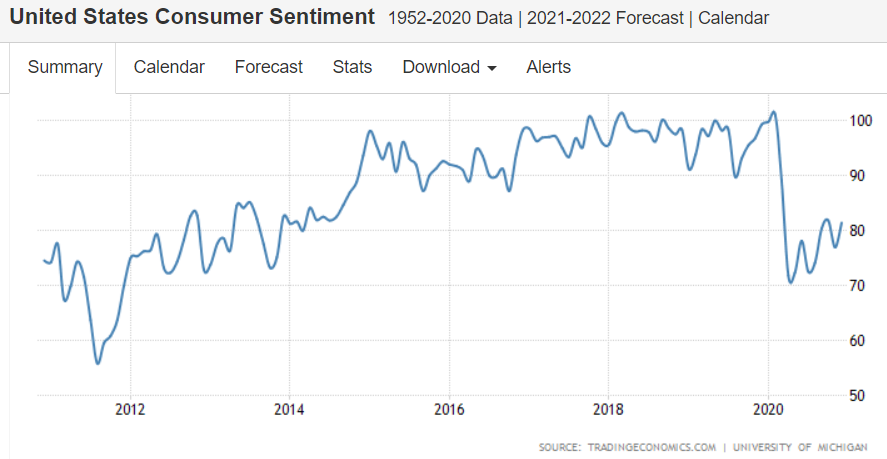

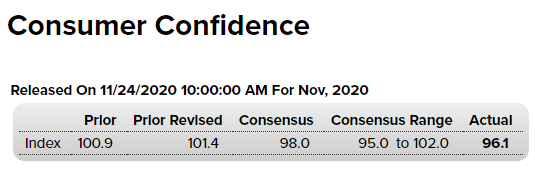

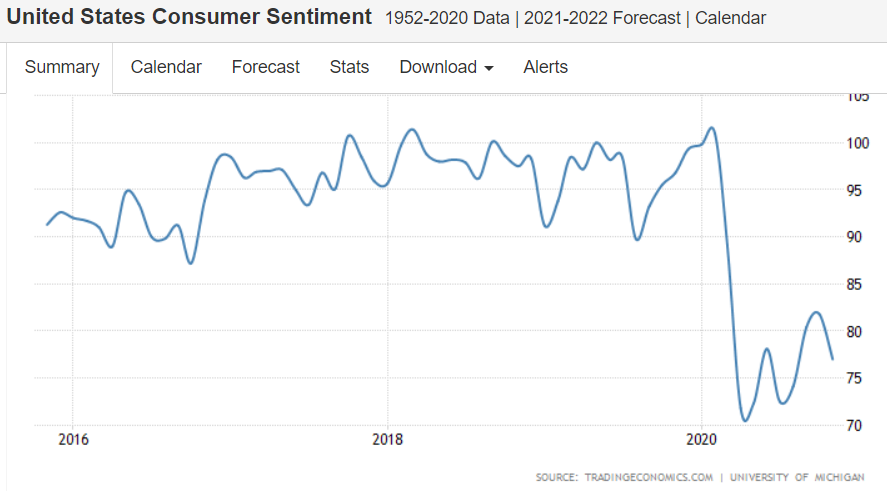

Still depressed:

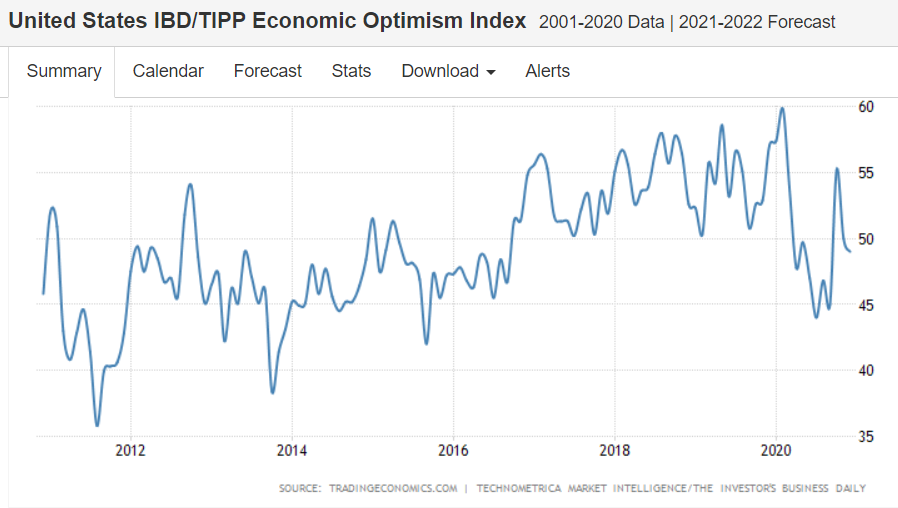

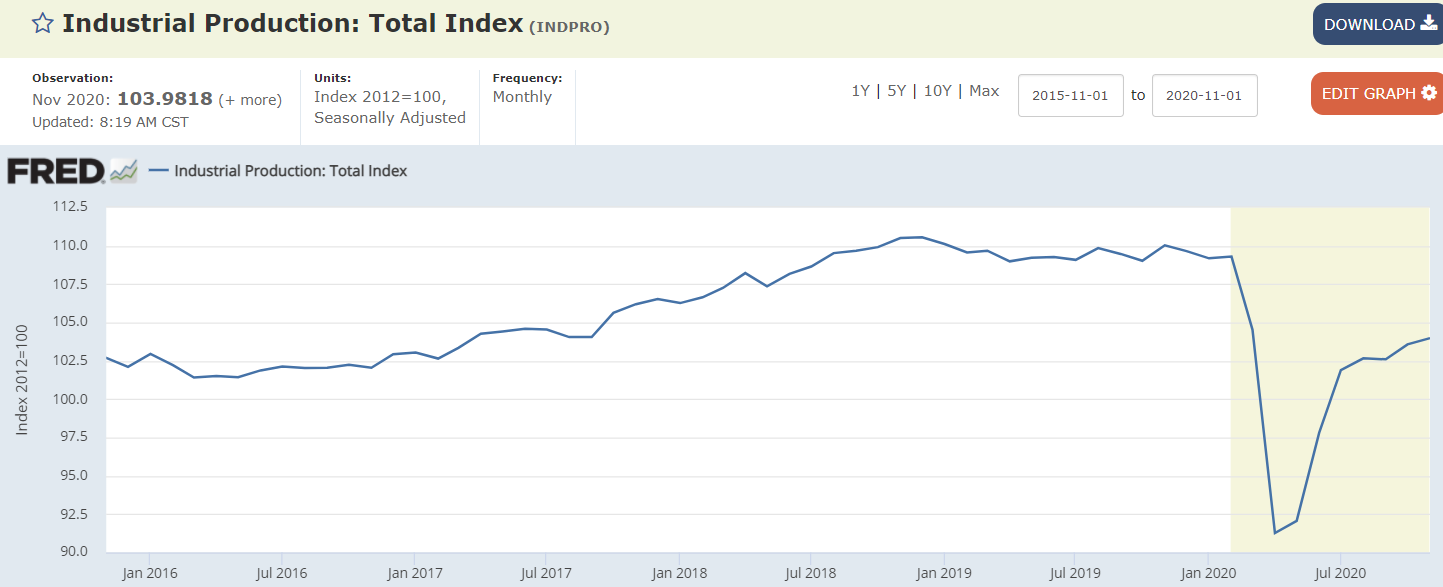

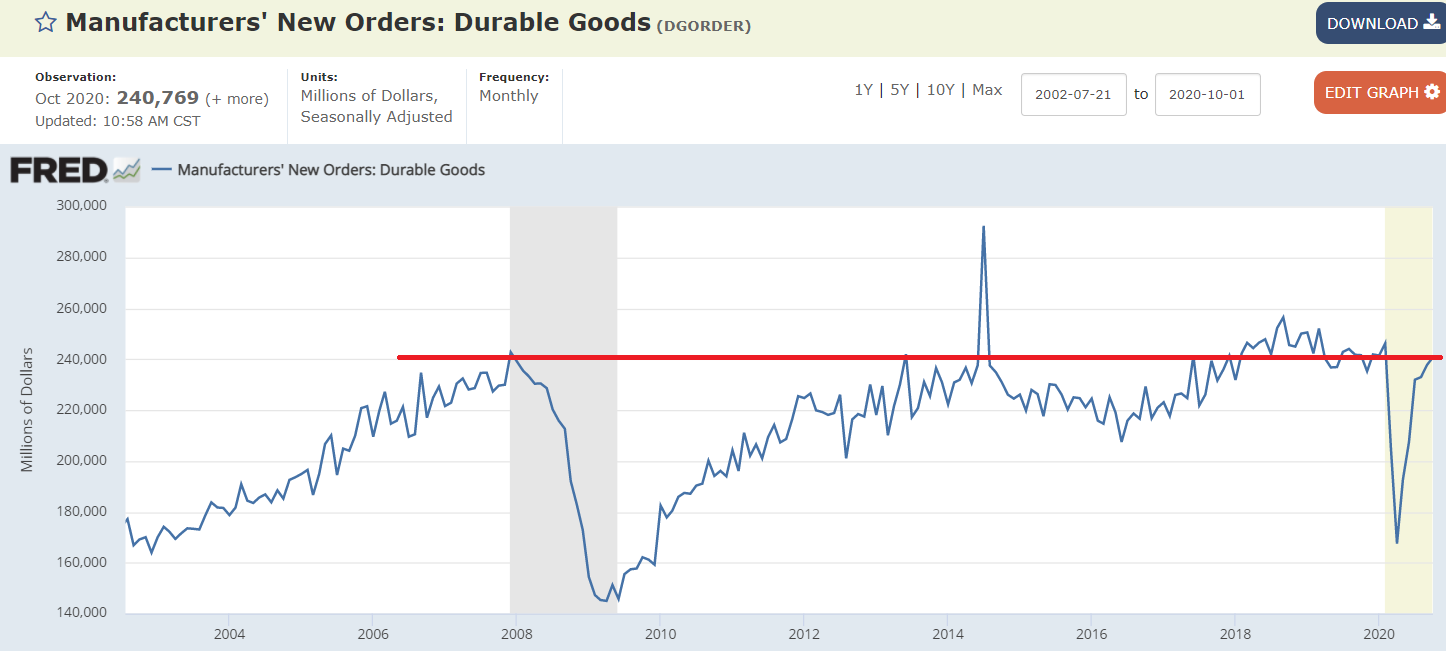

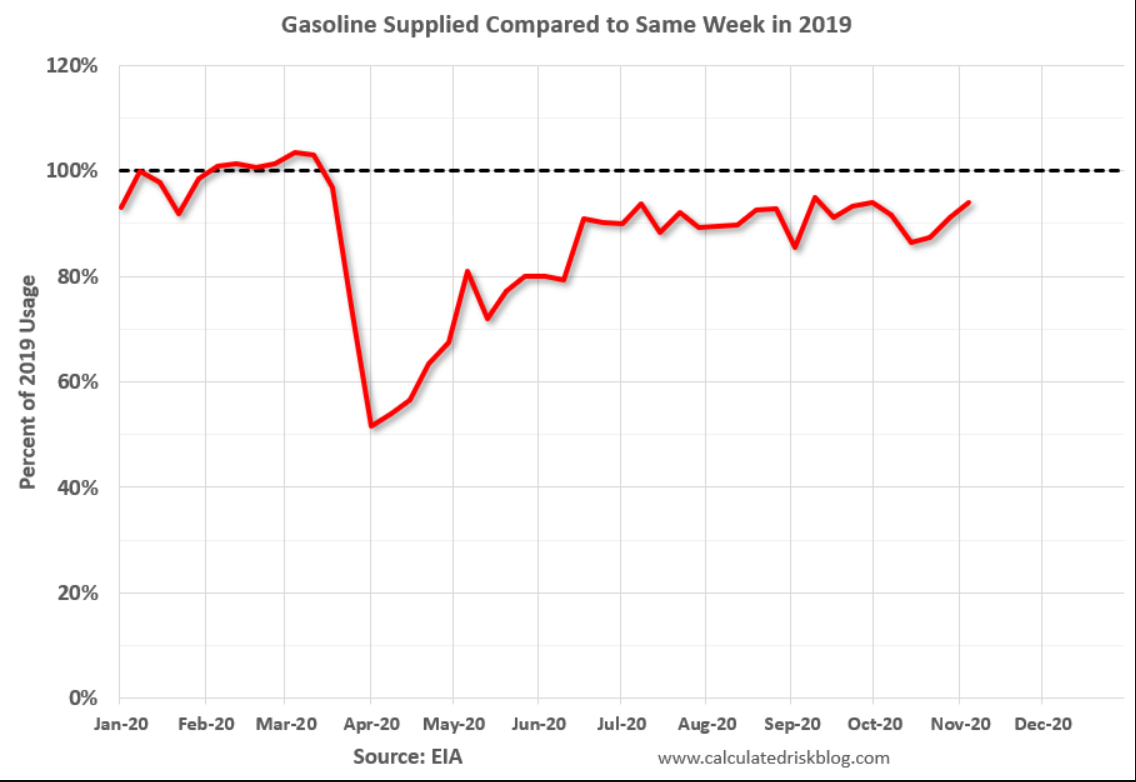

Tariffs turned this one south before covid did its thing:

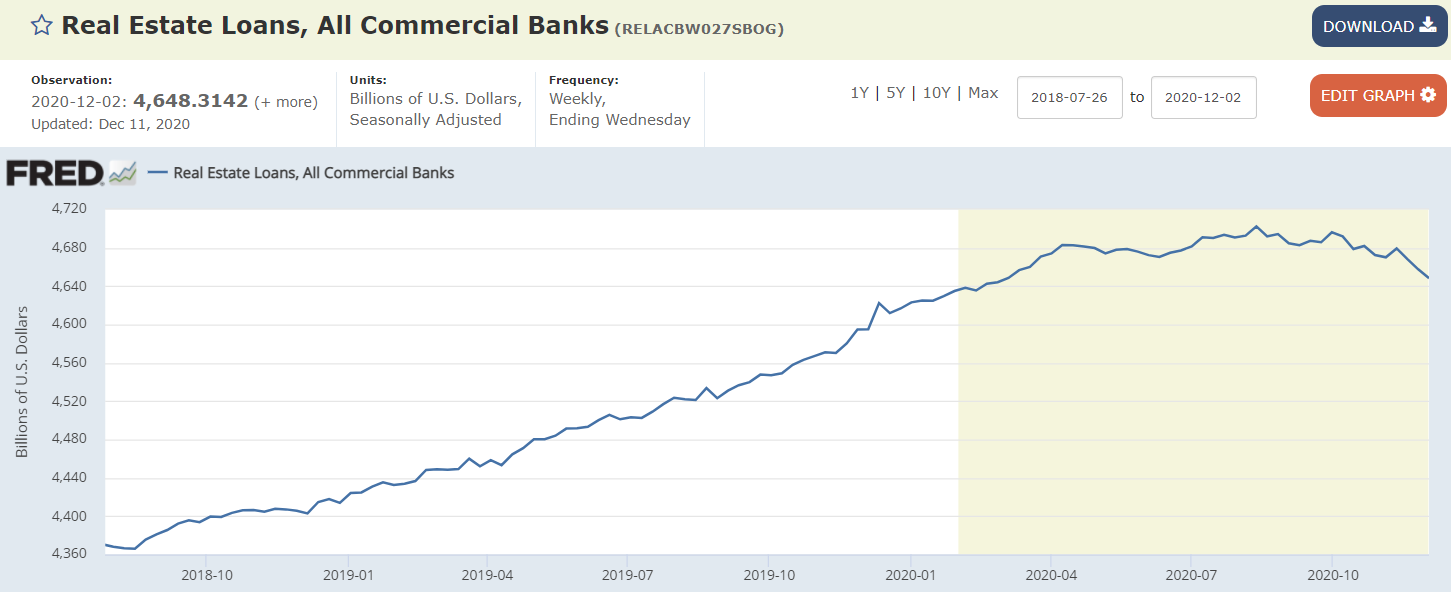

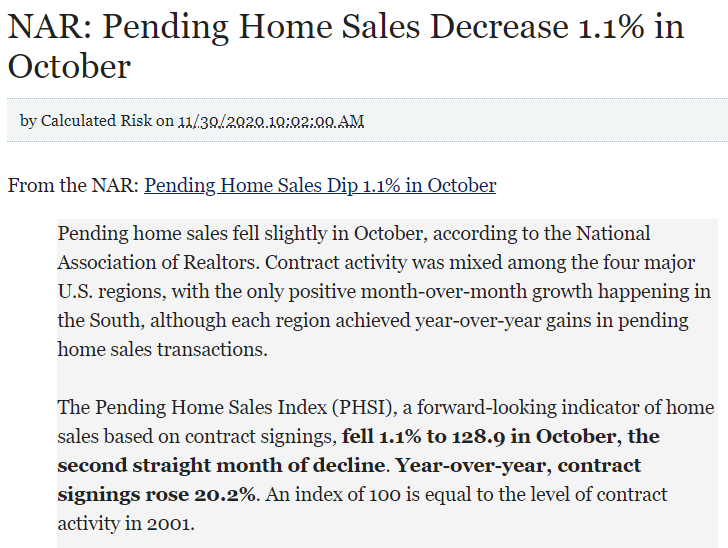

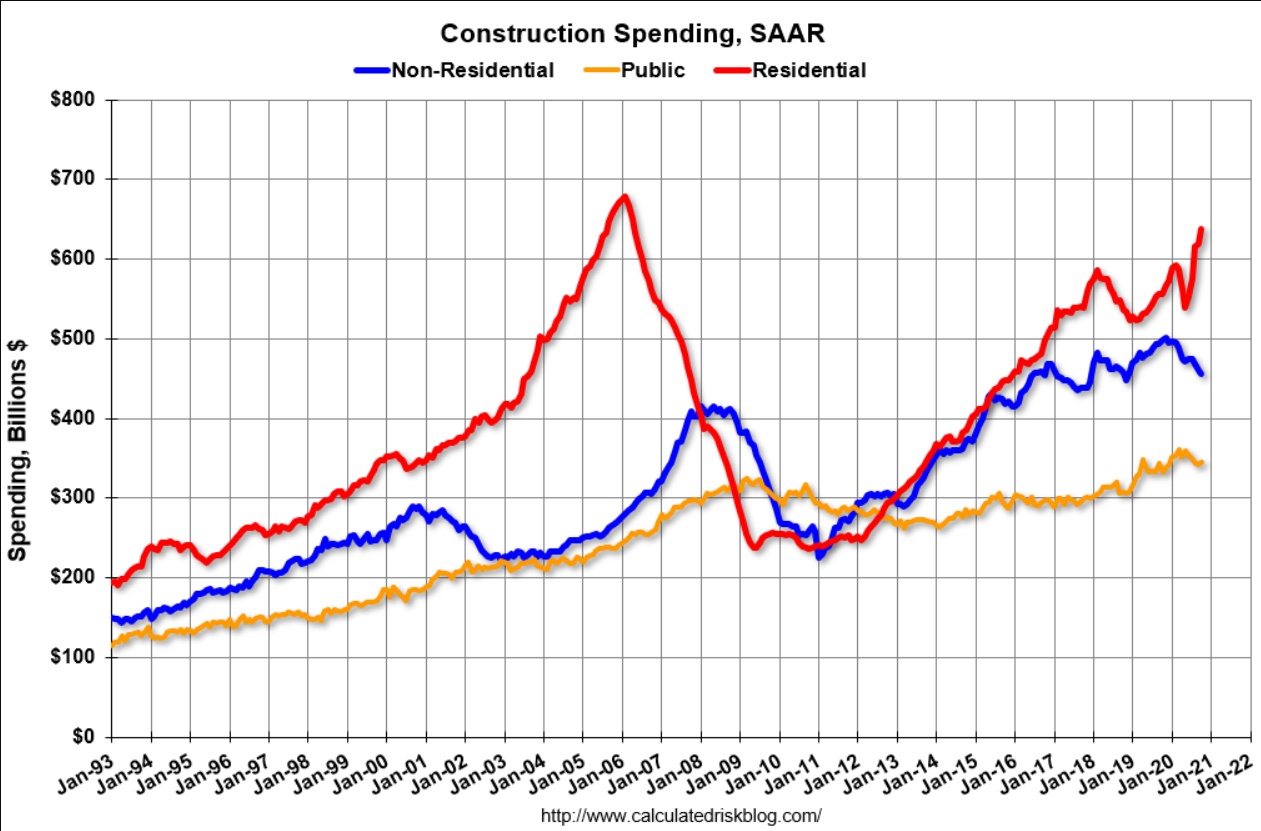

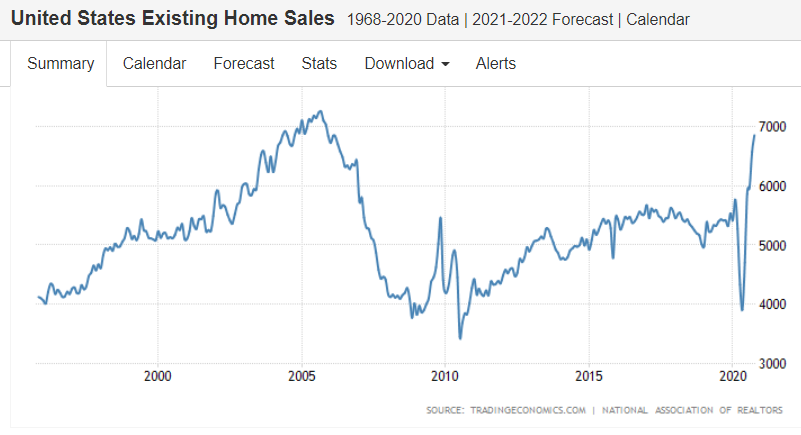

Some housing indicators may be looking up but not this one:

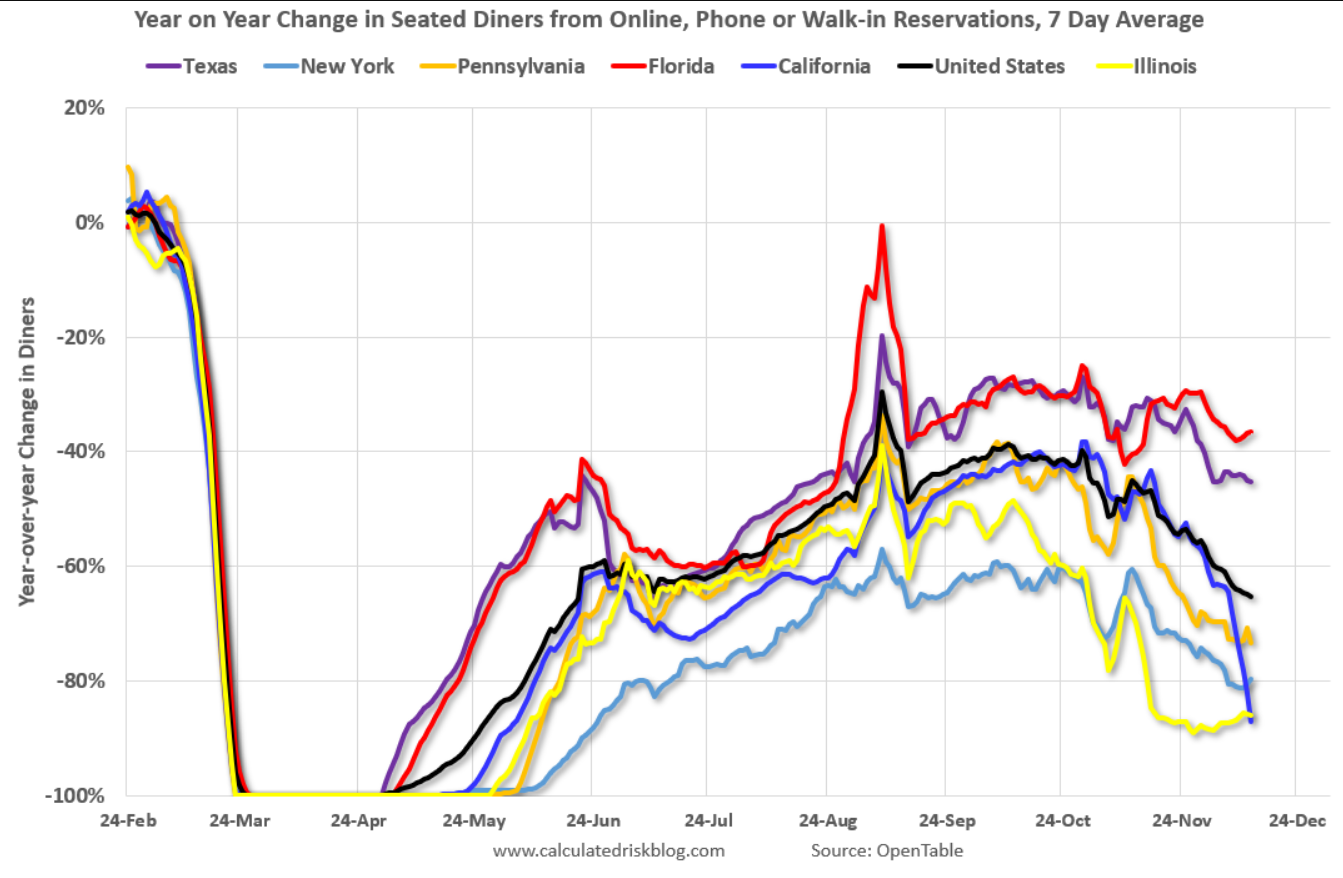

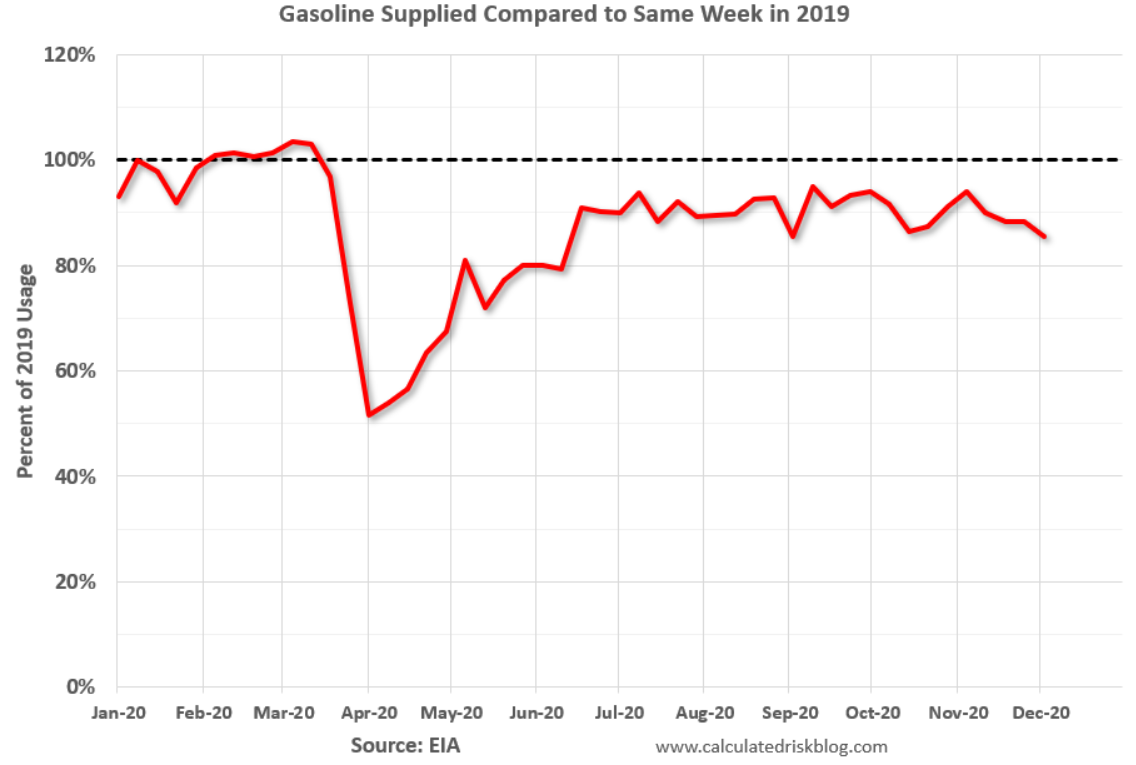

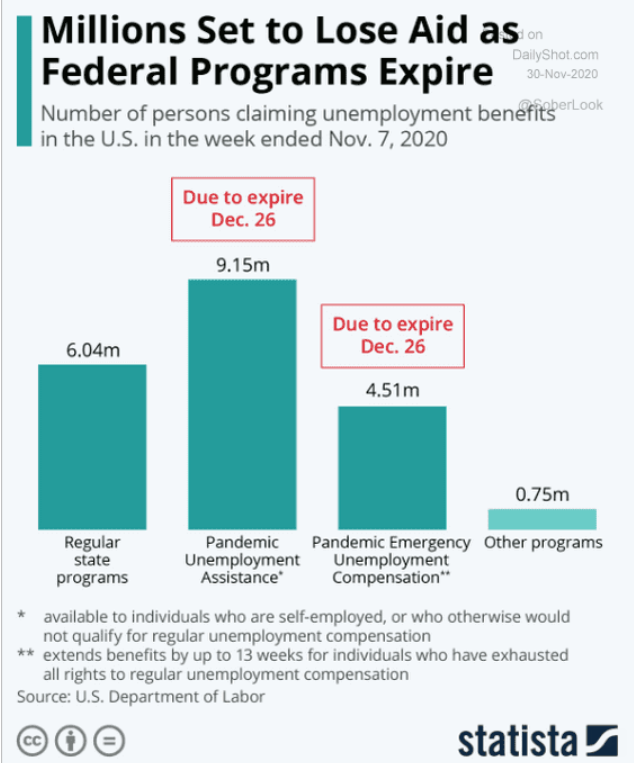

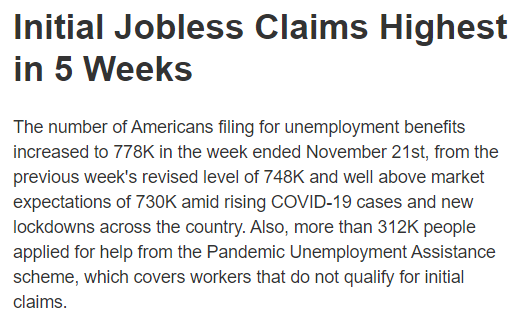

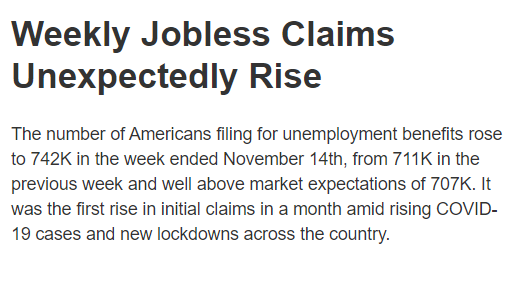

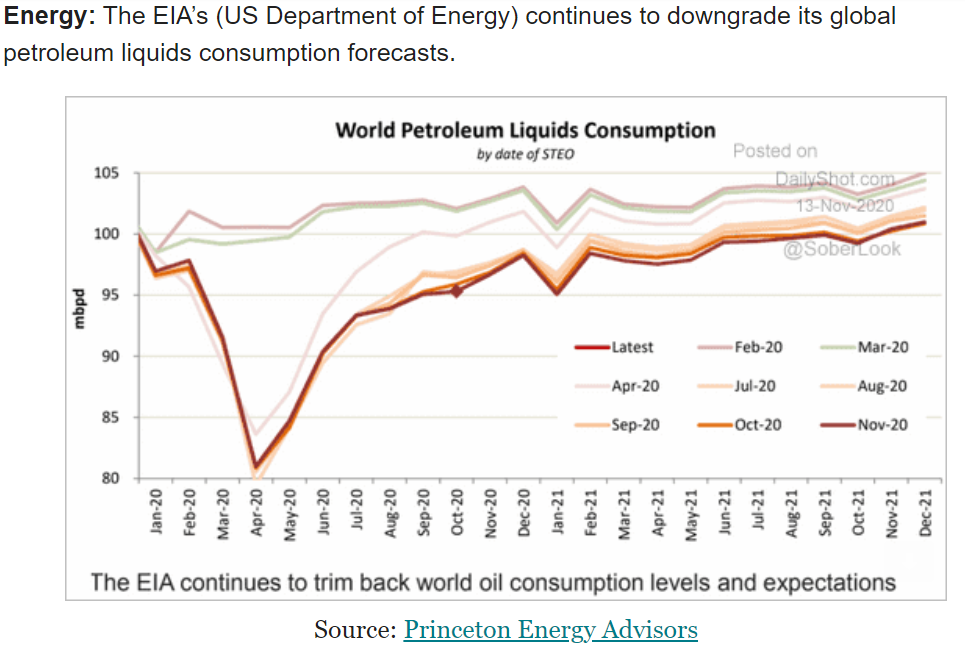

Other indicators sagging as well as the economy starts to go over the fiscal cliff as benefits expire:

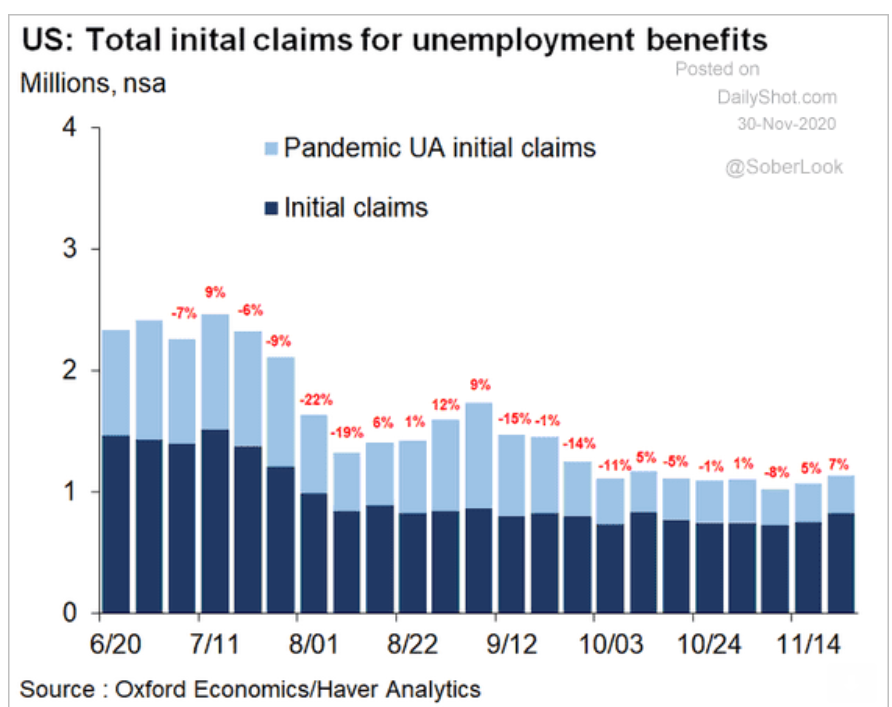

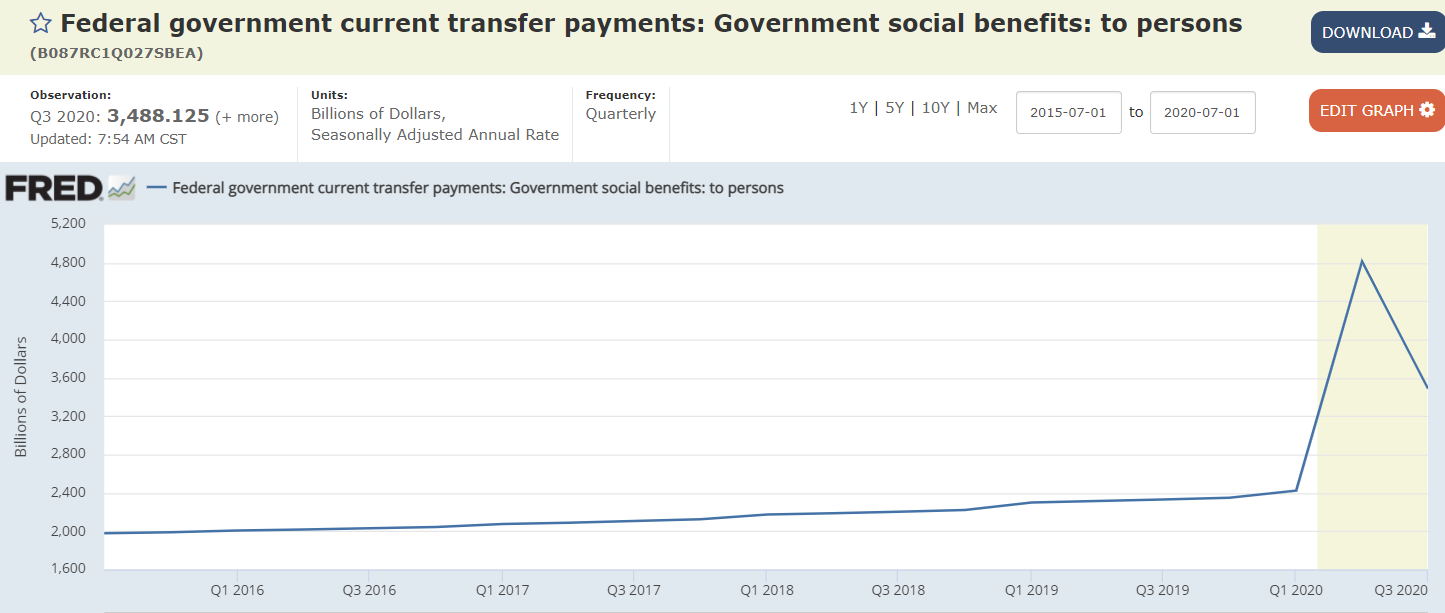

These continue at extraordinarily high levels:

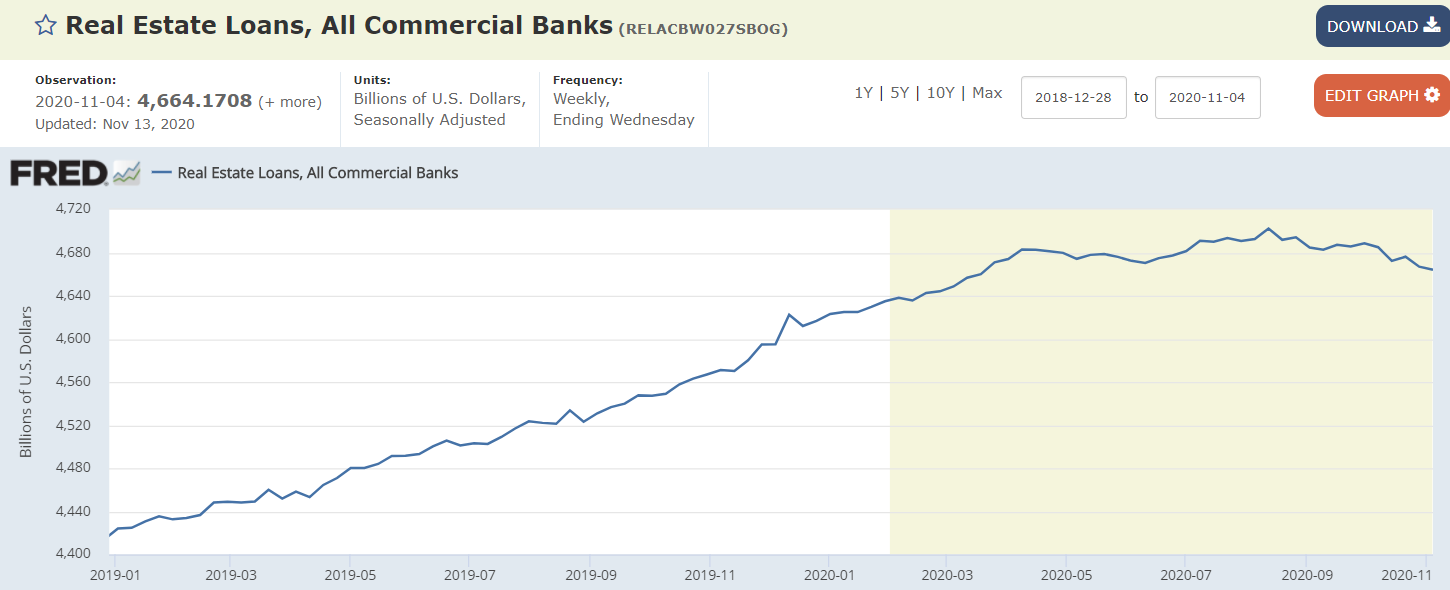

Still working its way lower, and never has had much of a recovery since the 2008 collapse. This chart isn’t inflation adjusted, so it’s that much worse than it looks:

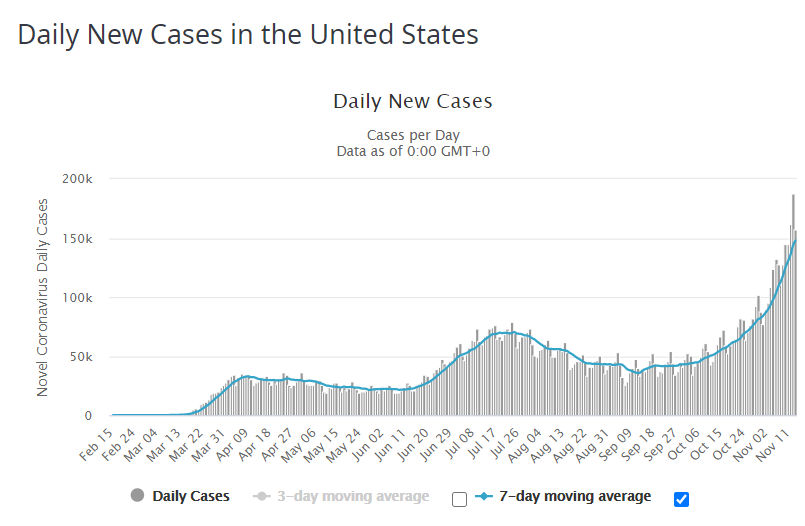

Still climbing. This is not good:

This is bad too:

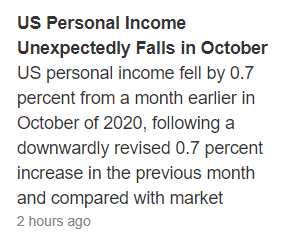

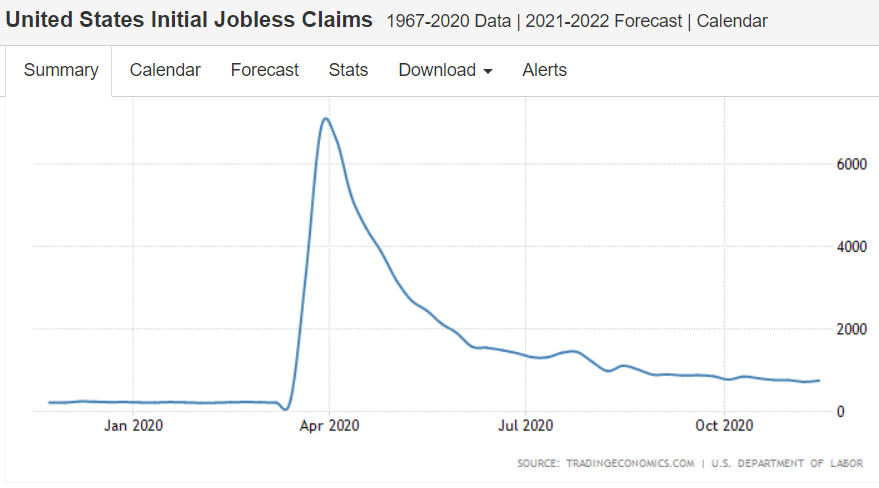

Working it’s way lower as benefits expire and employment growth sags:

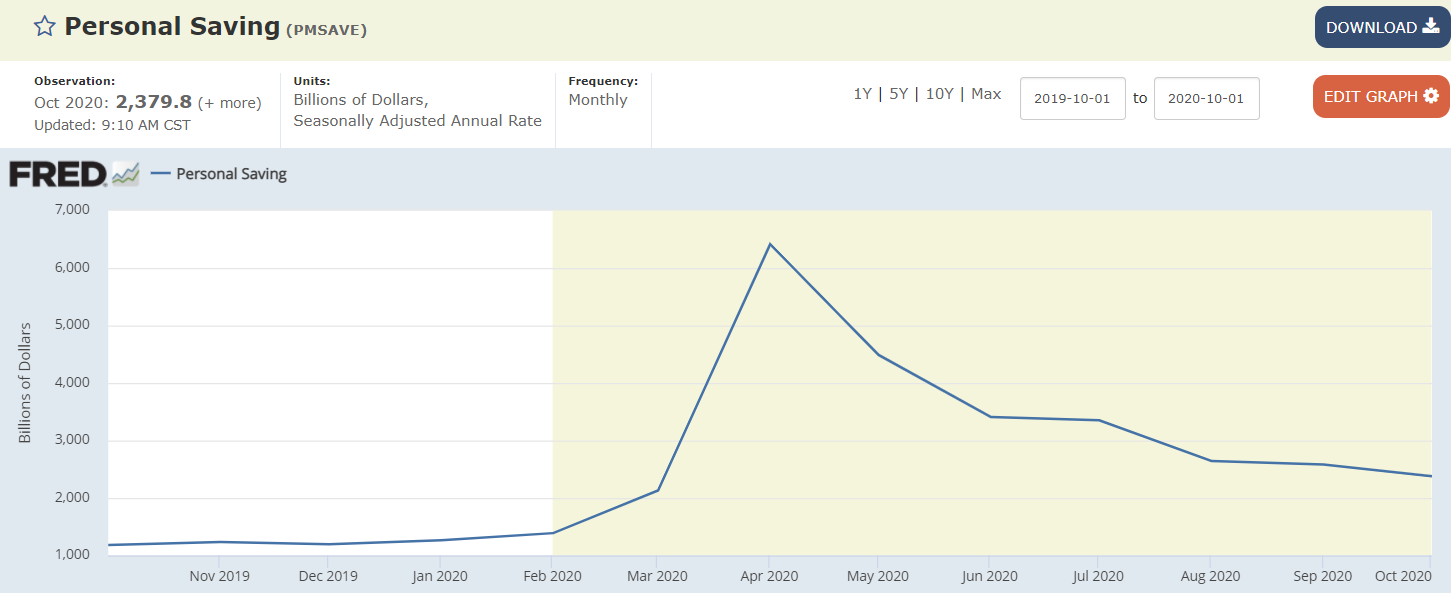

Savings added by fiscal adjustments are running down:

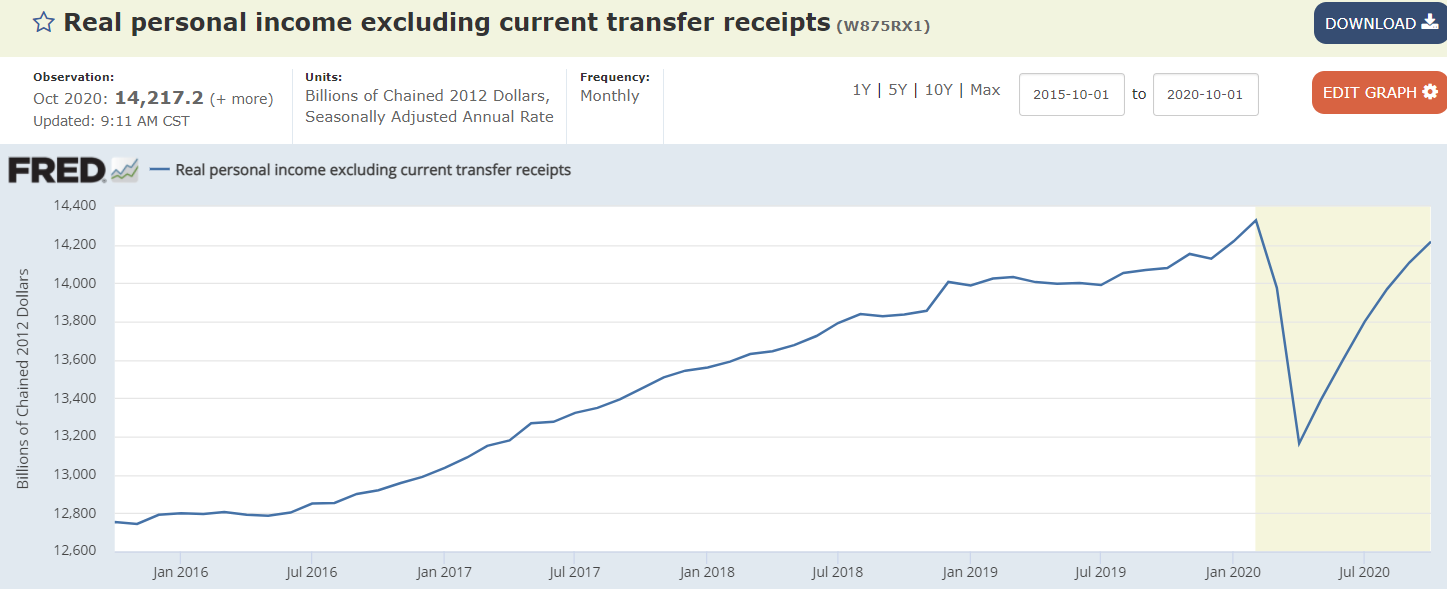

The economy has generated a lot less personal income than it would have generated without the covid crisis:

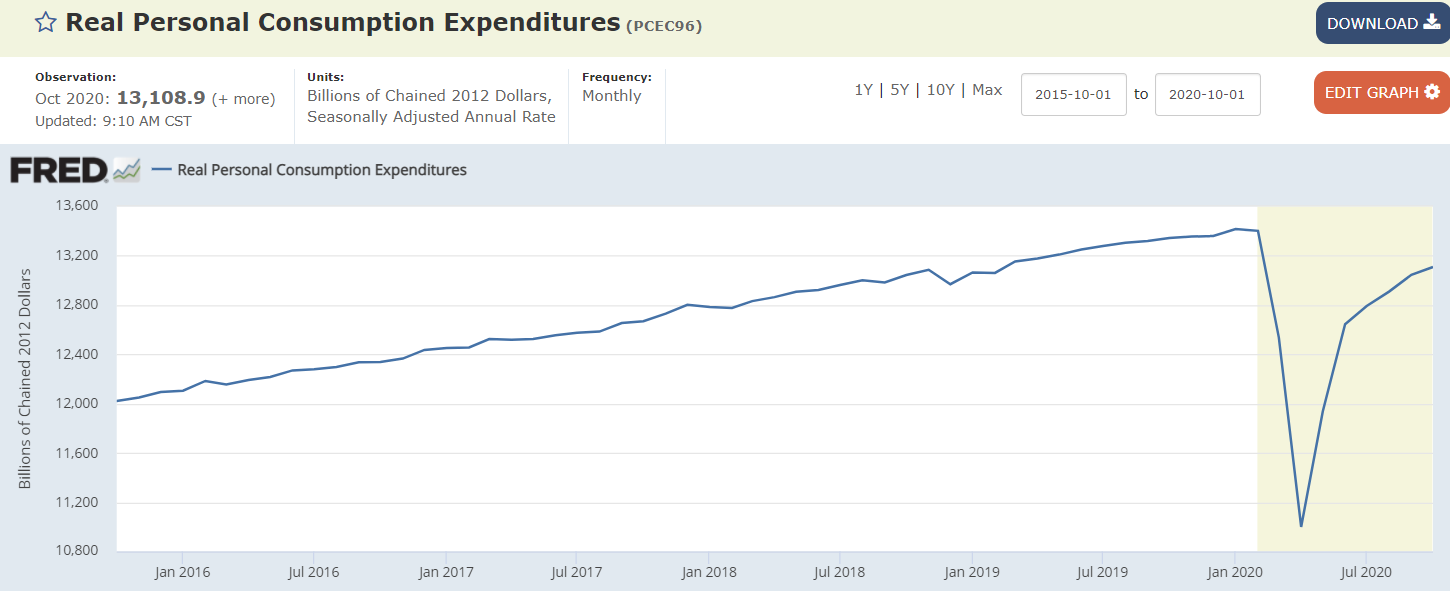

Same with consumption, which is about 70% of gdp:

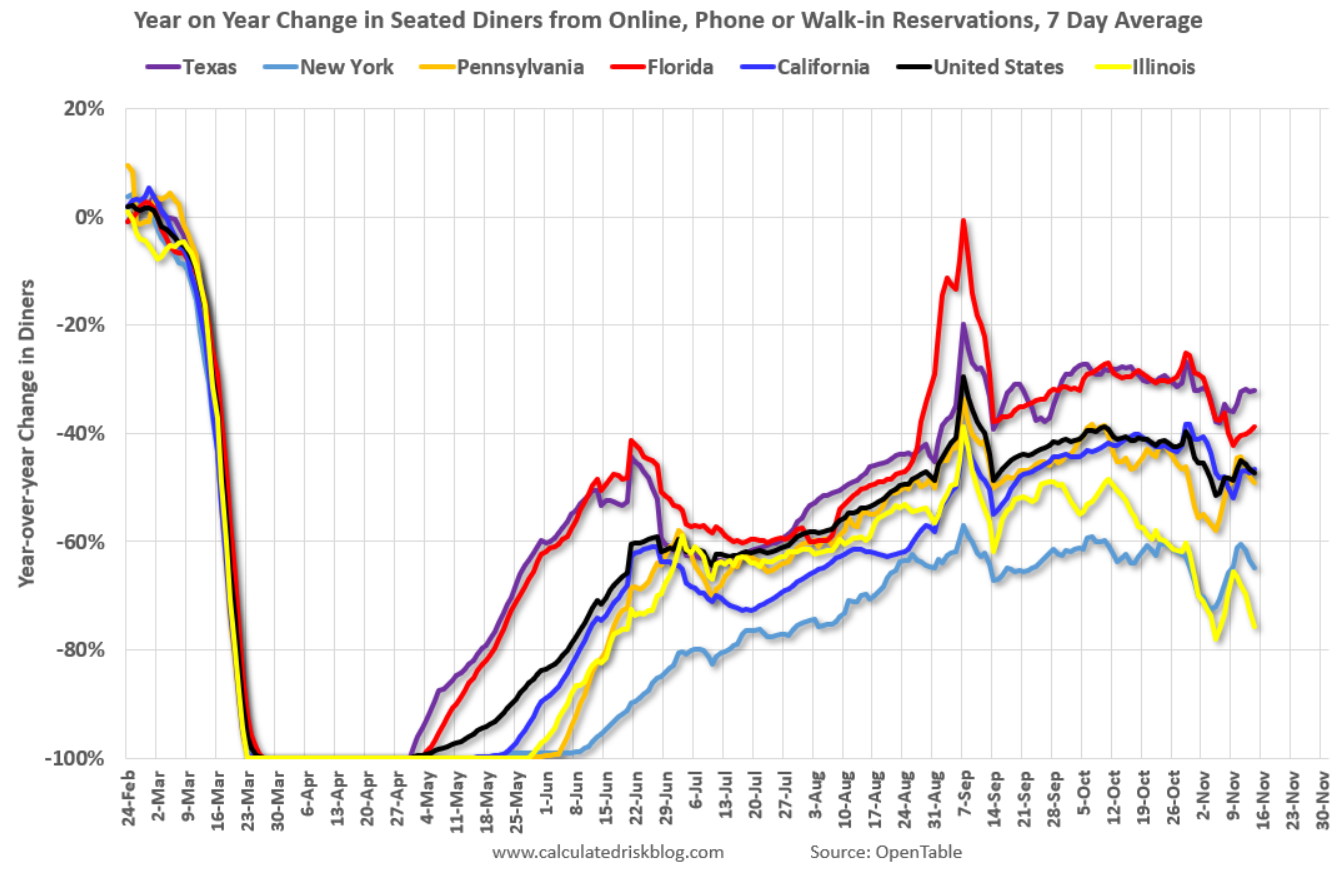

Fading:

Fading:

Still extremely high and now going higher:

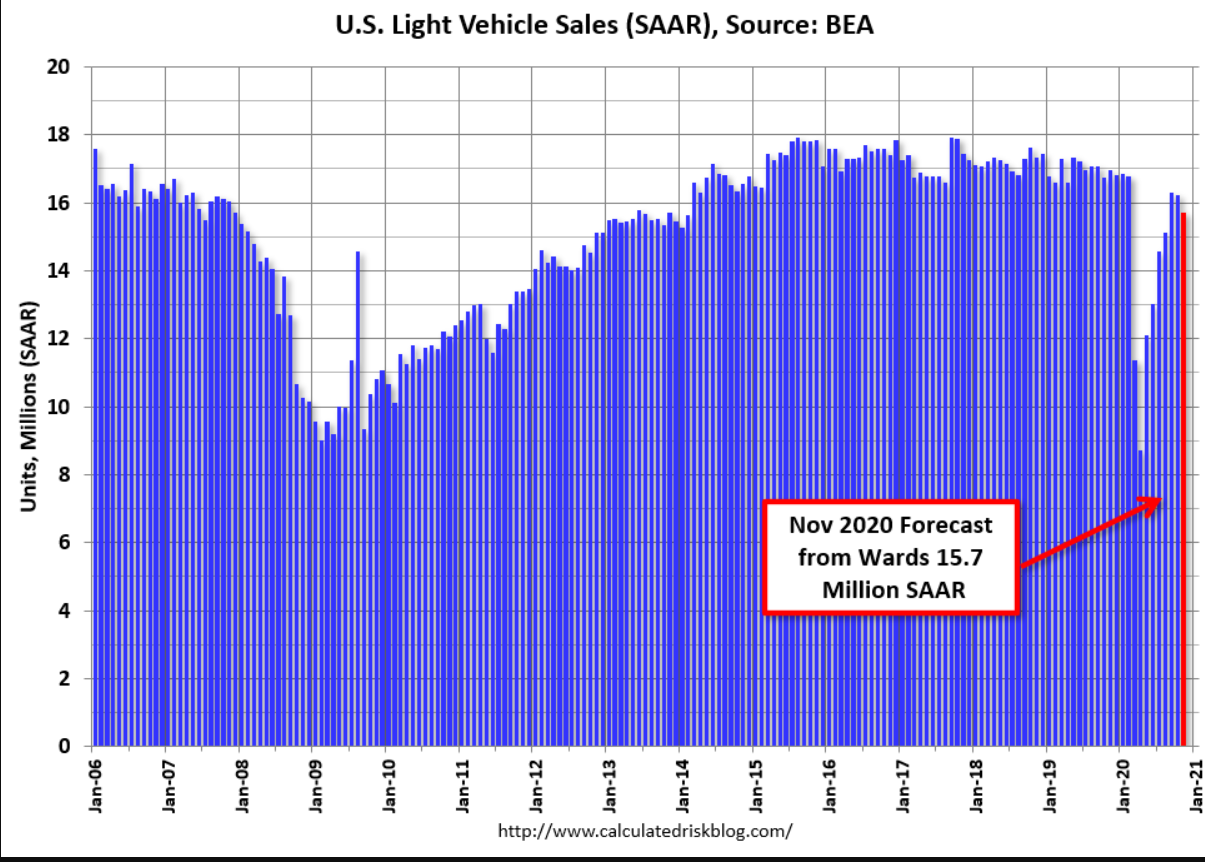

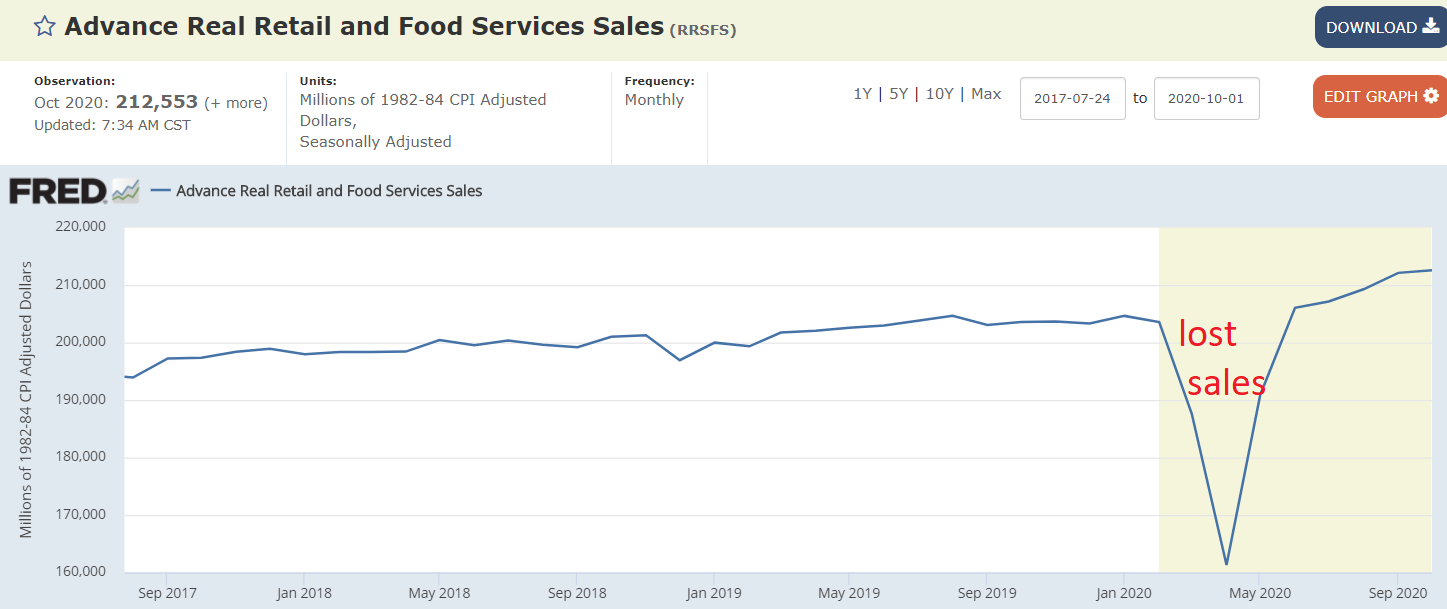

The large dip in sales was followed by a recovery, so the total sales over that time are about on track:

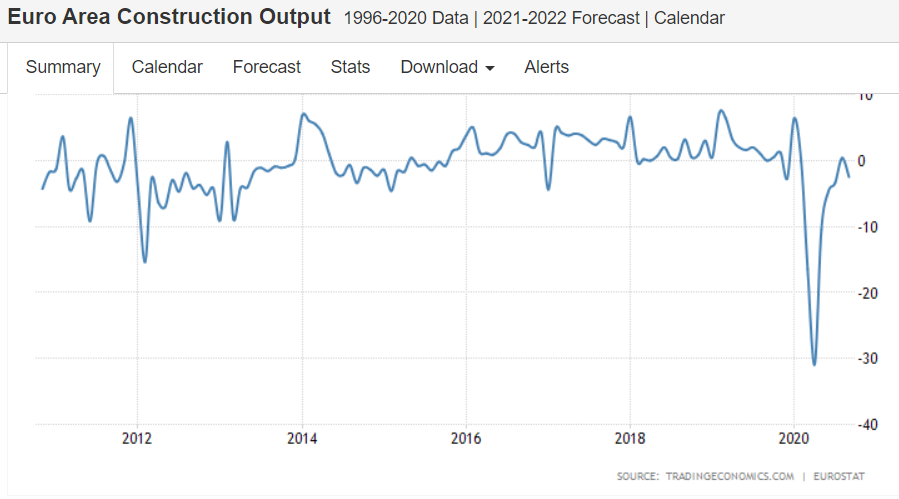

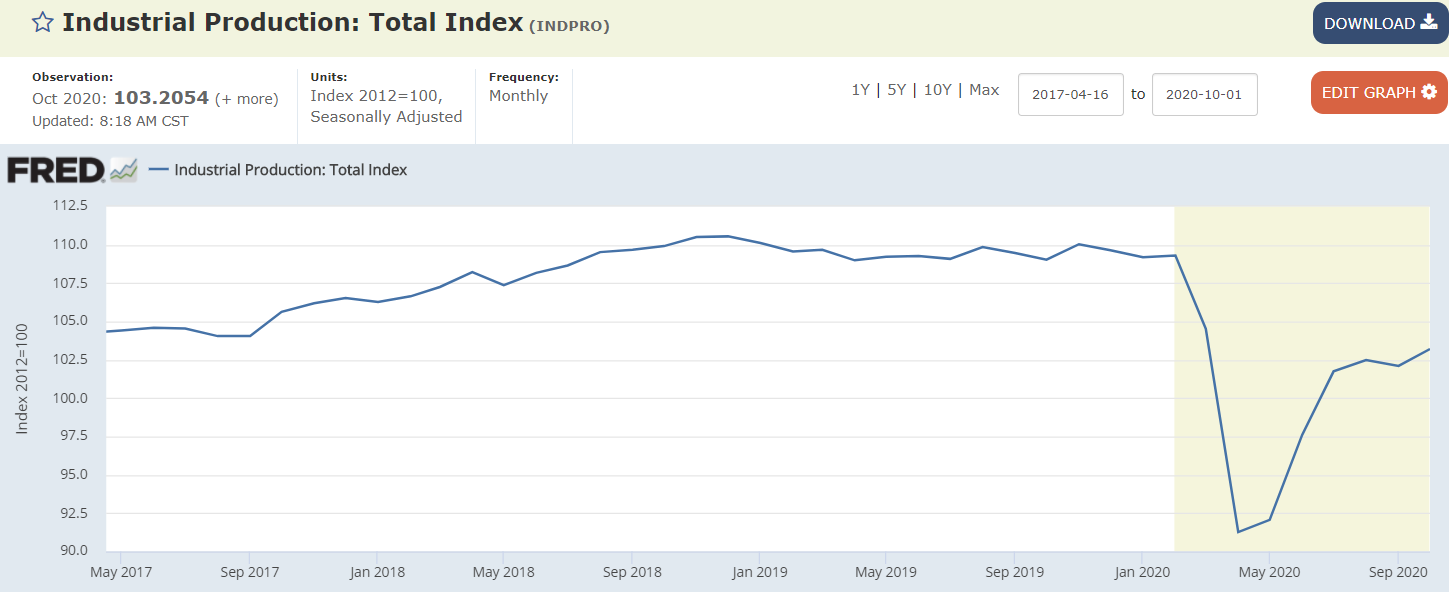

Back into contraction:

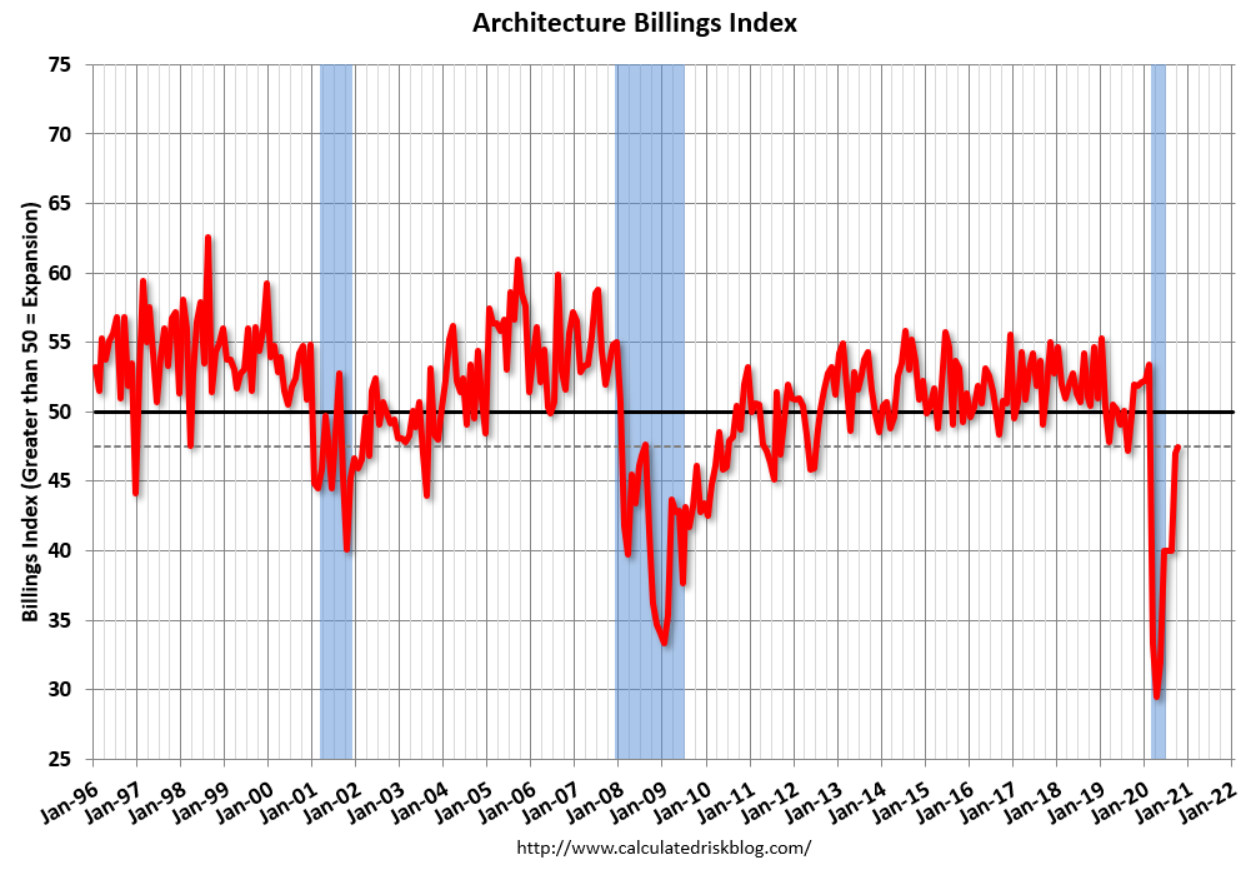

Still in contraction:

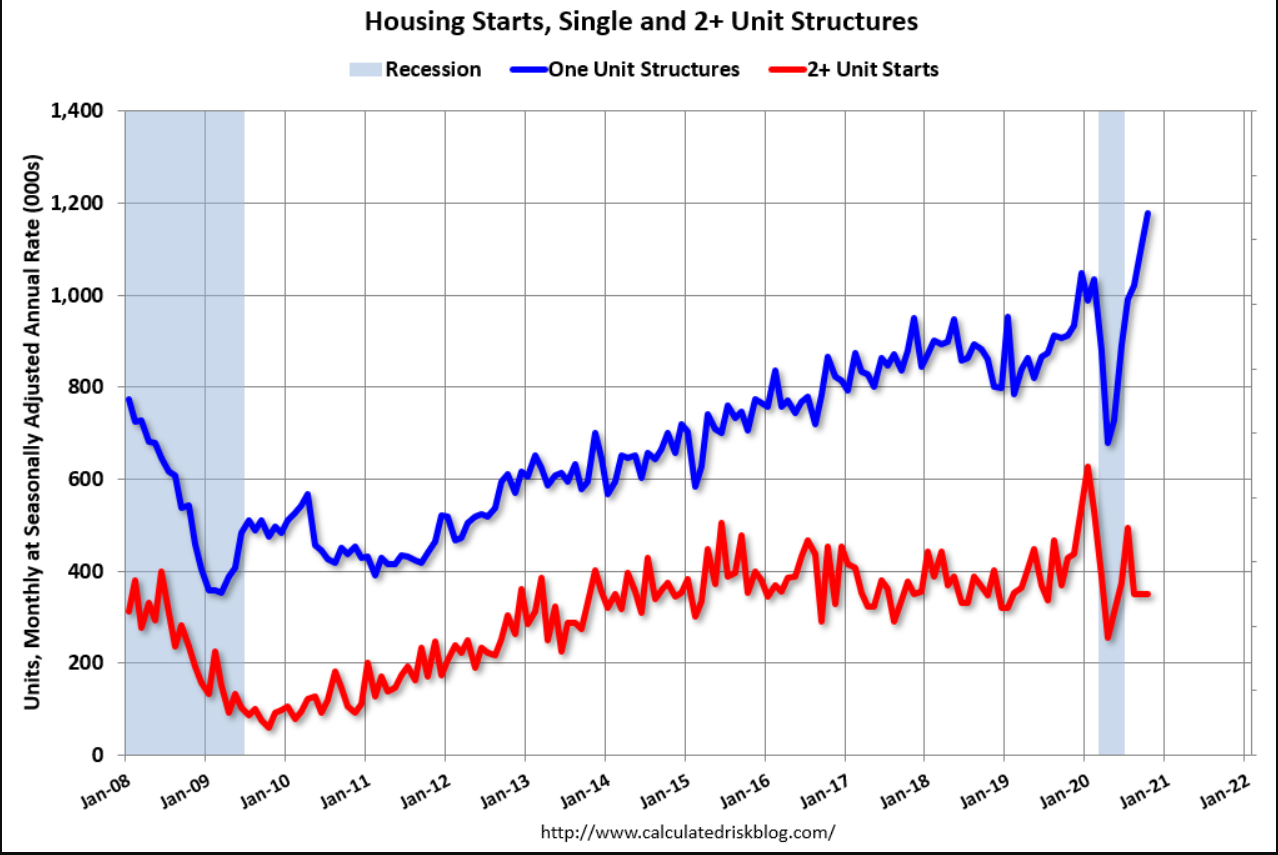

One unit starts are up but not enough to make up for the dip yet:

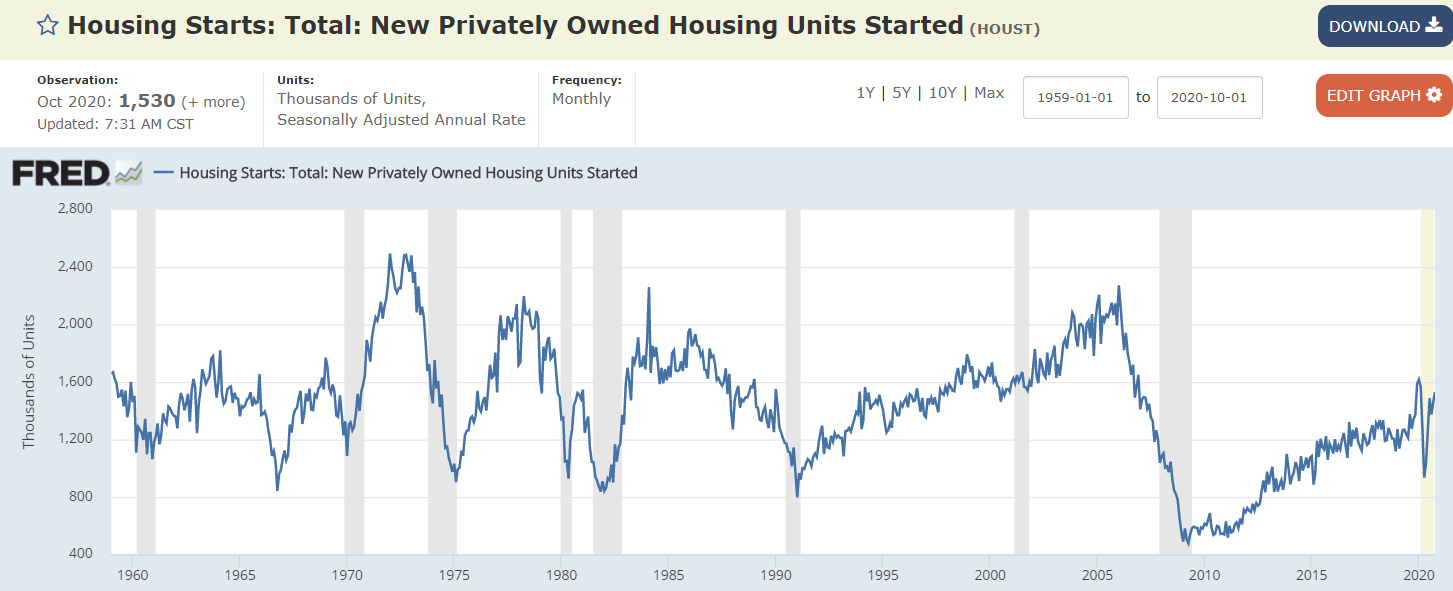

And housing remains historically depressed, and more so when factoring in population growth:

And lending growth has turned negative:

The lost sales are water under the bridge as

current sales growth has declined and leveled off

as federal support for lost personal income fades:

Same pattern here- big dip, but only a partial recovery before leveling off:

An already weak economy seems to be turning south:

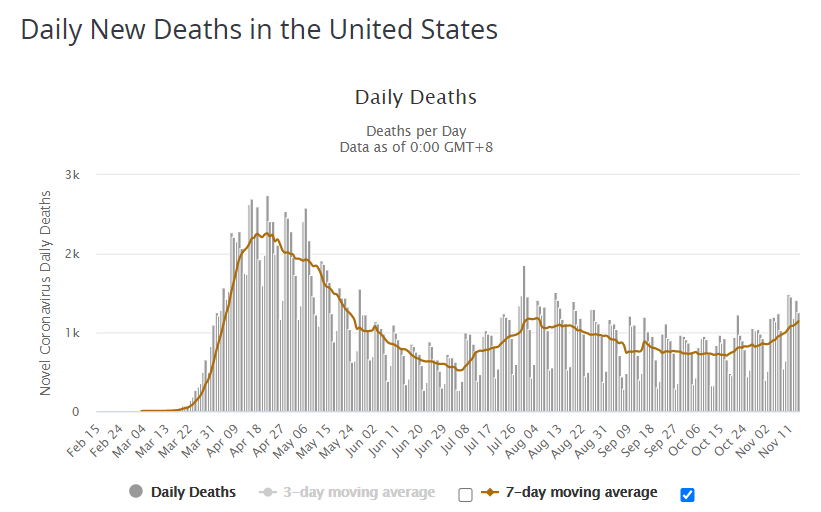

Deaths lag new cases by several weeks= they are going a lot higher: