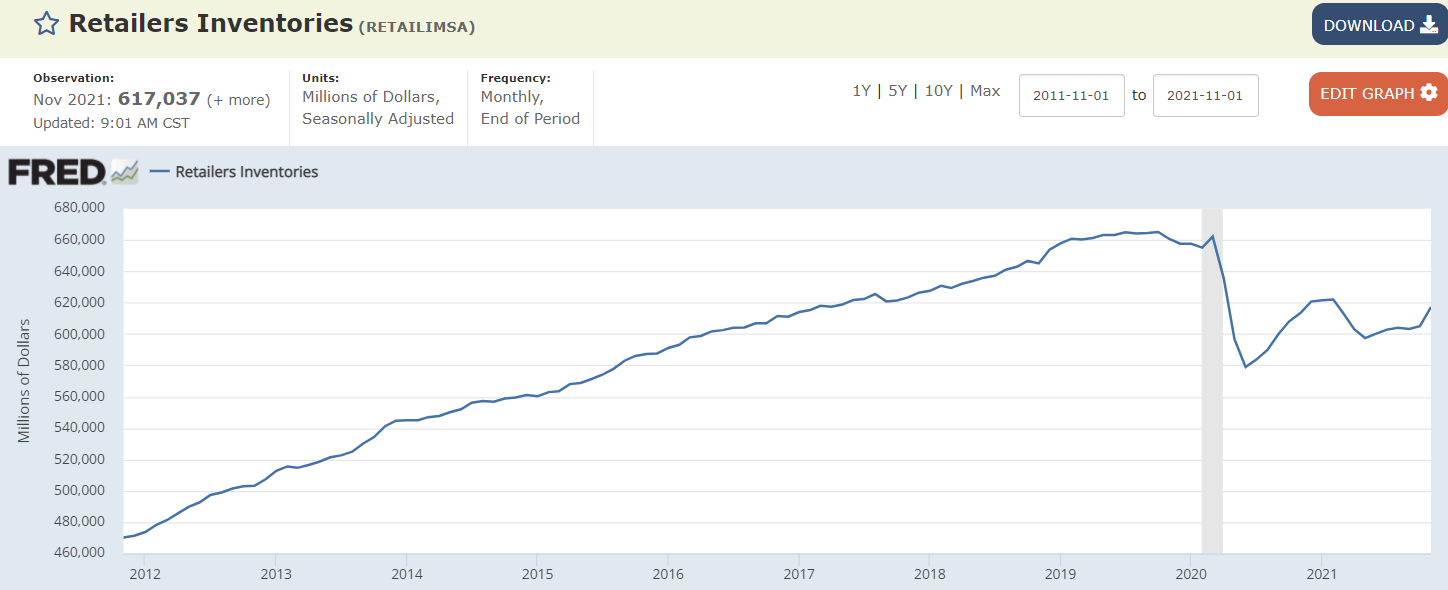

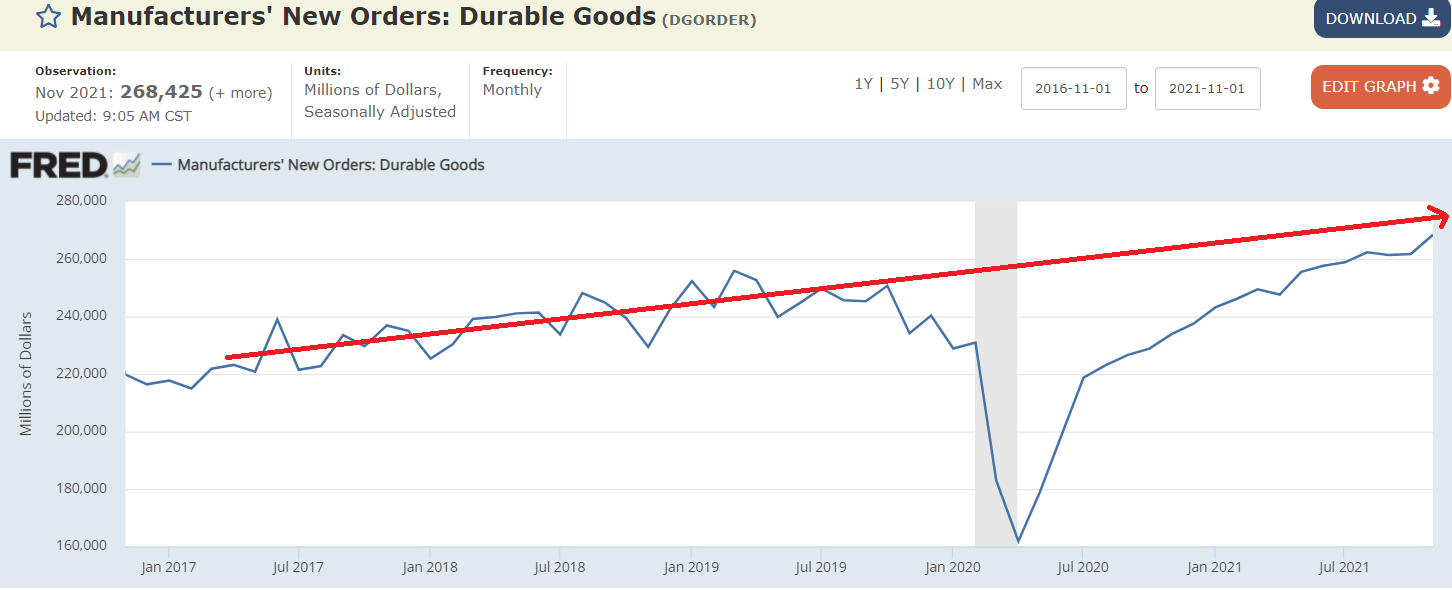

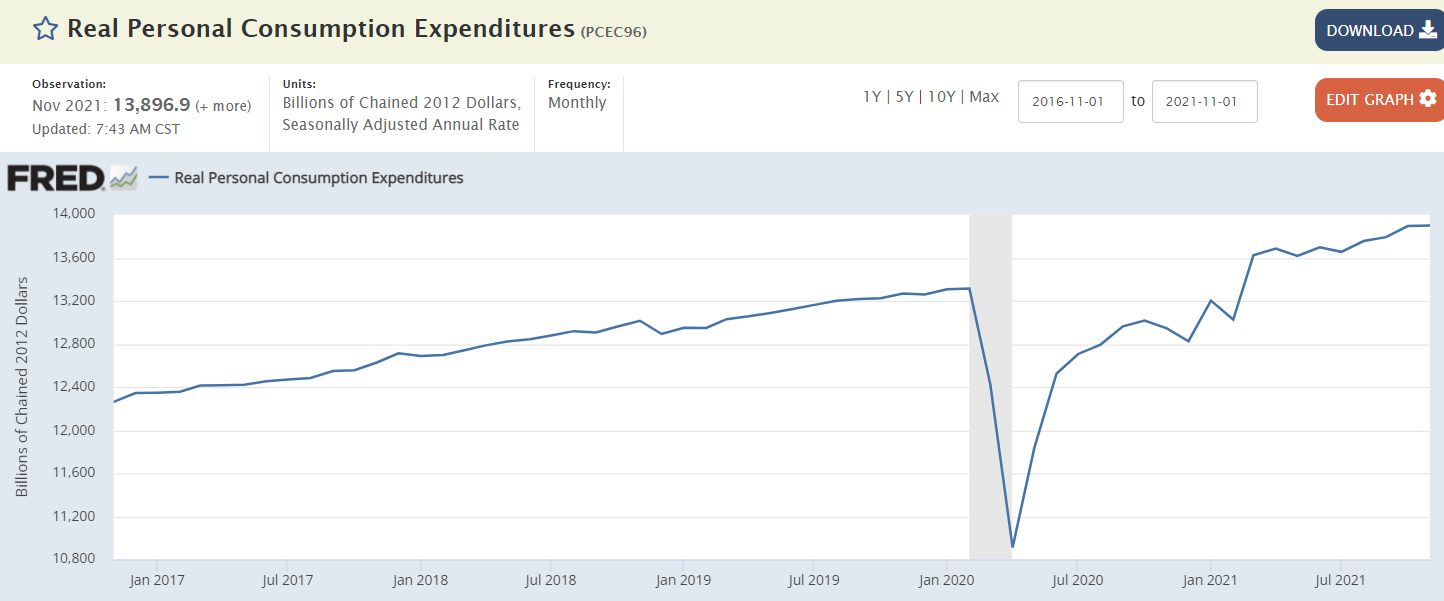

Starting to fade, and this is not adjusted for inflation:

Not sure what to make of this except the post covid bounce seems to be leveling off?

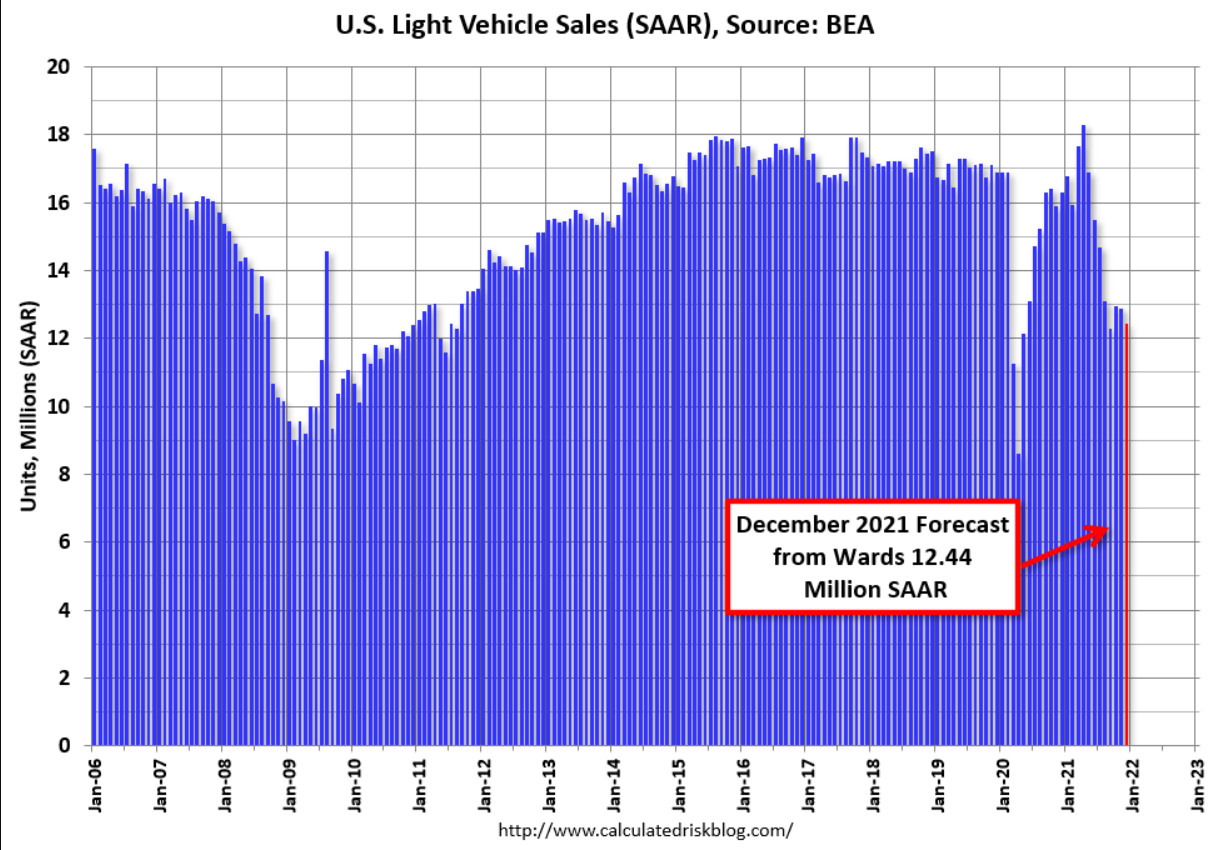

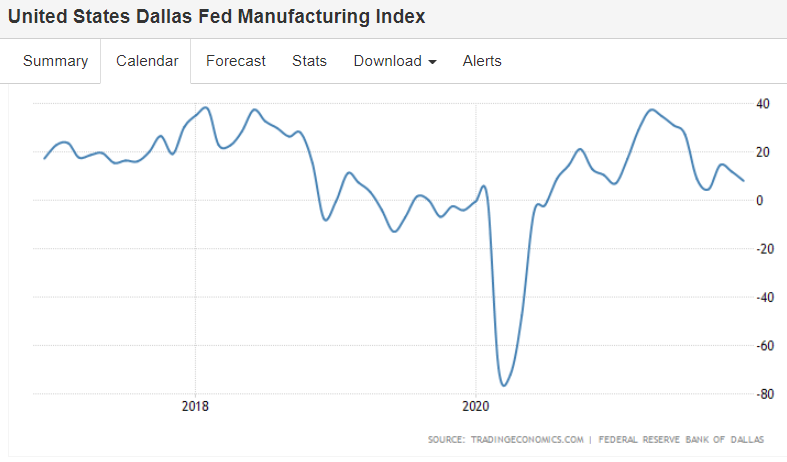

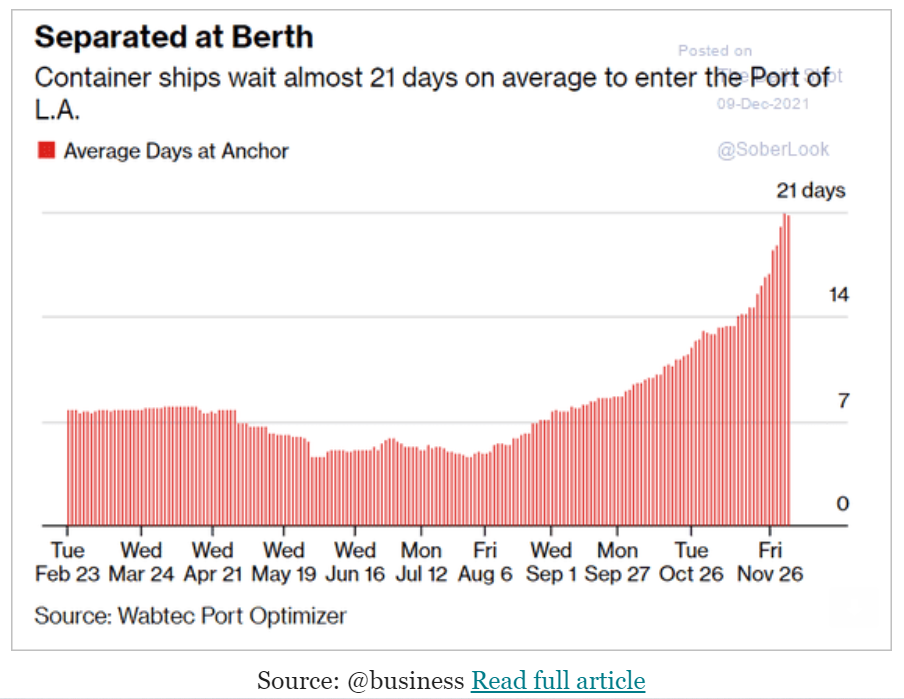

This slowdown is more than just a parts shortage:

This slowdown is more than just a parts shortage:

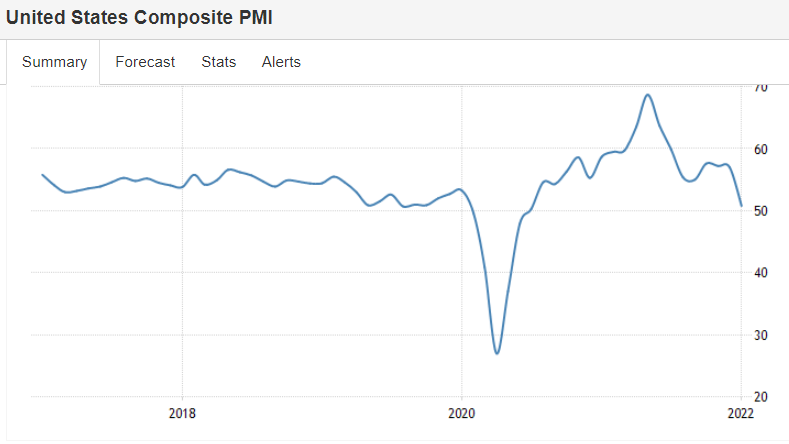

Working its way lower as are most of the indicators:

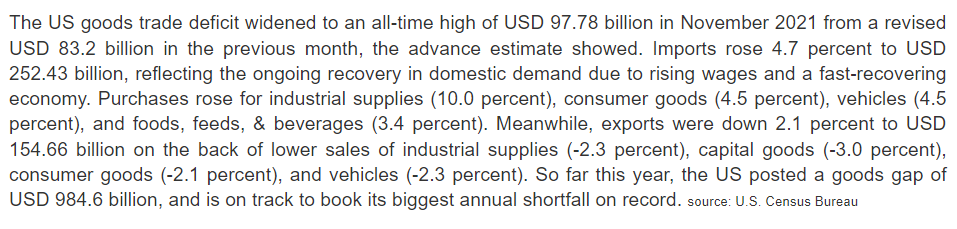

This has helped keep US demand down as fiscal transfers sustained income in the midsts of extensive supply side issues:

Looks to be leveling off:

Fallen back to pre covid trend was fiscal transfers expire, with more on the way for Jan:

Back to low growth mode:

After a nice bounce from the covid dip they seem to be leveling off.

And these numbers aren’t adjusted for ‘inflation:’

Up last month but still look to be going sideways:

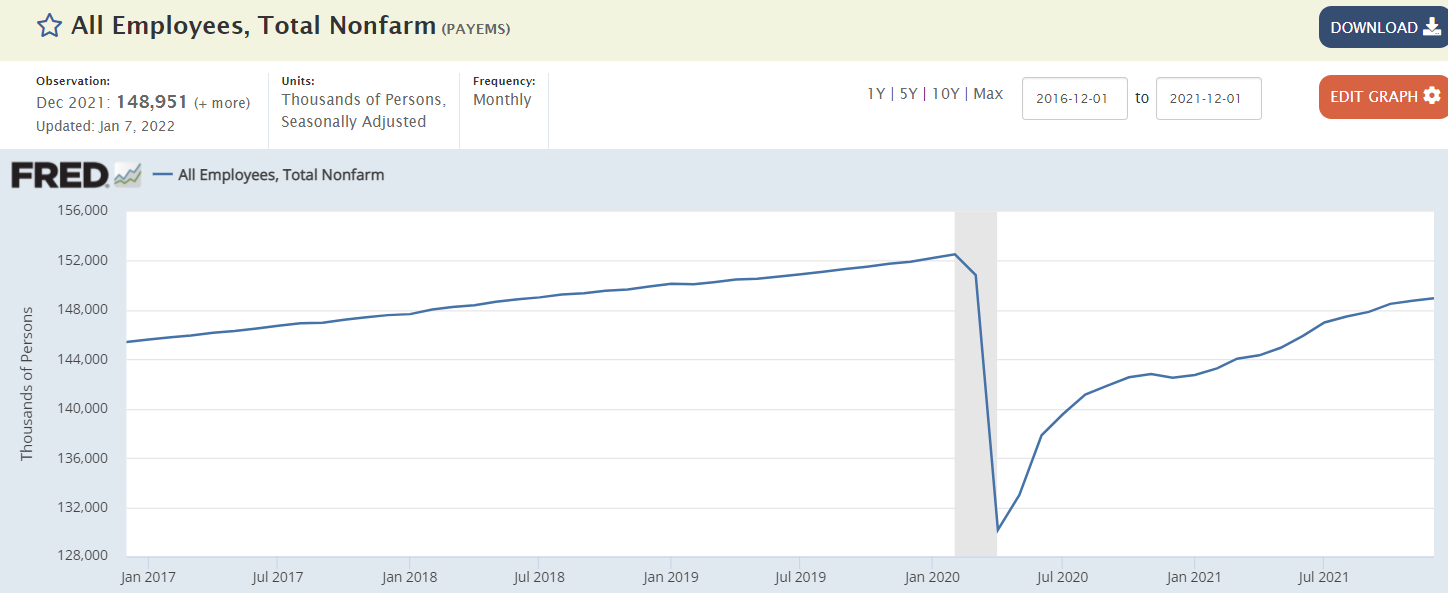

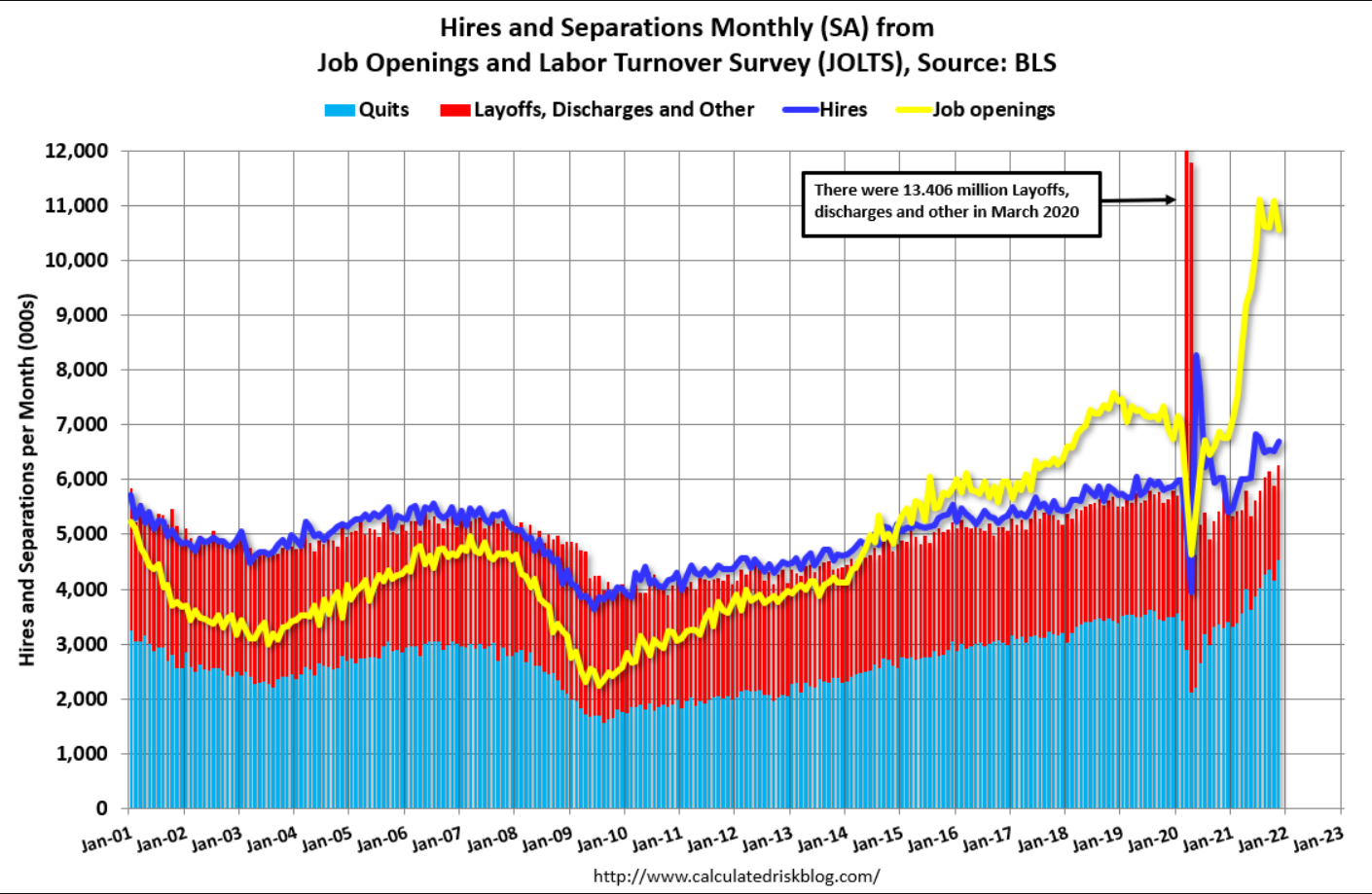

Still slowly recovering to pre covid levels:

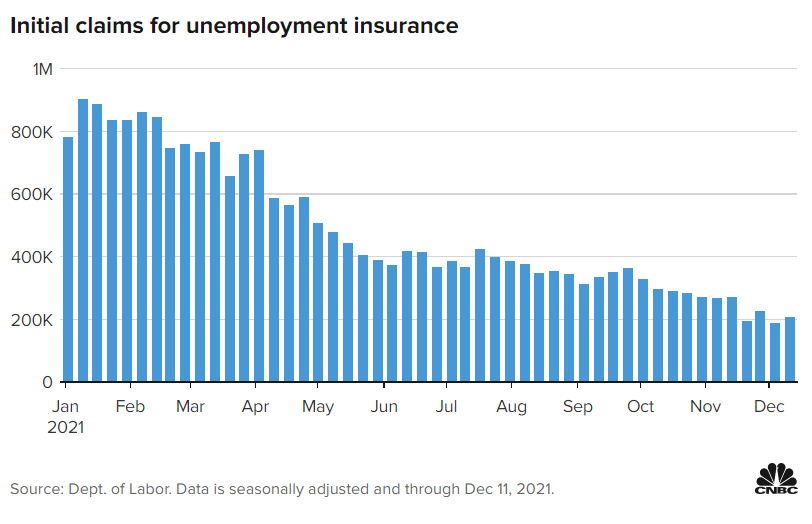

New claims for unemployment comp remain low:

Back to pre covid levels as fewer people are being let go:

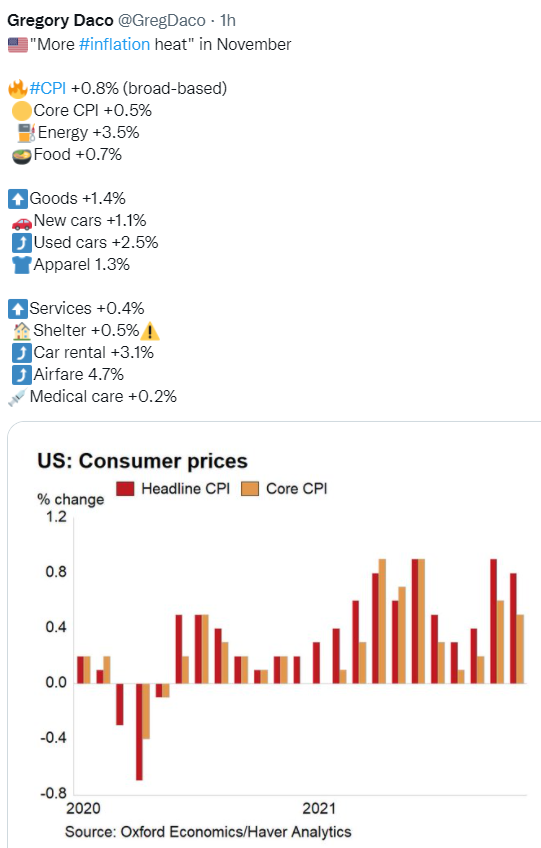

Looks to me like the increases will subside if energy prices stabilize:

Still looks to be on the decline, as federal deficit spending is quickly fading and inflation reduces the value of savings, causing people and businesses to spend less as they try to sustain a comfortable level of savings: