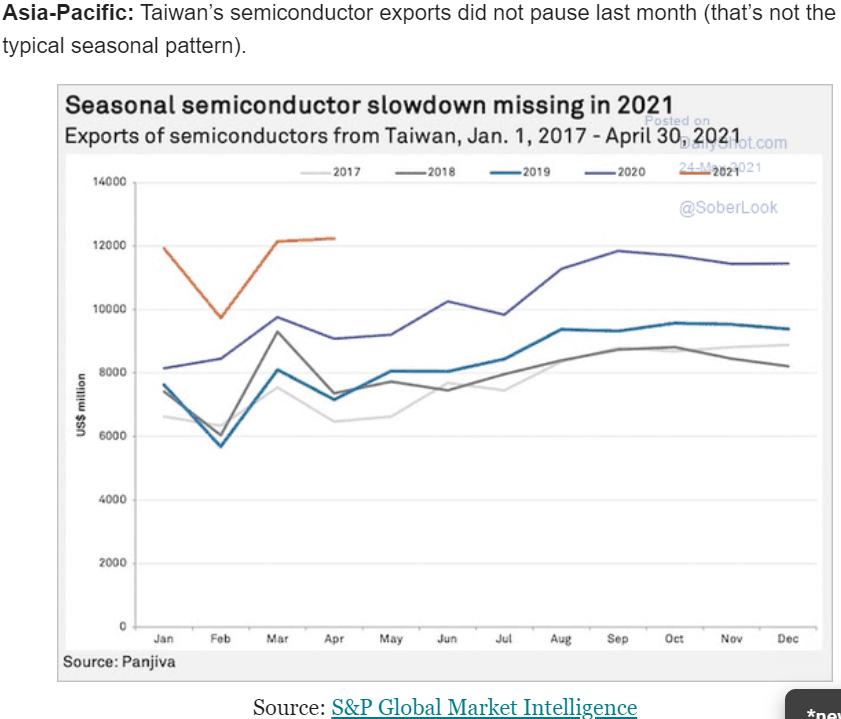

More signs of stagnation:

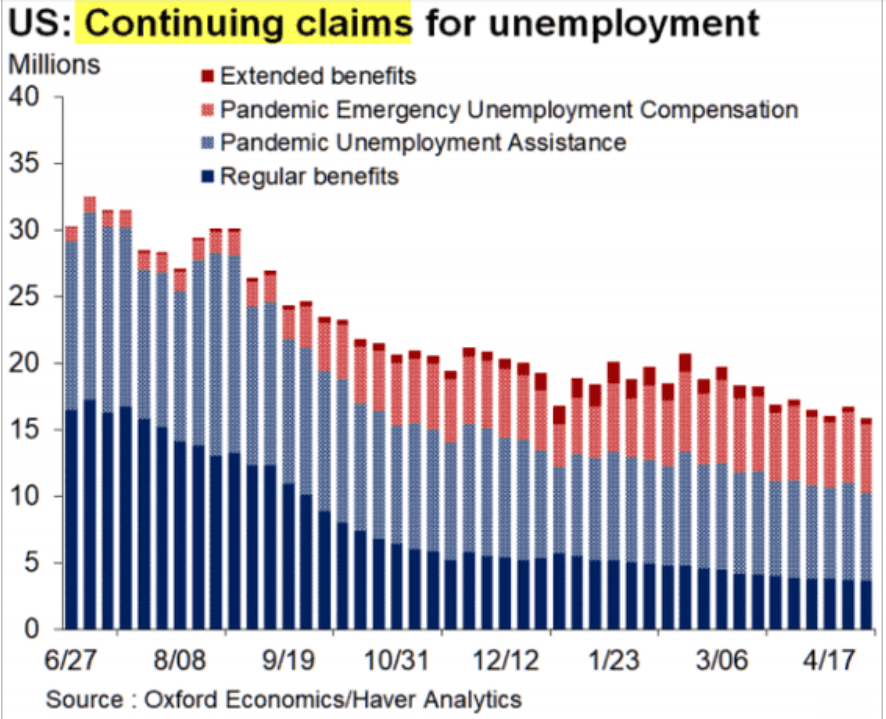

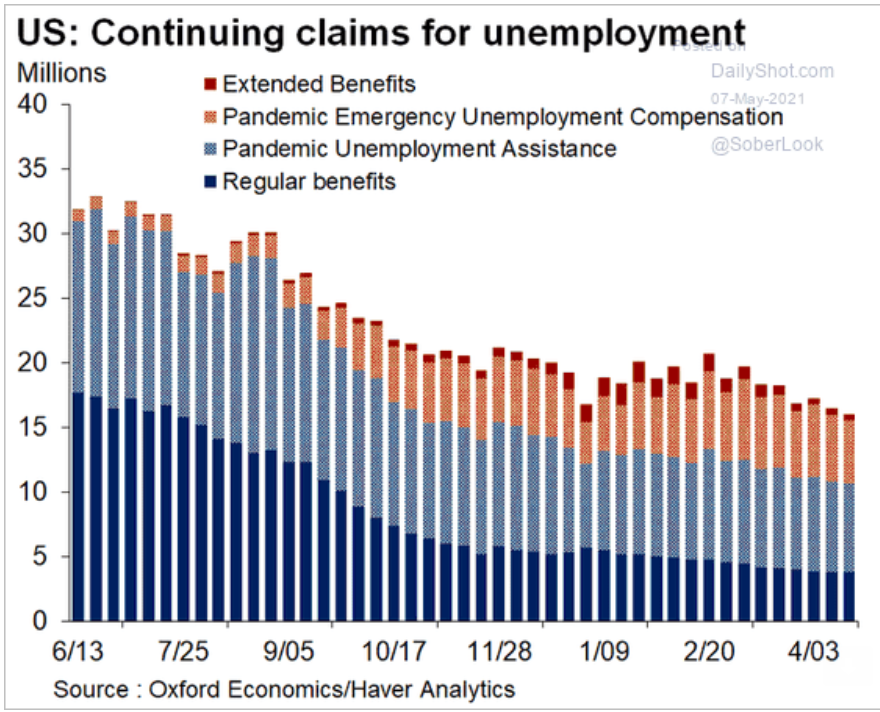

A lot of people collecting unemployment benefits. Most is gone by labor day:

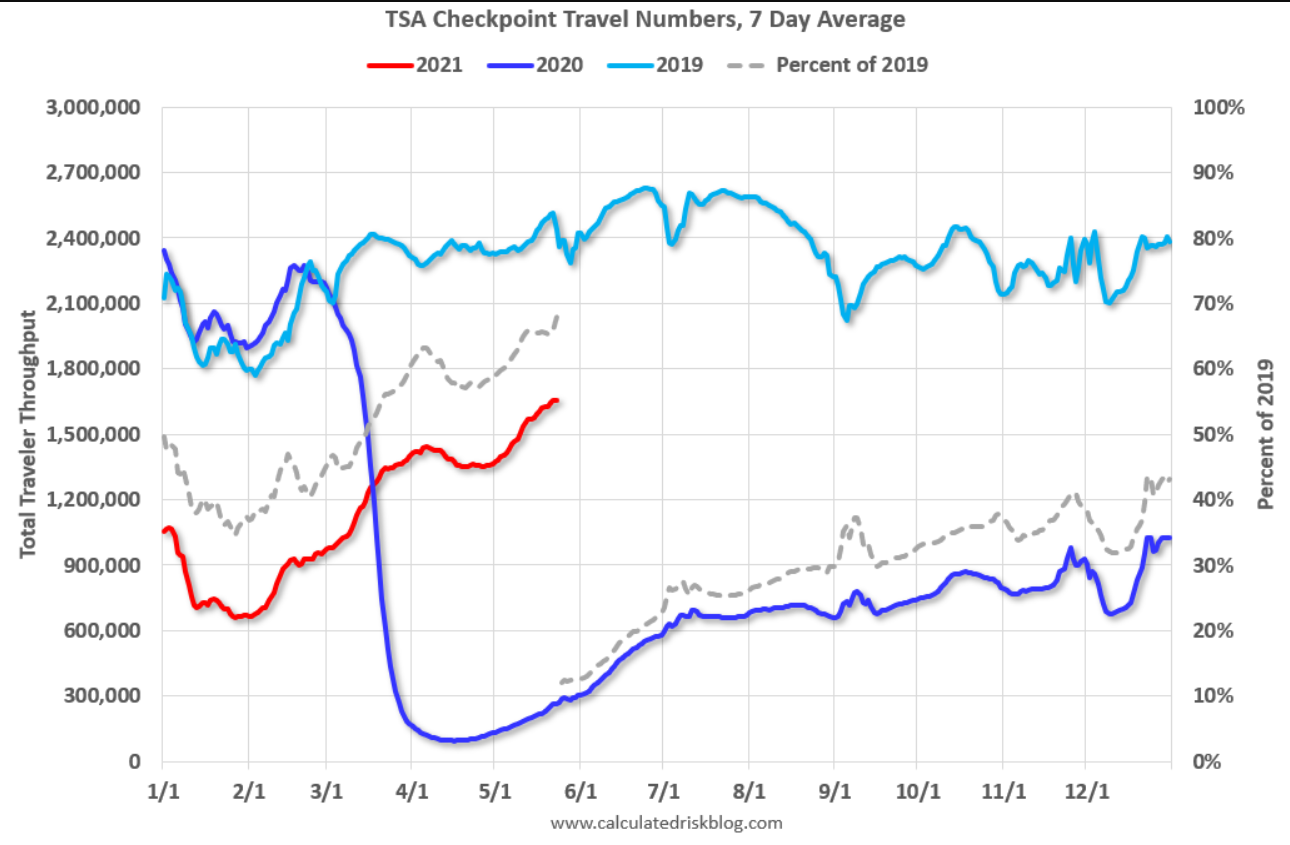

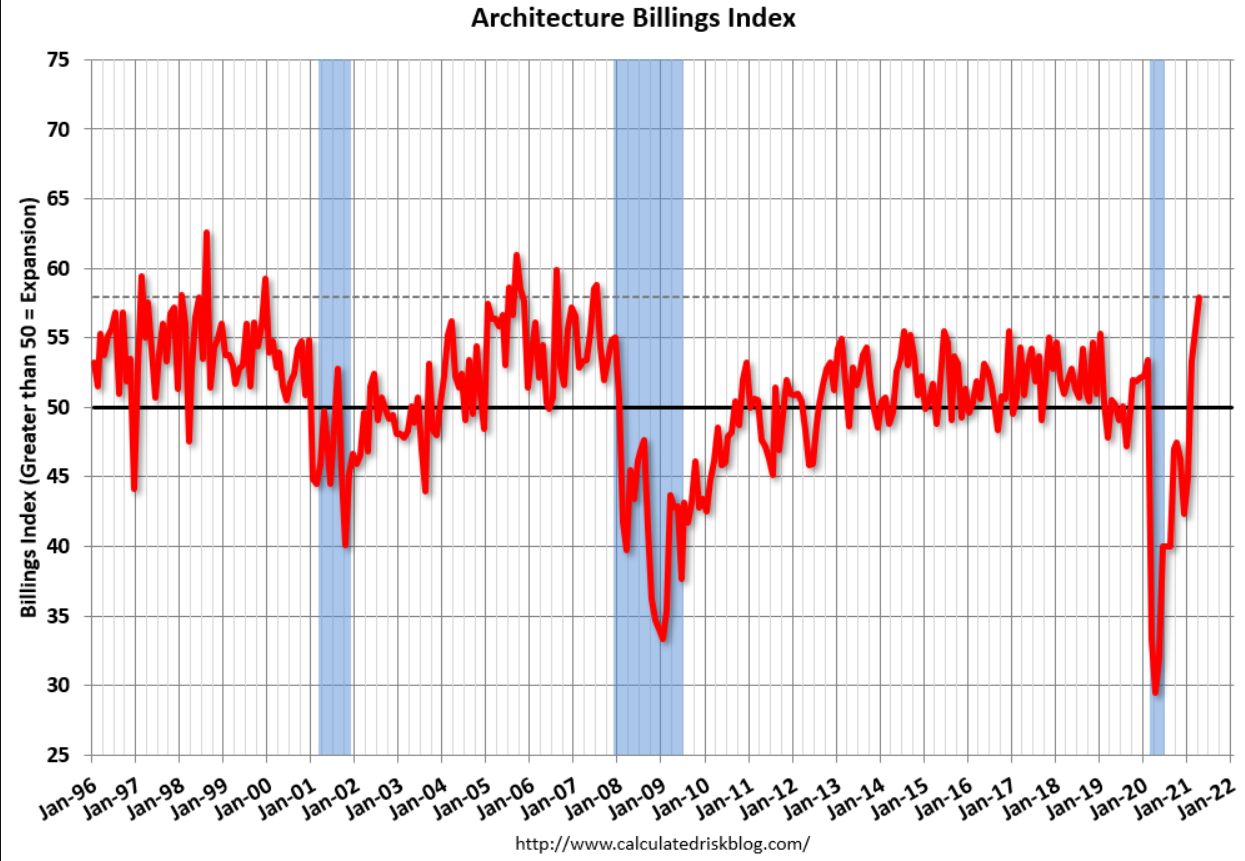

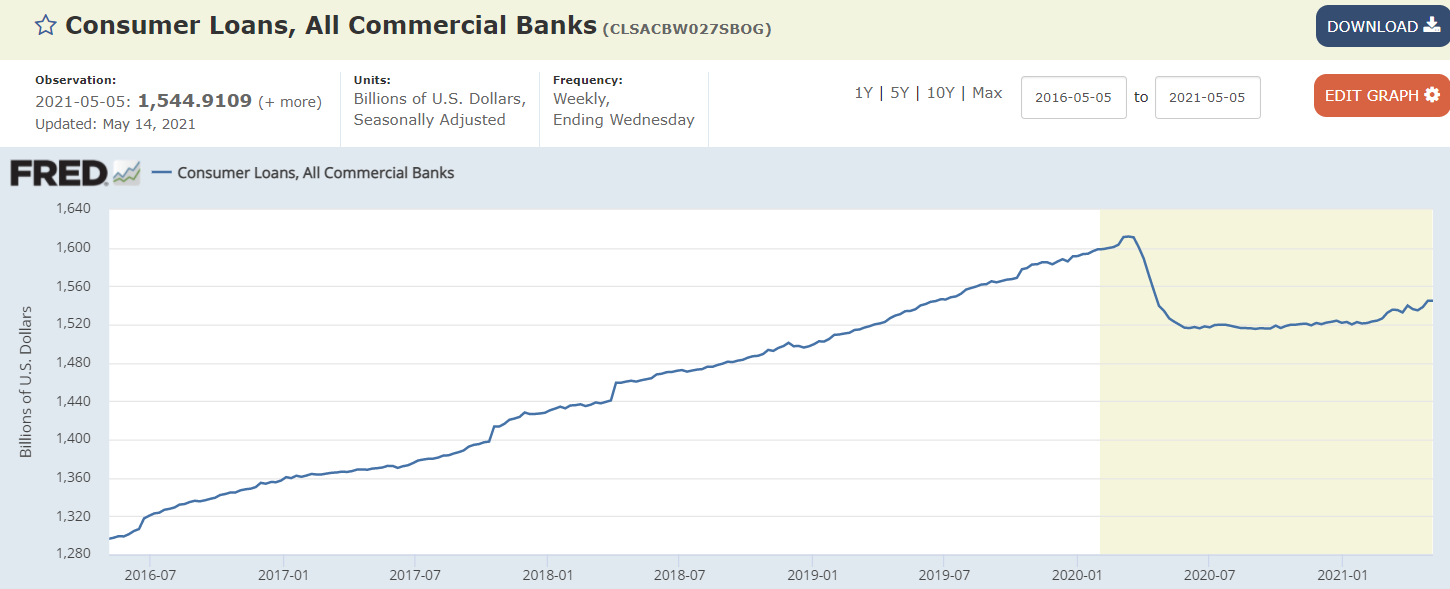

Another hint at a softening:

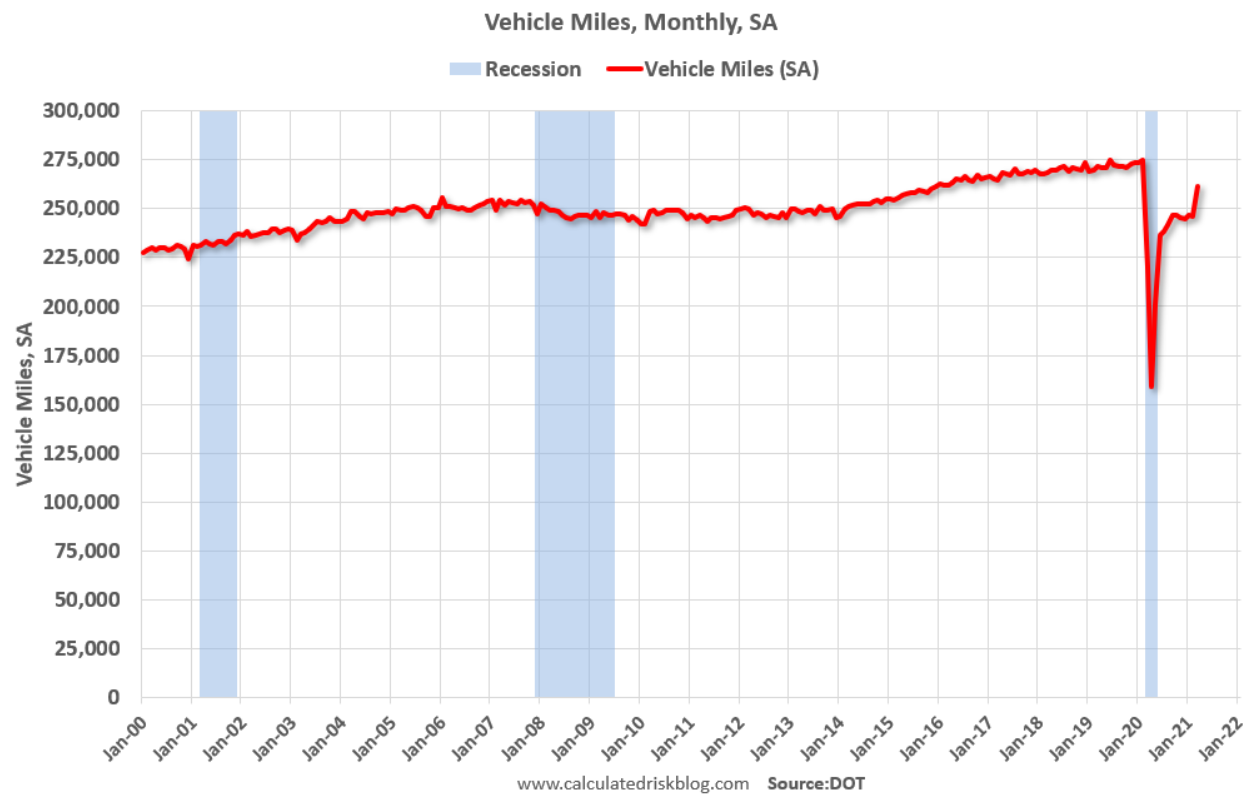

Carbon footprints on the rise but still well below pre covid levels:

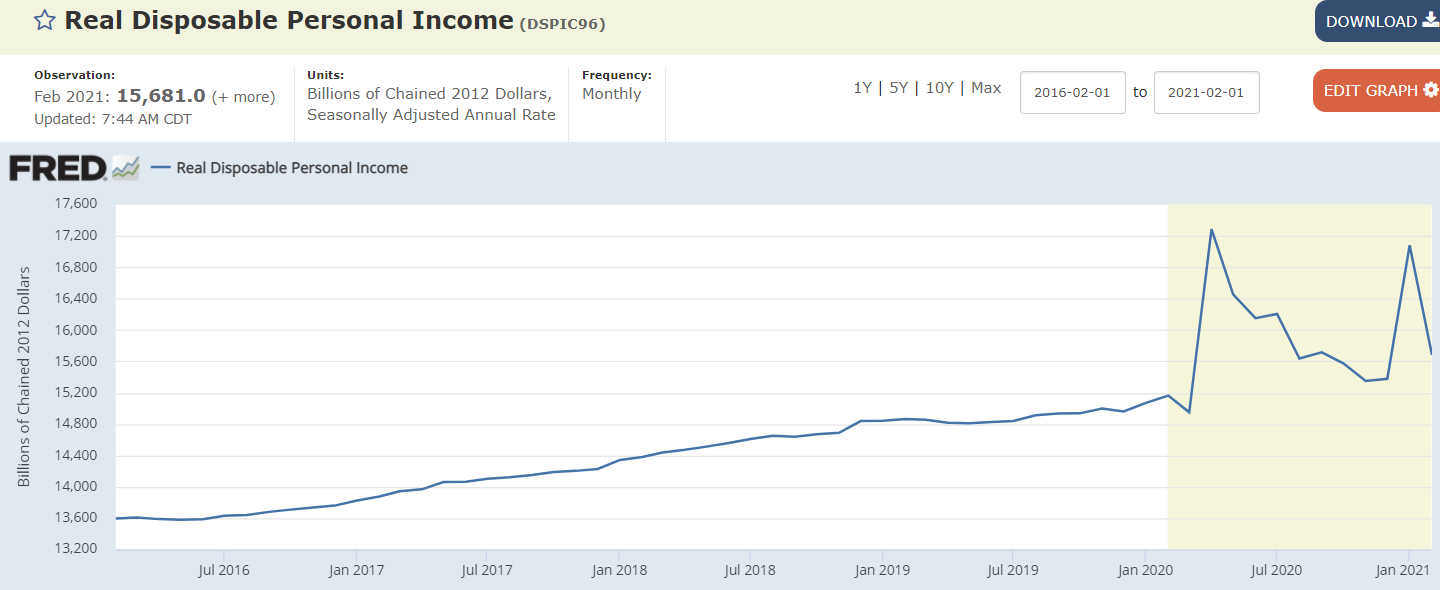

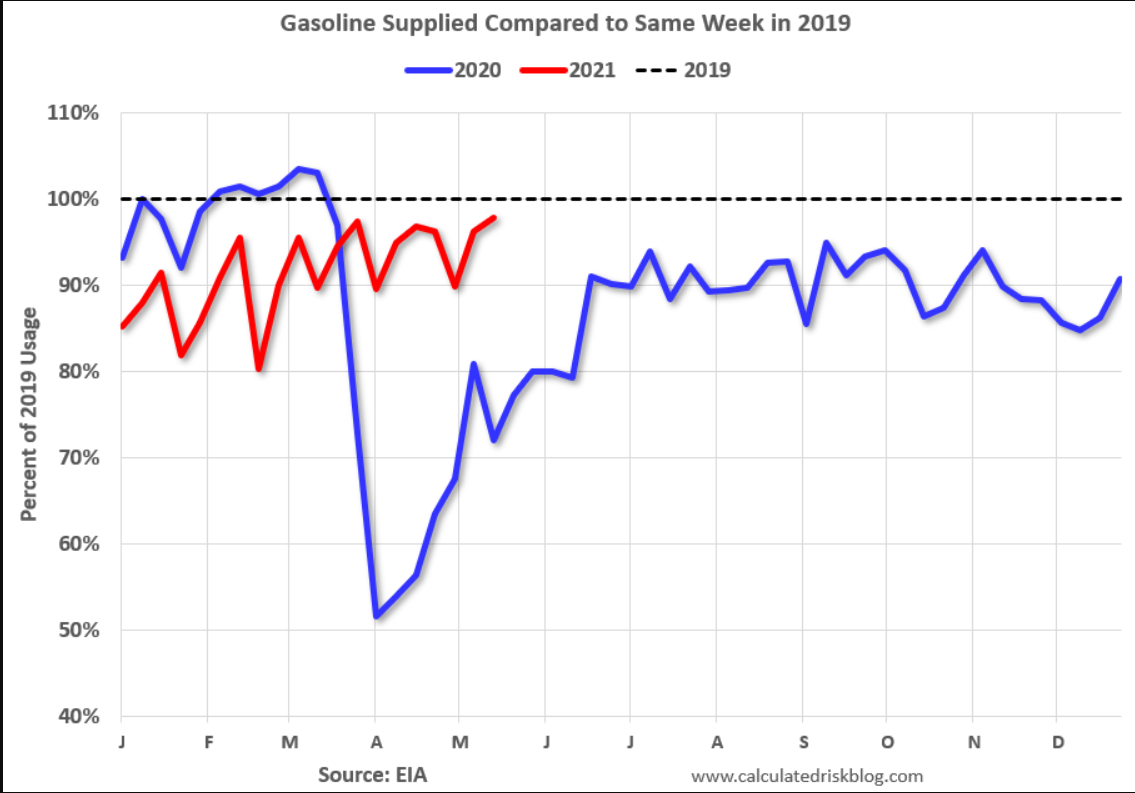

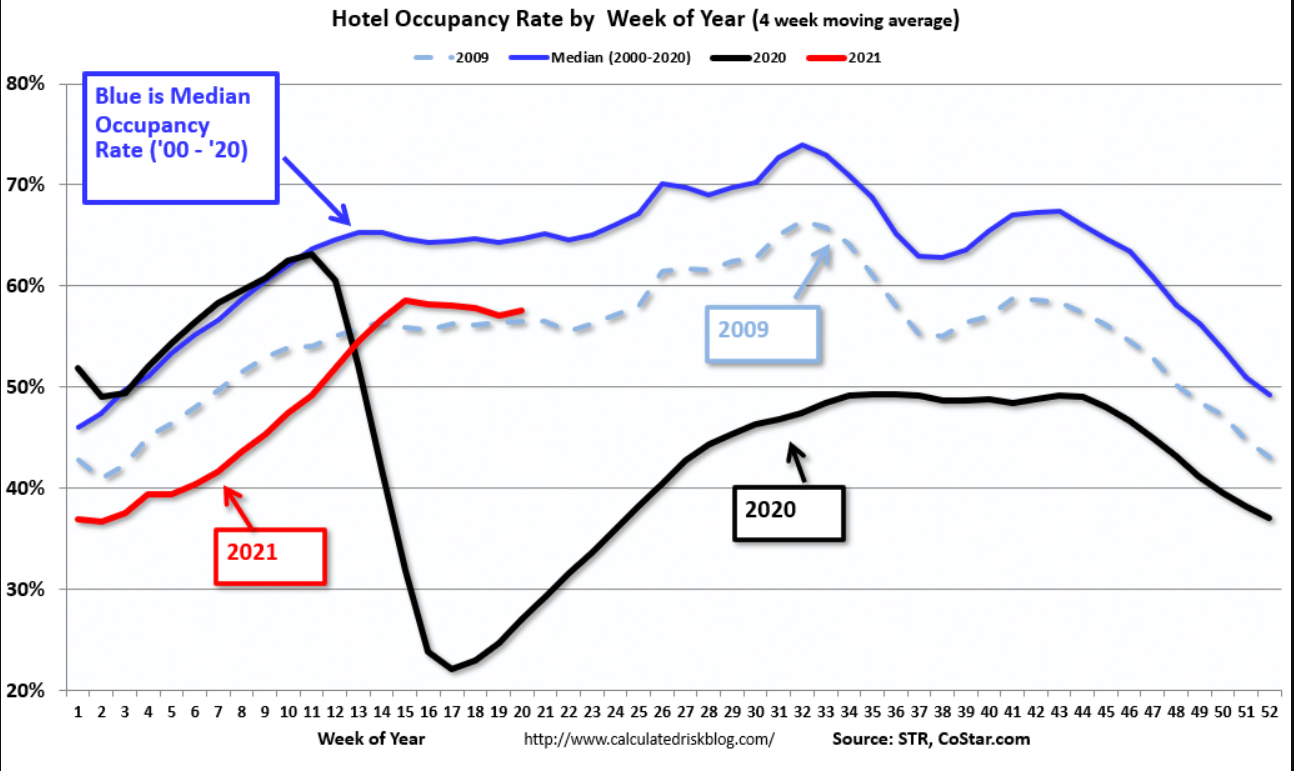

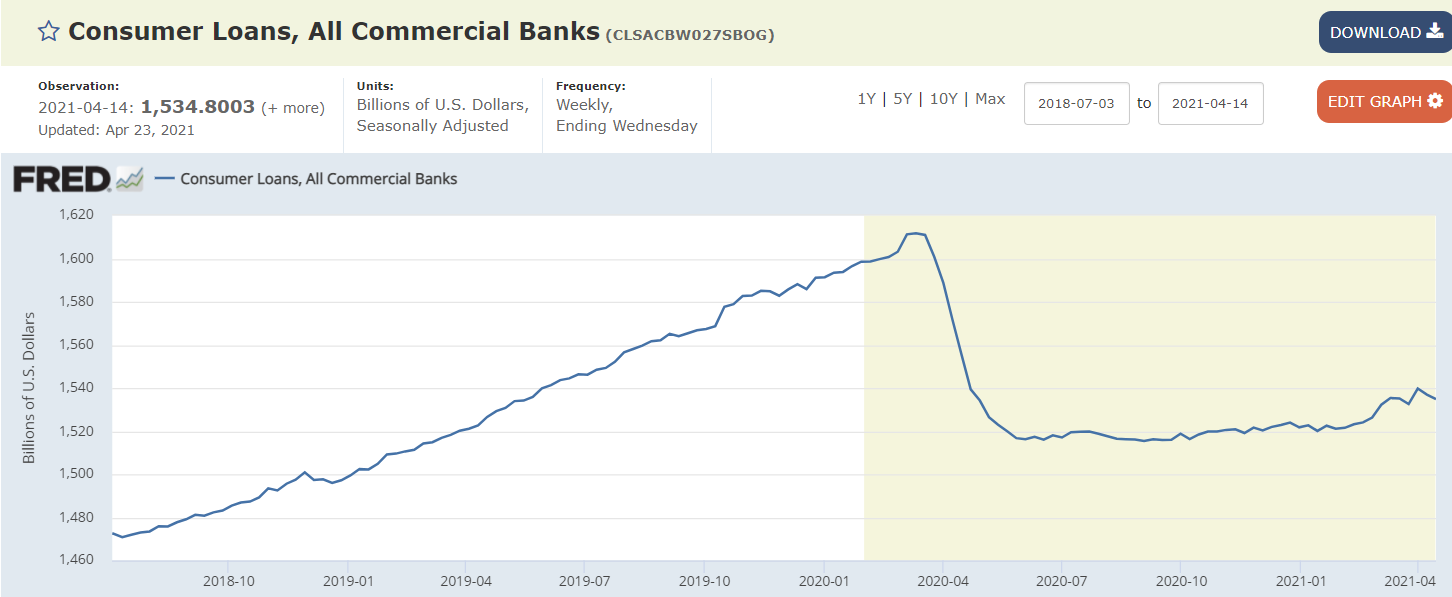

Moving back down to pre covid levels:

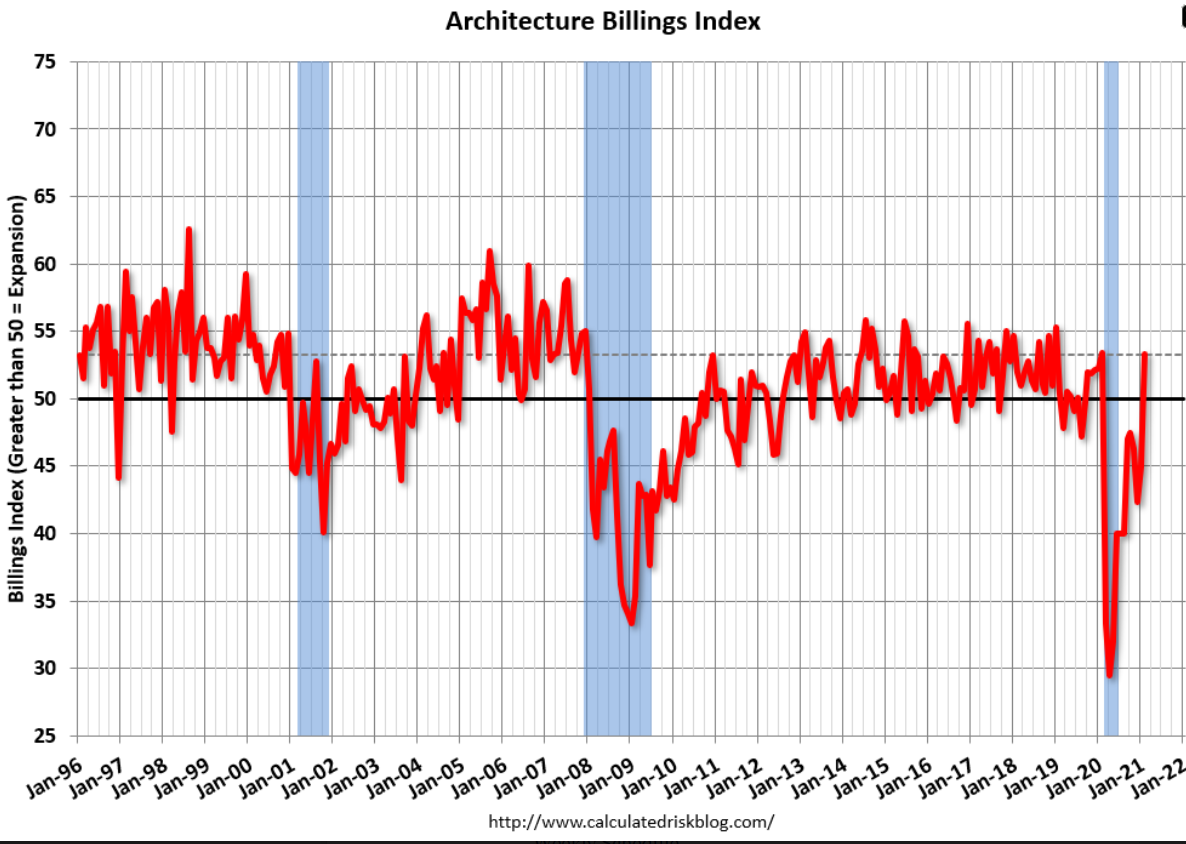

Like the other surveys, this can be misleading as it shows the % of businesses showing increases, regardless of the magnitude of the increases:

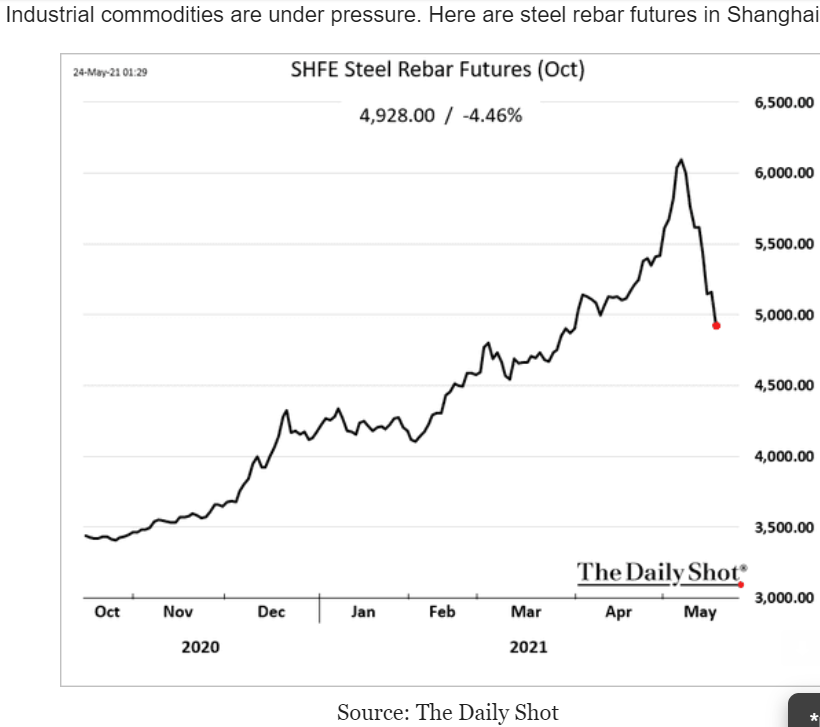

The commodity spike may be reversing?

Coming down, but still a lot of people collecting benefits

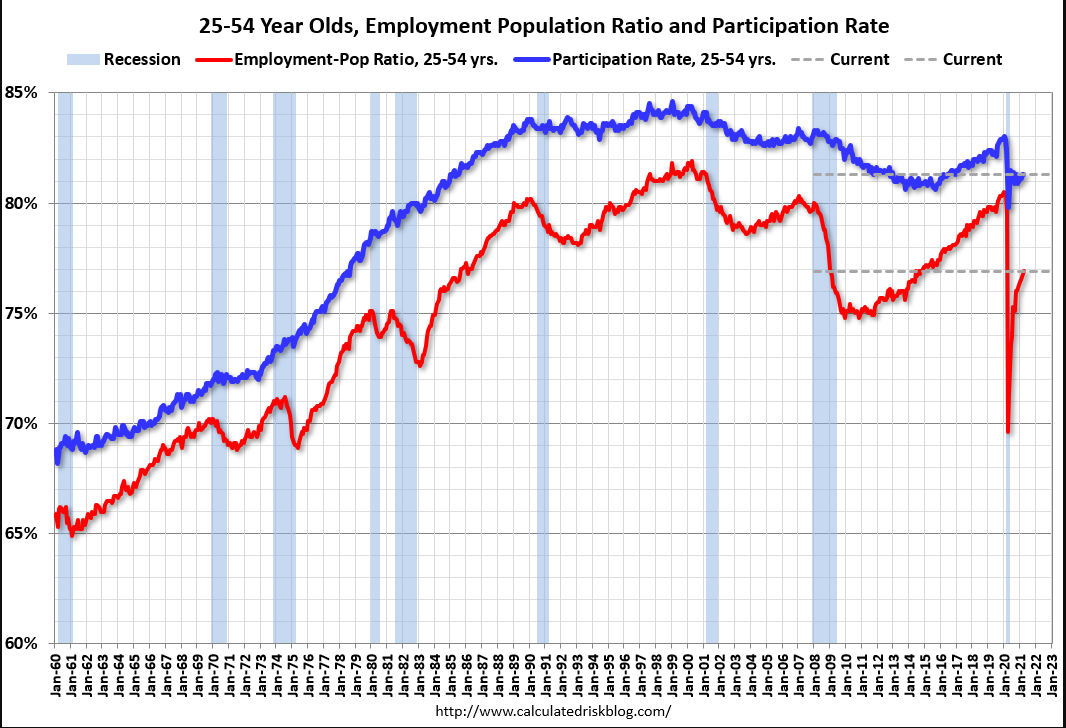

:(

Counter to what the Fed believes, the 0 rate policy has a damping effect on growth

and inflation due to the income interest paid by the Treasury to the economy, and

also due to forward pricing effects.

So far, the increase in gov deficit spending has about offset the decrease in private sector

deficit spending. Nor do I see much more in the way of Federal deficit spending as

the infrastructure bill seems to be both watered down and bogged down, and there’s a substantial

belief in the narrative that Federal benefits are keeping people from working.

We’ll see what happens with covid fears fading, but it may already be priced into the financial markets.

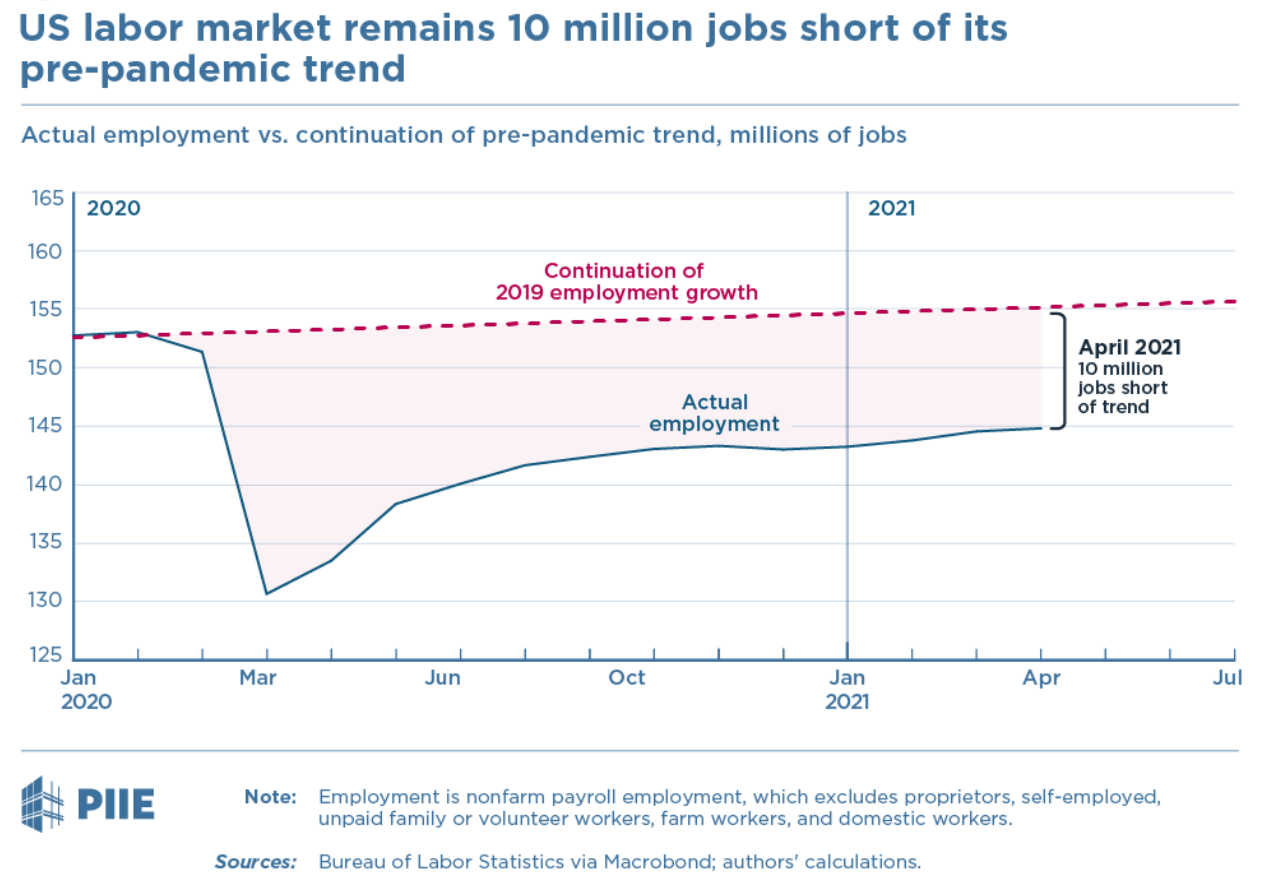

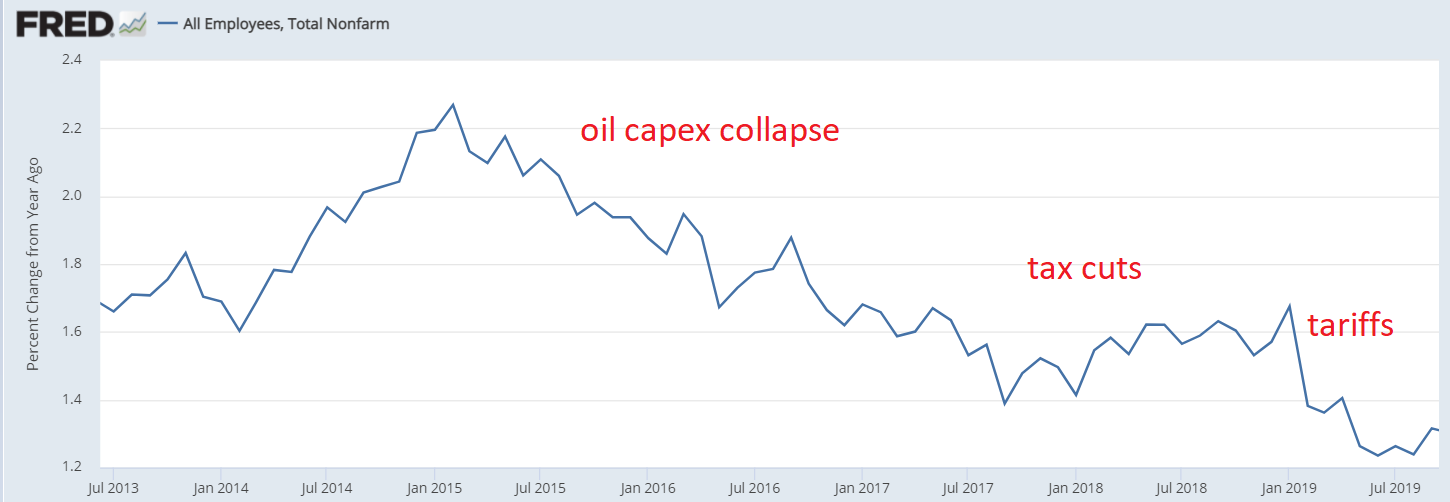

Before Covid, employment growth had already been decelerating due to the tariffs,

which continue under President Biden:

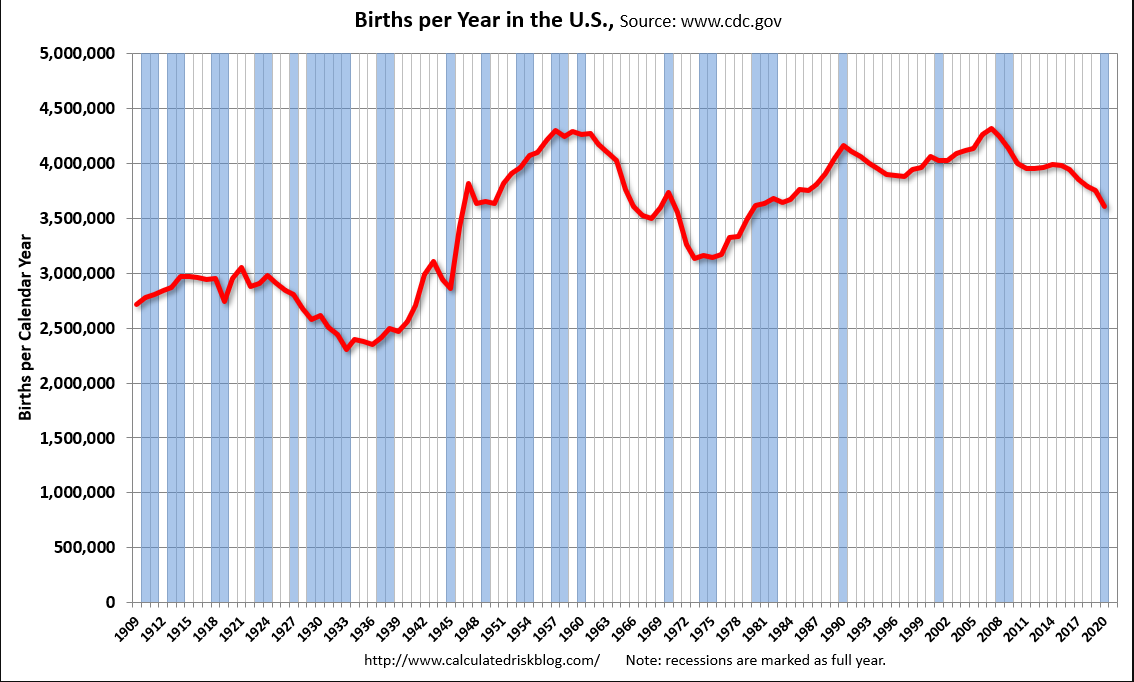

Births keep falling, and this is not population adjusted:

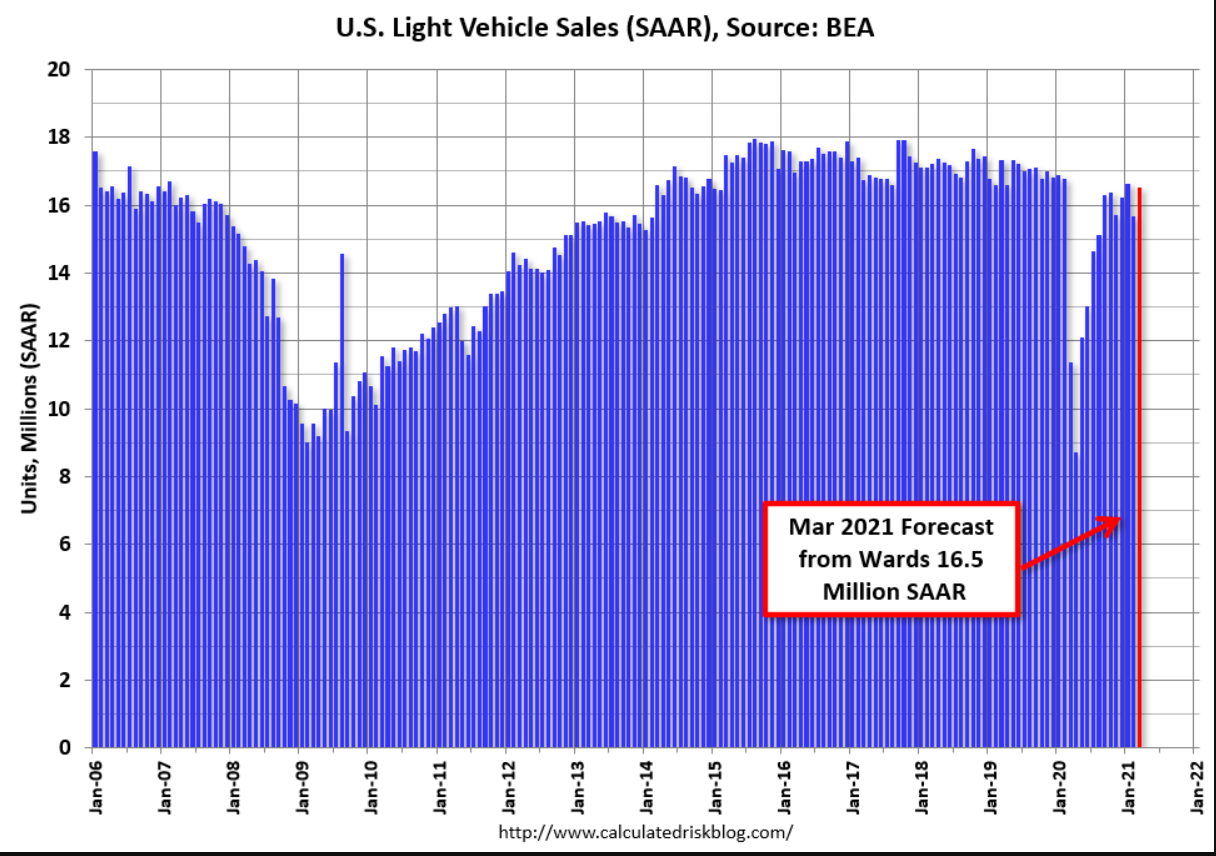

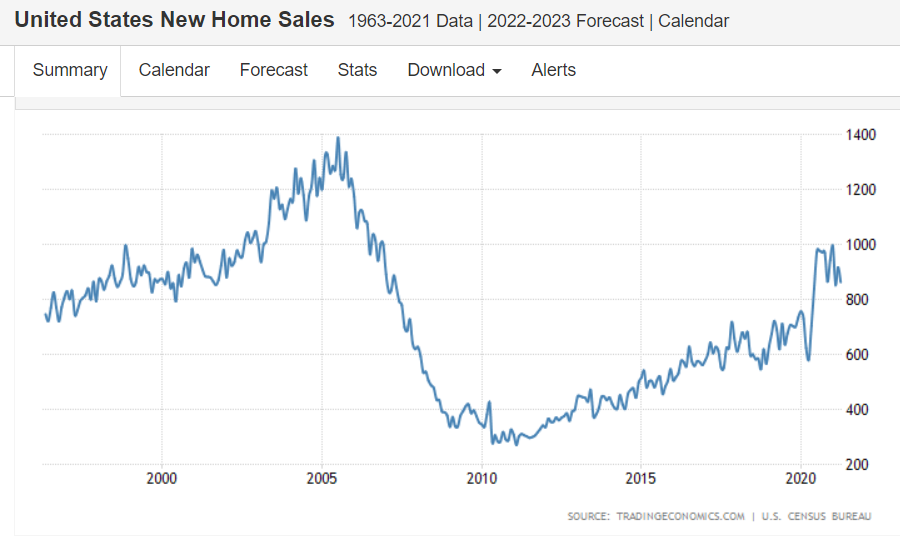

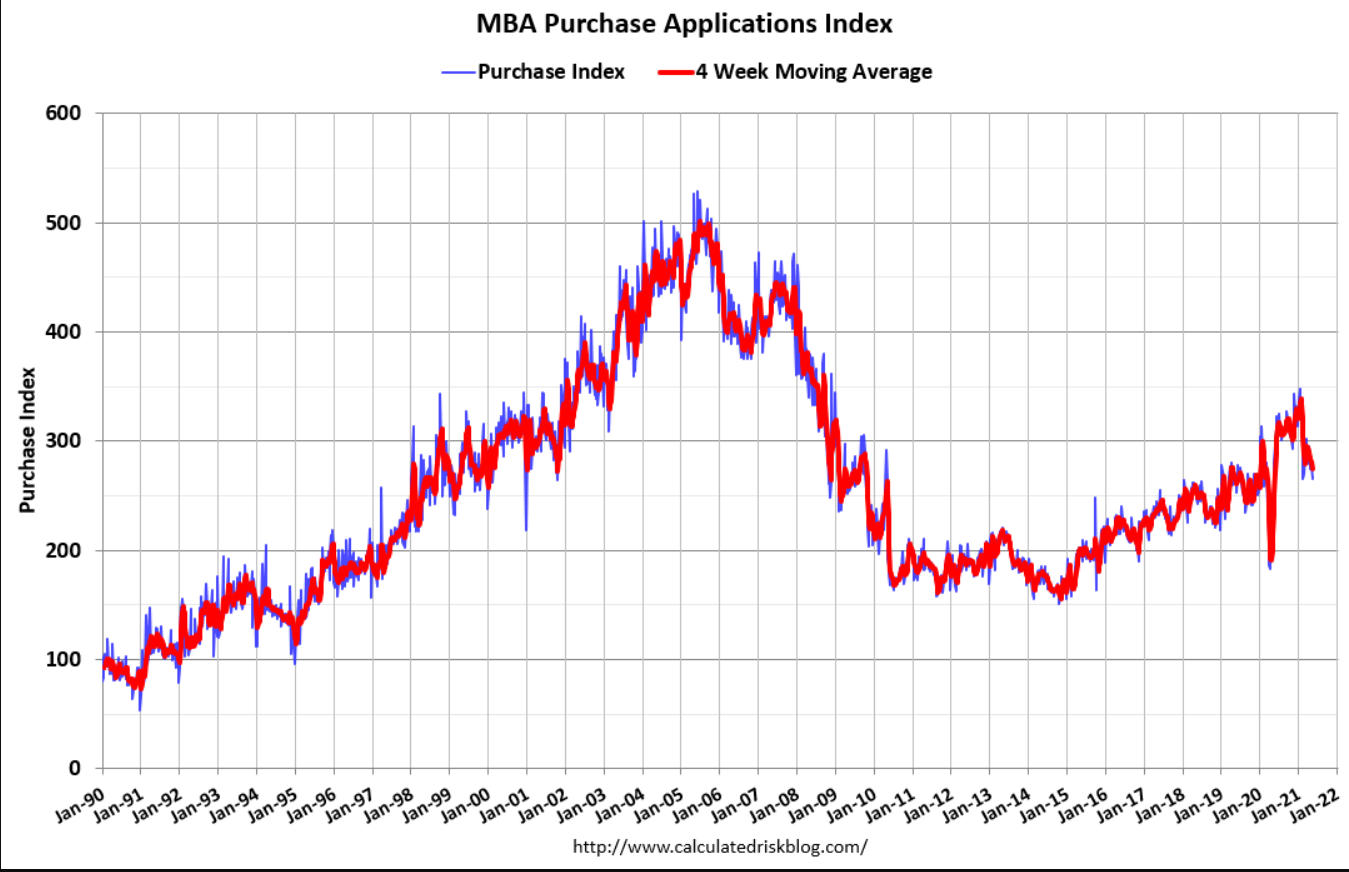

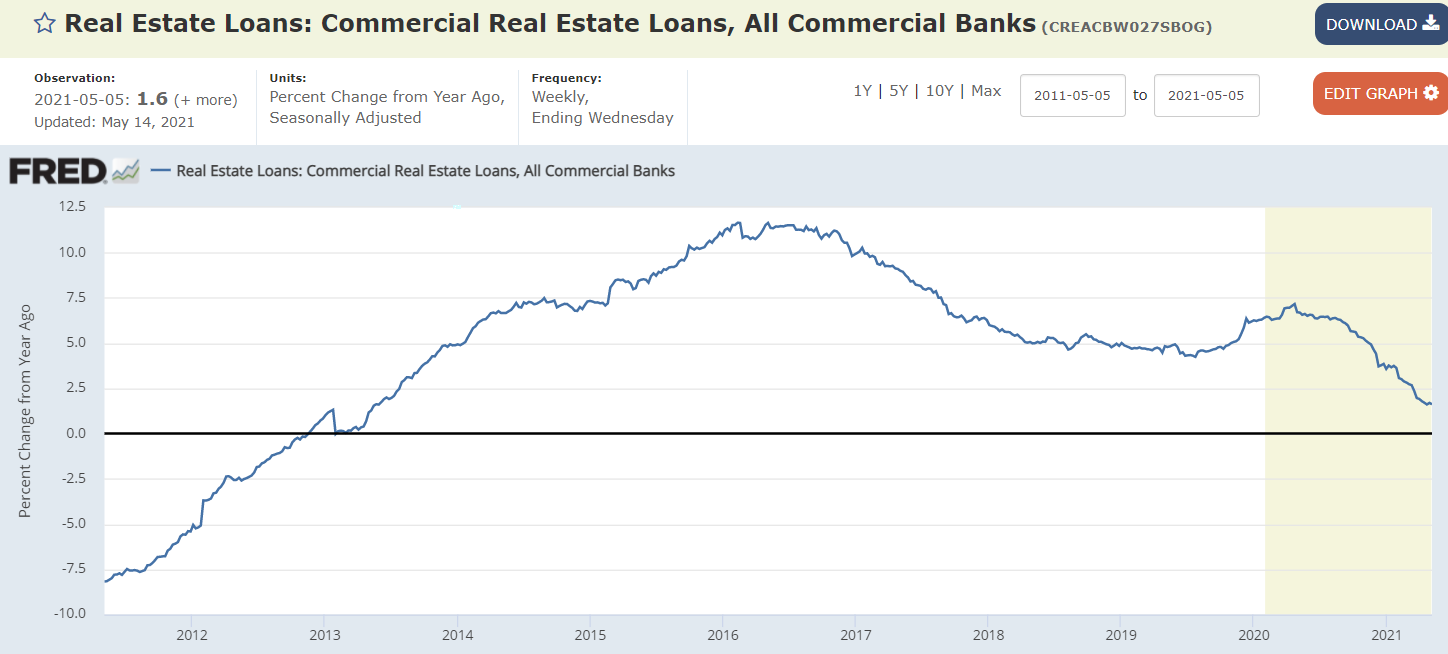

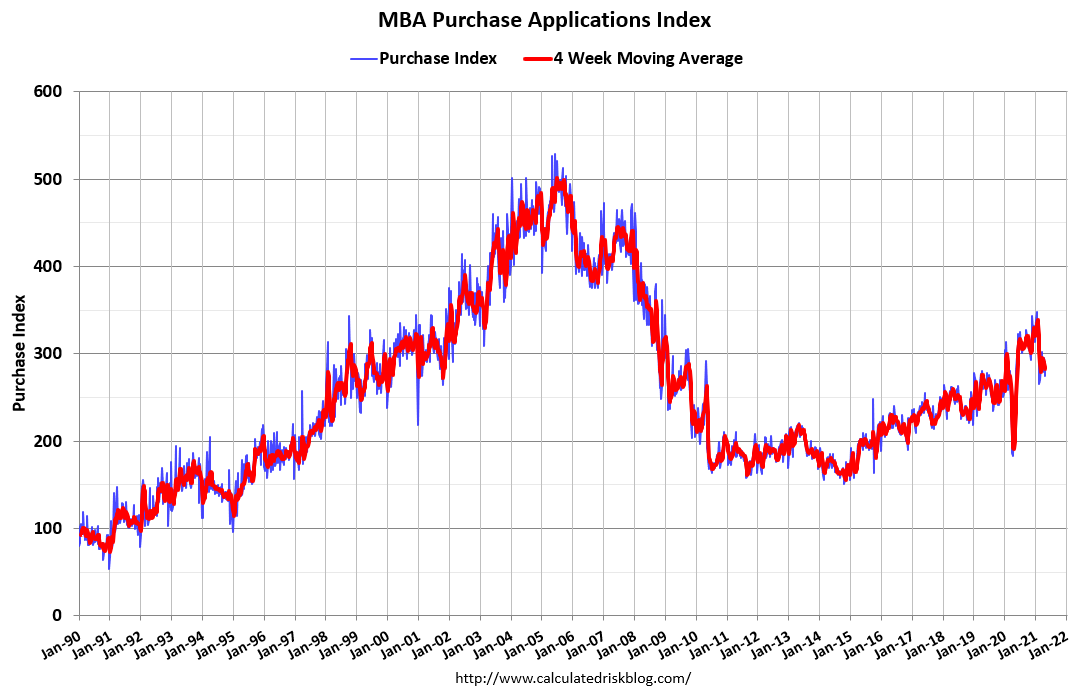

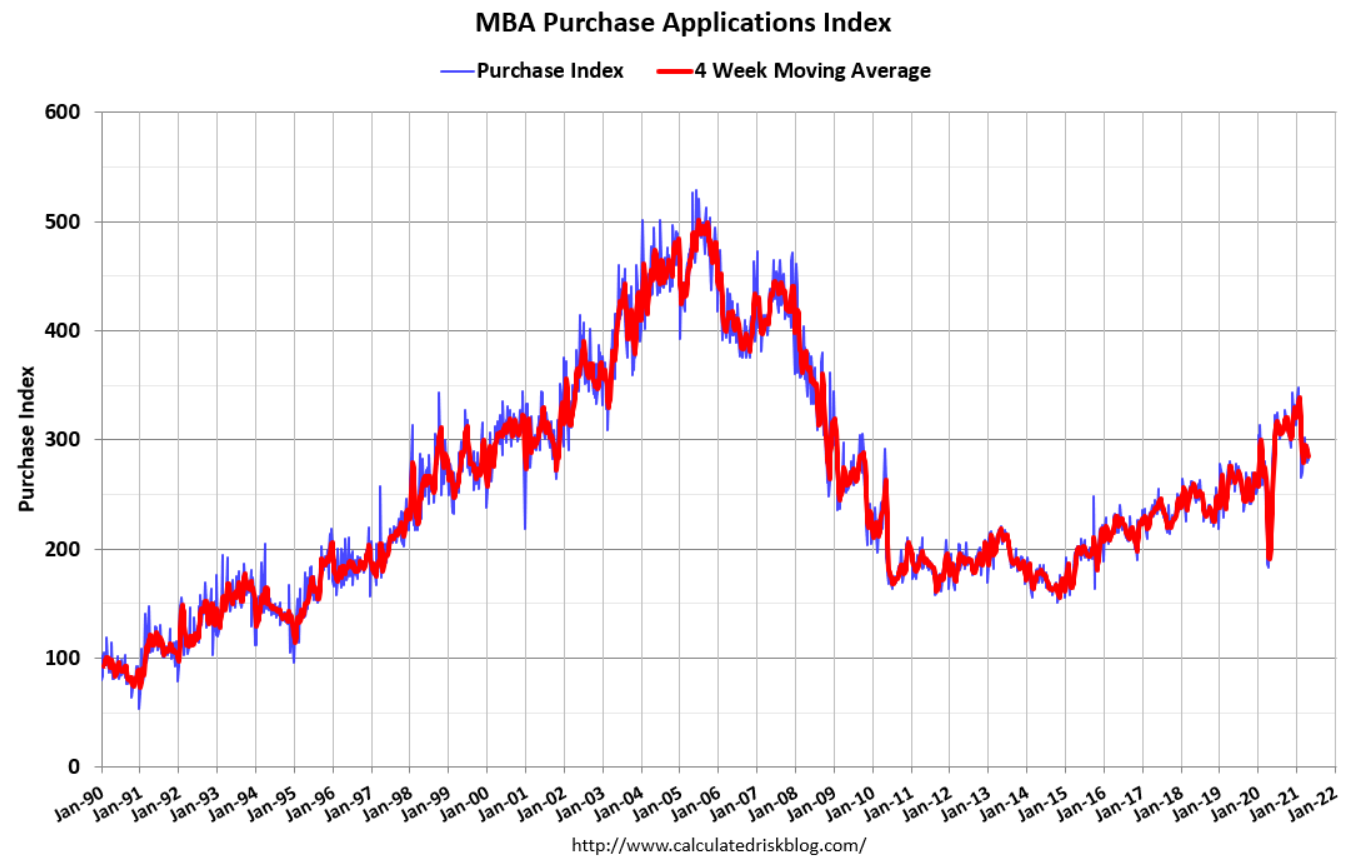

Looks like real estate activity is settling in at pre crisis muddle through levels:

Doesn’t look like much of a housing boom here:

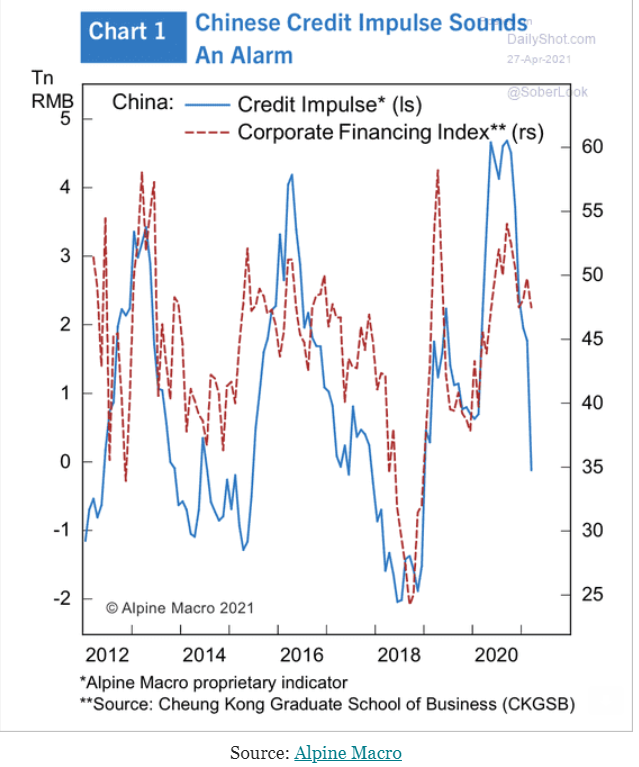

China had been expanding:

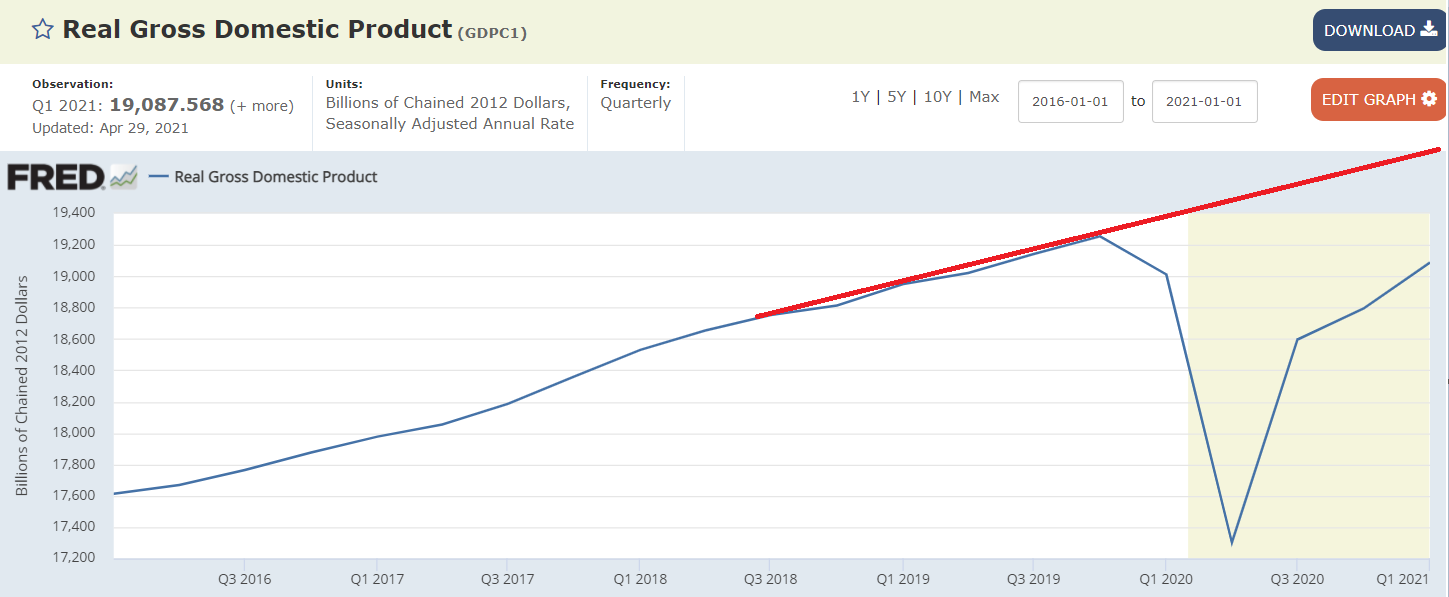

GDP is rising but still has a long way to go:

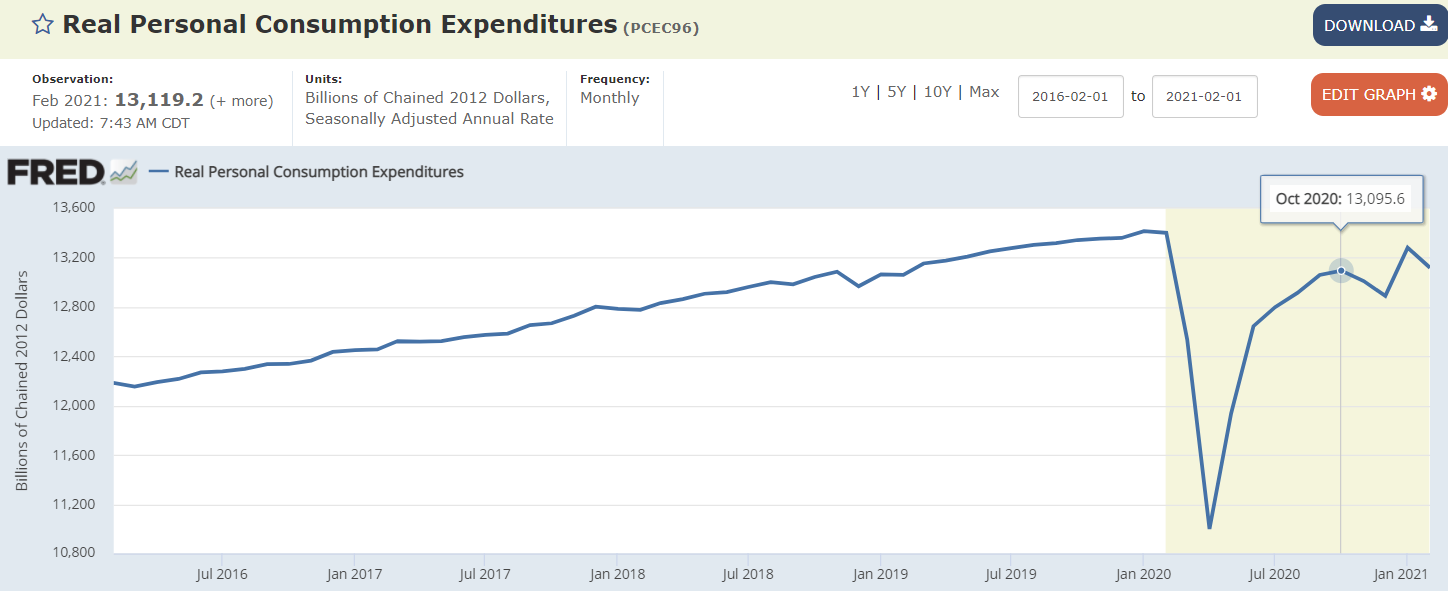

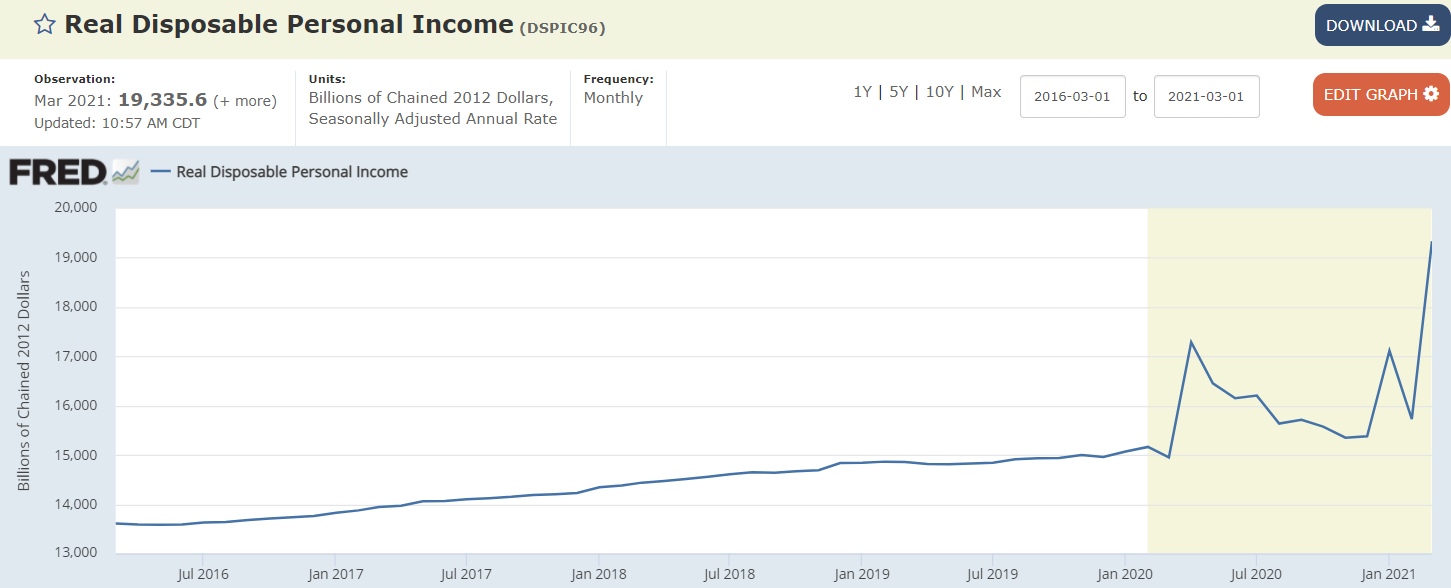

With consumption as weak as it is, the latest fiscal adjustment probably won’t put much upward pressure on prices: