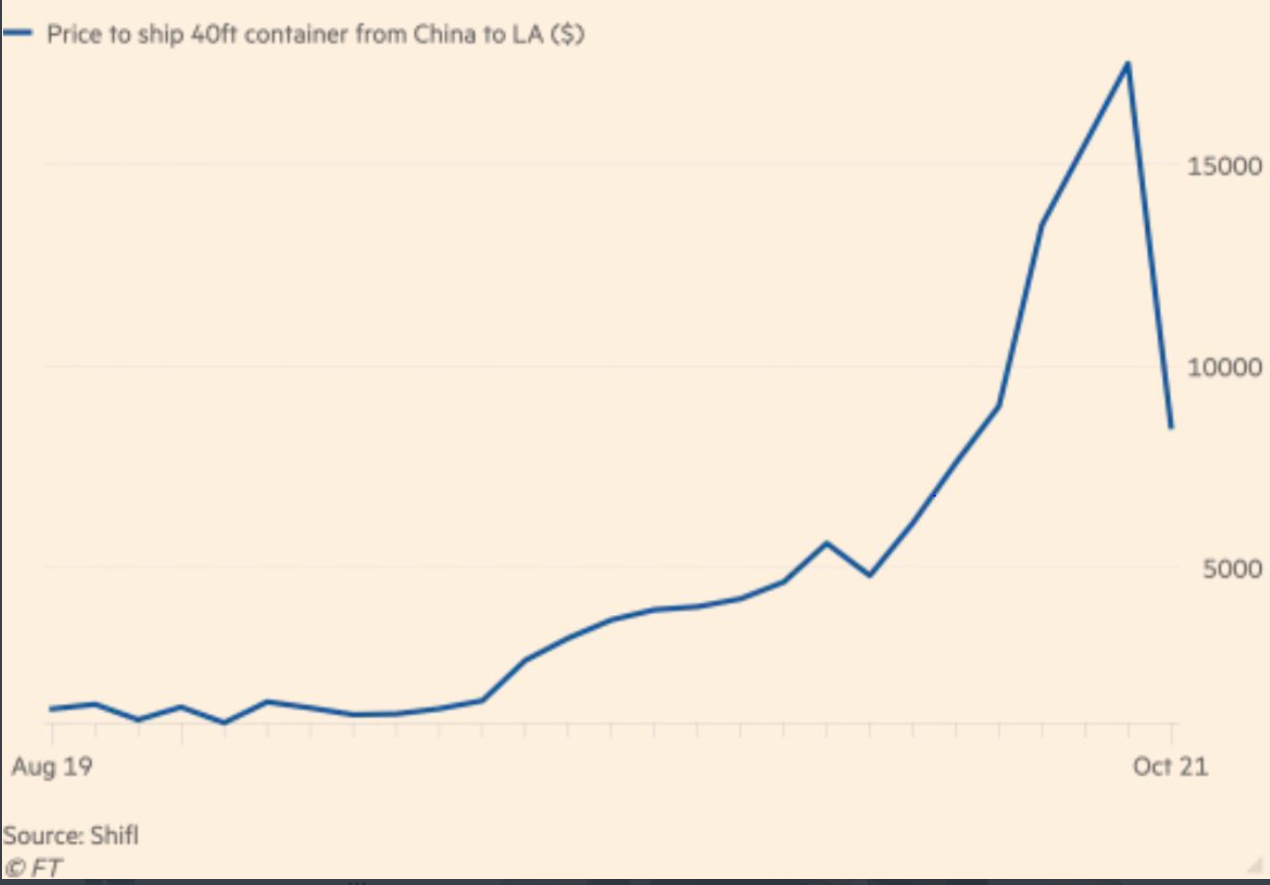

Apparently ports are clearing:

https://www.cnbc.com/2021/11/01/commerce-secretary-gina-raimondo-sees-clear-improvements-happening-at-congested-us-ports.html

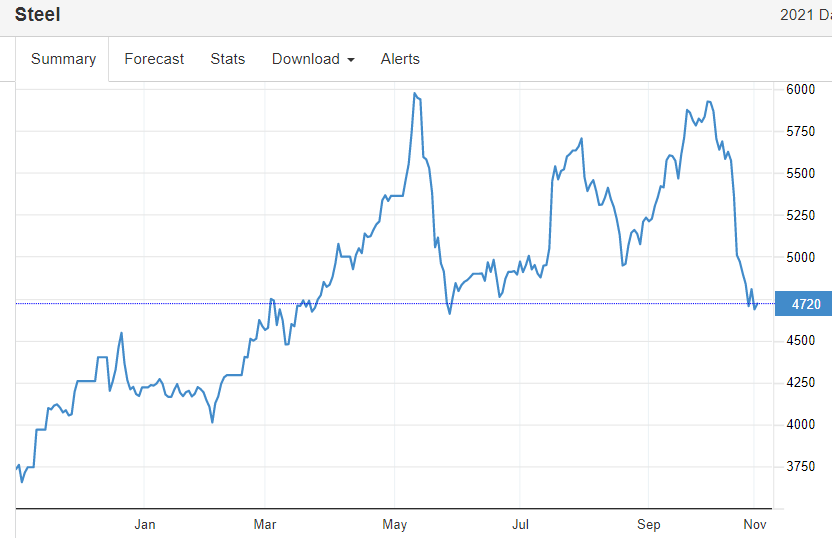

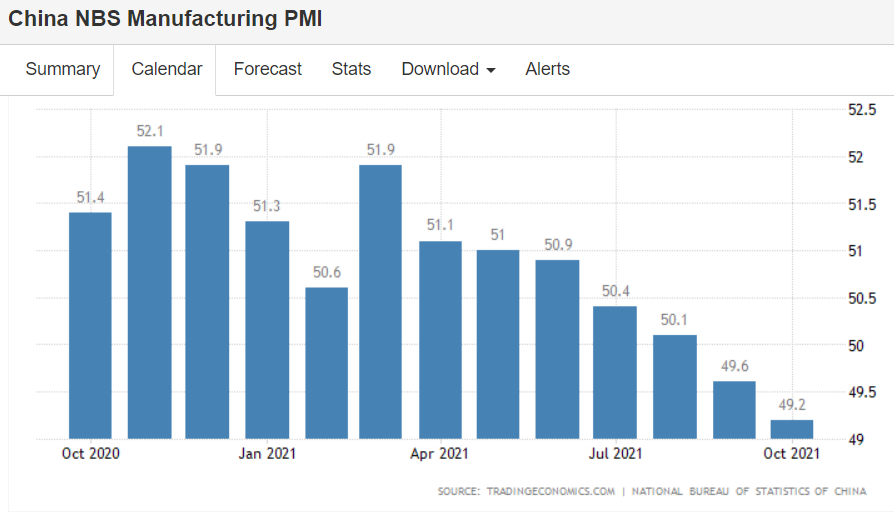

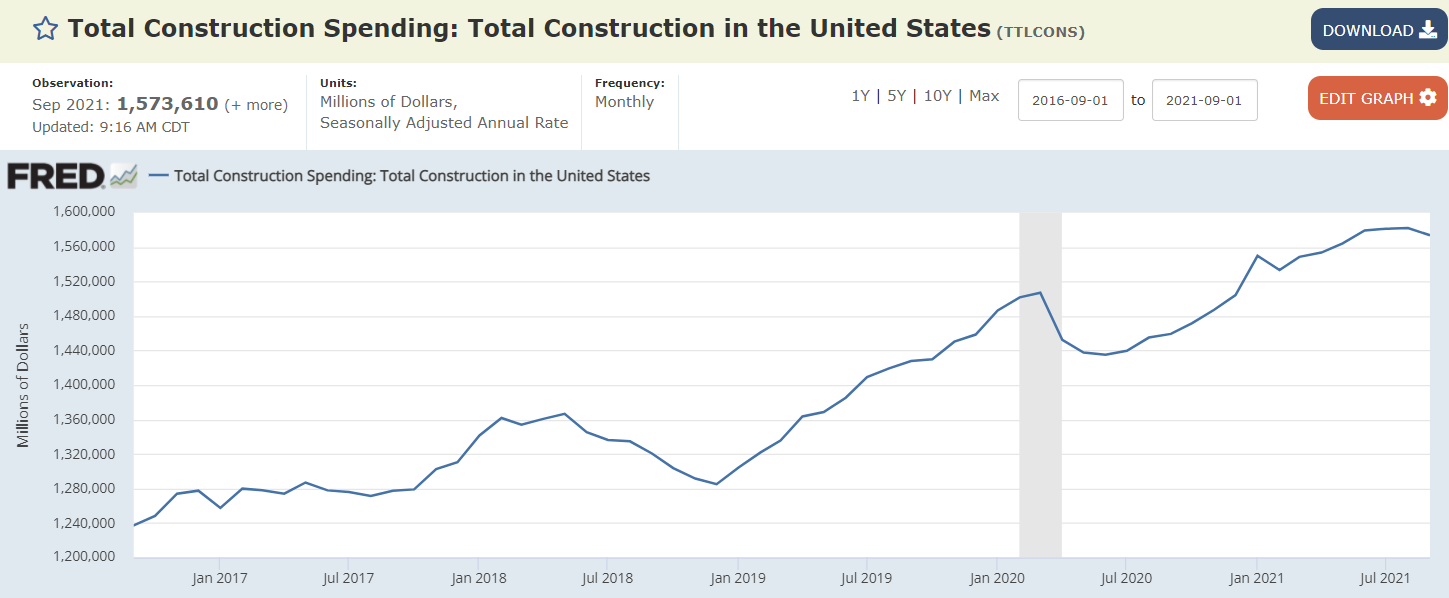

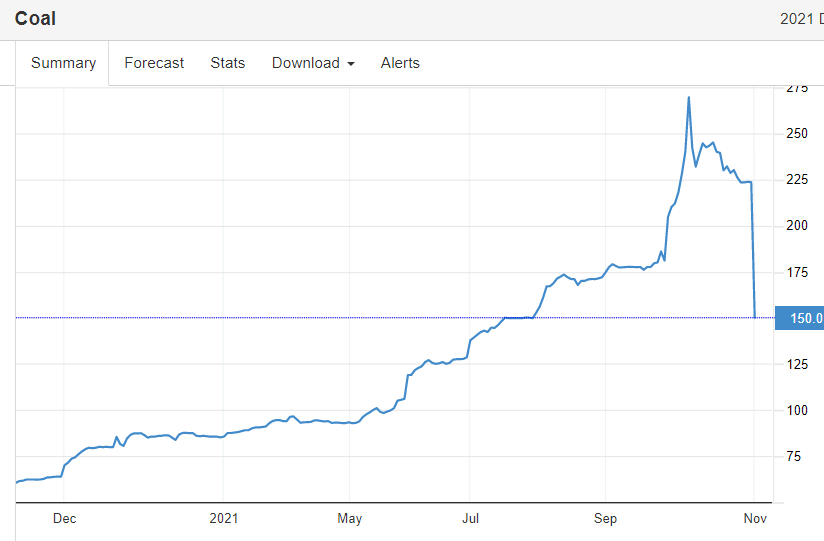

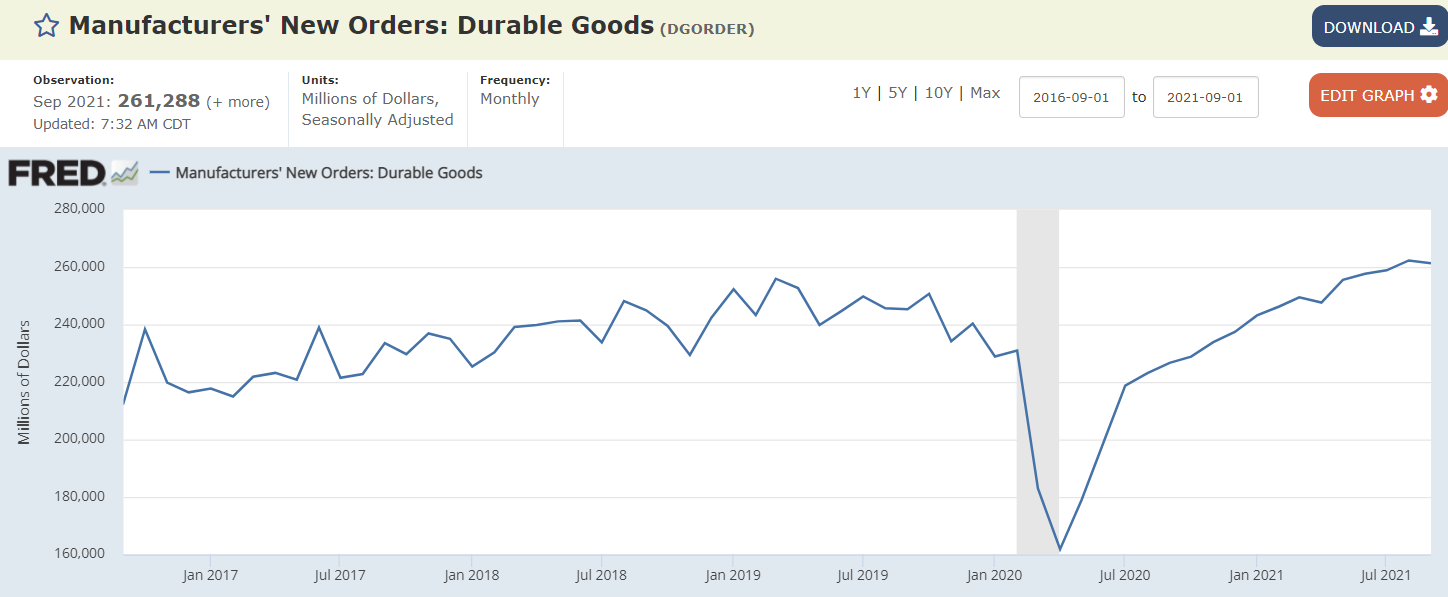

Several commodities seem to have peaked and then fallen back.

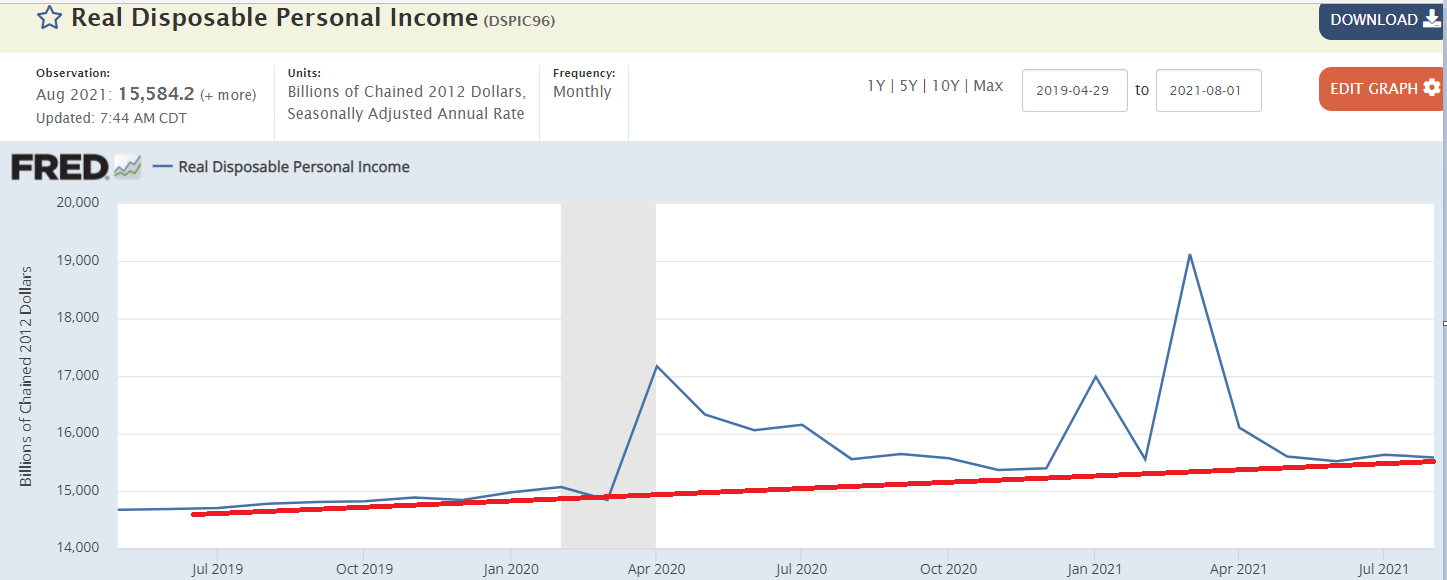

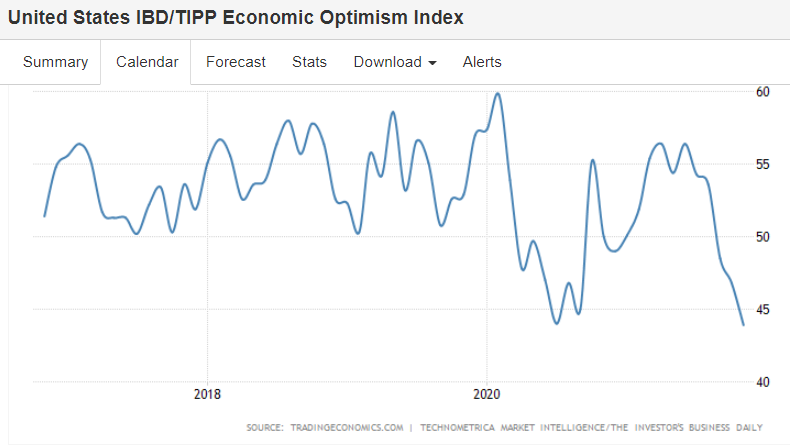

Inflation is a continuous increase in the price level, so it doesn’t seem like that’s yet the case: