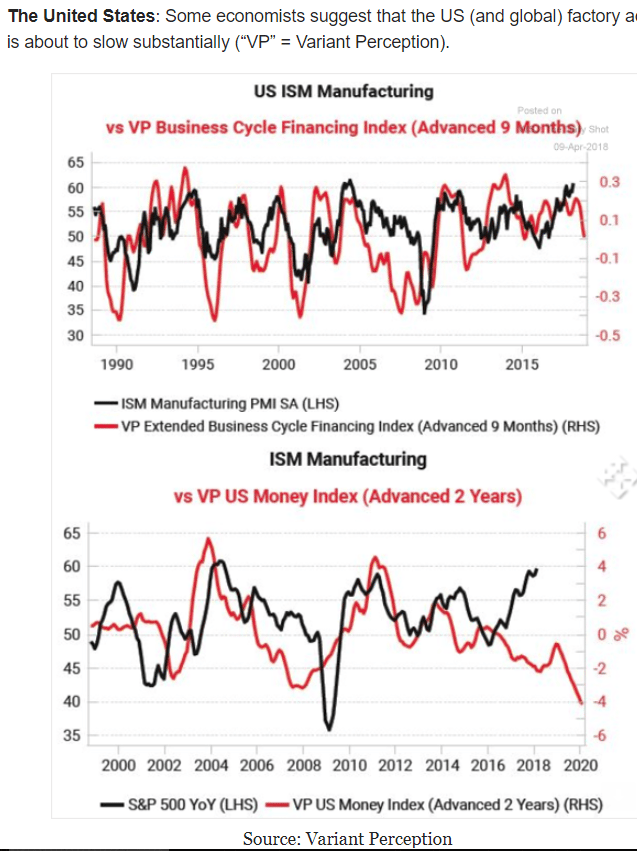

Trumped up expectations reversing?

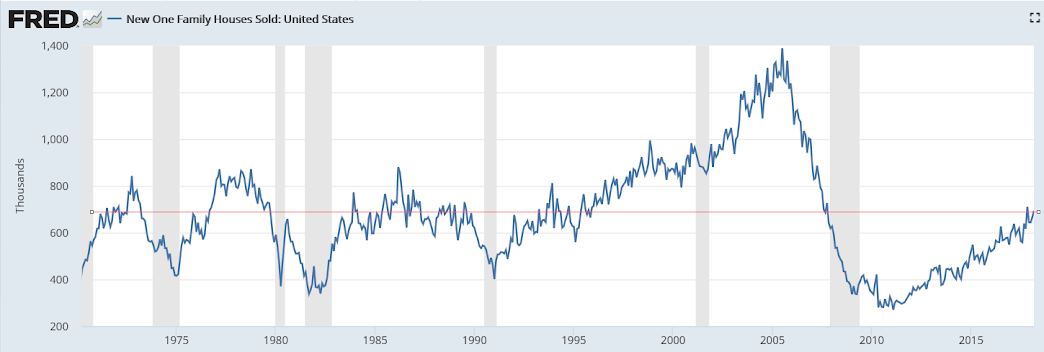

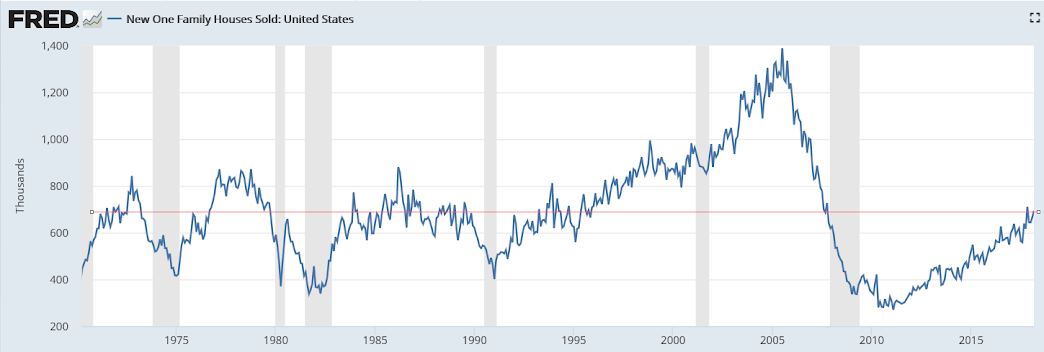

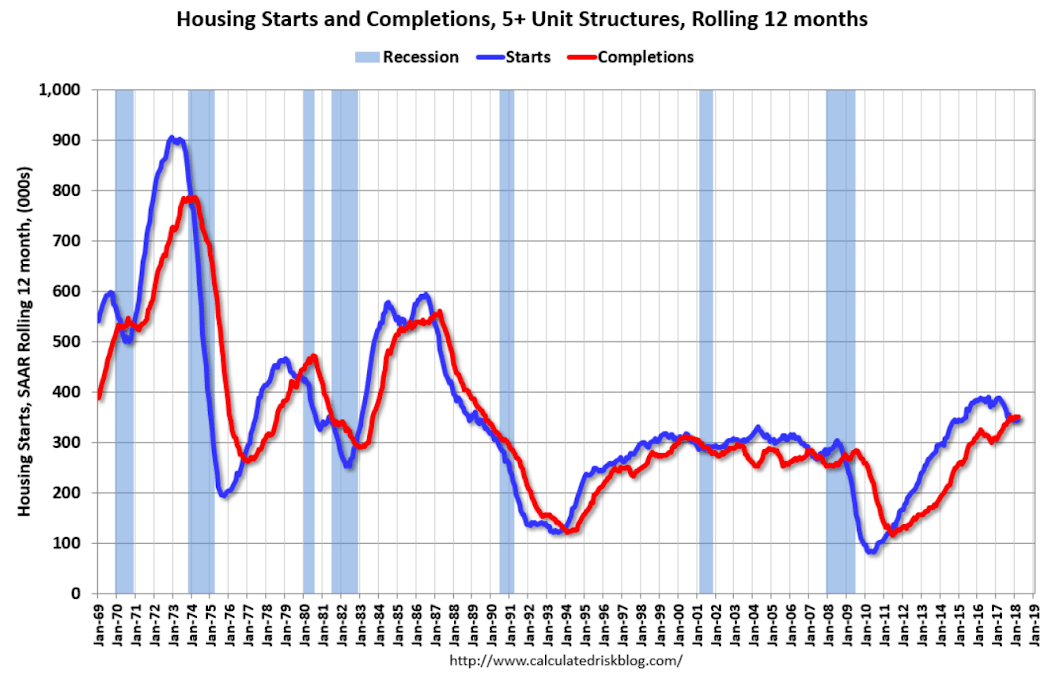

Growing modestly, and still below levels of the early 1970’s, and well below levels of the 2001 recession. The chart is not adjusted for population:

Trumped up expectations reversing?

Growing modestly, and still below levels of the early 1970’s, and well below levels of the 2001 recession. The chart is not adjusted for population:

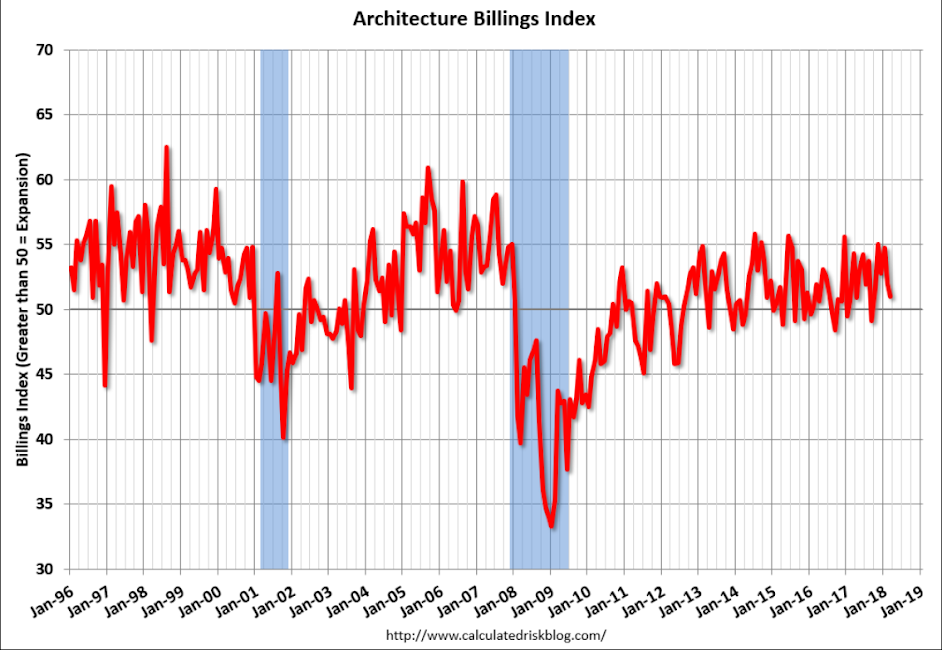

Muddling through at depressed levels:

Saudis set price. If they decide to hike as below, it will happen:

OPEC’s new price hawk Saudi Arabia seeks oil as high as $100

Apr 18 (Reuters) — Top oil exporter Saudi Arabia would be happy to see crude rise to $80 or even $100 a barrel. OPEC, Russia and several other producers began to reduce supply in January 2017 in an attempt to erase a glut. They have extended the pact until December 2018 and meet in June to review policy. OPEC is closing in on the original target of the pact – reducing industrialized nations’ oil inventories to their five-year average. Two industry sources said a desired crude price of $80 or even $100 was circulated by senior Saudi officials in closed-door briefings in recent weeks.

Must be some tax thing driving multifamily last month:

Highlights

The residential construction business had a very strong March: housing starts easily topped Econoday’s high estimate at a 1.319 million annualized rate while permits came in just shy of the top estimate at a very strong 1.354 million.

Multi-family units are the standout in the March report. Starts for this group rose 14.4 percent in the month to a 452,000 rate with permits 19.0 percent higher at 514,000. Single-family units are soft with starts down 3.7 percent to an 867,000 rate and with permits down 5.5 percent to an 840,000 rate in a result offset by a large upward revision to February.

One clear negative, perhaps tied to weather, is a slowing in completions which fell 5.1 percent to 1.217 million. This is not good news for a housing market starved of supply.

Housing had an uneven start to the year with March sales results still to be posted. Sales side, residential investment looks to be a positive contributor to first-quarter GDP as housing construction ended the quarter with visible momentum going into the second quarter.

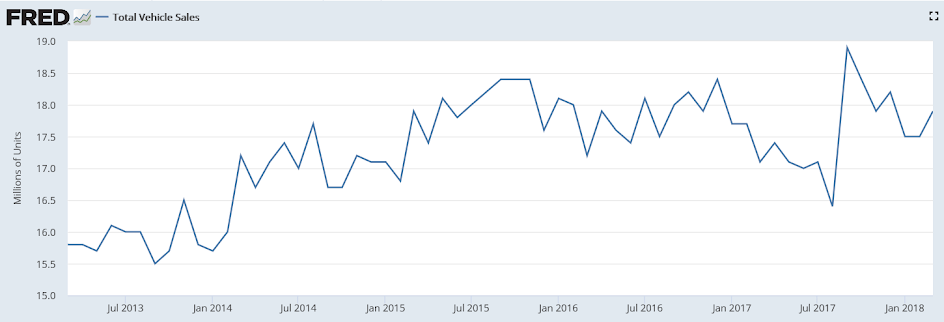

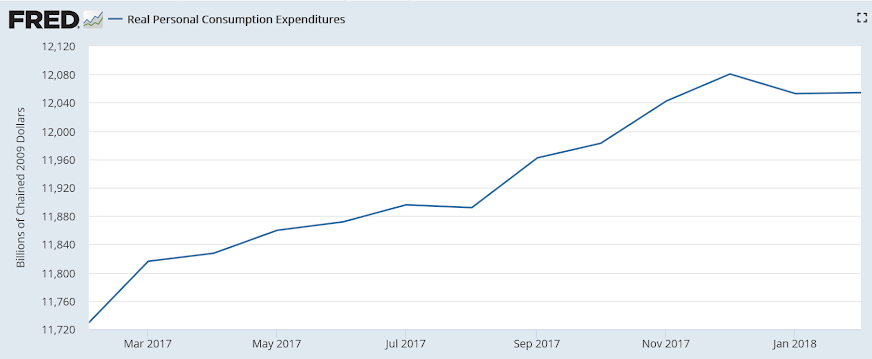

Chugging along at modest rates of growth, back to the highs of several years ago:

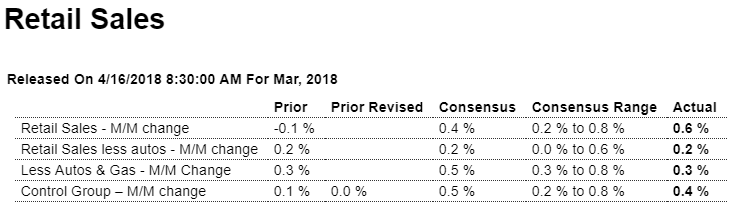

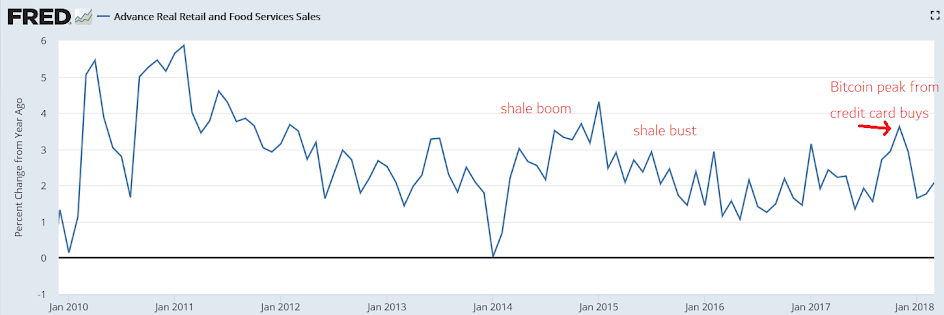

Propped up by autos, as the rest continues weak, and autos aren’t looking so good longer term either:

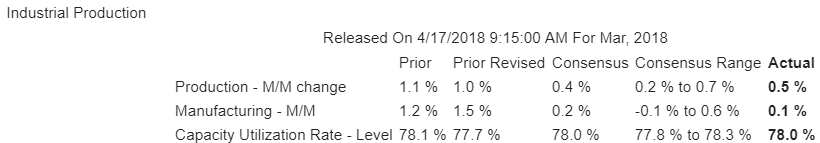

Highlights

In a slight reversal of expectations, retail sales proved stronger at the headline level, up 0.6 percent in March, than the core readings which did however still post respectable gains at 0.3 percent less autos and gas and 0.4 percent for the control group.

Autos are the big story in March, jumping 2.0 percent and finally shaking off the long lull following the replacement surge of September’s hurricanes. Excluding autos, retail sales managed only a 0.2 percent gain following only 0.2 percent and 0.1 percent gains in the prior two months in results that do not point to much consumer strength.

Department stores are having a very hard time, falling 0.3 percent after February’s 0.9 percent plunge. Clothing stores also posted a big decline in the month, at 0.8 percent, as did building materials at minus 0.6 percent and sporting goods at 1.8 percent. Gasoline proved a bit of a wildcard in this report, falling only 0.3 percent which is less severe than many expected.

But there are positives in the report including a second straight 0.4 percent gain for restaurants and a second straight solid rise, at 0.7 percent, for furniture stores. And nonstore retailers are once again at the top of the data, at a 0.8 percent gain following February’s 0.9 percent jump.

But this report, after two soft showings in January and February, doesn’t show the fundamental acceleration that was expected for March, evident in the year-on-year growth rates for the core readings: down 2 tenths to 3.9 percent ex-gas ex-auto and down 3 tenths for the control group at 3.8 percent. Though service spending may very well bail out the first quarter, consumer spending doesn’t look to be much of a contributor to first-quarter GDP.

Last months small move up in vehicle sales was what caused retail sales to be better than expected:

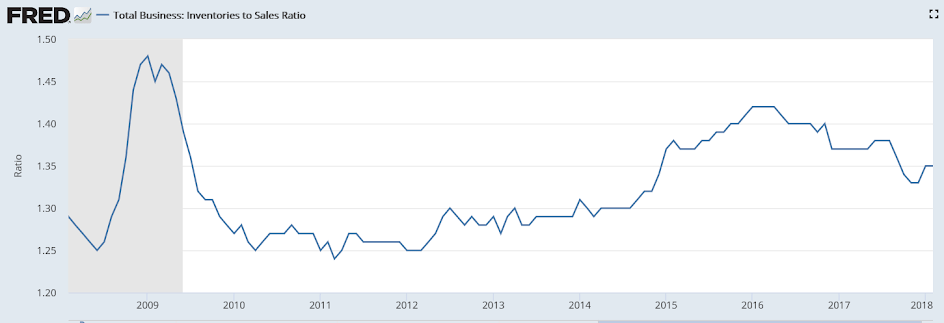

Inventories are still elevated relative to sales:

Eine neue wissenschaftliche Wahrheit pflegt sich nicht in der Weise durchzusetzen, daß ihre Gegner überzeugt werden und sich als belehrt erklären, sondern vielmehr dadurch, daß ihre Gegner allmählich aussterben und daß die heranwachsende Generation von vornherein mit der Wahrheit vertraut gemacht ist.

“A new scientific truth does not triumph by convincing its opponents and making them see the light, but rather because its opponents eventually die, and a new generation grows up that is familiar with it.”

Yellen and other economists say tax cuts are blowing up the budget

Former Federal Reserve Chair Janet Yellen and a team of economists argue that tax cuts are blowing a hole in the federal budget. The argument, made in a Washington Post op-ed, rejects a Hoover Institution study that blamed entitlements for trillion-dollar deficits forecast for the years ahead. Though Fed leaders including Yellen and others for years pleaded for fiscal assistance from Congress, the op-ed argues that the stimulus was ill-timed.

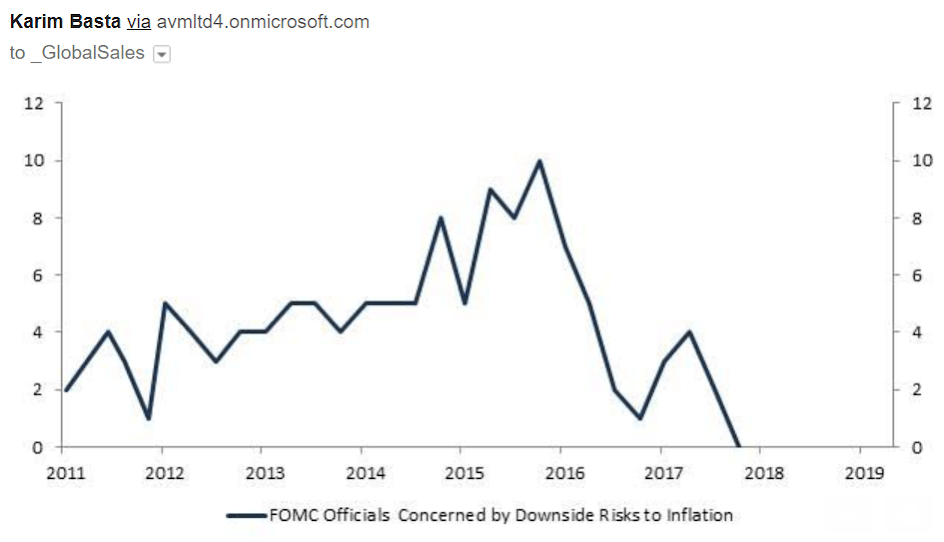

More evidence higher rates cause inflation?

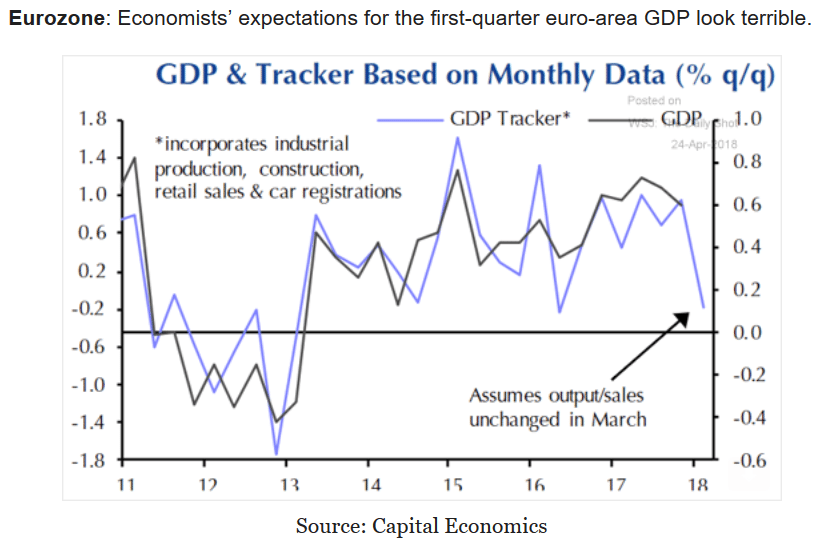

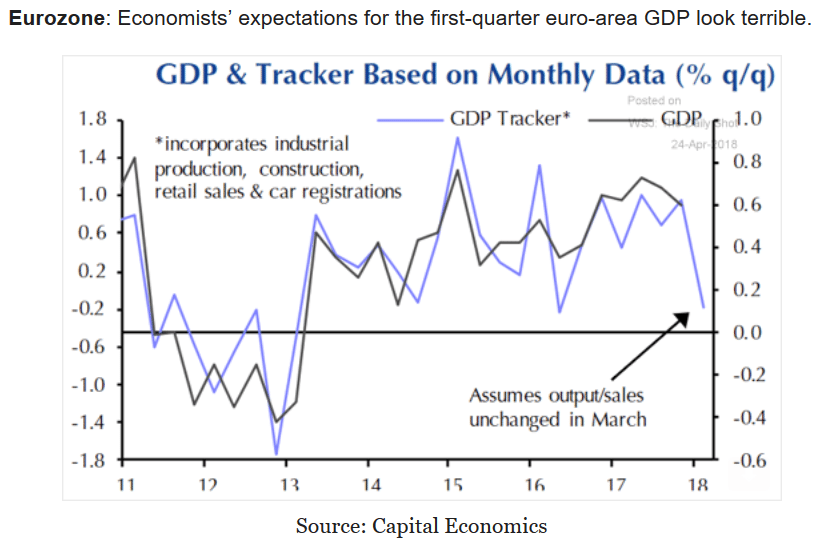

The ECB is concerned about euro strength cutting into exports. Hence that makes them more likely to continue with negative deposit rates, etc. However in my humble opinion the negative rates contribute to a strong euro as well as low inflation (via the interest income channels, etc.) which means they, along with all the major CB’s, have it backwards.

To again quote the hairdresser, ‘no matter how much I cut off it’s still too short’…

ECB members considered that a strong euro may weigh on inflation outlook and that developments in foreign exchange markets continued to be a significant source of uncertainty, minutes from the ECB’s March meeting showed.

Highlights

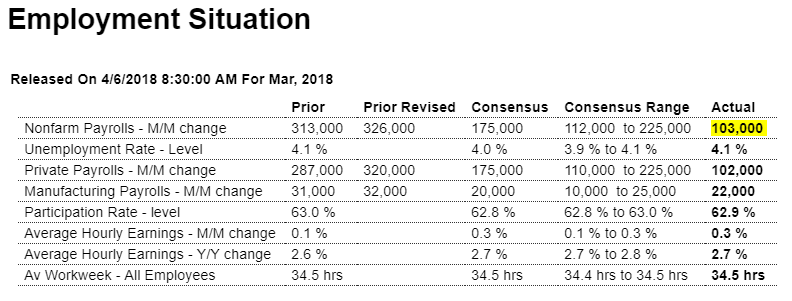

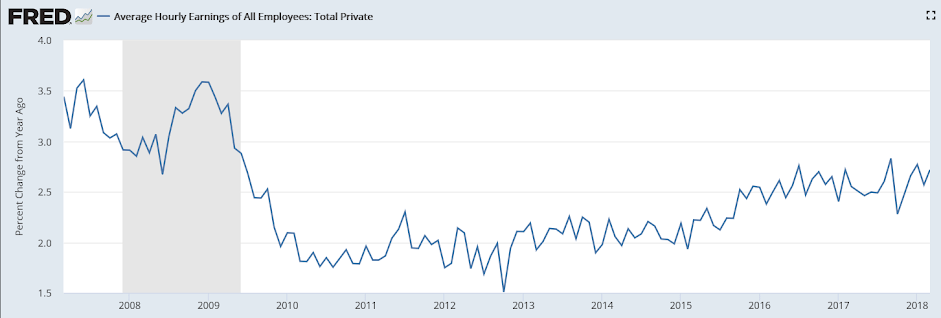

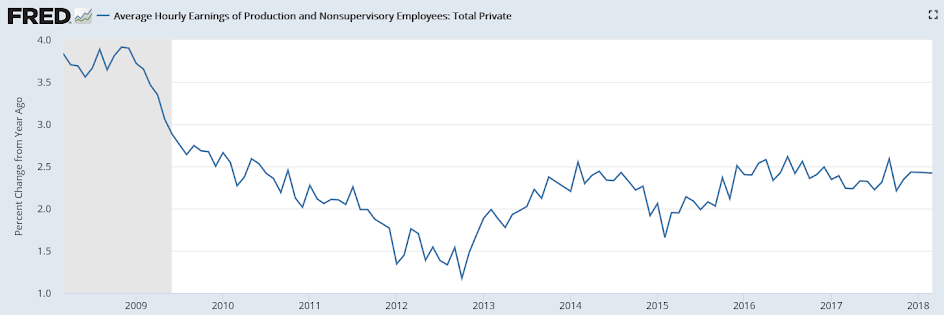

In mixed results, March payroll growth of 103,000 is well below expectations but wage indications from average hourly earnings do show a little pressure as was expected, up 0.3 percent on the month with the year-on-year rate up 1 tenth to 2.7 percent. The unemployment rate did not move down which was the consensus, instead holding steady at what is still a very low 4.1 percent.

Looking first at payroll growth, February and January have been revised with a net of minus 50,000 the result. The first quarter average of 202,000 is a bit below the fourth quarter’s 221,000. The breakdown for March shows another very strong showing for manufacturing, up 22,000 which hits Econoday’s consensus, and with professional & business services, a key component for tracking labor demand, rising a respectable 33,000. Yet the temporary help subcomponent for this reading fell 1,000 after rising 21,000 in February. And construction payrolls, which have been on the rise, fell 15,000. Retail also fell, down 4,000 in the month.

Judging by today’s results, the labor market wasn’t quite as hot as previously expected which turns down concern over wages even though those pressures did rise tangibly in March. On net, the March employment report will not likely turn up the heat on the Federal Reserve to increase its pace of rate tightenings.

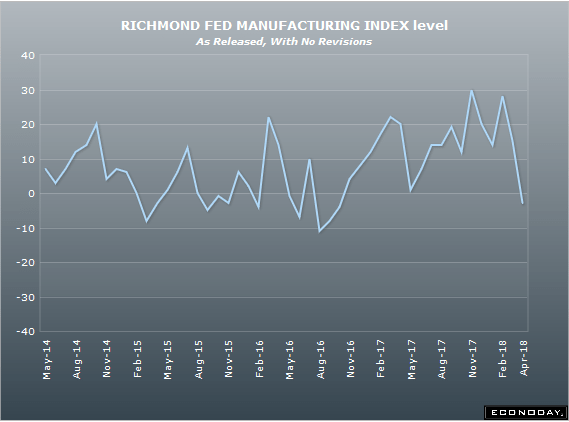

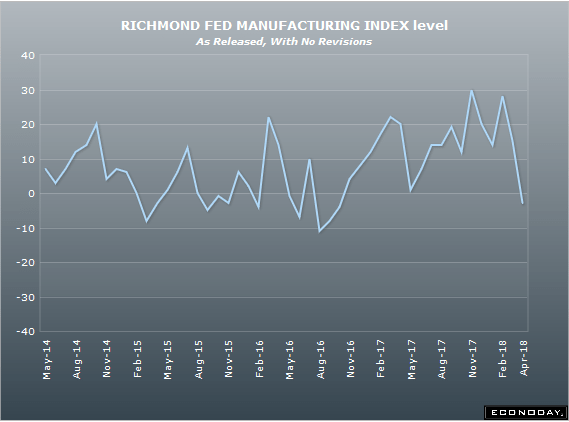

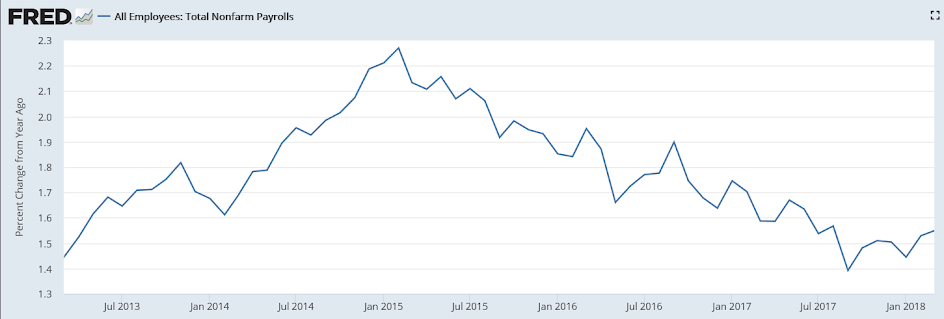

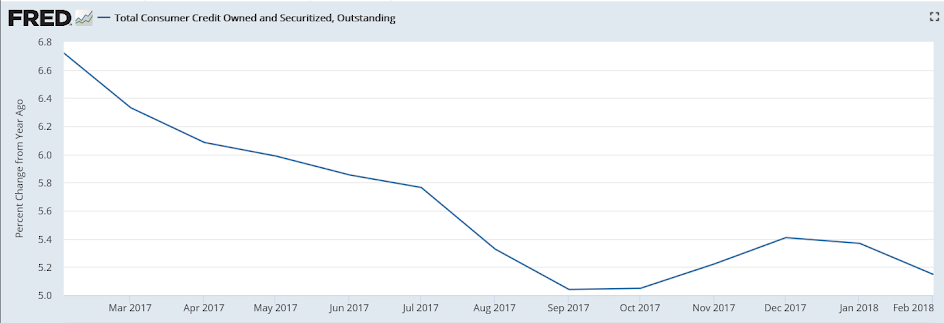

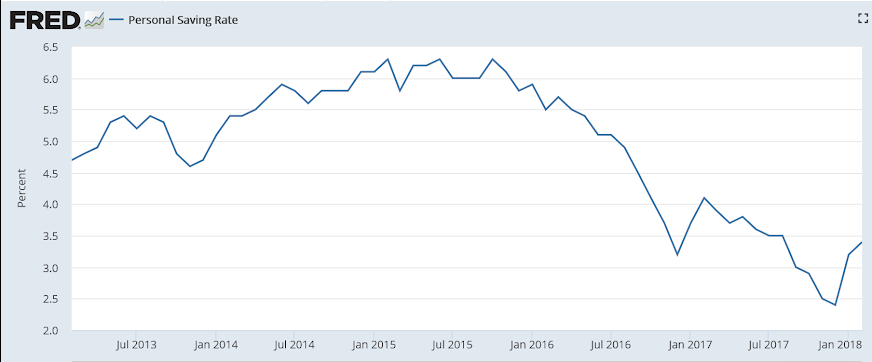

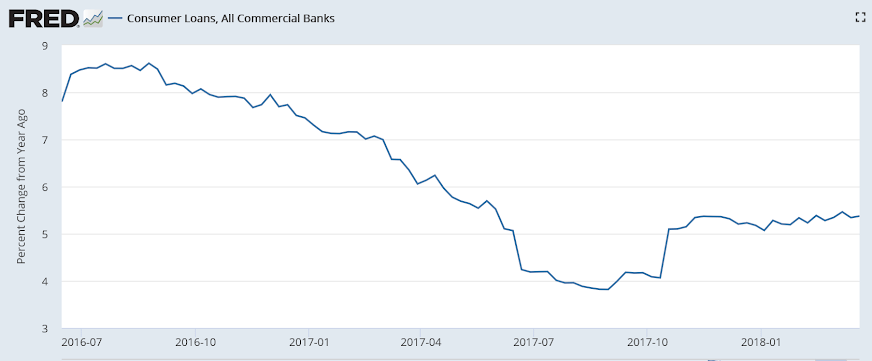

Still looking like it’s been going downhill for over two years:

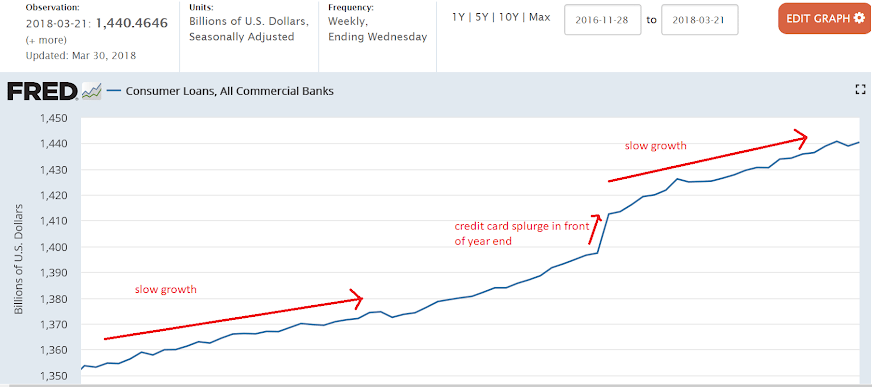

I don’t see any ‘acceleration’ here:

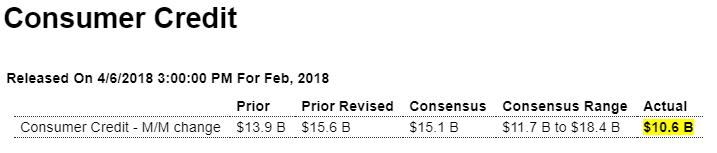

Highlights

Consumer spending was soft in February and part of the reason was reluctance to run up credit cards. Revolving credit inched only $0.1 billion higher in February for the lowest result in 4-1/2 years. Nonrevolving credit, where student loans and vehicle financing are tracked, did rise $10.5 billion in the month which, however, is soft for this reading. Together they make for a $10.6 rise in total consumer credit which is well under Econoday’s low estimate. These results point to a cautious consumer and hint at trouble for the consumer’s contribution to first-quarter GDP.

Decelerating again after the mini spike in December that may have been used to buy Bitcoin:

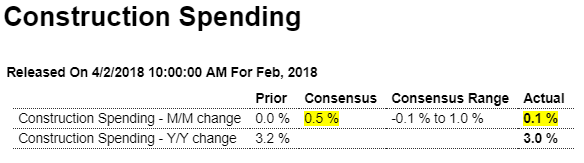

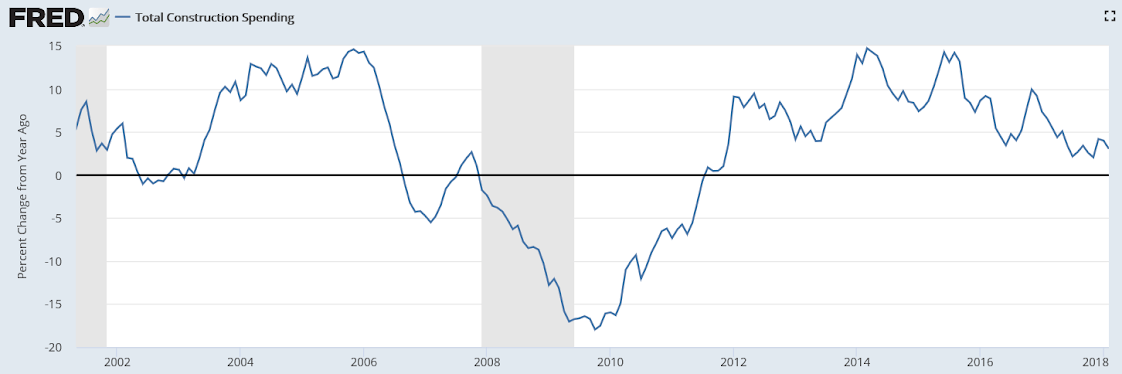

Worse than expected, weak, and decelerating:

Highlights

Construction spending has been soft, inching only 0.1 percent higher in February after posting no change in January but there are definitely signs of strength in the details. The most important gains are being posted for new single-family homes, up 0.9 percent for a second straight month for a year-on-year February increase of 9.5 percent. Multi-family homes, where spending has been weak, bounced back a monthly 1.2 percent for a yearly 0.9 percent increase. The weakness in February’s overall report comes from home improvements, which fell a monthly 1.5 percent for only a 1.4 percent yearly gain.

Public spending also weakened in February with educational and highway spending both slipping into slightly negative ground on the month. But private nonresidential spending is a positive, up 1.5 percent on the month though the year-on-year increase is still subdued at 1.1 percent. Power and manufacturing construction have been showing the most weakness though both posted gains in February. Transportation, despite a February slip, has been very strong as has commercial building while office spending, after a big monthly jump, moved back into the year-on-year plus column.

But total year-on-year spending is still subdued, down 2 tenths to only 3.0 percent. Yet the gains in single-family homes are a big plus for the housing market and should help build expectations for a badly needed rise in housing supply in what would prove a major plus for housing sales. Watch on Friday for construction payrolls in the employment report, a component that has been showing solid gains over the past year.

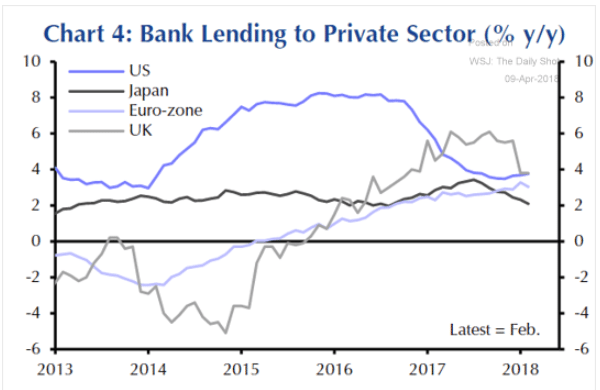

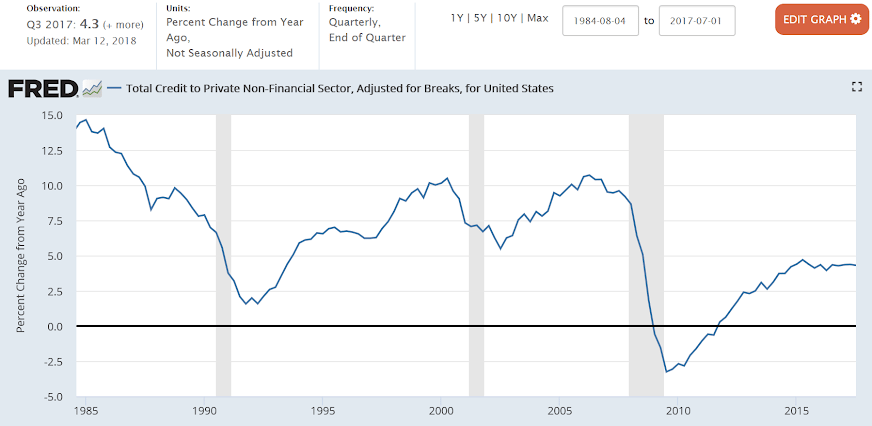

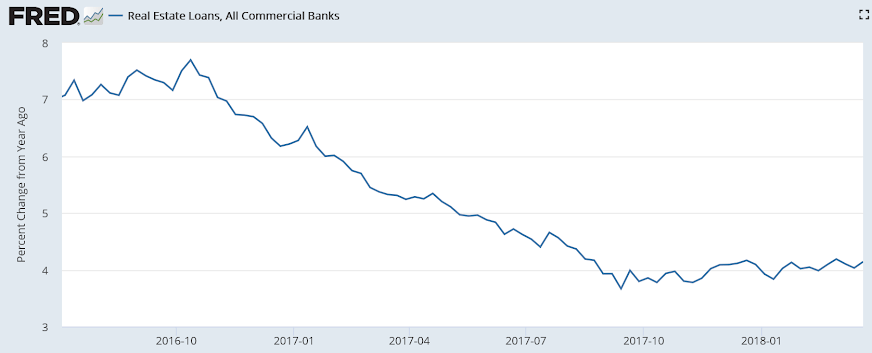

Another indicator showing how the credit expansion has stalled:

Erdogan has it right, of course:

Emerging Markets: A quote from Turkey’s Recep Tayyip Erdogan showing incredible ignorance:

The interest rate is both the mother and the father of the inflation. Those who don’t know this, they should. Anyone attempting to act against this would find me facing them.

This is not going to end well for Turkey.

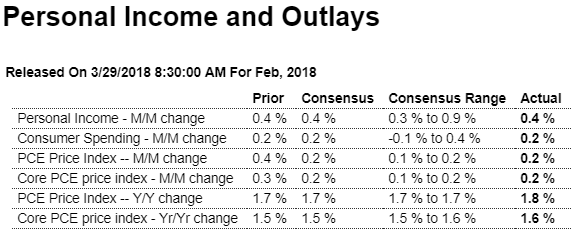

Everything pretty much as expected, more comments via the charts:

Highlights

Inflation data are inching higher while softness in spending is offset by strength in wages. The core PCE price index managed only an as-expected 0.2 percent gain in February though the year-on-year rate moved a notch higher to 1.6 percent, which is still subdued but just better than Econoday’s consensus. Overall prices also rose 0.2 percent with this yearly rate also up 1 tenth, at 1.8 percent. Movement is slow but is consistent with the Fed’s expectations for a gradual rise this year to their 2 percent inflation target.

The strongest news in the report comes from the wages & salaries component of personal income which posted a fourth straight sharp gain, at 0.5 percent. This helped total income which rose 0.4 percent for a third straight month and also helped the savings rate which rose 2 tenths to a still modest 3.4 percent.

Also helping savings, unfortunately for retailers at least, was softness in spending which gained only 0.2 percent for the second straight month. Spending on services, at 0.3 percent, continues to hold up this component.

Consumer spending doesn’t look like it will be the backbone of the first-quarter GDP report like it was in the fourth quarter, barring that is a standout month for March. Otherwise, wages and inflation are moving in the right direction, that is consistent with moderate economic growth and gradual removal of stimulus by the Fed.

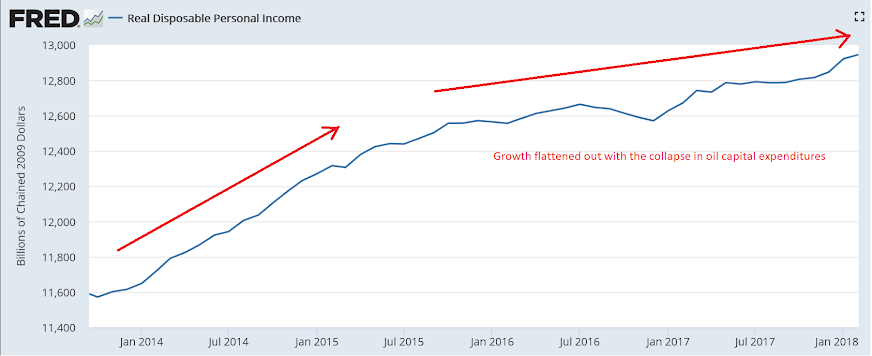

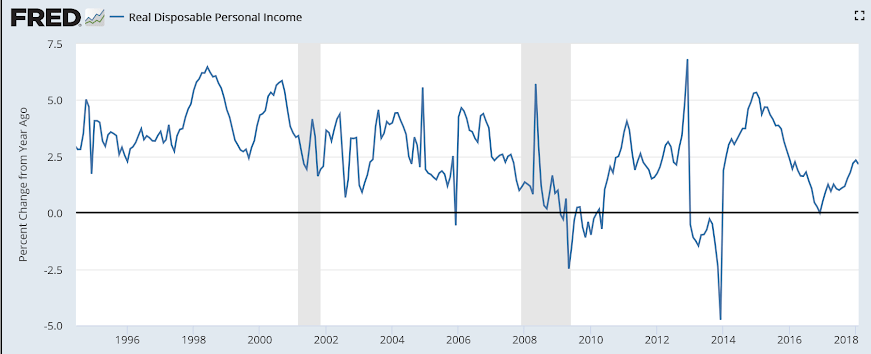

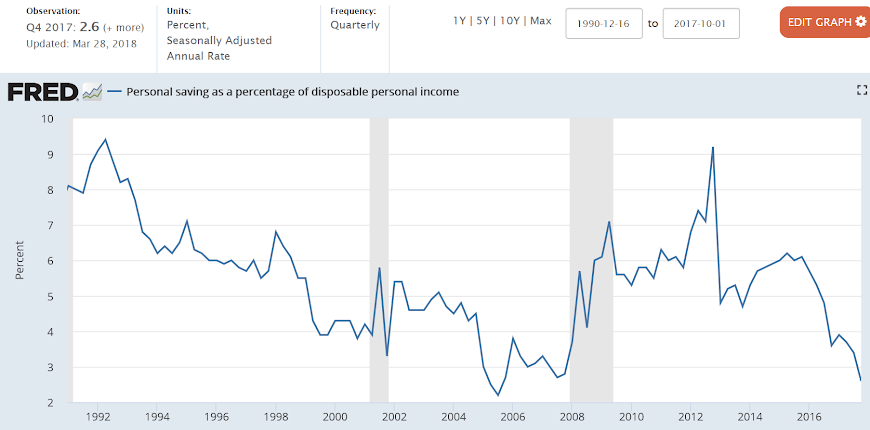

Growth is plenty low enough for a recession, depending on desired savings rates:

Starting to slow after a year end credit driven mini spending spree further depleted savings:

The personal savings rate began dropping after oil capex collapsed as income growth slowed more rapidly than consumption growth slowed, as it remains at what looks to me are unsustainably low levels.

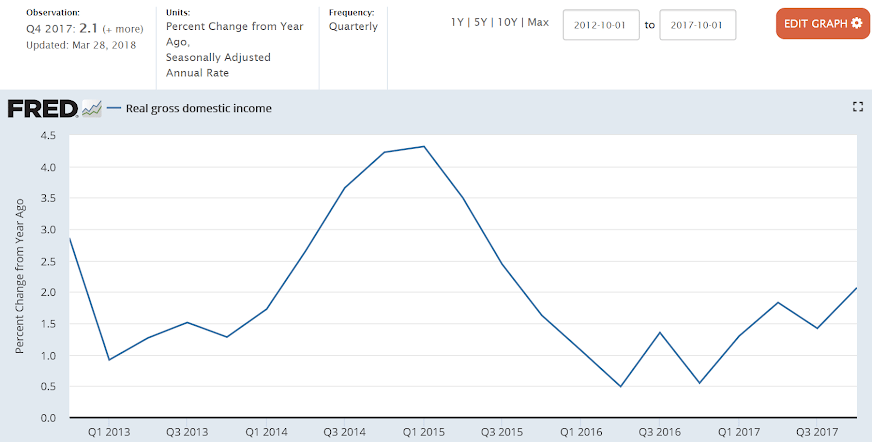

GDI and GDP are equal by identity, as one man’s sales are another’s income. However they are compiled independently using estimates and are often very different when first released, generally coming together over time with revisions as more data becomes available. Most recently GDI has been substantially below GDP and it remains to be seen which will turn out to have been more nearly correct:

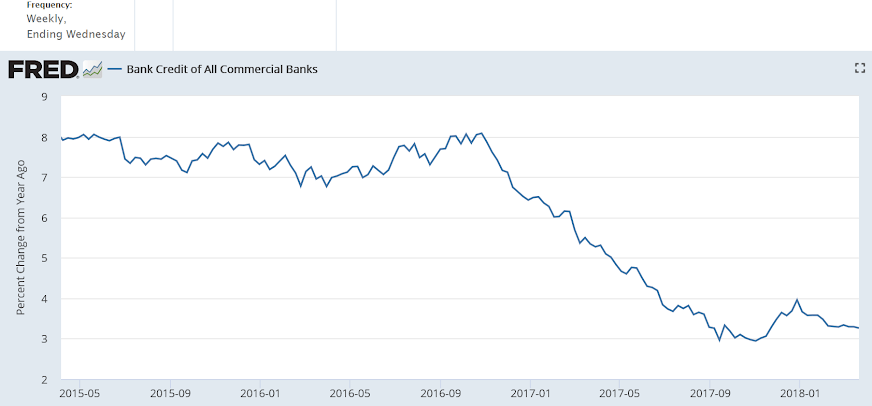

Bank loan growth remains depressed, and as bank loans create bank deposits, the growth of that component of ‘money supply’ also remains depressed:

The second article reveals the year over year situation, which takes out seasonal factors:

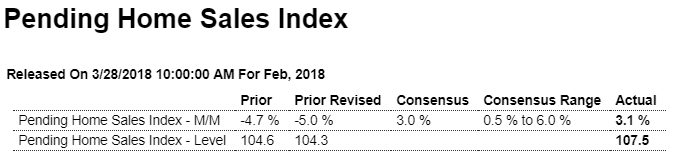

Highlights

Existing home sales have been struggling to move higher but today’s pending home sales index will raise expectations for improvement. Pending home sales rose a sharp 3.1 percent in data for February though they follow an even sharper 5.0 percent revised decline in January. The Northeast has been showing life in recent housing data with February pending sales jumping 10.3 percent in the month. Pending sales in the South rose 3.0 percent with the Midwest up 0.7 percent and the West up 0.4 percent.

United States Pending Home Sales

Contracts to buy previously owned homes in the United States shrank 4.1 percent year-on-year in February of 2018, following an upwardly revised 4 percent drop in January. It is the biggest decline since June of 2014 as contracts fell in all main regions: Northeast (-5.1 percent), Midwest (-9.5 percent), South (-1.5 percent) and the West (-2.2 percent). Compared to the previous month, pending home sales increased 3.1 percent, rebounding from an upwardly revised 5 percent fall in January and beating forecasts of a 2.1 percent gain.

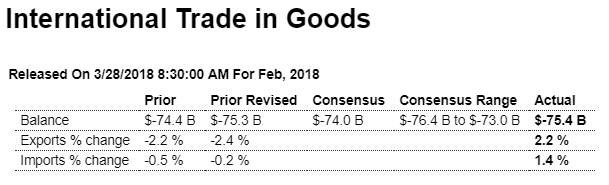

Worse than expected, nor are rising inventories a good sign:

Highlights

The nation’s trade deficit in goods failed to improve in February, at a very steep $75.4 billion which is nearly $1.5 billion deeper than Econoday’s consensus and little changed from January’s revised $75.3 billion. Imports rose 1.4 percent in the month with foods rising sharply along with imports of capital goods and industrial supplies as well. Imports of vehicles rose sizably but not consumer goods which posted only a small gain.

Exports are actually strong in this report, up 2.2 percent with gains centered in vehicles, which are usually a weak category, and also capital goods which is the nation’s strength. Exports of consumer goods, a major weakness, declined sharply after bouncing higher in January.

Based on two months of data, net exports won’t be helping first-quarter GDP though the negative pull may be offset by a rising inventory build, data for which were also released this morning.

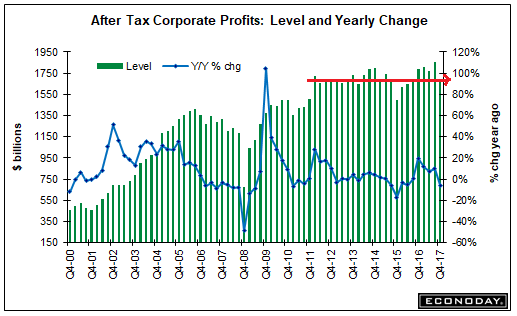

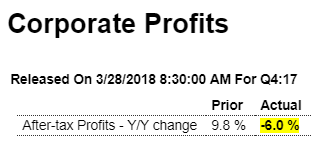

The mainstream had been measuring profit growth from the 2015 dip, but now seems they’ve settled in at about prior year levels and are showing now growth:

Highlights

Going into 2018, corporate profits weren’t getting any tax-related boost. After-tax corporate profits fell a year-on-year 6.0 percent in the fourth quarter to $1.68 trillion compared to a 5.8 percent decline on a pre-tax basis to $2.13 trillion. Profits are after tax without inventory valuation or capital consumption adjustments.