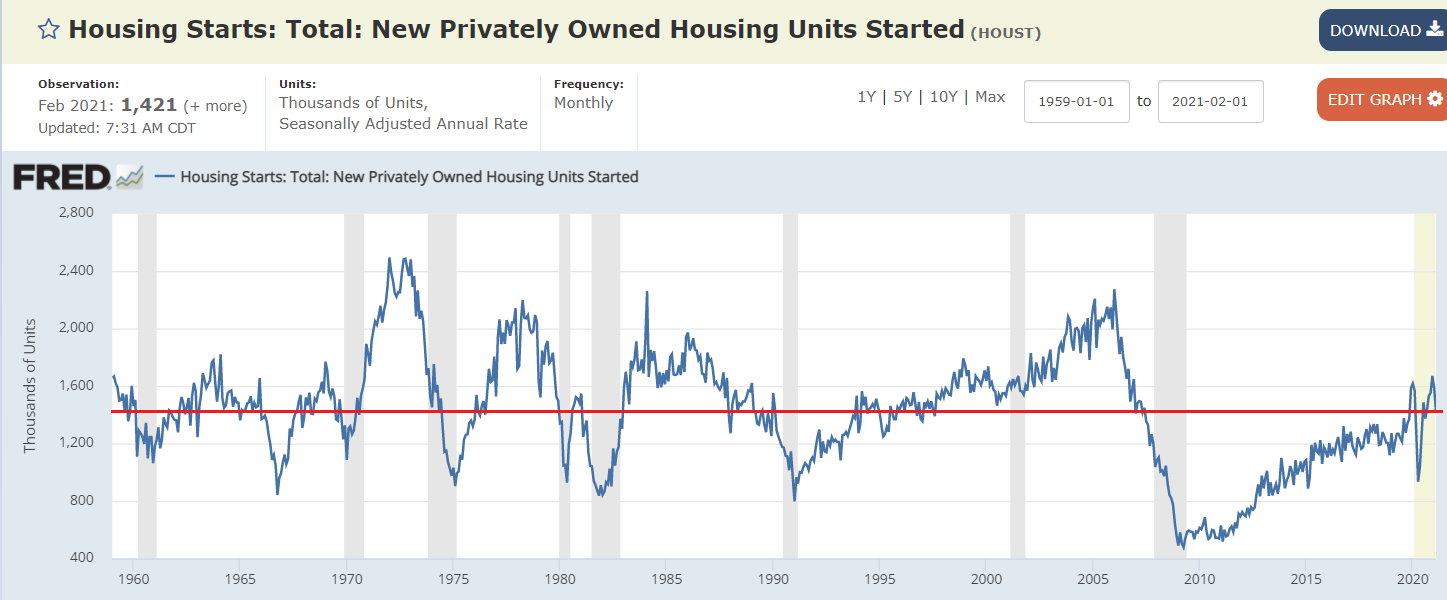

A setback to levels of the 1950’s when there were half as many people:

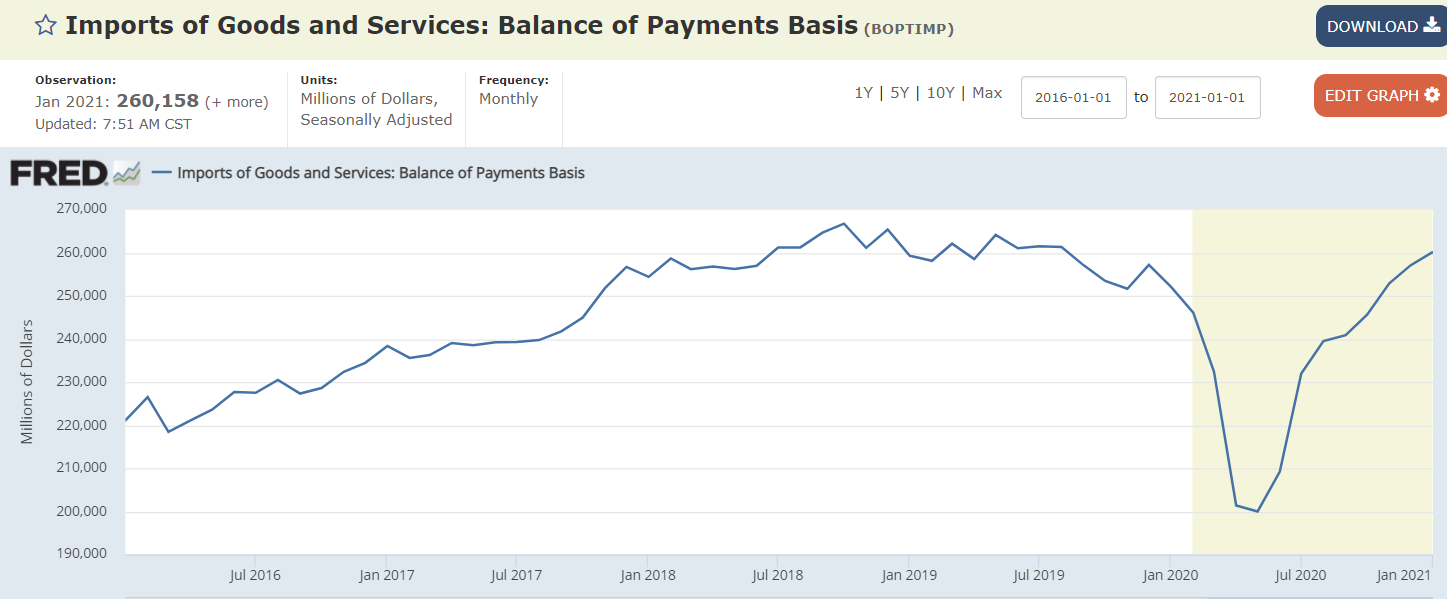

Imports up, exports down:

A setback to levels of the 1950’s when there were half as many people:

Imports up, exports down:

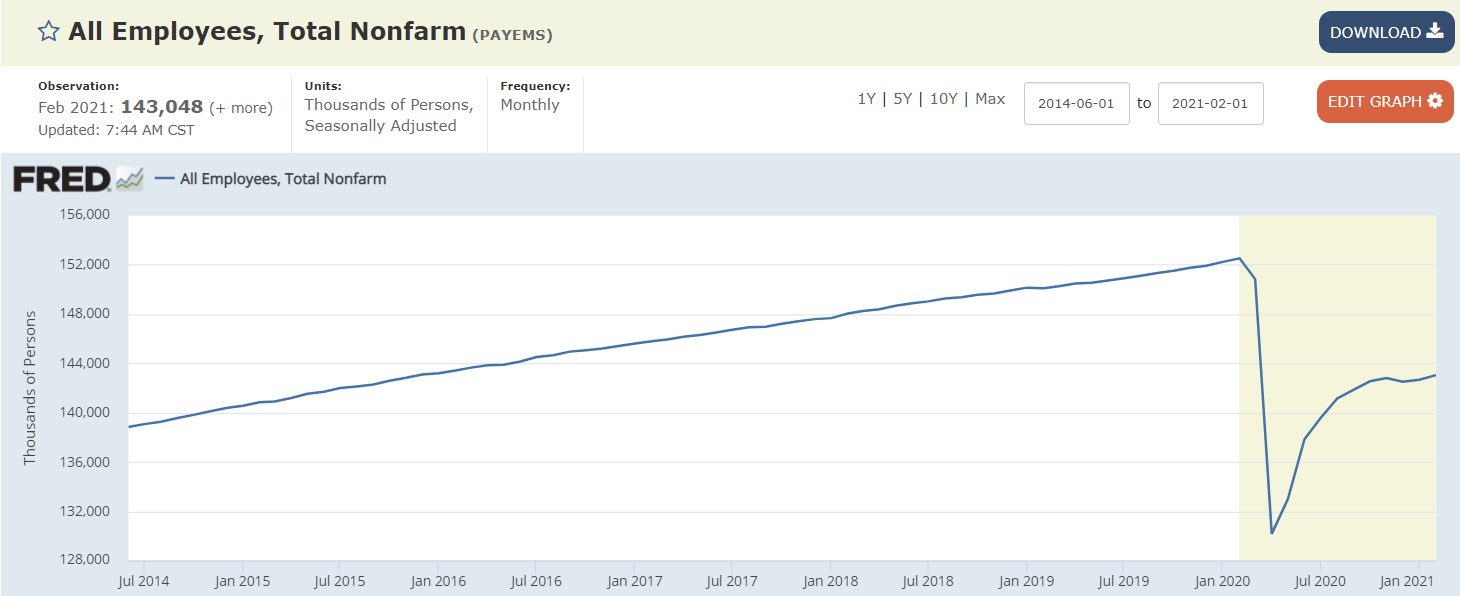

Employment increased more than expected last month but still looking anemic overall:

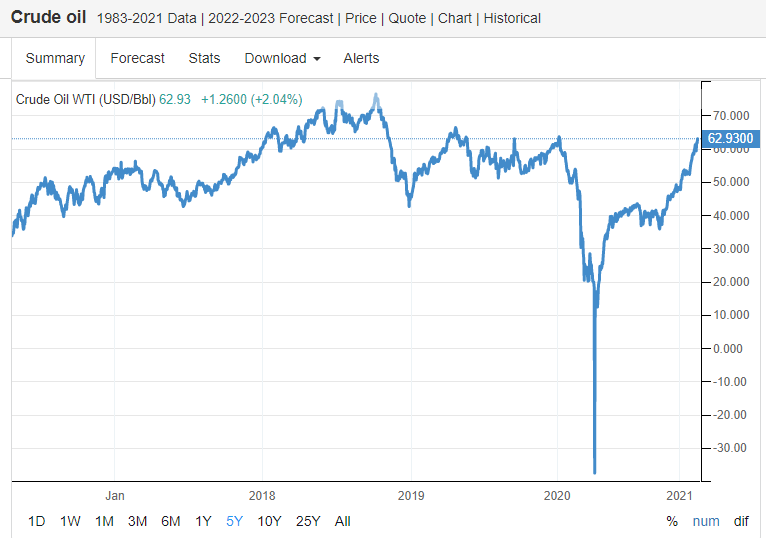

Returning to normal, good for the global economy:

Back to 2018 levels with lots lost during the dip:

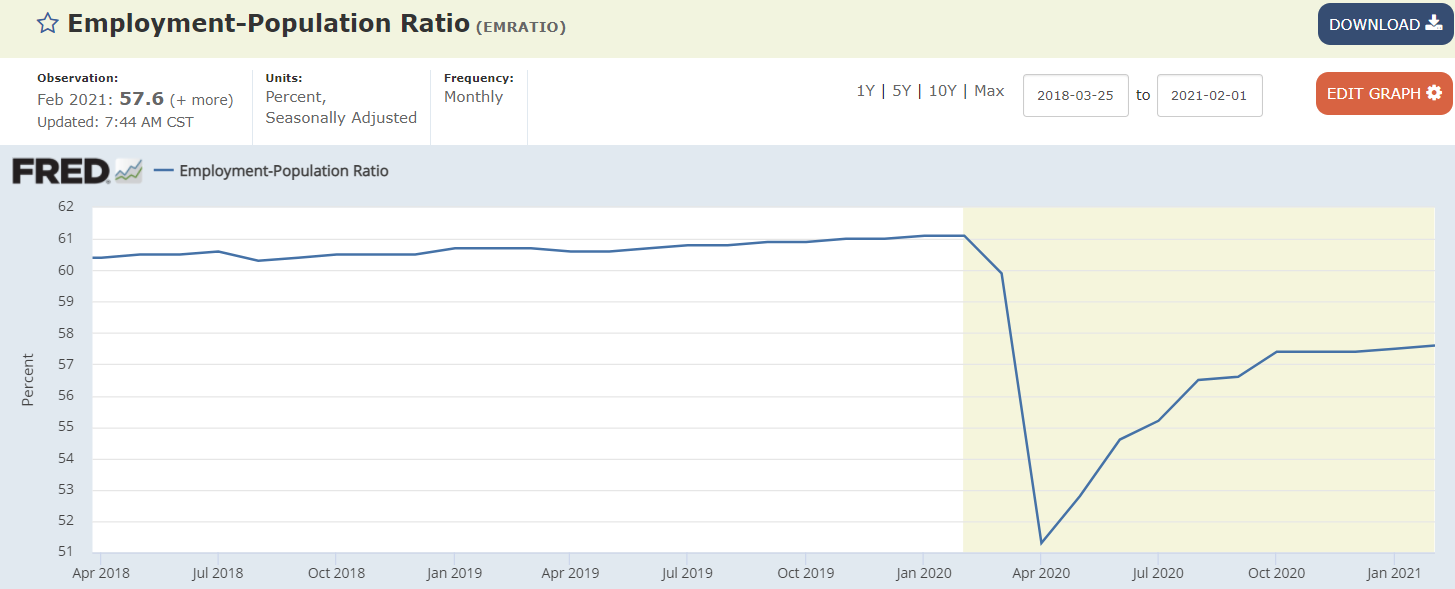

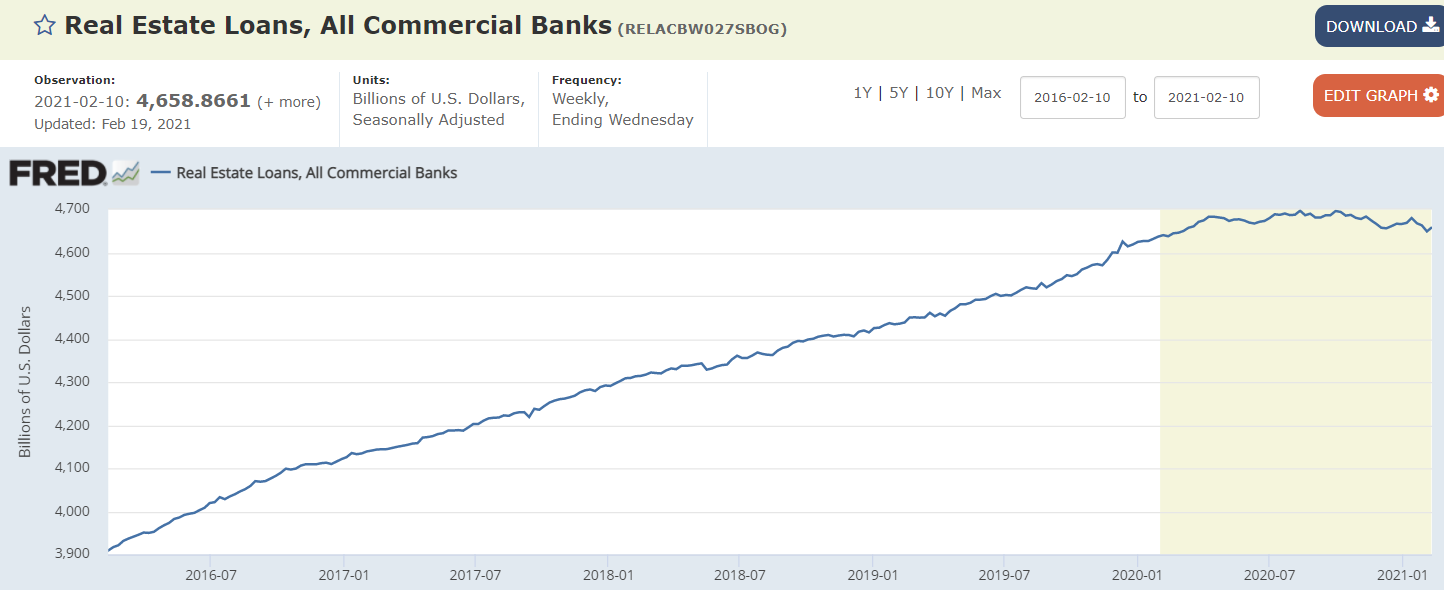

Still drifting lower:

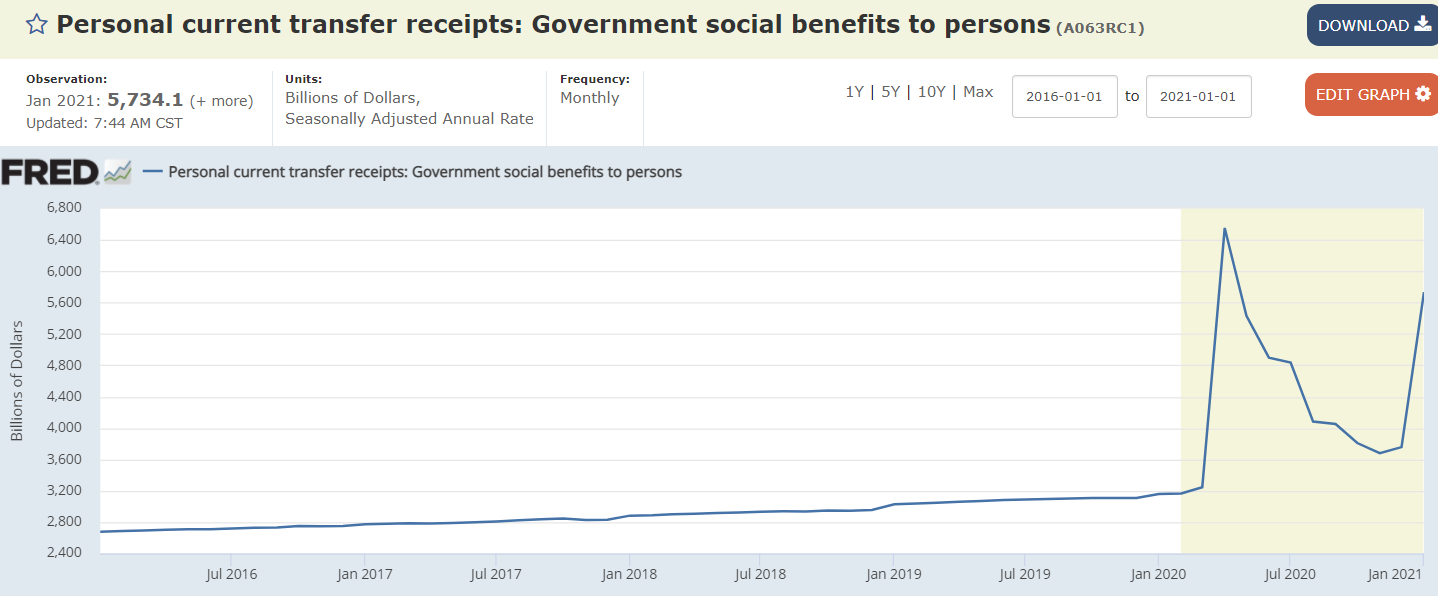

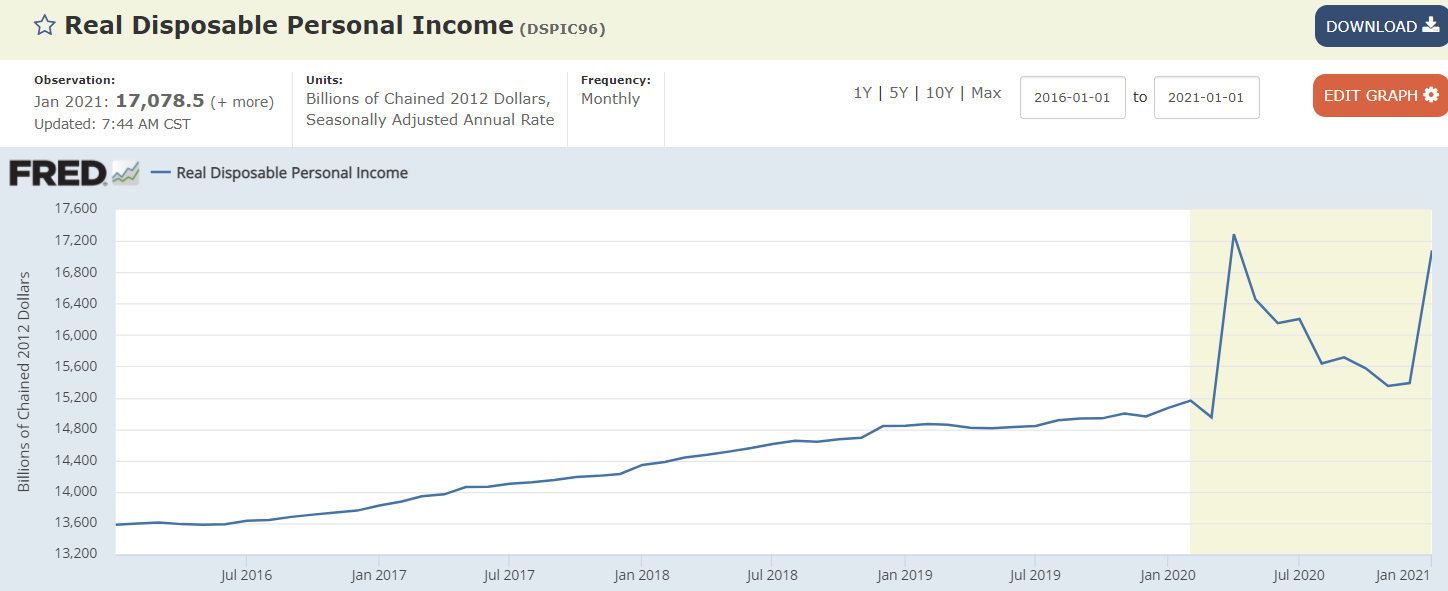

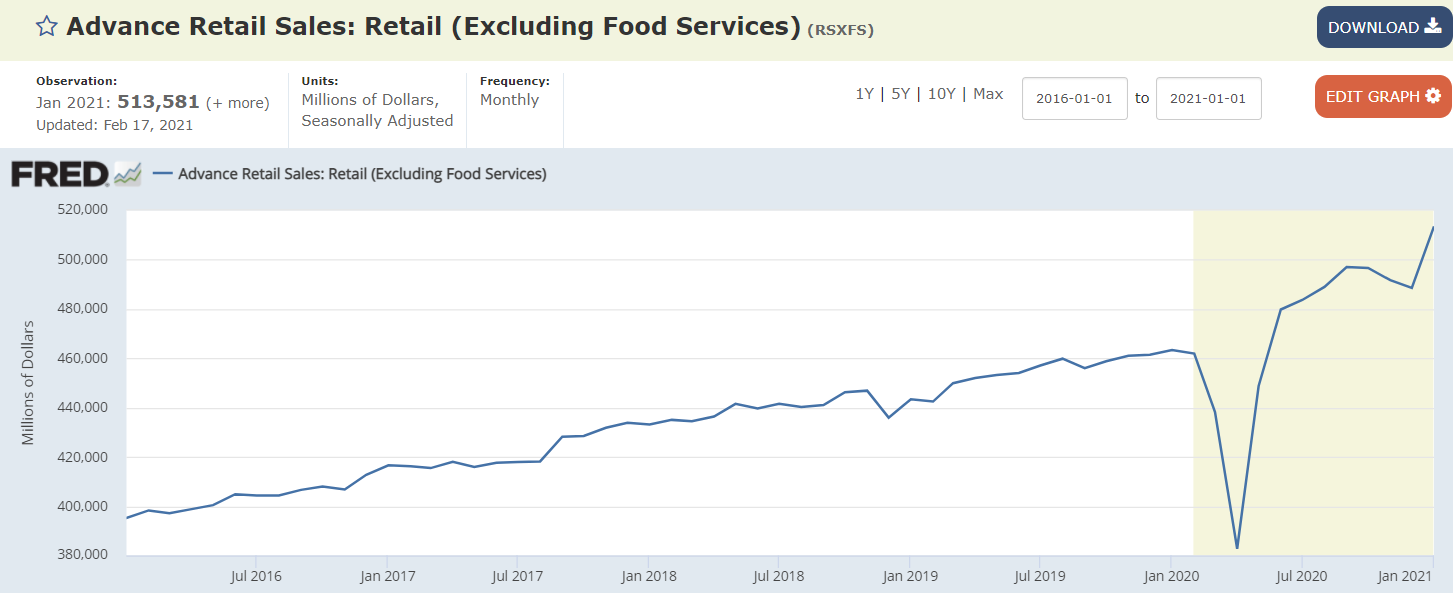

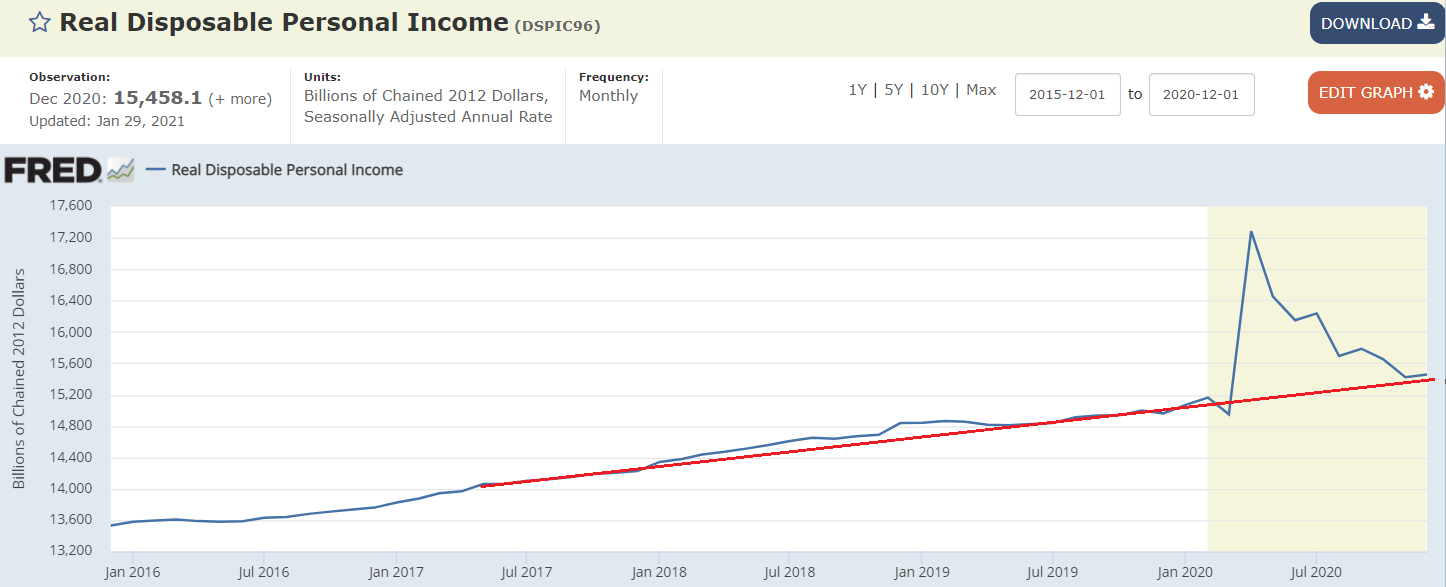

Another round of Federal checks hit last month:

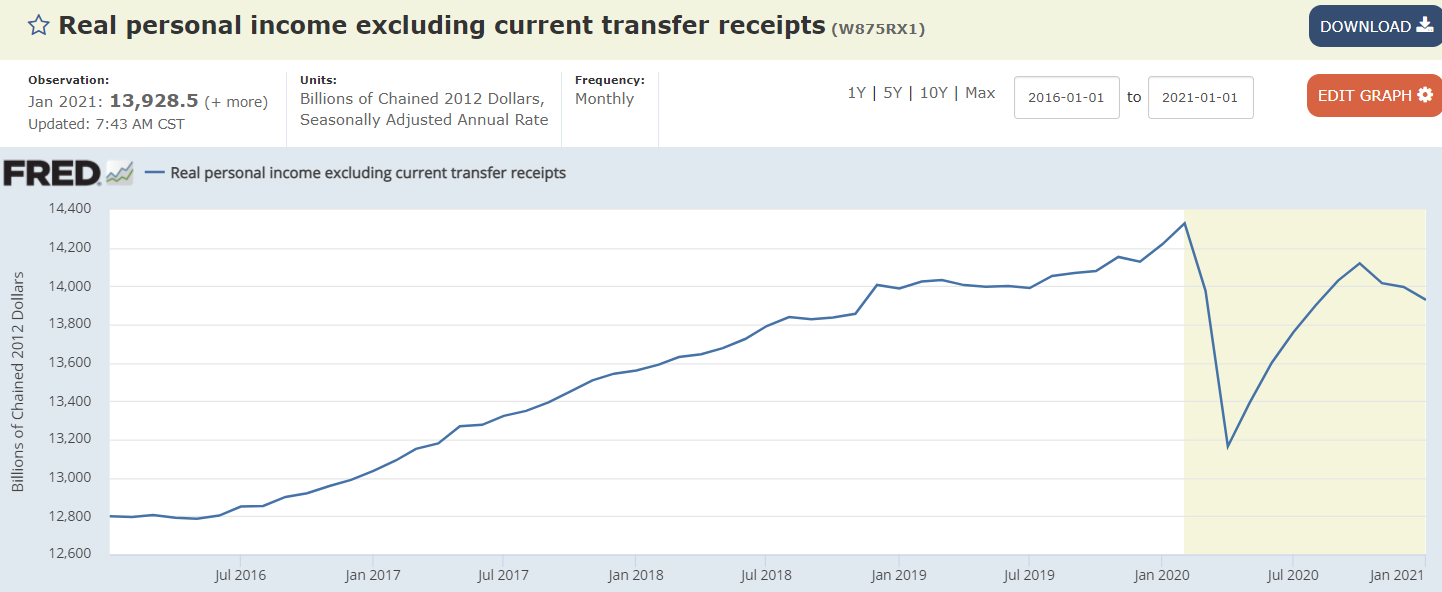

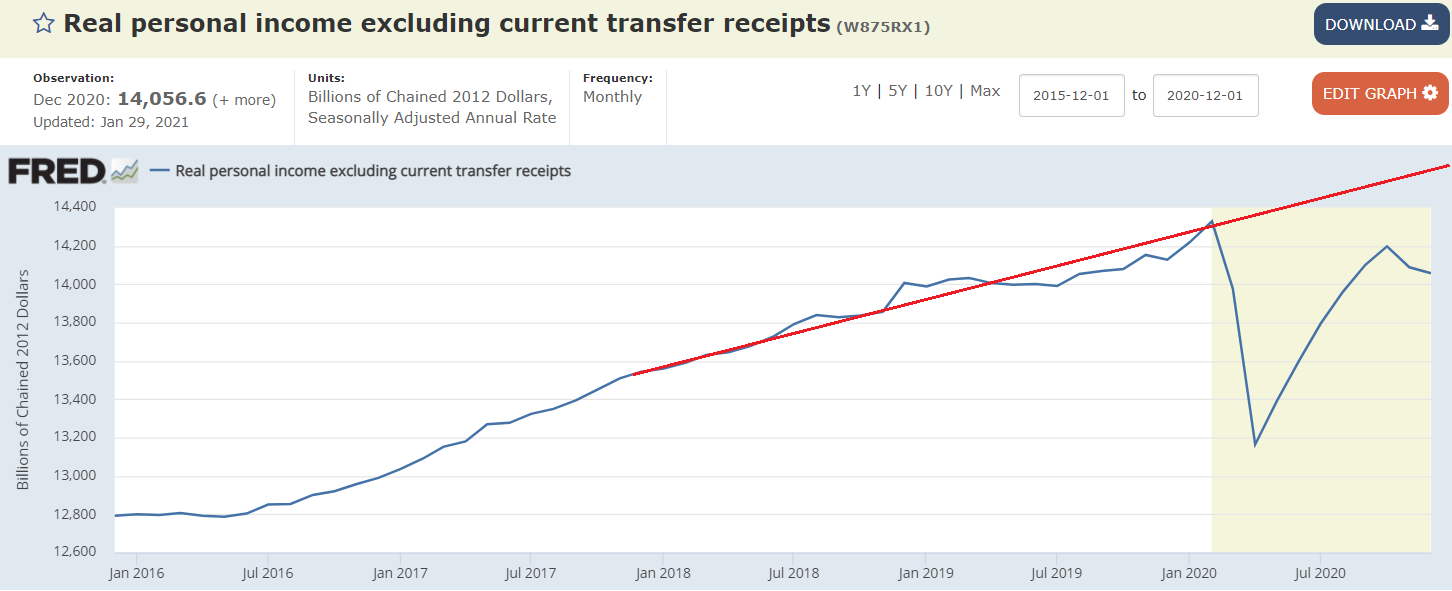

The economy is generating less personal income than pre covid and fading:

Some of the increased income was saved:

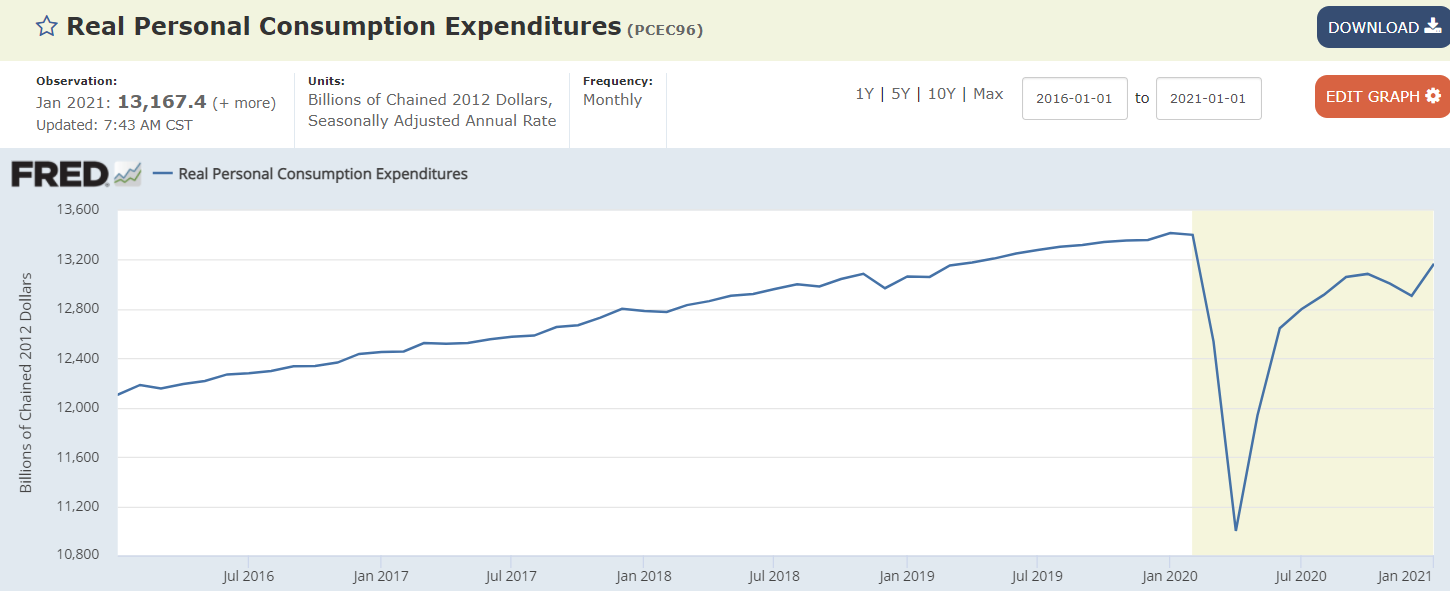

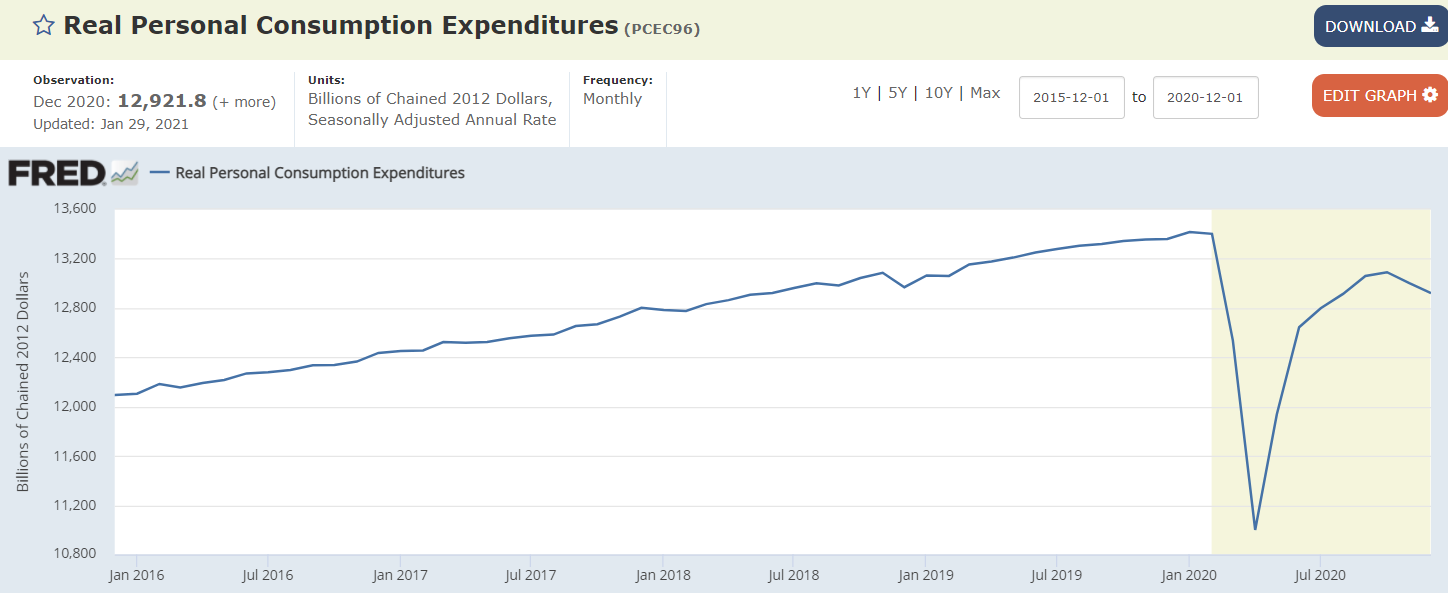

Some was spent, but consumption has still not fully recovered:

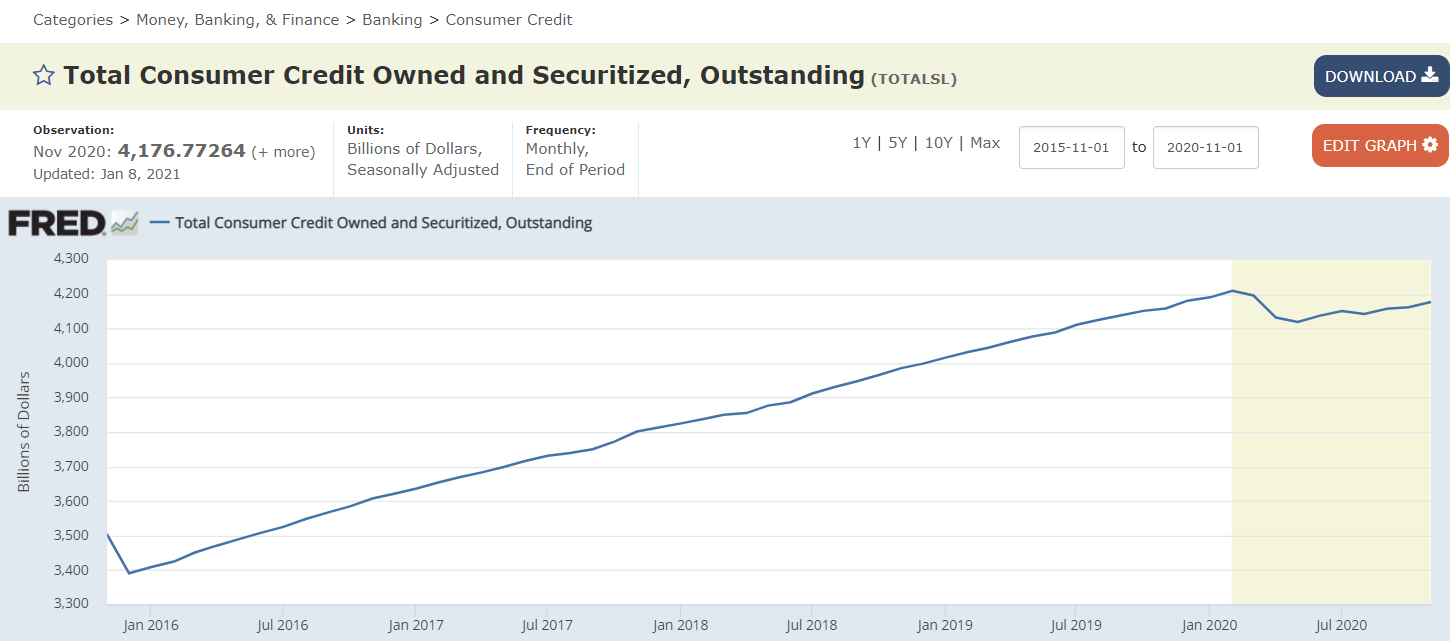

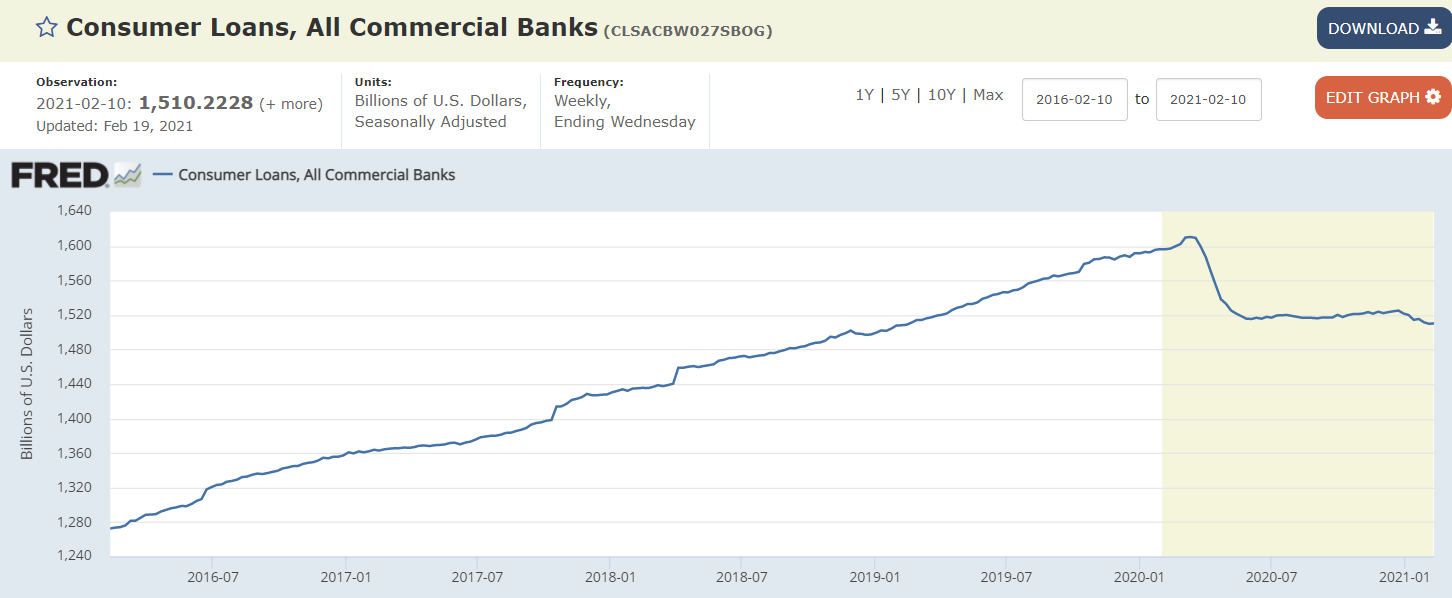

Consumer borrowing to spend has shifted lower:

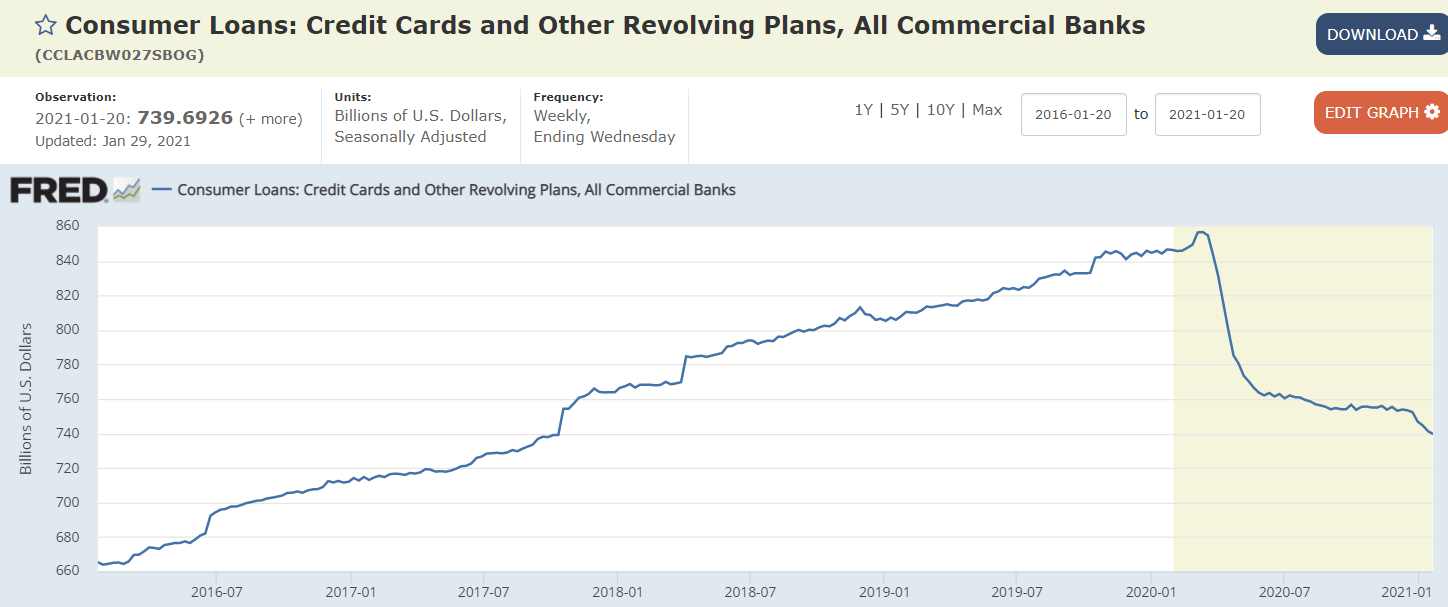

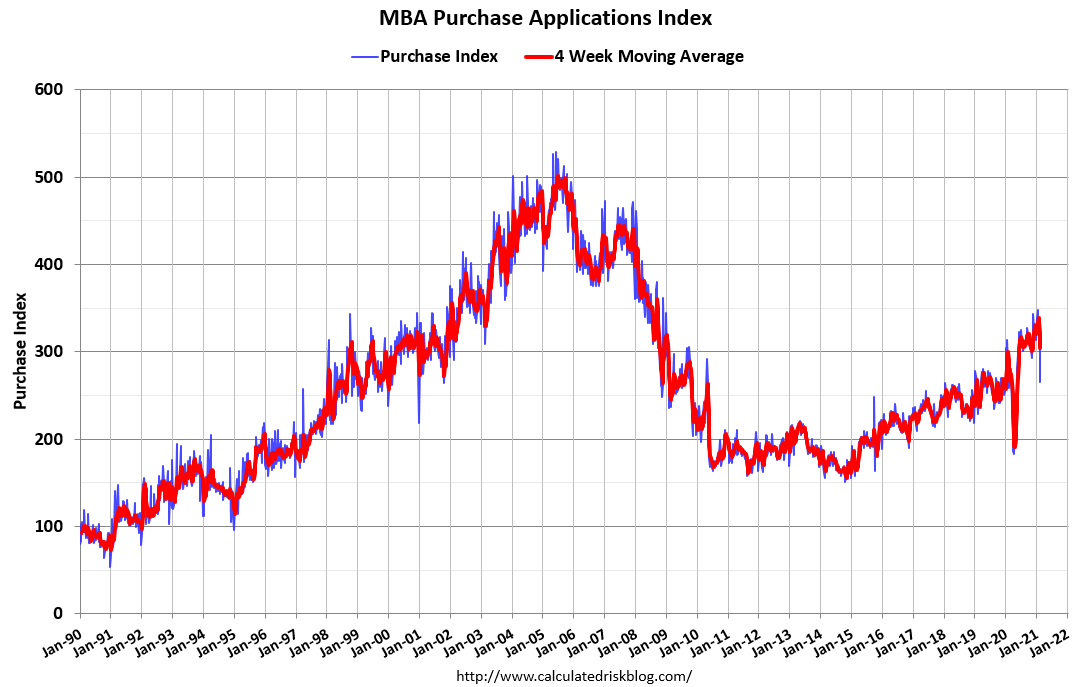

Settling in at perhaps somewhat higher levels:

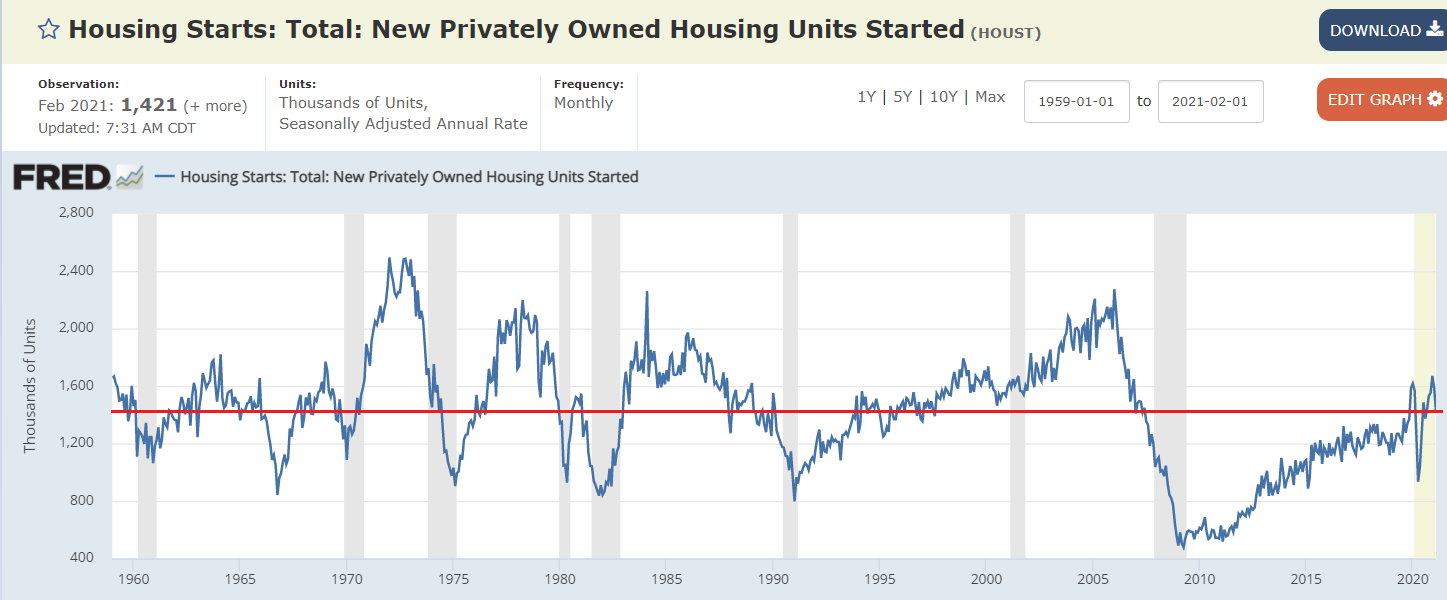

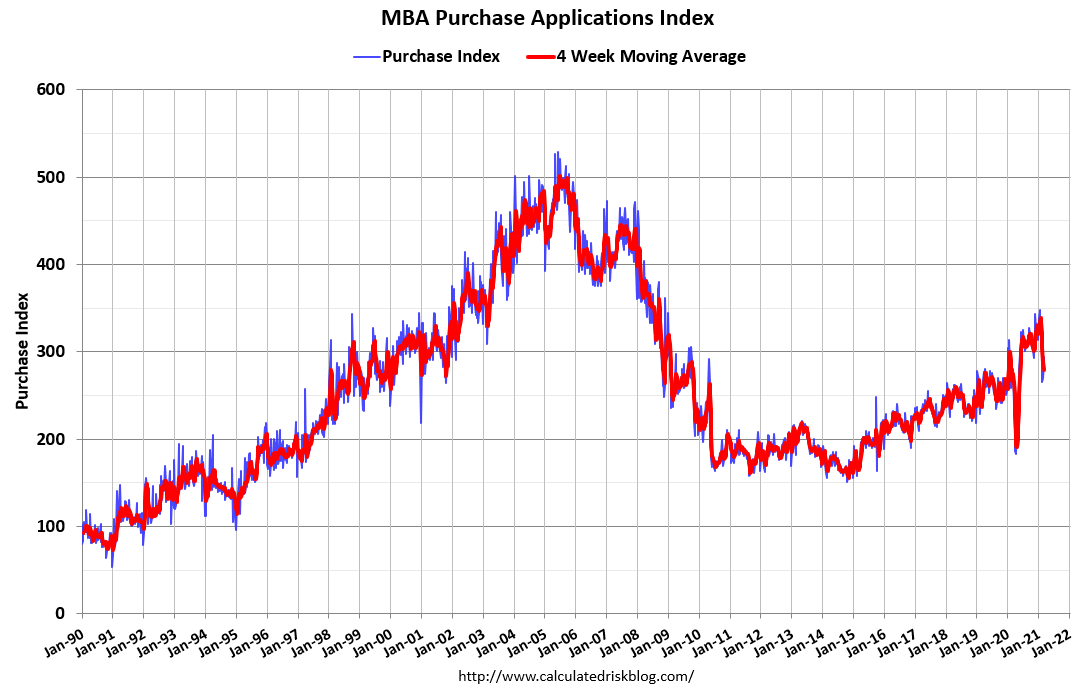

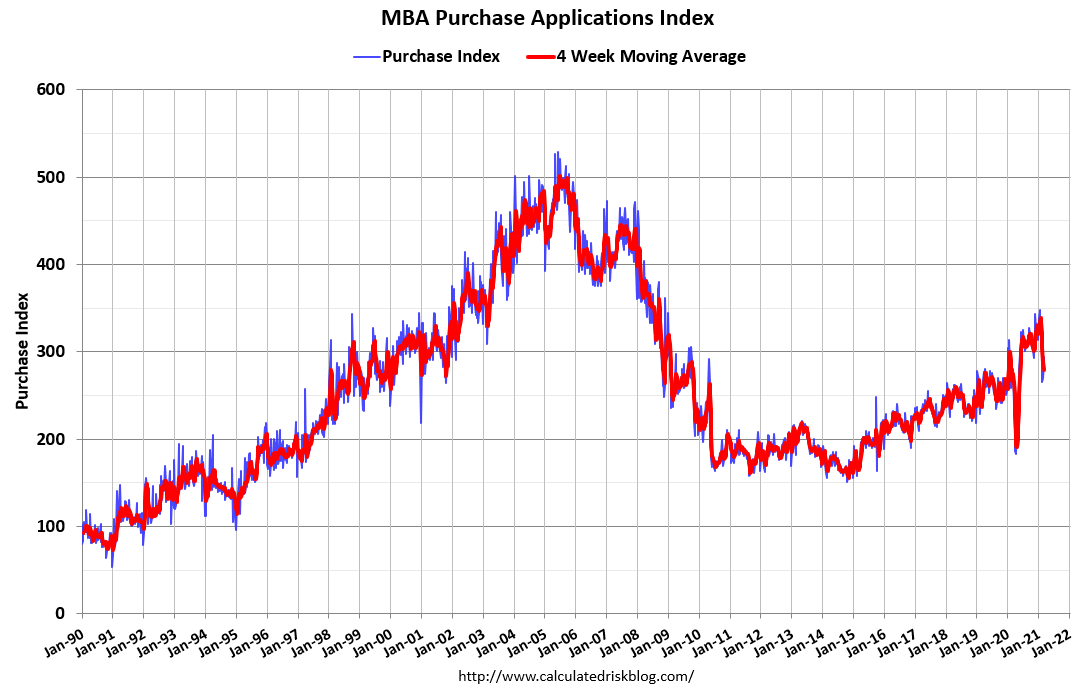

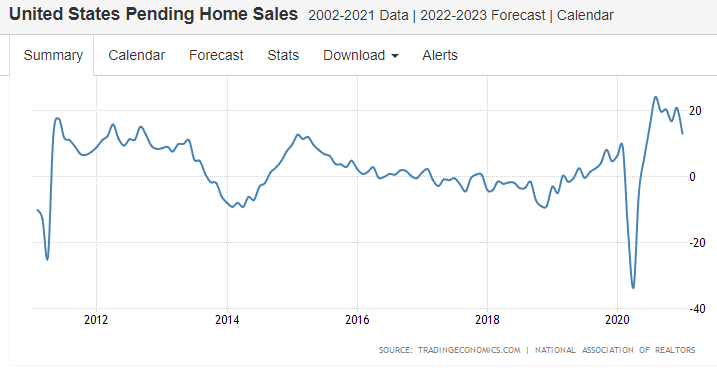

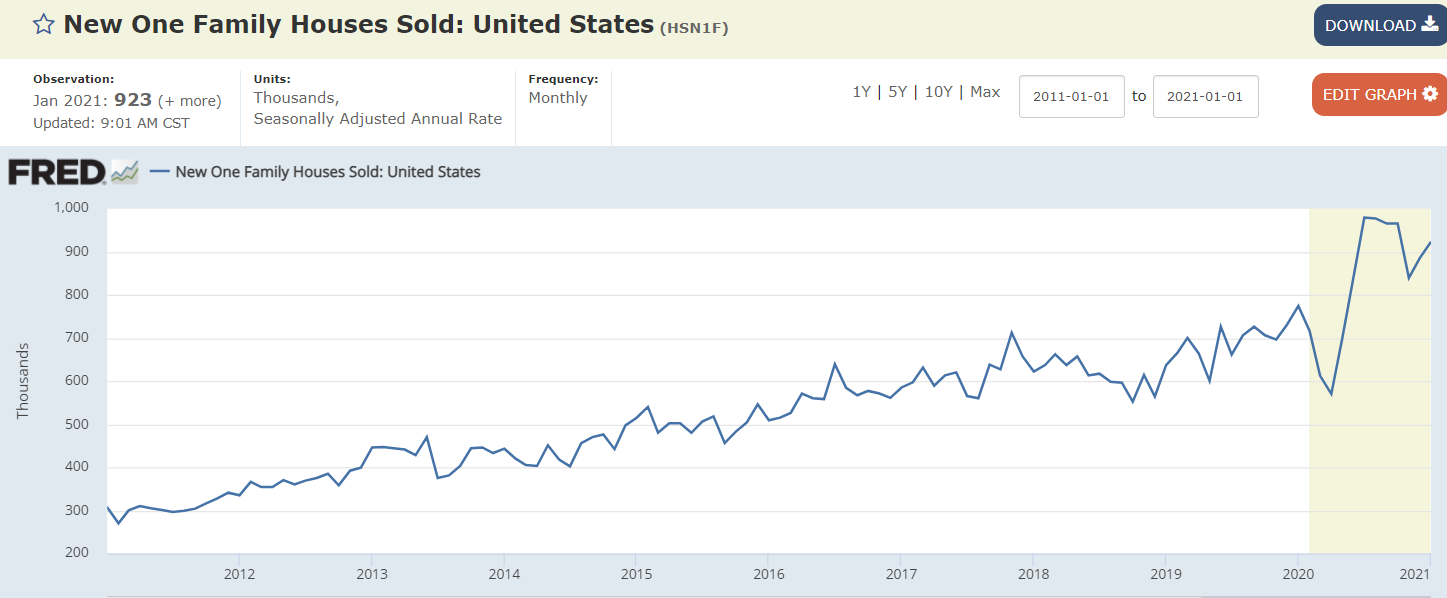

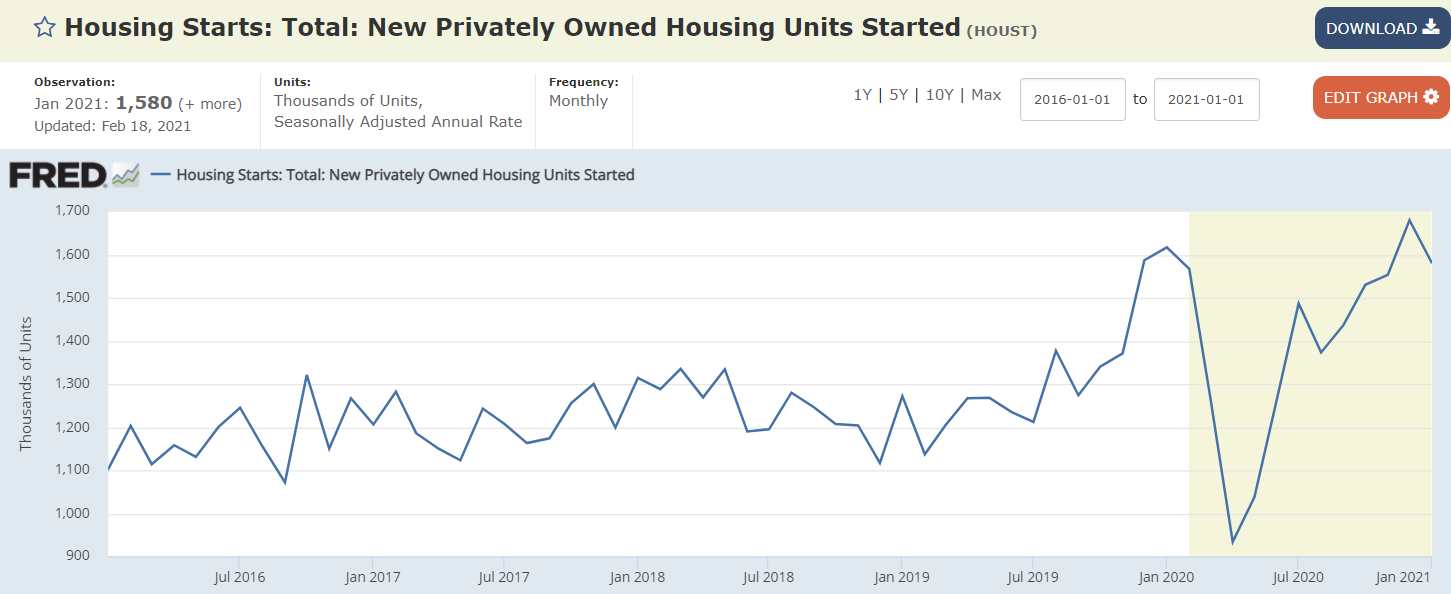

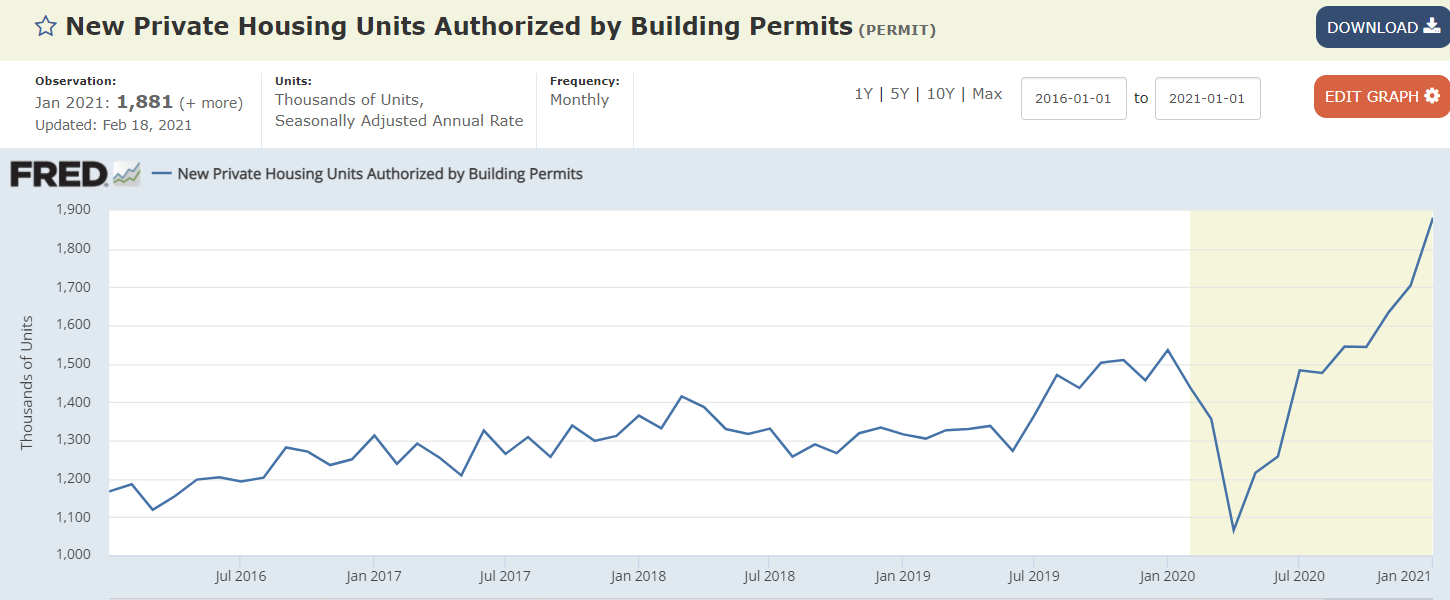

Promising!

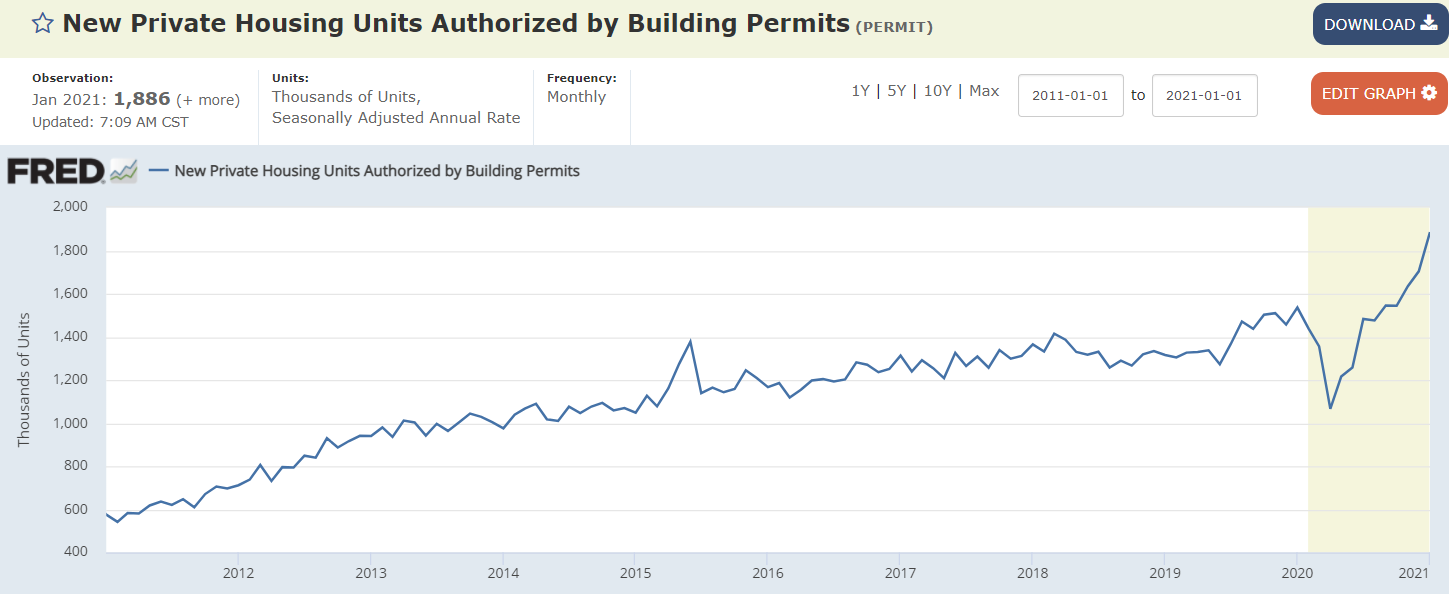

Not showing up here yet:

No telling what the Saudis are up to:

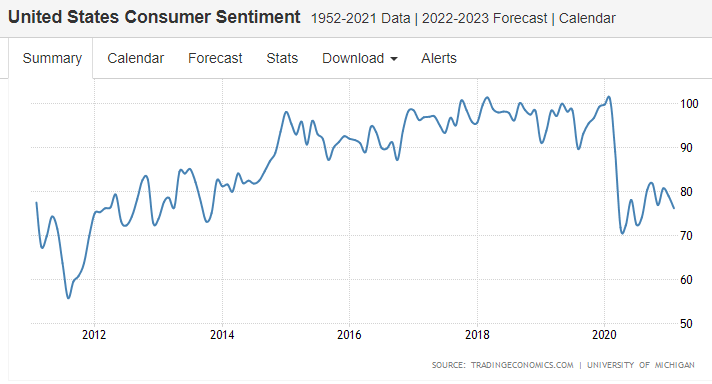

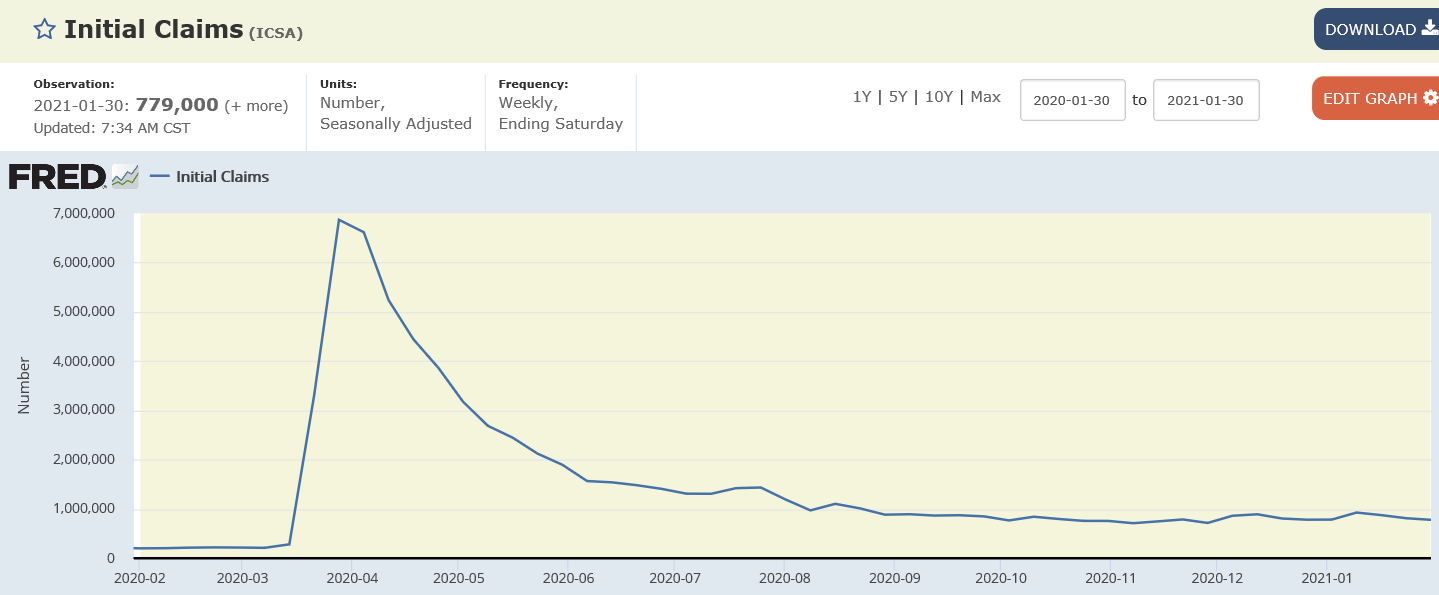

Alarmingly high this long after the crisis and no longer moving lower:

Seems ‘on average’ it’s hard to say much has changed:

Though this looks promising:

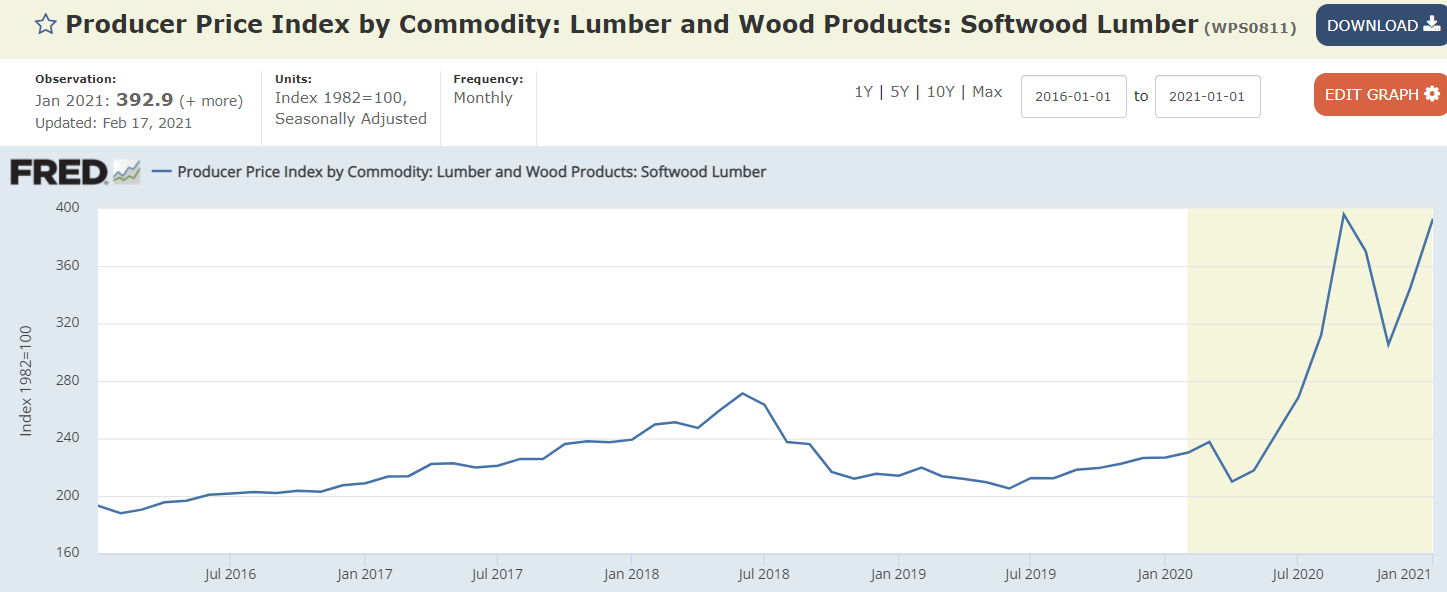

Tariffs and Covid related supply issues are commonplace:

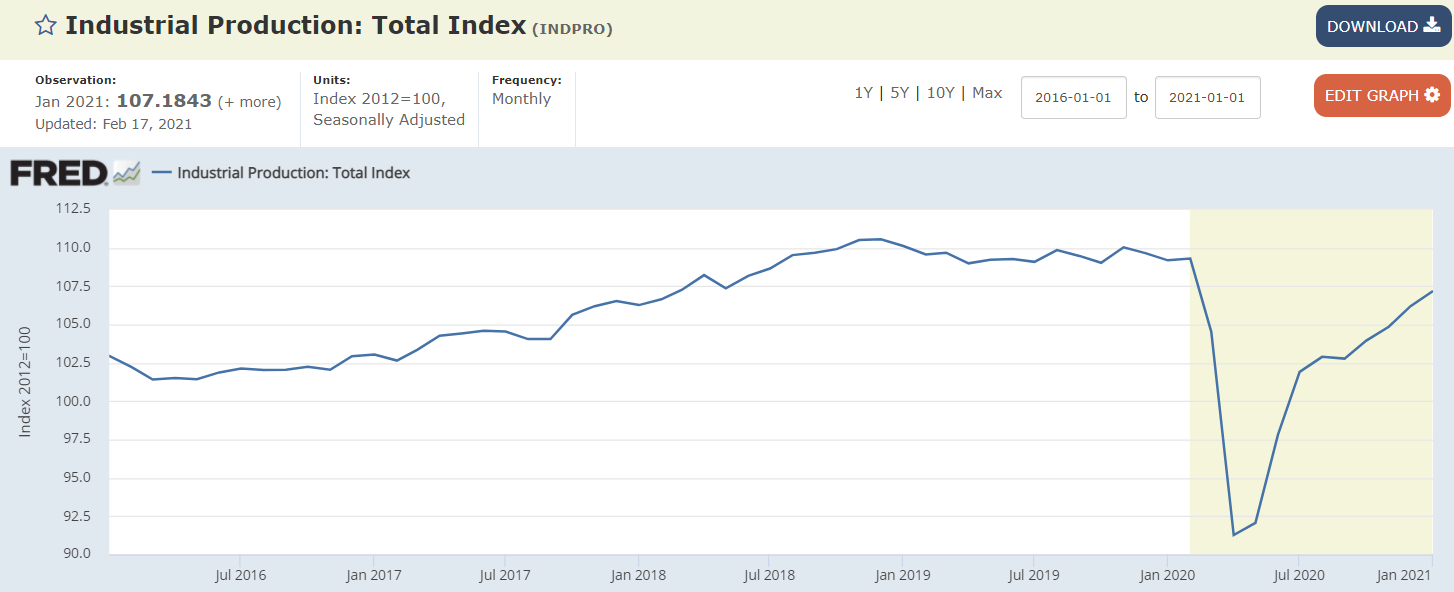

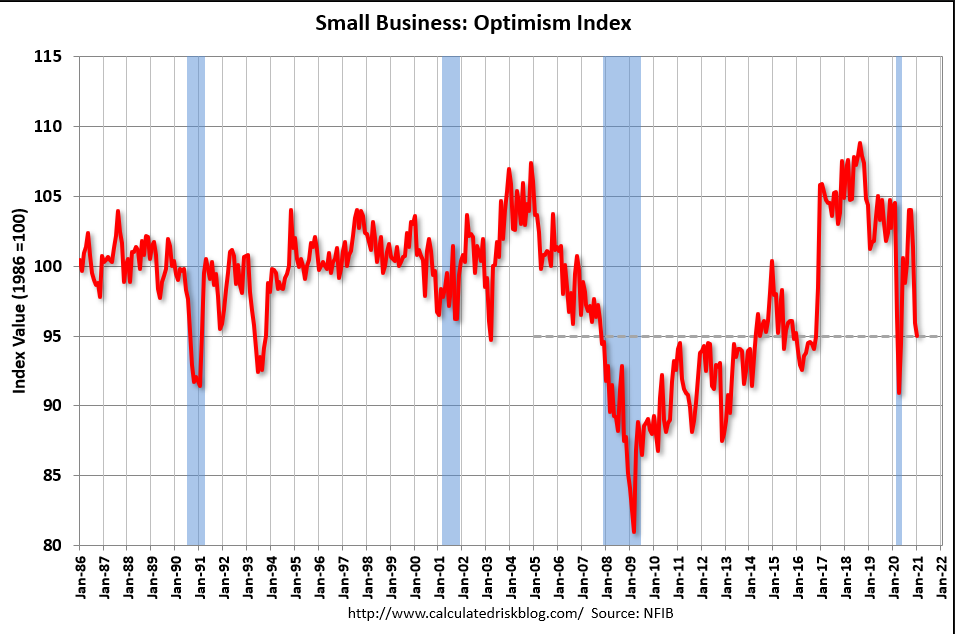

Nice move up after the move down, but still looking net lower than otherwise for the last 12 months due to the crisis:

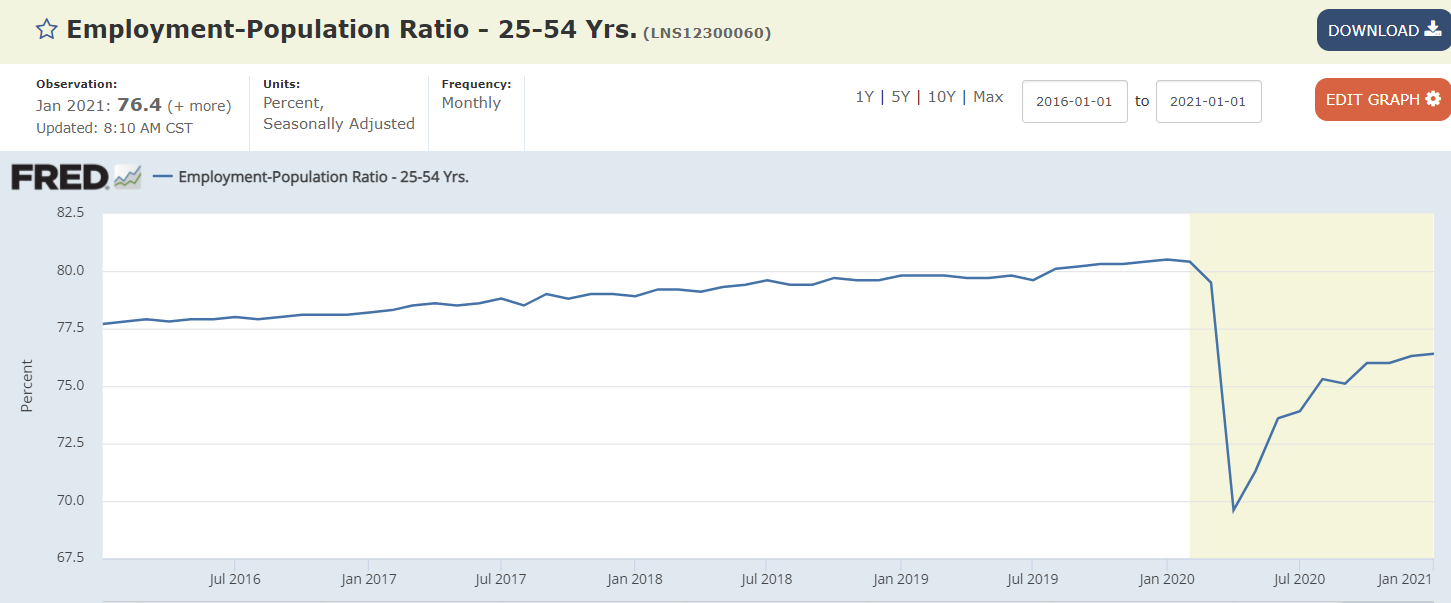

Back towards prior levels but still way down overall for the last year:

Back to where it was pre Trump:

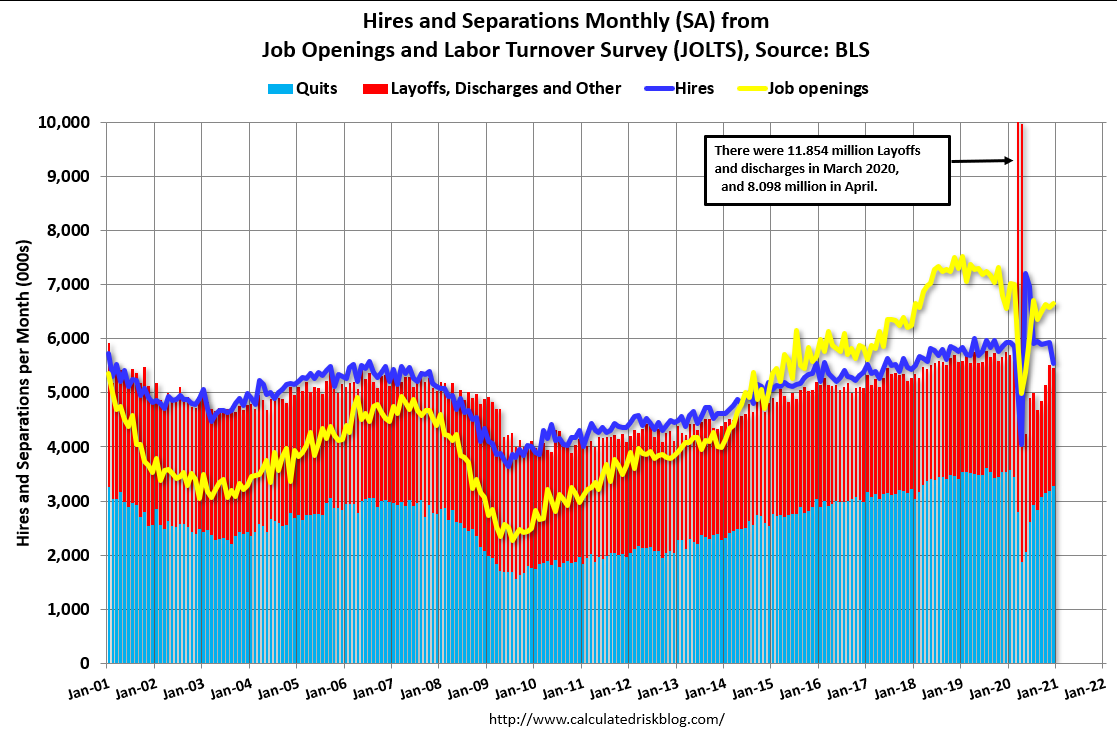

New hires down, openings up some but that includes openings to replace higher cost workers:

Exporting our food supply (in addition to turning it into motor fuel and burning it up) so we can pay more fighting over what’s left:

Looking bad:

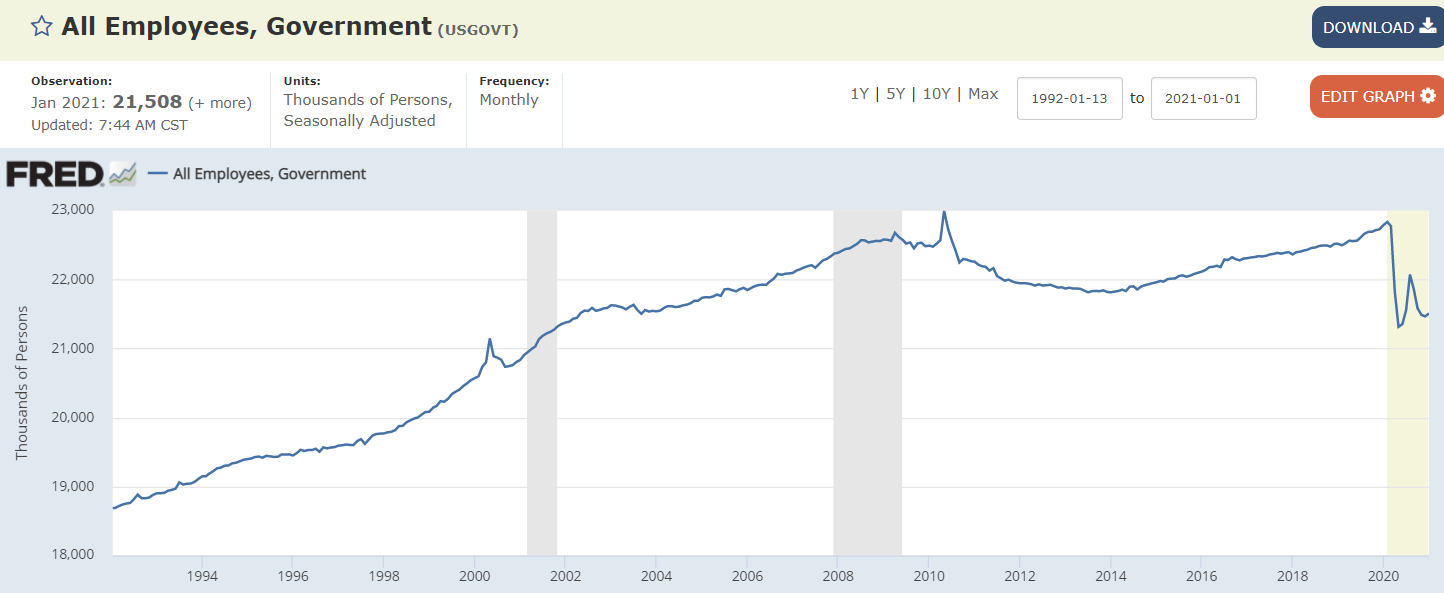

Looks like the long term growth of government employment was reversed by Obama, then it increased under Trump until the covid crisis:

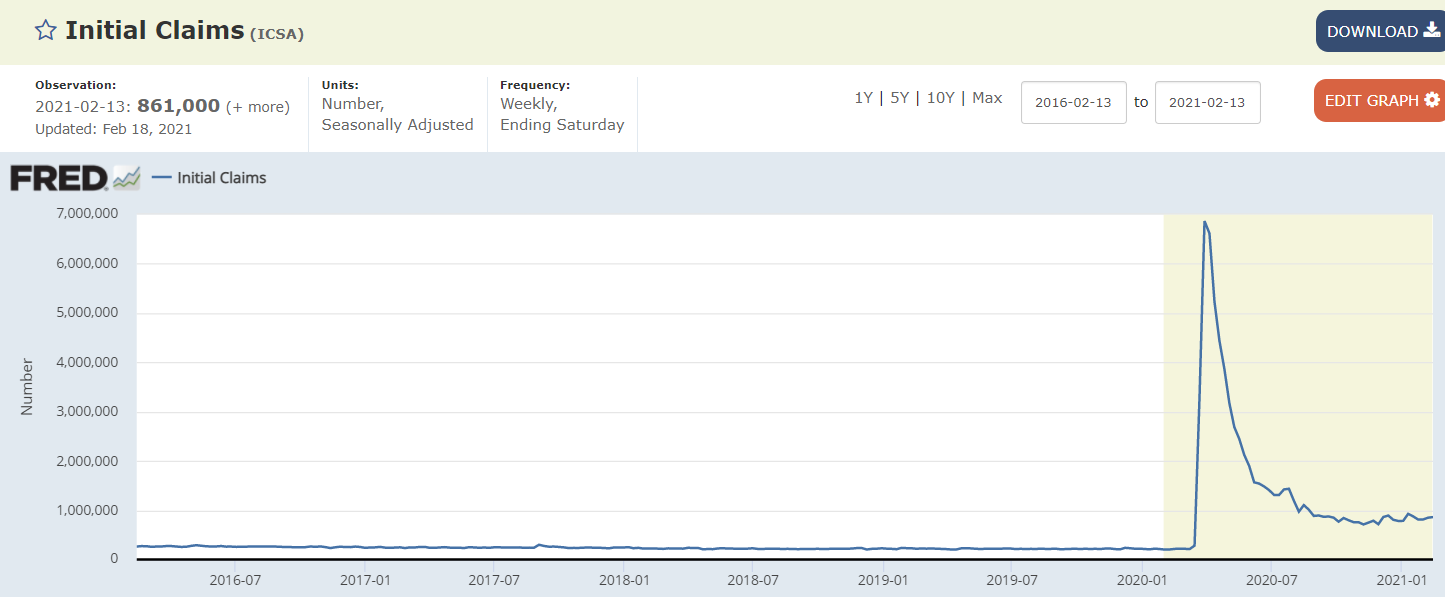

Still massively elevated:

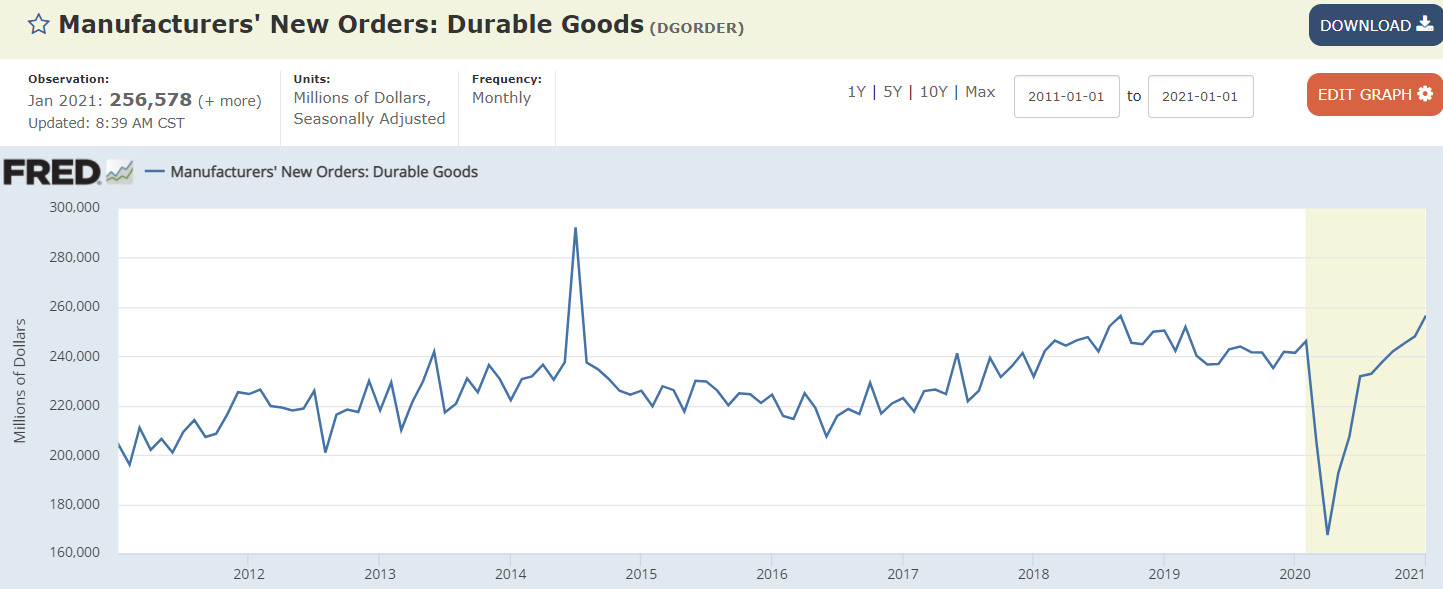

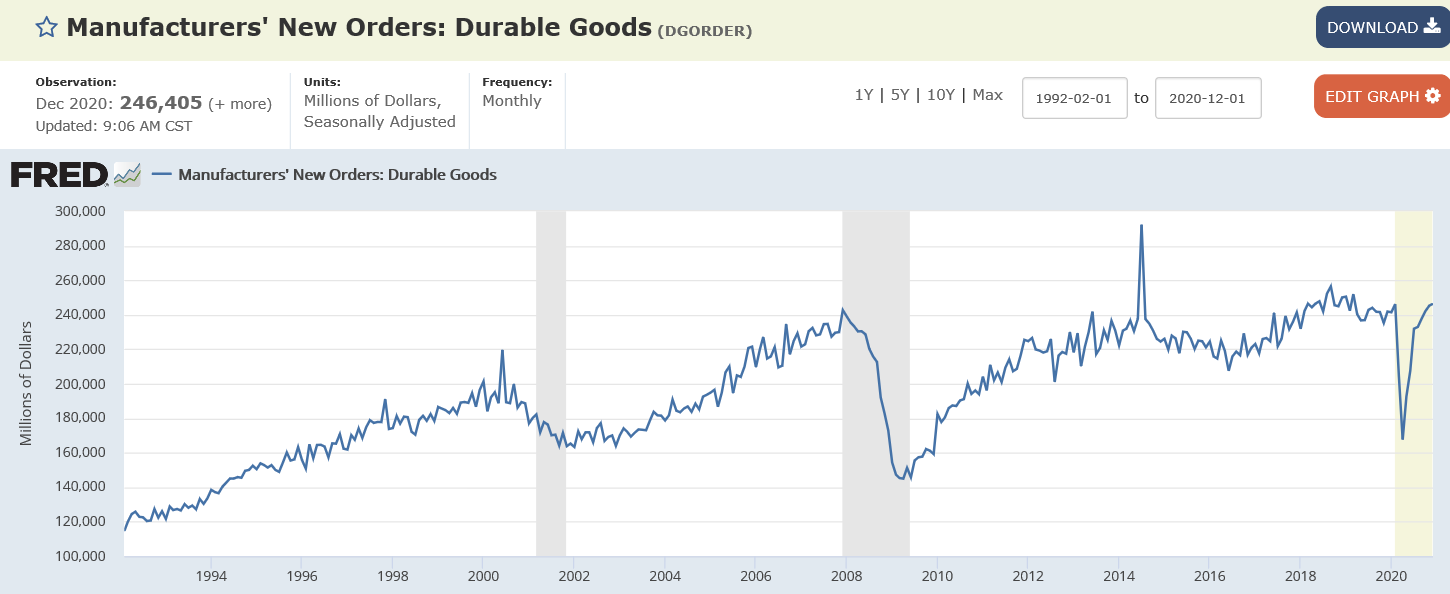

Orders are about back to where they were but remain at sub 2018 levels:

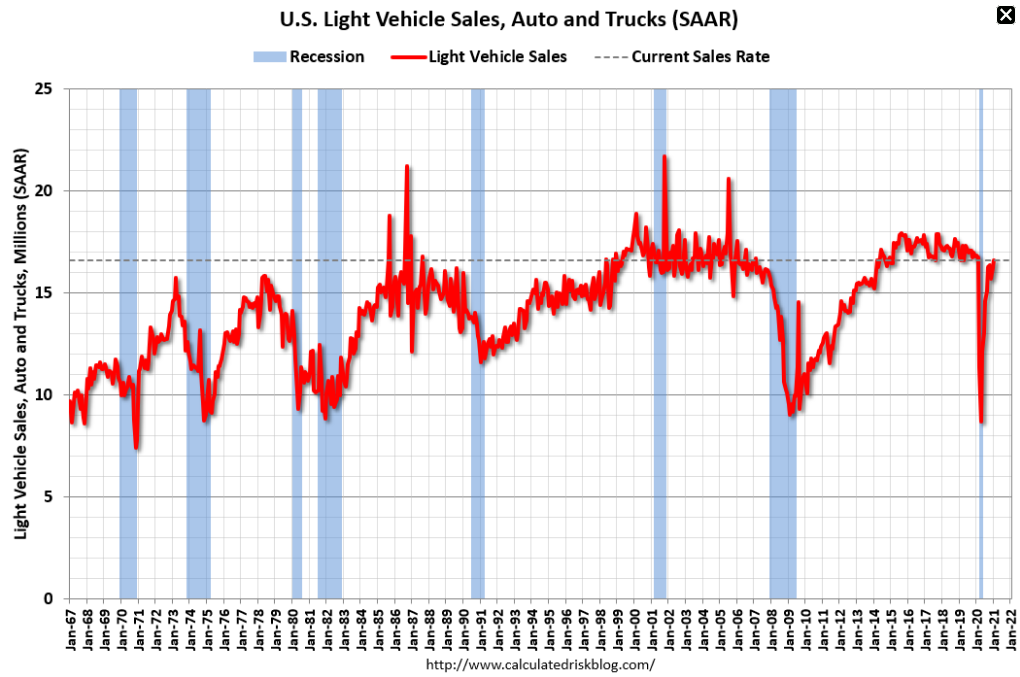

Still soft and sales lost during the dip not recovered:

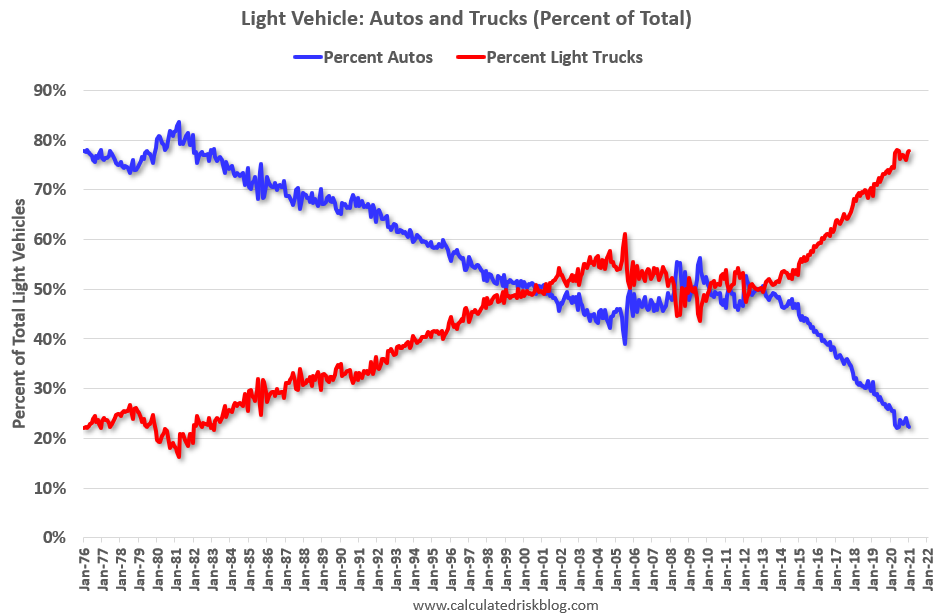

Sales continue to shift from passenger cars:

Personal income went up with the crisis due to Federal transfers of the Cares Act, which subsequently faded:

Personal income excluding government support continues to lag behind prior levels:

Even with the higher levels of total personal income consumption has lagged and most recently decreased as government benefits expired:

A part of consumption comes from buying on credit, and with employment down, fewer people qualify for credit. So while the additional income reduces the need for credit in order to spend, it appears the further drop in credit due to unemployment has resulted in a net drop in consumer spending: